Short Squueze in DNDN Sends Stock Up 500% in Two Weeks!.

and

Does FDA Really Care about Terminal

Prostate Cancer Patients?

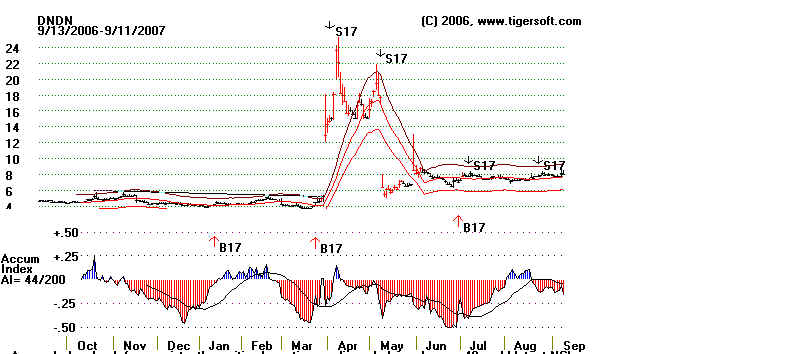

Dendreon (DNDN) 2006-2007

There's an important lesson here. Don't short a stock

that has too high a short interest.

And if unexpected good news should

befall the company, buy the stock aggressively. The

stock will go up, as the shorts

rush to cover.

Take the case of Dendreon (DNDN). In late March, just before its

breathtaking

ascent from $5 to a high of $25 in

7 trading days, its anti-cancer drug, a vacine named

Provenge, was considered by

an FDA advisory panel. Such panels routinely provide guidance

that the FDA usually accepts or

considers very closely in deciding whether or not to give a

drug final approval.

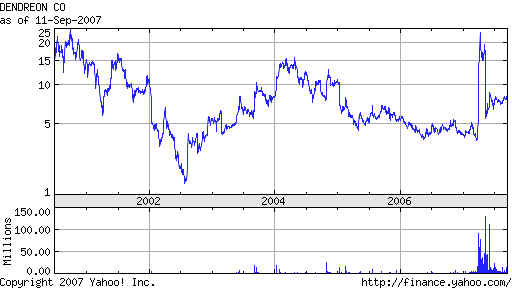

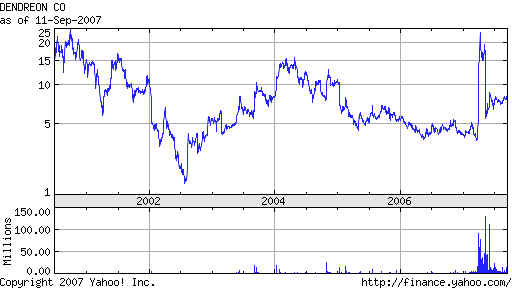

As you can see in the 7 year chart at the bottom of this page, DNDN had been steadily

falling since early 2004, when it

was 15. Reports had come out that its Provenge, which is used

to treat prostate cancer that does

not respond to hormone therapy, was not reaching its primary

"end-points" in the

trials for slowing the progress of the disease. As a result, it was widely

believed that the Advisory Panel would

recommend against the drug on grounds of unproven

efficacy as well as safety. And the

stock was heavily shorted. In March, 26.4 million shares

had been sold short. This was 11

times the average trading volume and an amzing 34.7% of all the

shares outstanding. Clearly many of

the shares sold short were "naked" short sales, where the

stock was never even borrowed when it was

sold. (The Securities and Exchange Commission

usually does little more than shake its

finger at the accused brokerages when such cases are

pointed out to them!)

The monthly short interest figures published by the NASDAQ.

Settlement

Date |

Short

Interest |

Avg Daily

Share Volume |

Days

to Cover |

| Aug. 15, 2007 |

36,029,103 |

4,134,767 |

8.71 |

| Jul. 13, 2007 |

42,339,655 |

8,288,430 |

5.11 |

| Jun. 15, 2007 |

40,847,280 |

20,081,558 |

2.03 |

| May 15, 2007 |

41,662,926 |

32,227,947 |

1.29 |

| Apr. 13, 2007 |

33,901,959 |

29,283,869 |

1.16 |

| Mar. 15, 2007 |

26,419,737 |

2,389,099 |

11.06 |

| Feb. 15, 2007 |

20,306,278 |

1,537,648 |

13.21 |

| Jan. 12, 2007 |

16,799,777 |

1,392,811 |

12.06 |

| Dec. 15, 2006 |

13,055,168 |

1,605,236 |

8.13 |

| Nov. 15, 2006 |

12,425,374 |

1,323,045 |

9.39 |

| Oct. 13, 2006 |

12,323,167 |

513,946 |

23.98 |

| Sep. 15, 2006 |

12,565,560 |

602,930 |

20.84 |

The Bullish Surprise.

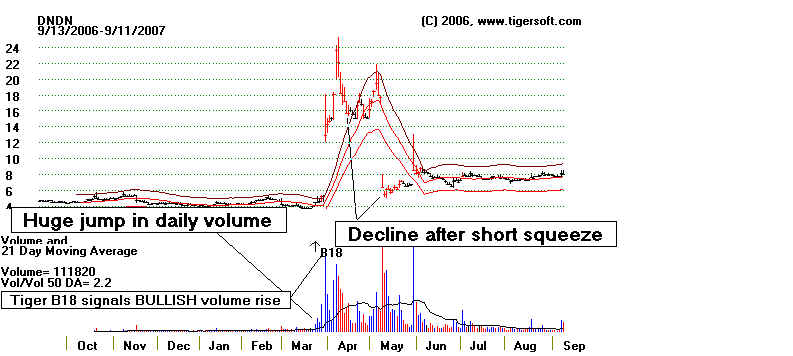

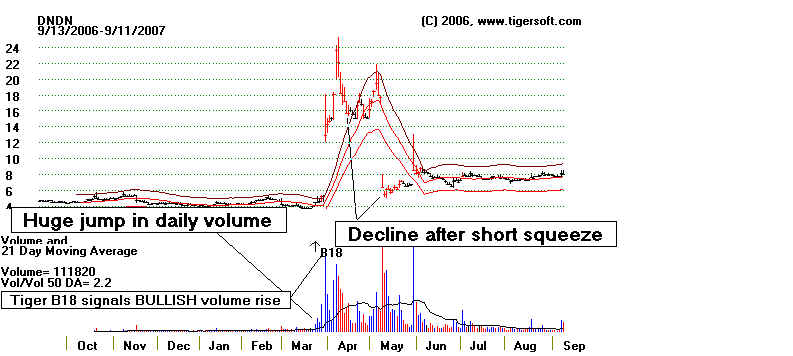

To the surprise of all the shorts, though the drug did not

meet the goals set out

in the original study, the average survival time of patients on Provenge was increased by

3 to 5 months. Moreover, the mode of treatment was far less destructive of a

patient's final

days than the alternative, radiation therapy. /The FDA Advisory Panel voted

unanimously

that the drug was safe, as it was grown from the patient's own cells, and voted by 13-4

that

it was "effective". Word got out the day before the announcement.

On March 28th, trading

volume more than tripled from the day before and the stock rose from 4,612 to 5.22.

On the day

of the panel's meeting, the NASDAQ halted trading.. On the next day, March 30th, the

stock

tripled and opened at 17.92. It closed at 12.93. The volume that day was

925,478 shares,

a

9-fold increase from what it had been the day before the announcement. It rose each

of the

next

5 days and hit 25.25 on the sixth. It came very close to its all-time high.

The rise was

all

short squeeze.

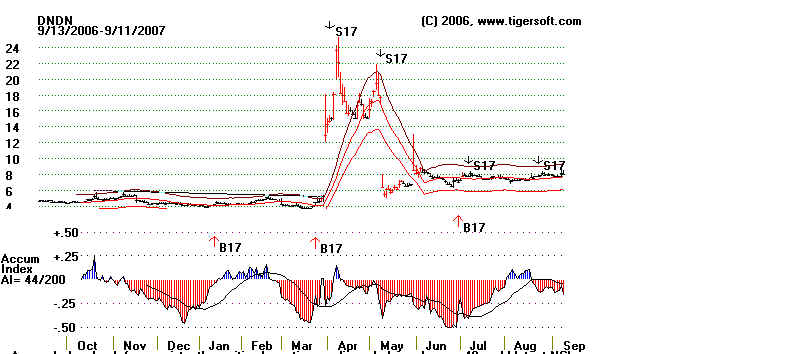

What's The Lesson Here.

Buy aggressively stocks that have unexpectely very good news

when the short

positions are so high. Watch the news in very high volume stocks, if you are a day

trader or even a short-term trader. And when you look at a Tiger chart, know

that

insiders can be wrong. The Tiger Accumulation chart shows steady red distribution,

reflecting heavy shorting. Seldom are the insider this wrong, but they can be very

wrong, in the short- term. Below is the Tiger Accumulation chart. In

fairness to it,

users know that sudden spikes of Accumulation are important. Tiger charts represent

these as Buy B17 and Sell S17 signals. Use these when the closing price is within

the bands. With this understood, these signals excel.

Back to Earth: Does The FDA Care?

DNDN's stock quickly fell back once the short squeeze was

over. And, as

if to prove the insiders were right all along to short the stock, on May 8th the FDA

disregarded its Panel's advise and raised new questions about the new vacine's

efficacy that will probably not be answered until 2010! So, ultimately, the cynical

insider-short sellers will probably be proven right. They understood how

bureaucratic

the FDA is. They understood how much more concerned the FDA is in protecting

itself from criticism it is than in alleviating pain and suffering among a class of

patients

that is presently quite doomed!

g

|

Dendreon Corp.

3005 First Avenue

Seattle, WA 98121

United States - Map

Phone: 206-256-4545

Fax: 206-256-0571

Web Site: http://www.dendreon.com

DNDN engages in the discovery, development, and commercialization of therapeutics that

harness the immune system

to fight cancer. Its product portfolio includes active cellular immunotherapy, monoclonal

antibody, and small molecule

product candidates to treat various cancers. The company's product candidates include

Provenge (sipuleucel-T),

an active cellular immunotherapy that is in FDA priority review status for the treatment

of asymptomatic, metastatic,

androgen-independent prostate cancer. See also http://finance.yahoo.com/q/pr?s=DNDN |

Did The FDA Make A Mistake?

Q&A: Dendreon’s Vaccine for Prostate Cancer

Patients

An FDA advisory committee yesterday voted 13-4 in favor of Provenge, an experimental

treatment for advanced

prostate cancer. The vote was hotly anticipated by cancer patients and investors in

Dendreon, the Seattle-based

biotech company whose future is pegged to Provenge. Shares in the company rose more than

100% today. Provenge

commands special attention because it’s a vaccine, derived from a patient’s own

cells, that mobilizes the immune system

to attack cancer.

But what would Provenge mean for men with prostate cancer? To find out, we called Simon Hall,

director of the

Deane Prostate Health and Research center at the Mount Sinai School of Medicine in New

York, and an investigator

on a trial of Provenge. (Hall told the Health Blog he has no financial ties to Dendreon.)

Here are the highlights of our

conversation.

Q: If the FDA approves Provenge, how would it fit in with current treatment?

A: The vast majority of patients are diagnosed with localized disease, which is treated

with surgery or radiation.

About a third of those patients will have a recurrence — if they live long enough,

they’ll have metastatic disease and

have hormone treatment. For the vast majority of those patients, that will buy them

several years where their disease

is under control. But then the cells will adapt and start to grow anyway. I would estimate

between 29,000 and 40,000

men are in this boat. The only treatment that has ever been shown to have any advantage

for these patients was taxotere

[a chemotherapy drug from Sanofi-Aventis], shown to extend life by 3 months. But the

bottom line is patients don’t

want chemotherapy. The reality will be that when the patients get to this point,

they’re probably going to do the vaccine.

I think there will be a huge demand. I’ve had a lot of my own patients calling me and

saying, “Can I get the vaccine?”

Q: Any idea how much Provenge will cost? Will the price influence who gets it?

A: It’s going to be a very expensive, boutique-type agent. Different from drugs or

even vaccines that are in the pipeline,

this one is custom made for each individual patient with their own cells. A lot of times

we use drugs off label; I don’t

think it will happen in this case because of the expense. The rumor is it will cost

$20,000 per infusion. And the way

the trials have been done, it’s been three infusions per patient.

Q: The clinical studies failed to meet their goals, but suggested the vaccine

prolongs survival for four months.

Is that significant?

A: You set up a study and you say my primary endpoint is time to progression, and my

secondary endpoint is delaying

time to pain. They failed on that. They were disappointed, and I’m sure they had

statisticians come in and say, “How

can we carve up the data and get something out of the study? And they were like,

“Holy cow, at 36 months, only 10%

of those on placebo were still alive, but you’ve got a third of those on Provenge

still alive.”

Q: Do you think the FDA will follow the committee’s advice?

It’s hard to guess. Would they approve a drug based on one very small study that was

sort of done backwards?

A committee looks at it and votes 13-4 to approve. I don’t know what they will do.

Will they approve?

Or will they say, “Listen, you’ve got this other big study that’s going on

and maybe we should wait a year and see

what that says.”

Q: What’s the bottom line for Provenge?

We need it. There’s little toxicity. If the larger study validates the first study,

or clinical experience validates it, it will be

a step forward for men with prostate cancer, and for this whole idea of using the immune

system to fight cancer.

(Source: http://blogs.wsj.com/health/2007/03/30/qa-dendreons-vaccine-for-prostate-cancer-patients/

)

|

.

|