|

Daily Blog - Tiger Software People have asked me to

write a Daily Blog. They seem to want |

Spring Fever Joke

Four high school boys afflicted with spring fever skipped

morning classes.

After lunch they reported to the teacher that they had a flat tire.

Much to their relief she smiled and said, "Well, you missed a test today so

take seats apart from one another and take out a piece of paper."

Still smiling, she waited for them to sit down. Then she said:

"First Question: Which tire was flat?"

......................................................................................................................

Summer Solstice

In the northern hemisphere, the longest day of the year (near June 22)

when the Sun is farthest

north. Shakespeare's Midsummer Night

occurred on this day. The Druids believed midsummer was the

"Apex of Light," when the Oak King gave way to the gloomier

Holly King who reigned until the Winter Solstice.

Astrology, Seasonality and the Stock Market

"All signs are pointing to a downturn in the stock market, and there

are multiple scandals going on in our government..."

Lynn Hayes - astrodynamics.blogspot.com/2006/

Summer Rally? How does the market behave

behave from June 22nd

for the next two months when it has already had a big gain in the first

part of the year, as in 2007? The new book I am writing gives us the

answer for the DJI-30.

There were 25 cases when the DJI-30 rose steadily in the first 5 months

of the year and was up more than 12%. In 7 (28%) cases, the DJI rose steadily

for the rest of the year. In the other 72% of cases, tops that brought declines of more

than 10% followed before the end of the year. Consider how often these tops

took place in the subsequent months from June through December. From this

we may conclude that there is a 68% probability of at least a 10% correction

by the end of October this year.

June

1950, 1954

July

1919, 1933, 1943, 1975, 1986, 1997, 1998

August

1987, 1999

September

1955, 1967, 1976

October

1922, 1927, 1989

November

1925, 1935

December

A top in July is the most likely scenario for 2007, but

there is a 28% chance,

based on these case, that there will be no significant top. Using Peerless

will give us the best read on the market as time goes by this summer. Nearly

all the significant tops were called by Peerless as they were occurring or

soon before or afterwards..

1915 - Ascending triangle breakout at 72.5 and rallied

strongly to 100 by end of year.

1919 - 10% correction starting on 7/14 and lasting until 8/20. Peerless will show

you how

this top would have been spotted.

1922 - Flat topped breakout and DJI peaked on 10/16

1925 - Flat topped breakout and DJI did not peak until 11/6.

1927 - Early July breakout and steep advance until 10/3. Peerless

will show

you

how this top would have been spotted.

1933 - DJI-30 peaked on 7/19 and fell 17% in 4 trading days. Peerless

will

show

you how this top would have been spotted.

1935 - June breakout led to a strong advance until 11/20.

1943 - DJI peaked on 7/16 and fell 11% over next five months.

Peerless will

show

you how this reversal would have been spotted.

1950 - DJI peaked on 6/12 and then fell 15%. Peerless will show

you how

this

reversal would have been spotted.

1954 - Breakout in DJI-30 in late June. The DJI rallied

for the rest of the year,

1955 - DJI rallied until 9/23 and then fell 10%. Peerless will show you

how

this

reversal would have been spotted.

1967 - DJI rallied until 9/25 and then fell 10%. Peerless will show you

how

this

reversal would have been spotted.

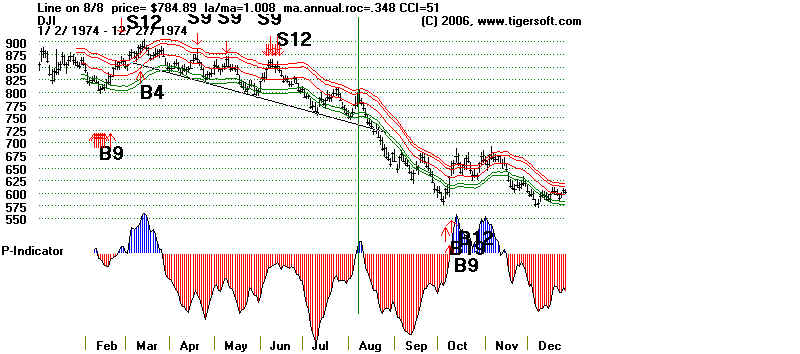

1975 - DJI rallied until 7/15 and then fell 10%. Peerless will

show you how

this

reversal would have been spotted.

1976 - DJI rallied until 9/22 and then fell 10%. Peerless will

show you how

this

reversal would have been spotted

1983 - DJI rallied until January of the

next year.

1986 - DJI rallied until 7/2 and then fell 10%. Peerless will

show you how

this

top would have been spotted.

1987 - DJI rallied until 8/26 and then fell 36%. Peerless will

show you how

this

top would have been spotted.

1989 - DJI rallied until 10/9 and then fell 10%. Peerless will

show you how

this

top would have been spotted

1991 - DJI moved sidewise and up all year.

1993 - DJI moved sidewise and up all year.

1995 - DJI moved sidewise and up all year.

1997 - DJI rallied until 7/31 and then fell 15%. Peerless

will show you how

this

top would have been spotted.

1998 - DJI rallied until 7/20 and then fell 20%. Peerless

will show you how

this

top would have been spotted.

1999 - DJI rallied until 8/24 and then fell 20%. Peerless

will show you how

this

top would have been spotted.

2003 - Flat topped breakout in August and DJI-30 moved up for rest of year.

Seasonality has its fans among stock market investors.

Tiger believes in its value. For example, the TigerSoft programs

tell us that after June 21sth since 1965 the DJI has been

weak for two weeks and then gets stronger.

Holding Period Avg, Pct

Change Pct. of Years

in

DJI-30

that

DJI-30 was up.

---------------

----------------- --------------------

1 trading day

0.1%

62.5%

2 trading days

0.0%

50.0%

3 trading days

-0.2%

52.5%

5 trading days

-0.3%

37.5%

1 week

10 trading days -0.5%

40.0%

2 weeks

21 trading days -0.4%

50.0%

1 month

42 trading days 0.2%

60.0%

2 months