|

Yes, Playing

Biotechs Can Be A Lot Like Playing Roulette.

But TigerSoft's Power Stock Ranker

Lets You Beat The House...

INSIDER TRADING

Walk up to a roulette table, place your money on a single number

and the odds are only

one in 37 (European wheel) or one in 38 (American

wheel) that your bet will pay off. But when you

do win, you get a big stack of chips back, 35

for every one you invested. It's like that in biotechs.

For every Amgen there are hundreds of biotechs still

trying to hit it big.

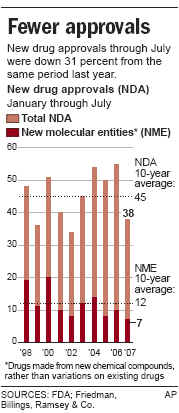

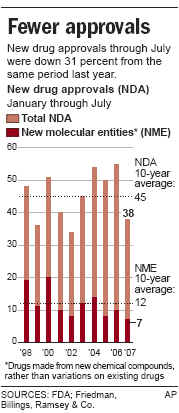

The FDA has become increasingly cautions after the withdrawl of Vioxx. The FDA

approved only 17 new prescription drugs in 2006, the

lowest number in a decade. This is a

major factor in the past year's weakness in biotechs.

(Source: http://www.msnbc.msn.com/id/20321830/

)

The prospects for a change in the FDA approvals' downtrend are not bright, though

according

to the Pharmaceutical Research and Manufacturers of America, pharmaceutical companies have in

development 646 compounds for cancer, 146 for

heart disease and stroke, 77 for HIV/AIDS and

56 for diabetes. There is a concern about the lack of new

drugs for diseases without treatments.

Bush's hypocritical and anti-science vetoing of

government assistance to stem cell research makes

matters much worse. Showing either his

limited math skills or his very political side, or both, Bush

announced that cancer deaths had just recorded

the "steepest

drop ever recorded". That was just

after the news came out in 2004 that the number

of cancer deaths declined by all of one half of one

percent between 2003 and 2004.

How To Trade Biotechs with TigerSoft

Still, the biotech industry is not a lottery or a game in a casino. From the

investments of

perhaps $150-200 billion to date, will come drugs and

vacines that will save millions of lives ultimately.

But it does take years and years of research to bring

a new successful drug to market. During that time,

thousands get a preview of its effectiveness.

If things go well for the company, the stock moves

up years before the final FDA approval and the first

prescriptions are given. TigerSoft users

see lots of blue accumulation if things are going

well. They see an uptrend even in a bear market.

And usually they see long periods of inactivity

followed by brief bursts of very high volume when

a new drug's trials are formally reviewed by the Food

and Drug Administration's regulatory process.

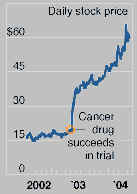

The success or failure of a new drug's clinical trials is quickly translated into movement

by

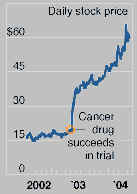

the company's stock price. Consider two cases.

Genentech and La Jolla Pharmaceuticals in the

same period 2002-2004.

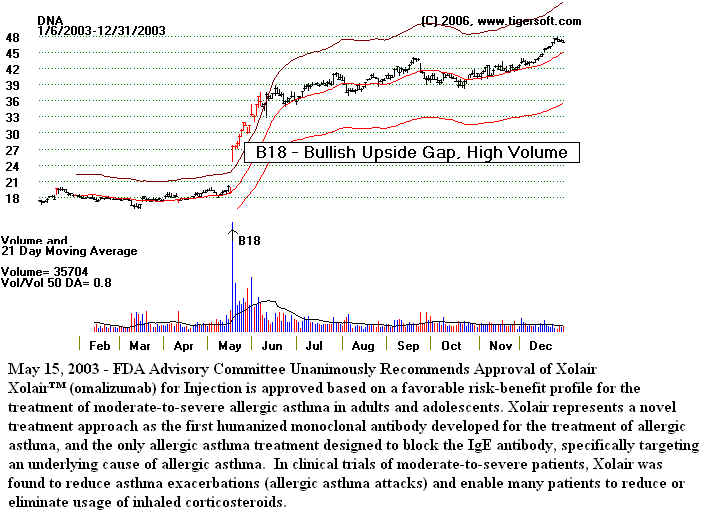

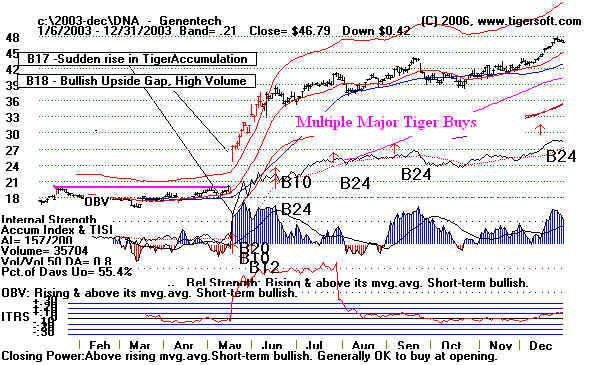

Genentech (L)

La Jolla Pharmaceuticals (R)

TigerSoft's

Trading Secrets

To be successful, the biotech trader should screen stocks

above their 50-day ma

for:

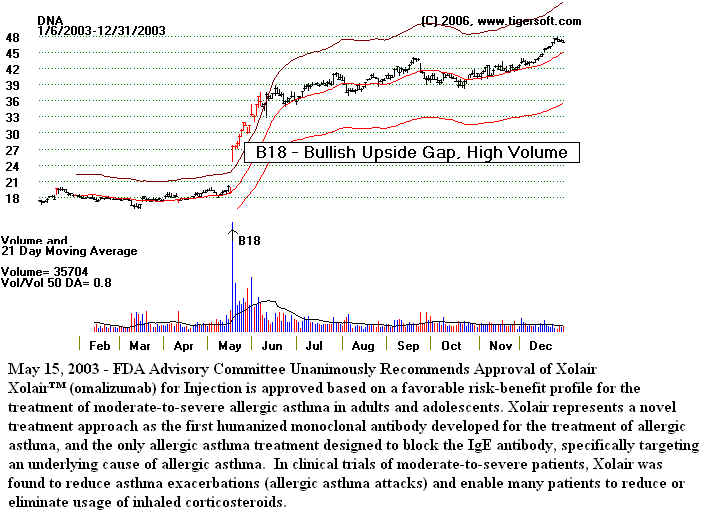

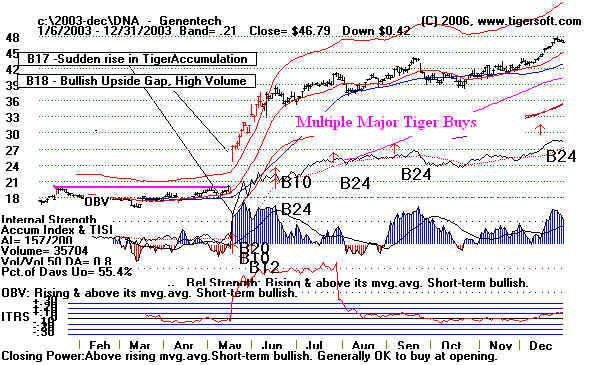

1) Sometimes subtle rise in relative strength - see DNA, July to December 2002.

2) Gaps with sudden changes in volume - see DNA, May 2003. (BuyB18)

3) Sudden rises in accumulation as measured by Tiger's Accumulation Index - see DNA

May 2003.

(Buy B17)

4) Accumulation Index up to level we consider it a sign of "insider

buying"- see DNA May 2003.

(Buy B24)

5) Price Breakout. see DNA May 2003. (Buy B10)

DNA -2002

In the bear market of 2002, DNA ran up to and backed off from the neckline - resistance

at 19-20 on sixe different occastions. Any move above should have been considered as

a very

bullish sign.

DNA -2003 Breakout, Gap and High

Volume over $20.

DNA -2003 - Continued

|

LJPC - La Jolla Pharmaceuticals - 2002

LJPC - La Jolla Pharmaceuticals - 2003

On February 13, 2003, La Jolla Pharmaceutical Company announced preliminary findings from

a Phase III clinical trial evaluating Riquent™,

previously known as LJP 394, for the treatment of lupus

renal disease.

"Initial assessment of the trial data indicates

that treatment with Riquent did not

increase length

of time to renal flare, the primary endpoint, in a statistically significant manner

when compared

with placebo through the end of the study." This sentence caused the

stock to drop

28 points!

Buying before the Phase III trial results are released is very risky. Biotechs that

are going to

report excellent

Phase III trials are likely to be in uptrends even in a down market. Elsewhere we

saw

this was true

with Amgen from late

1989-1990.

Examples of

Gaps, Volume and Tiger Accumulation Surges

in Biotech Stocks in

2006-2007 over $10 And Their Outcome

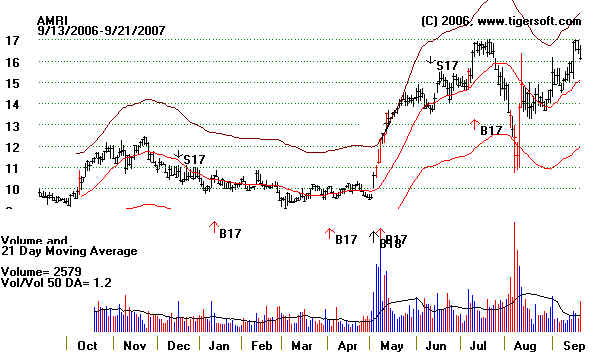

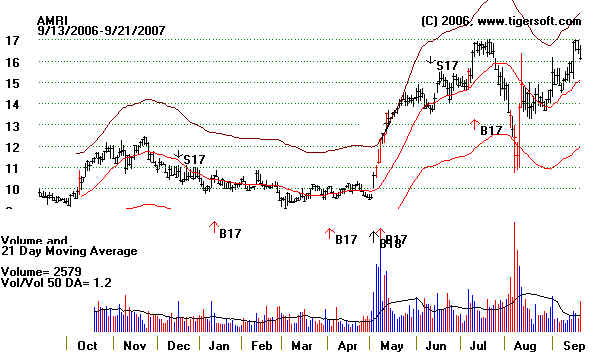

These are flagged as "Buy B17s and

B18s with Red Price Bars". They are the first

to occur after September 2006. Both

B17 and B18 must occur on same day.

(This is not to say that a Buy B17 won't

work by itself or when the stock is under $3.

Look at AGEN on 3/30/2007.)

The B17 and B18 should not be more than 10 days apart.

Major B10s, B12s and B24s also work

well here.

Tiger's

Power-Ranker flags and lists these stocks for you each night with just one command..

Look at the news for the stock.

Upgrades are fine. No apparent news is even better.

ABAX 20.57 1/26/07 hit

27 on 4/16/07 ...by Augiust it had fallen back to close the gap

ACAD 13.61 3/19/61 hit 17 on

4/4/2007 ... Dipped back to 12.5 and retested 17..

ACL 129.77

2/8/2007 hit 144 on 4/27/07... Dipped back to 130 and re-tested 145.

AGIX 12.06

1/5/2007 hit 19.9 on 2/15/07/ Then declined down to 2! It's 50-day ma never

turned up.

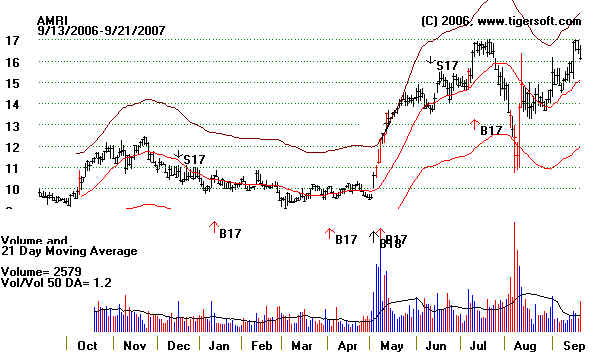

AMRI 12.58

5/9/2007 hit 17 in July. Closed gap down to 11 in August and re-tested lows.

Jeffries & Co.

changed their rating for the chemistry services and drug-discovery company to buy from

hold.

ARTC 39.69

4/13/2007 hit 60 in August. (See chart below).

Lazard upgrade to

buy from hold

|

New

Drug Approvals By Year (A work in progress)

I think there is a need for a simplified master list of new drugs getting approval.

I have started building

such a list below, along with refernces to news items

about the FDA for each year, starting in 1990. The materials

below will be expanded, as time permits. This

will also allow us to see how readily one can make money investing

in companies when they finally DO get approval for

new drugs..

Non-Generic

Year

FDA Approvals

-------

-----------------

2007

September 14, 2007 Evista,

Lilly's osteoporosis drug for use in reducing the risk

of

invasive breast cancer. The approval covers postmenopausal women with

osteoporosis

and postmenopausal women at high risk for

invasive breast cancer.

April 6, 2007, Shire

and its newly acquired subsidiary—New River Pharmaceuticals—

won final

approval from the U.S. Food and Drug Administration (FDA) last month to market

lisdexamfetamine (Vyvanse)

for treatment of attention-deficit/hyperactivity disorder (ADHD) in

children and

adolescents aged 6 to 12.

FDA more cautious after Viozz was pulled. Rejecting or delaying

more new drugs. Through mid-August

2007, the FDA has approved 61

percent of drug applications, down from 73

percent in the same period

of 2006.

FDA staff now realize new drugs will be used by many patients beyond

those intended — known as off-label use because the drug is taken for

another condition than the one it was approved to treat. That often boosts

the chances that some patients will be harmed by side effects.

But the caution causes deaths, too. The DC Court of Appeals has ruled that

patients don't have the right to

potentially life saving drugs.

Diabetes drugs Avandia and Actos forced to show warning labels

about the medicines worsening heart failure. Made by Glaxon SmithKline

and Tekeda Pharm.

FDA

criticized after study finds drug-related deaths doubled between

1998 and 2005. Myriad problems with the government's monitoring

of drugs before approval and after they are on the market.

Approvals for Endo Pharm.'s migraine drug was delayed for use

in preventing menstrual migraines.

Merck's Arcoxia was rejected in April It was the long-planned

successor to Vioxx.

FDA has cited safety or effectiveness

questions in rejecting or delaying

approval for experimental drugs including Novartis' diabetes drug

Galvus, Sanofi-Aventis' weight-loss drug Zimulti, and even a higher

dose of GlaxoSmithKline's Advair Diskus for bronchitis and emphysema

symptoms. Also shot down: Wyeth's experimental schizophrenia drug

bifeprunox and Wyeth's Pristiq, which would have been the first

nonhormonal drug for menopause symptoms. (8/17/05 - MSNBC)

2006

17 or 18

2005

20 (new molecular entity) 36 (new fotmulations)

82 See full FDA list http://www.fda.gov/CDER/rdmt/InternetNDA05.htm

AMLN - Exenatide - 4/28/2005

Biolvail Labs - Tramadol (A

happy pill!) 5/5/2005

Teva Pharm. - Metronidazole 5/20/2005

Biovail - Zolpidem - 5/26/2005

Biovail - Metformin - 6/3/2005

Sicor Pharm - Levofloxacin - 6/05/20

Celgene - Revlimid (Lenalidomide) 12/27/05

-Postponed decision of morning-after pill.

-Spring 2005, a second pain pill in the same class known as Cox-2

inhibitors, Pfizer Inc.'s Bextra, was withdrawn

-Decline is because the federal

agency is exercising more caution

following the recall of the drug Vioxx in 2004, which has resulted in

more than 6,000 lawsuits after it was linked with heart attacks and strokes.

-Most frequent suspect drugs in death and "serious non-fatal outcomes"

were pain narcotics Oxycodone and Fentanyl, which are both in the

class of drugs known as opioid analgesics.

2004

29 or 36

DNA - Tarveca - treatment of lung cancer

DNA - Avastin - treatment for colon cancer

MYLAN LABS - Apokyn Research)

for Parkinson's disease

ILEX Oncology - Clorar - for children with leukemia

Merck KGaA. - Sante drug for alcoholism treatment

2003

14

2002

20

To be

continued.....

2001

2000

1999

1998

1997

1996

1995

1994

1993

1992

1991

|