- A Special Introduction -

Learn The Rules and Get The Tools

To Survive The Wall Street Jungle

Come to The Next San Diego TigerSoft User Group Meeting About Us

Learn How To Trade Stocks Very

Profitably while Limiting Risk.

Wall Street, too often, has mainly served INSIDERS and PROFESSIONALS.

Here you will learn the rules to beat Wall Street at its own game. We apply the

TigerSoft tools you will need to make investing and trading stocks much more

profitable. Bluntly restated, without this knowledge and TigerSoft, the stock

market is a very dangerous place for your hard-earned money. Please read more.

(C) 2009 William Schmidt, Ph.D. All rights reserved.

Our Products/Services - Order Forms More Reading To Help You Beat The Pros

TigerSoft Links: See also www.tigersoft.com

Welcome Testimonials What We Offer Insider Trading Predictions Cassandra's Curse About Us

Tiger Blog Tiger's Books on Investing Automatic Buys/Sells on Stocks Explosive Super Stocks

Killer Short Sales Techniques Gold and Silver Stocks Crude Oil Calling All Tops

Longer-Term Investing Blue Chip Stocks Different Trading Applications of TigerSoft

Thank you for visiting. These are the starting rules we teach our customers.

They are based on 30 years' observation, testing and discussions with hundreds of

professional traders. If you don't understand something here, give us a call at

858-273-5900. We will make the concepts and tools clearer and apply them

to the stocks you are interested in. The best time to call is in the afternoon.

Read some more and we will explain the Buys and Sells here.

You May Want To Reconsider Your Trading Approach

We strongly suggest you re-think "buying and holding", only "selling when

you have a profit" and "shooting from the hip" buying because a stock just

looks cheap. You might make money for a while. But not in the long run. These

trading approaches are very dangerous to your pocket-book. So is buying on

a "tip". Some who will read this are high-powered people who are used to making

important decisions on their own with their own expertise. If that describes you,

be sure to take the time to read what follows closely. The rules below are vital.

The Trend Is Your Friend.

But What "Trends" Are The Most Important?

If all this is too hard to swallow, keep repeating the mantra, "the trend is your

friend" and look back at what just happened to the stock market between

October 2007 and March 2008, when the Dow Jones Average fell 54%. Most

"buy and hold" portfolios were down much more. Using the rules detailed here,

ones which we have advocated for many years, would have kept you out of

all the losses since 2007. You would have lost nothing and would even have

been far ahead in a retirement account.

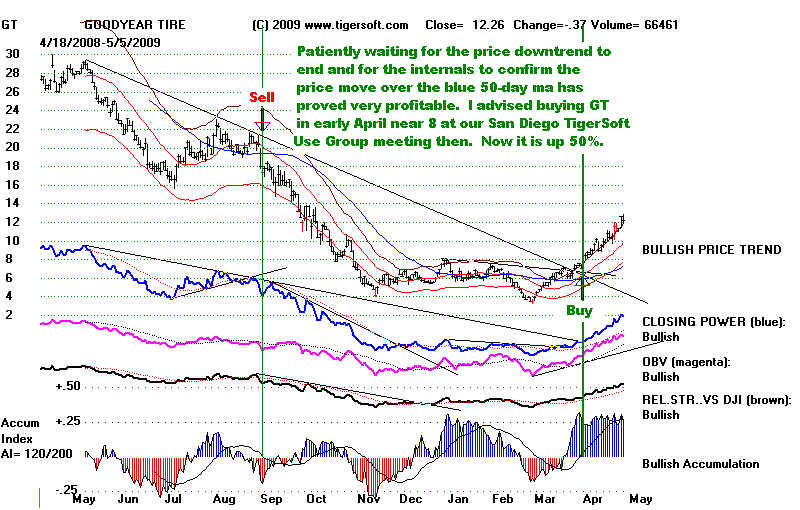

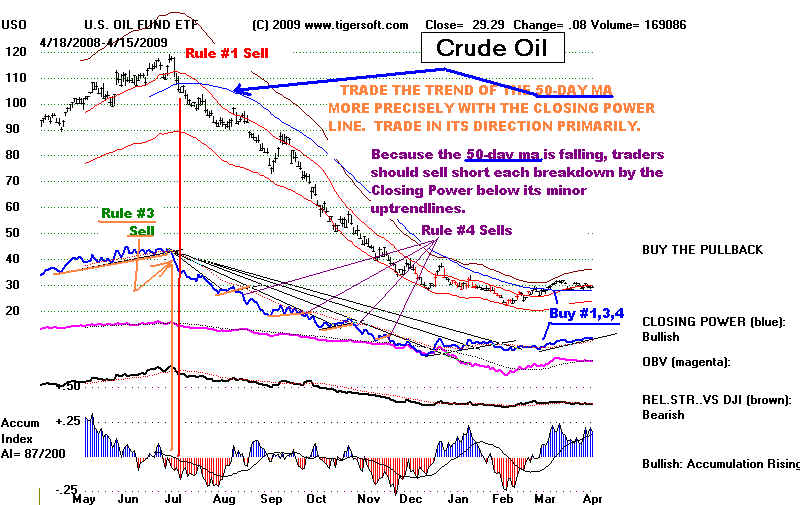

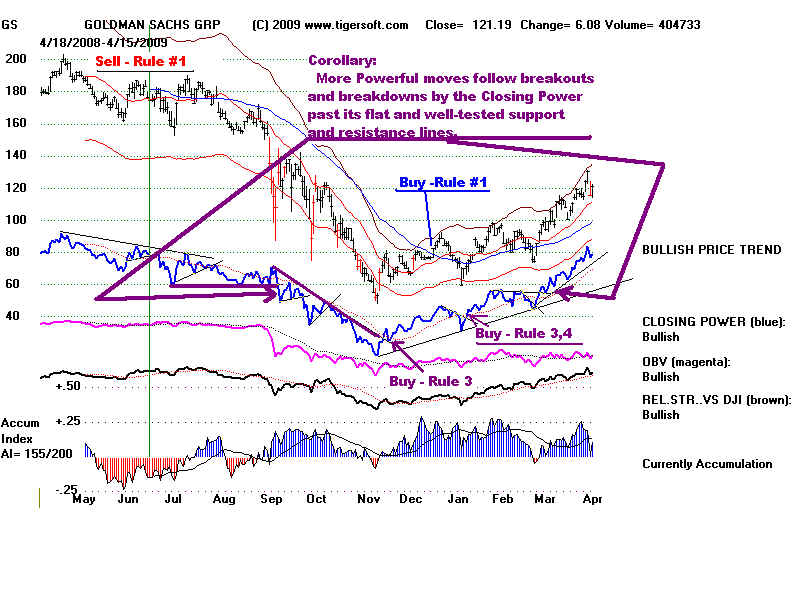

The trends to follow are the 50-day mvg.avg. of price, TigerSoft's Accumulation

Index and TigerSoft's Closing Power. There's more. But mastering these concepts

will be of enormous help.

There's a lot you can quickly discover here. Read on. I will post many more

examples in the coming weeks and I suggest regular reading of the Tiger Blog.

Here are the basics.

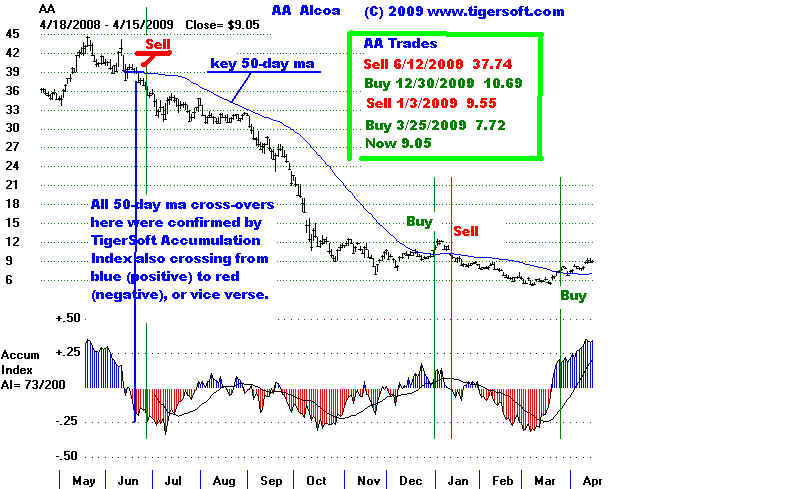

Rule #1 Watch the 50-day moving average of stock prices. Its "trend is your friend".

This rule is something you will see espoused in Investors' Business Daily and

by many other traders.

BUY - When a stock's prices close the day ABOVE the 50-day ma with

the Tiger Accumulation Index POSITIVE, we should treat that as a Buy.

SELL - When a stock's prices close the day BELOW the 50-day ma with

the Tiger Accumulation Index NEGATIVE, we should treat that as a Buy.

Using only prices crossing a 50-day ma alone can often produce

whip-saws. This occurs when prices go back and forth over the 50-day

ma several times in rapid succession without making a bigger, profitable

move. That is the reason we also require TigerSoft's Accumulation Index,

which is a measure of insider and professional accumulation and

distribution, to CONFIRM the move past the 50-day ma.

Rule #2 When prices cross above the 50-day ma and the Accumulation Index is

still in negative (red) territory, treat this as an UNCONFIRMED

CROSS-OVER. Similarly, when prices cross below the 50-day ma and the

Accumulation Index is still in positive (blue) territory, we also treat this

as an UNCONFIRMED CROSS-OVER. In these cases, prices usually pull-

back to the 50-day ma and we must watch for a confirmed cross-over,

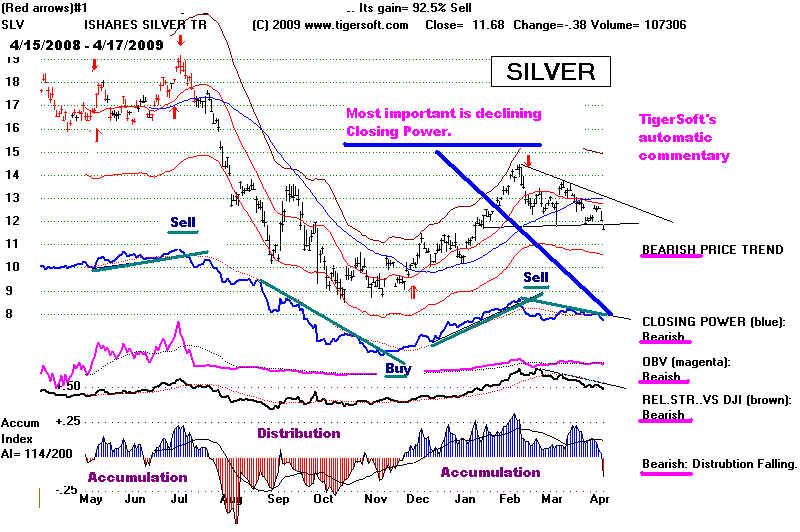

Always also watch the trend of the (blue) TigerSoft Closing Power. Its trend

is your friend if you abide by it and do not fight it. Only TigerSoft has this

indicator.

Silver has moved up and down with swings of TigerSoft Closing Power

and Tiger's Accumulation Index. Both indicators were created by TigerSoft.

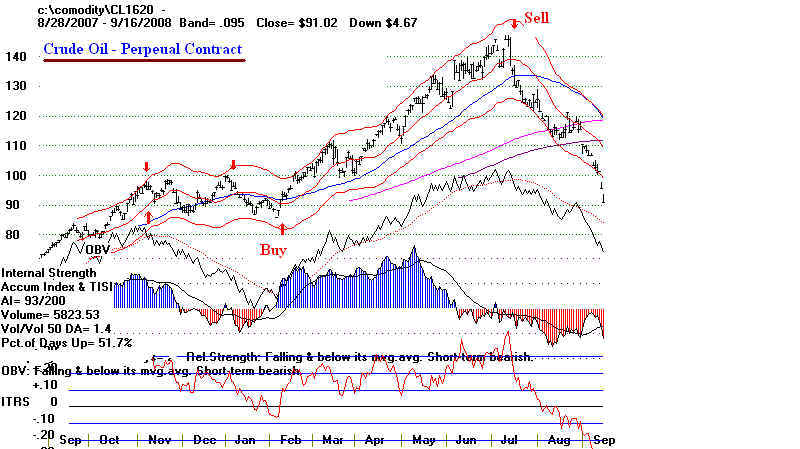

Rule #3 Watch the (blue) TigerSoft Closing Power. Draw-lines through its highs

when it is declining.

Rule #3 BUYs take place on cross-overs by the Closing Power above its

downtrendline.

Draw lines through its bottoms when it is rising.

Rule #3 SELLs take place on cross-overs by the Closing Power below its

uptrendline.

This approach gives more Buys and Sells than Rule #1. It is for traders. It

ensures that you will miss very few substantial price moves.

Rule #4: You will usually do much better using Rule #3 BUYs when the stock is already

on a Rule #1 BUY. In other words, you can buy stocks that move above their

Closing Power resistance line more confidently when the stock is also

above its 50-day ma and the Tiger Accumulation Index is positive.

Similarly, short sellers will do very well using Rule #3 SELLs when the stock

is already on a Rule #1 SELL. In other words, Sell stocks short more confidently

when their Closing Power uptrend support line is violated and the stock is below

its 50-day ma and the Tiger Accumulation Index is negative.

Horizontal Closing Power resistance and support levels when violated

bring powerful moves,

What A Very Bullish Stock Look

Like

What A Very Bullish Stock Look

Like at The Start of Its Advance

Explosive Super Stocks Book

Rule #5

Use Tiger's Power-Stock-Ranker the find the best stocks to buy.

They often show intense, massive, steady Insider Buying/Accumulation.

Buy them when the (blue) TigerSoft Closing Power's downtrend line

is broken.

December 31, 2007 What Distinguished Early-on The Stocks about To Rise The Most in 2007

June 18, 2008 Picking the Best Performing Stocks of 2008 Is Easy with TigerSoft's Power Ranker

and our Accumulation Index.