|

See earlier related Blogs here:

August 27, 2007 Technical Resistance Has

Many Meanings: Recognize Them And Profit.

August 9, 2007 China Now Controls

America's Financial Destiny

July12, 2007 US Dollar's Decline Is

Getting Serious

July 3, 2007 British Pound Makes A 25

Year New High And Poses Dangers for The US Stock Market

July 2, 2007

Where

Are The US High Tech Jobs Going?

June 28, 2007 Housing Correction

Continues. No Bottom In Sight, Yet

June 24, 2007

The 1929 Crash: Could

It Happen Again? Yes- Absolutely.

June 14, 2007 Ending The War in Iraq

Would Be Bullish.

--------------------------------------------------------------------------------------------------------------------------------------------------------

9/13/2007

The Coming Dollar

Collapse, Gold and Interest Rates

Yes, this is a scary headline. But if you google "Dollar Colapse" you get

dozens and

dozens of links to

investigate. Since writing a dissertation on the British Chancellors of the

Exchequer at Columbia, I have

thought about this subect over and over. I do commend to

you one

link from an author, Samuel Brittan, whom I read while writing my dissertation.

And, one final thought, no

one in Germany in 1920 expected the Deutsche Mark to become

worthless in 4 years. But it did. And the

consequences were grave.

My Thoughts

Down rushes the US dollar. Bush's trillion dollar Iraq blunder continues. Congress

lacks the will to stop this

costly tragedy. And American jobs keep leaving the country. Meanwhile,

the Fed is under massive

pressure by banks, home builders and mortgage lenders for rescue. Only

the World bull market keeps

the US from slipping into recession. So, what can you do in this

environment to make money.

Buying gold stocks is certainly one time-tested approach. Another

is buying oil stocks, and

another is buying Biotechs, which are more resistanct to recessions

and the initial onset of a

bear market. Will there be a massive liquidity crisis that takes down the

value of all liquid assets,

gold and gold stocks included? That is what we started to see in August,

until the Fed came to the

rescue. These are subjects Our Hotline discusses each night. Here we

want to focus on Gold Stocks,

but first consider the Dollar's steepening decline.

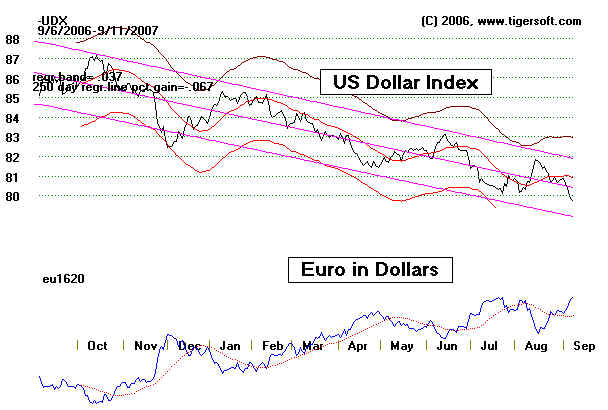

The Dollar and The Euro

These charts do not show very big drop in Dollar in last two days.

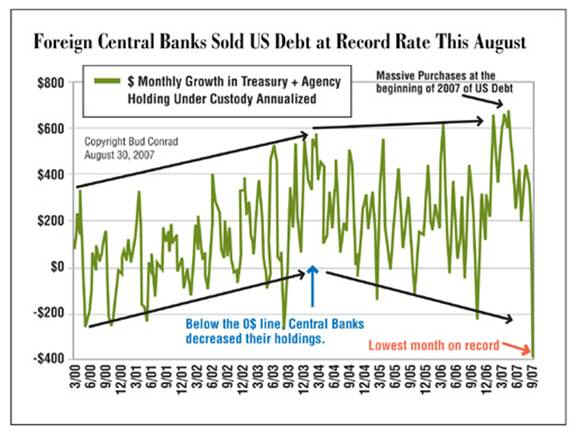

There is mounting evidence that foreigners are increasingly unwilling to buy US

debt. And why

should they continue? They

are compensated with interest rates of 6% while the US dollar

declines at a 6.8% clip.

The chart below shows that Central Banks have recently dramatically

increased their selling of US Treasuries. This

means the Fed will have to "print money" in ways

we can't imagine, if they want to

shore up the economy and the stock market until after the

2008 Presidential Election, as

history shows they are want to do. Bernanke in 2003 reportedly

said he would have dropped tons of

freshly printed greenbacks in the 1930's to have prevented the

Great Depression. Much of

his, and his mentor, Milton Friedman's, academic research was

on the monetary mistakes made

between 1928 and 1933.

How To Trade Gold Stocks

Tiger's Automatic Buy and Sell Signals have done particularly well with XAU, the Gold

Stock

Index. $10,000

invested in their Buys and Sells would have brought a profit of

118.7% in the last 11

months.

This does require short selling. If short-selling were not done, the gain

would have been

57% when taking the signals

at the next day's opening. TigerSofts charts calculate this for any stock

you want. It allows $40 per

trade in commission and "slippage". Simply trading the long side would

have produced very good gain in

2005-2006, 40.6%. If you read further, you can see how a trader

might know when to shift from a

trending market to a trading market. In the current situation,

we will know to shift to a trending

approach when the XAU makes a decisive breakout above

160 and Gold Bullion makes an

all-time high above 725. In the meantime, we now have an

automatic Sell on the XAU, though I

would personally want to wait long to sell out gold stocks.

The dollar is profoundly weak.

With interest rates being lowered by the Fed, it will be harder

and harder for the Treasury to sell

its massive debt to pay for Bush's Trillion Dollar Iraq War.

The XAU has been trading essentially sidewise for since January 2005. Tiger's

Automatic

Buys and Sells sense this and

produce signals appropriate for this type of stock behavior.

2006-2007

2005-2006

From March 2006 to December 2006, Tiger's automatic signals would have

gained a trader

65.4%, or 40.6% only buying and selling. This sues the next day's

opening price.

2004-2005

In 2004 the XAU was in a strong uptrend. We can see this in any ways.

But look at the ITRS indicator at the bottom of the chart below. This shows how

well the XAU is doing versus the Dow Jones Ind. Avg. Until March 2006, it

has been steadily positive. A SIMPLE way to trade a market or stock like this,

is to buy the stock when it is above a 20 or 21 day mvg. avg. That would have

gained 57% between July 2004 and March 2005.

Gold is fast approaching its 1980 peak at

$725.

Trading the Fidelity Gold Fund with TigerSoft

TigerSoft signals here would

have produced an 88% gain since November 2006.

|

Gold Seasonality

A peak in October, a shallow decline into November and then a

year-end rally are what seasonality

would lead us to expect.

30-year Study by seasonalcharts.com

Adam Hamilton on Gold Seasonality

"Seasonality also exists in gold. There are times of the calendar year when

gold tends to do well and other times when it does not. Although there are many

varying reasons for this phenomenon around the world, the most famous example

of gold seasonality has to be the Indian wedding season.

"Indians have a deep cultural

affinity for gold, so in the autumn India's farmers

tend to invest their profits from harvest in gold. But even more gold is bought

for the Indian weddings that happen late in the year during festivals, mainly

in October and November. Something like 40% of India's annual gold demand

occurs in this short period of time. Wedding gold is often in the form of intricate

22-karat jewelry that the bride's parents give her to secure her financial future

and financial independence within her husband's family.

"Just as wheat traders use

wheat's seasonality to help them make trading decisions,

gold and even gold-stock traders can use gold's seasonality. With gold having definite

seasonal tendencies at different times during the calendar year, investors and speculators

can study it to better understand when seasonality helps or hinders their probabilities

for

success in launching new trades."

(Source: http://www.321gold.com/editorials/hamilton/hamilton071307.html

) |

.

|