The NASDAQ-100 (QQQQ) is forming a clearly discernible head

and shoulders pattern, with a neckline at 40. Any closing much below 40,

by, say, a point, would complete the pattern and be bearish for high tech stocks

generally. That the SOX (Semi-Conductor Index) has already completed

a small head and shoulders top, is not constructive for high techs. Apparently,

interest rate hikes are expected. They take a toll on smaller companies.

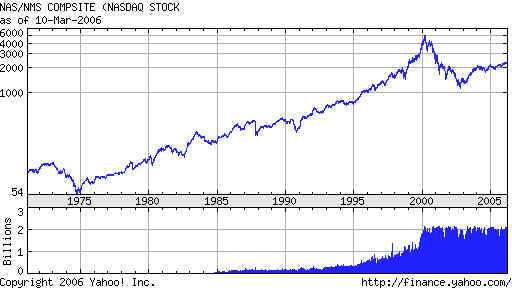

While this pattern is bearish, it would be well to keep in mind the powerful

uptrend the NASDAQ has shown throughout most of its existence since 1970.

The chart at the bottom helps us keep things in a longer term perspective.

The most bullish thing the Nasdaq-100 (QQQQ) could do would be to

abort this pattern by moving past the right shoulder's apex, 42.5. That would

make shorts cover and the QQQQ should then run quickly to new highs mast 43.25.