TigerSoft and Peerless Daily

Hotline

www.tigersoft.com/-HL2013M28M/index.htm

IMPORTANT: The Server has become very, very slow. We will use

http://www.tigersoftware.com/SUPPLEMENTA/7-16-2013/index.htm

starting

7/16/2013 evening

This

address will change soon. But no notice has been sent out

yet giving new addresses, includingh Data Page and Elite Page.

-----------------------------------------------------------------------------------------------------------------------

(C) 1985-2013 William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Tiger Software 858-273-5900

PO Box 22784 San Diego, CA 92192

Email william_schmidt@hotmail.com

-----------------------------------------------------------------------------------------------------------------------

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

with you and a violation of copyright laws. I work hard for you. Respect that

effort!

---> To

renew this Hotline,

order here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

-----------------------------------------------------------------------------------------------------

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

1965 1965-6 1966 1966-7 1967 1967-8 1968 1968-9 1969 1969-70

1970 1970-1 1971

1971-2 1972 1972-3 1973 1973-4 1974 1974-5 1975 1975-6 1976 1976-7 1977 1977-1978

1978 1978-79 1979 1979-80 1980 1980-1 1981 1981-2 1982 1982-1983 1983 1983-1984

1984 1984-1985 1985 1985-1986

1986 1986-1987 1987 1987-8 1988 1988-9

1989 1989-90

1990 1990-1 1991 1991-2 1992 1992-3 1993 1993-4 1994 1994-5 1995 1995-1996 1996

1996-7 1997 1997-8 1998 1998-1999 1999 1999-2000 2000 2000-1 2001 2001-2 2002

2002-3 2003 2003-4 2004 2004-5 2005 2005-6 2006 2006-7 2007 2007-8 2008 2008-9

2009 2009-10 2010 2010-11 2011 2011-12 2012 2012-2013

Background

New Introduction to

Tiger/Peerless Buys and Sells.

Peerless Charts and Signals

Documentation for TigerSoft

Automatic and Optimized Signals.

======================================================================================

IMPORTANT: The Server has become very, very slow. We will use

www.tigersoftware/SUPPLEMENTA

starting 7/16/2013 evening

7/15/2013 If NYSE declines outpace advancers at the close tomorrow

by 100 or more, I think we should trust Peerless and short DIA or SPY.

There are still lots of high Accumulation breakouts. That makes me think

we should delay taking profits in in the very strong and high Accum. ETFs

like URTY.

See http://tigersoftware.com/SUPPLEMENTA/7-15-2013/Special/up715/index.html

Current

Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I

P-I ch P^ ^ IP21 V-I Opct 65PctChange

7/15/2013

15484 +20 1.027 .243

+282

-69 +282 -.039

-21 +.246 .041

7/15//2013 ---> To Key Index and Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

----> 257 MAXCP stocks Bullish MAXCP Stocks (7/15/2013) Bullish plurality

---> 42 MINCP stocks Bearish MINCP

Stocks (7/12/2013)

---> 208 New Highs on NASDAQ 9

new lows. Bullish

plurality

---> 174 New Highs on NYSE 11 new

lows. Bullish plurality

Friday's Peerless Sell S8 was not "clinched" today, as

there were

.

739 more up than down on the New York Stock Exchange. The Russell-2000,

Value Line, SAA (Leveraged Ultra

Small Caps' ETF), URTY

(Leveraged Russell-2000 ETF) and TNA (3x Leveraged Small Cap) all made

good gains. Their Closing Powers are still rising. Speculative momentum

and the demands for high performance from funds keep boosting the

best performing stocks. Wall Street believes that Bernanke and the

Fed will not dare to push up rates higher for fear of causing the weak

economy recovery to falter.

But Peerless has given a new signal. A Sell S5. It is based the

DJI being

above the 2.65% upper band with a very big non-confirmation from the

P-Indicator (the 21-day ma of NYSE advances - declines). The current

P-Indicator must be less than 50% of its 2 month high. The Sell S5 only

can occur from April to July.

New Sell S5

Its Sell signals have always been profitable. Paper losses were never over

2.5% in the new Peerless. The average DJI decline by the time of the next

Peerless Buy signal was 7.6%. The risk:reward ratio favors the short side

here.

But there is one important caveat. The adjusted P-Indicator

now is higher than in any

of the earlier Sell S5 cases. As with every new Peerless signal, I think it

is important

to place lower credibity on it if any of its key values (especially the P-Indicator

when adjusted) lie outside the range of their range in earlier signals.

Conclusion

With all the strength we are still seeing in the broader market, as

opposed

to the DJI-30 or even the SP-500, I think we have to wait, at least, for

NYSE declines to outnumber advances by more than 100 at the close.

This "clinching" rule worked very well in June 1987, as I mentioned last

night. Meanwhile, our long positions keep rising and the bearish MINCPs

are having a difficult time finding support. If NYSE

declines outpace advancers

at the close tomorrow, I think we should trust Peerless and short DIA or SPY,

but for now hold long the very strong ETFs, like URTY.

Past Sell S5s since 1929

Date

DJIA LA/MA

AnnRoc P-I

P-I ch P^ ^ IP21 V-I

Opct 65PctChange

7/15/2013

15484 1.027

.243

282 -69

282 -.039

-21 .256 .041

-----------------------------------------------------------------------------------------------------------------------------------------

1 6/19/1934 12.4% drop to next Peerless Buy signal.

99.00 1.033 .473

9

-7 52

-.001 -6 .151

-.037

-----------------------------------------------------------------------------------------------------------------------------------------

2 4/3/1936 6.5% drop to next Peerless Buy signal.

160.1 1.024

.198 -37

-10 -160 -.126 .112 ?

?

-----------------------------------------------------------------------------------------------------------------------------------------

3 6/5/1939 3.1% drop to next Peerless Buy signal.

137.1 1.027 .465

42

-7 195

.037 24 .318

-.067

-----------------------------------------------------------------------------------------------------------------------------------------

4 5/29/1946 23.2% drop to next Peerless Buy signal.

212.5 1.029

.329 64

-4 251

.260 43 .275 .142

-----------------------------------------------------------------------------------------------------------------------------------------

5 4/4/1956 8.3% drop to next Peerless Buy signal.

518.7 1.024

.636

39

-20 125 .14

4 -79

.468 .062

-----------------------------------------------------------------------------------------------------------------------------------------

6 4/12/1972 3.3% drop to next Peerless Buy signal.

966.96

1.023 .483

-2

43 -4

.087 0

.234 .064

-----------------------------------------------------------------------------------------------------------------------------------------

7 6/21/1976 4.7% drop to next Peerless Buy signal.

1007.45 1.031 .124

28

-3

52 .058 0

.024 .028

-----------------------------------------------------------------------------------------------------------------------------------------

8 6/6/1978 5.0% drop to next Peerless Buy signal.

866.51 1.028

.53

88

-2 183 .027 3

.264 .159

-----------------------------------------------------------------------------------------------------------------------------------------

9 5/1/1984 8.1% drop to next Peerless Buy signal.

1182.89

1.025 .186

-37

32 -65

-.004 -2 .114

-.039

-----------------------------------------------------------------------------------------------------------------------------------------

10 6/2/1986 2.2% drop to next Peerless Buy signal.

DJI rose from 1862 to 1909. Paper loss = 2.5%

(approx.)

1862 1.031

.556

51

-8

99 .135 5

.006 .086

-----------------------------------------------------------------------------------------------------------------------------------------

11 4/8/1988 2.8% drop to next Peerless Buy signal.

DJI rose from 2090 to 2110. Paper loss = 1% (approx.)

2090 1.027

.093 -39 21

-66 .043

-4 .242

.025

-----------------------------------------------------------------------------------------------------------------------------------------

12 7/19/1990 18.1% drop to next Peerless Buy signal.

DJI rose from 2090 to 2110. Paper loss = 1% (approx.)

2994 1.027

.41 0

-16

-0

.065 -5 .416

.082

-----------------------------------------------------------------------------------------------------------------------------------------

13 4/21/1992 1.6%

drop to next Peerless Buy signal.

DJI rose from 3354 to 3413 Paper loss = 2% (approx.)

3343 1.023

.244

-125

-15 -241

.064 -19

.235 .023

-----------------------------------------------------------------------------------------------------------------------------------------

14 7/6/1999 9.1% drop to next Peerless Buy signal.

DJI rose from 11194 to to 11326 Paper

loss = 1.2% (approx.)

11135 1.034

.371

58

-43

57 .043 -6 .18 .132

-----------------------------------------------------------------------------------------------------------------------------------------

15 5/3/2001 5.1% drop to next Peerless Buy signal.

12808 1.027

.412

113

-99

113 .154 -47

.335 .083

-----------------------------------------------------------------------------------------------------------------------------------------

SPY has gotten above its upper band. It is at the cusp

of a breakout

or a breakdown. Its volume recently has been low. Its Closing

Power is lagging. This makes it more vulnerable if prices do turn

down. .

|

|

|

A Comparison between MAXCP Stocks and

MINCP Stocks

MINCPs Are Declining and show very weak internals.

|

--------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

------------------------------------------------------------------------------------------------------------------------------------------------------

7/13/2013 Wait for the new Sell S8 to be

"Clinched". Stay short some of

the bearish MINCP stocks. These are South

American stocks and

short ETFs on smaller, less well-known stocks. Stay long the Leveraged

IWM ETF URTY and some of the Bullish MAXCPs.

Speculation

is picking up and will not be easy to stop. A number of

SP-500 stocks

made attractive and bullish flat topped breakouts on their

weekly charts.

So wait to act on the Sell S8. Otherwise, let's see what happens this week.

Ordinarily, the market is down starting the third week in July. Looking

all the 5 trading day periods after July 14th since 1965, we find that the

DJI was down 61.7% of the time. A continuation of the rally this week

despite those odds would be an impressive display of strength for the bulls.

Current Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I

P-I ch P^ ^ IP21 V-I Opct 65PctChange

7/12/2013

15464 +3 1.026 .371

+350

+91 +350 -.008 -.044 -4 +.264 .044

7/12//2013 ---> To Key Index and Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

Sell S8s can fail for a while. Study the failed

case of June 1987. We have an

increasingly speculative market. The excesses always seem to get bigger

than we might imagine.

"The market can stay irrational longer than you can stay

solvent."

-- John Maynard Keynes

7/13/2013 New Sell S8

using the new 7/4/2013 Peerless. This link shows the track

record of the signal and its technical basis. The previous version of Peerless

shows the

operative Peerless signal still to be a Sell S9-B. The 7/27/2006 version

helpfully warns

of the A/D Line non-confirmation with a minor Sell S13 (which did not have a strong

track record.)

These Sell S8 signals are not perfect, but they are reliable enought to act on,

once the

market stops rising with positive breadth. Only one of the 14 Sell S8s brought a

loss

at the time of the next Peerless Buy. Half of them led to declines of 10% or more,

though the declines sometimes delayed. But the signal is not perfect. There

were

3 paper losses between 3% and 4.1%. If they do not bring about a decline now, it

usually

means a bigger decline is coming after Labor Day. (Think of leaves and stocks

falling

together).

Because the P-Indicator is positive, we do have to be concerned that the market will

keep rising as it did in June of 1987. As in the June 1987 case, the percent

change

of the DJI now over 65 days is relatively small. Keep in mind that big reversals are

more likely to come in the Fall and when there is more to reverse. So, if the DJI

makes

a brief sidewise pattern here with excellent breadth, we could see a new Buy signal,

most likely a Buy B4, as in 1987. We'll watch also to see if the Accumulation Index

turns up quite positively, as it did in late June and early July 1987.

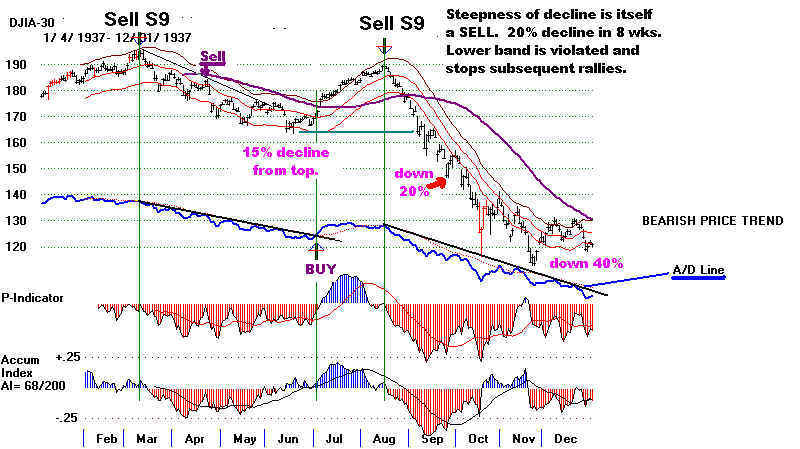

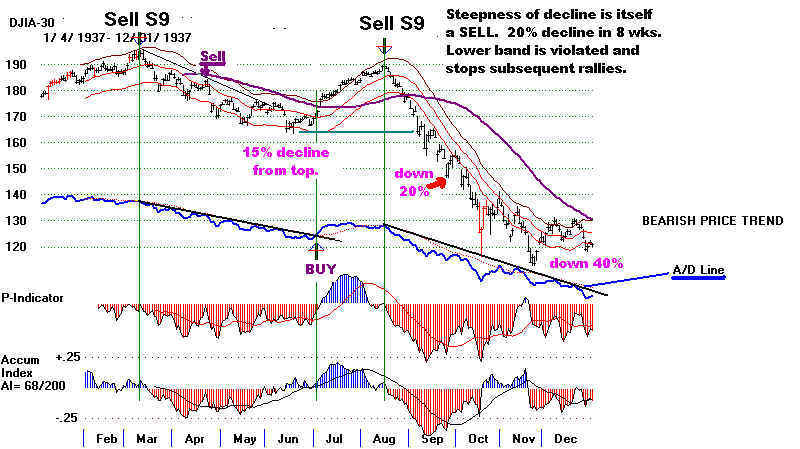

1987's Failed June Sell S8/S9/S12 led eventually to

a much bigger October Crash.

As I have been saying. we have an increasingly speculative market.

The large

number Bullish MAXCPs testify to that. So do the bullish leveraged ETFs.

So, at this stage, the Sell S8 signal applies mostly to the DJI-30 and NYSE

and not so much to the NASDAQ.

Details are important. If you study the key values associated with past Sell S8s

and the new one now, you will see that the failed June 1987 Sell S8 and the current

S8 case have something in common. The 65-day Pct Change in both cases was

up less than 4.5%. All the others had a higher key value. This means that

prices

may not be sufficiently over-bought to be reversed. We'll see.

Back in June 1987, we worked with a "clinching rule". There had be 25 more

NYSE stocks down than up on the day of the signal or on a subsequent day to

"clinch" the Sell S9 back then. As it turned out, the S9 then was never

"clinched:

before a new Buy B4 signal reversed the unclinched Sell. This turned out well

because the DJI advanced another 10% by mid August.

So, while the DJI may fall

back from the 15500 resistance, the NASDAQ,

SAA (Leveraged Ultra Small Caps' ETF), URTY (Leveraged Russell-2000 ETF)

and TNA (3x Leveraged Small Cap) show high Accumulation and very superior

strength relative to the DJI. It would be surprising for their advances to halt

before they reach the top of their price channels. And, of course, they might

breakout, just to make life more miserable for the shorts and for the

skeptical.

Accordingly, if you hold URTY, as recommended here when the head/shoulders

pattern was aborted by the DJI closing above 15050, I would let them run further.

This has become a speculative market for secondary stocks. Money has been

coming out of well-known dividend stocks and put to work in high performance stocks.

That is likely to continue even if the DJI pauses or pulls back. (If you do not have

a position in URTY, we have to hope for a pull-back.) But keep in mind, the moves

up by TNA and URTY are not fluke-moves. Look at the high Accumulation, the

high relative strength and the very high trading volume in TNA. Speculative

advances in the "cats and dogs" has a long Wall Street tradition. It is

usually

the final stage up of a bull market and it can last a year or two, 1967-1968 and

1998-2000.

2013's Explosive Super Stocks

The 22 stocks here are worth studying, so that we have

no doubts about what to look

for in search for the best performing stocks.

But they have another use. Below I have created an Index of the 22 stocks

making new highs today that show extremely big bulges of Accumulation (IP21>.48)

at one or points this past year and are also up 110% over the last year. These

I call EXPLOSIVE SUPER STOCKS. I will post its chart here regularly.

It should be helpful to watch the A/D Line and RSQ (Relative Strength) Line for this group

of stocks. Until these uptrend-lines are broken, I suspect the speculative

surge we are

mpw seeing will continue despite the Peerless Sell S4. It is hard for stock

markets not

to top out (or bottom out) without going to some foolish excess. The psychology of greed

and fear among the masses of fund managers (not to mention the broad public) are just

too entrenched by the need to perform well. They are too powerful to resist.

It is better

to accept that reality than fight it, I think, provided one is particularly vigilant and

sensitive to changes in the these trends.

----> 222

MAXCP stocks Bullish MAXCP Stocks (7/12/2013) Bullish plurality

---> 35 MINCP stocks Bearish MINCP

Stocks (7/12/2013)

---> 173 New Highs on NASDAQ 5

new lows. Bullish

plurality

---> 149 New Highs on NYSE 7 new

lows. Bullish plurality

=====================================================================================

OLDER HOTLINES

=====================================================================================

7/11/2013

No Peerless Sell Yet but the Distribution

in many of the

biggest

stocks in the SP-500 continues and is a warning.

Current Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I

P-I ch P^ ^ IP21 V-I Opct 65PctChange

7/11/2013

15461 +169 1.028 .268

+258 +217 +258 -.044

-25

+.186 .053

7/11//2013 ---> To Key Index and Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

The High Ratio (>7:1) of NYSE UP Volume to NYSE Down Volume today

prevented a

Peerless Sell S9V and a Sell S12. But with the heavy distribution and the DJI

at the

upper band, waiting for a pullback to buy more seems best. Hold long some of

the lesser

known, high Accumulation stocks and the ETFs IWM or URTY. Stay short

a few

Bearish MINCPs, too. We may still get a Sell tomorrow.

By my

research below, there is a 18% chance for an additional 13%-20% DJI

gain, but a

27% chance of an immediate sell off. If the rally continues, know

that in all

the Summers since 1929 in this this technical configuration, there were

only 2

cases of the DJI rallying more than 4.5% and 5 cases where the rally ended

with a a

further gain of 1% to 4.5% plus the 3 cases of an immediate sell-off. .

Consider

the history of negative divergences by the IP21 (Accum. Index) and V-Indicator

when the

DJI is 2.8% over the 21-day ma. since 1929 shows. I found 11 cases from

mid June

18th to September 8th. We see this is normally a bearish combination.

thuough

there are a 2 cases when prices rise to much higher levels, only to eventually

fall even

further.

In 3 of the

11 cases, the DJI fell immediately and below the lower band.

This alone

argues for

caution even though there was no official Sell yet. +27.2%

Probability.

In 5 of the

11 cases, the DJI first rallied 1% to 4% and then fell below the lower band.

This

included the Crash of 1929. In 4 of these 5 cases, the DJI fell below the lower

band.

+45.5% Probability.

In 2

of the 11 cases, the DJI rallied strongly. In the first case, 1935. momentum was

very

poswerful. The DJI was up 20% over the last 65 trading days. In the second case,the DJI

was

also

up 5.3% on 6/18/1987 when a Sell S12 occurred which failed as rhw DJI rallied

for

two more months before crashing. See 1987 The DJI is now also up 5.3%

over the

last

65 trading days. The adjustible P-I readings are also similar now compared to the

June

1987 case, +256 to +370. So, good momentum and comparable P-Indicator readings

offer

hope to the bulls that we may see another two months' strength. +18.2% Probability.

Negative IP21 and V-I in Rising Markets

with DJI 2.7% or more over 21-day ma

from July to September

1.

7/3/1929 DJI rallied 13% (from 342 to 381.2

on 9/3/1929) and

then crashed to 198. (11/131929) 65-day pct

change pct = 13.4%. P^^=20

2.

8/22/1929 DJI rallied 2.5% more from 369.9 to to 381.2

(9/3/1929) and

then crashed to 198. (11/131929)

Adjusted P-I = -135. 65-day pct change pct = 17.7%.

3.

9/6/1932 DJI fell immediately

from 77.3 to 56.4 on 11/30/1932.

5.4% over the 21-dma with IP21 = -.05

4.

6/24/1935 DJI rallied strongly.

This was not allowed because the DJI was up 20.3% over the last 65 days,

showing too much momentum with adjusted P-I was +165, too.

DJI was 3.5% over 21-dma with IP21 = -.024

5.

7/26/1938 DJI fell immediately from 143.3 to 129.9

(9/26/1938).

6.

7/1/1959 DJI rose 4% from 650.2 to 678.1 (8/3/59)

and then

fell to 616.5 on 9/22/1959. This was a Sell

S9/S12

7.

8/17/1971 DJI rose 2% from 899.9 to 916.47

(9/6/1971) and then

fell to 797.97 (11/23/1971). This was a Sell S12

8.

6/18/1987 DJI rose 13% from 2408.13 to 2722.42 (8/25/1987)

and then

fell to 1728.74 on 10/19/87. This was a Sell S9/S12

9.

7/8/1998 DJI rose 2% from

9174.57 to 9337.97 (7/17/1998) and then

fell to 7827.4 on 9/1/98. This was a Sell S9/S12

10.

8/14/2000 DJI rose 1% from 11176.14 to

11310.64 (9/6/00) and then

fell to 9975.02 on 10/18/2000. This was a Sell

S9/S12

11.

7/17/2007 DJI fell immediately from 13971.55 to 12845.70 on

8/16/2007.

This was a Sell S9/S12. Sell S9/S12

------------------------------------------------------------------------------------------------------------------------------------------------

7/11/2013 New Bullish Leveraged ETFs

----> 228 MAXCP stocks Bullish

MAXCP Stocks (7/11/2013) Bullish plurality

---> 63 -2 MINCP stocks

Bearish MINCP Stocks (7/11/2013)

---> 250 New Highs on NASDAQ 7 new

lows. Bullish plurality

--->232 New Highs on NYSE 2

new lows. Bullish plurality

=====================================================================================

OLDER HOTLINES

=====================================================================================

7/10/2013

We Are Close to A Peerless Sell S12. Usually

after a Sell S9B,

the DJI

goes into a trading range. Here the likely boundaries would be 14500 and

15500.

The big

jump in Crude Oil prices will hurt the recovery and could cause the

Fed to

raise interest rates more quickly than otherwise. It certainly is bearish

for LFL, Latin American Airlines Group.

The minutes for

the June Fed meeting on interest rates released late today suggest

there will not be

much if any reduction in QE-3 this year because the recovery

is still too

fragile. Knowledge of these minutes prior its public release was

something big

banks clearly have already acted on. After all, it is their

representatives

who make up the Open Market Committee. This accounts for

a big part of the

recent rally up from 14500. So, buying tomorrow morning on the

basis of this

"news" is probably not a good idea.

The DJI

stands +1.7% over the 21-day ma with an IP21 (Accum. index) of -.072

and a V-I

of -72. A rally of 153 points would cause the DJI to be

at the 2.7%

upper band

tomorrow. Since these internal strength indicators cannot easily

turn

positive. Peerless may give a Sell S9-V, a Sell S12 or a Sell S15 tomorrow

if the

closing price holds the higher opening.

We use 21-day moving averages. The numbers being

dropped off Thursday

and Friday

reflect big down-days. That will boost the Accumulation Index and

the

V-Indicator. It is not clear if it will be enough to avoid a sell signal.

Dummy

numbers

into the DATA.txt file using Peercomm and Edit towards the close tomorrow

to get a

preview of whether there is a Sell. (Thank you, Michael, for suggesting

this.)

Right now the DJI Futures would put the our key

index up 146 points tomorrow morning.

Since several key

Peerless internal strength indicators are negative, it is likely we will see

a Peerless Sell

S12 or S15 tomorrow. Don't rush to sell everything. We

probably

should wait to

see the signal clinched by more down than up on the NYSE. Secondary

stocks will hold

likely hold up a little longer, as happened in mid 1999. That the bearish

divergences now

in the Accumulation Index and ClosingPower have not lasted

a long time and

that we have not seen several Peerless S9s or S12s in the last 6 months

argue against

more of a retreat than back to the lower band, once there is a reversal.

Let's compile a

list of July Sell S12s from http://tigersoft.com/PeerInst-2012/--SellS12-.htm

since 1966 in

rising markets. There have only been 2 or 3 cases. In one case (1968),

the

DJI fell to the

lower band. The 1998 instance saw a much bigger decline. The 2000 case

brought a DJI

decline to the lower 2% band, then a 5% paper loss and then a 15%

DJI decline.

More tomorrow night if we get the signal...

3 July Sell S12s since 1965

...S12 #1 S7/S12 7/11/1968 922.82 Drop to next Buy = +4.3%

7/11/1968 922.82 la/ma=1.017 21dma.roc=.081

la/65dma=1.022 65dma.roc=.35

P= 36 Pchange=-18 IP21= -.052 V= 5 OP= -.008

-------------------------------------------------------------------------------------------------------------------------------------------------

...S12 #2 7/7/1998 9085.04 Drop to next Buy = +16.8%

7/7/1998 9085.04 la/ma=1.021 21dma.roc=.063

la/65dma=1.009 65dma.roc=.042 P=-5 Pchange=-38

IP21= -.047 V=-19 OP= .056

------------------------------------------------------------------------------------

...S12 #3 7/ 17/ 2000 10804.27 +0.3%

( This has been dropped by new Peerless as a Sell S12.

Not sure why. Will have to check code tomorrow.)

7/17/0 10804.27 la/ma=1.023 21dma.roc=.101 la/65dma=1.016

65dma.roc=-.117 P= 104 Pchange=-8

IP21= -.046 V=-61 OP= .202

------------------------------------------------------------------------------------

The Booming "Cats and Dogs"

Low Priced Speculative Boom. The shift of money from dividend

stocks to lesser known,

small companies

continued today. This theory explains why the Russell-2000.

the Value Line, IWM, URTY (3x leveraged IWM) and TNA (3x Leveraged Small cap ETF

are now moving to

new highs ahead of DIA, SPY.

These smaller cap ETFs show none

of the red

Distribution now seen in the Tiger charts of DIA, SPY and many individual high caps.

We should start

watching TZA, the very heavily traded, 3x leveraged Short

Small Caps

ETF.

Its chart below is a classic bearish one, complete with heavy red Distribution,

flat-bottomed

breakdowns, failed rallies to a falling 65-dma and a blue Closing Power

that regularly

confirmed new lows. See also TWM. (the Ultra

Short ETF on IWM.

Oil prices jumped

still higher today, showing their recent Accumulation and Closing Power

confirmed

breakout was significant. Our Perpetual Crude Oil chart,

CL1600, shows a classic,

bullish breakout.

And if there are any doubts of this, see how classically bearish looking

the ETF shorts on

Crude Oil look, namely actively traded SCO and DTO.

We should

all remember how

$145 Crude Oil killed the stock market in mid 2008. Oil prices

this high are a

heavy tax on consumers and may cause more Fed Governors to

make fighting

inflation their highest priority.

South

America's economies are now being hit with a pair of triple whammies,

falling prices

for gold, silver and copper, rising interest rates, oil prices and public

expectations.

Accordingly, consider shorting LFL, Latin

American Airlines Group.

----> 228 MAXCP stocks Bullish MAXCP

Stocks (7/10/2013) Bullish plurality

---> 63 -2 MINCP stocks

Bearish MINCP Stocks (7/10/2013)

---> 120 New Highs on NASDAQ 7 new

lows. Bullish plurality

--->88 New Highs on NYSE 19

new lows. Bullish plurality

====================================================================================

OLDER HOTLINES

====================================================================================

7/9/2013 The Accumulation Index Shows Lots of Distribution on This Rally.

A July Top Seems Likely.

That would be consistent with the earlied Sell S9B marking

the start of a trading range.

I think we have to wait for a new Peerless Sell.

Tiger Sell S9s (Negative

Accumulation at the upper band) can be now displayed on a

number of important

stocks: WFC (Wells Fargo), UPS

(United Parcel), USB (US Bank Corp),

UTX (Unitied Tech), XOM (Exxon), V (Visa), ADBE and in SP-500: AMP,

FII, JNJ,

K, KLAC, ROP, SLB,

AFLAC, BBT, CAM, CERN (two days ago), CFN, CTAS,

FRX, GD, GME, HIG,

I{G, NTRS, RAI, TSS, WDC. You can also put Tiger S9

on the NASDAQ and DIA (below).

Another 1% rally higher

will most likely cause a comparable Peerless Sell S12 to appear

on the DJIA chart.

Remember the Peerless Sell S9 is different. The Tiger Sell S9 is

similar to, but usually

leads, the Peerless S12 and Sell S15. Only in 3 of the 14 cases of a

Tiger Sell S9 since

1998 did the DIA rally right afterwards. One case was in 1999 when

the market had become

very speculative, as I was discussing yesterday, In two of the

other 3 instances of a

rally following the S9, there had just been a long bear market.

How Well Do Past Tiger S9s Predict The DIA?

The 14 Earlier Cases since DIA's Inception.

BAD 4/7/99 DIA rallied from 101 to 112.93

on 8/24 and then fell to 100 on 10/15 and rallied

again.

A Peerless S12 did not occur until 6/8/1999 and on 8/23/1999 with DIA at 113.29. n

12/23/99 DIA fell from 114.48 to 109.76 on 1/4/2000 and then to 100.32 on 3/9/2000.

There soon followed Peerless S9s and S15s.

12/13/2000 DIA fell from 108.06 to 102.95 on 12/20/2000, rallied

4% and fell to 93.45 on 3/22/1001.

A Peerless S9 had occurred two days earlier. A Peerless Sell S8 stopped the recovery

rally.

BAD 4/23/2003 DIA rallied much higher as new bull

market began,

There was no Peerless Sell.

2/15/05 DIA fell from 108.48 to 100.05 on 4/28/2007

A Peerless Sell S15 on 3/4/2005 (109/54) marked the exact

top.

12/19/06 DIA fell from 108.21 to rising 65 day ma, 106.47 on 1/20/2--6)

and then rallied.

There was no Peerless Sell.

1/5/06 DIA fell from 108.88 to rising 65 day ma, 106.47 on 1/20/2--6)

and then rallied.

There was no Peerless Sell.

2/15/06 DJI fell only 2% and then rallied 6%.

There was no Peerless Sell.

6/18/07 DIA rallied first from 135.94 to 139.80 on 7/17/07 and then fell to 128.85 on 8/15/2000.

Peerless Sell S9 and Peerless Sell S12 marked the exact top

in July.

11/4/2008 DIA fell immediately from 96.21 to 80.54 on 11/21/2008.

This coincided with a Peerless Sell S12

BAD 3/19/2009 DIA rallied strongly into a new

bull market.

There was no Peerless Sell

10/14/2009 DIA fell only 3% to rising 65-dma and then

rallied for 3 months.

A Peerless Sell S12 followed a few days later.

12/7/2011 DIA fell only from 122.07 to 117.36 on 12/19 and then

rallied strongly.

Peerless gave a Buy B13 at bottom.

10/11/2012 DIA fell from 13313.13 to 125.06 on 11/16

Peerless had given a Sell S4 a few days earlier.

The Bearish MINCP stocks include a number of companies

from Chile, Argentina

and Brazil.

Experience suggests that their appearance in numbers is significantly

bearish. .

Current Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I P-I

ch P^ ^ IP21

V-I

Opct 65PctChange

7/9/2013

15300 +76 1.018 .041

+15 +14 +14 -.076

-71

+.111 .05

7/9//2013 ---> To Key Index and Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

----> 232 -8 MAXCP stocks Bullish MAXCP

Stocks (7/9/2013) Bullish plurality

---> 65 -21 MINCP stocks

Bearish MINCP Stocks (7/9/2013)

---> 179 New Highs on NASDAQ 9 new

lows. Bullish plurality

--->171 New Highs on NYSE 13

new lows. Bullish plurality

Let's watch to see if the Closing Power uptrend of the most bullish leveraged Sector

funds is

broken, suggesting an end to their rally. They have approached their upper

band

without a big improvement in their Closing Powers. For now, I would hold them,

but also

stay short some bearish MINCP stocks as a hedge.

====================================================================================

OLDER HOTLINES

====================================================================================

7/8/2013

A July Peak for SPY and DIA May Be Shaping

Up. IWM and

Value

Line are another story.

The DJI seems to be rallying on higher Openings up to the

upper band,

about 2% higher where it will generate a Sell S12 or Sell S9-V based on the

negative Accumulation Index and V-I Indicators. Meanwhile, secondary stocks are

getting some of the money that was previously invested in NYSE dividend stocks.

The

uptrend of IWM may continue for a while after a Peerless Sell signal. That,

at

least, is the lesson that 1999 offers.

Current Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I P-I

ch P^ ^ IP21

V-I

Opct 65PctChange

7/8/2013

15225 +89

1.013 .146

+1

-60 +1 -.053 -73 +.109 .042

There are many, many lesser known stocks breaking out with very hiigh

Accumulation. See tonight's Bullish MAXCPs.

Speculation has moved away from

dividend paying blue chips and SP-500 stocks. It's not clear that even a

retreat by the DJI

would curb the broad rise in lesser known stocks. I won't call them "cats and

dogs", but there are eerie similarities to 1968 and 1999 when many unfamiliar

symbols made very big advances. after a very long bull market. URTY is the ETF

I would use to trade this advance in secondary stocks. Since URTY;s Closing Power

has not confirmed the breakout, I would still be hedged some of the

Bearish MINCP stocks.

7/8//2013 ---> To

Key Index and Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

Similarities with the Summer of 1999

We

want now to watch the Russell-2000 and Value Line. Breakouts with

confirming Closing Power new highs would be quite bullish for a month or so

in

these secondary stocks. The lagging Closing Power on the DIA and SPY support

this

interpretation. The way the Closing Power is lagging now is starting to look

like

the way Closing Power lagged the SPY throughout 1999. In that year, there

was a

10% decline in the Value Line only after a second Sell S9. All we had to

then

was play the price-trend of the Value Line in 1999 to reap the bulk of

its

big gains. This is worth considering as a strategy for playing the lagging

Closing Powers and the lagging SPY and DIA. Because we have not had a similar

Peerless Sell and because the Closing Power has only recently started to lag

prices, I would think the Value Line and Russell-2000 has 10%+ more upside now.

Compare the way the Closing Power for SPY lagged prices throughout 1999.

SPY 1998-1999

|

1999 SPY

|

----> 250 +7 MAXCP stocks Bullish

MAXCP Stocks (7/8/2013) Bullish plurality

---> 86 +3 MINCP stocks

Bearish MINCP Stocks (7/8/2013)

---> 197 New Highs on NASDAQ 4 new

lows. Bullish plurality

--->147 New Highs on NYSE 20

new lows. Bullish plurality

=====================================================================================

OLDER HOTLINES

=====================================================================================

7/5/2013

Hedging with some short

sales among the Bearish MINCP Stocks

still

seems advisable. But a breakout by the Russell-2000 or

the Value Line

would

show that we may be entering a period of increased speculation in smaller

stocks. Such a phase often ends a long bull market. Note

the Buy B19

on

6/25/2013 using revised Peerless (7/4/2013). It is based on its "breakaway

gap" from previous day's close. See below the beakaway gap on the Buy

B19

early

in 1939.

!938-1939 Shows 3 New Peerless Signals.

The Closing Power's divergence from Prices and Openings in the DIA and

SPY

charts are not bearish unless the DJI falls back below the 65-dma. That

could

happen if the July 4th week's low volume gains prove to be only temporary.

Current Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I P-I

ch P^ ^ IP21

V-I

Opct 65PctChange

7/5/2013

15136 +147 1.008 .139 +60

+111 +60 -.021 -53 +.108 .04

----> 243 MAXCP stocks Bullish

MAXCP Stocks (7/5/2013) Bullish plurality

---> 83 +33 MINCP stocks Bearish MINCP Stocks (7/5/2013)

---> 250 New Highs on NASDAQ 10 new

lows. Bullish plurality

--->173 New Highs on NYSE 43

new lows. Bullish plurality

7/5//2013 ---> To Key Index and

Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

Interest Rates on The Rise

Interest rate worries? While the rise in interest rates may

bring another decline

to

the lower band, in the past, there have been many 1/4% rises in the Prime Rate

or

Discount Rate and as long as rates were very low, under 3 1/2%, the DJI seldom

fell

much below the lower band. There are two exceptions. The first was in

January

2003,

when Greenspan blundered

and raised rates while the DJI was still in a bear market.

The

second was on February 4, 1994 when the Federal Funds were raised from 3% to 3 1/4%.

That

immediately brought a 10% decline. Greenspan's first blunder, of course, was in

September 1987. which precipitated the DJI's 33% free-fall the next month. We do

have

to worry that the Fed will blunder. Or perhaps, Obama has decided NOT to reappoint

Bernanke because the Fed Chairman no longer wants to provide extremely low rates.

End of The Head/Shoulders Pattern

The

DJI rose above the apex of its potential right shoulder in head/shoulder pattern

on

Friday. This was on light holiday trading volume. So, we will have to

wait to see

whether the big market's players, banks and institutions, allow the breakout over 15500.

But,

at this time, it looks like the bearish head/shoulders pattern scenario, which I have been

mentioning here, has been destroyed.

Peerless Should Probably Be More Political

Peerless

does not require users to indicate who is in the White House. But maybe,

it should.

A Democrat in White House clearly favors more of a Summer Rally in

the

post-Presidential Election Year than a Republican in the White House does.

See

Thursday's Hotline.

Buy B19 - Reversal Up

New

research here shows that the reversal on June 25 should probably have been

treated as

a Buy B9 despite the earlier Sell S9-B. History shows that when a powerful

reversal

upwards takes place with a price gap between the previous day's close and

the low on

the reversal day, it is a reliable B19 reversal.

July 4, 2013 New Peerless

All

things considered, I now take the operative Peerless signal to be a Buy B19.

The

new Peerless release of today reflects that. I am posting links to all its charts

since 1965

above

for your reference. The signals have been changed in a number of places. The

July

2013 documentation still remains undone. That will be the highest priority now.

It

will be posted separately from the Documentation

for the last update, March 2013.

In

the new update, there are many more Buy B2s, much revised Sell S7s and Sell S8s

and a

new Sell S16 for year-end false rallies. The signals test very well back to 1929.

There

is a simpler procedure for using the Extreme Bearish Mode.

When the

new Program's documentation is done, it will be posted. My Peerless book

will

include documentation back to 1928. plus a lot more. Links to download this July

2013

update will

be sent to purchasers and Elite Subscribers later tonight. If

you want this update,

please send

a check for $75 to William Schmidt, 5970 Gullstrand Street, San Diego,

CA 92122.

I still can take CCs, but they are very time-consuming to enter, there is a delay

and the

bank takes too much money. So, I appreciate your help here.

Can The Market Really Rally with Rates Up So Much?

Technically, the odds favor a rally almost to the upper band at 15500 and then

another decline to the lower band since the V-Indicator remains quite negative.

Moreover, the DJI and SP-500

are in downtrends. So are the Closing Powers

for

the DIA and SPY.

Meanwhile, the Russell-2000 looks like it may breakout

above

its flat resistance and start a good advance made up mostly of non-dividend

paying stocks. Utilities, bonds, REITs and many

NYSE dividend favorites

will

probably not participte unless the FED eases off its plans to wean the market

off

of QE-III.

Bernanke and the Fed will have a lot to say about rates later this week. And that

will

have a big impact on whether there is much of a rally from here. If Bernanke

is

watching the prices of Crude Oil, which has run up to

$103, he may agree with the

"hawks" that inflation is now a problem. Or he may argue that, Crude Oil's

rally

reflects the turmoil in Egypt, where the Suez Canal is. Deflation seems more

in

evidence to me. Food prices remain in a decline, as is Gold, Silver, natural gas,

copper and coal. Since the Dollar and 10-year

Interest Rates jumped to new highs,

Bernanke may decide to try to calm the fears of bondholders in his next speech.

Friday's Job Report was ambiguous. Yes, more jobs were created than expected,

but

Unemployment here in the US and in Europe is way to high.

The

interest rate on 10-Yr Treasury Bonds has risen more than 1% in under

2

months. In the past, big jumps in the Discunt Rates, by

1/2% in one accouncement

were

very likely to bring a 10% DJI drop of more. This was true in the aftermath

of

the rate hikes of 8/23/1957, 2/26/1973, 4/25/1974, 4/9/1984, 9/4/1987, 8/16/1994

and

5/16/2000.

However, rises in interest rates from very low levels mostly do not seem to halt

market

rallies for very long. Consider how Prime Rate increases affected the stock

market between

August 1, 1948 (2% +1/4%) to August 6, 1957 (4.5% + 1/2%) and between 2002

and

2007 when Discount Rates were regularly raised. 4 of the 8 Prime rate increases

up to

3 1/2% brought significant advances. Rate increases did not

drop the DJI below

the

lower band until the Prime Rate rose over 3 1/2% and over 3 1/2% for Discount

Rate.

1 August 1, 1948

2% DJI declined from 181.3 to 176 (9/27/48)

Bigger move was up

and then rallied to upper band (189) on 10/27/1948

2 September

22, 1950 2.25%

DJI rallied to upper band two

weeks later,

Flat

and then fell to lower band.

3 January

8, 1951

2.5% DJI rallied

9% from 242 to 263 in five months.

Big move continued

4

October 17, 1951

2.75%

DJI fell 7%, from 273.5 to 257 on 11/23 and

First move was down.

then rallied back to 275 on 1/22/1952

5

December 19,

1951 3.0% DJI rallied 3% from 268 back to 275 on 1/22/1952

Big move was down.

and then fell 7% to 258.5 and lower band on 2/20/1952

6

April 27, 1953

3.25% DJI rallied 2+% from

272.7 to 278.8 on 5.11/1953

Big move was down.

and then fell 6% to 262.9 om 6/16/1953

March 17, 1954

3.0% This launches big bull

market.

7 August 4, 1955

3.25% DJI fell from 454.2 to 448.8 5 days later and then

Bigger move was up

broke out and rallied past the upper band.

to 486 on 9/22/1955

8

October 14, 1955

3.5%

DJI rallied from 445 back to old highs at 489 on 11/17/1955.

Bigger move was up

April 13, 1956

3.75% DJI rallied 2% and

then fell to 468.8 on 5/28/1956.

Big move was down.

August 21, 1956

4.0% DJI fell 505 to 466,1 on 11/28/1956.

Big move was down.

August 6, 1957

4.5% DJI started bear market,

fell 494 to 420 on 10/22/1957.

Big move was down.

Greenspan and Discount Rates

1/25/2003

1.75% to 2.00%

DJI fell below lower band m 8131to 6524 on

3/11/03

Bear market had not ended.

6/30/2004

2.25% DJI fell from 10435 to 9815 (lower band) on 8/6/2004

8/10/2004

2.5% 3rd rise did not bring a

decline.

DJI rallied from lower band almost to upper band.

9/21/2004

2.75% DJI fell from 10245 to 9755 (lower band) on 95/2005

11/10/2004

3.0% DJI rallied 5% from 10385 to 10941 on

3/4.2005.

12/14/2004

3.25% DJI went sidewise for 4 month before falling to lower band.

2/2/2005

3.5% DJI rallied 3% and then fell below lower bamd.

3/22/2005

3.75% DJI fell 5% from 19565 to 100012 a month later/

=====================================================================================

OLDER HOTLINES

=====================================================================================

7/3/2013

Peerless Sell S9B

While, the Key Values are mostly STILL Negative, a

Democrat in

the White House favors a Summer Rally this year. A decisive move

above 15050

would destroy the bearish-looking head/shoulders pattern.

Current Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I P-I

ch P^ ^ IP21

V-I

Opct 65PctChange

7/3/2013

14989 +56 .99 -.150 -52 6

-52

-.076 -88 +.03 .022

----> 160 MAXCP stocks Bullish

MAXCP Stocks (7/3/2013) Bullish plurality

---> 50 MINCP stocks Bearish MINCP Stocks (7/3/2013)

---> 63 New Highs on NASDAQ 9

new lows. Bullish plurality

---> 33 New Highs on NYSE 19

new lows. Bullish plurality

7/3//2013 ---> To Key Index and

Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

The DJI is

developing in the classic fashion that a potential head/shoulders does.

It is hesitating

as it traces out a potential right shoulder.

The bearish

scenario requires a penetration of the rising 14500-14600

neckline.

This only happened in 1971 Sell-S9B case.

More common is for the

DJI to enter an

extended trading range, as it did in 1986 and 2004 after a Sell S9-B.

There is also a

chance that the DJI will surge upwards once it surpasses the 15000-15100

right shoulder

apex. This destroys the head/shoulders pattern and causes

a rush of

short-covering. This happened following a Sell S9-B in 1945. See

the second chart

below.

Wednesday's rally

did see an up-closing after a weak opening. This is what

caused the Closing Powers to turn up. Crude

Oil broke out further over resistance and

$100 barrier.

AAPLE is trying to turn around. Biotechs have held above the

neckline in their

own head/shoulders pattern. Auto stocks are doing well.

But on Wednesday,

there were more down than up on the NYSE as concerns about

rising interest

rates continued. Will the rally continue when more normal trading

starts next week?

A retreat back to 14500 would make the DJI's formation look

more like a

bearish head and shoulders. Our Stocks' Hotline is comfortably hedged.

I think a lot

depends on whether the 15000 resistance on the DJI is decisively

overcome.

An advance above that would destroy the potential head and

shoulders

pattern. Often as in 1945, this brings a strong advance.

1945 Sell S9-B Case

Be flexible.

There are enough high Accumulation stocks breaking out among the

Bullish MAXCP to

give us plenty more stocks to go long if this happens.

Obama - Wall Street's Ally.

The pattern of

Summer Rallies when a Democrat is in the White House should

also encourage us

to play the long side if the market rallies next week. See how

differently the

DJI generally behaved after July 4th in the Post-Presidential Election

Year when a

Democrat was in office as opposed to when a Republican was charge.

Since 1945, only

once was there a July decline when a Democrat was in control

in 8 cases.

August was almost as bullish.

Of course, one

could argue that Obama is less powerful because Austerity-minded

Republicans

control the House of Representaives. To the extent that is true,

Obama's case may

still bear more resemblance to Jummy Carter's Austerity

in 1977.

Rhetoric aside, I believe Obama has helped Wall Street and the bull market

repeatedly since

2009. He has, for example, not muttered a single word about a

tax on

computerized trading. Now he is backing down regarding businesses being

required to buy

Health Care insurance for all employees in 2014.

DJIA with Democrat in White House

7 of 8 brought gains for rest of year.

Red shows a down month.

July

Aug

Sept

Oct

Nov

Dec

7/3 7/31

8/31 9/31

10/31 11/30 12/30

-------------------------------------------------------------------------------------------------------------------------------

1945

165.7 162.9

174.3 180.1 186.6

191.5 192.9 Celebration- end of

WW-II

1949

168.1 175.9

178.7 182.5 189.5

191.6 200.5 Very

strong rally after June 14th,

1961

689.8

705.3 716.9 701.2 701.1 721.6

731.5 JFK and Camelot enchantment.

1965

875.2 881.7

893.1 930.6 960.8

946.7 969.3

LBJ and War reving up.

1977 912.65 890.1 851

847.1 818.4

829.7 831.2 Carter was

not a Keynesian

1993 3484

3539 3651

3555

3681 3684

3754 Clinton and Rubin start dereg.

1997

7896

8223 7622 7945 7442

7823 7908 Clinton and Rubin

dereg.

2009

8281

9172 9496 9712 6

9713 10345 10428 Recovery

---------------------------------------------------------------------------------------------------------------------------------

6 up 6 up 5

up 5 up 8 up

8 up

2 down 2 down 3 down 3 down 0

down 0 down |

DJIA with Republican in White

House

Red shows a down month. 5 of 9 brought declines for rest of year.

July

Aug

Sept

Oct

Nov

Dec

7/3 7/31

8/31 9/31

10/31 11/30 12/30

-------------------------------------------------------------------------------------------------------------------------------

1953

270.5

275.4 261.2 264.0

275.8 281.4 278.3 bottom was on Sept 15th

1957

513.3 508.5 484.4 456.3 441.0 446.0 435.7 bear market

-July S9.

1969

886.1 815.5 828.4 813.1 856.0 812.3

800.36

1973 886.0 926.4 891.0 947.1 957.0

822.3 848.02

1981 959.2 952.3 881.5

845/0 852.6 889.0 875.00

1985

1326.4 1347.5 1334 1329 1374 1472 1547

1989

2452.8 2660.7

2737 2693 2645 2706

2753

2001

10571 10523

9950 8848 9074 9852

10002 9/11 Attack

2005

10303 10641 10482 10569 10440 10806 10718

---------------------------------------------------------------------------------------------------------------------------------

5 up 2 up 3

up 6 up 7 up

4 up

4 down 7 down 6 down 3

down 2 down 5 down

|

====================================================================================

OLDER HOTLINES

====================================================================================

7/2/2013

Peerless Sell S9B

The Key Values are mostly STILL Negative.

The bearish head and shoulders pattern is more fully taking shape

At best, a Trading Range between 14500 and 15000 is developing. But note

the DJI's emerging price pattern is a bearish head and shoulders formation.

If this pattern were to be completed with a DJI close below 14500, it would

look a lot like 1971 which produced a 17% DJI

decline. That the DIA and

Closing Powers have failed to rise over the last 5-days's advance is bearish.

New York Professionals are selling to hot money buyers from overseas,

who apparently are buying blue chips here because of the strong dollar. Much

now depends on interest rates and foreign markets.

|

|

Most of the Sell S9B-s merely bring declines which double-test

the lower band. However, a breaking of the neckline, here that

means 14500, completes a bearish head and shoulders pattern. That

would set up a minimum downside target 1000 DJI points lower.

If foreign markets go to new lows and the interest rate on 10-year

bonds make new highs, the dangers of a bigger decline in our

markets

will become obvious and acute. The 5-day Stochastic-K-Line told

us to sell into this rally. I would become hedged with some of the

bearish MINCP stocks. The seasonality right

after the July 4th

week has tended to be bearish. A 10%-15% decline following a

tightening shift in Fed policies would normally be expected. With Crude

Oil knocking on $100/bar, the hawks on the Fed may have

added

power even though Food Commodities are hitting new lows and

Deflation not Inflation is clearly the bigger danger.

Current Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I P-I

ch P^ ^ IP21

V-I

Opct 65PctChange

7/2/2013

14975 -42 .996 -.111 -41 +165

-41 -.057

-87

+.045 .026

----> 165 -28 MAXCP stocks Bullish

MAXCP Stocks (7/2/2013) Bullish plurality

---> 63 +28 MINCP stocks Bearish MINCP Stocks (7/2/2013)

Low Accumulation Stocks 7/1/2013

---> 84 New Highs on NASDAQ 13

new lows. Bullish plurality

---> 47 New Highs on NYSE 16

new lows. Bullish plurality

7/2//2013 ---> To Key Index and

Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

THE FOURTH OF JULY

On the eve of the Fourth of July, we should not underestimate popular discontent

with the status quo.

Eurozone unemployment rate: 12.2%

Eurozone youth

unemployment rate: 23.9%

Loan practices of China's banks raising concern

China

tightens bank credit to cool fast-growing economy

America's Declaration of Independence" created new standards by which rulers

everywhere would be judged. "We hold these truths to be self-evident, that

all men are created equal, that they are endowed by

their Creator with certain

unalienable Rights, that among these are Life, Liberty and the pursuit of

Happiness."

Thomas Jefferson, an avid reader of John Locke and a slave owner, too, aged

only 33, wrote these words as goals for a new nation. Abrham Lincloln believed

the constitution must be interpreted with these goals in mind and America should

in its deeds live up to its fine words. These goals are not handed to us. They have

required great sacrifice. 600,000 soldiers died in America's bloody Civil War.

American soldiers' deaths in World War I were 117,000 and 430,000 in World War

II.

Abraham Lincoln understood this well. The sacrifices were to keep alive the goal

that there should be new type of nation, with a "government of the people, by the

people

(and) for the people.”

=====================================================================================

OLDER HOTLINES

=====================================================================================

7/1/2013 Peerless Sell

S9B All the Key Values are STILL Negative.

A Trading Range between 14500 and

15000 seems to be developing.

If the DJI does breakout past the 15000 resistance, we will need to

see much more Professional buying to become bullish. Right now,

there is a good amount of short-covering in the lowest

Accumulation,

Bearish MINCP and gold/silver stocks.

Sometimes, this foreshadows a good rally.

But right now it looks like pre-July-Fourth reducing positions while waiting for

non-seasonal signs of a sustainable trend.

The comments from 6/28/2013 apply still. Especially notice how the

market is going up because of overseas buying. We should note that the correlation

between the Japanese stock market and the US stock market is the lowest

of all the foreign ETFs. This has to be viewed as a warning that just because

Japan's market and economy are improving because of their currency

devaluation, the US stock market is not made more bullish. I would argue

the contrary. Imports are cheaper and exports are harder to sell there.

Instead of buying ETFs right now that may fall back from the overhead selling,

such as we saw today, buy the highest Accumulation stocks breaking out with

confirming Closing Power strength.

Current Peerless Key Values

Date

DJIA

La/MA

AnnRoc P-I P-I

ch P^ ^ IP21

V-I

Opct 65PctChange

7/1/2013

14975 +65 .996 -.111 -41

+165 -41 -.057

-87

+.045 .026

big improvement

----> 192 +50 MAXCP stocks Bullish

MAXCP Stocks (7/1/2013) Bullish plurality

---> 35 -7 MINCP stocks Bearish MINCP Stocks (7/1/2013)

Low Accumulation Stocks 7/1/2013

---> 140 New Highs on NASDAQ 7 new lows. Bullish plurality

---> 98 New Highs on NYSE 6 new

lows. Bullish plurality

7/1//2013 ---> To Key Index and

Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

Insider Buying That Should Over-Power

Any Market Weakness

Buy SPA and JOUT.

I want to emphasize tonight the importance of intermediate and longer-

term investors looking for stocks with very intense Accumulation and

Insider Buying. Here we want to find stocks whose IP21 has risen

above not merely +.375 (where the horizontal line crosses in the Tiger charts,

but above +.45 or even +.5. We can buy these stocks on pullbacks when

their Closing Power turns up or when they make new highs on red high volume.

In the past, I have usually said sell these when the Closing Power uptrends are

violated. Instead, I now would recommend just holding them while they

stay above their 65-dma. This gives them ample chance to show why

insiders were so eager to buy them. Stocks that are under Accumulation

often have their best advances a full six months after the initial bulges

of insider buying. So, we have to give these stocks more chance to flower.

Run the Power Ranker against the ACCUMVER data download to get

some good ideas. ACCUMVER is regularly updated to show stocks that

have had significant bulges of Accumulation. See a sample of very high

Accumulation stocks today.

I would put much less faith in stocks under $10 that show high Accumulation

For a variety of possible reasons, the insiders in these stocks are often not as

adept or successful in their buying own stock. The major exception to this

is after a long bear market. Then such lower priced stocks are often the stars

of the show.

LGND Is An Example

See the article Monday on LGND showing "Insider

Cluster-Buying at LGND"

"A particularly strong insider buying signal is

what we call a "cluster-buy"

where three or more different insiders make open market purchases within a

short period of one another. At Ligand Pharmaceuticals Inc (NASDAQ:LGND),

3 different insiders purchased 2,043 shares at an average price of $17.36/share, for

a total of $35,466, with the most recent purchase on June 28, 2013. "

.

.

Stocks Now Showing Intense Accumulation

SPA

| nsider Transactions Reported - Last Two Years |

| Date |

Insider |

Shares |

Type |

Transaction |

Value* |

| May 15, 2013 |

KORWIN

STEVEN M.Officer |

1,695 |

Indirect |

Purchase at $14.70 per share. |

24,916 |

| May 13, 2013 |

KORWIN

STEVEN M.Officer |

1,792 |

Indirect |

Purchase at $13.88 per share. |

24,872 |

| May 9, 2013 |

SWARTWOUT

JAMES RDirector |

1,000 |

Direct |

Purchase at $13.65 per share. |

13,650 |

| Mar 27, 2013 |

KUMMETH

CHARLES R.Director |

2,000 |

Direct |

Purchase at $13.34 per share. |

26,680 |

| Feb 20, 2013 |

GRIMM

ROBERT L. IIOfficer |

2,000 |

Direct |

Sale at $14.70 per share. |

29,400 |

| Feb 12, 2013 |

GRIMM

ROBERT L. IIOfficer |

1,000 |

Direct |

Sale at $14.75 per share. |

14,750 |

| Feb 6, 2013 |

SCHLEI

MARKOfficer |

5,300 |

Direct |

Purchase at $14.50 per share. |

76,850 |

| Jan 31, 2013 |

FAST

JAMES DDirector |

1,216 |

Direct |

Option Exercise at $6.52 per

share. |

|

Sparton Corporation, together with its subsidiaries, engages in the concept development,

industrial design, design and manufacturing engineering, production, distribution, and

field service of electromechanical devices. The company?s Medical Device segment is

involved in the contract development, design, production, and fulfillment of medical and

biotech devices, and sub-assemblies primarily for use the diagnostic, therapeutic, and

surgical applications of the medical device and biotech markets.

| % of Shares Held by All Insider and 5% Owners: |

15% |

| % of Shares Held by Institutional & Mutual

Fund Owners: |

54% |

| % of Float Held by Institutional & Mutual

Fund Owners: |

64% |

| Number of Institutions Holding Shares: |

52 |

=====================================================================================

JOUT

Johnson Outdoors Inc., together with its subsidiaries, designs, manufactures, and markets

seasonal outdoor recreation products used primarily for fishing, diving, paddling, hiking,

and camping. The company?s Marine Electronics segment offers battery powered fishing

motors for trolling or primary propulsion; sonar and GPS equipment for fish finding and

navigation; downriggers for controlled-depth fishing; and lake charts.

| nsider Transactions Reported - Last Two Years |

| Date |

Insider |

Shares |

Type |

Transaction |

Value* |

| Feb 28, 2013 |

LANG

EDWARD FDirector |

1,320 |

Direct |

Acquisition (Non Open Market) at

$0 per share. |

N/A |

| Feb 28, 2013 |

LONDON

TERRY EDirector |

1,320 |

Direct |

Acquisition (Non Open Market) at

$0 per share. |

N/A |

| Feb 28, 2013 |

FAHEY

JOHN M JRDirector |

1,000 |

Direct |

Sale at $22.61 per share. |

22,610 |

| Feb 28, 2013 |

PYLE

THOMAS F JRDirector |

1,320 |

Direct |

Acquisition (Non Open Market) at

$0 per share. |

N/A |

| Feb 28, 2013 |

FAHEY

JOHN M JRDirector |

1,320 |

Direct |

Acquisition (Non Open Market) at

$0 per share. |

N/A |

| Feb 28, 2013 |

MCCOLLUM

LEEDirector |

1,320 |

Direct |

Acquisition (Non Open Market) at

$0 per share. |

N/A |

|

|

|

|

|

| % of Shares Held by All Insider and 5% Owners: |

14% |

| % of Shares Held by Institutional & Mutual Fund Owners: |

71% |

| % of Float Held by Institutional & Mutual Fund Owners: |

82% |

| Number of Institutions Holding Shares: |

63 |

|

====================================================================================

OLDER HOTLINES

====================================================================================

6/28/2013 Peerless Sell

S9B All the Key Values are Negative.

A

Trading Range between 14500 and 15000 seems to be developing.

The

5-Day Stochastic-K-Line turned down Friday for DIA, SPY and IWM but not

for QQQ. Nevertheless, the Futures are up +63 at this

writing. We will need

to

see additional gains after the opening to be impressed.

A rally

right before July 4th is likely. Usually, these gains are given back by the 10th

After

that, Julys are a bullish month. The pre-holiday gains

have been quite muted recently.

6/30

7/3 7/10

7/31

2003

8995.44

9070.21 9036.04

9233.80 Rising

Market

2004

10435.40

10282.83

10213.22

10139.71

Slightly

Falling Trading Market

2005

10274.97

10303.44

10449.14

10640.91 Trading Range Market

2006

11150.22

11220.02

11103.55

11185.68

Recovering from May S9.

2007

13408.52 13577.30 13501.70

13211.99

Topping out.

2008

11350.01

11288.54

11229.02

11583.69 A month before big decline started,

2009

8447.00

8280.74

8146.52

9171.61 Bull

market.

2010

9774.02

9686.48 10138.99

10465.94

Trading Range

2011

12414.34

12582.77

12657.20 12143.24 DJI about to fall 16%

2012

12880.09

12943.82 12653.12

13073.01 DJI recovering to new high.

60% up 30% up

80% up.

The technical indicators are mostly weak for the major market. Watch to

see if the indexes can surpass their weakening 65-dma. A failure to do that in

this normally bullish week celebrating American Independence (July 4th)

would be quite bearish.

A Trading Range Market Is Most Likely

Usually Sell S9Bs start a trading range. Most likely that is what we are in now.

This is means the 5-day L-Line Stochastics should do well. Run the Power

against the STOCH5 download and short the New Red Sell, Bearish ranked

stocks. Example EVP and FSTR, shown below DJI chart.

But after a 52 month, 133% Bull Marlet

advance, a correction of 10%-15%

should not come as a big surprise, especially if the Fed is no longer guaranteeing

the market that it will not let a decline occur. The risk in any declne,

however,

is that it could get out of control. The US stock market has been stronger

than most other markets. Without the FED prop, there are real risks. And if

the

rich reduce their spending because of a bigger market decline, will not already

weak economic conditions get much worse?

I want to emphasize, however, that the internals of the market now appear vastly

stronger than they did in 1929, 1930, 1937, 1987, 2000 or 2007.

We do not

see an A/D Line that has been lagging for months, negative P-I and V-I

readings for months and multiple Peerless Sells.

The DJI fell back Friday and lost all that it had gained on Thursday. IBM's loss

accounted for about half the decline. The reversal brought a Sell from the (fast)

5-day Stochastic-K-line. It turned down from above 80. This is important

because my research shows this is indicator is overall the best short-term

signal for trading ranges, especially when Peerless is already on a Sell.

The bearish scenario for the Sell S9-B I've mentioned could still play out.

We have to be concerned that interest rates are likely to

keep rising. Though

food commodities are in a downtrend now, Crude Oil shows

lots of blue

Accumulation and could break out over $100/b. A breakout by Crude Oil and

a rally by Gold which is very oversold, would give ammunition

to the three "hawks"

on the Federal Reserve Board who want to bring QE-III to an end.

See http://static.reuters.com/resources/media/global/editorial/interactives/hawks_vs_doves_js/iframe_hawksVSdoves.html

Keep in mind how the DJI dropped 16% after a Sell S9-B

and a completed

head/shoulders pattern in 1971. This is when

Pres. Nixon decided officially to stop

backing Dollars with Gold. For the stock market, this a very big change of policy.

Some called it the "Nixon

Shock". Similarly now, the start of a new Fed set of policies that

bring a halt to its buying massive amounts of long-term debt would have similar sizeable

effects on stocks. So, the DJI's Friday decline keeps alive the potential head and

shoulders pattern there. (See the chart below).

Again Closing Power failed to rise. It is usually bearish when a rally occurs

only because of higher openings, as happened Monday, Tuesday and Wednesday

last week. So, all the key general market ETFs' Closing Powers are in falling

trends. This shows the Public and Overseas Buyers are still optimistic but

Professionals in New York are not.

Our Tiger Stocks' Hotline remains more short than long. And because of the new

Stochastic-K-Line sells, traders should have sold the ETFs I recommended

as long plays for last week's rally. Taking short positions if the opening is

not to weak seems reasonable.

Current Peerless Key Values

Date

DJIA

La/MA AnnRoc P-I

P-I ch P^ ^ IP21 V-I Opct

65PctChange

6/28/2013

14910 -115 ..991

-.328

-206 -26 -206 -.103 -138

-.051 .025

----> 142 +36 MAXCP stocks Bullish

MAXCP Stocks (6/28/2013) Bullish plurality

---> 42 -25 MINCP stocks Bearish MINCP Stocks (6/28/2013)

Bearish plurality

---> 67 New Highs on NASDAQ 19 new lows. Bullish plurality

---> 35 New Highs on NYSE 8 new

lows. Bullish plurality

6/28//2013 ---> To Key Index and

Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

New Peerless

Later this week, I will be releasing the new Peerless. It's almost done.

It has been extensively back-tested to 1929. Software users will see a new

Sell Signal. And all the signals will have been fine-tuned. Their trading

results will be shown on a different internet page than the one we are using

now. This update is $75 by check. Send check to William Schmidt,

5970 Gullstrand, San Diego 92122 California. I will be posting the new

Peerless on the Elite Stock Professional Page later this week. .

New Red Sells - 5-Day Stochastic-K-Line

|

|

=====================================================================================

OLDER HOTLINES

=====================================================================================

6/27/2013

Peerless Sell S9B

Three Straight Excellent Days. What's Up?

Current Peerless Key Values

Date

DJIA

La/MA AnnRoc P-I

P-I ch P^ ^ IP21 V-I Opct

65PctChange

6/27/2013

15024 +114

..998

-.22 -180 +189 -180 -.075 -115

.077 .031

----> 106 MAXCP stocks Bullish

MAXCP Stocks (6/27/2013) Bullish plurality

---> 67 -29 MINCP stocks Bearish MINCP Stocks (6/27/2013)

Bearish plurality

---> 90 New Highs on NASDAQ

19 new lows. Bullish plurality

---> 66 New Highs on NYSE 11 new

lows. Bullish plurality

6/27//2013 ---> To Key Index and

Leading Stock Charts

5-day

Pct-K Stochastic SPY Chart

We've just seen 3 straight

days with the DJI up more than 100 each day and with

the daily ratio of NYSE

advancers to decliners ranging between 3+ to 5+ each day.

This is impressive,

There is new hope because of weak economic news that the Fed

will delay its weaning the

market off of QE-III The yield on Ten-Yr Year Treasuries

has fallen back below 2.5%,

but the blue Closing Power uptrend is in tact.

Earlier this week, I

suggested using the short-term Stochastic-K-line Buys after the DJI

held up at its neckline,

14500, because of these signals' unusual reliability and because one

could make a case for a Buy

B19 on the first day up. It was the presence of an S9

in the previous 15 days which

denied it. But the S9 here was not the very bearish type based

on a phoney DJI rally to the

upper band with the P-Indicator negative, Instead, the most

recent S9 was based on the

P-Indicator finally turning negative after 105 straight days of being

positive.

S9Bs in the past have never

been reversed with a recovery rally that rises far

above the highs of the

previous month. That scenario just has not played out after

a Sell S9b without there

first being a Peerless Buy. Instead, we see THREE other

scanerios after a Sell S9B.

First, there is the bearish scenario where a head/shoulders

develops following the S9B

and the DJI falls significantly. This is what happened in 1971.

A reversal back DOWN tomorrow

would keep alive that possibility.

A continuation of the rally

to the upper band would set up the other tww scenarios.

If no new high is made and

the DJI turns back down near the upper band,

it will look like the 2004 scenario, in which the DJI fell back gradually

for 7 months.

But if the DJI makes a new

high, goes sidewise and then falls back, it will set up a flat

trading range as it did in 1986, which will eventually be broken out of quite

powerfully,

perhaps 6 months from now.

Negative Internals Still