Momentum Trading. Does It Work?

"Yes",

If You Use Peerless,TigerSoft and Get Our Books.

Four months ago Tiger Software published a

report on the top performing stocks from

July 2006 to February 22, 20076. Here we see what has happened in the last 5

months (101

trading days) to all those stocks that were up at least 125%. This

gives a sample of 40 stocks.

It might be considered that any stock that was up more than 125% had

accomplished a lot

technicially, in moving up past the point where simple Sell-after-A-Double

prifit-taking would

have occurred.

Below is a table showing the ranking of the percent

gans of these stocks. They all had

risen at least 125% from July 2006 to February 22, 2007. 16 of the 41

rose more than 20%,

but 18 lost money in a rising general market. Clearly, simply buying

the best performing

stocks is risky. So, what do you do? In a word, TigerSoft.

Use our books and software. They

show you which stocks to buy and own and which to sell. Look at the

shcarts of the best performing

stocks and see the notes I have added. Compare them with the poorest

performing "ex-momentum"

stocks.

C:\momentum Days back= 101

2 / 20 / 2007 - 7 / 16 / 2007

Rank Symbol Name Price Pct.Gain

--------- ---------------------------- ------- ----------

1 BCSI --- 54.69 67%

2 TRA Terra Industries 29 63%

3 RIMM Research In Motion Ltd. 226.54 59%

4 MFW M & F Worldwide Corp. 66.18 58%

5 PRGX Profit Recovery Group 15.93 46%

6 ALGN --- 25.97 45%

7 CEA China Eastern Airlines 49.1 43%

8 TRT Trio-Tech International 22.19 37%

9 CCOI --- 32.31 33%

10 VDSI VASCO Data Security Int'l 24.43 32%

11 TVL --- 18.94 31%

12 ZNH China Southern Airlines 32.8 26%

13 CHDX US-China Industrial Exch. 25.9 25%

14 REFR Research Frontiers 13.36 25%

15 DLX Deluxe Corporation 41.25 24%

16 JADE LJ International 12.35 23%

17 MICC Millicom Int'l Cellular 97.05 19%

18 LFL Lan Chile S.A. 85.21 14%

19 POZN --- 19.21 12%

20 SIGM Sigma Designs 30.57 11%

21 MWP --- 59.02 2%

22 SPAR Spartan Motors 16.4 1%

23 TBWC --- 24.69 0%

24 IGLD --- 13.99 -3%

25 JST Jinpan International LTD 20.61 -4%

26 ACY Aerocentury Corporation 18.25 -5%

27 TTEC TeleTech Holdings Inc. 31.8 -6%

28 SRSL SRS Labs 11.25 -11%

29 ACP Amer. Real Estate Partner 97.7 -17%

30 ACOR --- 20.4 -18%

31 TATTF TAT Technologies Ltd. 20.94 -18%

32 DIT --- 22.05 -19%

33 VPHM ViroPharma 14.5 -20%

34 NTY --- 41.47 -23%

35 PCCC PC Connection 13.48 -24%

36 SYX Systemax Inc. 21.06 -31%

37 LTS --- 2.16 -32%

38 BITS Bitstream Inc. 7.12 -37%

39 ANGN Angeion Corporation 8.83 -47%

40 NYNY --- 6.55 -49%

41 AXR AMREP Corporation 48.32 -51%

|

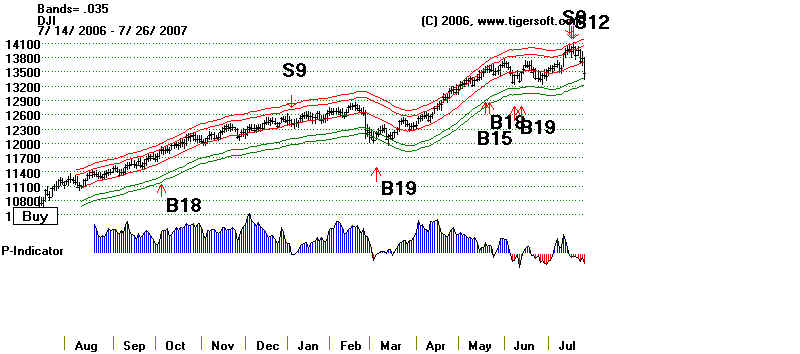

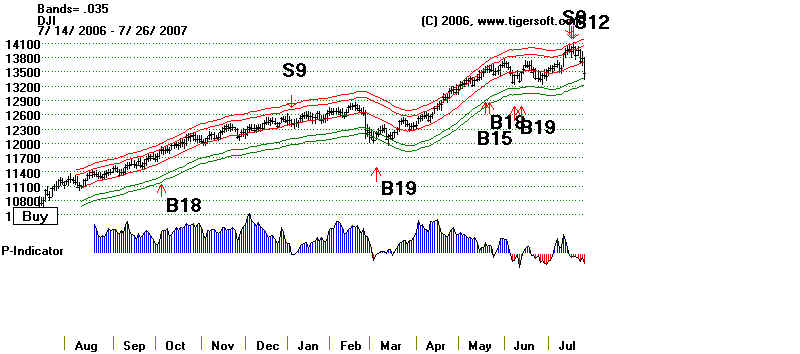

Use Peerless To Know When To Stop Buying Strength

7/26/2007

There is a point at which you have to stop buying strength.

That occurs when Peerless gives

a major Sell Signal. On 7/17/2007, that happened.

Take a look at the stocks now in light

of that sell signal. Here is the chart a week later.

.

|