Daily Blog

- Tiger SoftwareShort-Term Trading Using TigerSoft

A DEMONSTRATION

2/5/2009

Recommended Stocks' prices updated for 2/10/2009

William Schmidt, - Tiger Software's Creator

(C) 2009 William Schmidt, Ph. D. - All Rights Reserved.

www.tigersoft.com

No reproductions of this blog or quoting from it

without explicit written consent by its author is permitted.

TIGER BLOG

Short-Term Trading

Using TigerSoft

A DEMONSTRATION

2/5/2009 Prices Updated 2/9/2009

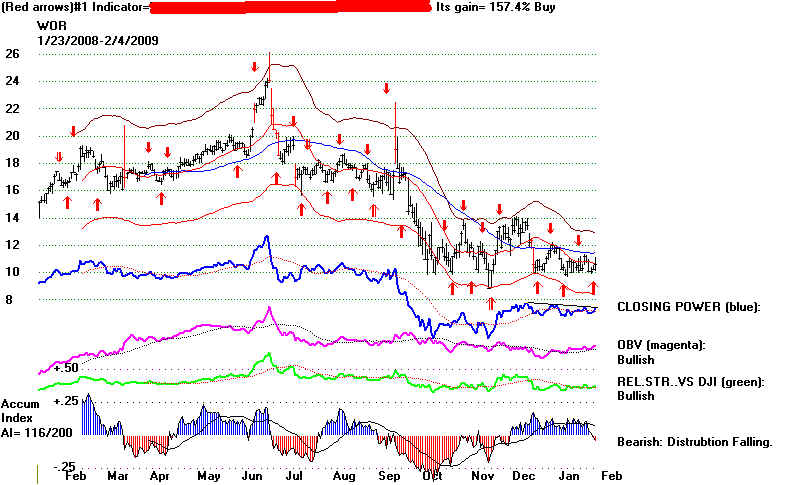

Sample Chart

Look at the chart of YRCW above. It is a a sample TigerSoft chart. The red Buys and Sells are

optimized, meaning the computer, before it even puts a chart on the screen, in a flash calculates what the

best trading system is for a stock and then displays its red Buys and Sells. The TigerSoft chart then displays

the gains achieved had one traded the signals, buying, selling and selling short; or if someone likes, what the

gains were only buying and selling. The indicators below the year's price history are automatically interpretated.

History Does Repeat over and over.

There is no guarantee that the future will work out like the past, of course, but stocks do have personalities,

because each stock attracts a certain type of person, trader or investor. And so the trading patterns are likely

to continue. In many cases, the best trading system continue to work for years, known only to professionals

controlling the stock and to.TigerSoft users. How can anyone seriously understanding how to trade any

given stock, not want to know what TigerSoft can teach.

Professionals Make Certain Trading Systems Work Repeatedly

We have discovered that professional traders, such as those that make markets in options

on a stock,

commonly use one particular indicator to

control and trade those stocks that are particularly amenable to

their control. The best trading system for YRCW

or any stock is shown at the top of the ordinary chart.

along with the percent gain obtained for the

last year when trading it with a starting capital of $10,000.

Use TigerSoft's Power Ranker To Find The Best Trading System

TigerSoft users can readily find stocks that are controlled in this fashion by noting what

is the basis of the

best trading system for these stocks.

To make this search easy, TIgerSoft's Power-Ranker lists all stocks'

best trading systems and gains. We

especially like one particular system used for very short-term trading,

but you could easily pick another system

and quickly see the stocks traded best with it. This allows you

to find the stocks that are best traded

over various time periods, from very short-term to three or more months.

The Preferred Trading System of Professionals

When we do

a frequency distribution of what is the best trading system for all stocks, we commonly

find

that one particular system occurs 3 or 4

times more often than would be expected by chance. This we call the

the traders' most preferred system. That is the

basis of the superb trading with YRCW. To make

it easy for traders starting out with

TigerSoft to use our tools most effectively, I have built a group of about

150 stocks that trade exceptionally well

with this particular system. Their yearly gains are over well over

+100% for the year using the Red buy and

Sell arrows. Users can quickly download the data for these

stocks and scan them for new Buys and

Sells. Look at the high performance achieved in trading the stocks

for buys below:

Performance of TigerSoft's Best Trading System

-Buy on Red Buys and Selling Short on Red Sells.

-Close out position on Opposite Signal.

-Reinvest Gains, Start with $10,000, $40 trade/slippage.

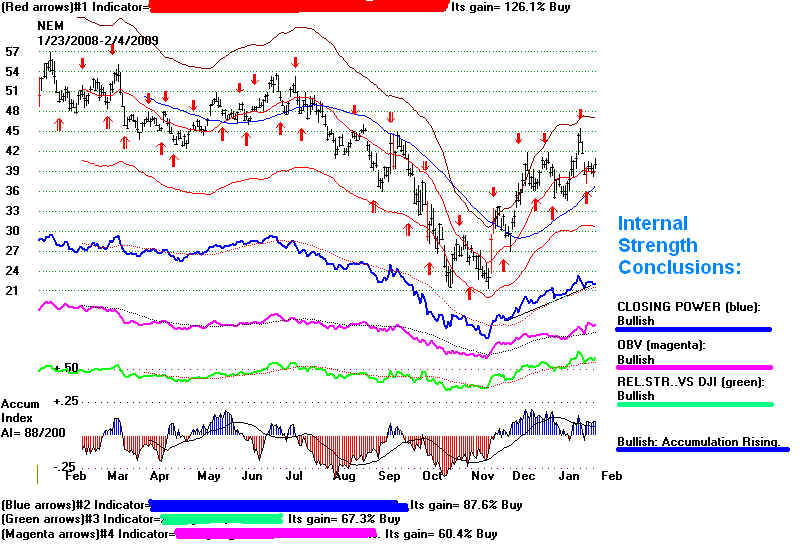

NEM Newmont Gold

+126.1%

DGIT DG FastChannel

+328.1%

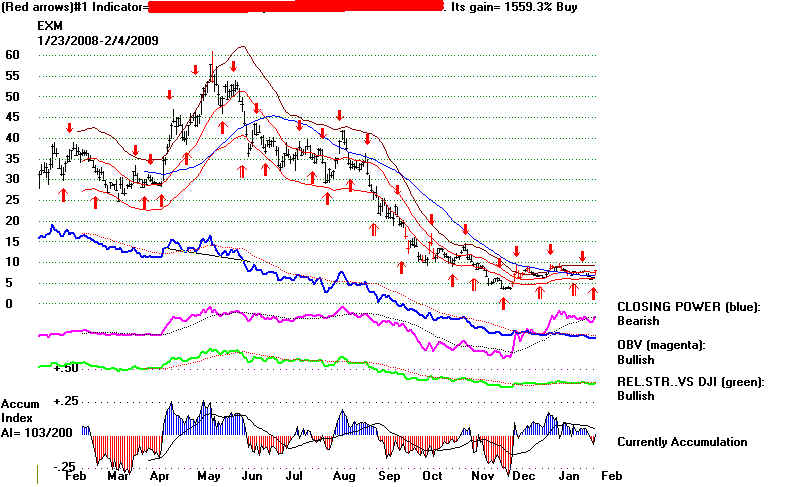

EXM Excel Maritime Carriers

+1559.3%

GT GoodYear Tire

+100.1%

PAA Plains All American Pipeline +143.8%

PHM Pulte Homes

+327.7%

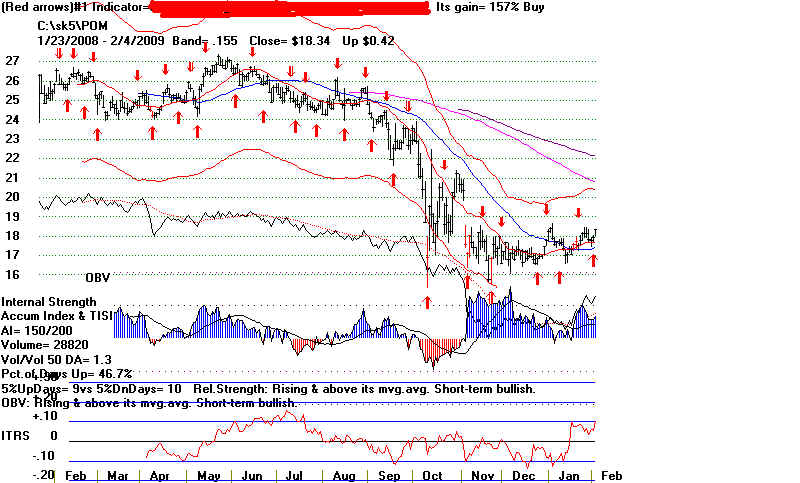

POM Perco Holding

+157.0%

WOR Worthington Ind

+157.4%

Short-Term Trading Buys Now

Morning,

February 5th, 2009: The market turned up strongly after a week opening. Out

Hotline has

said to wait for this to do some

buying. What stocks might have been bought today? I list below

some attractive Buys among the

"preferred trading stocks.: In picking these stocks, we would want

also to assess support and

resistance levels and chart patterns. But this takes some experience.

It is better for new users simply

to see:

1) how many of the key internal strength readings are rated "Bullish".

Four is best.

2) if the TigerSoft chart shows the 2nd, 3rd and 4th best trading systems are also on

Buys.

The NEM (Newmont Gold) illustrates

a new red Buy with both other factors also rated bullish.

Summary of Buys from 2/4/2009:

Red = Red Sell on stock

Red

= short-term Sell from SP-500 and QQQQ

2/4

2/5

2/6

2/9

NEM Newmont Gold

39.99

40.91 41.53

40.36

DGIT DG FastChannel

13.92 14.57

15.00 14.90

EXM Excel Maritime Carriers 7.98

7.60 8.09

8.74

GT GoodYear Tire

6.40 6.93

7.17

7.24

PAA Plains All American Pipeline 36.28

37.50

38.10

38.25

PHM Pulte Homes

10.83 11.28

12.34

11.36

POM Perco Holding

18.34 18.31

18.58

18.59

WOR Worthington Ind

10.56 10.62

11.32

11.17