HOW TO GET A JOB IN A DEEP RECESSION

JOB SEEKERS, USE TIGERSOFT:

TO SUPPLEMENT YOUR INVESTMENT RETURNS,

TO FIND THE BEST COMPANIES TO APPLY TO,

TO IMPRESS THE INTERVIEWER.

BECOME A TIGERSOFT SALESMAN, too.

UNEMPLOYED? Ask about our discount for unemployed folks.

WE CAN REALLY HELP YOU - Read on...

|

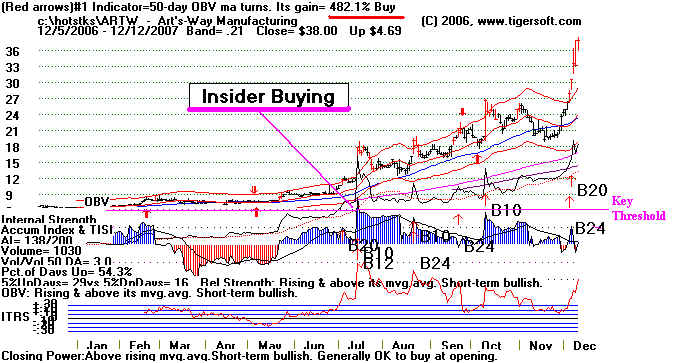

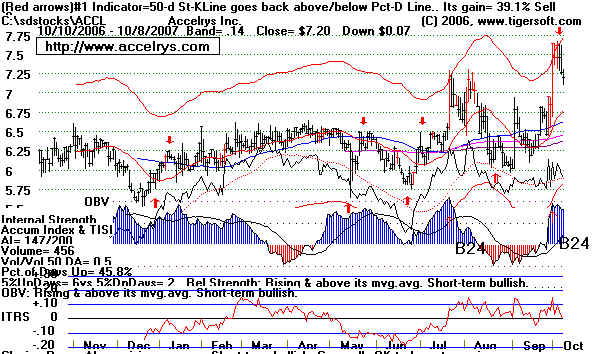

Tiger Software's |

|

Want a part-time job selling TigerSoft? It's not hard, the hours are yours to determine and you will get the satisfaction of helping folks build a bigger nest egg for their retirement. We pay a generous commission / finder's fee when you refer someone to us who buys our software, data or market / stocks' hotline. Email us for more information. Some Advise for Job Seekers: How To Impress Your Interviewers. Getting A Job Is A Serious Undertaking - Instead of paying a high priced recruiting agency, consider using one that does not charge its candidates for assisting them. Also, consider getting TigerSoft. Learn to buy and sell stocks profitably, especially high tech stocks. Not only is this a skill you can put to use to make extra money while searching for a job, you'll be able to use the skills we teach for many years. Learn when to buy, when to sell and when to sell short. From TigerSoft, you'll also learn how to spot expanding companies. With their stocks on the rise, expanding companies are your best bets for finding a corporate job. We suggest, with these companies' names in hand from using TigerSoft's Power-Ranker, that you go to their websites using Yahoo Finance and quickly see which positions they are seeking to fill. They will be impressed when you tell them you are contacting them directly. When you go for an interview at a publicly traded company, bring in a TigerSoft chart of them to show them how much more you know about their own stock's fluctuations and prospects than they themselves probably do. You will readily be able to show the the best trading system for exploiting their stocks ups and downs. And you'll be able to show them whether the stock is under insider accumulation or distribution and selling. They will always want to get a better look into their company's future. That alone will make your name stand out among candidates. Example - Let's say you're interviewing at the University of Phoenix. In this case, the parent company's (APOL) Buys and Sells would have gained someone 234% after commissions (buying and selling short) or 78% in this terrible market just buying and selling at the next day's opening, after commissions. If I were an employer, I would be very interested that someone I was thinking about hiring knew more about my company's stock than I did! And, I would not tell them where I learned this until they hired me.  Of course, you'll want to read what's out there on the internet, about resume writing, networking, preparing for the interview and even when in the interview it's best to discuss your salary and how much to ask for. You can Google these subjects and learn a lot. Check out http://www.glassdoor.com/index.htm See how employees rate and review their own companies. See what different companies pay their workers. This is a free service. If Staffing companies's stocks are recovering, the economy is recovering and prospects of new jobs are real. See the current yearly TigerSoft index of Recruiting/Staffing stocks. It has clearly turned up, but its still shows negative Accumulation from the Tiger indicator. Big money is still cautious about the recovery continuing. Until we see the Tiger Staffing Stock Index start making more recovery highs and show some positive Accumulation, the Job Market does not looks challenging, to say the least. By the way, historical testing shows that this is a coincident indicator for the general market. 2008-2009 Recession Bottom?  2008 - How the recession developed..  |

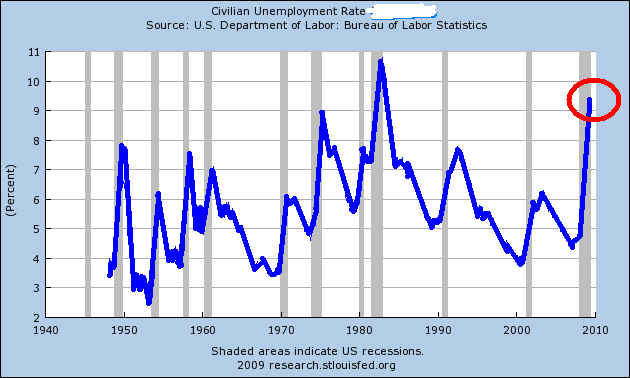

US Dept. of Labor - June 5, 2009

The official unemployment levels vary widely from state to state, city to city and

industry

to industry.... Civilian unemployment is higher,

Nonfarm payroll employment fell by 345,000 in May, about half the average monthly decline for the prior 6 months, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The unem- ployment rate continued to rise, increasing from 8.9 to 9.4 percent. Steep job losses continued in manufacturing, while declines moderated in construction and several service-providing industries. Unemployment (Household Survey Data) The number of unemployed persons increased by 787,000 to 14.5 million in May, and the unemployment rate rose to 9.4 percent. Since the start of the recession in December 2007, the number of unemployed persons has risen by 7.0 million, and the unemployment rate has grown by 4.5 percent- age points. (See table A-1.) Unemployment rates rose in May for adult men (9.8 percent), adult women (7.5 percent), whites (8.6 percent), and Hispanics (12.7 percent). The jobless rates for teenagers (22.7 percent) and blacks (14.9 percent) were little changed over the month. The unemployment rate for Asians was 6.7 percent in May, not seasonally adjusted, up from 3.8 percent a year earlier. (See tables A-1, A-2, and A-3.) Among the unemployed, the number of job losers and persons who completed temporary jobs rose by 732,000 in May to 9.5 million. This group has in- creased by 5.8 million since the start of the recession.

"Official" unemployment rose much more than expected.

It is now the highest since 1982. The official unemployment

rate is now approaching 10%. It does not include those

who have given up on finding a job and those who have

involuntarily taken only part-time work. Just to keep up

with the population gains, the country needs 125,000 new jobs

a month. The pain was pervasive, across almost all major

sectors of the economy. The consumer is tapped out. Top-Down

bailout spending has been sold as an aid to freeing up the

credit market. But if people lose their jobs, the banks

won't loan them money. Taxpayer money is given to the banks

so that they can then charge borrowers up to 30% for their

own money. The TOP-DOWN subsidies are the biggest scam

ever perpetuated on the American people. They show clearly

that America is not a true democracy. It is a plutocracy run

by and for the very rich. Both political parties take

their orders from corporate America and Wall Street. Marx

would say to us now, "I told you so."

For those still working, the pay squeeze has tightened.

Employers now have a large army of unemployed to hire from

to threaten their existing workers.

"Over the last year, the average hourly pay of rank-and-file

workers – roughly 80 percent of the work force – has risen

only 3.4 percent, according to the new numbers. The average

workweek has also become shorter, so the increase in

weekly pay has been even smaller: only 2.8 percent.

Inflation has been running at about 5 percent a year, which

means that the most workers have taken an effective pay cut

over the last year".

(Source: http://economix.blogs.nytimes.com/2008/10/03/jobs-report-underlines-economic-decline/?hp

See also http://money.cnn.com/2008/09/05/markets/stockswatch/index.htm

and Robert Reich's blog. http://robertreich.blogsp

This phenomemon of shrinking real hourly wages

began in the 1970s. Meanwhile wealth has become

more and more concentrated. Threaten higher taxes

on the rich and the media crucifies you. Succeed

in somehow getting legislation through the rich mans'

Senate and getting higher taxes and the unpatriotic

rich quickly hide their money in the Caymans, Bermuda

or Switzerland. Don't look for economic justice in

the US anytime soon. You have to fend for yourself.

And TigerSoft will help you. r.

Wall Street Bankers as Puppet-Master.

That the leading Democrats caved in so quickly to the Paulson - Goldman Sachs -

Bernanke bankers' bailout last Fall and without a public hearing, proves several things:

1) They, like Obama, have no back-bones and will not stand up for rank and file Americans

against their Wall Street masters,

2) They can be suckered twice (the first being Bush's assurances that Iraq had nuclear

weapons and was harboring Al Qida)

3) They are every bit as much the puppets of Wall Street as most Republicans.

All you have to do is look at who the advisers & backers of both McCain and Obama are

to see that Wall Street is the master puppeteer and Obama and McCain are both taking

their swings and jabs at each other as only puppets can. Obama's pro-banker policies

are very clear now. He will not order an investigation into the financial collapse. He tells

us Wall Street broke no laws, without an investigation. He sets out the Federal Reserve

to be the new regulator of the financial industry! They are not even a public body. They

are comprised of bankers. Clearly, they did next to nothing to prevent the Collapse,

even though outside economists warned them about what was about to happen.

With fear on the rise, it would be well to look at 1929-1938 and 1973-1982 to see how

bear markets play out. That is what our Peerless Stock Market Timing does.

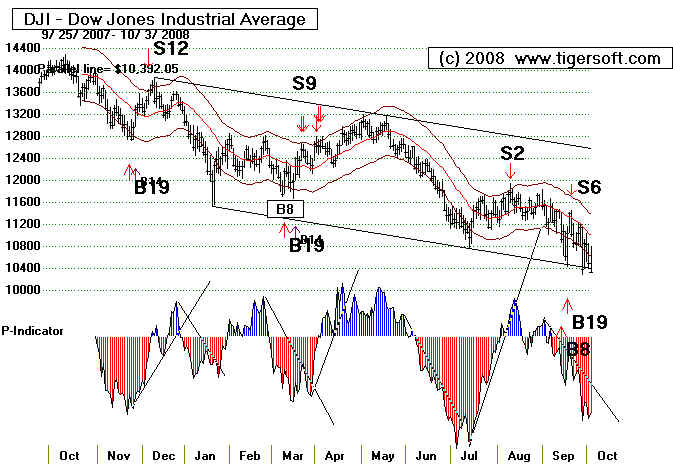

Each day our Peerless software gives major Buys and Sells on the general market using

the DJI. The system is back-tested to 1915 Most stocks will move up and down with it.

That the leading Democrats caved in so quickly to the Paulson - Goldman Sachs -

Bernanke bankers' bailout last Fall and without a public hearing, proves several things:

1) They, like Obama, have no back-bones and will not stand up for rank and file Americans

against their Wall Street masters,

2) They can be suckered twice (the first being Bush's assurances that Iraq had nuclear

weapons and was harboring Al Qida)

3) They are every bit as much the puppets of Wall Street as most Republicans.

All you have to do is look at who the advisers & backers of both McCain and Obama are

to see that Wall Street is the master puppeteer and Obama and McCain are both taking

their swings and jabs at each other as only puppets can. Obama's pro-banker policies

are very clear now. He will not order an investigation into the financial collapse. He tells

us Wall Street broke no laws, without an investigation. He sets out the Federal Reserve

to be the new regulator of the financial industry! They are not even a public body. They

are comprised of bankers. Clearly, they did next to nothing to prevent the Collapse,

even though outside economists warned them about what was about to happen.

With fear on the rise, it would be well to look at 1929-1938 and 1973-1982 to see how

bear markets play out. That is what our Peerless Stock Market Timing does.

Each day our Peerless software gives major Buys and Sells on the general market using

the DJI. The system is back-tested to 1915 Most stocks will move up and down with it.

1974 Was A Year When Distrust of Presidency Was Very High.

It was the year of Nixon's impeachment.

1974 Was A Year When Distrust of Presidency Was Very High.

It was the year of Nixon's impeachment.

Obama seems to have the backbone of a jellyfish. So, it's up

to you to make the best of this sad and bad situation. Get TigerSoft

and we will help you. And make your vote in November count for something.

As you know, too many jobs are being exported because of how the current

Republican Administration protects corporate profits not American jobs.

See - http://www.cbsnews.com/stories/2004/02/13/opinion/main600351.shtml

http://www.buzzflash.com/store/reviews/572

Sadly, Obama's stance seems vague, shifty and guarded, ibutions!

Obama Continues The Cover-Up

The official rate of unemployment is pure malarkey.

Just as the real rate of inflation is. Did you know that when

you have not been working for more than 6 months, the

Federal Government no longer counts you as unemployed!.

You still have bills to pay. You do what millions do:

You take part-time, low-paying, less paying jobs.

You drop your health insurance and stop going to the

Doctors for checkups! Real wages, are a better measure

of the real state of jobs in the US. Recent numbers

are not available. They are too embarrassing! But

despite big increases in productivity, real wages have been

declining since 1973.

http://blogs.wsj.com/economics/2008/08/01/

"

Obama seems to have the backbone of a jellyfish. So, it's up

to you to make the best of this sad and bad situation. Get TigerSoft

and we will help you. And make your vote in November count for something.

As you know, too many jobs are being exported because of how the current

Republican Administration protects corporate profits not American jobs.

See - http://www.cbsnews.com/stories/2004/02/13/opinion/main600351.shtml

http://www.buzzflash.com/store/reviews/572

Sadly, Obama's stance seems vague, shifty and guarded, ibutions!

Obama Continues The Cover-Up

The official rate of unemployment is pure malarkey.

Just as the real rate of inflation is. Did you know that when

you have not been working for more than 6 months, the

Federal Government no longer counts you as unemployed!.

You still have bills to pay. You do what millions do:

You take part-time, low-paying, less paying jobs.

You drop your health insurance and stop going to the

Doctors for checkups! Real wages, are a better measure

of the real state of jobs in the US. Recent numbers

are not available. They are too embarrassing! But

despite big increases in productivity, real wages have been

declining since 1973.

http://blogs.wsj.com/economics/2008/08/01/

"  http://www.conference-board.org/economics/ConsumerConfidence.cfm

June 30, 2009

The Conference Board Consumer Confidence Index™, which had

improved considerably in May, retreated in June. The Index

now stands at 49.3 (1985=100), down from 54.8 in May. The

Present Situation Index decreased to 24.8 from 29.7. The

Expectations Index declined to 65.5 from 71.5 in May.

The Consumer Confidence SurveyTM is based on a

representative sample of 5,000 U.S. households.

The monthly survey is conducted for The Conference Board

by TNS. TNS is the world’s largest custom research company.

http://www.conference-board.org/economics/ConsumerConfidence.cfm

June 30, 2009

The Conference Board Consumer Confidence Index™, which had

improved considerably in May, retreated in June. The Index

now stands at 49.3 (1985=100), down from 54.8 in May. The

Present Situation Index decreased to 24.8 from 29.7. The

Expectations Index declined to 65.5 from 71.5 in May.

The Consumer Confidence SurveyTM is based on a

representative sample of 5,000 U.S. households.

The monthly survey is conducted for The Conference Board

by TNS. TNS is the world’s largest custom research company.

Job Outsourcing Job off-shoring and the illegal misuse of temporaries continue unabated. Anti-unions companies like Walmart, Hewlett Packard and Cannon should be investigated. But they| are not. IT outsourcing to India and now China is negatively impacting Americans with a college education now. See how a leading outsourcing company Hewitt Associates, HEW, remains in a strong uptrend despite the bear market elsewhere. 3.3 million jobs will be exported in less than 15 years, according to recent report by Forrester Research. But the sheer size of the exodus isn't what's worrying analysts the most — it's the type of jobs: software development, customer service, accounting, back-office support, product development and other white collar endeavors. See - http://www.pbs.org/now/politics/outsource.html.

| Projected Number of U.S. Jobs to Move Overseas |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

U.S. workers are used to seeing manufacturing jobs lost to much lower wages,

according to the Bureau of Labor Statistics and the International Labour Organization,

U.S. manufacturing average hourly compensation is $21.33, in Mexico: $2.38 and in

China less than one dollar an hour. It should be noted that while salaries are much lower

in India and other BPO hot spots, that does not mean that the companies are providing

inadequate compensation — the cost of living is significantly lower in India.

However, as

both THE TIMES OF INDIA and THE ECONOMIST have recently noted, some jobs

are in turn leaving India for even cheaper locales. And where are those jobs going? Some

are

heading to China, Russia, Vietnam, the Philippines, Malaysia, and the Czech Republic.

In short, they are moving toward cheaper labor costs than those in India.

| Salary Comparisons: US vs India |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

http://www.pbs.org/now/politics/outsource.html

Outsourcing - The Destruction of American Workers

Some say this is what should be expected in a culture dominated by a

"bought-and-paid-for"

Government when corporate and CEO Greed reaches levels many consider treason.

A Reagan

Assistant Secty. of Treasury says that a bleak trend is afoot. High tech

development and

manufacturing is increasingly being outsourced. "The highly skilled US work

force

is being gradually transformed into the domestic service workforce characteristic of third

world

economies. " Source.

Take Florida for example. "Between 2001 and 2007, 100,900 Florida

jobs were outsourced to various employers in China. In 2007 alone, 17,000 jobs were sent

overseas

to the country. This is even more significant due to the recent report that says that

Florida has lost

over 74,700 jobs since June of 2007 and June of 2008, according to the Miami Herald. Of the jobs

lost to China, 31 percent were previously held by Floridian workers that had at least one

college

degree. Those who lost their jobs due to outsourcing reported making, on average, $8,146 a

year

less with their new employers." Source.

The TigerSoft chart of Placement and Staffing Stocks is testing is recent

lows. Though this

Index tops out ahead of the Job market, it acts mostly as a coincident indicator at

bottoms.

Tech Stocks Have Weakened Again

Use TigerSoft to spot the trends in the NASDAQ-100 (QQQQ).

Right now the QQQQ is weakening as it responds to a red Tiger Sell

signal. The weekly report I do for Elite Subscribers Professionals (ESP)

can find very, very few tech stocks, other than in biotechnology, that

look very good. Most are weakening as the economy slips into what looks

like a long recession. The outlook is not good because of the size of the

US deficits (governmental and trade) and because Republicans' greed

and ideology, coupled with Obama's timidity,. will deny the country what

it so badly needs, a massive public works' program to rebuild our infrastucture

to make for brighter and more productive future.

High

Tech Heavy - NASDAQ-100 10/3/2008

===================================================================================

6/30/20098 Best Performing NASDAQ-100

Stocks:

Up 20% or More in Last 3 Months ices

Other high Accummulation, Strong Stocks -

6/30/2009

|

Additional Job Search Links: - 4/9/2008 Looking for A Job in San Diego - Use TigerSoft. You'll Impress Them. - US DoL's Occupational Outlook Handbook (OOH), 2008-09 Edition - Annual survey of college recruiters: employers plan to hire 16 percent more new college graduates in 2007-08 - http://jobs.care2.com/ World's Largest listing of jobs with socially responsible companies. - Work with a reputable professional recruiter. See http://hightechpros.com - http://www.monster.com/ http://www.careerbuilder.com http://www.simplyhired.com/ http://www.helpwanted.com/ - TigerSoft's Best performing US stocks of the last 12 months - Quarterly study - http://www.tigersoftware.com/TigerBlogs/4-10-08/index.html Executive recruiting outook.6/3/2008 http://www.execunet.com/r_trends_rci.cfm - http://www.conference-board.org/economics/helpwantedOnline.cfm |

Tiger Staffing Index Shows A Bear Market.

Let's Hope It's Not Too Long.

The Credit Crunch Is Not Over: 5/7/2008. 5/1/2008 4/9/2008

4/7/2008

Seeking A Bottom

There is some good news. Tech companies are doing

better than most. IBM is

close to its 12-month highs and AAPLE is near its highs. The Democrats

typcially do better for tech stocks than Republicans do. So, perhaps, there will

be a significant change in the policies espoused by next year's White House occupant.

Perhaps, CEOs will take some of the bundle of money they have been taking from

the companies they run and share it with their workers and their consumers.

If they don't, the pressures to replace them all, will keep building like a volcano.

So, if you're an enginner or have a tech specialty, take heart. And you can use

our software to find the best in this area and make contacts with the companies

whose stocks are behaving most favorably. Since our software

measures internal

(volume and relative strength), we can easily inspect the NASDAQ-100 stocks to see which

seem positioned to perform best over the next 6 months. This is the function of

Tiger's Power-Ranker.

The top TigerSoft Power Ranked

stocks in NASDAQ-100,

as of 5/30/2008 with charts, as of 7/31/2008

==============================================================================

The list of the Recruiting

Companies that comprise the above index.

Typically the Tiger Index of publicly traded recruiting firms tops out ahead of the

general market, sometimes by as much as 18 months as happened between 1998 and

2000.

Back last Summer (2007) I

wrotw that this "means unless this index turns up dramatically

quite soon, there will be a profound economic slow-down in 2008-2009." Of course, many

jobs in the US are being shifted overseas r turned over to temporary agencies so that the

hiring companies can avoid paying their workers benefits. In fact, some of these

outsourcing

firms are clear uptrends. See the strong uptrend of HEW (Hewitt Associates) Until this

pernicious trend is reversed I don't see how the US can avoid a lasting recession.

In the

end, the bull market of the 1920's turned into a Depression because workers' pay was not

high

enough to buy what was being manufactured. This is the "under-consumption"

explanation of

the Great Depression. See - http://rrp.sagepub.com/cgi/content/abstract/15/2/1

http://ideas.repec.org/p/usg/dp2002/2002-14.html

http://en.wikipedia.org/wiki/Causes_of_the_Great_Depression

No Bottom Yet

Texas Has The Most New Jobs

The Job Market Continues To Be Tight.

Employers slashed 80,000 jobs in March. This was the most in five years

and the third straight month of losses. The "official" US unemployment rate rose

from 4.8 percent to 5.1 percent. Clearly the economy is slipping into

recession.

See http://biz.yahoo.com/ap/080404/economy.html

Not only that oil prices

are very high and as the Dollar is falling at an annualized 12% a year, making

imports more expensive. But the Dollar's decline is also boosting US exports.

And our index of Staffing Stocks, shown below, has not recently made a new

low and has even broke its downtrend. So the job market may start to improve.

Job-Outsourcing Continues Unabated!

5/27/2008

Strong Up-Trend seen in stock of outsourcer Hewitt Associates (HEW)

Clearly companies are rushing to use this companies' services. Full

time jobs with benefits

are getting

harder and harder to find. Use a Recuiter (see list at bottom of page) and TigerSoft

to give you an

edge if you're looking for a new and better job in the US! See how the bulge

of insider buying in

October told us correctly that this stock would go higher.

What You Can Do To Help Yourself

Demand that the candidates running for public office support decent wages

and an end ot

outsourcing of jobs and jobs with full benefits, not contract and temporary

work. If the CEOs

lowered their obscenely high pay, the companies could afford to

pay their workers

decent wages and the US recession would quickly disappear.

Focus Job Search and Buying of Stocks on Strongest Sectors.

5/18/2008

I previously suggested on focusing on stocks making new highs if you are a job-seeker.

But today there were NO

new highs on the NYSE. Instead, if you are a job seeker or stock

trader, I would focus

on the industries that are doing best. TigerSoft lets you rank by price performance

the Fidelity Sector

funds and also Sector ETFs. TigerSoft lets you see which industry goups are

strongest

for, say, the last 100

days. Here are the Fidelity Sector and Sector FTFs rankings. You can see

the particular stocks

that the ETFs and Fidelity Sector funds have positions in.

Strongest Fidelity Sector Funds for The Last 100 trading

says, 5/27/2008

============================================

Sector

Gain Biggest Stock Positions. (Look up their symbols on Yahoo.)

-----------

----- ------------------------

FSNGX Natural Gas

+9% KWK,

RRC, VLO, UPL, PXP, EOG, XTO, RIG, DYN, CHK

FNARX Natural Resources +6% XOM,

SLB, NOV, VLO, BTU, COP, CNX, RIG, XTO, WMB

FSCHX Chemicals

FSDPX Industrial Materials +6%

FSENX Energy

+6%

FSESX Energy Services

+4%

Strongest

ETF (Exchange Traded Funds) Sectors for The Last 100 trading says, 5/27/2008

===================================================================

GAZ +47% The fund is

designed to reflect the performance of natural gas.

UNG +47% The trust will invest in

futures contracts on natural gas traded on

the NYMEX that is the near month contract to expire..

DBE +37% The index is a

rules-based index composed of futures contracts on some of the most heavily traded energy

commodities in the world— Light Sweet Crude Oil (WTI),

Heating Oil, Brent Crude Oil, RBOB gasoline and Natural Gas.

JJE +37% The index is

composed of four futures contracts, crude oil, heating oil,

natural gas and unleaded gasoline.

USL +35% light,

sweet crude oil

DBO +33% Light

Sweet Crude Oil

OIL +33% The investment is linked

to the performance of the Goldman Sachs Crude Oil Return

Index and reflects the returns that are potentially available through an unleveraged

investment in the futures contacts comprising the index plus the Treasury Bill rate of

interest that could be earned on funds committed to the trading of the underlying

contracts.

RJN +33% 6 energy commodity futures contracts.

USO +32% he fund will invest in futures

contracts for WTI light, sweet crude oil, other types of

crude oil, heating oil, gasoline, natural gas and other petroleum based-fuels

that are traded on exchanges.

UCR +28% West

Texas Intermediate crude oil.

GSC +27% the S&P GSCI Enhanced Commodity Total Return Strategy Index.

DBC +26% The index commodities are light, sweet crude oil, heating oil, aluminum, gold, corn and wheat.

GSP +26% Commodities

SLX +26% The fund will invest at

least 80% of assets in common stocks and ADRs of companies involved

in the steel industry.

It

is probably a good idea to avoid companies whose stocks are down sharply in the last, say,

100 trading days.

The weakest Fidelity Sector Funds can give you an idea of areas to avoid.

18 of the 43 Fidelity Select

funds are down 15% or more. So, you have to be selective in job search.

On other hand, when trading, the weakest sectors and industries have given us very profitable

short sales.

Weakest Fidelity Sector Funds - 100 Days Ending

5/18/2008

==========================================

Air Transport -26%

Medical -21%

Insurance -19%

Health Care -16%

Home Finance -14%

Home page www.tigersoft.com

|

Customers have asked: |

TRADING FOR A LIVING

USING TIGERSOFT

Commodities, gold,

silver and now oil have done very well and we have recommended them to our

subscribers. So, there is nearly always a

new trend developing somewhere to trade. And we

can give you the tools to trade very

profitably,

The single best thing you can do in looking

for a job, is to contact an employer whose business

is expanding quickly. That is when they are most eager to hire talented and energetic people,

like you! So, study the lists of best

performing stocks in your area and below. Realize that stock

prices anticipate earnings' growth. A

burst of hiring tends to coincide with the beginning of a

sharp rise in stock prices. As you can

see from this website, our Tiger Software is particularly

adept at finding these growth companies.

So look at the tables we show. And consider getting

our Tiger program to guard the money you do

have now and also to maximize the potential for

investment gains now.

===========================================================================

-

JOBS' REPORT

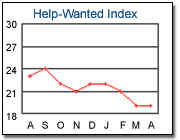

The Conference Board's Help-Wanted

Advertising Index

( http://www.conference-board.org/economics/helpwanted.cfm

)

Help Wanted OnLine Data by region of the US. Please go to

http://www.conference-board.org/economics/helpwantedOnline.cfm

Internet job advertising has served as an

increasingly effective substitute for newspaper advertising

in recent years. Instead of relying on the Help Wanted Index

shown below, I suggest paying

more attention to the Tiger Index of Recruitment and

Placement Firms' Stocks.

| May 29, 2008  This report is being

phased out This report is being

phased out"The Conference Board Help-Wanted Advertising Index was unchanged in April. The Index remains at 19, the same level as in March, but down 10 points from one year ago."In the last three months, help-wanted advertising declined in all nine U.S. regions. Steepest declines occurred in the New England (-26.8%), South Atlantic (-20.5%) and Pacific (-19.8%) regions. (Source: http://www.conference-board.org/economics/helpwanted.cfm ) |

- Online advertised vacancies dropped 579,000 from May 2007 to May 2008

- Demand for employees fell in all areas of the country

In May 2008, there were 3,795,400 online advertised job vacancies, a decline of 579,000 or 13.2 percent from the May 2007 level, according to The Conference Board Help-Wanted OnLine Data Series™ (HWOL) released today. This is the third consecutive month of declines for the nation as a whole (year-over-year). In May, there were 2.5 advertised vacancies posted online for every 100 persons in the labor force, down from a high of 2.9 in May 2007.

"May shows a slight recovery from the large April decline, but overall the number of online advertised vacancies has been on a downward trend for the past several months. The demand for labor will likely be sluggish this summer," said Gad Levanon, economist at The Conference Board. "This lackluster job outlook is clearly a contributing factor in consumer confidence shrinking to its lowest point in nearly two decades, as reported by The Conference Board Consumer Confidence Survey."

THE NATIONAL — REGIONAL PICTURE

- 2,743,700 new online ads posted in May

- All nine Census Regions post over-the-year declines in labor demand

In May, 2,743,700 of the 3,795,400 unduplicated online advertised vacancies were new ads that did not appear in April, while the remainder are reposted ads from the previous month. In May, a month expected to show a seasonal increase in labor demand, the number of total online advertised vacancies increased by 145,500 or 4 percent while new ads rose by 152,200 or 6 percent from April. However, the vulnerable labor demand is clear in the May year-over-year numbers where total ads fell 13.2 percent and new ads fell 2.5 percent.

The monthly national increase in advertised vacancies between April and May '08 reflected marginal increases in ads in all nine Census regions. However, online advertised vacancies in each of the nine Census regions were below last year's May levels.

STATE HIGHLIGHTS

- Alaska posts the highest ads rate in the country for the ninth month in a row

- Wyoming leads the nation with the lowest supply/demand rate

The number of advertised vacancies declined from May 2007 to May 2008 in 43 states (compared to 44 states in April 2008), and all the states experienced a slowing in the year-over-year growth rate. The April employment data released by the BLS indicates that 43 of the 50 states also experienced a slowing in their year-over-year growth rate of employment.

States where job seekers are continuing to see a large number of advertised vacancies include Alaska, Nevada and Colorado. Alaska posted 4.98 online advertised vacancies for every 100 persons in the state labor force, the highest rate in the nation. Alaska has held the number one position for nine months in a row. Nevada (4.17) and Colorado (4.14) were close behind in the number of advertised vacancies when adjusted for the size of the state labor force. Half of the top 10 states with the highest ads rate are west of the Mississippi and in addition to Alaska, Nevada and Colorado, include Arizona (3.74) and Washington (3.57). The remaining states were on the East Coast and include Delaware (3.90), Massachusetts (3.89), Maryland (3.77), Vermont (3.75) and Connecticut (3.55).

Online advertised vacancies in California, the state with the largest labor force in the nation, totaled 505,700 in May. The ad volume in California dropped by nearly 200,000 ads, 28 percent below the May 2007 level. The volume of online advertised vacancies in Texas (319,600) was down 13 percent and ads in New York (264,800) were down 16 percent from year ago levels.

Source: www.conference-board.org/economics/helpwantedOnline.cfm

1) Have You Considered Quitting Your Day Job and Trading The Stock Market.

Contrary to what you may think, this is feasible and reasonable if you have discipline

and are willing to work hard and get up before the market opens. Day trading is not needed.

Swing trading, where you hold a stock typically 3 to 50 days is, is recommended here.

We gave seminars in Las Vegas on this in the past. And can sell you this manuals with suitable

updates for only $125 if you have bought our Peerless and Tiger programs. Just call us and

ask for our new manual. :

"Yes! Quit Your Day Job and Trade The Stock Market for A Great Living."

Here are some of our basic propositions.

1. Peerless Major Buys and Sells ARE powerful and reliable. The book shows how to take

advantage of them. Discover the best Opportunity Patterns among stock charts in this

environment.

2. Trade the Most Accumulated Stocks. They are tightly held. Insiders know very good things

about them. And they rise more than 36% per year on average. But most of their gains

often come after certain setup-price patterns. Recognize them and take advantage of them.

3. Trade the best Opportunity Patterns. Make a list each night. And watch them. When

they hit the price we teach you to look for, pounce like a TIGER!

4. Watch for unusual volume. Learn how to investigate in on the internet.

5. Use TigerSoft to show you which sectors are hot. Sticking with these increases your

odds. And watch for the first stocks "out of the gate". They're the one you want to

own.

6. Trade the NASDAQ-100 stocks like a pro with short-term Buys and Sells.

7. Always PLAN and BE PATIENT. Wait for the right moment and pounce like a TIGER.

8. Use Tiger's Seasonality Studies for the stocks you trade. See which days are best for

buying and selling.

9. Don't Buy at The Opening, unless you Tiger shows you it is safe, which is unusual.

10. Buy stock that open higher and close still higher than the opening.

Get a 30% Commission on Each Sale.

You will need first to own TigerSoftware and Peerless. That will enable you to demo our software to full

advantage. The rest is easy. Find us customers and we will pay up to $300 per new customer.

An easy way to make money is to provide a link to Tiger Software and be paid when one of your people

buy the software. Use the gif file below. And contact us. We will explain how to be sure you are compensated.

Links you may want to look up.

Links you may want to look up.