8/15/2009 Tiger Software Home-Page www.tigersoft.com

TigerSoft &

Peerless

Preview

Since 1981, we have been helping Professionals and the Public

around the World to Maximize Stock Profits and Avoid Devastating Declines.

Tiger Software Charts Make Analysis of Stocks Simple, Easy and Profitable!

Next San Diego TigerSoft User Group Meeting July

11th

Next San Diego TigerSoft User Group Meeting July

11th

Call or write us today.

(C) 2009 www.tigersoft.com 858-273-5900

william_schmidt@hotmail.com PO Box 9491, San Diego,

CA 92169

Tiger Software offers

(1)

Peerless Stock Market Timing: 1915-2009

Automatic Buys and Sell Signals

back-tested to 1915

Peerless Means Bigger Profits and

More Safety

Peerless Is A Great

Way To Trade DIA, QQQQ, SPY or IWM,

Peerless Made More

than 200% in 2008-2009 Trading ETFs for Russia, Brazil and Mexico.

Peerless and Major

ETFs: 1996-2009

Peerless Buys and Sells Brought Whopping Gains

in Brokerage

Stocks, Gold Stocks and Volatile Tech Stocks.

http://www.tigersoft.com/--1--/PEERLESSindex.html

>>> ORDER $395

PEERLESS STOCK MARKET TIMING HERE. <<<

(2)

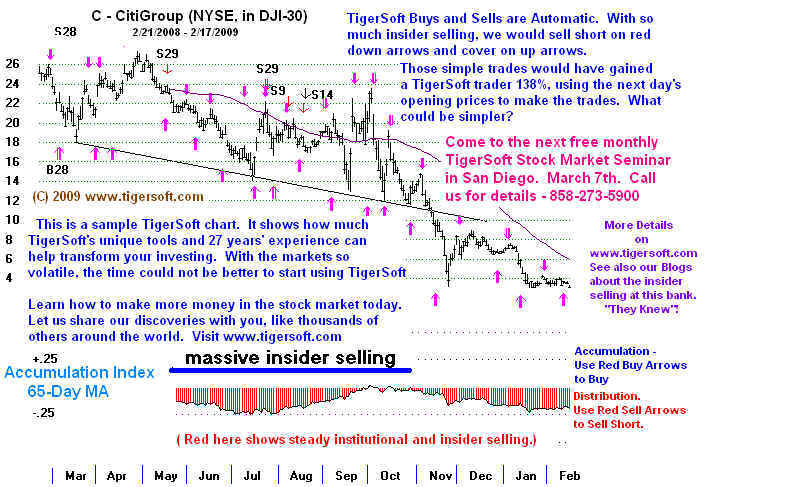

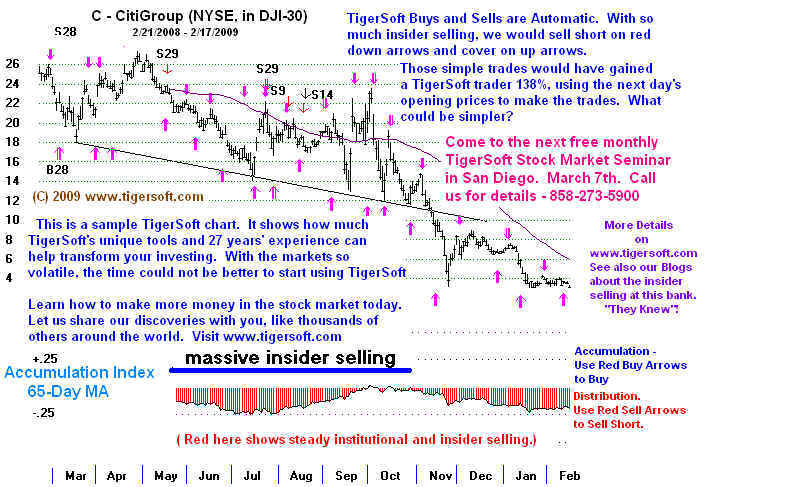

TigerSoft's Trading Advantage Tools

for Spotting Insider Buying and Selling

TIgerSoft is "Game

Changer! Separate Optimized Buys/Sells.

Trade with Tiger's Unique

Accumulation Index, Closing Power

and Very Profitable

Automatic Buys and Sells

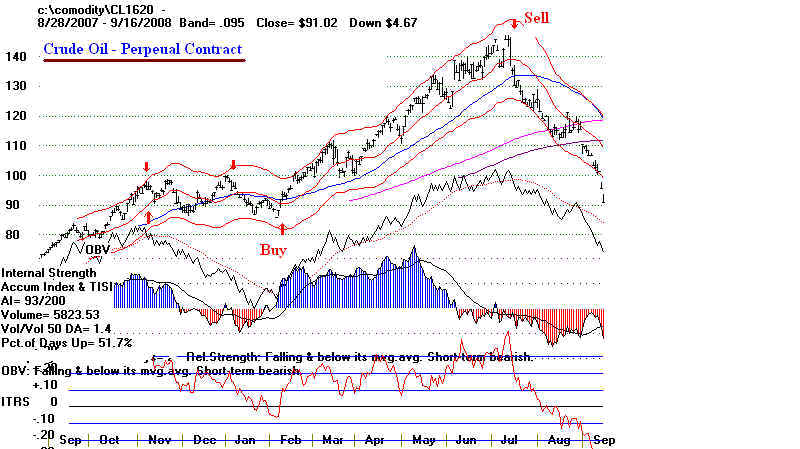

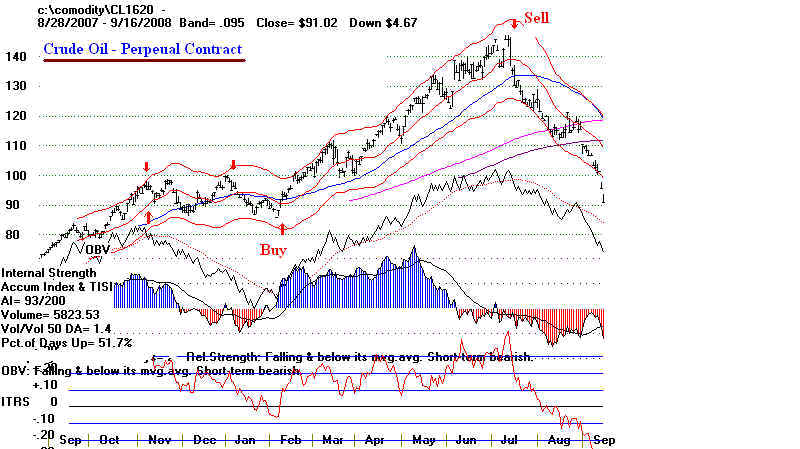

Insider Trading Is The Mother's Milk of

Wall Street.

Now TigerSoft Lets You Legally Trade

As Though You Were An Insider.

Spot The Difference.

Use TigerSoft's Unique Tools To Spot Insider

Trading

"Accumulation Index" and "Closing Power".

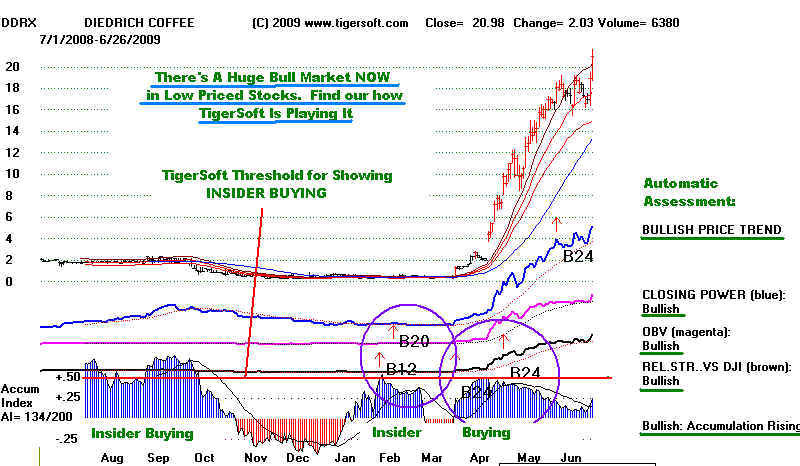

Insider Buying

Insider Selling.

Insider Selling in 1929 versus Bunker Hunt's Buying Silver in 1979.

Different Trading Applications of

TigerSoft

TigerSoft Insights into Key Insider

Trading

===> Order

TigerSoft Here ...$295.

===> TigerSoft/Peerless/Data

for 7 months, Hotline - 3 mo $495

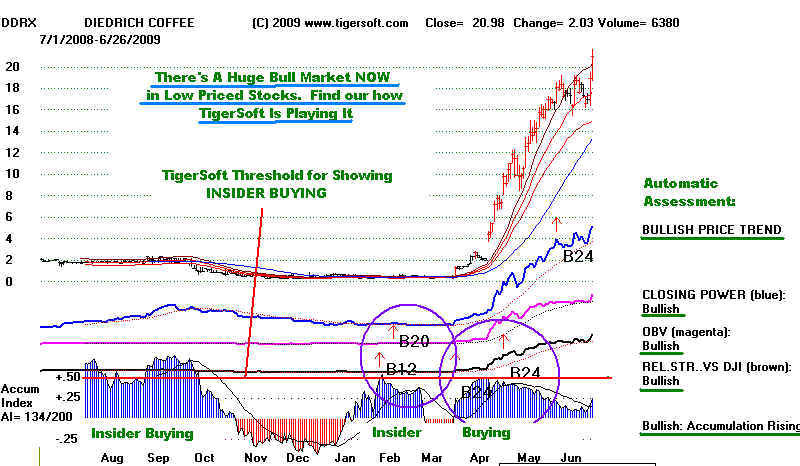

(3) Tiger Power

Ranker To Scan 7000 Stocks

with One Command To Find Most Bullish

and Most Bearish Stocks

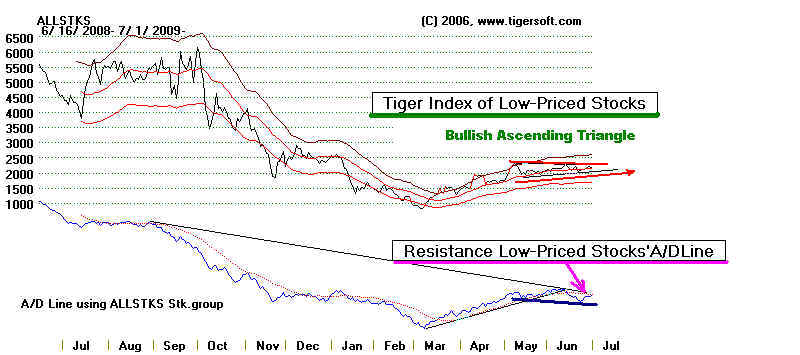

2009's Fabulous BULL

MARKET among Low Priced Stocks

TigerSoft's POWER STOCK RANKER

$395, after Purchase of

Peerless Stock Market Timing and

TigerSoft

(4) Nightly

On-Line Hotline for Market Timing

Nightly Hotline ($298/yr).

===> Order Here

$298

Total

Package -

Everything! Includes Peerless, TigerSoft and Tiger

Power-Ranker, 3 2Books,

Research, Data, Bullish and Bearish Special Situations....

plus Errkly Elite Stock Professional (ESP) Report and ALL Software Updates for a Year!

===> Order Here

....

$995.

====================================================================================

Examples:

(1) Peerless Stock Market Timing: 1915-2009

(2) TigerSoft's Trading Advantage

Tools

for Spotting Insider Buying and Selling

(3) Tiger Power Ranker To Scan

7000 Stocks

with One Command To Find Most Bullish

and Most Bearish Stocks

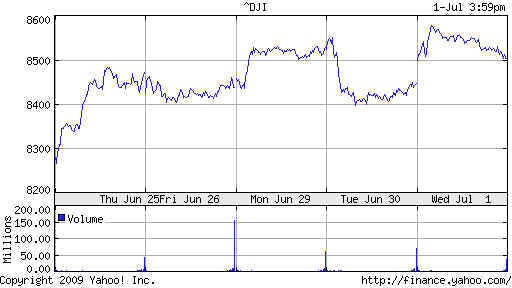

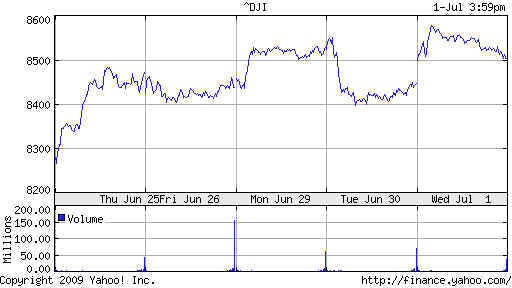

(4) Sample Nightly Hotline -

7/1/2009

7/1/2009

7/1/2009

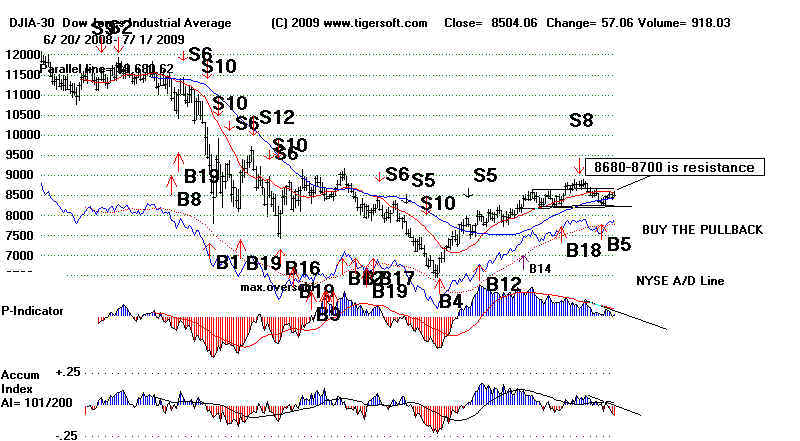

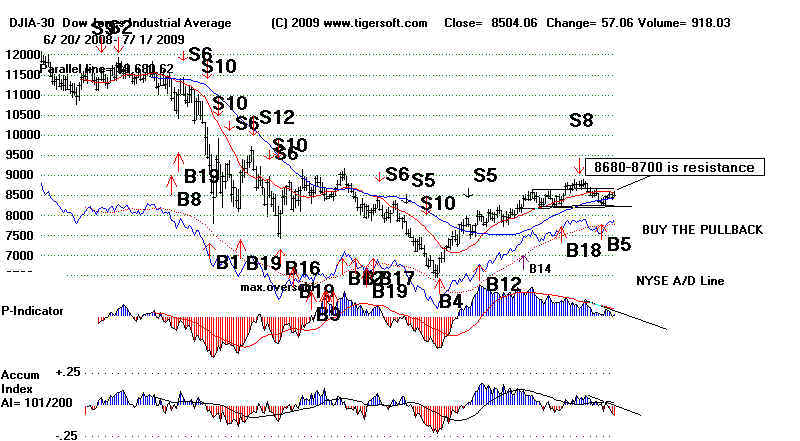

Peerless Buy B5 Operates ...

Resistance Levels Are Being Challenged.

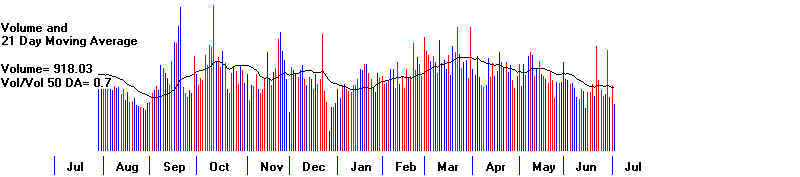

DJI 8504 +0.68%

SP-500 923.33 +4.01

NASDAQ 1846 +10.68 +0.68%

USO 37.46 -1.24% GLD

92.39 +1.33%

SLV 13.55

+1.27%

DJIA AND SUPER-IMPOSED PEERLESS

SIGNALS STOCKS

7/1/2009 la/ma= .992 21dma roc=-.328 P= 30 IP21=

-.08 V=-148 OP = -.243

DIA - ETF for DJIA

Chart

Note the bearish head and shoulders pattern

that is developing with DIA's Closing Power. The DIA's price pattern shows such

a pattern is emerging. The DIA's red Buy is based on its

upside penetration of 50-dma.

The DIA's Closing Power's downtrend has been penetrated for a trading Buy.

The Closing Power is bearishly below its falling mvg avg. Expect resistance at

86-87

as the DJI tests the right shoulder in a potential head and shoulders pattern. Support

is at 82. Wednesday'-Fridays are each up 50.9% to 52.9% for the last year.

It's

Mondays (22.4%) and Tuesdays (48.1%) that longs have to be worry about.

QQQQ Chart

The QQQQ is

rebounding from its rising 50-day ma. Its internal strength readings are

rated "bullish". 38 is a reasonable target based on the height of its

earlier trading

range, 26-32 and its breakout at 32 plus the height of the base pattern. The

exceeded

April

high at 35 did act as support. That is bullish. The QQQQ has been

outperforming

the

DJI for 5 months when one looks back 50 days and 7% over the last 50 trading days.

Mondays for the last year have brought a QQQQ gain only 33% of the time.

Wednesday, Thursday and Friday show a probability between 49% and 51%. It's

Accum. Index is still considered "bullish".

SPY Chart Note the emerging head and shoulders pattern. the neckline crosses

at 89.5. The Closing Power could not get past past its falling 21-day ma.

TheCP is also

forming what may become a head and shoulders top pattern.

The SPY is now

above its now rising 50-day ma and falling 200 day ma. Mondays

for the last year have brought an SPY gain only 33% of the time. Tuesdays and

Wednesdays rise 51.8% of the time. Thursday's are up 60% and Fridays 57%.

IWM - Chart

IWM has turned up from its rising 50-day ma. It now faces the resistance of its

price downtrendline. A breakout would be bullish. Its Closing Power

downtrend

has been violated giving traders a Buy. Wednesday's are

up 57% of the time, Thursday's

50% and Fridays 67%. Mondays - 32.6% and Tuesday's 51.8%.

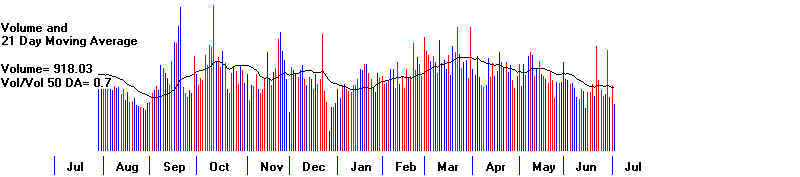

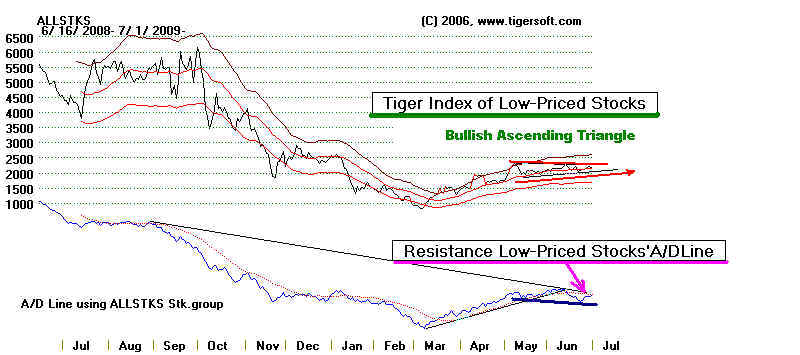

Tiger Index of Low Priced Stocks

7/1/2009 Buy B5 ... Resistance Levels Are Being Challenged

The period just before the July 4th weekend rallies more than 70% of the time.

A move above the H&S apexes of the SPY and DIA coupled with breaks in the 12 month

down-trendlines of the QQQQ and IWM under the normally bullish influence of

trading before July 4th may cause a short-term jump in prices. Look at how often

markets take off after prices exceed the resistance of the apex of right shoulders

in these patterns.

The resistance of the downtrending A/D Line for speculative low priced stocks

has also been reached. The operative Buy B5 and rising Closing Powers suggest

an upside breakout. Even if it does not occur, the head and shoulders pattern will

still

not be bearishly completed until the necklines' supports are taken out.

Many high accumulation low priced stocks seem indifferent to the techincal

significance of trading the next few days. Look at how strong are BORL, GPX, ATSI,

DRCO, TRCR, HWKN, AIXG, BKYF, CRAY, LAD and STEC.

Surely, it is bullish that the market can rally when the biggest state in the Union

cannot pay its bills and when so many low priced stocks can double and double again

in 4 months without Wall Steet heralding or hawking them to private investors.

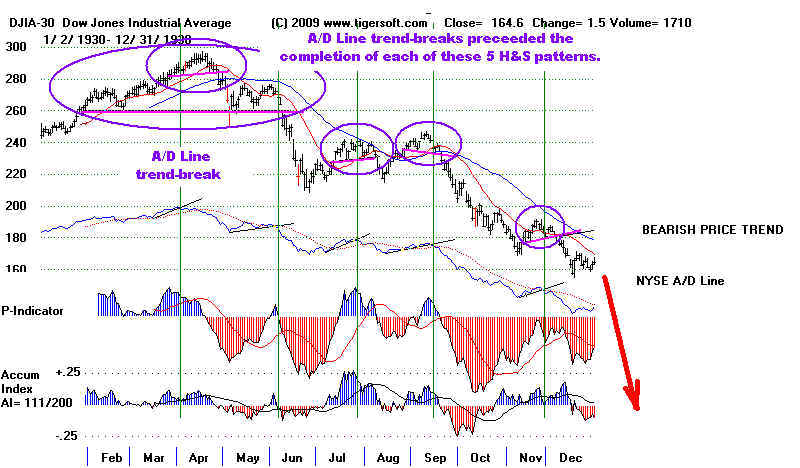

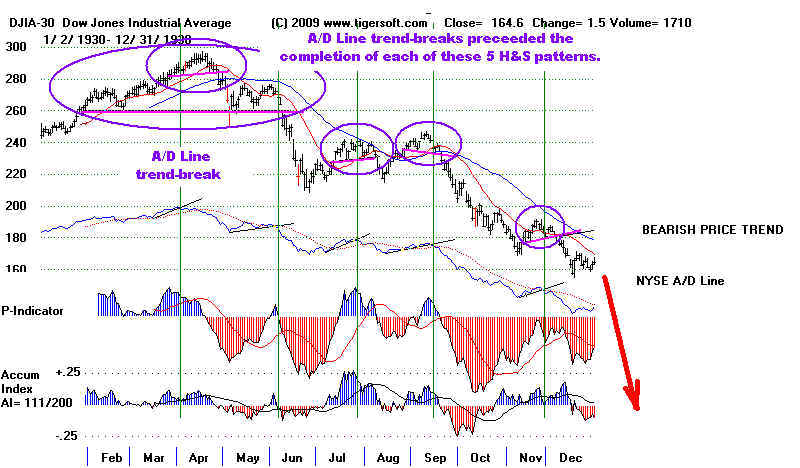

The NYSE A/D Line now is still uptrending. Typically, there

first is a break in the

NYSE A/D Line uptrend before a DJI head and shoulders pattern is completed.

That was true in each of the five head and shoulders patterns in the period 1930.

Five Head and Shoulder Patterns in the DJI in 1930

The A/D Line Uptrend in Each Was First Violated.

Next San Diego TigerSoft User Group Meeting July

11th

Next San Diego TigerSoft User Group Meeting July

11th