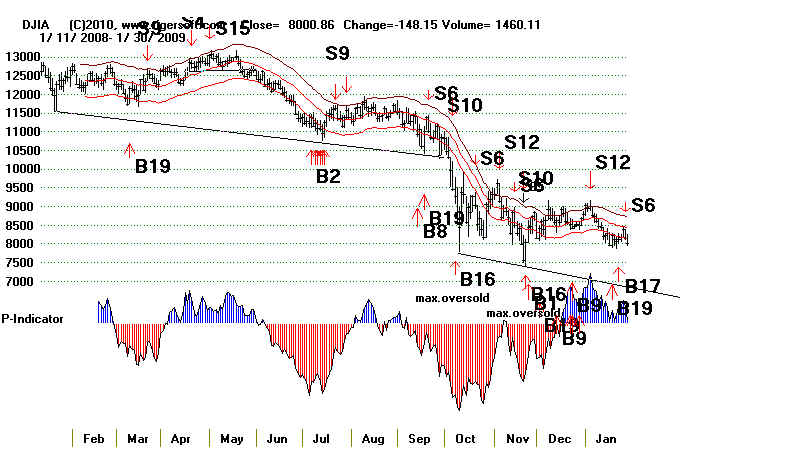

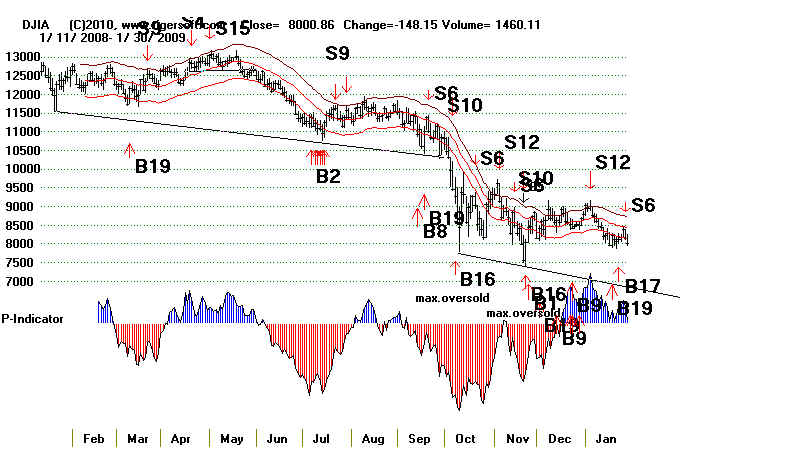

By May the DJI's weak recovery has topped out

with a head/shoulders pattern and multiple Peerless

Sells.

PEERLESS STOCK MARKET TIMING

and TIGERSOFT EXPLOSIVE SUPER STOCKS

Chinese Market's 2007-2009

Decline

Actually Led the DJIA Down and

then

Back Up.

2008

PEERLESS

STOCK MARKET TIMING 2008

By May the DJI's weak recovery

has topped out

with a head/shoulders pattern

and multiple Peerless

Sells.

Before this,

the Chinese markets had formed

a completed

head and shoulders at the end

of November 2007.

Daily Bog

- Tiger Software

November 22, 2007

http://tigersoft.com/Tiger-Blogs/11-22-2007/index.html

Head and Shoulders Tops Warn That The Long World Bull Market

May Be Ending. If so, Big Trouble Lies Ahead.

Watch to see if TigerSoft's ALL-ETF Index Completes Its Head

And Shoulders Pattern. It Is Very Close To Doing That.

Watch TigerSoft's China Index in The Same Way,

Tiger Index of 42

Chinese Stocks and Closed End Funds

A

breaking of the neckline would be quite bearish, given its long advance.

US Trading Partners Collapsed, too:

Canada, Mexico, Europe, Japan, Emerging Markets

The US Stock Markets collapsed simultaneously.

The Extreme US Bear Market Lasted

Until March 2009.

It declined until the Chinese markets refuse to make new lows

to confirm the DJI new lows.