Check current Oil Prices

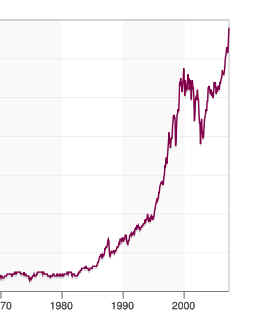

Oil Prices and The Stock Market: 1970-2006

Will US Attack Iran?

At the start of Bush's decision to have the US attack Iraq, light crude was priced under

$25/bar.

It has now

nearly tripled. The new British Prime Minister, Gordon Brown, recently declined to

reject outright

military

action against Iran. Prospects of such an attack would almost certainly cause oil

futures to

go through

the roof. Is such an attack likely? Investors will want to read what I have

quickly gathered

on the

internet and then do their own research, Watching crude oil futures will likely give

investors a better

way to see

this coming than listening to Bush or Brown.

It is said that rising oil prices act like a tax on consumers.

Money spent by consumers on oil

is

not spent on other goods and services. So, profits and sales in many other businesses are

squeezed..

Far

too simple, this overlooks the additional buying power that oil companies and their

employees may

have

and use. I see this each time I get an order from someone in Texas.

A bigger danger is that oil producing countries may stop accepting dollars for payment,

because

the

dollar becomes too weak. Iran announced this April that they would accept only Euros

or Yen. The US

has a

current net -$862,300,000,000.00

in its

international trades of goods and services. When OPEC

was

formed, all the OPEC countries agreed that they would only sell oil for dollars and dollar

denominated securities. In other words, if you wanted to buy oil from an OPEC country, you

had to

buy

dollars first. This created a ready demand for dollars. And OPEC countries

tended to invest

much

of the "petro dollar wealth" back in the US. The run-up in oil prices

since 2002 thus actually

boosted the US stock market and its economy. If OPEC changed their rules and allowed

other

countries to buy in another currency, it would mean far higher interest rates and

hyper-inflation in the US.

Read William

Clark's Petroldollar Warfare.

"It is now obvious the invasion of Iraq had less to do with any threat from Saddam's

long-gone

WMD

program and certainly less to do to do with fighting International terrorism than it has

to do with

gaining strategic control over Iraq's hydrocarbon reserves and, in doing so, maintain the

U.S. dollar as

the

monopoly currency for the critical international oil market. Throughout 2004, information

provided

by

former administration insiders revealed the Bush/Cheney administration entered into office

with the

intention of toppling Saddam Hussein.....

"Candidly stated, "Operation Iraqi Freedom" was a war designed to install a

pro-U.S. government

in

Iraq, establish multiple U.S military bases before the onset of global Peak Oil, and to

reconvert Iraq

back

to petrodollars while hoping to thwart further OPEC momentum towards the euro as an

alternative

oil

transaction currency. [ However, subsequent geopolitical events have exposed

neoconservative

strategy as fundamentally flawed, with Iran moving towards a petroeuro system for

international oil

trades, while Russia evaluates this option with the European Union."

(Source: http://www.energybulletin.net/7707.html

)

War with Iran

An attack on Iran is by, no means, unlikely. Pentagon war planning has started.

Administration

planning seeks to a regime change in Iran by covert means. Seymour Hersch wrote in

2005 in the New

Yorker:

"In my interviews [with former high-level intelligence officials], I was repeatedly

told that the

next strategic target was Iran. Everyone is saying, "You can't be serious about

targeting Iran.

Look at Iraq," the former [CIA] intelligence official told me. But the [Bush

administration officials]

say, "We've got some lessons learned , not militarily, but how we did it politically.

We're not

going to rely on agency pissants? No loose ends, and that?s why the C.I.A. is out of

there."

An article in The American Conservative by intelligence analyst

Philip Giraldi should be read.

"In Case of Emergency, Nuke Iran," suggested the resurrection of active U.S.

military planning against

Iran" but with the shocking disclosure that in the event of another 9/11-type

terrorist attack on U.S. soil,

Vice President Dick Cheney?s office wants the Pentagon to be prepared to launch a

potential tactical

nuclear attack on Iran ? even if the Iranian government was not involved with any such

terrorist attack

against the U.S.: (Source: http://www.energybulletin.net/7707.html

)

Cheney

pushes Bush to act on Iran Cheney

pushes Bush to act on Iran

"Military solution back in favour as Rice loses out

President not prepared to leave conflict unresolved."

Ewen MacAskill in Washington and

Julian Borger

Guardian (UK) Monday July 16, 2007

"The balance in the internal White House debate over

Iran has shifted back in favour of military

action before President George Bush leaves office in 18 months, the Guardian has learned.

The shift follows an internal review involving the White House, the Pentagon and the state

department

over the last month. Although the Bush administration is in deep trouble over Iraq, it

remains focused

on Iran. A well-placed source in Washington said: "Bush is not going to leave office

with Iran still in limbo...

"Almost half of the US's 277 warships are stationed close to Iran, including

two aircraft carrier groups.

The aircraft carrier USS Enterprise left Virginia last week for the Gulf. A Pentagon

spokesman said

it was to replace the USS Nimitz and there would be no overlap that would mean three

carriers in

Gulf at the same time."

...............................................................................................................................................

Crude Oil: 2002-2007

The current yearly chart of crude oil (using the perpetual contract data from Dial Data)

shows

an inverted head

and shoulders pattern. The height of the pattern before prices broke past

the pattern's

neckline in June was 15 points, measuring from the January low at 51 straight up

to the neckline

there mat 66. Prices broke out above the neckline at 70; so, if we add 15 to 70

we get $85.

This is the classic way technicans set minimum price objectives. See Edwards

and Magee,

Technical

Analysis of Stock Trends.

Probably, the price target is better set conservatively at 83-85. Either way, crude

oil

should rise, at a

minimum another 10% in the months ahead. The surpassing $80 will probably

spook the stock

market. So we should be careful. As crude oil goes up, inflationary numbers

start giving the

Fed more ammunition to raise interest rates. In truth, the Fed is less

concerned about

inflation, per

se, and more concerned with what level of interest rates it must set to get foreigners

to buy bonds

denominated in sagging US dollars. Friday the Euro and the British Pound made 5 year

highs

versus the

dollar. The Japanese yen moved back above its key 50-day mvg, avg,

There are probably many other relationships between crude oil prices and

and the stock market

than I can point out below. But one lesson is that the steep

rise in crude oil, from

$14/bar to $39/bar in a little more than a year after the Iranian

revolution in 1979 set

off inflation and much higher interest rates in the US. Steep runups

in crude oil prices

coincided with bear markets in 1973-1974 and 1990. Between 1979

and 1980 there were two

corrections (mini-crashes) of more than 10% in the DJI and

a full-fledged bear

market from early 1981 to July 1983. The bear market stemmed

directly from very high

interest rates, which were a result of the enormous rise in oil

and other commodities.

The reverse relationship has taken place between March 2003 and

July 2007: oil prices

and stock prices have risen together.

Different Seasonalities.

Whereas the stock market tends to be strongest from November to April, oil prices

tend to peak in

the summer when demand is greatest and when middle-Eastern wars tend

to happen.

Different Countries and Sectors Are Affected Differently.

Source:

http://www.gold-eagle.com/editorials_03/mauldin122203.html

- Asia tends to be more insulated from oil price shocks, than Europe, by a factor of

nearly 2-to-1, with Germany, Switzerland, Italy, Sweden, and the Netherlands being

more vulnerable ... against which Japan, Singapore, and Hong Kong are LESS

vulnerable, stock-market wise.

- The United States is the second MOST 'vulnerable', in terms of the potential negative

influence on the broader stock market, via rising oil prices ... second only to the

Netherlands.

Further, within the dynamic as influences the US stock market, we note the following

conclusions

reached by the report:

- Cyclical Services are MOST negatively influenced when oil prices rise.

- Cyclical Consumer Goods are second most negatively influenced.

- Financials ... third most negatively influenced stock market sector.

DJI - 1970-2006

-----------------------------------------------------------------------------------------------------------------------------

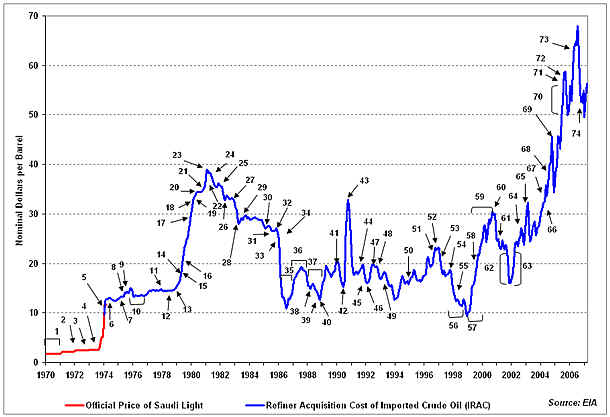

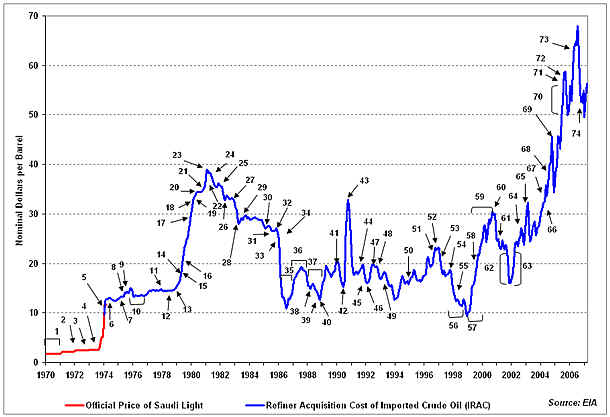

The price data graphed above are in nominal terms, i.e., they are in

"dollars-of-the-day" and have not been adjusted for inflation. Clicking the

picture above will enable you to access oil prices in real terms that are adjusted for inflation. Historical and forecast real

and nominal crude oil and gasoline price information is maintained on a more frequent

basis on the Short Term Energy Outlook Webpage .1. OPEC begins to assert power; raises tax rate & posted

prices

2. OPEC

begins nationalization process; raises prices in response to falling US dollar.

3. Negotiations

for gradual transfer of ownership of western assets in OPEC countries

4. Oil

embargo begins (October 19-20, 1973)

5. OPEC

freezes posted prices; US begins mandatory oil allocation

6. Oil

embargo ends (March 18, 1974)

7. Saudis

increase tax rates and royalties

8. US

crude oil entitlements program begins

9. OPEC

announces 15% revenue increase effective October 1, 1975

10. Official

Saudi Light price held constant for 1976

11. Iranian

oil production hits a 27-year low

12. OPEC

decides on 14.5% price increase for 1979

13. Iranian

revolution; Shah deposed

14. OPEC

raises prices 14.5% on April 1, 1979

15. US

phased price decontrol begins

16. OPEC

raises prices 15%

17. Iran

takes hostages; President Carter halts imports from Iran; Iran cancels US contracts;

Non-OPEC output hits 17.0 million b/d

18. Saudis

raise marker crude price from 19$/bbl to 26$/bbl

19. Windfall

Profits Tax enacted

20. Kuwait,

Iran, and Libya production cuts drop OPEC oil production to 27 million b/d

21. Saudi

Light raised to $28/bbl

22. Saudi

Light raised to $34/bbl

23. First

major fighting in Iran-Iraq War

24. President

Reagan abolishes remaining price and allocation controls

25. Spot

prices dominate official OPEC prices

26. US

boycotts Libyan crude; OPEC plans 18 million b/d output

27. Syria

cuts off Iraqi pipeline

28. Libya

initiates discounts; Non-OPEC output reaches 20 million b/d; OPEC output drops to 15

million b/d

29. OPEC

cuts prices by $5/bbl and agrees to 17.5 million b/d output – January 1983

30. Norway,

United Kingdom, and Nigeria cut prices

31. OPEC

accord cuts Saudi Light price to $28/bbl

32. OPEC

output falls to 13.7 million b/d

33. Saudis

link to spot price and begin to raise output – June 1985

34. OPEC

output reaches 18 million b/d

35. Wide

use of netback pricing

36. Wide

use of fixed prices

37. Wide

use of formula pricing

38. OPEC/Non-OPEC

meeting failure

39. OPEC

production accord; Fulmar/Brent production outages in the North Sea

40. Exxon's

Valdez tanker spills 11 million gallons of crude oil

41. OPEC

raises production ceiling to 19.5 million b/d – June 1989

43. Operation

Desert Storm begins; 17.3 million barrels of SPR crude oil sales is awarded

44. Persian

Gulf war ends

45. Dissolution

of Soviet Union; Last Kuwaiti oil fire is extinguished on November 6, 1991

46. UN

sanctions threatened against Libya

47. Saudi

Arabia agrees to support OPEC price increase

48. OPEC

production reaches 25.3 million b/d, the highest in over a decade

49. Kuwait

boosts production by 560,000 b/d in defiance of OPEC quota

50. Nigerian

oil workers' strike

51. Extremely

cold weather in the US and Europe

52. U.S.

launches cruise missile attacks into southern Iraq following an Iraqi-supported invasion

of Kurdish safe haven areas in northern Iraq.

53. Iraq

begins exporting oil under United Nations Security Council Resolution 986.

54. Prices

rise as Iraq's refusal to allow United Nations weapons inspectors into

"sensitive" sites raises tensions in the oil-rich Middle East.

55. OPEC

raises its production ceiling by 2.5 million barrels per day to 27.5 million barrels per

day. This is the first increase in 4 years.

56. World

oil supply increases by 2.25 million barrels per day in 1997, the largest annual increase

since 1988.

57. Oil

prices continue to plummet as increased production from Iraq coincides with no growth in

Asian oil demand due to the Asian economic crisis and increases in world oil inventories

following two unusually warm winters.

58. OPEC

pledges additional production cuts for the third time since March 1998. Total pledged cuts

amount to about 4.3 million barrels per day.

59. Oil

prices triple between January 1999 and September 2000 due to strong world oil demand, OPEC

oil production cutbacks, and other factors, including weather and low oil stock levels.

60. President

Clinton authorizes the release of 30 million barrels of oil from the Strategic Petroleum

Reserve (SPR) over 30 days to bolster oil supplies, particularly heating oil in the

Northeast.

61. Oil

prices fall due to weak world demand (largely as a result of economic recession in

the United States) and OPEC overproduction.

62. Oil

prices decline sharply following the September 11, 2001 terrorist attacks on the United

States, largely on increased fears of a sharper worldwide economic downturn (and therefore

sharply lower oil demand). Prices then increase on oil production cuts by OPEC and

non-OPEC at the beginning of 2002, plus unrest in the Middle East and the possibility of

renewed conflict with Iraq.

63. OPEC

oil production cuts, unrest in Venezuela, and rising tension in the Middle East contribute

to a significant increase in oil prices between January and June.

64. A

general strike in Venezuela, concern over a possible military conflict in Iraq, and cold

winter weather all contribute to a sharp decline in U.S. oil inventories and cause oil

prices to escalate further at the end of the year.

65. Continued

unrest in Venezuela and oil traders' anticipation of imminent military action in Iraq

causes prices to rise in January and February, 2003.

66. Military

action commences in Iraq on March 19, 2003. Iraqi oil fields are not destroyed as had been

feared. Prices fall.

67. OPEC

delegates agree to lower the cartel’s output ceiling by 1 million barrels per day, to

23.5 million barrels per day, effective April 2004.

68. OPEC

agrees to raise its crude oil production target by 500,000 barrels (2% of current OPEC

production) by August 1—in an effort to moderate high crude oil prices.

69. Hurricane

Ivan causes lasting damage to the energy infrastructure in the Gulf of Mexico and

interrupts oil and natural gas supplies to the United States. U.S. Secretary of Energy

Spencer Abraham agrees to release 1.7 million barrels of oil in the form of a loan from

the Strategic Petroleum Reserve.

70. Continuing

oil supply disruptions in Iraq and Nigeria, as well as strong energy demand, raise prices

during the first and second quarters of 2005.

71. Tropical

Storm Cindy and Hurricanes Dennis, Katrina, and Rita disrupt oil supply in the Gulf of

Mexico.

72. In

response to the hurricanes, the Department of Energy provides emergency loans of 9.8

million barrels and sold 11 million barrels of oil from the SPR.

73. Militant

attacks in Nigeria shut in more than 600,000 barrels per day of oil production beginning

in February 2006.

74. OPEC

members agree to cut the organization’s crude oil output by 1.2 million barrels per

day effective November 1, 2006. In December, the group agrees to cut output by a further

500,000 barrels per day effective February 2007.

Source: http://www.eia.doe.gov/emeu/cabs/AOMC/Overview.html

|

Spme Very Powerful Oil Stocks

.

|

Cheney

pushes Bush to act on Iran

Cheney

pushes Bush to act on Iran