TIGERSOFT IS

EASY ,

Order

here $295

TIGERSOFT IS

EASY ,

Order

here $29512/12/2010 www.tigersoft.com

What we wrote here in 2010 still works very well.

Highlighs

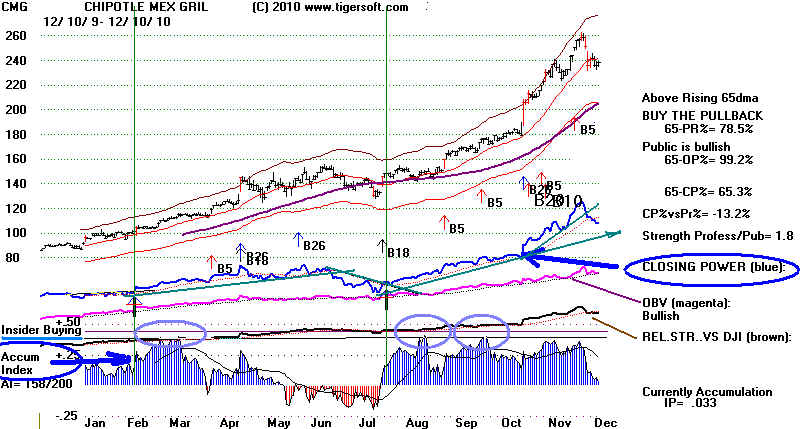

- Automatic Buy and Sell Signals based on Internal Technical Strength vis-a-vis purple 65-dma

- Blue Closing Power (beneath prices) to show Net Professional Buying or Selling

- Accumulation Index (Blue and Red, at bottom) to show key Insider Buying and Insider Selling

- Red 21-day ma offers good buy points when Closing Power and Accum. Index are rated

as "Bullish" on right side of chart.

Sample TigerSoft Chart CMG was actually recommnded at 50 back in December 2008. It's now 400+ in 2012.

WHAT YOU NEED TO KNOW TO MAKE BIG MONEY IS SIMPLE:

> Buy only stocks showing Insider AND Professional Buying in TigerSoft charts.

Just learn and apply the 4 terms below and stock market profits will become routine, because

you will be trading the best stocks in the same direction that Professionals and Insiders are.

1. Closing Power ™ 2. TigerSoft Accumulation Index ™ 3. MAXCP Stocks ™ 4. MINCP Stocks ™

Closing Power ™ -- TigerSoft's 1999 Invention to measure whether Professionals are net buyers

or sellers. This is the blue line beneath prices on a Tiger graph. On the right side of a TigerSoft

chart, Professionals are noted as either buying, selling or neutral. Professionals are distinguished

from overseas and public buying interest by TigerSoft's charts.

TigerSoft Accumulation Index ™ -- TigerSoft's 1981 invention to allow stocks to be compared

for the amount of Insider Buying or Selling they show. Spikes of blue TigerSoft Accumulation

Index above a key threshold signify insider buying, not necessarily from within the corporation,

but from their associates, friends and family. The opposite, deep dips of red in this indicator show

insider informed selling, especially when the red heavy distribution pattern persists.

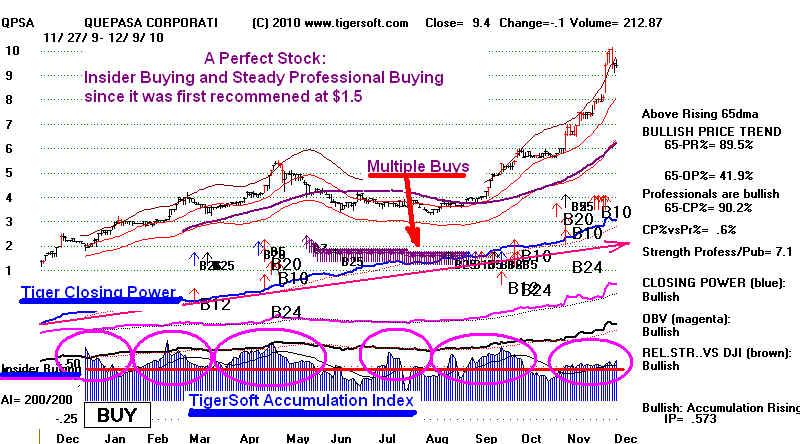

MAXCP Stocks ™ These are the stocks PROFESSIONALS are clearly buying, judging from

their very unusual strength shown by Tiger's Accumulation Index. They vary in number each

night. The data for the nightly MAXCP stocks is offered susbcribers on the Tiger Data Page.

Tiger's Power Ranker's ™ "BULLISH" screening applied to the MAXCP stocks will find

you the candidates for purchase that show the very highest levels of PROFESSIONAL and

INSIDER BUYING from 6000 stocks. This screening takes place in seconds. Tiger users are

advised to buy from this group as long as Peerless Stock Market Timing remains on a Buy,

In sum, TigerSoft allows you to identify easily the stocks that both PROFESSIONALS and INSIDERS

are buying. Our experience suggests the most BULLISH MAXCP stocks should make you money easily, in all but very weak general markets. Our Peerless Stock Market Timing's automatic

BUYS and SELLS should be able to tell you when the market is too weak to keep buying these stocks and selling is advisable. As long as they show heavy PROFESSIONAL and INSIDER BUYING, we expect them to be the leaders. Intense Insider Buying often occurs a year

before the stock peaks. Insiders know long in advance of the general public. When

their choices are confirmed by lots of Professional Buying, expect a big advance.

To make this even easier for new customers, our Nightly Hotline posts the most Bullish MAXCP

stocks each night. Traders should Buy them and hold them until the stock's Tiger Closing Power uptrend is violated.

RECENT BULLISH MAXCP EXAMPLES 12/12/2010

Peaked at 15.

We sold at 13+.

It's now back to 4.

+

+