www.tigerSoft.com -

7/2/2012 william_schmidt@hotmail.com

www.tigerSoft.com -

7/2/2012 william_schmidt@hotmail.com So Many Dirty Little Secrets on Wall Street:

Every Day More Cases of Fraud and Insider Trading.

(C) 2012 William Schmidt,

Ph.D. (Columbia University) www.tigersoft.com

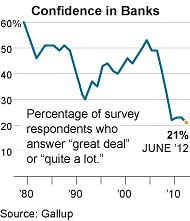

Do You Trust The Big Banks?

Even the

NY Times agress with this negative assessment of Wall Street.

The

Spreading Scourge of Corporate Corruption By EDUARDO

PORTER

The

misconduct of the financial industry no longer surprises most Americans, and trust in big

business

overall

is declining. We should be alarmed.

|

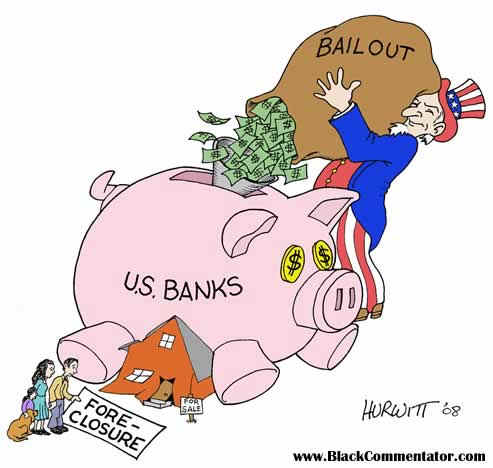

Wall Street Is Not Fooling Anyone, Not Anymore! If the Public really knew how corrosively corrupt Wall Street is, one might think that they would not let their money go near the place. But, an honest picture of the place is not often presented by the mass media, apart from the New York Times and the Wall Street Journal, which are in many ways the daily newspapers for those who work there. Even so, with the pattern of fraud and unbridled greed now pervasive there, trust is long gone. To the extent the general public thinks about Wall Street, they probably feel "slimed" by the Greed sickness that makes a hedge fund manager or a big bank CEO want hundreds of million dollars in pay and bonuses while doing virtually nothing to help mankind except devise ways to close down American factories, to send jobs overseas and to hear rumors of mergers, earnings reports and new bankruptcies ahead of other investors. I think the general public understands how the Fed. Reserve and the American Government protect and make still bigger the big banks that a few years ago were said to be "too big to fail" by both President Bush and by the new President Obama and their Wall Street serving Treasury Secretaries, Paulson and Geithner. The public understands very well how incestuous the relationship between Wall Street and Washington is. They may not know the names, but they understand the essence of how Goldman Sachs is Greed Connection between Wall Street and Washington, with its people, including Robert Rubin, Henry Paulson, Larry Summers, Gary Gensler... The public knows that Congressmen get bundles of bribes (called campaign contributions), sweet-heart loans and mortgages (Chris Dodd) from the big banks and insider trading tips, too, from Wall Street. They fully unstrand how politically weak they are compared to Wall Street, though they couldn't tell you that the finance industry now has 3000 paid lobbyists or more than five for each member of Congress. That Wall Sreet openly runs the US economically, financially and politically is not news! They know, for example, that a major reason their jobs are in jeopardy is because Wall Street can pressure any big company it wants,by driving its stock down, into layoffs and sending its work force overseas. The American people fully understand that the reason that they pay a higher rate of taxes than Wall Street millionaires do is because social security taxes are only levied paid on the first $110,000 in income a year and Wall Street has vetoed every effort to tax stock trading profits at a rate equal to the taxes on hourly wage earners. To most Americans, it is no surprise that even a very small tax, like the Europeans have, on banks' computerized, short-term trading is not even considered by the Obama Administration or the Republican Party plutocrats. John Q. Public knows all these things. But in a weak economy with few new employment options, and with stock prices rising, he bites his longue and buys and sells a few stocks each year, sometimes desperately, to try to build up a retirement fund, He knows that Wall Street is still a better place than real estate and his kids' education costs will not get any cheaper. So despite. all of Wall Street's lies and double-dealing, the public has decided to learn to live with Wall Street. The public knows the game there is crooked. Insiders nearly always know in advance. The SEC is largely toothless when it comes to enforcing the laws against illegal insider trading based on material non-public information. Motivation is hard to prove. Tape recordings are often necessary. The case has to be especially flagrant for any of handful of SEC trial lawyers to police the tens of thousands of high ranking corporate executives who are privy to key information about their company's earnings and trade their stock with suspicious profitability.. View "An Inside Job" and see if you don't react this way. This is a documentary on Wall Street and the World Financial Collapse of 2007-2009, The summary on Wikopedia is excellent. http://en.wikipedia.org/wiki/Inside_Job_%28film%29 As an introduction, there is a discussion about the Deregulation of Wall Street under the Democrat Clinton and the Republican Bush. I've written about this aplenty, too. See http://www.tigersoftware.com/TigerBlogs/September-18-2008/index.html For the first time snce 1932, Banks were allowed in 1999 to become brokerages and trade stocks and all manner of leveraged "investments" , like credit default swaps (insurance on your neighbor's bank failing) and collaterized debt instruments (bundled sub-prime mortgages). They were allowed also to use dangerous amounts of leverage and make great numbers of "sub-prime" (i.e. only marginally safe) home and business loans. Why did they take these risks? The banks will tell you that they were pressured into doing so by Democrats, who wanted more loans for minorities. But the truth is they loved making these loans. They were hugely profitable. Angelo Mozzila of Country Wide made $470 MILLION between 2001 and 2006 by having his salesmen make thousands of "Liars' Loans" with "baloon" payment schedules. The idea was to make as much money as possible and let someone else worry about the fall-out. Regulators might have looked back at the tech bubble of the late 1990s and learned something about the housing bubble. They did not. They consistently chose to protect their clients, the big banks, and ignore all the published and even FBI warnings that a vast, unsustainable housing bubble was being created. Instead, the banks saw record profits coming in, and their executives were making tens and hundreds of millions of dollars, as part of short-term performance "incentives". Why should they rock the boat. They were getting fabulously wealthy. Hardly surprisingly, the big banks coddled, cajoled and bribed rating agencies like Mood'y's and Standard and Poor's to give their loans and the big banks themselves very high investment grade ratings, even while thousands and thousands of mortgages were going into default. Investment banks like Goldman knew very well that the ratings were a fiction, that they were putting "lipstick" on a pig, but they sold them anyway, all the while they privately laughed at the "schnooks" who were buying them and even setting up $10 billion dollar hedge funds to sell short the very sub-prime loans they were selling to retirees around the world. "Fiduciary responsibility?" Banks profits were what mattered most. Screw the client. if the CEOs were to keep making their millions and award their loyal co-conspirators "Christmas" bonus bribes to buy their silence, the enormous game of fraud had to continue. In the end,

the biggest banks like JP Morgan, Goldman Sachs and Wells |

Ridiculously high salaries for bankers

are being perpetuated by the Federal Reserve.

No one has ever explained why

bankers should be paid so much for making

so much money simply by borrowing money from the Fed at 1/4% and then

buying US or other governmental securities with much higher yields?

Fraudulent misrepresentation of Facebook.

Facebook

Bankers Secretly Cut Facebook’s Revenue Estimates In Middle

Of

IPO Roadshow

Wall Street's abetting

of the tax-evasion and trading done by tens of thousands

of rich Americans and

corporations with Swiss bank accounts.

Swiss

bank indictment details tax evasion ploys

Wall Street threatens

to destroy the last vestiges of American Democracy by the

wholesale buying of

Congress and Presidents through bribes, i.e. million dollar

campaign

contrition.

Keeping secret its

hidden costs ... financial products?

Mutual funds, annuities, long/short/leveraged ETF’s, SPDR’s, Index funds, closed

end,

open end…the list goes on.

Most pervasive of

all is INSIDER TRADING.

Why do stocks often go down on Good News?

Why do stocks often go up on Bad News?

Seemingly counter-intuitive price reactions to earnings announcements

occur because the insiders already have taken their positions in advance

of the news. So, when the good news comes out, they sell to the public

buyers and when the bad news comes out they cover their short sales.

How To Spot

Significant Insider Trading

Using TigerSoft's Unique Tools for This.

www.tigersoft.com

TigerSoft

Studies of Insider Trading

In 1973, I developed the formula for the Tiger Accumulation Index

using a Bowmar calculator and then used a mainframe IBM computer

to test the idea. The results produced by my early Accumulation Index

were so negative on so many stocks that I was sure I had made a

mathematical error in the formula. I had not. It was the start of

the 1973-1974 bear market. True story.

The Tiger Accumulation Index is one of several technical

tools for stock market analysis we have invented. Another is

our Professional versus Public Buying and Selling concept.

The third is our Day Traders' Tool. See them at work in a typical

oil drilling stock in 2008, Baker Hughes.

BHI with Tiger Closing Power and

Accumulation Index

BHI with Tiger Day Traders' Tool

If

you study market history, as much we have since 1981, you will

see that our three tools measures meaningful insider buying and selling

much more effectively than do the published reports of "insider" trading,

as the US Securities and Exchange Commission now defines it and

has it reported.

These tools work because they are not fooled by lies and exaggerations.

They are based on what Wall Street traders are actually doing with the

money they control. Our Accumulation Index works because it measures all

"

"insider buying" and "insider selling, not just that which is reported

to

the SEC.

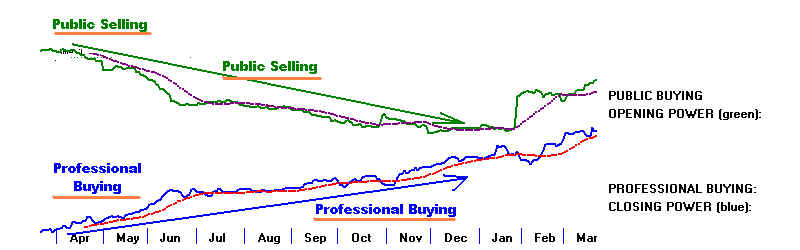

in the chart of AAPL below, you can see how Professionals turned

bullish between February and Jul 2009, while the Public remained

skepticallyt

neutral.

These indicators produce Tiger's automatic Buys and Sells.

They have been extensively back-tested back to 1979, even earlier.

With TigerSoft it is to easy to spot insider Stock Buying and

Insider Selling.

Imagine the

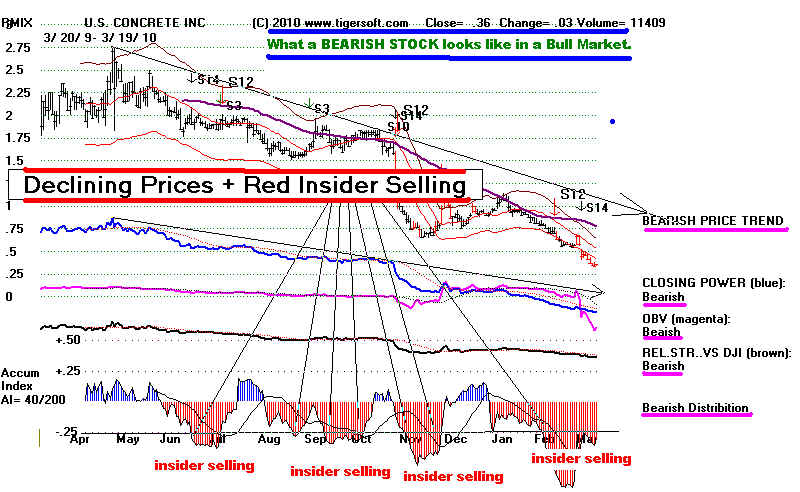

disappointment felt by those holding a declining

stock in the wonderful rally of 2009. Look at the chart below.

See how TigerSoft picks up on this stock's extreme bearishness

in

two important and unique ways, besides price trend.

1) The first is the way the Tiger Accumulation Index

frequently

dips below -.25 in red territory and thereby confirms the

falling price trend.

2) The second key warning for us is that Professionals were

selling

and it was the Public that was Buying. See at the

bottom of the chart how

the two lines representing these two perspectives diverge. Public buying

from Professionals is a loud siren.

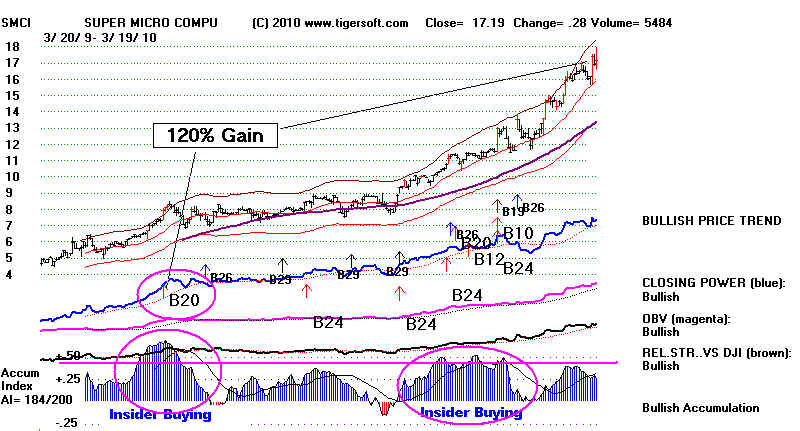

A

daily TigerSoft chart below shows a year's price fluctuations

Most important is what the internal strength TigerSoft

indicators

at the chart's bottom shows. Most important are Extreme

Bulges

in the Tiger Accumulation Index. They show insider buying.

These bulges very often occur months before big price advances.

Insiders are buying because they are anticipating very good news in

the stock. It is that

good news which makes the stock rise. Very often

the Public does not believe

the early rally. But, typically, at some point, the

Public becomes a believer in the

stock. That is not immediately

bearish/ In fact, the

biggest gains take place in the later stages of

stock's long advance very often come when both the Public and the

Professionals buy the stock. This may create a buying climax, or

it may just bring the stock up to a much higher price plateau.

It is

worth noting that this "acceleration-up" bullish condition is one

our Tiger Ranker's best flags. It allows traders to make the big gains

in the shortest period of time.

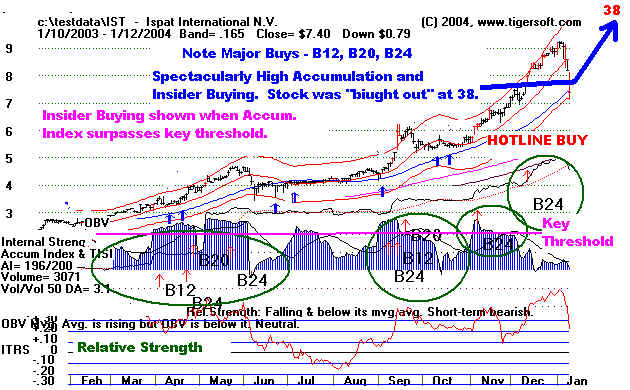

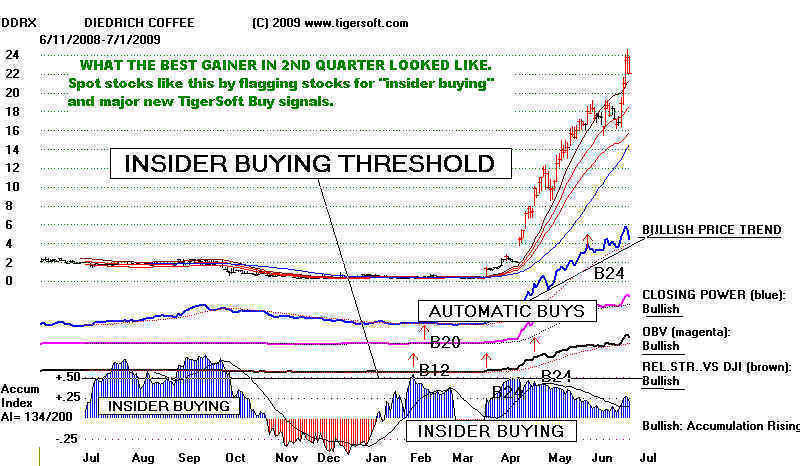

Below are some

Bullish examples of intense insider buying,

Public skepticism, Professional Buying and

late-stage Public

buying. The bulges of Blue Accumulation produce

red Buys.

Automatic Buy arrows

appear when the bulges and Professional

buying are considered very significant. The Buy B12, B20 and B24

signals show when TigerSoft users should buy the stock. Tiger

users may or may not know anything about the company. All they

need to know is that insiders and professionals are buying and that

TigerSoft has back-tested this method of

trading extensively,

as far back as 1928.

SCSS (below) is a another recent example. Click on CNAM, CYT, DTG,

EZPW, NENG, PCYC, SANM and WAVX to see some others. In

each case, notice

how the bulge of insider buying and TigerSoft automatic Buys soon afterwards

brought very profitable rallies.

It's true: these are smaller, less well know companies. That's where

the most opportunity has usually been. Bigger capitalization stocks

show the same characteristics. Mostly they don't move up as much.

Our website has hundreds of examples of the importance of looking for

these bulges of insider buying and watching what Professionals, not the

Public, is doing with its money, in all types of stocks, commodities and ETFs.

USE TIGERSOFT - TRADE LIKE AN INSIDER

So, now you see that you CAN Trade The Stock Market

like An Insider. The

major difference is that with TigerSoft

you can do it legally.

Insiders invariably trade at a huge advantage. Many know exactly

what the news will be for their company. Many trade illegally,

because the SEC is ineffective and serves mainly to make

individual stock investors think the playing field is level.

Below is a recent typical Tiger

pick. Study the TigerSoft chart.

See how it showed bulges of key insider buying and was a Buy

when the automatic Buy Signals appeared.

TURN INSIDER TRADING TO YOUR ADVANTAGE

BUY WHAT INSIDERS ARE BUYING

SELL WHEN INSIDERS ARE SELLING

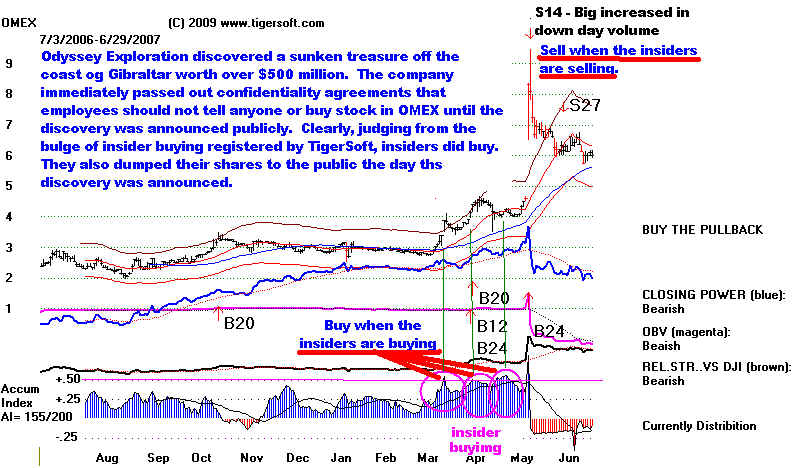

Odyssey Exploration - 2007 - is just one example

among thousands.

Someone always knows first. And,

most likely, he tells his wife or

someone else as part of a mutual

"back-scratching" business arrangement.

When an insider buys a lot of the stock in the

exploration company

he works for, his stock broker will usually

take notice and starts buying,

too. I would say such cases show

that it is nearly impossible to prevent

serious insider buying, even when the

company takes every step it can

to prevent it, as Odyssey in the example below

appears to have done.

Discovery

of The Black Swan - Discovery Channel

Odyssey Exploration, a publicly traded company in

Tampa,

discovered more than a half a billion dollars worth of Gold

and Silver in a 400-year old sunken treasure ship in the

Spring of 2007. The key oceanographer, Ernie Tapanes, who

made the actual discovery then bought more than 42,000 shares

of the company's stock before the company released the

information to the public.

I would say that judging from the jump in trading activity in the

stock at this time (See below), the oceanographer did not keep

the secret very well, even even though he and other Odyssey

employees had been advised by the company, that such

purchases would be illegal insider trading. Odyssey employees

were at the time required by the company to sign non-disclosure

pledges and a statement that they would not buy the stock until the

public announcement.

Tapanes was not the only eager new buyer in the last

two months of the chart below, when the stock rose 50% and

right before the public announcement of the discovery. Other insiders,

as TigerSoft defines them, who did not even work for the

company, were very likely pushing the stock up. The term "insiders"

refers to anyone privy to material non-public knowledge about the

company's prospects, not simply the CEO, officers of the company

or Board members who are legally required to report transactions in

the company's stock. The nested Tigersoft "B12", "B20" and

"B24"

signals register such trading and are our alerts. (For more

information about what is legally defined as "insider trading"

and TigerSoft's working definition of it for trading purposes, please

see - http://www.tigersoft.com/Insiders/index.html

)

Keeping A Secret like This Is Next To Impossible.

We will never know with any certainty who these other buyers were

and why they bought Odyssey at this time. Did Tapanes tell his wife

why he was buying 42,000 shares of stock? Did she tell others?

Did he or she call home to Canada or Cuba and tell anyone? I believe

it's more likely he told others. Who could keep a secret like this?

Tapanes, after all, was the one who found the treasure. Most people

in this situation would be bursting to tell of their life's dream come true.

Nevertheless, the law required him to tell no one. Once he started

working for a publicly traded company, he had fiduciary responsibilities

to the company's shareholders.

Did the brokers who took the unusual order to buy shares in the

exploration company by the lead explorer there, take note and buy

shares themselves? My experience with stock brokers suggests

they probably did. That's how they make a living! Did they tell

others? Again, that's how they make a living.

Motivations are always hard to disentangle. They are even harder

to prove. To further confuse the issue of why OMEX rose 50% in

the two months before the public announcement of the discovery,

we must mention that in March 2007, the Spanish government finally

consented to the company's excavation of the previously discovered

British ship, the Sussex. Spain had blocked this for 14 months.

(Source.)

What's more, the DJIA rose 10% from March to May 2007.

Our Recommendation To Buy

All we know for sure is that TigerSoft recommended buying

Odyssey at 4.24 on our Stocks' Hotline and Elite Stock Professional

(ESP) service two weeks before the company announced the

discovery of the "Black Swan". Here is an email I got at the

time:

May 18th, 2007

"Bill,

Just wanted you to know you made me a lot of money today...

OMR (now OMEX) entered my watch lists after showing up in the Elite report...

Not a bad day, up about $60,000 in a single stock. Without Tiger

I never would have found this...

Thanks, JS"

Odyssey Exploration's Stock

Prices

Just before The Accouncement

of The Discovery of The Black Swan

in May 2007

Announcement about The Treasure's Discovery

Not surprisingly, when the discovery was made public the stock

immediately doubled, at which point the the oceanographer

promptly sold his shares. The stock soon collapsed as Spain

challenged the company's right to "their" gold and short-sellers

ganged up on the stock, figuring that all the good news was

now out and most people who had been interested in buying the

stock aggressively would have already done so... Our Accumulation

Index quickly turned negative. This can occur when professional

short sellers take control of the stock. In other cases, it means

insiders are selling the

stock.

Below is the TigerSoft chart of Odyssey back then. Note that we

define bulges of our TigerSoft Accumulation Index above +.50 to be

"insider buying". The legal definition of "insider trading" is

not

practical for trading purposes. "Insider" trade reporting as required

by the SEC is quite limited in scope, applying mostly to the officers

of a company.

Odyssey Exploration - 2006-2007

The SEC's Reaction

Even the SEC admitted this was an egregious case of insider trading.

The toothless Bush SEC did not seek a criminal prosecution. It did not

require Tapanes to say under oath who else he had informed,

outside the company. Instead, Tapanes relinquished his profit

and paid an additional $107,000 fine. The SEC has said that no other

Odyssey employees were under suspicion of insider trading.

The St. Petersburg Times wrote: "Odyssey executives distanced

themselves from Tapanes on Thursday. In a written statement, the

treasure-hunting company identified him as "one of many independent

consultants" and "not a direct employee." But published accounts

show that the quiet, cigar-smoking Tapanes has been an integral part

of the company's success."

(Source: http://www.sptimes.com/2008/01/18/Business/Illegal_insider_tradi.shtml )

There are two morals here: (1) Heed the classic adage:

"Buy on the rumor and sell on the news." (2) Use TigerSoft.

The SEC is there to only give the appearance of a level playing field.

We at TigerSoft were not privy to the rumor; yet we recommended

buying Odyssey at 4.25 two weeks before it doubled, simply

because of the bulge of insider buying that the TigerSoft charts

showed. ( On July 15, 2009 the SEC charged six Odyssey

insiders with insider trading.)

If you study market history, as much we have since 1981, you will see

that our Accumulation Index measures of insider buying is much

more effective in predicting stock behavior than watching the

published reports of "insider" trading, as the US Securities and

Exchange Commission now defines it. And it works with overseas

stocks, too, for which there are no published reports of insider

buying and selling. The TIgerSoft Accumulation Index is one of

several technical tools for stock market analysis we have invented

and extensively back-tested that is truly indispensible to someone

seriously seeking consistent stock profits.

The battle for investment Survival Just Got

A Lot Easier with TigerSoft..

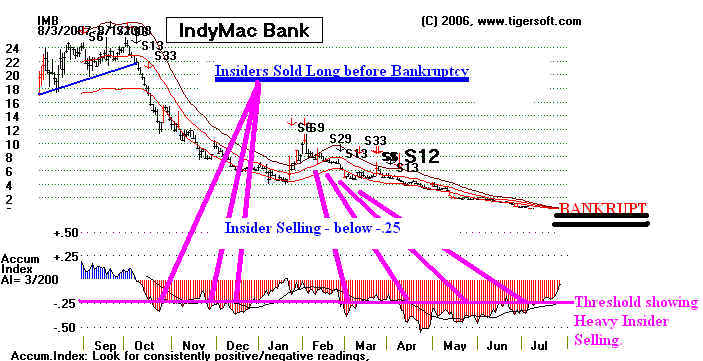

Insider Selling Is Rampant before A Bankruptcy or Steep Stock Decline.

Examples:

WAMU, CITIGROUP, BANK OF AMERICA, NORTHERN ROCK,

CHINESE STOCKS, INDY BANK, GENERAL MOTORS...

How Does TigerSoft Spot Insider Selling?

Deeply Negative (red) Accumulation and False Rallies.

Example: Apple Computer's stock

dropped 50% in three weeks in 1987.

TigerSoft spotted it and warned customers of an impending

general market collapse. The method for spotting its top

has worked in calling general market and stoock tops

since 1929, as you will see below. The TigerSoft "S9"

on APPLE was very bearish, given how far up the stock was.

AAPLE - 1987 Top

What Identifies An Explosive Super Stock BEFORE It Doubles or Triples?

Lengthy periods of Positive (blue) Accumulation and

Intense Bulges of Accumulation and New Price Highs

Many examples - see AMGN, IST, KIRK, DDRX etc...below

Our trading strategy is simple.

First, know if the general

market is safe

or dangerous, by using Peerless Stock

Market Timing.

See Peerless Stock Market Timing:

1915-2009,

Secondly,

know whether Insiders and

Professionals Are Buying or Selling Your

Stocks.

Please read on for

more exmples.....

With TigerSoft it is to easy to spot early-on insider Buying and

Insider Buying

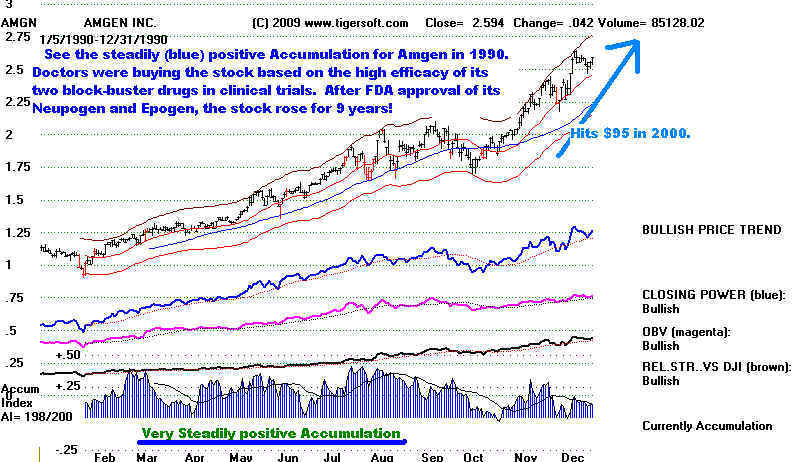

Steadily (blue) Accumulation means heavy institutional buying.

Example: AMGN 1990 -

hit $95 in 2000.

More information - Tiger's Power Ranker

If there are bulges of (blue) Accumulation above +.50 and prices

rise afterwards, consider savvy insiders themselves to be buying.

Use next automatic TigerSoft Buy then

and hold until (blue) 50-day

mvg.avg, is violated.

KIRK in 2009 is now 14.24, up 300% in 4 months!

There are many more like this in the stealthy 2009 Bull

Market.

Example: Take-Over target - IST rise from 9 to 38 in a year,

Insider Selling

If the the Accumulation Index becomes steadily (red) negative

and drops below -.25, consider insider selling to be taking place.

Examples:

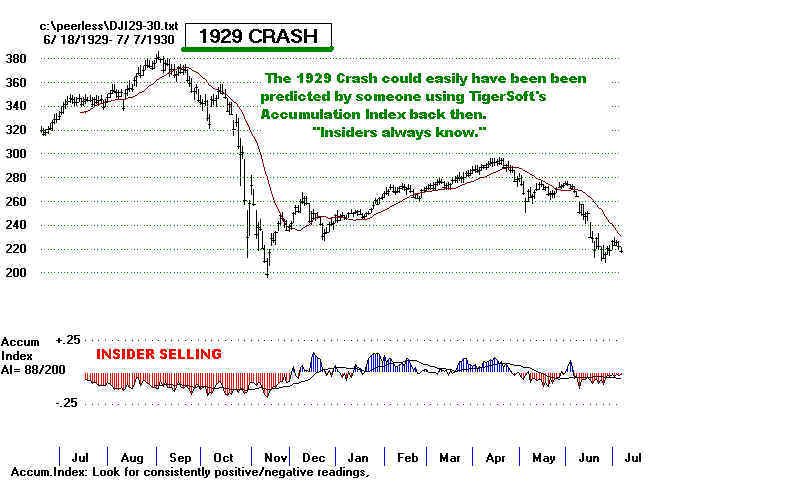

Dow Jones Industrial Avg, in 1929

False rallies showing (red) negative distribution

bring major severe market declines and bear markets.

See the false rally tops in the DJI

charts of 1966,1972, 1987,

2000 and 2007 at the bottom of this page.

Peerless Stock Market Timing:

1915-2009 shows them all.

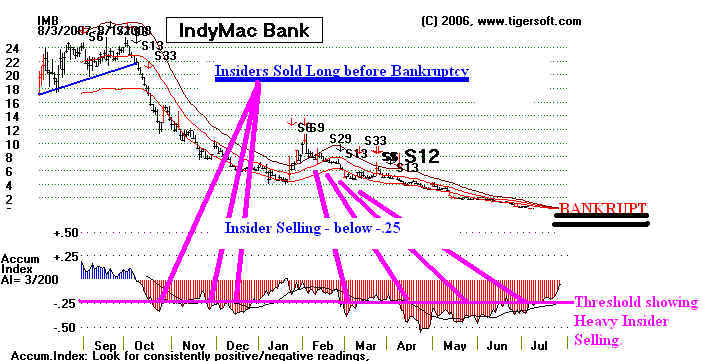

Insiders knew BANKRUPTCY was coming to INDY-MAC!

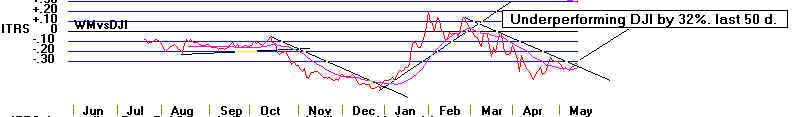

WASHINGTON MUTUAL: 2007-2008 Go To ZERO!

TigerSoft

warned it would go bankrupt in 2007 after seeing

how

extensive the insider selling was, specifically by its CEO.

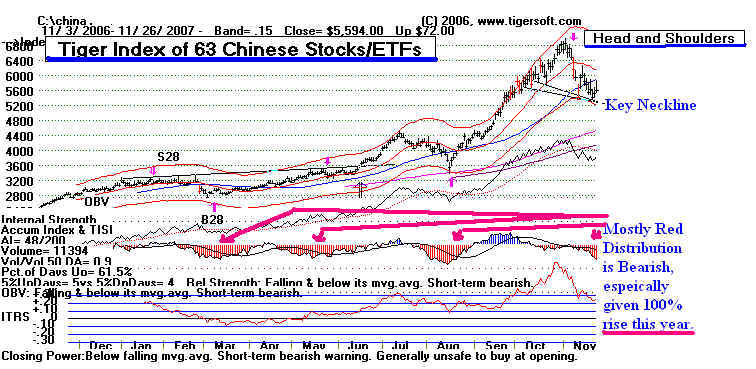

Chinese Stock Index in November 2007.

Our TigerSoft

predicted a Crash for Chinese stocks

Insider Selling in England

British Northern Rock Debacle Made

Insiders A Billion Pounds

General Motors

So, trading and investing need not be difficult or dangerous.

TigerSoft, you will see, is Easy, Reliable, Fairly

Priced

And Is Backed up with Friendly Support and Rich

Historical Documentation from All Market Eras. We provide

data and a nightly hotline, so that you can "earn while

you learn" what we show you based on 28 years of

intensive studies of the financial markets.

(C) 2010 www.tigersoft.com

Since 1981, we have been helping investors and traders gain in

the stock market by showing them how to spot insider buying and

insider selling, using TigerSoft's Accumulation Index, Tiger's Closing Power

and Peerless Stock Market Timing: 1915-2010. Without such tools,

trading losses are a high risk in markets like we have just seen.

|

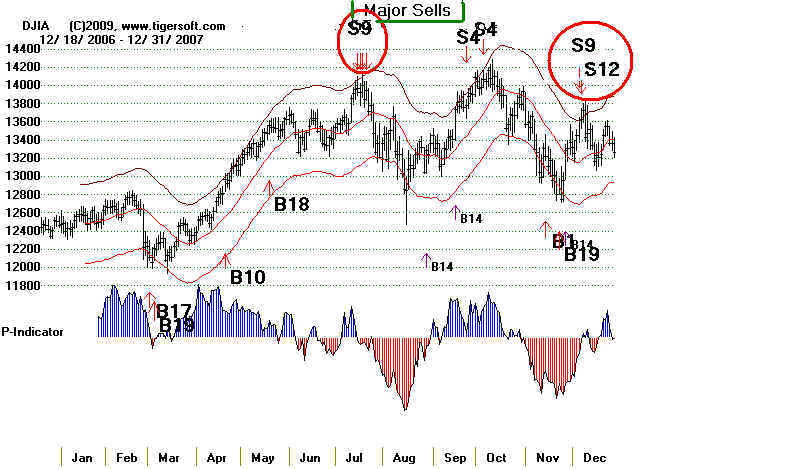

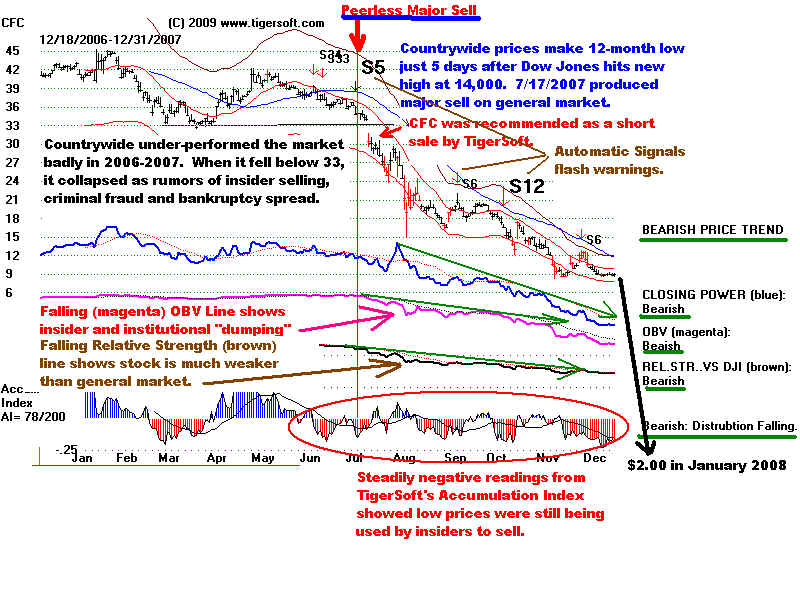

"CALLING ALL TOPS" - SAFETY IS THE FIRST PRIORITY The 2003-2007 bull market ended with multiple sets of major sells and a key support failure, This we show elsewhere is exactly how all other bull markets have ended since 1928. That year's data is the earliest there is for producing all the automatic Buys and Sells on our Peerless Stock Market Timing, 2007 - MARKET TOP  |

We offer:

Stock/Commodity Charting and Analytical Software.

Many Years of Back-Testing To Maximize Performance.

Unique Tiger's Trend and Insider Trading Analysis

A Nightly On-Line Hotline

Automatic Nightly Data Feed.

Our Software and Services Feature:

--- Unique Tools To Spot Key

Insider Buying and Selling.

--- Trading / Investing Software - Simple To

Use.

--- Make Your Retirement Account Safer

--- Buy The Best Stocks, When The Market Environment

Is Safe.

--- Time-Tested Automatic Buy and Sell Signals.

Plus

--- The World's Best Technical Support.

--- Monthly San Diego TigerSoft User

Meetings.

=====================================================================================

PROFITS ARE EASY - WHEN YOU'RE AN INSIDER

OR WHEN YOU USE TIGERSOFT!

TigerSoft will show you how to

make Goldman Sachs pay!

Goldman

Sachs Is "The GREED CONNECTION" between Wall Street and Washington

http://www.tigersoftware.com/TigerBlogs/April-7-2009/index.html

Paulson

Takes Corruption and Cronyism To Dizzying New Highs.

http://www.tigersoft.com/Tiger-Blogs/September19-2008/index.html

Goldman Sachs has its people everywhere in

government.

Small wonder it

is the most profitable, glorified Wall Street

hedge-fund,

masquerading as a commercial bank so that

it can get access

to cheap money at the Federal Reserve.

The CEOs at these companies have little shame.

So, don't

be surprised when

they try to steal your money, if you

don't have

TigerSoft to tell you the score and show you

how the game is

being played. Example: last September,

Henry Paulson,

Bush's Treasury Secretary - who had

previously been

Goldman's CEO, arranged a taxpayer gift

of $12.9 BILLION

for Goldman when he bailed out AIG.

If AIG - the big

insurance company - had been allowed to fail,

as Goldman's

rivals - Bear Stearns and Lehman Brothers -

did,

Goldman would be probably have gone broke or

have become just

another $10 has-been stock!

But Goldman had

been slipping protection money to Paulson,

now worth 1/2 Billion,

in the form of years of huge bonuses.

And now - what a

surprise! - we discover that Obama's

biggest campaign

contributor was none other than Goldman

Sachs. Not for

nothing as a result - but for a million dollars

up-front, Obama has

publicly declared that Wall Street had

done nothing criminally

wrong or fraudulent in bringing on

the 2007-2008 World

Financial Collapse. This Obama assures

us, while refusing to

order a full-blown investigation of

the facts behind the

Crash before prejudging Goldman's

innocence!

http://www.tigersoft.com/Tiger-Blogs/September19-2008/index.html

Goldman's TigerSoft Chart show how bullish a stock can

look

when the companies'

insiders know it is fully backed and

financed by the US

Government. The public thought Obama

would reform Wall

Street! Insiders at Goldman knew he

was their ally, protector

and benefactor!

TIGERSOFT CHART of GOLDMAN SACHS

In our opinion,

far too many CEOs are over-paid criminals.

They add insult to injury by then selling

millions of

dollars worth of their companies' shares at

the top

and buy them back at the bottom.

Too harsh? Who but a crook would take 1/2

Billion from

a company's shareholders and customers

and then sell out

his shares at the top, six months before the

company goes

bankrupt, for all practical

purposes?

With TigerSoft, we can see this insider

selling, as it is taking

place. We could even sell short

these shares and make

"killer short sale profits."

===============================================================

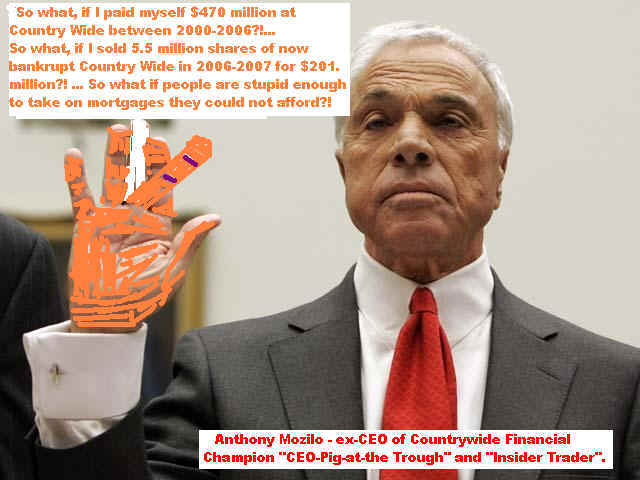

The soon-to-be criminal case of Anthony Mozilla,

ex-CEO of Countrywide Financial.

June 5, 2009 - Countrywide's Mozilo

charged with fraud, insider trading by SEC

Don't expect CNBC to tell you to sell.

CNBC's Jim Cramer urged his viewers in 2007 NOT to sell Countrywide.

February 7, 2007 - http://www.thestreet.com/story/10337828/jim-cramers-stop-trading-buy-countrywide.html

August 16, 2007 - http://www.thestreet.com/story/10374792/jim-cramers-stop-trading-dont-sell-countrywide.html

TigerSoft's Blog on August 2, 2007

showed folks how to find the best stocks like Countrywide to go short.

TIGERSOFT CHART of COUNTRYSIDE

FINANCIAL, 2007

SO MANY EXAMPLES OF INSIDER TRADING.

Insider selling before the collapse of a stock

is rampant.

Investors and traders need TigerSoft for their

own protection.

Here are some TigerSoft links showing insider

selling, heavy

(red) Distribution from TigerSoft and

subsequent price

collapses in shares:

Washington

Mutual - ex-CEO Killinger

CitiGroup - Board

member, ex-Goldman CEO,

US Treasury

Secretary under Clinton - Robert Rubin

Bank of America - Ken Lewis

Ryland Group - Dreier Chad

Donald Trump

Here

are the three greediest of the greedy - CEOs who

defrauded shareholders and committed insider trading and

stock

manipulation. thestackeddeck.com's

This was

prepared before Goldman Sachs took the stage in 2007-2009,

Ken

Lay of Enron CEO

Card

Caption:

This part-time Bush advisor and full-time millionaire was

selling company stock while telling employees to buy. Big surprise Enron folded

under his watch. He happily drove up energy prices in 2001 by manipulating

the energy futures, causing deadly "brown-outs.".

Dennis

Kozlowski - Tyco CEO

Caption- "A true Tycoon of corporate

malfeasance: tax evasion, grand larceny,

enterprise corruption, falsifying business records, and securities fraud."

Martha Stewart and

Sam *the weasel)

Martha Stewart and

Sam *the weasel)

Waksaal of Imclone.

What A Stock Looks Like Headed To ZERO!

TIGERSOFT's ACCUMULATION INDEX

and CLOSING POWER ARE THE DIFFERENCE.

One

more example - CitiGroup. It hit $1.00 a share in March 2009.

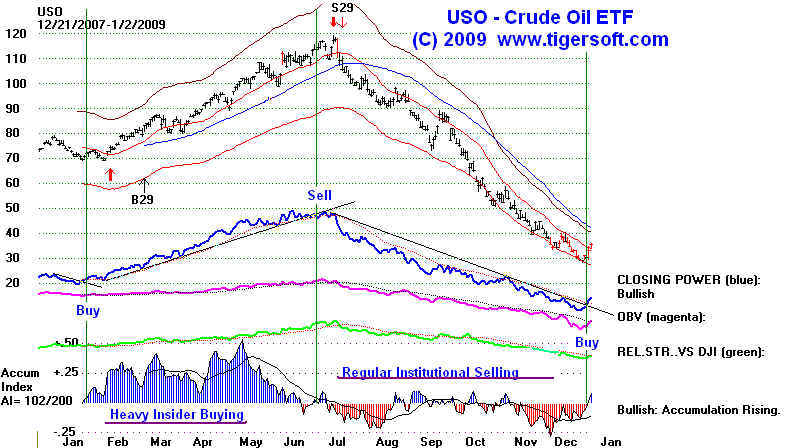

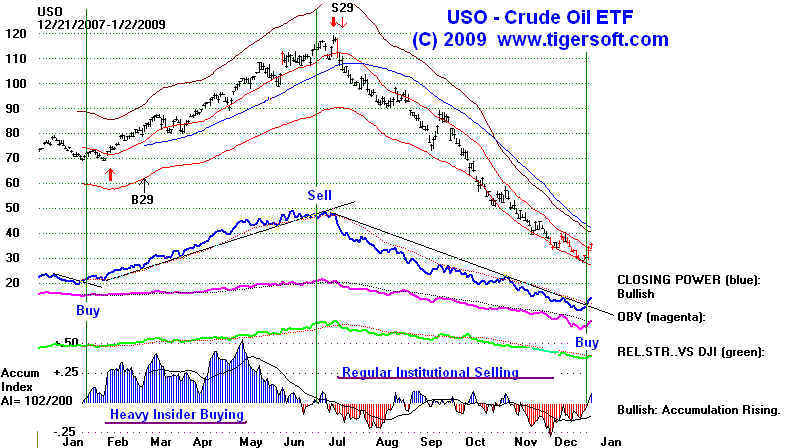

CRUDE

OIL: 2007-2008 Illustrates how quickly the Tiger Accumulation

Index can change from BULLISH ACCUMULATION to BEARISH DISTRIBUTION.

The trend-changes of Tiger'S Closing Power confirmed the trend-change.

Both tools were

invented by TigerSoft and have been back-tested as far

back as 1928.

====================================================================================

INSIDER BUYING IS THE SINGLE BEST

PREDICTOR

OF A FUTURE EXPLOSIVE SUPER STOCK

Bulges of intense

(Blue) Accumulation show insider buying. If the insiders are

savvy and the

general market holds up, prices will soon breakout to new highs

and advance

quickly. Only after prices have already risen a long way will the

good news that

propels them upwards come out. That is when the broad public

usually buys.

We want our people to get in at the beginning of the move. The

early major Buy

signals tell us when to buy. We hold as long as the trend is up,

using the blue

50-day moving average. TigerSoft makes finding such stocks

very easy.

Our Peerless Stock Market Timing tell you when the market is safe.

|

MORE EXAMPLES TO STUDY!