The Bernanke Breakout:

Tigersoft Says "Thank You".

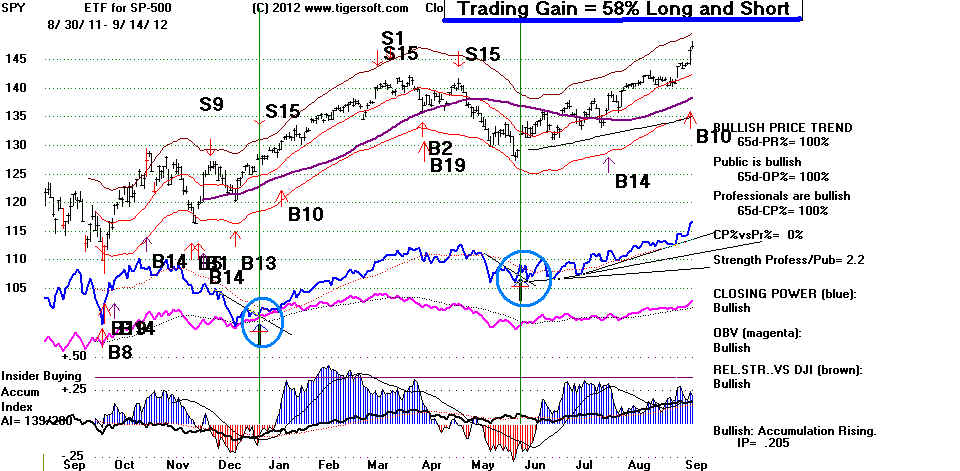

Ways To Profit from TigerSoft and Peerless Now

(C) 2012 September 14, 2012 William Schmidt, Ph.D.,, Creator of Tiger Software, Peerless Stocks Market Timing

The Tiger Power Ranker, The Nightly Tiger/Peerless Hotline..

---------------------------------------------------------------------------------------------------------------------------------------------------

Our Tiger/Peerless Hotline and Software Predicted The Breakout

Peerless was on a Buy. The Tiger Closing Powers were rising.

Professionals were aggressively buying 10 times more stocks than they

were aggressively selling. And our recent studies of market history

helped a lot. We told subscribers on our Hotline that the market

last month was showing many compellingly bullish parallels with

the past juat before significant advances. All these elements made us

very bullish on our Hotline, just before the "Breakout". But there

was much more.

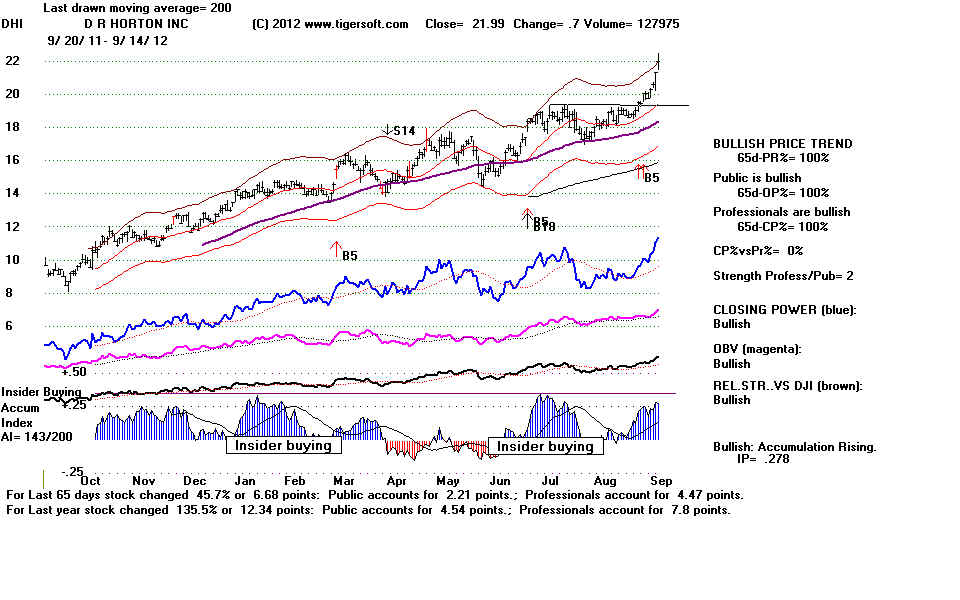

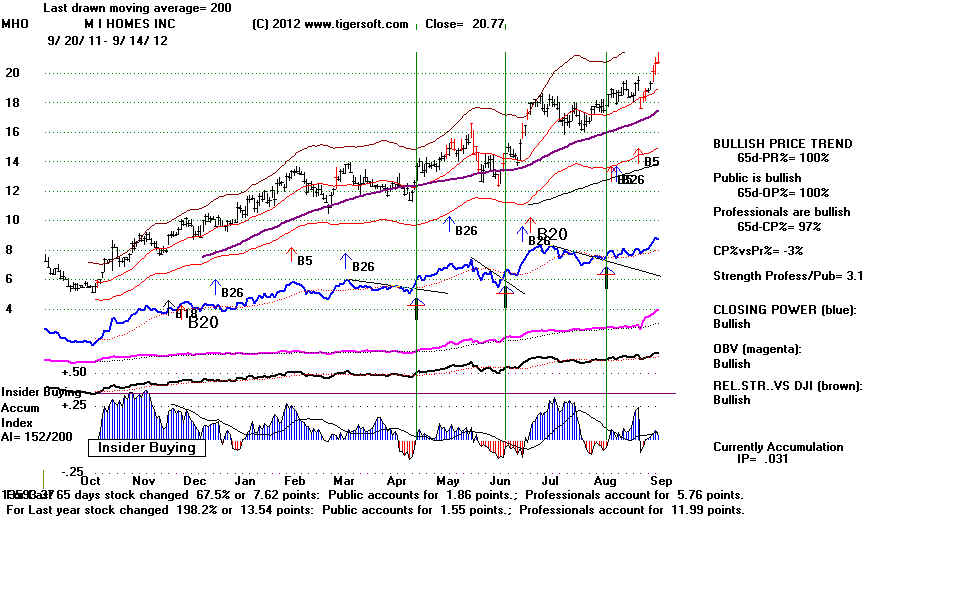

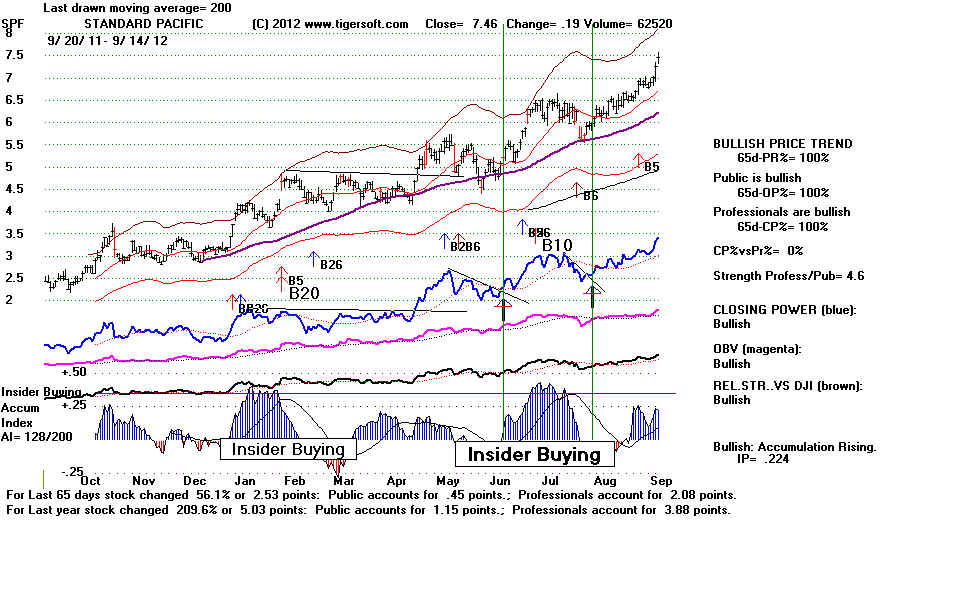

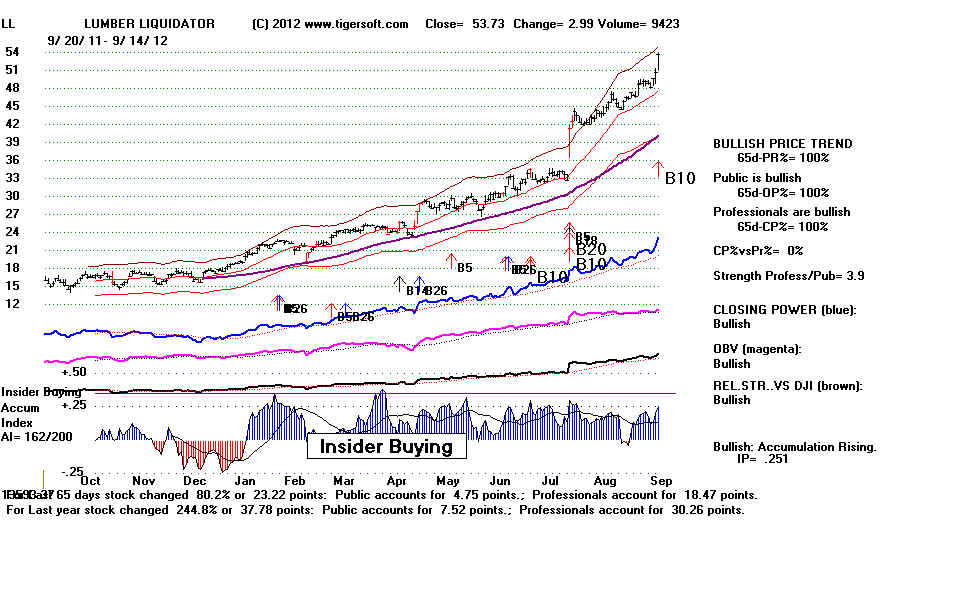

The bank stocks were rising before it. They had been told

in advance of Bernanke's plans. Homebuilders were strong, too.

As were inflation hedges, Gold, Silver and Crude Oil. Our first

principle is always, "Insiders always know first".

And there were stil more bullish signs. Despite all the compelling evidence

disclosed in a US Senate Investigation, and our own research back in 2009,

Goldman Sachs was never charged with Fraud and Misrepresentation by

the Obama Justice Department. This has been the pattern. We knew that Obama,

the Fed and Wall Street have been in league since March 2009, each for a

different reason, to get the stock market back to new all-time highs by November 2012's

Presidential Election.

TigerSoft Blog 3/18/2009: Obama Coddles Wall Street

TigerSoft Blog: 3/19/2009 Who's Lying?

TigerSoft Blog: 3/25/2009

Wall Street Now Realizes Obama Is Their Protector and

Obama's Populist Rhetoric Is Meant Only To Fool The Angry Public.

TigerSoft Blog: 4/4/2010 Why The Market Keeps Rising.

What You Should Know.

TigerSoft and Peerless watches the Insiders Closely for you.

1.> From their price action, it seems clear that Banking Insiders knew in advance

that the the Europeon Central Bank and then the US Federal Reserve under Bernanke

would provide unprecedented new stimulus and liquidity for the stock market. (See

their charts further on down this page.)

2.>Peerless has a long history of predicting stock market prices, especially

for big banks. Look at how profitable Peerless has been for the last year.

Big Banks

CitiGroup (C - US) + 180% Trading Gain using Peerless automatic signals

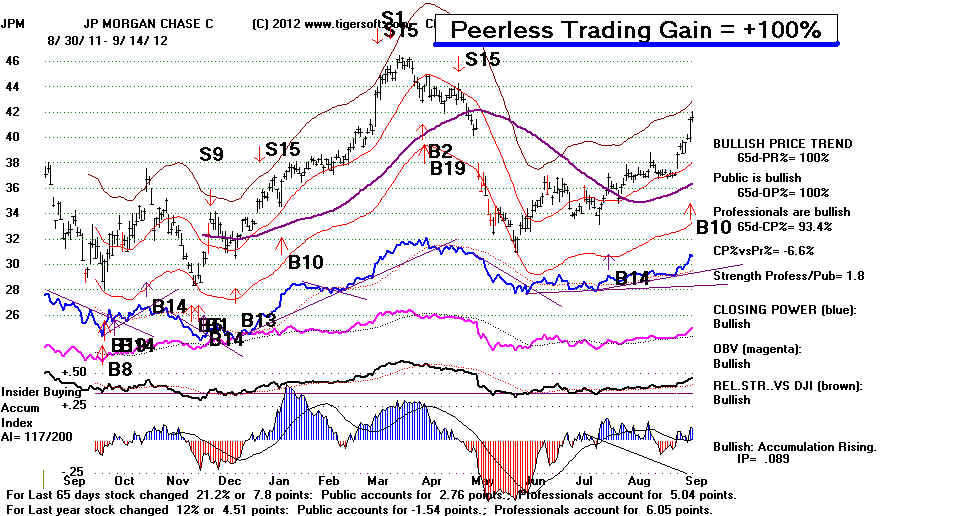

JP Morgan (C - US) + 100% Trading Gain using Peerless automatic signals

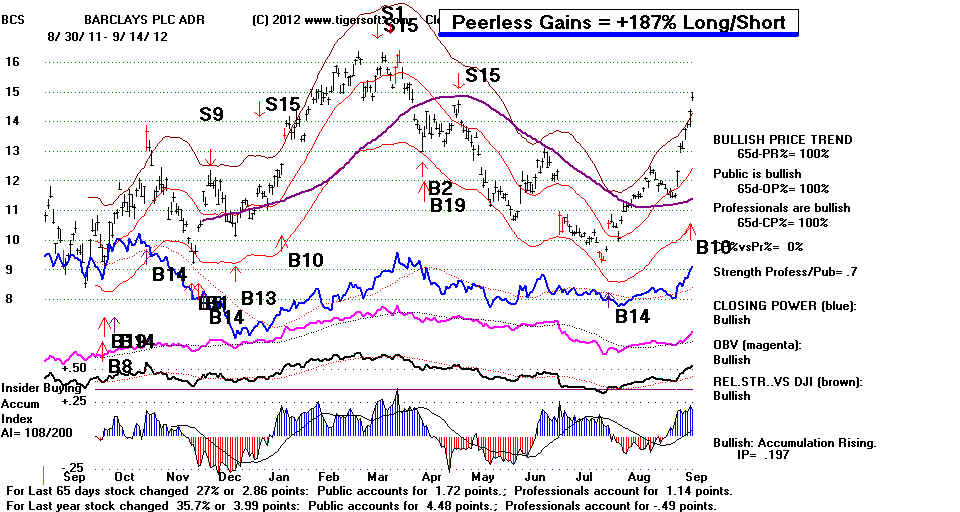

Barclays (BCS - UK), +187% Trading Gain using Peerless automatic signals

Deutsche Bank (DB - DB) + 90% Trading Gain using Peerless automatic signals

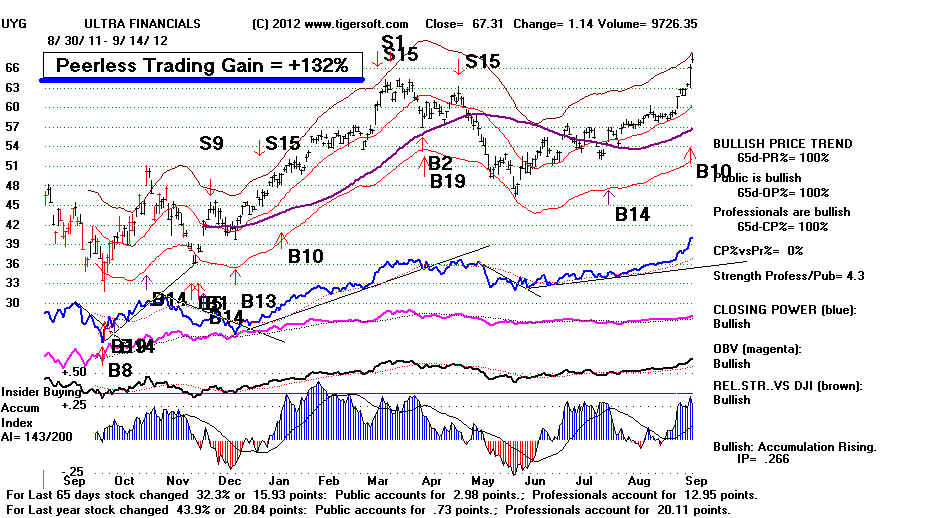

UYG Leveraged Long Ultra Finanacial Fund + 132% Trading Gain using Peerless automatic signals

3.> The Peerless automatic Buys and Sells have been back-tested now to 1928 and

used real-time since 1981. (Click on this link for more details).

4. > By successfully predicting the DJI and big bank stocks, Peerless and TigerSoft

predict other indexes and ETFs.

NASDAQ +50% Trading Gain using Peerless automatic signals

3x Leveraged Small Caps; ETF - TNA + 105% Trading Gain using Peerless automatic signals

QQQ

IWM

DIA

SPY

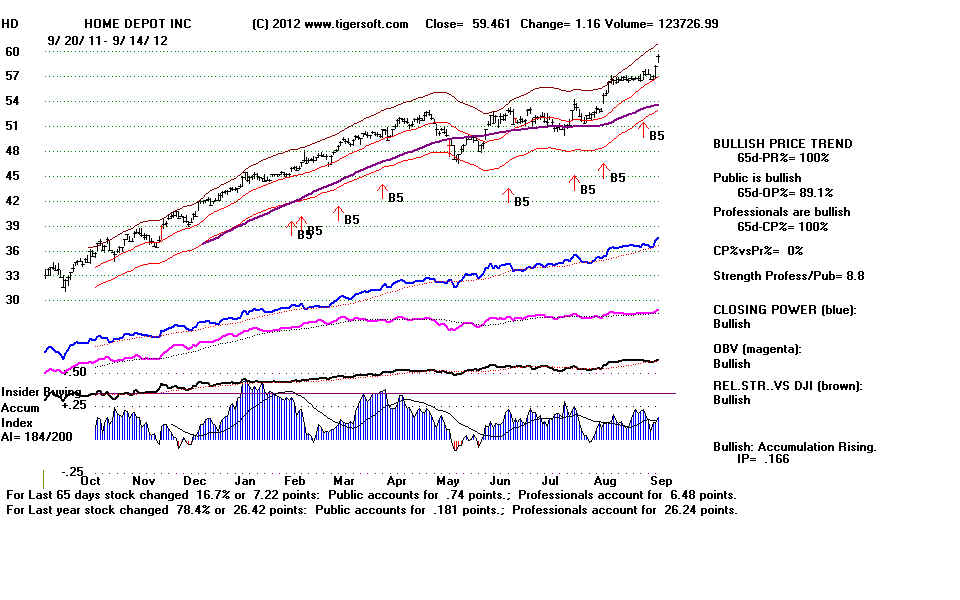

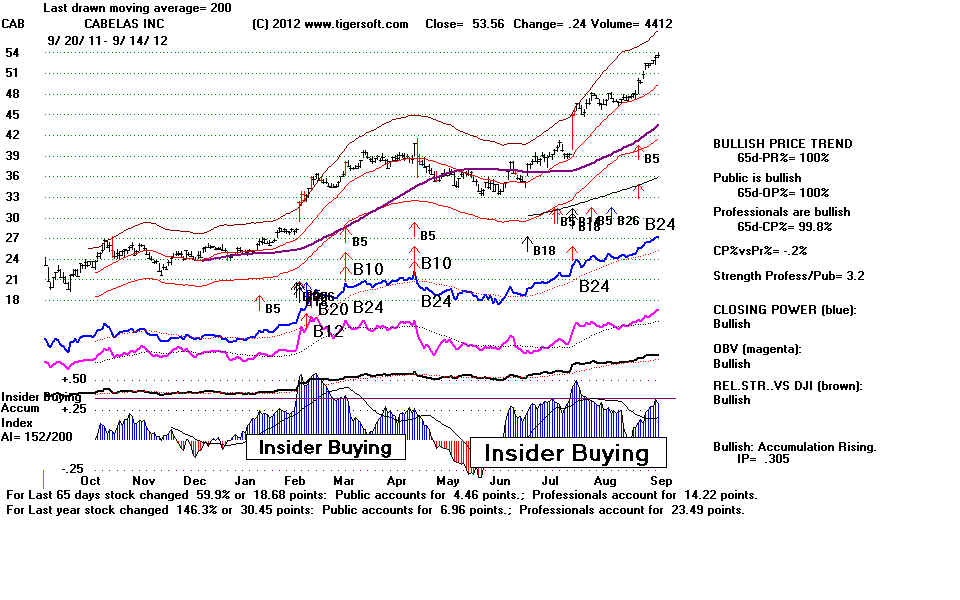

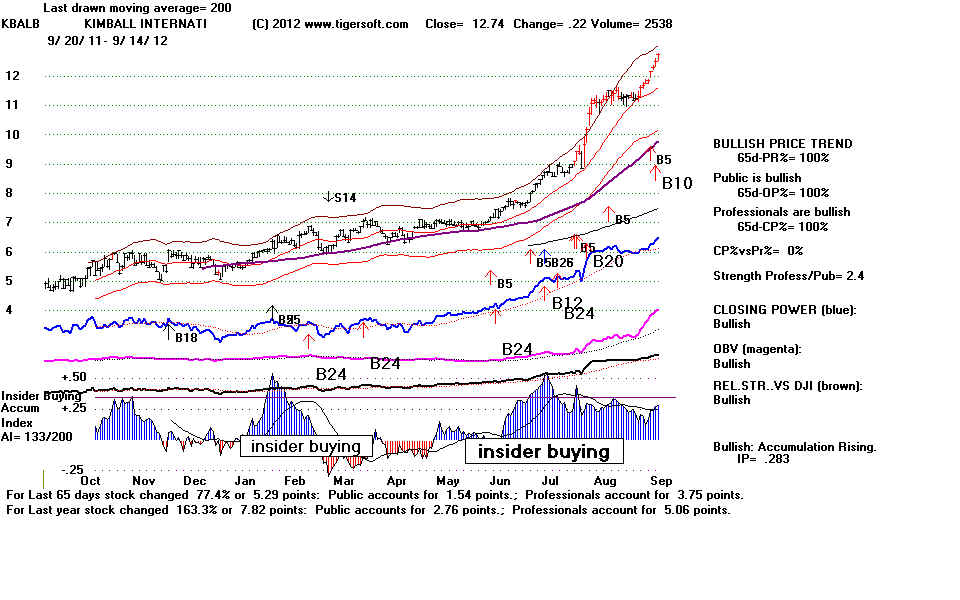

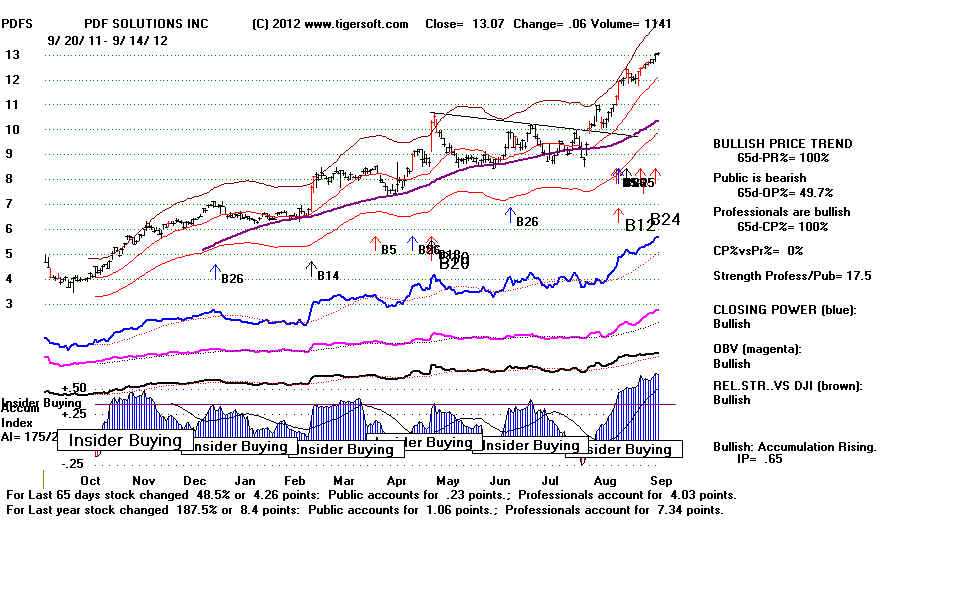

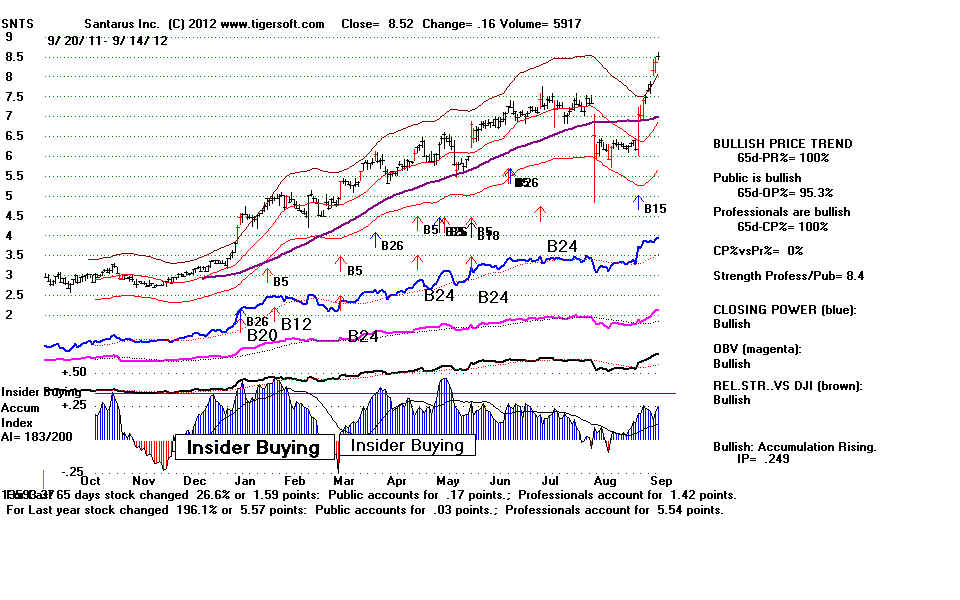

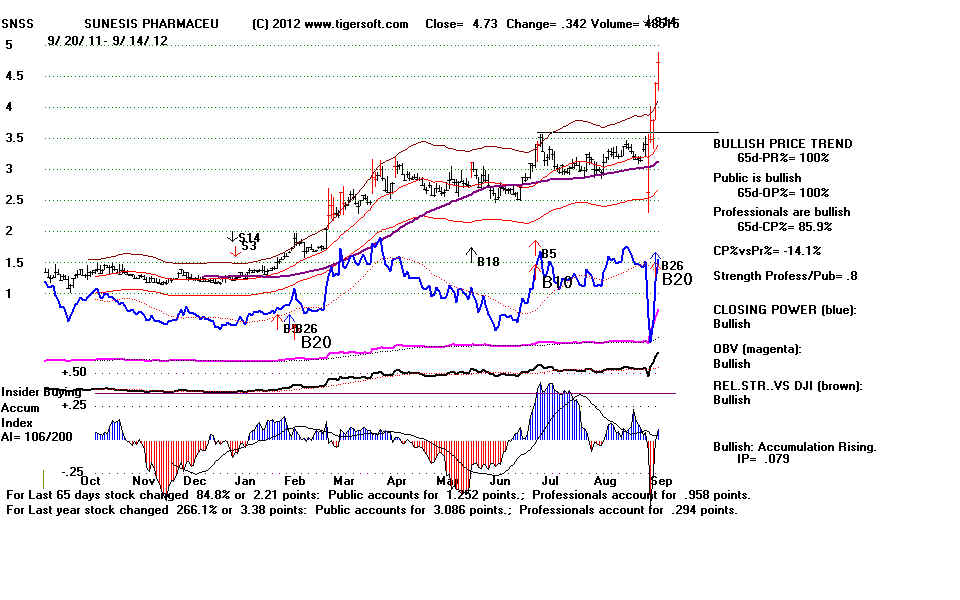

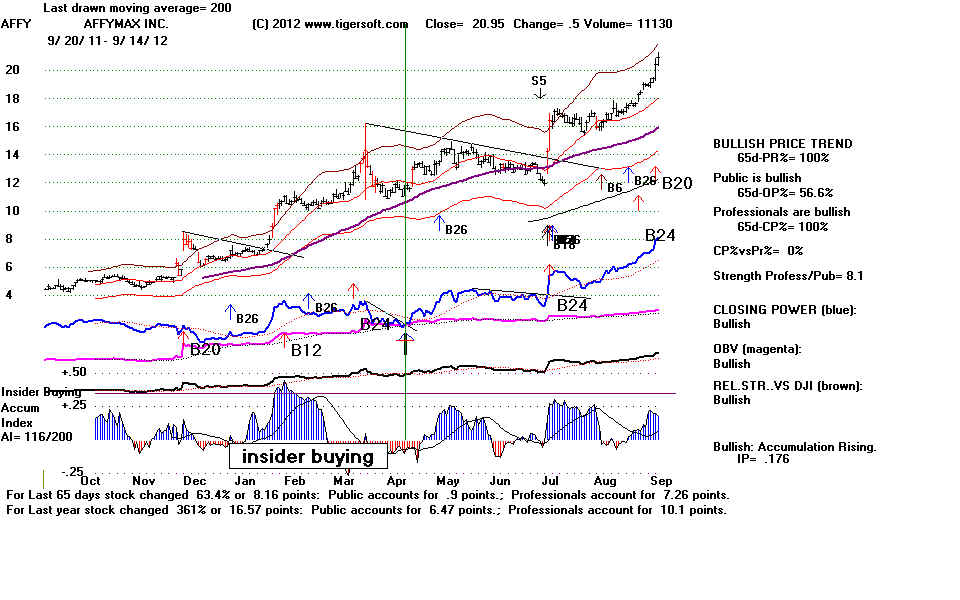

5. > If you buy the best stocks when Peerless switches to a Buy, you can consistently

make a lot of money. The best stocks show surges in our creation, the Tiger

Accumulation Index above +.375 and a strongly rising trend in oue Tiger Closing

Power. These we call Explosive Super Stocks. See also http://tigersoft.com/--3--/

Peerless and Tiger are very profitable. Ask us for your stock's chart:

Email william_schmidt@hotmail.com

JP Morgan (JPM - US)

Trading

Gain, Long and Short + 100% |

Barclays (BCS - UK) Trading Gain, Long and

Short + 187%

Leveraged Financials' ETF (UYG) Trading Gain, Long and Short + 132%

indexes and ETFs.

NASDAQ Trading Gain = +50%, Long and Short