|

Blame The SEC for Making This Decline So Brutal

If You're A Realtor, Blame SEC Chairman Cox for Destroying Your Business.

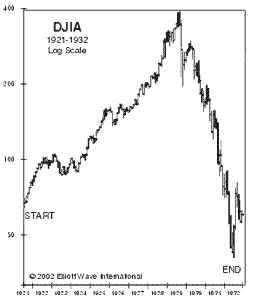

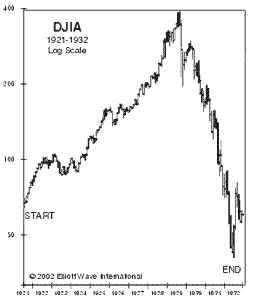

A brutal stock market decline has started. And the US

Securities

and Exchange Commission has

just made matters much worse.

Professional Bear Raids Are Only Starting

By abolishing the up-tick rule

and not enforcing "naked"

short-selling,

the Securities &

Exchange Commission has now made it much easier for

professional

"Bear Raids". These were so hurtful to stocks between 1929

and 1932, that they

were banned by law. Last month the SEC bowed to

pressures from reckless

Wall Street insiders who plan to terrorize individual

investors with steep

drops in prices, artificially produced by massive naked

short-selling on

down-ticks.

The 1929-1933 Stock Market collapse destroyed the lives and businesses

of millions of people around

the world. It set in motion the tensions that

created World War II and the

death of 20 million souls! The US Congress

recognized how dangerous and

instrumental trading abuses were in the

financial carnage of the

1930's and they created new laws and set up the

US Securities and Exchange

Commission to protect investors in 1934.

For 70 years, short sales were by law to be only

executed when stock was

available for borrowing and the

short sales were done on up-ticks or zero-plus

ticks. Selling short at the

market, hitting the bid, was prohibited in the case

of individual stocks.

This was to stop the predatory practice of "bear raids".

Many write

that the extent of the 1929-1932 collapse cannot be explained

by blaming speculators like

Jesse Livermore, Bernard Baruch and Jospeh

Kennedy or organized cabals

of shorts dumping shares they did not own

on the market in a concerted

way and then concocting bearish rumors and

bleak sounding news to give

to the press to scare the public.... Maybe so,

but these unregulated

speculaors surely made a very bad situation much worse.

"Torpedoing The Tape"

Jim Cramer of CNBC

described how loosely knit groups of short

sellers would try to crash the market down when he ran a hedge fund in the 1990's.

"On days like today when I was short, I would come in with a lot of firepower and

try to blast things down at 2:45. I wasn't alone. We were never organized, but we

did get the call from the trading desks that other guys were torpedoing the tape...

And don't forget, it's fun for these guys to try to break the market. And there's a

level of sport in the bigs that can't be denied."

Is this illegal manipulation? Not according to the SEC or CNBC. "Who

cares who gets hurt?" Compassionless greed runs wild! Such

activities

require bears to be able to sell short without even having to obtain stock

to borrow. No problem. The SEC hardly ever does anything about "naked

short selling".

Even Cramer is now warning that the SEC has gone too far:

The

"new stupid

downtick rule makes it really easy to raid. How is

it that NO ONE remembers why the SEC set it up to begin with? ...

You can roll this market on nothing now. No specialists; unlimited downticks,

faster futures than common, ETF shorts, and no takeovers, so you can

run roughshod."

For more information take a look at www.investigatethesec.com. Cramer's

quote comes from this source.

The SEC claims that their rule change

will not have a deleterious impact on

stock prices. They claim they have previously tested this in 2005 and 2006 with

a pilot group of stocks. But this testing proves NOTHING. Traders may have

been

on "good behavior" in it becuase they knew the SEC was watching. And it

was

not undertaken in a weak market environment.

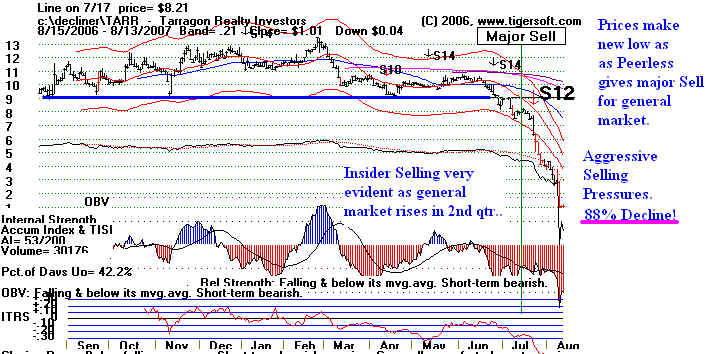

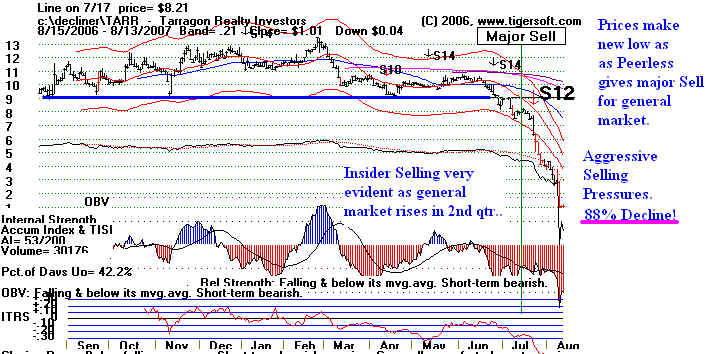

The SEC has brought back much greater down-side volatility since their

abandonment of the 70 year rule against selling short on down-ticks. Now it

does not take big volume to drive stocks down. People who think that light

volume on this decline are making a big mistake!

For more information on Chairman Cox's background,

see my earlier blog.

===========================================================================================

Don't let this happen to you. Don't be a

"deer in the headlights".

--

|