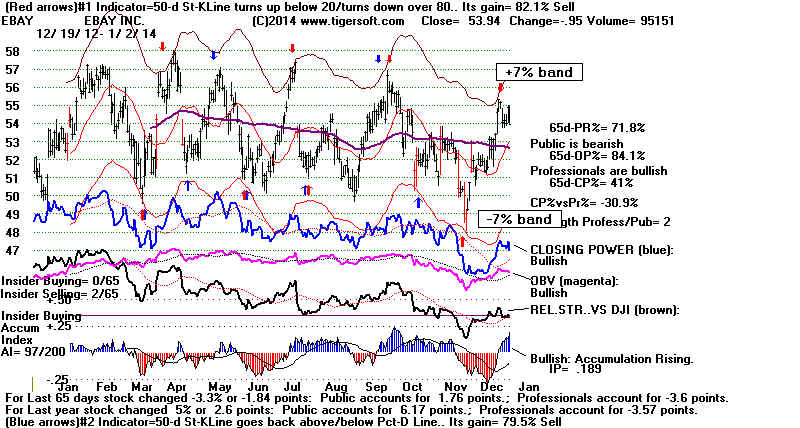

TigerSoft invented Bands around a Moving Average back in 1981. They are

now used widely. Our bands are fixed interval bands. The upper and lower bands

are the same width away from the moving average. Optimized, they bracket 93%

of the close for a year. Some stocks bounce up and down between their bands

for a year or more, EBAY did below. But that is unusual.

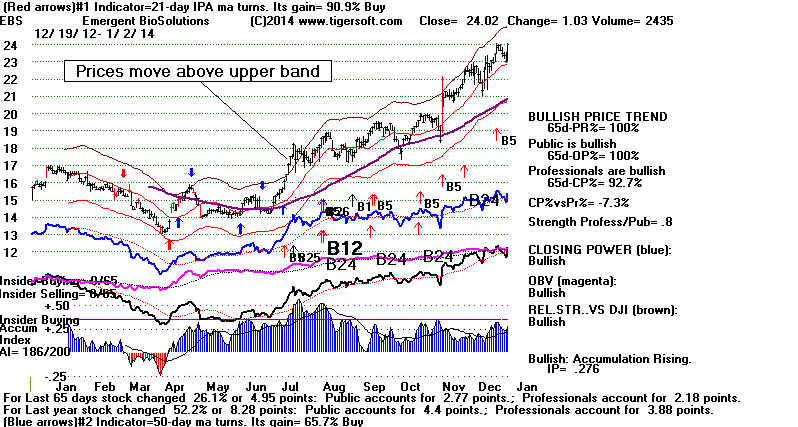

When prices move past the bands, the stock is either accelerating up or

accelerating down. Usually this is a break-away move if the TigerSoft Accumulation

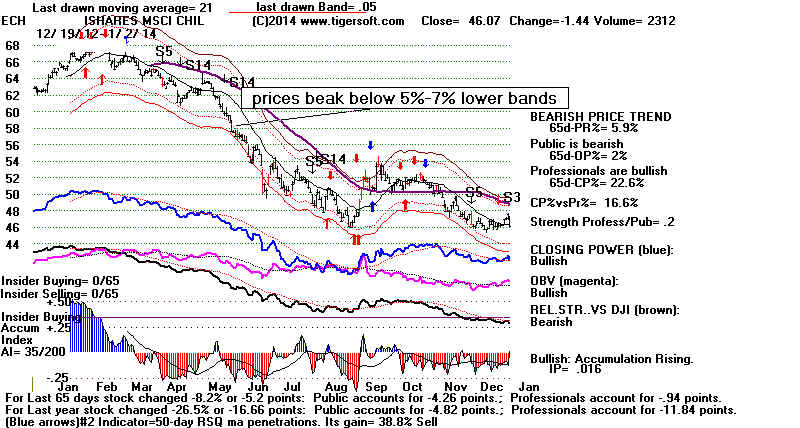

Index confirms it. When they break below their lower band, prices are usually

accelerating down.

UPPER BAND VIOLATION

LOWER BAND VIOLATION

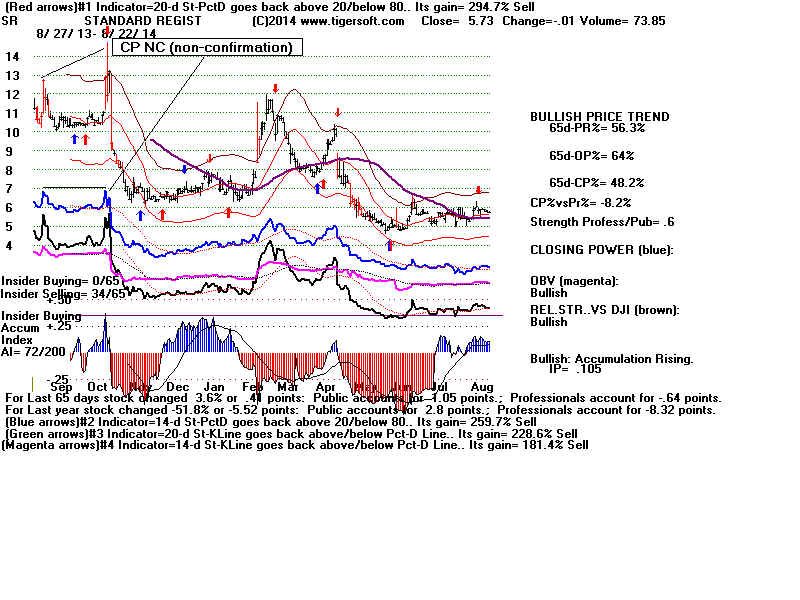

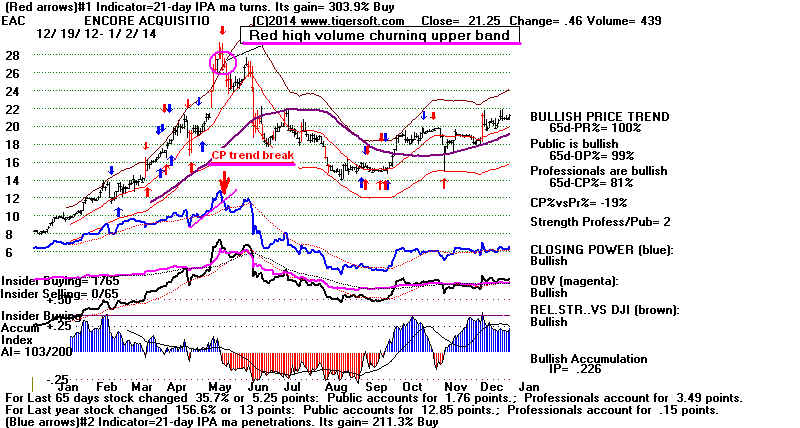

When prices churn on red high volume at the upper band, they tend to turn down

and vice verse. In these cases, we usually wait for the blue Closing Power Line

beneath the price chart to break its uptrendline to sell or, if internals are very poor,

to sell short.

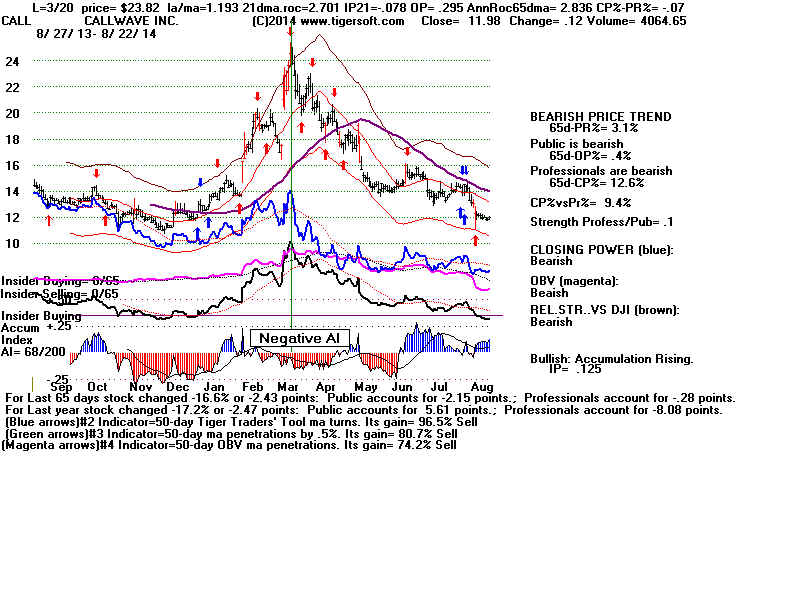

When prices reach the upper band and our internal strength indicators are declining

or negative a reversal downward is likely and vice verse. Most of the Tiger and

Peerless automatic signals are derived from where the index, stock, ETF or commodity

is in relation to its price bands and how strong the P-I is for the DJI and how strong

the Accumulation Index is for stocks and ETFS. The internal strength indicators.

Closing Power, OBV, Relative Strength Quotient and Accumulation Index are at the

bottom of the Tigersoft and Peerless charts. We constantly compare their strength

witht the price action. Thus we simultaneously employ both momentum and divergence

analysis in generating automatic signals. Besides Accumulation Index warnings, we alse

watch for Closing Power and Relative Strength divergences as the upper band is reached.

More on all these below.

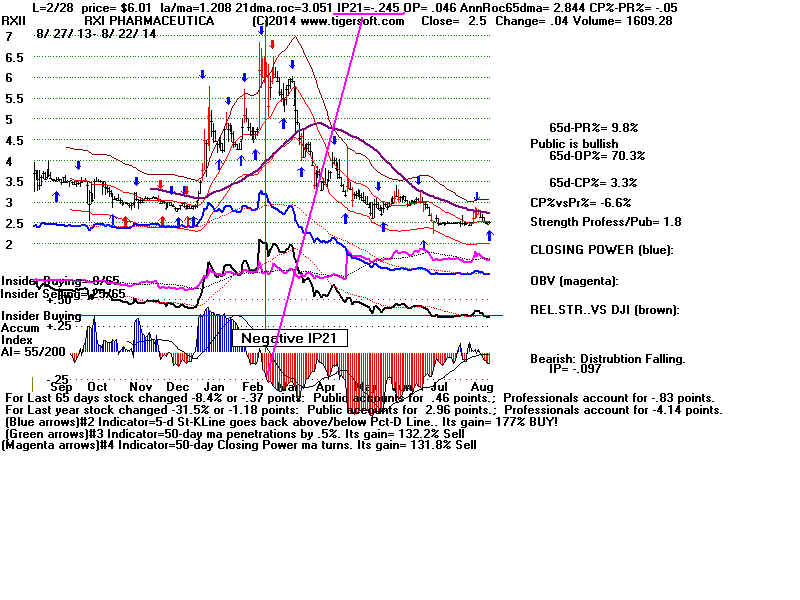

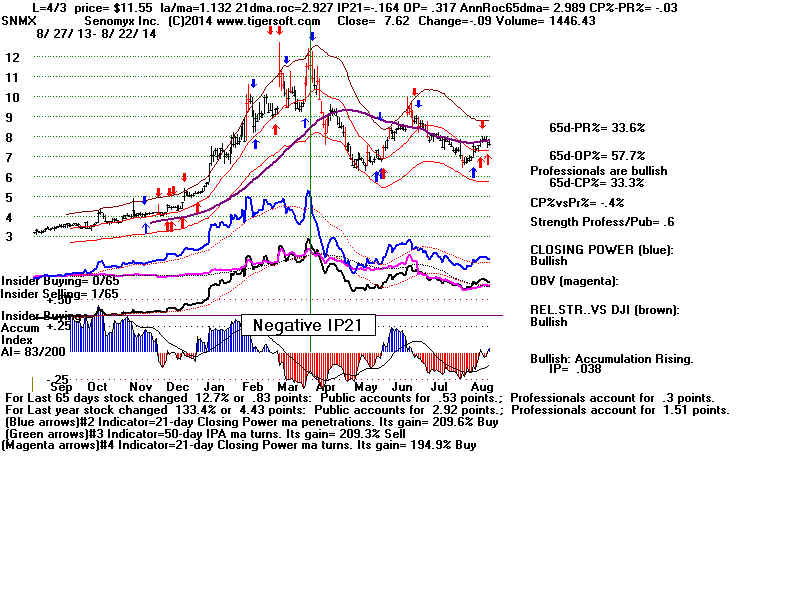

Here are some cases of big declines in 2014 where the Accumulation Index was

negative at the upper band as the stocks made major tops. By itself, this is not

sufficient reason to sell short. We would also want the Blue Closing Power to break

its uptrend and, it would be great, too, if Peerless gave a Sell Signal on the overall

market.

for the Accumulation Index