|

Daily Blog - Tiger Software Back to Home Page - www.tigersoft.com WATCHING APPLE'S STOCK WILL HELP YOU

CATCH |

|

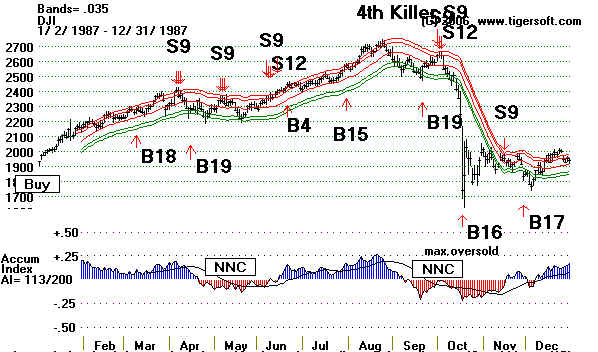

It's hard to make a case that watching the news will help you trade stocks better. Consider the best day and the worst day in stock market history. Using technical analysis, especially Tiger's Accumulation Index and the major Buys and Sells of Peerless will probably help a lot more. Biggest Up-Day in Stock Market History It is interesting how bullish it is when the market goes up on bleak news. Here is what the DJI looked like at the market's bottom in July 1932 and re-test of those lows. The DJI had fallen from 380 to 42, between 1929 and 1932. The largest single day gain ever was +15.34% on March 15th. 1933. See how the high volume breakaway gap would have told the attentive technician the trend had changed. (No advance and decline data exists for this period, so we can not show normal Peerless automatic Buys and Sells as they now exist.)  What was the background? Would reading the newspaper have told you to buy? Congress had in February repealed Prohibition. "Demon Rum" was loose. Franklin Roosevelt was inaugurated on Match 4th and promptly proclaimed a 10-day Bank holiday saying "We have nothing to fear but fear itself." On March 7th, the game of "Monopoly" was invented. The Civilian Conservation Corp began operations with tree conservation at this time.. Meanwhile, Hitler was establishing a Nazi dictatorship. On January 29th, Hitler become Chancellor of Germany and promised a "parliamentary democracy" and then dissolved the German Parliament. Goring then banned Communist meetings and demonstrations. A few days later, he banned the most important social-democratic newspaper. The aging German President Von Hindenburg limited freedom of the press. Catholic newspapers in Prussia were prohibited. The SA/SS-"Police" were formed and quickly killed 50 protestors. The Nazis burn the Rechstag and blame the Communists. On March 15th, Hitler and Goring had a German Cabinet meeting in which they discussed how to complete the process of establishing a Nazi dictatorship by getting the Parliament to pass an Enabling Act which would give Hitler the power to destroy State government independence as well as make all laws and treaties and control the budget without bothering with legislative hearings or votes. On March 23rd, the German Parliament grants Hitler dictatorial powers. In April, the first anti-Jewish "laws" go into effect. and the Nazis stage public book burnings. . The largest one-day percentage drop since 1914 occurred on October 19, 1987, when the DJIA fell 22.61%. This was a Monday. After a very weak Friday, Mondays often are dominated by climactic emotional selling. We were short then. Our Peerless system had given its fourth major S9 signal of the year in early October. Many Tiger customers made thousands and thousands of dollars in this period with put options. Biggest Down Day in Market History  What was the background? Would reading the newspaper have told you to sell before the decline and buy on the extreme weakness of this day? Here was the news background. I can see nothing here that could remotely explain the market's extreme negative volatility. August 2, 1987 - U.S.S.R. performs nuclear test at Eastern Kazakh/Semipalitinsk U.S.S.R. August 7, 1987 - 5 Central American presidents sign peace accord in Guatemala August 16, 1987 - Astrological Harmonic Convergence - Dawn of New Age August 27, 1987 - Dow Jones Industrial Avg closes above 2,700 for 1st time (2,700.57) It peaks on August 25th at 2722,42 September 1, 1987 - Smoking forbidden in public buildings in Belgium September 18, 1987 - U.S.S.R. performs nuclear test at Eastern Kazakh/Semipalitinsk U.S.S.R. September 24, 1987 - U.S. performs nuclear test at Nevada Test Site A better clue of market vulnerability was the way the Federal Reserve had started to tighten money in from February 1987 to September 1987. The Fed Funds' rate rose sharply in the Summer of 1987. 01/1987, 6.43 02/1987, 6.10 03/1987, 6.13 04/1987, 6.37 05/1987, 6.85 06/1987, 6.73 07/1987, 6.58 08/1987, 6.73 09/1987, 7.22 Up 1.12% in 7 months. 10/1987, 7.29 11/1987, 6.69 12/1987, 6.77 (You can see these statistics at http://www.federalreserve.gov/releases/h15/data/Monthly/H15_FF_O.txt ) The Crash of 1987 Was An Artificial System Failure In 1987, the rising tide of short-term interest rates accenuated the move by some big funds to use the Futures market and Index options to hedge their positions. Many feel the "tail wagged the dog", namely that it was the rush to go short the thinner Futures market using computerized trading that caused the extreme declines. Large baskets of stocks were sold this way, owing purely to general market conditions. The evidence is strong that it was the breaking of the DJI-30's 200-day moving averaged on Friday,. with the DJI still 700 points up off the final bottom, that started this rush to by insurance in the form of put options and being short the S%P futures. When individuals heard of the massive declines, some rushed to sell. So many market orders came in that the computers could no longer report the last trade. As a result, many who panicked got prices much lower than they expected. There were no "circuit breakers" to give the computers a chance to catch up in their reporting and give everyone a chance to think more cooly. When, finally after the close, it was revealed how much lower many individual stocks' prices had fallen, there was a rush to buy at the next day's opening. Overnight, the Fed told Big Wall Street traders and institutions that they would provide all the liquidity needed to avert a financial collapse. They wanted to share prices to quickly rise so that big specialist firms and brokerages would not collapse. The Fed guaranteed, in effect, their solvency. With the backing of the Fed, the market turned back upwards. Hence the phrase, "Don't fight the Fed". The world-wide markets were all affected similarly, showing the dangers, too, of such linkage and instant communications. Want more reading. Look at http://www.lope.ca/markets/1987crash/ Many Key Individual Stocks in 1987 Did Show Bearish Signs Before Crashing Here is what Apple looked like three weeks before the Crash. To most observers the stock looked great. Not to Tiger user; the Tiger Accumulation Index remained negative despite its gaining nearly 200h% in the previous year. Its OBV was also not confirming its run to new highs. This meant informed Big Money Insiders were selling heavily and the public was running out of money to buy the stock aggressively.  Look at what happened after the beginning of October 1987 with

AAPL's stock. In

|

|

What does Apple's Stock Look Like Now? All the news is good. The stock seems to be starting another run. Why would anyone want to sell? But someone is. Tiger's Accumulation Index is nearly negative. And aggressive public buyers are not boosting the OBV Line to levels that correspond to the new highs by the price of the stock.  > Just as in October 1987, AAPL showed a new high with its Accumulation negative or nearly so, despite the new high. > Just as in October 1987, AAPL's OBV Line was not confirming the new high. > Unlike in 1987, AAPL's stock had only doubled, not tripled in the past year. > ??? - Sell S9... Now would be a good time to get Peerless Stock Market Timing.

|