|

Better Learn Chinese.

China Can Now Make or Break US Economy!

Look at the Tiger Index of 35 Chinese stocks and closed end funds. The US and

Chinese markets and fortunes seem to be

running on parallel tracks.

Chinese Stocks Are

Predicted Well by Tiger's Peerless Buy and Sell Signals.

We now offer daily data

on these stocks, too. And Tiger lets you build your own

index of any

group of stocks you like.

---------------------------------------------------------------------------------------------------------------------------

China is on The Move!

1,500,000,000

- The estimated current population of China.

China's sustained

economic growth has been amazing. Its gross domestic product (GDP) rose, on average,

more than 8 percent annually since 1978.

China has become a major player in the global economy. All the

talk about inefficient bureaucracies and

corruption pale when considering this growth. Pollution and rural

poverty remain unsolved problems.

China's economic output in 2006 was $2.68 TRILLION, the third largest

in the world. 70% of China's GDP is

in the private sector. The smaller public sector is dominated by about

200 large state enterprises concentrated mostly in utilities, heavy

industries, and energy

resources.

Since 1978 the People's Republic of China (PRC) government has

been reforming its economy from a

Soviet-style centrally

planned economy to a more market-oriented economy while remaining within the

political framework provided by the Communist Party of China. This system has been called

"Socialism

with Chinese characteristics" and

is one type of mixed

economy. These reforms started since 1978 has

helped lift millions of people out of

poverty, bringing the poverty rate down from 53% of population in

1981 to 8% by 2001 (See: http://en.wikipedia.org/wiki/Economy_of_the_People's_Republic_of_China

)

( Source: http://news.bbc.co.uk/1/hi/business/6106280.stm

)

Example,

when you go to Home Depot, look around. See where things are made.

Made in China exceeds made in US 3:1, at least. Try Walmart's, too.

----------------------------------------------------------------------------------------------------------------------------

How Much of A Threat Is China?

In many ways, we in the US are fortunate that it is China that has become so powerful.

Except for

Tibet, China does not have a history of

imperialism or attacking its neighbors since the militaristic Manchu or

Qing Dynasty of

the 17th century. Its rulers then were not ethnically Han Chinese but Manchu.

(See http://en.wikipedia.org/wiki/Chinese_imperialism

)

Flag - 1890-1912. Flag - 1890-1912.  Chinese Flag Now.

Chinese Flag Now.

China is ruled by an aging Communist (mostly in name) oligarchy, who are more interested

in economic

development than ideological crusades. They are

often ruthless with internal opponents, but they also practical

and patient, believing history is on their

side. Those in the West who paint China as an inevitable opponent in

the competition for secure natural resources,

most notably oil, tell us that China is just biding its time before

it can use manipulation of its currency to

create financial panic and havoc in the United States.

Love

Love  Peace Peace

(Better learn Chinese - http://www.chinapage.com/learnchinese.html

)

|

The Great Wall of China was built over 2,000 years ago, by Qin Shi

Huangdi,

the first emperor of China during the Qin (Ch'in) Dynasty (221 B.C - 206 B.C.).

After subjugating and uniting China from seven Warring States, the emperor

connected and extended four old fortification walls along the north of China that

originated about 700 B.C. (over 2500 years ago). Armies were stationed along

the wall as a first line of defense against the invading nomadic Hsiung Nu tribes

north of China (the Huns).

Signal fires from the Wall provided early warning of an

attack....During the Ming Dynasty (1368-1644), the Great Wall was enlarged to 6,400

kilometers (4,000 miles) and renovated over a 200 year period, with watch-towers

and cannons added. |

|

A Dollar Free-Fall Is Surely Coming

>>>> Clinton's last budget had a

$250 billion dollar surplus.

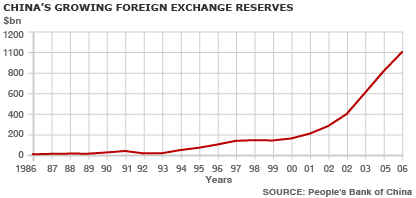

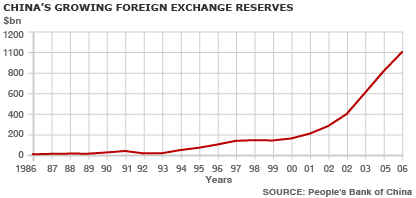

>>>> China's trade surplus

jumped almost 60 percent in July, widening to $23.1 billion

from $14.6 billion a year earlier.

>>>> China has 70% of its trillion dollar

foreign exchange reserves in low yielding US

fixed income securities, whose value has steadily declined as the dollar buys less and

less.

>>>> The cost of Bush's war on Iraq will

surely be far more than a trillion dollars when

all the bills come in.

>>>> The US federal government now

owes $2.2 trillion to foreigners and foreign nations.

US Pressures on China

China, unlike Europe and the rest of the Western world, has refused to let the dollar fall

freely against its

currency. Instead, the Chinese leaders have decided

to keep the yuan’s value pegged closely to the dollar,

allowing it to rise by only 9 percent over the past

two years. Many US Congressmen say that American

businesses would be more competitive globally if the

dollar’s international value depreciated. The US Treasury

claims the yaun is 40% under-value and that the

Chinese leadership must soon lift it vis-a-vis the dollar.

True,

a cheaper dollar would make American exports relatively less expensive. America

should

be able to sell more goods to its trade partners, and

the trade deficit should diminish. This view does not

seem to understand how much of the industrial base of the

US has already been lost overseas. It would

surely take 15 years to rebuild an industrial base here, if

there was the political will, which there is not

presently. The Bush Administration is too busy

wasting money a world away. A much reduced dollar

that would mean dramatically higher prices in the US.

It would mean the US would have to borrow at much

higher interest rates and send that much more American

wealth to foreigners. President Franklin Roosevelt

once stated that America did not need to worry about debt because

it was owed to Americans. Those days

are now a distant memory.

As America becomes more

and more projectionist vis-a-vis China, it may soon unleash a global backlash.

No longer the dominant creditor nation, it is now the

world's largest debtor nation. The US federal

government owes $2.2 trillion to foreigners and

foreign nations.

What if China Dumped Its US Treasury Notes and Bonds?

What if It imply Stopped Buying Them?

"In a Wednesday opinion piece in the state-run China Daily, a Chinese government researcher made

what sounded like a warning to U.S. policymakers not to get

too tough in insisting the yuan should appreciate.

The researcher, He Fan, noted that China

has accumulated "a large sum of U.S. dollars" and that its holdings

contribute "a great deal to maintaining the position

of the U.S. dollar as an international currency." If the yuan's

exchange-rate against the dollar does not remain stable, he

said, China could be forced to take strong action.

China has $1.33 trillion in foreign-exchange reserves, with

$407 billion in U.S. Treasuries, the second-largest

holder after Japan.

A substantial sell-off of the reserves could spark a recession in the U.S. economy, which

is

already experiencing a housing slump, financial analysts

said.... He's statements were an apparent response

to the Senate Finance Committee, which last month approved legislation aimed at

pressing for faster

appreciation of the yuan." (Source: August 9th - Washington Post Krissah Williams )

But China Is Hooked on American Exports, too.

China

would hurt itself if it dumped its US securities. After Japan, China is America's biggest

lenders.

Dumping US securities would cause a panic in a key asset it owns.

And if it stopped lending money to the

US, it would devastate its own growing economy. Their

economy is heavily dependent on US exports.

81% of the Chinese Gross National Product goes into foreign

trade.

The Mere Threat of Dumping May Cause The Dollar To Fall

Sharply

Fear,

itself, drops the dollar. The mere fear that any country, and it might be China,

Japan, Korea

or an OPEC country would no longer take any more dollars or US debt may

cause other foreign holders

to get out of dollars.or sell US Treasury securities and US stocks.

Consequences of A Refusal To Accept Dollars Will Be Very

Inflationary

The US Treasury would then

have to print a lot more money or raise interest rates to attract

foreigners into financing the ever-growing, on-going debt.

Prices for US consumers will rise dramatically.

Since the US has lost so much of its industrial base to

China and elsewhere, stores in the US will still

have to stock their shelves with things made overseas, but

which now cost a lot more. With less

buying power and less money to invest, the US stock market

will surely decline. That would almost

certainly bring a global recession/depression, economic

nationalism, tariffs, quotas and, probably, war,

in all its futility. When the US was forced to go off

the last vestiges of the Gold Standard in the early 1970s,

to help pay for the US war in Viet Nam, it led to

violent ups and downs of the stock market until 1982.

A Dollar Collapse Could Bring Hyper-Inflation to the US.

Here inflation

becomes "A vicious circle is created in which more and

more inflation is created with each

iteration of the cycle. Although there is a great deal of debate

about the root causes of hyperinflation, it becomes

visible when there is an unchecked increase in the money supply or

drastic debasement of coinage, and is often

associated with wars (or their aftermath), economic

depressions, and political or social upheavals. This has most

often occurred because of excessive money printing. It

effectively wipes out the purchasing power of private and

public savings, distorts the economy in favor of extreme

consumption and hoarding of real assets, causes the

monetary base whether specie or hard currency to

flee the country, and makes the afflicted area anathema to

investment. The aftermath of hyperinflation is equally

complex. As hyperinflation has always been a traumatic

experience for the area which suffers it, the next policy regime

almost always enacts policies to prevent its recurrence.

The 1920s German inflation

Before

World War I Germany was a prosperous country, with a gold-backed currency, expanding

industry,

and world leadership in optics, chemicals, and machinery. The German

Mark, the British shilling, the French franc,

and the Italian lira all had about equal value, and all were exchanged

four or five to the dollar. That was in 1914. In

1923, at the most fevered moment of the German hyperinflation, the

exchange rate between the dollar and the Mark

was one trillion Marks to one dollar, and a wheelbarrow full of money

would not even buy a newspaper.

(Source: http://www.pbs.org/wgbh/commandingheights/shared/minitext/ess_germanhyperinflation.html

)

Germany abandoned the

gold backing of its currency in 1914. The war was expected to be short, so it was

financed by government borrowing, not by savings and taxation. In

Germany prices doubled between 1914 and

1919. Bourgeois habits were very strong. Ordinary citizens worked

at their jobs, sent their children to school

and worried about their grades, maneuvered for promotions and

rejoiced when they got them, and generally expected

things to get better. But the prices that had doubled from 1914

to 1919 doubled again during just five months in

1922. Milk went from 7 Marks per liter to 16; beer from 5.6 to 18.

There were complaints about the high cost of

living. Professors and civil servants complained of getting

squeezed. Factory workers pressed for wage increases.

An underground economy developed, aided by a desire to beat the

tax collector.

On June 24, 1922,

right-wing fanatics assassinated Walter Rathenau, the moderate, able foreign minister.

Rathenau was a charismatic figure, and the idea that a popular,

wealthy, and glamorous government minister could be

shot in a law-abiding society shattered the faith of the Germans,

who wanted to believe that things were going to be all

right. Rathenau's state funeral was a national trauma. The

nervous citizens of the Ruhr were already getting their money

out of the currency and into real goods -- diamonds, works of art, safe

real estate. Now ordinary Germans began

to get out of Marks and into real goods.

It is sometimes

argued that Germany had to inflate its currency to pay the war reparations required under

the Treaty of Versailles, but this is only part of the story.

Reparations accounted for about one third of the

German deficit from 1920 to 1923. Nonetheless, the government

found reparations a convenient scapegoat.

Other scapegoats included Jewish bankers and foreign speculators became

popular political targets. The inflation

reached its peak by November 1923, but ended when a new currency (the Rentenmark)

was introduced.

The government stated this new currency had a fixed value, and this was

accepted. Hyperinflation did not directly

bring about the Nazi takeover of Germany; the inflation ended with the introduction of

the Rentenmark and the

Weimar Republic continued for a decade afterward. The inflation did,

however, raise doubts about the

competence of liberal institutions, especially amongst a middle class, many of

whom lost their all their savings.

Nothing makes me think America would be not be a ripe ground for

fascism if this happened.

(See http://en.wikipedia.org/wiki/Hyperinflation#Root_causes_of_hyperinflation

)

Additional Sources:

http://www.oftwominds.com/blogjuly06/hot-airdragon.html

http://www.financialsense.com/fsu/editorials/dorsch/2006/1129.html

)

http://johnibii.wordpress.com/2007/07/25/to-the-us-treasury-secretary-china-is-your-worst-nightmare-sir/

|

Flag - 1890-1912.

Flag - 1890-1912.  Chinese Flag Now.

Chinese Flag Now. Love

Love  Peace

Peace