Buy This 160 Page Book:

Killer Short

Selling: Using Tiger's Accumulation Index To Spot Insider Selling.

$75. --> Order here.

$295

- Introductory

TigerSoft

$995

- TigerSoft + Peerless Stock

Market Timing + Tiger Power Ranker

======================================================================================

To Find The Best Short Sales.

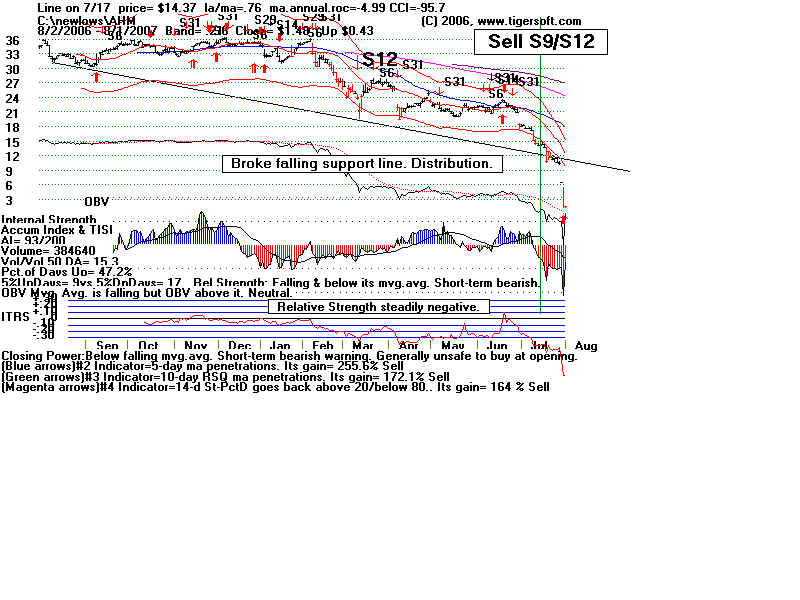

1.) Locate The Biggest Decliners since Our

Major Sell on July 17th.

2) They Should Show Heavy Red Distribution and

Insider Selling.

3) They Should Be Breaking Major Support and

Making New 12-Month PriceLows.

William

Schmidt, - Tiger Software's Creator (C) 2007 William

Schmidt, Ph. D. - All Rights Reserved.

In

a bull market, we search for the first stocks out of the gate. The best early

performers usually do very

well. They are the stocks big institutions want to buy en masse.

In a bear market, the

opposite is true. Find the worst performers in the first stage of

a big decline and you will

find the stocks that will do the worst and may even go bankrupt.

A Look at the biggest decliners since our major Sell on July 17th.

Close Pct Change

Since 7/17

AHM

1.48

-90%

American Home Mortgage

Investment Corp

8/3/2007 Law suit claimes company failed to

discolse loan failures.

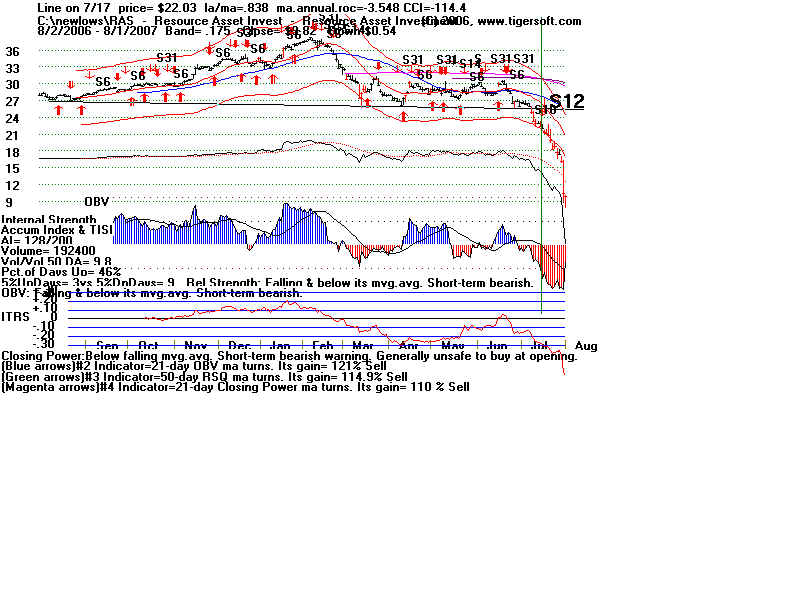

RAS

9.82

-56%

RAIT Financial Trust

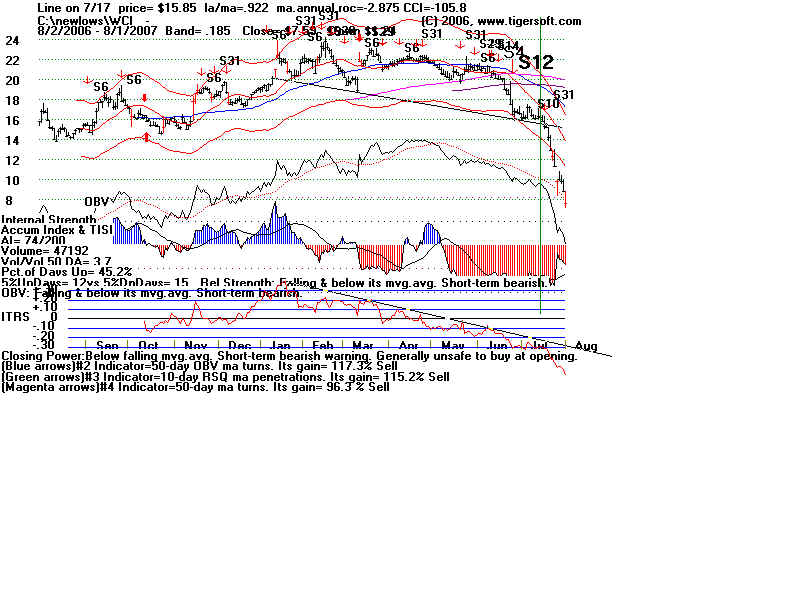

WCI

7.59

-53%

WCI Communities Inc,

Luxury condos.

8/2/2007 Moody's cut

WCI's debt deeper into junk

OPTM

7.36 -48% Optium

Corporation

Optical subsystems for use in

telecommunications and cable TV network systems.

7/31/2007 - Downgraded after company

forecasts fiscal loss in next quarter.

FMT

5.74

-48% Fremont

General Corporation

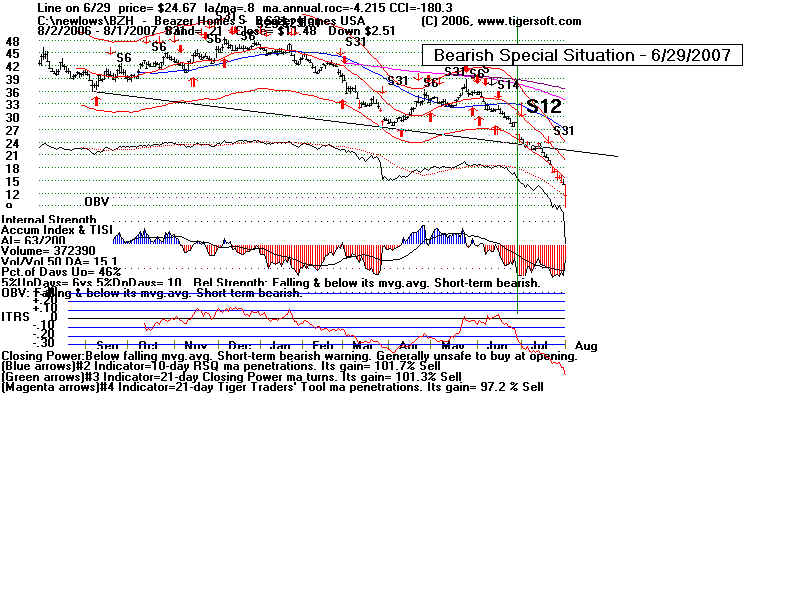

BZH

11.40

-47%

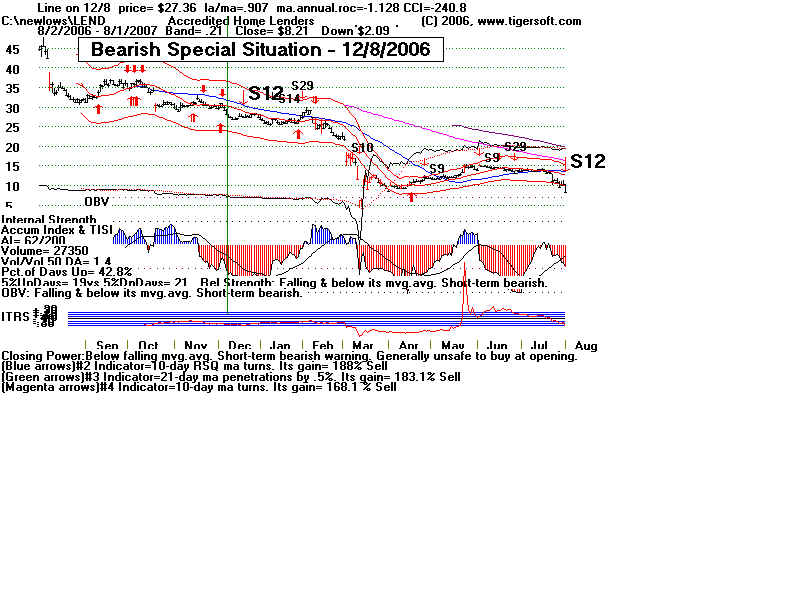

LEND 8.21

-42%

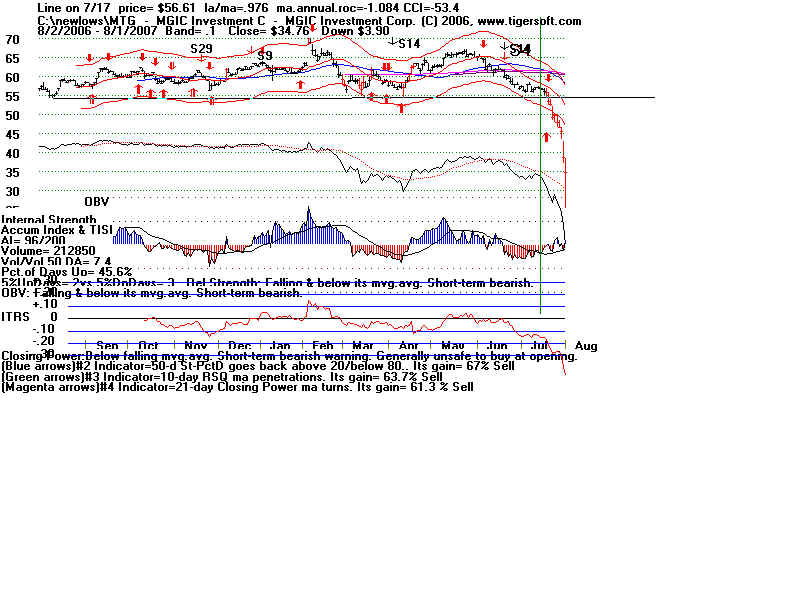

MTG 34.76

-39%

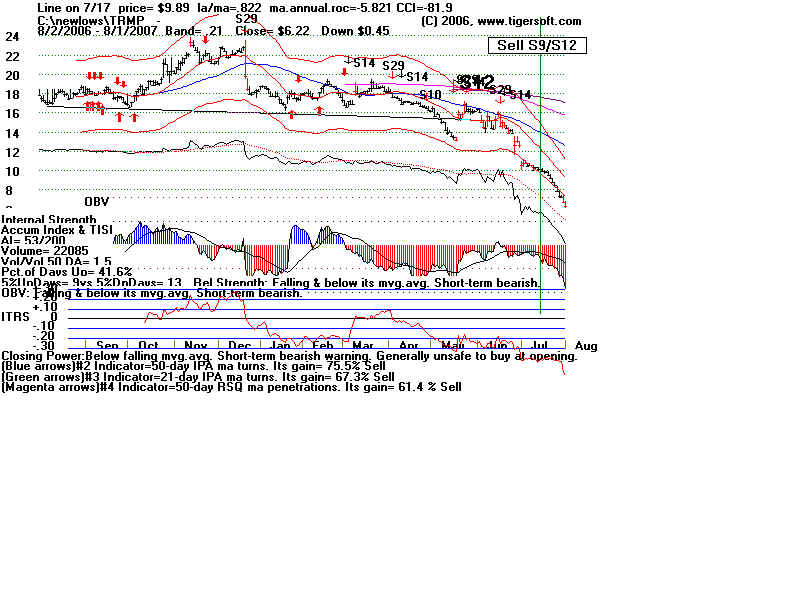

TRMP

6.22

-38%

CHC

11.29

-34%

HOV

11.95

-33%

LEV

6.72

-32%

BHS

19.66

-31%

TGIC

26.03

-30%

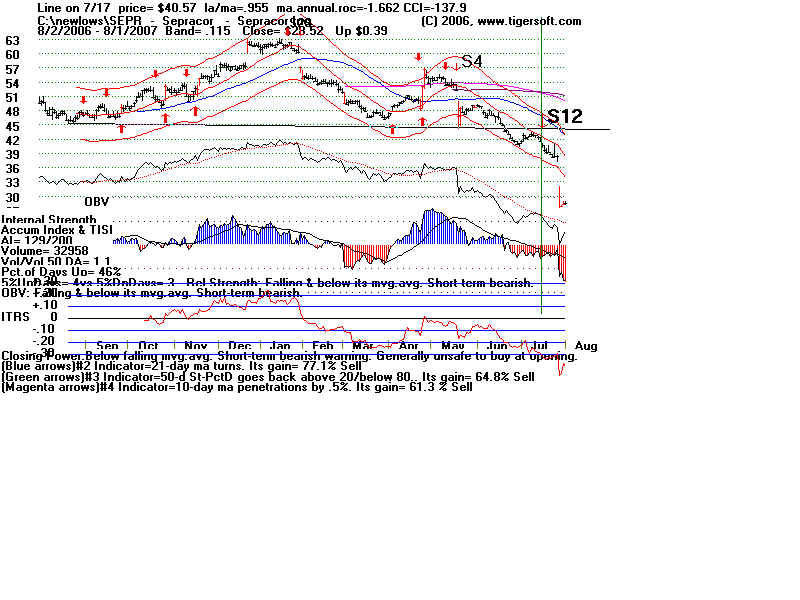

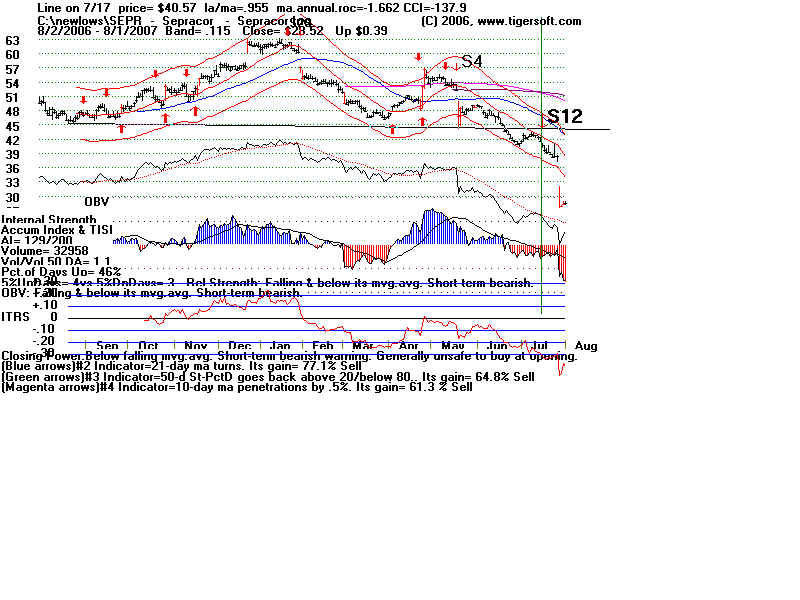

SEPR

28.52

-30%

RWT

31.92

-30%

JRT

10.03

-30%

JRCC 8.23

-30%

A Good Summary of The Apparent

Cause for the Decline.

1

"The widening fallout in the

U.S. mortgage industry has reminded investors of a risk they had forgotten:

the fear of risk itself. As

unpaid mortgages and bankrupt lenders bring the weakest segments of the

mortgage industry to its knees,

investors have begun dumping debt and other investments that would

seem to have nothing to do with

home loans. Corporations are paying higher interest rates on their

bonds (and) some private-equity

firms are having trouble raising money to close big purchases...

Subprime refers to people with spotty

credit histories. Fueled by Wall Street's easy money, the subprime

mortgage market exploded to $1.3 trillion

over the past few years. But as home prices sagged and more

borrowers missed payments on these loans,

the industry fell into turmoil this year. The meltdown of this

comparatively small segment of the U.S. economy

is contributing to a much bigger and broader issue:

lenders around the world are growing scared to

lend." By Dan

Seymour, AP Business Writer 8/1/2007

When you look at these charts you can see how

weak the stocks looked the day of our major Sell

signal. We chorted many of these then. My

reasoning was if they can't do up in a bull market, surely

they will go down in a bear market. You

will see multiple sell signals on these charts, support failures

and heavy distribution by insoder-informed big

money holders and short sellers. We have earlier noted

the insider selling in many of these mortgage

company's stocks. Law suits will surely be filed about the

insider selling many of them clearly show

See our piece, dated 3/10/2007 - "Insider Selling in Mortage

Lenders is Being Investigated."

.

|