1999 - Euro

In this year, trading simple crossovers of the

21-day and 50-day ma would not have

been profitable. Instead, look for:

(1) Divergences between price and the Accumulation Index. A new low is

clearly made

and the Accumulation Index is positive. (July)

(2) Upside cross-overs of these moving averages confirmed by a very positive

Accumulation Index. (July)

(3) Take profits at resistance of earlier highs that occurred before long price

downtrend

break. Bottoms take months to form. (August)

(4) Go short on penetration of 50-day ma with Accumulation Index negative.

September would have meant a whip-saw loss. November worked out well.

(5) Objective for short sale is previous low. (November).

1999-2000 - EURO

|

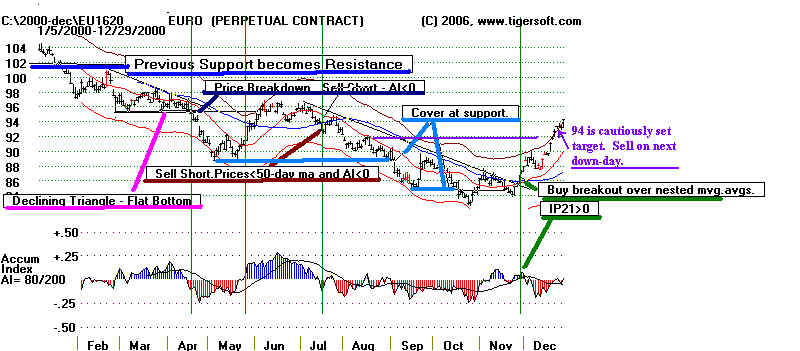

2000 - Euro

6.) Use recoveries back to the falling blue 50-day

ma, to sell short if the TigerSoft

Accumulation Index is negative. (February)

7.) Go short on breakdown below flat support when rallies

fail at lower and lower levels

with negative TigerSoft Accumulation index. (April)

8.) Cover short sales on rally back above 21-day ma.

(May)

9.) Consider upside potential before buying on penetration

of 50-day ma with Tiger Accumulation

Index is positive. The flat bottomed price pattern breakdown in April at 95 set up

that level as

resistance. The rule is that previous failed support becomes resistance on the next

rally to that

level.

4.) Go short

on penetration of 50-day ma with Accumulation Index negative. (July)

5.) Objective for short sale is previous low. (August).

6.) Use recoveries back to the falling blue 50-day ma, to

sell short if the TigerSoft

Accumulation Index is negative. (September)

5.) Objective for short sale is previous low. (October)

10.) Buy on close above nested mvg.avgs. and breakout above

downtrendline if TigerSoft

Accumulation Index is positive.

3) Take profits at resistance of earlier highs that

occurred before long price downtrend

break. Bottoms take months to form. (December)

11.) After a trend-break in price, set a conservtive

goal based based on recent highs. 92 was a

conservative goal here. One might have waited for the first down-day after 92 was

achieved and

then taken profits.

2000-2001 - EURO

|

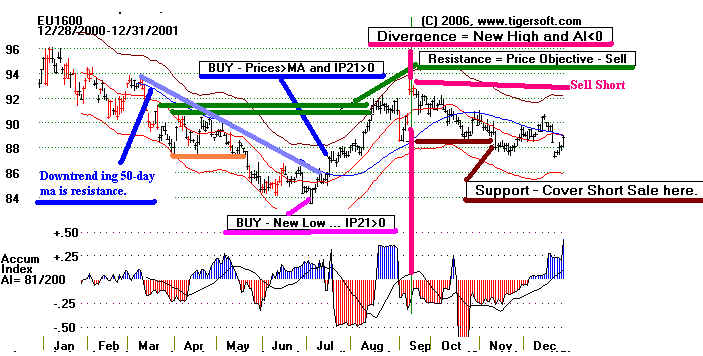

2001 - Euro

Respect the downtrend shown by the declining blue 50-day ma. The Tiger Accumulation

Index

was not red enough at this time to go short unless one were to be very aggressive and

work

with much more modest objectives. The same applies to the breakdown below 87.

(1) Divergences between price and the Accumulation Index.

A new low is clearly made

and

the Accumulation Index is positive. (June)

(3, 11) Take profits at resistance of earlier highs that

occurred before long price downtrend

break. 90.5 is target. Best to

wait for the next down day after price objective is reached.

12.) Sell short on negative non-confirmation by Tiger Accumulation Index of new high.

(September)

(4) Go short on penetration of 50-day ma with

Accumulation Index negative. (October)

(5.) Objective for short sale is previous low. (October)

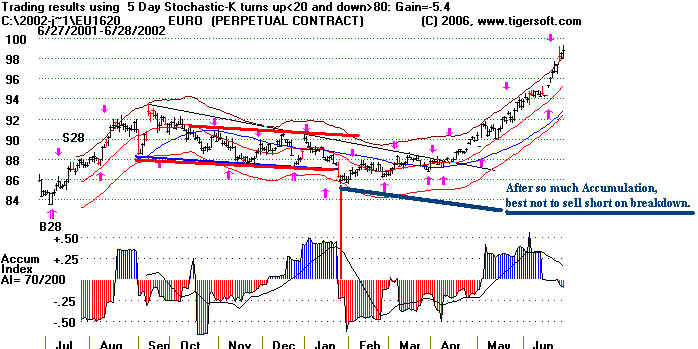

2001-2002 - EURO

|

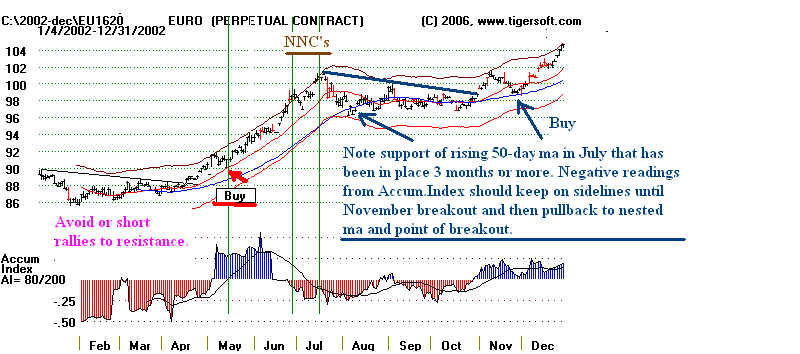

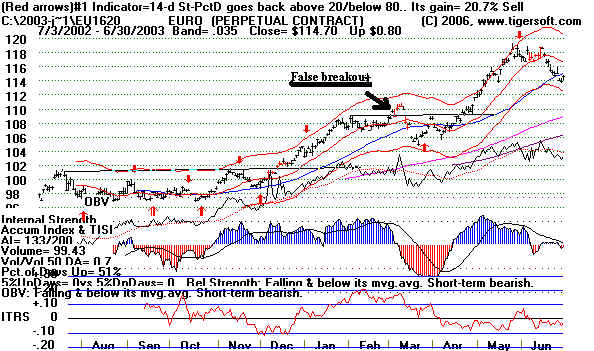

2002 - Euro

2002-2003 - EURO

|

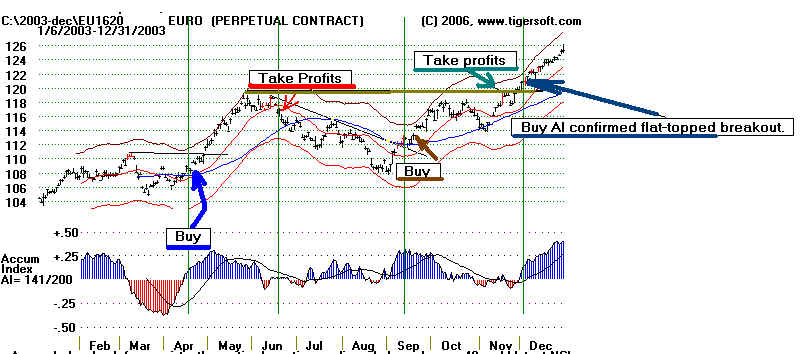

2003 - Euro

2003-2004 - EURO |

2004 - Euro

All this Blue Accumulation should tell you to buy breakouts and even

tests of support.

Use the recent highs as price objectives.

If they are exceeded, you shoud usually retake

the position.

2004-2005 - EURO see above and

below. |

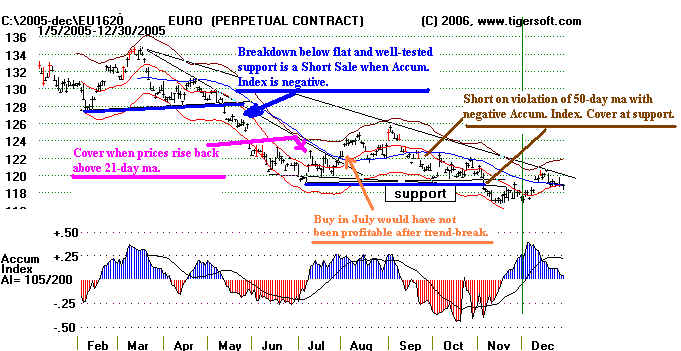

2005 - Euro

2005-2006 - EURO

When you see a pattern of steadily positive (Blue) Tiger Accumulation,

look for

buying

opportunities. Breakouts over moving averages and trendlines will work.

So

will pullbacks to points of breakout (in December).

Use

the optimized red Buy signals, too in this context to take positions.

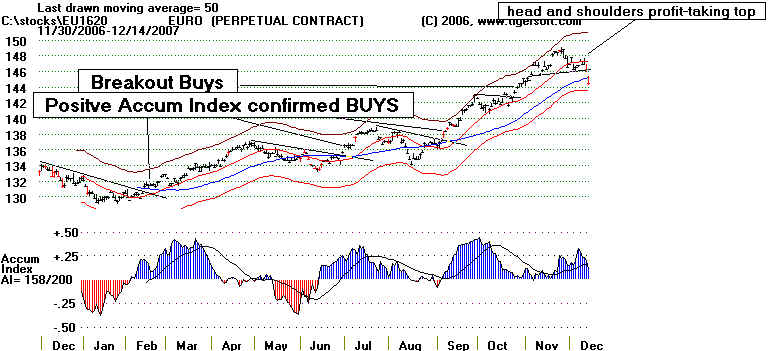

2006 - Euro

Buy on Breakouts confirmed by the Tiger Accumulation Index.

Where there is much blue

Accumulation, buy on

tests of the lows, if you are aggressive and wiling to quickly get out of

the positions if that

support fails.

2006-2007 - EURO |

2007 - Euro |

Buying on breakouts confirmed by positive readings from the Tiger

Accumulation

Index

were great places to Buy in 2006-2007.

The

head and shoulders pattern which was completed in December looks bearish.

But

it was not confirmed by the Tiger Accumulation Index being negative.

|

|