Tiger Software - Bill's Blog

9/26/2007 Stock Market Seasonality

Tiger Software - Bill's Blog

9/26/2007 Stock Market Seasonality |

Daily Blog - Tiger Software Stock Market Behavior in Fourth Quarter in 3rd Year of Presidential 4 Year Cycle

======================================= |

| Tiger Software - Helping Investors since 1981 - How To Boost Your Retirement Account Suggestions: Peerless Stock Market Timing: 1928-1966 Track Record of Major Peerless Signals Earlier Peerless-DJIA charts 7 Paths To Making 25+%/Yr. Using TigerSoft Index Options FOREX trading Investing Longer-Term Mutual Funds Speculative Stocks Swing Trading Day Trading Stock Options Commodity Trading |

DJI's

Performance in Fourth Quarter

in 3rd Year of Presidential 4 Year Cycle

65% of the time, Septembers bring a market decline. It wasn't true last year.

And it's

not true this year. What's

Up? Is a decline just being postponed?

I was first turned onto seasonality in the stock market reading Arthur Merrill's gem,

Behavior

of Prices on Wall Street. His study of the markets from 1886 to 1983 shows

that Septembers are up typically

only 38% of the time, Octobers are up 50% of the time,

Novembers 56% of the time and

December 80% of the time. Clearly "Helicopter Ben"'s

easing of credit and adding of cash

(printing money) is inflating the market. We should

ask at what price and for how long.

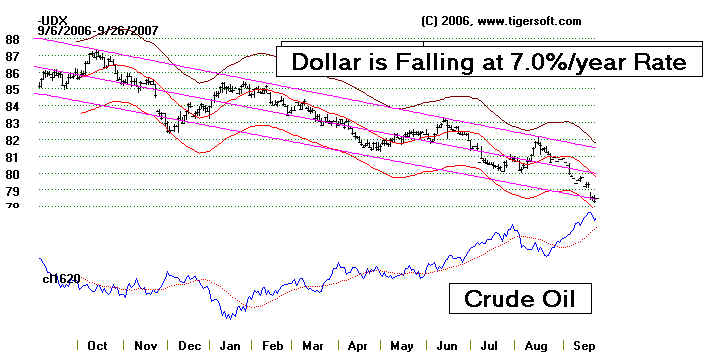

The weakness of the dollar and great strength in oil,

gold, foreign ETFs and telecomms

and Chinese stocks all stem from the deliberate policy

of debasing the greenback.

How long can the rally continue? I looked back at my data, which starts at 1915.

There

is still a chance for a September

peak. In the years before a Presidential Election, a September

peak was seen in 1939 (followed by

a long bear market as WWII started) and in 1955

(followed by a bull market).

A peak in October would be more bearish, if the two cases 1979

(12% decline in DJI) and 1983 (9

months' decline) are any indication. A top in November

this year would be bearish if

1919's November top was significant, but would be of only

passing importance if the 1939 case

(DJI dropped to the lower band and then rallied) were

repeated. Decembers are

bullish. But a peak then would be bearish based on the single case,

1919.

If

the DJI rally can continue for the rest of the year without a decline to even the lower

band,

the market will look like it did in

1963 (when an intermediate 10% decline did not occur until

mid 1965), in 1991 (when the market

rose steadily until March the next year, only to endure a

shallow 7% pullback) and 1995 (when

priced soared for nearly five years, though there was

a 10% decline after a May 1996

top).