Daily Blog - Tiger Software 2/13/2008

Trading Hints

When The Market's Tide Is Low,

You Can Find Lots of Good Trades.

(C) William Schmidt, Ph.D. www.tigersoft.com

|

Tiger Software Suggestions: Peerless Stock Market Timing: 1928-1966 Track Record of Major Peerless Signals Earlier Peerless-DJIA charts 7 Paths To Making 25+%/Yr. Using TigerSoft Index Options FOREX trading Investing Longer-Term Mutual Funds Speculative Stocks Swing Trading Day Trading Stock Options Commodity Trading

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

TIGERSOFT HINTS - 2/13/2008

(C) William Schmidt, Ph.D.

When The Market's Tide Is

Low, You Can Find Lots of Good Trades.

http://www.pbs.org/odyssey/odyssey/20021021_log_transcript.html

http://www.fotosearch.com/NGF005/72932265/

http://www.fotosearch.com/PHC006/72930899/

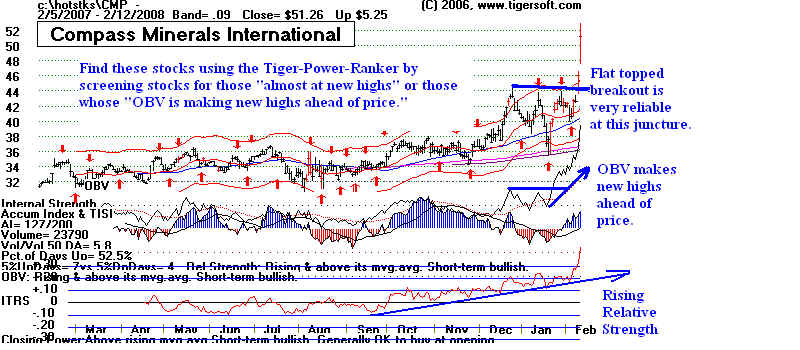

Bulging Accumulation, a steady uptrend and

flat tops: these are very bullish signs.

TigerSoft's creation, the Tiger Accumulation Index, is

probably the most

valuable, single technical tool you will ever use. It predicts the biggest winners year after year.

See also

http://www.tigersoft.com/Tiger-Blogs/12-31-2007/index.htm

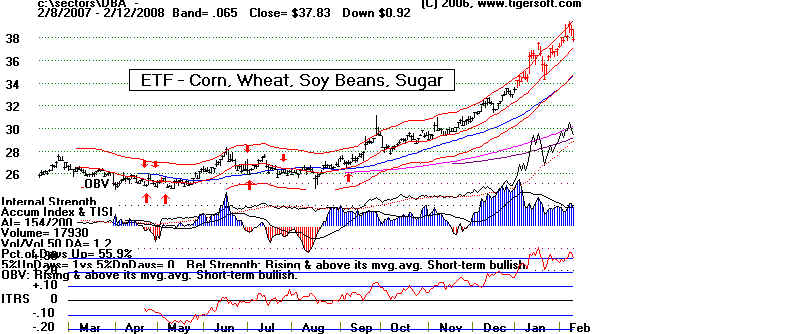

DBC - PowerShares

DB Commodity Idx Trking Fund

Investor's Business Daily http://biz.yahoo.com/ibd/080208/etf.html?.v=1

DBC -

Commodity ETF Jumps As Wheat Hits Record

It

like when the tide goes way out and you can see the all the concealed rocks.

Declines like we have

just seen let you find the best stocks for a rebound.

Here are some ways to do this.

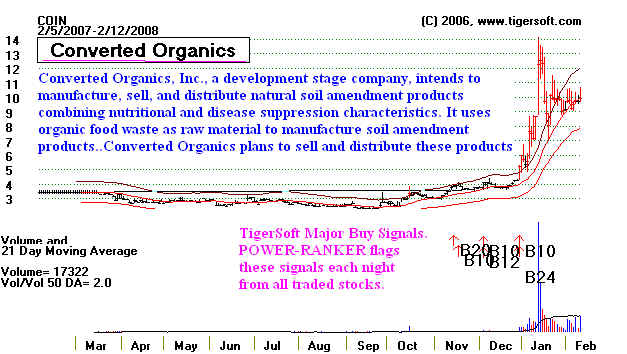

CMP and COIN are in the hot fertilizer market. DBA and DBC

represents agricultural commodities.

KWK is an oil and gas producer. SID is a Bazilian

steel maker. It shows wonderfully high

Accumulation readings and is in a firm uptrend.

arranged on a line usually make good short-term trades,

Quicksilver Resources, Inc. engages in the exploitation, exploration, development, production, and sale of natural gas, crude oil, and natural gas liquids (NGLs) in the United States and Canada. It also involves in marketing, processing, and transmission of natural gas.

stock coming out of long bases, making new highs, major Buy signals and showing unusual volume.

The rising 21-day ma acts as a good place to look for renewed support. See Explosive Super Stocks.