TigerSoft News Service 10/19/2009

www.tigersoft.com

TigerSoft News Service 10/19/2009

www.tigersoft.com Other Free Tiger Blogs - http://www.tigersoft.com/Tiger-Blogs/index.htm

THE MURDEROUS CONSEQUENCES

OF AMERICAN INEQUALITY

with a Prologue on Inequality and Crashes of 1873, 1893, 1907, 1929, 2008 and possibly 2012-3

6/3/2012 - links collected...

"La majestueuse égalité des lois, qui interdit au riche comme au pauvre de

coucher sous les ponts, de mendier dans les rues et de voler du pain."

Translation:

"The Law, in its majestic equality, forbids the rich, as well as the poor, to sleep

under the bridges, to beg in the streets, and to steal bread." (Le Lys Rouge)

Anatole France also wrote: "Of all sexual aberrations, chastity is the strangest."

"In our country ... one class of men makes war and leaves another to fight it.

General William Tecumseh Sherman, 1820-1891. Returning American

veterans are committing suicide at the rate of 120 a week. (CBS-11/17/2007)

""I had other priorities in the '60s than military service." VP Cheney, architect,

promoter and beneficary of the American War on Iraq.

“There’s class warfare, all right,” Mr. Buffett said, “but it’s my class, the rich class,

that’s making war, and we’re winning.”

"The rich are tolerable only so long as their gains appear to bear some relation to

roughly what they have contributed to society." John Maynard Keynes

by William Schmidt, Ph.D.

===================================================================

Buy and Holding Is Dangerous See All The Peerless Real-Time Signals: 1981-2009

Tiger Software - Helping Investors since 1981 Make Your Retirement Grow

Suggestions:

Peerless Stock Market Timing: 1928-1966

Track Record of Major Peerless Signals

Earlier Peerless-DJIA charts

7 Paths To Making 25+%/Yr. Using TigerSoft

Index Options

FOREX trading

Investing Longer-Term

Mutual Funds

Speculative Stocks

Swing Trading

Day Trading

Stock Options

Commodity Trading

Research on

Individual Stocks upon Request: Composite Seasonality Graph

of Any Stock for $125. Example of

historical research NEM - Newmont Mining. Order Here.

THE STARKLY BLEAK CONSEQUENCES OF

ACCELERATING AMERICAN INEQUALITY:

Wealth, Earnings, Education, Health, Housing and Opportunity

by William Schmidt, Ph.D.

For thirty years, a class war has been waged

in the US.

Now we see what happens when

one side barely fights back.

Real wages in the peaked in

1978. How would you like to

feel going 30 years without a

wage increase? And it was not

because workers did not get

better or more productive.

Productivity per worker more

than doubled since 1978.

( Source

)

The US has the bleak distinction of

being the 3rd most

unequal country in the world,

according to a new UN study.

The Grand Canyon sized gap

between the rich and the poor

is worse only in Hong Kong

and Singapore. Why do I say this

is so terrible? Please,

if you have to ask, you need to see how

the other 90% live and ask

basic questions about why we

pretend t be a Democracy.

Preponderant Inequality means

preponderant poverty.

It means suffering, ill health, frustration,

anger, high crime, social

fear and early deaths. It means wasted,

unproductive, uneducated

lives. It means lazy, self-indulgent,

seld-centered, hypocritical

hedonism, where servility to the

rich are placed at a higher

value than hard work and creativity.

Economic Canabalism

The "middle class" is

slipping, closer and closer to poverty.

A woman wrote me today about how

over-whelmed she feels.

She has $3000 in expenses and $600

in income. Her business

has evaporated. In

desperation, she is selling a multi-level|

marketing legal services plan to

other people, as desperate

as she is. When one worries

about money, every hour of the

day, it's not much of a life.

Anger and frustration grow. If

there is not a dramatic improvement

in incomes and jobs

very seen, the murder rate, the

divorce rate and the child abuse

rate will go up to levels that will

shock the compacent. Here is

a poster someone put up in London

recently. This is not

what Americans want. But

people can only be pushed so

far and so long.

One thousand individuals were worth

a BILLION Dollars.

Who needs a billion dollars?

Who needs a 10 million dollars?

What if all this private wealth was

taken away and used to create

universal health care and

education, a job guarantee for everyone,

and an immediate repairing of

America's exhausted infrastructure

of bridges, railroads, dams and

levees? The media does not

ask these questions?

Apparently, these people are too frightened

by their bosses and advertisers to

ask these questions. Because

no one asked these questions, the

rich have won the undeclared

class war... until now.

A new

Harvard study says that 45,000 are killed each year by

the lack of health insurance.

This is more than drunk driving

and homicide combined. Adults

64 and younger who lack health

insurance have a 40% higher

rate of dying. A similar study in

1993 found a 25% high risk of

death. There are millions more

now who lack health insurance

and so wait until they are very

sick to get medical

attention. Sadly, the study did not show how

much at risk are those with

$5000 deductibles also of dying because

they also cannot afford to

see a doctor or get prevetative checkups.

This is murder! Shame

on those who tolerate this in the name

of capitalism.

Capitalism should be liberating, not murderous.

My brother is in this

situation. But, at least, he can drive 500 miles

to a VA hospital in

Montana.

Malnutition and Hunger

The US Agricultural

Dept. reports that last year one in seven American

households was

not getting enough FOOD to live. Lack of jobs,

exhaustion of all

financial resources, onerous qualifying conditions

to get food

stamps, Food Stamps' inadquacy as food prices rise

and the lack of

homeless shelters and food banks are to blame.

Nearly 17,000,000

children do not get enough food! (Source. )

Trillions for Wall Street Con-Men.

Disillusionment with Obama is

growing. Millions feel betrayed

by his subservience to Wall

Street.

Geithner

Aides Reaped Millions Working for Banks, Hedge Funds Bloomberg

Goldman

Sachs: Overlords-R-Us

Goldman Sachs has

announced that it is more than double its bonus pool:

from 11

billion in 2007 to 23 billion in 2008.

Not surprisingly, the man who is now the Inspector General of the

TARP bailout billions loans for

banks admits that "the

Treasury's actions

in this regard have

contributed to damage the credibility of the

program and of the government

itself, and the anger, cynicism

and distrust created must be

chalked up as one of the substantial,

albeit unnecessary, costs of

TARP." Barofsky said public

suspicion

was fed by the Bush and the

Obama Treasurys' decision not to

require banks to report how

they used their "rescue money" and

its

"less-than-accurate" statements describing the financial

condition of nine large banks

that benefited from large infusions of aid

( Source )

Conservatives, too often, see

a trade off between Equality

and Growth and Corporate

Profits. Personally, I think that

Wall Street capitalism has

failed and must be changed dramatically.

Wall Street execitives are

paid 100 to 1000 times their social

value. But leaving that

aside, it can readily be shown that

America simply cannot afford

to ignore the chasm between

the rich and poor if it still

wishes to compete internationally

and not waste limited public

resources on prisons, subsistence

tokens for millions and

crowded emmergency rooms serving

those who cannot afford basic

preventative care. The main

reason there is a financial

crisis now is because so many people

have so little money to buy

basics.

Imagine for a minute if we

had a truly democratic Government.

If the 3 trillion dollars

given so quickly to banks by the Government

had instead gone to the 300

million Americans, each of us would

have received a checl for

$10,000. The 95% that own only 5%

of the country's wealth would

almost certainly have spent every

penny of it on basics.

None of them would be speculating on

Gold. The Dollar would

be stronger. This spending of $2.8 trillion

dollars would have given the

economy a huge lift-off boost.

Lay-offs would have stopped.

The Federal Government would be

collecting taxes instead of

printing paper. And Wall Street prices

would still have risen

sharply, because corporate profits would

have quickly rebounded.

The only difference would be that we

would live in a world no

longer run by Goldman Sachs, Bank of

America or Citi Group.

They would be defunct. They would have

failed and local banks would

have been given a chance to take

their place.

Read the 1994

Children’s Defense Fund's (CDF)

“Wasting

America’s Future: The Children’s Defense Fund Report on the Costs of Child

Poverty.”

Conservatively, they reckon that the yearly costs associated with future reduced

worker productivity and employment due to poverty among children may 2.5% of GDP.

That's $325 billion dollars in "lost economic activity". Sadly, this

study makes

no

effort to account for the losses stemming from the long-term health effects of poverty,

nor

does it include the resulting much higher costs of crime or incarcerating 1% of the

entire population! Source.

and the (Coming Crash of 2012-3?)

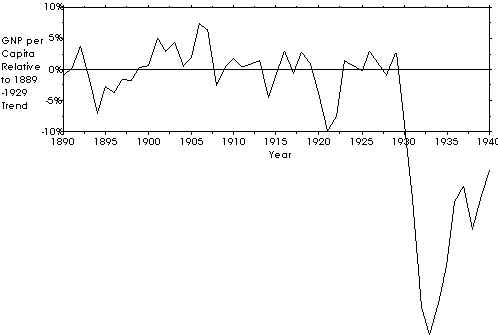

1873 - Panic of 1873 The financial panic of 1873

New York and the Panic of 1873 - NYTimes.com

TMF: comparison to crash of 1873 / The Paulson Plan

www.economicpopulist.org/content/1930

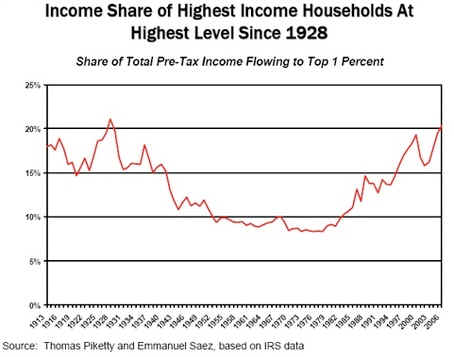

The Reign of the One Percenters

The deflation of 1873-1896 — Marginal Revolution

Ezra

Klein - Does income inequality cause financial crises?

"One

theory that's made intuitive sense to me is that the problem is not just the demand for

credit but the accompanying supply of idle money. When someone making $25,000 a year gets

a raise, they spend it. When someone making $2,500,000 a year gets a raise, they invest

it. And the more money there is sitting around, the more demand there is for high-yield

investments, which means the more reward there is for people who can invent new investment

vehicles with high yields. Hence, you have explosive innovations in weird financial

instruments that look good for a while because the risk is underpriced but end up making

the system more fragile when their risks come clear and everyone flees. "

Posted by: ceflynline | June 28, 2010 4:47 PM | Report

abuse

My idle money theory is that the primary driver of our current crisis is an investment glut created by income inequality. There's too much money chasing too few investments with the right kind of returns (privatizable). So, decent investments start giving poor returns, and very risky investments have a low rate of return that suggests they should be safe. This sets up a feedback loop that stimulates people to come up with increasingly crazy schemes, and for others to vette those streams as little as possible, since they are just desperate for a place to put the ever-increasing pile of cash so they can make their quarterlies. Bubbles are an inevitable feature of this inequality-driven system of idle wealth, they are not an aberration.

In my story, the pernicious impact of ridiculously low marginal tax rates is not just that it creates more idle wealth, but also that it also systematically starves the country of critical long-term public investments upon which private growth depends. We send more money to Wall Street and less to schools & bridges. And, in fact, the case of the 80's to the present (except under Clinton), it's arugably worse, because we deficit spend on non-productive things like the military and keeping the world's most inefficient health care system spectacularly inefficient. This juices the economy in the short-term while robbing it in the long-term, making the system not only unsustainable, but even harder to break out of because it's even more short-term beneficial and long-term costly.

And then there's the capture of Congress by the investment classes, the driving of more and more funds to Wall street, the ascendance of insane philosophies like the rational market and the deification of the executive (and the demonization of things like public investment). In this world, 401ks, which by changing tax revenue into mandatory Wall Street 40-year investments magically turn bridges into CDOs, we can see that 401ks are not a good thing. People should just be paid more salary.

Frankly, I think there's a little of "all the above" going on here in terms of the problem. Idle capital perverted the entire market, not just the investment side, but even the consumption side. We had UNDERconsumption of things people actually wanted to buy, because lower income people who consumed had relatively less money. We had OVERconsumption of things that people could get loans for--where the idle money had figured out a way to be used profitably in mortgages and credit cards.

But in all of this, income inequality is not a sideshow. It is the prime mover of our current problems.

Posted by: theorajones1 | June 28, 2010 6:20 PM | Report abuse

"Again, where 95 cents of every dollar siphoned from the company goes back to the Government, the fun of concocting schemes that get you massive incomes ceases to be worth it."

Well sure, but investing in a lot of things becomes pointless. Why invest in anything if your return is going to be gobbled away by taxes?

Posted by: justin84 | June 28, 2010 6:44 PM | Report abuse

with all the zombies still believing "government is the problem" and the mind set long ago instilled by bipartisan St. Ronnie's and the constant PR, we have long way to go before the reality hits these walking dead. these people still believe any government is bad, anything from local to state to federal laws are "bad". it is quite a thing to behold when they speak these "memes" from the Real America PR book. Paying for what we want. like all these "services, water, roads, schools, bridges and so on. pay for them with that nasty five letter word: TAXES.

Americans would rather listen to liars than pay taxes. and have for the last 40 years. now the bill are coming due.

the only way the zombies are going to wake up is when the "bad economy" hits their neighborhood. it is starting little by little. we now have Ayn Rand's free market. devoid of any rules other than the survival of the fittest/richest. no one/(gov) to stop the thieves. amazing these zombies think the rich will help them. give the rich money they might create jobs in China, where they will make more cash than if the jobs were here in America. most Americans still don't understand the poor will spend the money while the rich send it Dubai, Switzerland along with the corporations. As if the rich cared about anything more than getting richer. buying Congress certainly helped!!!

there's still too much pretending by these zombies. and when the zombies wake up, will it be more Tea Baggers. so idiotically confused about who is screwing whom. Americans are so special they want to be told what to think. they will pay mightily for gladly doing what the rich told them under St. Ronnie's PR campaign. Demonizing the "other" another form of "divide and conquer" American pocketbooks. lol. what a scam these zombies brought upon themselves. but don't' dare tell it to their face. they wont see it, even while they deny it could ever be.

America can't last too much longer economically, with Europe starting the ball rolling. it will not be pretty. but this is what the Zombies wanted. Talk about faith based chicanery.

as ye sow,so shall ye reap

Posted by: Beleck31 | June 28, 2010 6:54 PM | Report abuse

The combination of underconsumption and overspeculation didn't used to be a particularly unusual explanation for the Great Depression.

For example, see John Kenneth Galbraith's the Great Crash, and to lesser amounts the New Industrial State, Affluent Society, etc..

Posted by: StevenAttewell | June 28, 2010 7:25 PM | Report abuse

"The combination of under-consumption and over-speculation didn't used to be a particularly unusual explanation for the Great Depression."

Interesting.

Posted by: rmgregory | June 28, 2010 7:33 PM | Report abuse

theorajones1:

Add in the fact that money invested in Wall Street has virtually no impact on established companies unless they are doing a stock issue. Once a share of GM is sold, nothing it does in the form of going up, down, or sideways benefits GM in the least. The only people at GM who care after the stock is sold for the first time are the executives who need their bonus shares to rise sharply so they can make massive profits. Once they have cashed out, in fact, it behooves them to let the stock drop sharply so they can repeat the process. Most of the big investors are no longer the Al Sloans or DuPonts, but quick kill artists who need market volatility and enough inside information to know when to get in and when to get out. Long term big money stays away because it doesn't get the long term benefit of a stable, (if very large) or growing (if it isn't too large to easily grow) company over time.

If you want to be a Boss Kett or an Ermil Fraze you need smarts and patience. Low tax rates discourage either trait.

Posted by: ceflynline | June 28, 2010 8:01 PM | Report abuse

Ezra--

Didn't Dan Ariely show that above a certain threshold, increasing the financial compensation for a cognitively-demanding task causes an increase in recklessness risk-taking and a decrease in performance?

Furthermore, isn't there evidence that having a huge pile of personal wealth makes people more willing to make reckless investment decisions and engage in speculation? After all, if a multimillionaire loses half his money, he's probably still a multimillionaire.

A guy who makes half a milliom dollars a year, or even a few million, can't afford to lose his job; that puts some caution into his behavior. But what about a guy who makes 10 million a year? If he loses his job, he can probably just take an early retirement.

Posted by: matt297 | June 28, 2010 8:15 PM | Report abuse

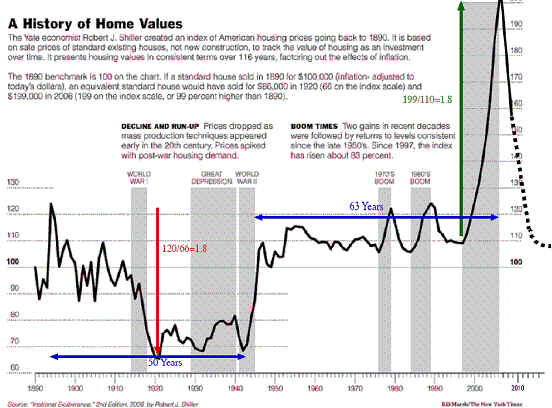

Rutgers historian James Livingston has written on this issue of inequality. In his story,

"The Great Depression was the consequence of a massive shift of income shares to profits, away from wages and thus consumption, at the very moment—the 1920s—that expanded production of consumer durables became the crucial condition of economic growth as such. This shift produced a tidal wave of surplus capital that, in the absence of any need for increased investment in productive capacity[...], flowed inevitably into speculative channels, particularly the stock market bubble of the late 20s; when the bubble burst [...] demand for securities listed on the stock exchange evaporated, and the banks were left holding billions of dollars in distressed assets. The credit freeze and the extraordinary deflation of the 1930s followed; not even the Reconstruction Finance Corporation could restore investor confidence and reflate the larger economy."

Of course "a massive shift of income shares to profits, away from wages and thus consumption" is another way of describing income inequality - wages were stagnant, and in order to consume, people borrowed. Profits were made by the rich, who invested them in whatever gave them the best return for their risk profile.

Posted by: enormousturnip | June 28, 2010 8:27 PM | Report abuse

" "Again, where 95 cents of every dollar siphoned from the company goes back to the Government, the fun of concocting schemes that get you massive incomes ceases to be worth it." Well sure, but investing in a lot of things becomes pointless. Why invest in anything if your return is going to be gobbled away by taxes? Posted by: justin84"

Hey, the man understands the principle. Now watch carefully as it is put into practice. The part of all personal incomes over 100 times the annual minimum wage is declared excess income. (currently that is a bit more than a million a year income.) Excess incomes are taxed with no possibility of exceptions, reductions, deferrals, or other reductions.

That portion of excess incomes between 100 times tha minimum wage and 200 times the minimum wage gets taxed at 50%. From 200 times to 300 times gets taxed at 55%, etc, until the total tax rate from INCOME TAXES, (property, sales, intangibles don't qualify) from all taxing authorities is 95%, at 1000 times the minimum wage. no need for high priced tax attorneys and accountants, tables do it nicely.

Most even more than medium investors don't earn a million a year from all sources and don';t worry. They live in the world of tax deductions and set backs and averaging. THEY have an incentive to invest. once they hit the 50% bracket things become less and less worth trying for that decreasing marginal benefit.

This puts investing back into the hands of the more than middle class, as compared now to the more than middle class being small fry for the too big to fail people to devour. Yeah, nobody has any good reason to try to earn half a billion dollars a year because 475 million of it goes to the government. Nice disincentive to wrecking economies.

And by the way, those big wig investors paying themselves these massive bonuses? If you are one of their investors, it came out of your dividends.

See, if they make lots of money they pay themselves lots of money and and pay you a dividend. They used your money and made lots of money for themselves. You get some of it but they get most of it. Because they were so brilliant with your money.

Of course if they screw up, and wreck the worlds economy, it was YOUR money they lost, and more of your money they used to pay themselves the big bucks for screwing up. Mad at them and want out? Pay them a transaction fee to cash out.

Maybe disincentives to bankers to keep them from doing this isn't such a bad idea after all.

Posted by: ceflynline | June 28, 2010 8:43 PM | Report abuse

If you go back and read contemporary accounts from the 1930s, income disparity from the 1920s very much was thought of as a contributing factor to the crash. It's amazing how completely people forgot this in later decades.

Posted by: leoklein | June 28, 2010 8:45 PM | Report abuse

Krugman's talk shows all the familiar charts, but he leaves one out:

http://en.wikipedia.org/wiki/File:MarginalIncomeTax.svg

Income tax rate changes preceded a lot of these other changes, and directly led to huge changes in income inequality.

Posted by: Ulium | June 28, 2010 10:13 PM | Report abuse

Its been a while since I've read his stuff, but I believe Ravi Batra has proposed a theory. Of course, he initially predicted a financial crisis in the early 90's. So, on one hand he was wrong, but maybe the internet/tech revolution merely postponed it.

The basic mechanism (if I recall) is akin to what people here have said. Following the drastic reduction in top marginal tax rates, companies had an incentive to keep earnings as profits (esp. CEO's who make a killing via stock options when profits go up), rather than reinvest that money back into the company or compensate labor with it. The workers see no real wage gains ("real" in the economic sense), and must borrow increasingly more every year while the excess of savings by the top overwhelms worthwhile investment and ends up in speculative endeavors. The increased corporate profits also lead to asset bubbles. I think there is also something in there about how increased profits lead to increases in production, but aggregate demand cannot keep up since workers do not see any increase in their real wage. I've probably got some of the details wrong. I've been meaning to go back and reread his stuff.

But on a more fundamental sense, prices serve a very specific function in capitalism. It is in fact the basis for the arguments proposed by Friedman, Hayek, etc. regarding the efficiency of capitalism. But how can prices do that when prices mean entirely different things to the haves and have-nots? How can one single price level exist when we have, in essence, two separate populations with entirely different views of what a dollar is worth? To some, $1,000 is a month's pay. To others, its 5 minutes of work. A standard macro model with a sole representative agent will never capture that phenomena.

Posted by: nylund | June 29, 2010 12:04 AM | Report abuse

Please be more honest and show a graph that shows AFTER TAX income. Since the lower half pay no income tax and the rich pay pretty much all of the tax burden, it will look differently.

Also, our "poor" enjoy cellphones, free housing, free food, they all have color TVs and computers.

They are rich by any world standard. To look in others' pockets for more than you're willing to earn is simply envy and jealously.

Posted by: WrongfulDeath | June 29, 2010 9:01 AM | Report abuse

Prof. Fred Block of UC Davis has an article talking about this as well

http://www.longviewinstitute.org/blckmortgage

Posted by: boing3887 | June 30, 2010 3:35 PM | Report abuse

umm...WrongfulDeath...even with aftertax income the rich have way more than the poor. by any measure used by statisticians and economists, income inequality is at an all-time high. you can go look for statistics that were brought up using methods that would ensure a favorable result, but you would probably have to go to AEI or Heritage for that kind of thing. you look at expert after expert, from the Economic Policy Institute to the Peterson Institute to Brookings, they all show that income inequality is at an all-time high and that income mobility is extremely low - we're at the level of a third-world country when it comes to income mobility. i guess libertarians like you don't care that in america the biggest determinant of future income is basically hereditary

Posted by: boing3887 | June 30, 2010 3:38 PM |

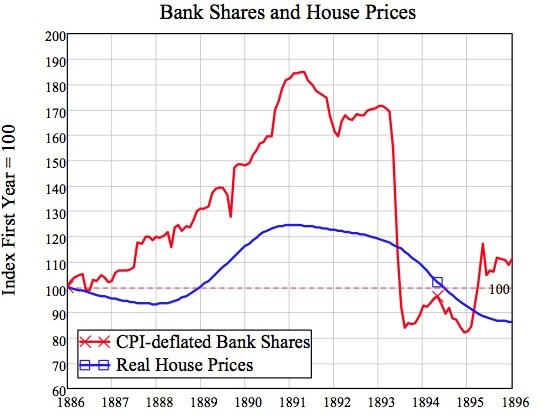

1893

CRASH http://en.wikipedia.org/wiki/Panic_of_1893

Two economists of the 1920s, Waddill

Catchings and William Trufant Foster

The US

economy produced more than it could consume. Underconsumption

was caused

by consumers not having enough income. .[33][34]

The government

needed to

put more buying power in the pockets of all consumers. Low income

people

would be the best consumers because their marginal spending (versus savings)

potential

was highest.

http://econ161.berkeley.edu/tceh/slouch_crash14.html

See also http://sciie.ucsc.edu/JIMF4/Revised_Bordo_Meissner.pdf

Very important see the writings of Jon D Wisman.

http://scholar.googleusercontent.com/scholar?q=cache:cfp7hVtE11gJ:scholar.google.com/+wealth++inequality+1928+stock+market+crash&hl=en&as_sdt=0,5&as_vis=1

See writing of Jon Wisman http://www.a7merican.edu/uploads/docs/wismanCV.7

pdf

See writing of Jon Wisman http://www.a7merican.edu/uploads/docs/wismanCV.7

pdf

..

....

Rising Inequality and the Financial Crises of 1929 and 2008.

Economic

Insecurity and Stress in a Capitalist Society

Wealth

Taxation for the United States

Consequences

of Economic Downturn

The

Ignored Question of Workplace Democracy in ...

Legitimating

Inequality: Fooling Most of the People All of the Time ...

The

Economics of Inequality: The Value of Early Childhood

"I can suggest a mechanism. When top level incomes were so low, there was a virtually unused sttep progressive income tax that republicans said stifled incentive for people to try to make those large incomes.

That it did. As the marginal top rates went away, it once again became profitable to try to amass Plutocratic wealth. Eventually it became worth Ivan Boesky and Michael Milkin's risking criminal prosecution to pull frauds like Milkin's Junk Bond desk, or Boesky's insider trading. When you are giving back 95 cents of every dollar you steal, the profit in such theft schemes isn't enough to be worth the risk. When you get to keep at least 60% plus whatever over that you can concoct a scheme to protect, it becomes a lucrative game.

CEO's soon realize that their primary objective should be to get as much personal wealth out of their company as possible, and that wealth comes either right out of the pockets of ordinary shareholders or out of the capital needed to keep their company up to date. In either case, or more typically in the combined case, the pursuit of personal enrichment invariably leads to severe or lethal wounds to the company.

Again, where 95 cents of every dollar siphoned from the company goes back to the Government, the fun of concocting schemes that get you massive incomes ceases to be worth it.

We could try a pragmatic experiment:

Since we need every source of revenue we can find, return to those high marginal rates for ten years and watch what happens to the economy. More importantly watch what happens to industry and commerce. When it isn't personally profitable to try buying up your competition, maybe the destruction of quite viable companies like Gold Circle, (condemned to death by Campeau's grandiose ambition to own the nations retail business as his personal fief.) Or all the Oil Refiners that have been bouight up and closed down over the decades since those marginal rates werte eliminated would cease.

Take the personal profit out of massive salaries and see if the species of CEOs evolves to be men interested in the business they run, and not in running their businesses into the ground for their personal enrichment.