Negative

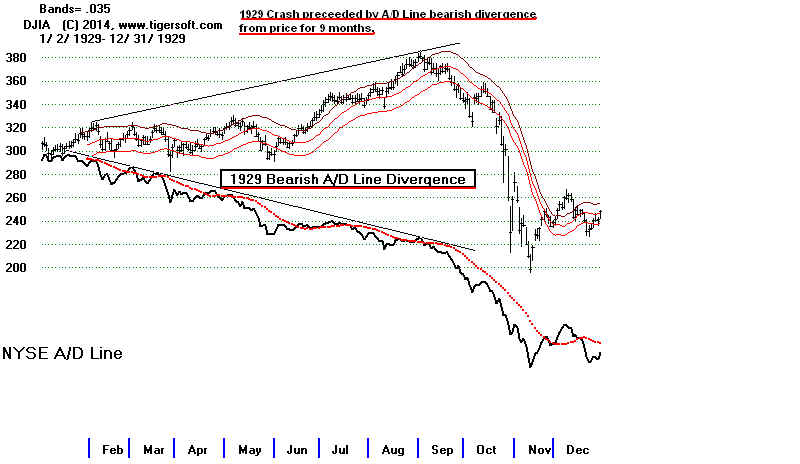

Non-Confirmations at Tops: 1928-2015

Frequency of NNCs at Major Market Tops:

PI<0

1929 1937 1939 1957

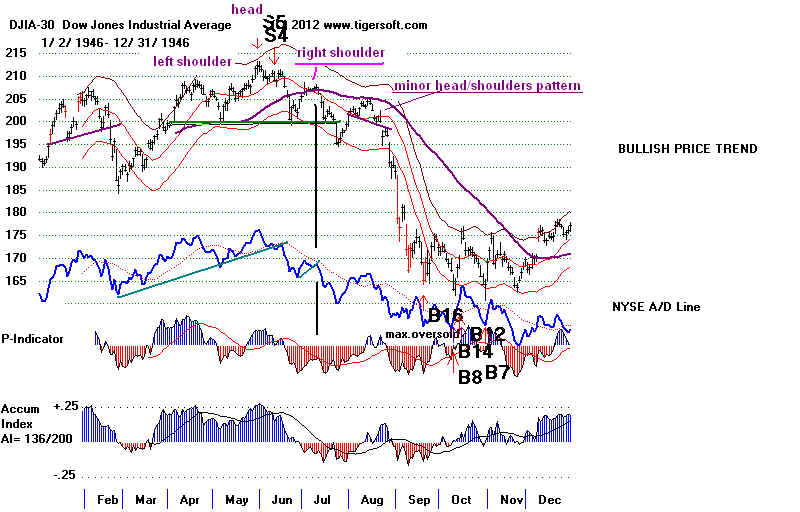

1969 1972 1980

1987 (8)

IP21<.008 1929

1960 1961 1966

1972

1980 1984 1987 (8)

VI<= 0 1929

1937 1939 1957

1960

1969 1972 1980 1981 1984 1987 (11)

OPct<0

1939 1957

PI<0

1990

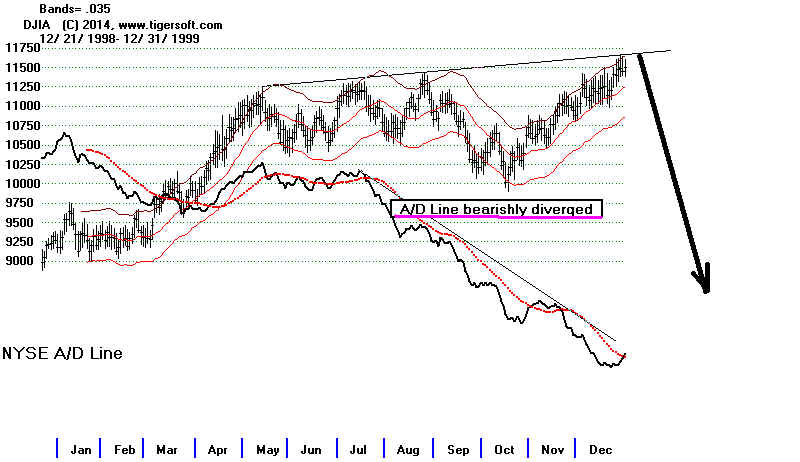

2000 2007

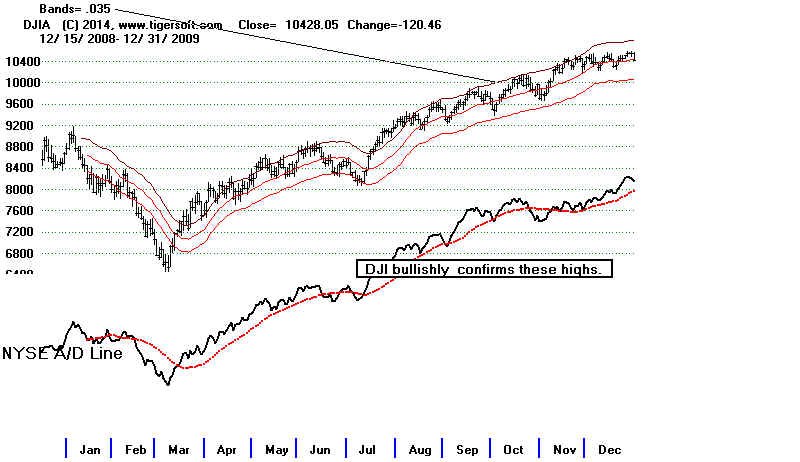

total 11

IP21<.008

1998 2000

total 10

VI<=0

1990

1998 2000 2007

2011 total 16

OPct<0

Tops before DJI Declines of More Than

20%: 1928-2015

(C) 2014 William Schmidt, Ph.D. www.tigersoft.comLength of A/D Resulting Bear Market

Divergence

---------------------------------------------------------------------------------------------------------

1 7

months 1929-1932

9/3/1929-7/8/1932 (35 months) 381.2 to 41.2

9/3/1929-2/27/1933

381.2 to 98.1

Sells at top: Sell S7,S12, S9

4/30/1969: la/ma 1.051, P=

-14, IP21 =-.126, V= -351 Opct= + .146, 65-day

pct ch= .281

---------------------------------------------------------------------------------------------------------

2 6

months 1937-1938 8/13/1937-

3/31/1938 (7 months) 189.3-98.9

Sells at top: Sell S4,S7,S9,S8

8/13/1937: la/ma 1.024, P= --2 , IP21 = .042, V=

-43, Opct=+.279, 65-day pct ch= .099

---------------------------------------------------------------------------------------------------------

3 8 months

1939

11/9/1939 - 4/11/1939 (

months) 158.1- 123.8

No Sell at top:

Later S16 12/30/1939 - 4/11/1939

154.4-123.8

and later still: S12, S3

12/30/1939: la/ma 1.029, P= --4 , IP21 = .046, V= 0, Opct=- .28, 65-day pct ch= .151

----------------------------------------------------------------------------------------------------------

4 8 months

1939-1942

9/12/1939-4/28/1942 (31 months) 155.9-92.9

Sell at top: Sell S9...later S16, S1

9/13/1937: la/ma 1.095, P= -43 , IP21 = .138, V=+56, Opct=+.326, 65-day pct ch= .107

---------------------------------------------------------------------------------------------------------

5 None

1946

5/29/1946-10/9/1946 (5 months) 212.5-163.1

H/S

Sell S5,S4

529/1946: la/ma 1.029, P= +64 , IP21 = .269, V=+43, Opct= +.375, 65-day pct ch=

.142

----------------------------------------------------------------------------------------------------------

6 16 months

1957

7/12/1957- 10/22/1957

520.8-419.8

Sell S7, S9, S4

7/12/1957: la/ma 1.022, P= --40, IP21 = .062, V=

-214,

Opct=- .248, 65-day pct ch= .078

----------------------------------------------------------------------------------------------------------------------------

7 8

months 1960

1/5/1960 - 10/25/1960

685.5 - 566.0

Sell S12, S16, S15, S1

7/12/1957: la/ma 1.018, P= +4, IP21

=-.038, V= -170, Opct=+ .099, 65-day pct ch= .085

----------------------------------------------------------------------------------------------------------------------------

8 5 months

1961-1962

11/16/1961-5/25/1962

734.3 - 536.7

Early S9, S16 (nearly perfect)

8/3/1961: la/ma 1.025, P= +34, IP21 =- .042, V= +6, Opct= + .378,

65-day pct ch= .058

-----------------------------------------------------------------------------------------------------------------------------

9 22 days

1966

2/9/1966-10/7/1967

995.15-744.32

Sell S4, S12

1/6/1966: la/ma 1.025, P= +34, IP21 =- .042, V= +6, Opct= + .378,

65-day pct ch= .058

-----------------------------------------------------------------------------------------------------------------------------

10 none at top

1968-1970 12/3/1969-5/26/1970

985.21 - 631.16

Sell S1

4 months 1969-1970

5/14/1969-5/26/1970

968.85 - 631.16

Sell S9,

S3

4/30/1969: la/ma 1.025, P= -30, IP21 =+ .083, V= -1, Opct= +

.219, 65-day pct ch= .01

----------------------------------------------------------------------------------------------------------------------------

11 7

months 1972-1973

1/11/1973 - 12/6/1974

1051.7 - 577.6

Sell S1, S9, S4, S12

1/11/1973: la/ma 1.024, P= -96, IP21 =+ .002, V= -2, Opct= +

.059, 65-day pct ch= .117

----------------------------------------------------------------------------------------------------------------------------

12

none

1976-1978

9/21/1976 - 2/28/1978

1014.79 -

742.12

Sell S1, S4, S16

9/21/1977: la/ma 1.033, P= +178, IP21 =+.181, V= +2, Opct= + .18,

65-day pct ch= .012

---------------------------------------------------------------------------------------------------------------------------

13

6 months 1980

2/13/1980 -

3/27/1980 903.84 -

759.98

Sell S4, S9, S15

2/13/1980: la/ma 1.028, P=

-26, IP21

=- .01, V= -1, Opct= + .212, 65-day pct ch=

.12

----------------------------------------------------------------------------------------------------------------------------

14

7 months 1981-1982

4/27/1981 - 8/11/1982

1024.05 -

777.21

Earlier S9s, Sell S4, S7, S15

4/27/1981: la/ma 1.02, P= +11, IP21 =+.026, V= 0, Opct= + .217, 65-day pct ch=

.098

---------------------------------------------------------------------------------------------------------------------------

15

7 months 1984

1/9/1984 - 7/24/1984

1286.22 - 1086.57

Sell S4, S12

1/9/1984: la/ma 1.021, P= +36, IP21

=+.007, V=-1, Opct= - .169, 65-day pct ch= .04

--------------------------------------------------------------------------------------------------------------------------

16

5 months 1987

8/25/1987-10/19/1987

2722.42 - 1738.74

Sell S4

Later S8, S9, S12 10/2/1987-10/19/1987

2640.99 - 1738.74

10/2/1987: la/ma 1.026, P= -56, IP21 =- .017, V= -7, Opct= +

.072, 65-day pct ch= .095

----------------------------------------------------------------------------------------------------------------------------

17

7 months 1990

7/17/1990-

10/11/1990 2999.75

- 2365.1

Sell S9,

S8, S5

7/17/1990: la/ma 1.032, P=

-1, IP21 =+ .024, V= -4, Opct= + .414, 65-day pct ch=

.09

---------------------------------------------------------------------------------------------------------------------------

18 4 months

1998

7/17/1998 - 8/31/1998

9337.97 - 7539.07

Sell S9, S12

7/8/1998: la/ma 1.03, P=+2, IP21 =-

.025, V=

-17, Opct= + .061, 65-day pct ch= .021

---------------------------------------------------------------------------------------------------------------------------

19 18 months

2000-2003

1/14/2000 - 3/11/2003

11722.98 - 7286.27 (10/9/02)

Sell S9, S12. S15, S4

1/7/2000: la/ma 1.021, P=-23, IP21 =- .028, V= -59, Opct= +

.356, 65-day pct ch= .088

----------------------------------------------------------------------------------------------------------------------------

20

4 months 2007-2009

10/9/2007 - 3/9/2009

11722.98 - 6547.05

Earlier Sell S9 and S5; concurrent S2, S4

7/19/2000: la/ma 1.028, P=-51, IP21 =+ .024, V= -131, Opct= +

.054, 65-day pct ch= .096

----------------------------------------------------------------------------------------------------------------------------

21

2011

5/2/2011 - 10/3/2011

12807.36 - 10655.3

Sell S5, S8

5/2/2010: la/ma 1.028, P=+212, IP21 =+ .147, V= -17, Opct= +

.349, 65-day pct ch= .068

Later S9V

7/21/2010: la/ma 1.025, P=+269, IP21 =+. 085, V= -51, Opct= +

.005, 65-day pct ch= .042

---------------------------------------------------------------------------------------------------------------------------- |