|

Daily Blog People have asked me to

write a Daily Blog. |

July 3, 2007

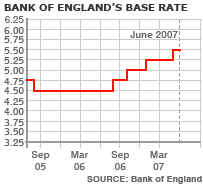

The Weakness in The US Dollar Will Likely Bring Higher US Interest Rates

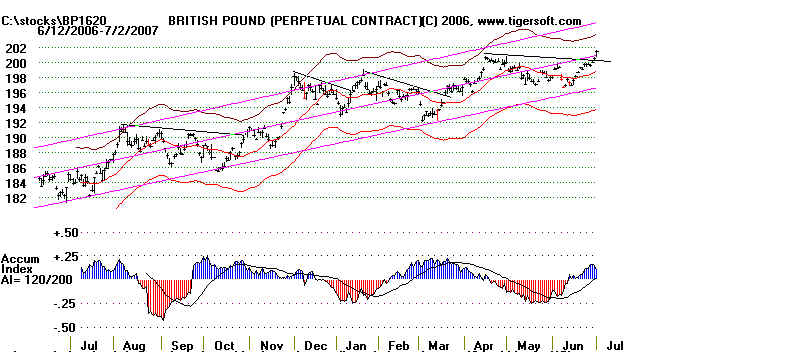

The British Pound has just made a 26 year high versus the Dollar. The last time the

Dollar was this weak was in June 1981, a point when the DJI and the US market

were about to fall by almost 20% over the next few months.

Bear Market of 1981 began when British ound Was Last This High.

|

Chanellors Who Become Prime Ministers

Follow The Orthodox

Persuasion of "The City", Britain's Wall Street.

My dissertaion at Columbia University was about how Chancellors of the

Exchequer, who live at 11 Downing Street, commonly became Prime Ministers,

provided they did not "rock the boat" and followed the orthodox expectations

of the Bank of England and protected the Pound and cut back governmental

spending, no matter the cost. By way of example, Neville Chamberlain had

been Chancellor before becoming Prime Minister in 1933. He fought over

and over with Churchill in the mid 30's and denied the latter's Air Ministry the

funding needed to prepare for World War II.

A tighter fiscal and monetary policy from the ex-ExChequer

Chancellor

who is now PM will boost the British Pound (which made a new high today),

but it will slow the economic boom down and probably force the US to tighten its

interest rates, to compete for international financing. Higher interest rates

in

Europe will spread here quickly, since the dollar is so weak. That explains why|

US Housing stocks were so weak today, even with the big rally.

The chart below shows TigerSoft's Index of 32 US Housing Stocks. Not the

new lows.

Scottish Humor: Gordon and the donkey

Many years ago a young Scot called Gordon bought a donkey from an old farmer for £100.00. The farmer agreed to deliver the donkey the next day. When the farmer drove up the next day, he said, "Sorry son, but I have some bad news...the donkey is on my truck, but he's dead." The young Scotsman replied, "Well then, just give me my money back." The farmer confessed, "I can't do that. I've already spent it." The Scotsman said, "OK then, just unload the donkey anyway". The farmer asked, "What are you going to do with him?" The young man said, "I'm going to raffle him off." To which the farmer exclaimed, "You can't raffle off a dead donkey!" But the Scot, with a big smile on his face, said "Of course I can. Just watch me. I just won't tell anybody that he's dead." A month later the two met up again and the farmer asked, "What happened with that dead donkey?" The young Scot said, "I raffled him off. I sold 500 tickets at two pounds a piece and made a huge profit." Totally amazed, the farmer asked, "Didn't anyone complain that you had stolen their money because you lied about the donkey being dead?" And the young man replied, "The only person who found out about the donkey being dead was the raffle winner, when he came to claim his prize. So I gave him his £2 back plus £200 extra, which is double the going value of a donkey, and he thought I was wonderful." The young Scotsman grew up and eventually became the Chancellor of the Exchequer, and no matter how many times he lied or how much money he stole from the voters, as long as he gave some of them back some of the stolen money, most of them thought he was wonderful. The moral of this story is that, if you think Gordon is about to play fair and do something for the everyday people of the country think again my friend, because you'll be better off flogging a dead donkey (Source: arksaccjokes.blogspot.com/2007_04_01_archive.html )

|

|