Madison's Timely Warning,

"Of all the enemies to public liberty war is, perhaps, the most to be dreaded

because it comprises and develops the germ of every other. War is the parent of armies;

from these proceed debts and taxes...known instruments for bringing the many under the

domination of the few…No nation could preserve its freedom in the midst of continual

warfare."

-- James Madison, Political Observations, 1795

===================================================================================

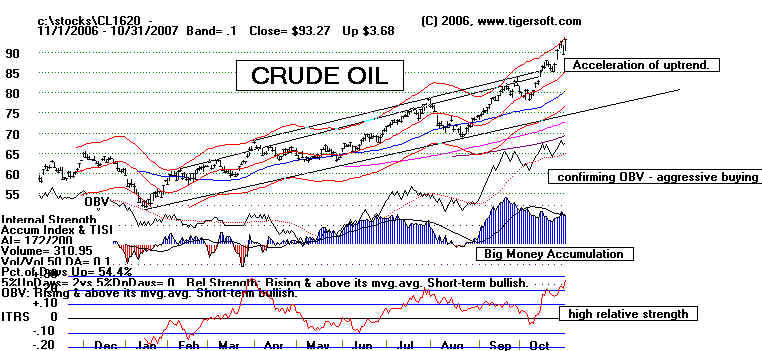

Petrodollar

Vicious Circle

As the US Dollar goes down in price, OPEC which sells all oil only in US Dollars,

naturally raises

its price. This increases the US Trade deficit. And the Dollar goes down still

more. So, OPEC raises

the price of oil some more. Eventually, oil prices will rise to a point where they

slow down demand for

oil, but bef before that point is reached, the stock market will turn down.

===================================================================================

Lowering US Interest

Rates Invites A Run on The

Dollar...

Will OPEC, CHINA and JAPAN Keep Accepting US Dollars?

What The Media Isn't Saying...

This is a continuation of my Blogs 7/12/2007,

7/23/2007 10/28/2007

Yes, the Dollar is going down much more. Its fate is sealed by Bush's 2 trillion

dollar blunder,

the Iraq occupation. As I see it, the US will bleed billions and billions more

dollars in its wasteful war of

occupation of Iraq, because Bush is a certifiable sadist with an absolute inability to

admit a mistake and

the Democrats in Congress are playing it safe politically. They know they will win big in

2008, as long

as they stay just to the left of Bush. Not voting appropriations for Bush's is too much of

a risk for them.

Of course, the dollar is weak for other reasons, too. The magnitude of the US trade

deficit is quite

beyond normal powers of comprehension. Much of the world now sees that the US as an Empire

in decline, whose currency is pegged artificially high because most big Central banks

don't want to rock

their financial boats. But not all of them. Russia, France, Iran and Venezuela would love

to force Bush to

stop his aggressive blustering. They see in the dollar's extreme weakness a way to

do just that. And

then there are the OPEC countries. Their purchasing power is eroded by the deal they

struck 30 years

ago with the US, that forces them to only take US dollars in exchange for their oil.

They want out.

They have their own economies. They do not want the monetary policy of the US

foisted upon them,

as pegging their currency to the dollar tends to do. And now there is a currency

alternative. The

Euro is becoming big enough so that it can be used, instead of the US Dollar.

So, we now have a game being played where each player will pretend it is loyal to the

dollar, but

each player is watching the others from the corner of his eyes, knowing they are all

tempted to dump

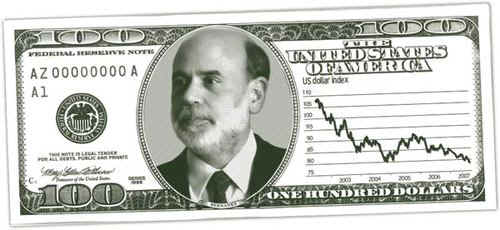

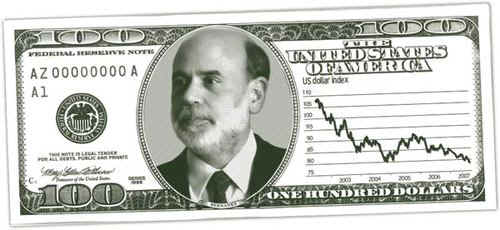

dollars before it is too late. Add to that equation, 'Hellicopter' Ben

Bernacke's cut in interest rates. This

is a man who thinks it was bad monetary policy that made the Great Depression, who plainly

fawns for Wall Street praise and wants to delay a stock market crash until after the 2008

elections, so

that a Democrat will be seen as responsible. Yes,

I'm afraid the Dollar's fate is sealed. Its collapse

must be honestly and calmly faced without blinkers, blinders or partisian prejudice if we

are

to profit from it. My Blog will tell the real story, not the homogenized version the

networks

offer. To see the story unfold, come back

often to http://www.tigersoft.com/Tiger-Blogs/index.htm

The only question is will there be a swift,

terrible panic or will the decline continue to be

gradual and steady. When the chief economist at the International Monetary Fund

warns

|

about a possible "run on the dollar", as he did in January 2006, we should take

note. With

the dollar in a state of accelerating decline, we should be alarmed.

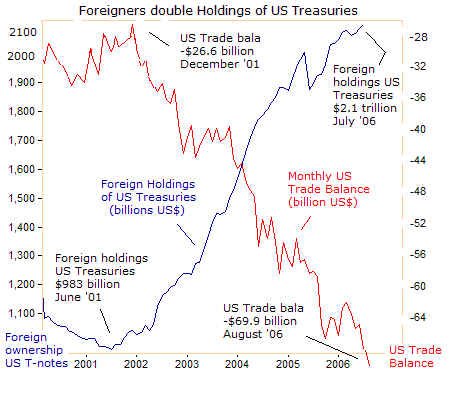

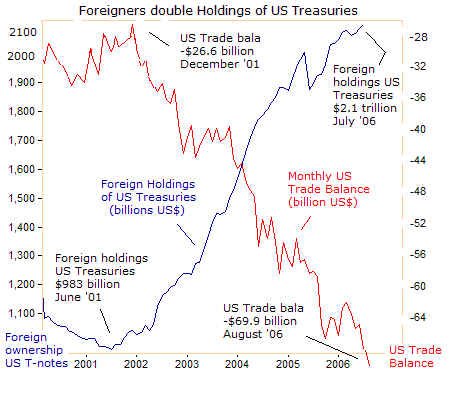

We all know the US has a massive governemental debt and an equally massive trade deficit.

These have signicantly worsened since 2000, when VP Cheney, whose nearly every public

utterance is discovered to be untrue, told us that "Deficits don't matter."

And we all know

the Chinese own more than half of the US governmental debt. In exchange for buying

our

US Treasuries, they get to dominate much of the US import market. They have a

tiger by the

tail. They dare not stop buying US Treasury notes or the whole Dollar house of

cards may come

down, and their massive holdings in US dollar debt will be halved in value, as the dollar

collapses

and their export economy screeches to a halt.

What is not widely known is that the dollar has been riding high for years because all oil

purchases made from OPEC nations must be made in US dollars. Back in 1975, when

Saudi Arabia needed to buy US military hardware and protection, it got the other OPEC

nations to accept an unpublicized US demand that all future oil purchases from OPEC must

be made in US dollars. This was monumnetal. It meant that every country that

wanted

to buy OPEC oil had to have large reserves of US dollars. It also meant that OPEC

nations

took their dollars and put many of them to buying US Treasury debt. 70% of all

international

trade was in dollars. US bankers loved this dynamic.

US Petrodollar exclusivity remained.unchallenged until

November 2000. "So long as the

dollar was the strongest currency, there was little reason to as well. But November was

when

French and other Euroland members finally convinced Saddam

Hussein to defy the United States

by selling Iraq’s oil-for-food not in dollars, ‘the enemy currency’

as Iraq named it, but only

in euros. The euros were (placed) on deposit in a special UN account of

the leading French bank,

BNP Paribas. Radio Liberty of the U.S. State Department ran a short wire on the news and

the

story was quickly hushed...

"This little-noted Iraq move to defy the dollar

in favor of the euro, in itself, was insignificant. Yet, if it

were to spread, especially at a point the dollar was already weakening, it could create a

panic selloff of dollars by foreign central banks and OPEC oil producers... (Additional)

hints in this direction were heard from Russia, Iran, Indonesia and even Venezuela. An

Iranian OPEC

official, Javad Yarjani, delivered a detailed analysis of how OPEC at some future point

might sell its oil

to the EU for euros not dollars. He spoke in April, 2002 in Oviedo Spain at the invitation

of the EU.

All indications are

that the Iraq war was seized on as the easiest way to deliver a deadly

pre-emptive warning to OPEC and

others, not to flirt with abandoning the Petro-dollar system

in favor of one based on the euro." (Source: http://www.williambowles.info/guests/euro_dollar.html

_ )

By June 2003, all Iraqi international oil

sales were once again denominated in US Dollars, not Euros.

This has adversely impacted Iraq revenue, as the Euro has proven much stronger than the

Dollar..

(Source: http://www.informationclearinghouse.info/article9698.htm

)

Iran's Oil Bourse and US Planning for An Attack on Iran.

There has been a complete

absence of coverage of the following information in the

US national media.

"Beginning in March 2006, the Tehran government has plans to begin competing with

New York's NYMEX and London's IPE with respect to international oil trades – using a

euro-based international oil-trading mechanism.[7] The proposed Iranian oil bourse

signifies

that without some sort of US intervention, the euro is going to establish a firm foothold

in the

international oil trade. Given U.S. debt levels and the stated neoconservative project of

U.S. global domination, Tehran's objective constitutes an obvious encroachment on

dollar supremacy in the crucial international oil market...

"From a purely

economic and monetary perspective, a petroeuro system is a logical

development given that the European Union imports more oil from OPEC producers than

does the U.S., and the E.U. accounted for 45% of exports sold to the Middle East.

"Vice President Dick

Cheney's office wants the Pentagon to be prepared to launch a

potential tactical nuclear attack on Iran – even if the Iranian government was not

involved

with any such terrorist attack against the U.S.".

Why? World hegemony? Unwillingness to face the dislocations and changes brought

about by the sharp decline in Petrodollars: new taxation will be needed of the wealthy,

new energy policies and conservation will be needed and new trade policies will be

needed...

(Sources: http://www.williambowles.info/guests/euro_dollar.html

_

http://www.informationclearinghouse.info/article9698.htm

http://www.tacomapjh.org/petrodollartheories.htm

)

A Rogue Seller Could Precipate An Avalanche of Dollar

Selling.

Foreign central bankers dominate currency trading. They appreciate the need

fragility

of trust when it comes to their own currencies. They want their country to keep

exporting

to the US market. This tends to lead them purchasing more dollar debt. However, they

must fear big speculators shorting the dollar or a "rogue" central bank (like

Russia or France)

trying to gett out of dollar assets ahead of others. With

the US Treasury virtually inviting

some defections among central bankers by lowering interest rates, some Central Bankers

are getting nervous. They are looking around at each other and wondering if the

others

can be trusted not to sell Dollars. If not,

they do not want to left holding a bag of depreciated

US Dollars. They can't talk publicly much about these concerns for fear of making

things

worse. But this is what they are thinking.

Dollar's double blow from Vietnam and Qatar

"Vietnam is planning to cut its purchases of US Treasuries and other dollar bonds,

raising fears

that Asian central banks with control over two thirds of the world's foreign reserves may

soon join

the flight from US assets. Vietnam is planning to cut its purchases of US

Treasuries and other dollar

bonds, raising fears that Asian central banks with control over two thirds of the world's

foreign

reserves may soon join the flight from US assets. Vietnam, which has mid-sized

reserves of $40bn,

iis seen as weather vane for the bigger Asian powers. Together they hold

$3,575bn of foreign

reserves, over 65pc of the world's total. China leads with $1,340bn, but South

Korea, Taiwan,

Singapore, and even Thailand all built up massive holdings. Separately, the gas-rich Gulf

state of Qatar

announced that it had cut the dollar holdings of its $50bn sovereign wealth fund

from 99pc to 40pc,

switching into investments in China, Japan, and emerging Asia."

(Source: October 4, 1907: http://sufiy.blogspot.com/2007/10/end-of-us-dollar-as-reserve-currency-of.html

)

Reuters reported, October 29, 2007

that OPEC will discuss the prospect of switching to

pricing its oil in US dollars to pricing in a basket of currencies. The

suggestion came from

Venezuela's energy minister, and Venezuela has been considered one of America's George

Bush's enemies.

But it's not just America's enemies who are concerned about the US dollar steep decline.

Inflation in

Saudi Arabia and the Gulf states is running rampant, and now the US is looking at lowering

its interest rate

yet again. Most Gulf states have their currencies pegged to the US dollar, which in turn

implies interest

rates must move accordingly as well. But the Gulf states should be putting up their rates,

not lowering them.

Reuters reports regional finance ministers and central bankers have met to review their

intentions to

create a monetary union and a single currency by 2010. The problem is some in the region

are unsure

how now to proceed given the impact a sliding US dollar is having on currency pegs. Each

country

has its own economic situation.

(Source: http://www.fnarena.com/index2.cfm?type=dsp_newsitem&n=E92D539F-17A4-1130-F5904C1416839340

)

Saudi Arabia "usually mimics every FOMC move. This time it has refused to cut

interest rates

in lockstep with the US Federal Reserve for the first time. According to

a UK Telegraph article

(Fears

of dollar collapse as Saudis take

fright, September 2007), is signalling that the oil-rich

Gulf kingdom is preparing to break the dollar currency peg. This

could potentially cause a cascading

chain reaction across the Middle East -- setting off a stampede out of the dollar and towards either

a

basket of currency, or more likely the Euro.

(Source: http://bigpicture.typepad.com/comments/2007/09/fears-of-dollar.html

_

An excellent way to stay in touch with the news that affects the US Dollar

is to visit:

http://www.dollarcollapse.com/contactus/contact_confirmation.asp

==================================================================================

For your Information:

"US economy's net foreign indebtedness--the accumulation of two decades of running

larger and larger trade deficits--will reach nearly 25 percent of US GDP this year, or

roughly $2.5 trillion. Fifteen years ago, it was zero. Before America's net balance of

foreign assets turned negative, in 1988, the United States was a creditor nation itself,

investing and lending vast capital to others, always more than it borrowed. Now the trend

line looks most alarming. If the deficits persist around the current level of $400 billion

a year or grow larger, the total US indebtedness should

reach $3.5 trillion in three years

or so. Within a decade, it would total 50 percent of GDP."

http://www.gold-eagle.com/editorials_05/dorsch102506.html

Take Our Dollars, or Else!

Washington is of course aware of these problems, and believes that overwhelming military

strength

and the will to use it supply the answer, persuading or forcing other countries to support

the dollar

at its artificial level as the key to their own security. In an article entitled

"Asia: the Military-Market Link,"

and published by the U.S. Naval Institute in January 2002, Professor Thomas Barnett of the

US Naval

War College, wrote: "We trade little pieces of paper (our currency, in the form of a

trade deficit) for

Asia's amazing array of products and services. We are smart enough to know this is a

patently unfair

deal unless we offer something of great value along with those little pieces of paper.

That product is a

strong US Pacific Fleet, which squares the transaction nicely."

Consequenes of A Dollar Collapse:

Think of Weimar Germany. Think of Argentina.

"So what happens if OPEC as a group decides to follow Iraq's

lead and suddenly begins trading oil

on the euro standard? Economic meltdown. Oil-consuming nations would have to flush dollars

out of their

central bank reserves and replace them with euros. The dollar would crash in value and the

consequences

would be those one could expect from any currency collapse and massive inflation (think of

Argentina for an

easy example) |