|

Daily Blog - Tiger Software

Send any comments or questions |

|

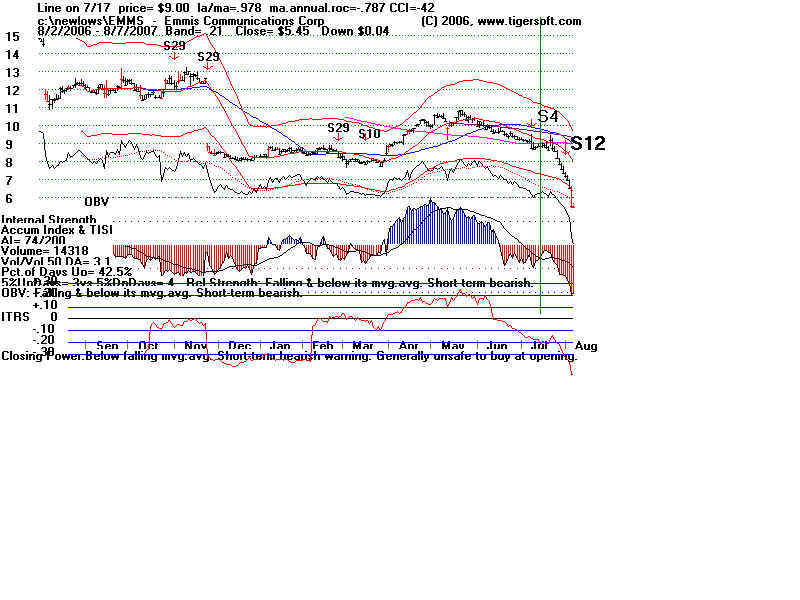

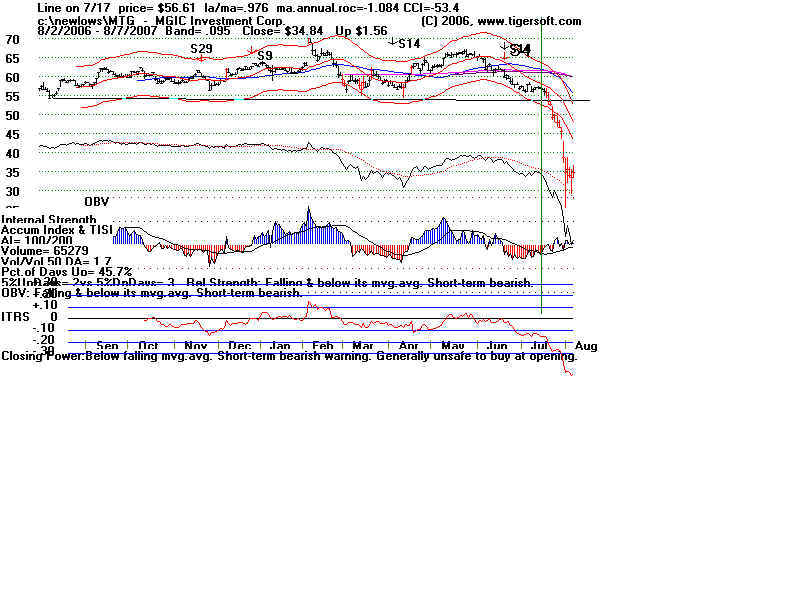

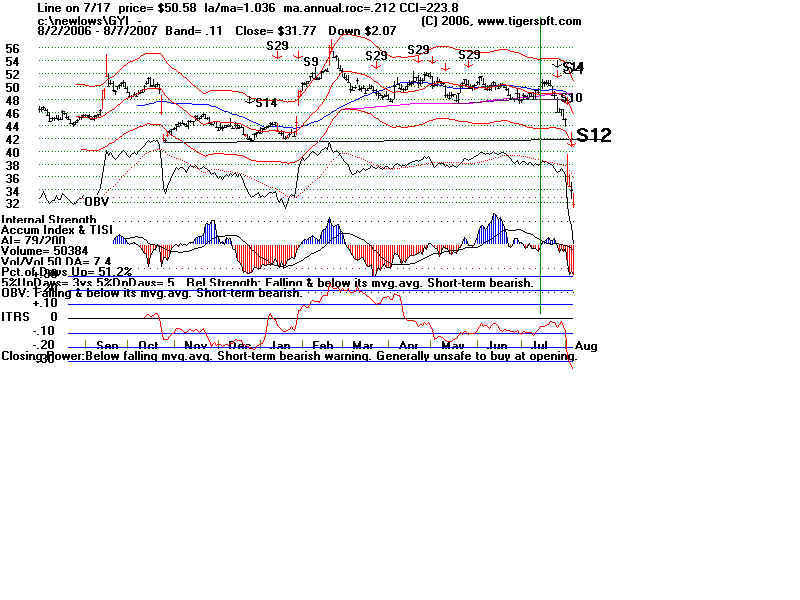

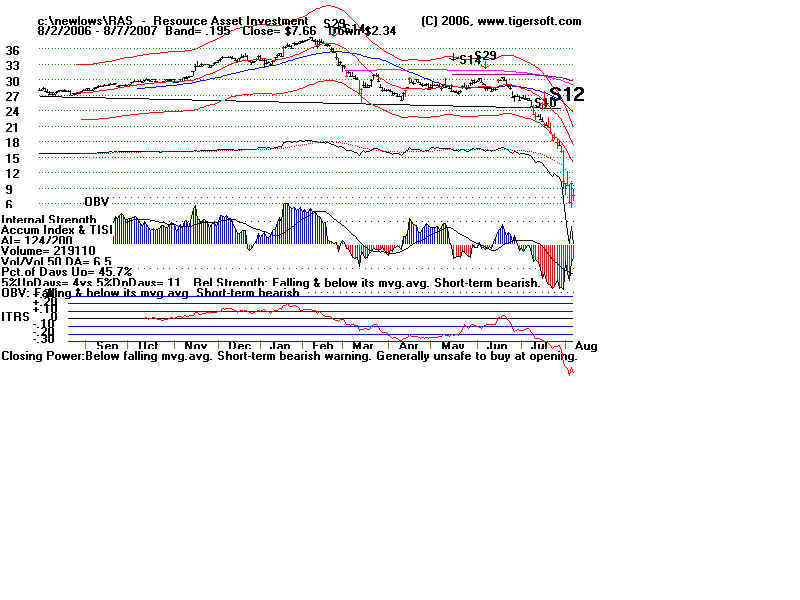

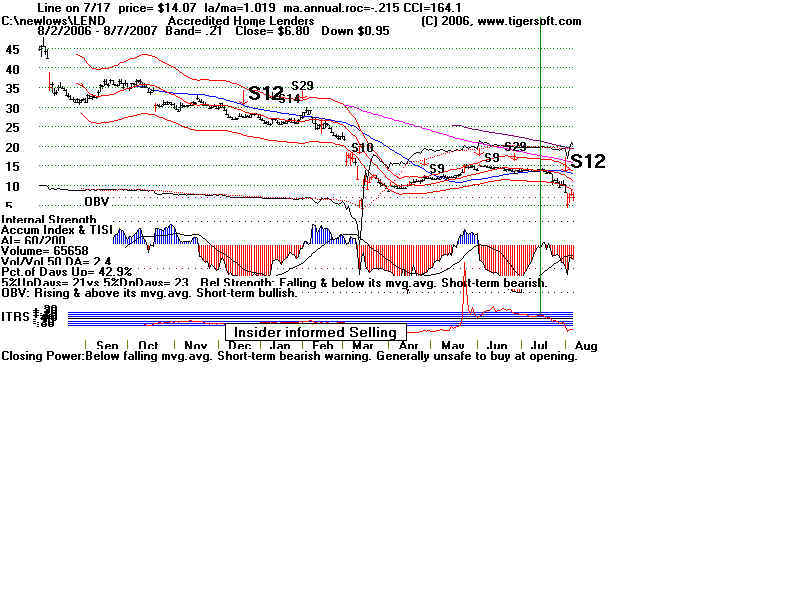

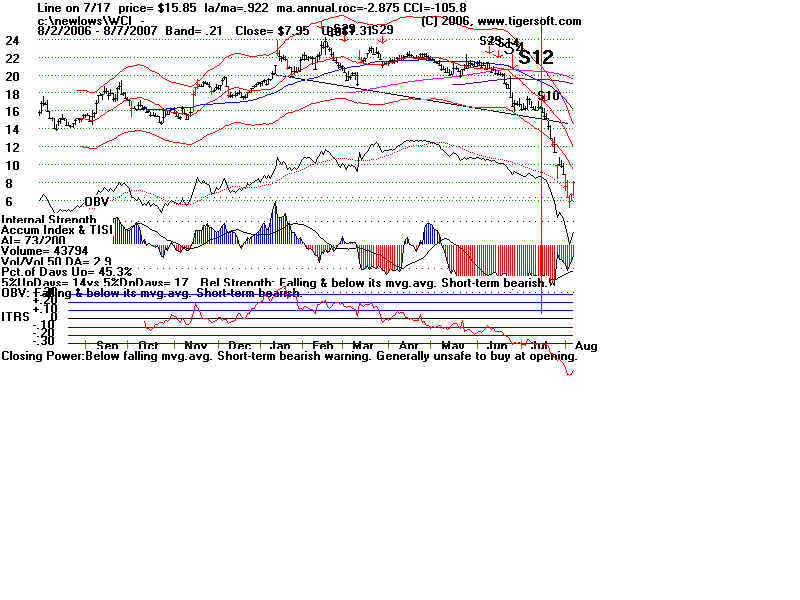

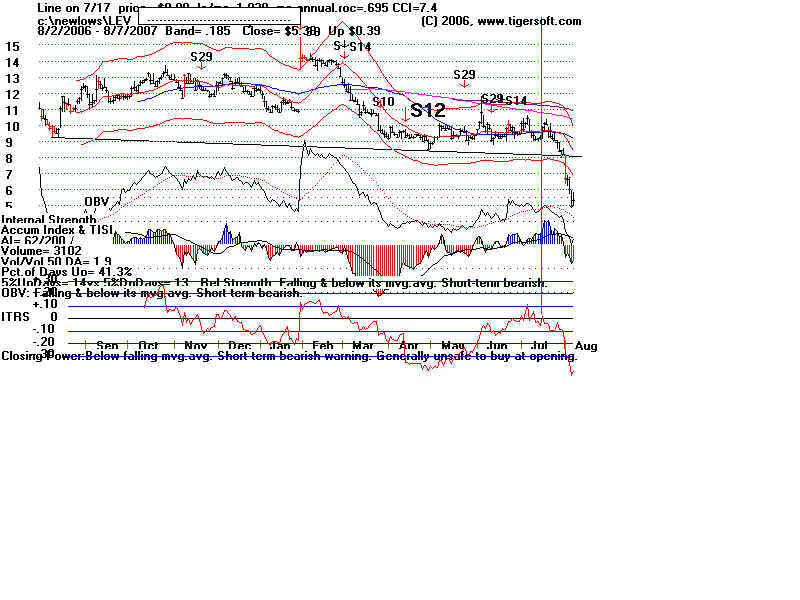

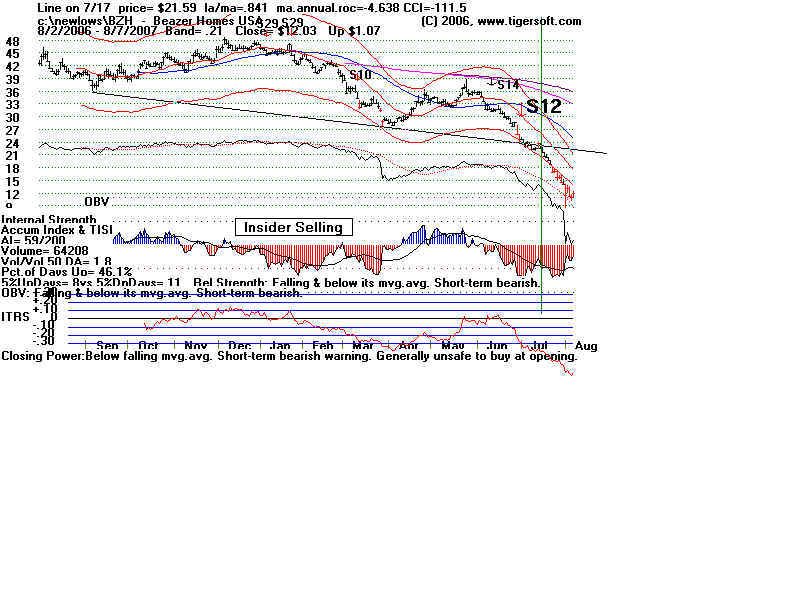

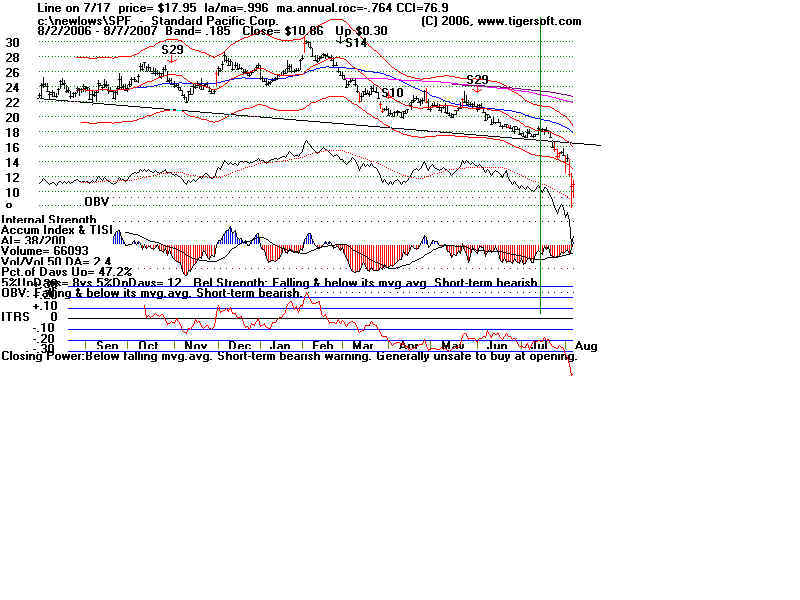

8/7/2007 HOW TO PICK GOOD SHORT SALES. Weak Stocks - Note How Many Show Significant Insider Informed Selling, shown when the stock does not rally with the general market under the weight of selling, shows very negative (red) Accumulation and then falls sharply when the supporters cease to hold the stock up. Stocks are often held up artificially to let big sellers get out at a price advantage. Downside gaps on high volume. All these patterns are flagged by our automatic signals: especially S10, S12, S14 and S29s Please consider getting Tiger Soft and Power-Ranker to Find these stocks each night or subscribe to the Full Hotline including Stock Recommendations for Tiger Software. Study these to see what predicts biggest decliners. Here are the 14stocks that have declined the most, 37% ore more, in this 3 week period. Only stocks still over $5.00 are shown.. The vertical line shows 7/17. Our Short Selling book discusses the best approach for finding great short sales and, just as important, when they should be covered. We used the Peerless signal to sell out and short stocks like this. As soon as we got the Sell S9, we looked for stocks that the Power-Ranker listed as having new Sells themselves, showed heavy distribution and aggressive dumping and were breaking down below major support. Get our software, books and and our hotline, and you can see how profitable declines we have just seen can be. Biggest Decliners Still over $5.00 RAS Resource Asset Mgt. -67.6% LEND Accredited Home Lenders -50.0% WCI -49.0% OPTM -48.0% LEV -48.0% BZH -42.0% SPF -41.0% IMP -39.0% EMMS Emmise Communication -39.0% MTG MGIC Investment Corp. -38.0% GYI -37.0% AHR Anthracite Capital Inc. -37.0%

,,,, ,,, ,,, ,,, ,,, ,,,

,,,

|

| . . . .

|

,

,