|

Daily Blog - Tiger Software Send any comments or questions |

|

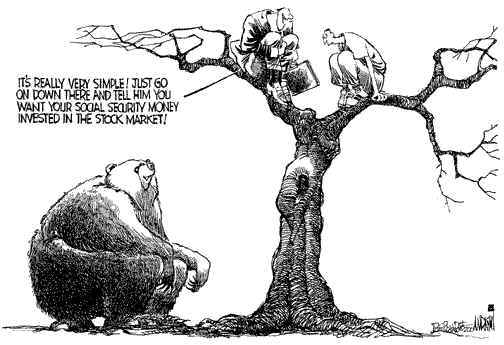

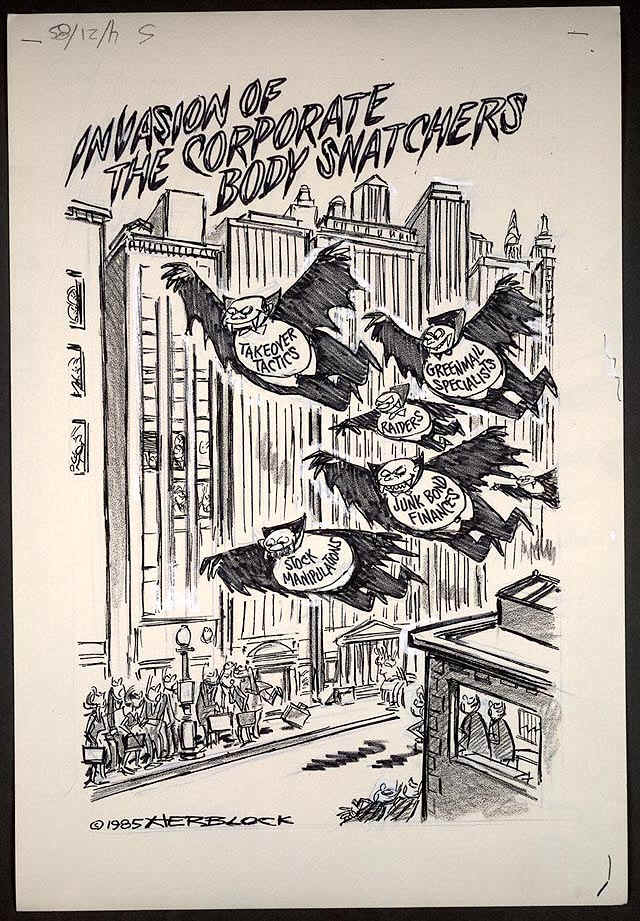

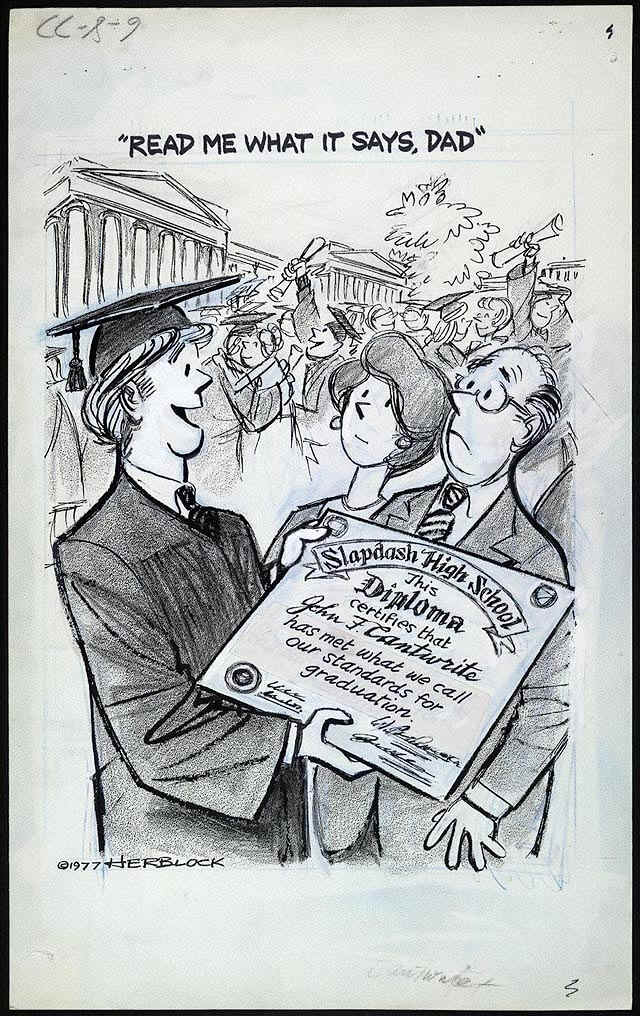

Just Barely... or The Bear Came over the Mountain: Cartoons Bears Will Like, I think. Bear with me. Just the bear facts. Bear and I, go down to the water... Let's go drink have some bears at the bear. Where I come from, a lot of words sound like bear.

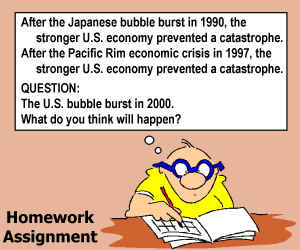

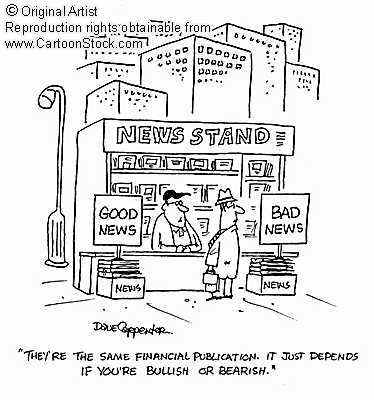

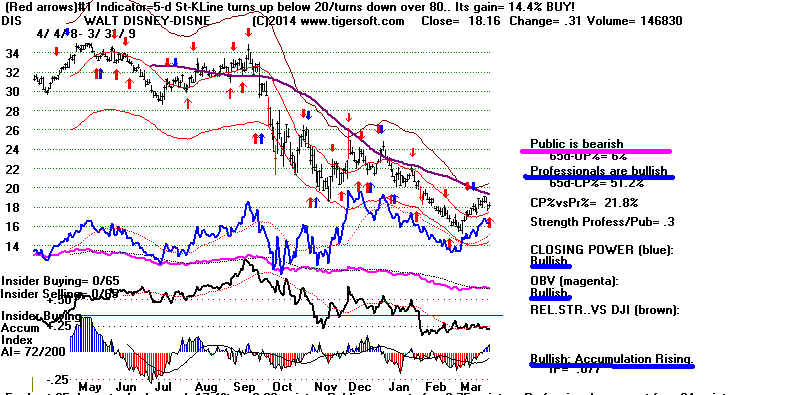

http://wallstreetfollies.com/  http://www.cartoonstock.com/directory/b/bearish.asp  =================================================================================== Look for more "splatter movies" . That's what bear markets spawn. Clearly, this is bad news for Disney. "The Walt Disney Company released its first feature-length cartoon in 1937, the year of the top of a roaring five-year bull market that accomplished the fastest 370% gain in U.S. stocks ever. As shown here by the titles listed on the top side of the graph, these films stayed popular for thirty years, culminating with the ultra-sunny Mary Poppins in 1964. ... For the next sixteen years, as stock prices fell along with social mood, most people thought Disney’s feature cartoons were silly and sentimental. Indeed, the studio’s productivity fell by more than 50%.... When the bull market returned in the 1980s and 1990s, so did feature-length Disney cartoons that have been both acknowledged classics and box-office blockbusters. In the last eleven years of bull market, Disney has produced ten feature cartoon films." By contrast, horror movies appear and are great hits in a bear market. Frankenstein and Dracula premiered in 1931. Dr. Jekyll and Mr. Hyde was released in 1932. A bottom might have been foretold when The Texas Chainsaw Massacre descended upon theaters in 1974. Stephen King made headlines in 1974 with Carrie The Shining appeared in 1977, followed quickly by Friday the 13th and Halloween. So says Pete Kendall - http://www.sociotimes.com/archives/2006/08/the_supreme_cri.aspx  What happened next? DIsney itself was a horror show over the next 18 months. It declined 50% by March 2009. But Professionals were turning Bullish while the Public remained Bearish. Look at rising Blue Closing Power in the chart below and the automatic technical comments on the right. The Pros were proven correct: a year later DIS was back to 34! The profits from Tiger's Closing Power's ability to spot the new trends for DIS would have taken a trader to the movies for a long time! DIS declines from 33 to 16 between April 2008 and March 2009.  Led by the Blue Professional Buying. DIS doubled between March 2009 and March 2010.  - |

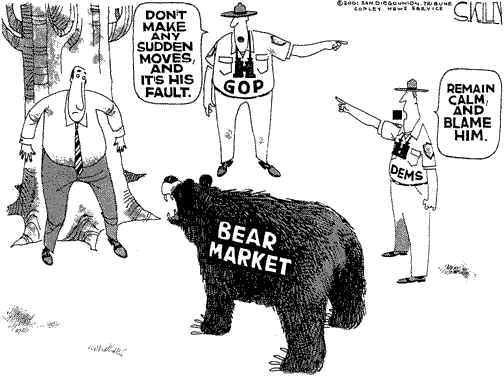

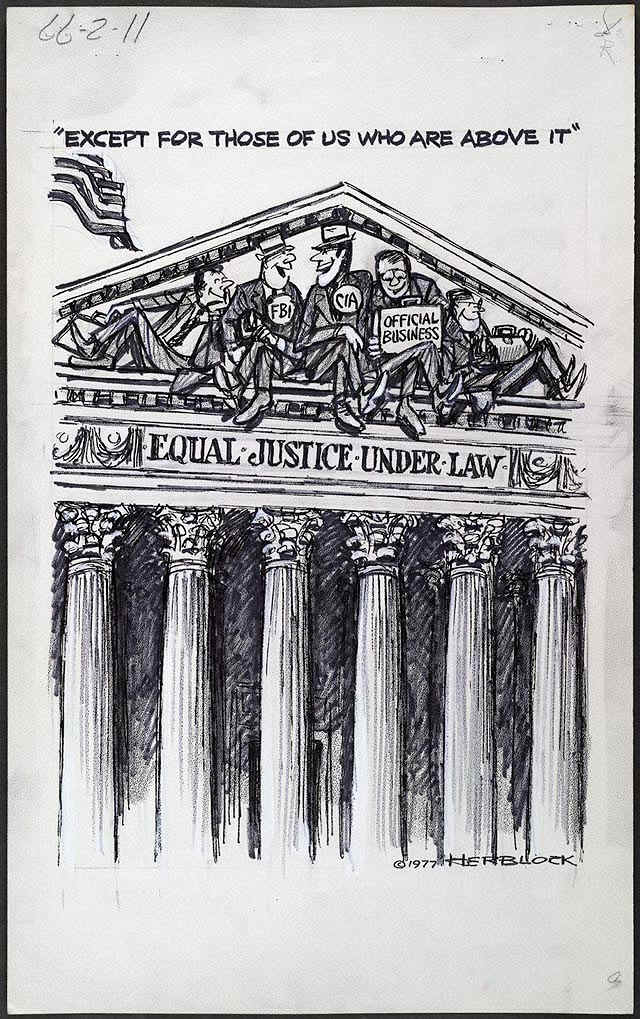

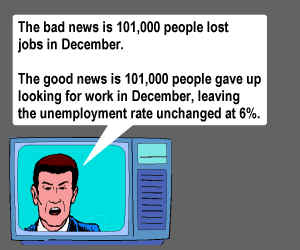

| More Cartoons

Steve Kelley, San Diego, CA, The San Diego Union Tribune . .

|