TigerSoft News Service (C) 5/14/2012

www.tigersoft.com

TigerSoft News Service (C) 5/14/2012

www.tigersoft.com What To Buy among Major Market ETFs for Next Rally

given the New Peerless Buy B2

There is a close correlation between the weakest ETFs for 2012 and their performance

when sold short on Peerless Sells and covered on Peerless Buys for the past 12 months.

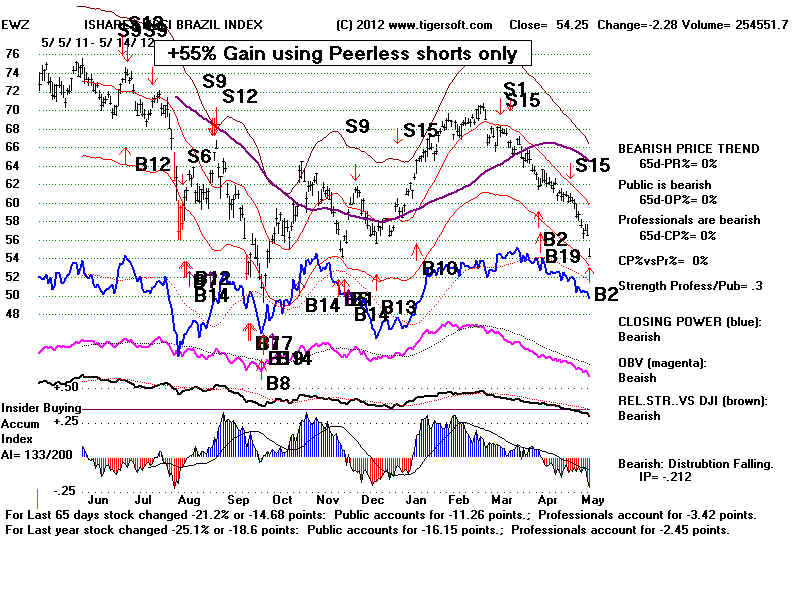

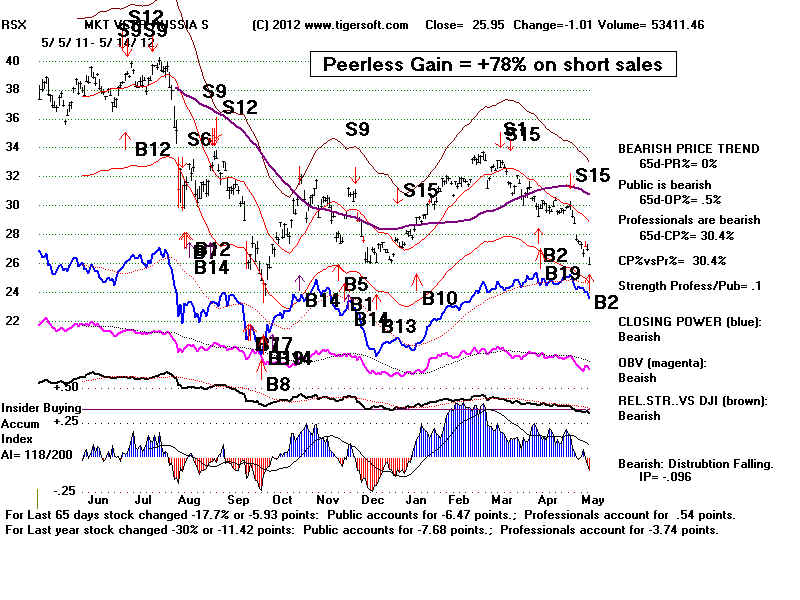

We correctly recommended shorting RSX (Russia) and EWZ (Brazil) on the last Peerless Sell

Now we have a Peerless Buy. If a rally develops here we might want to be long the strongest

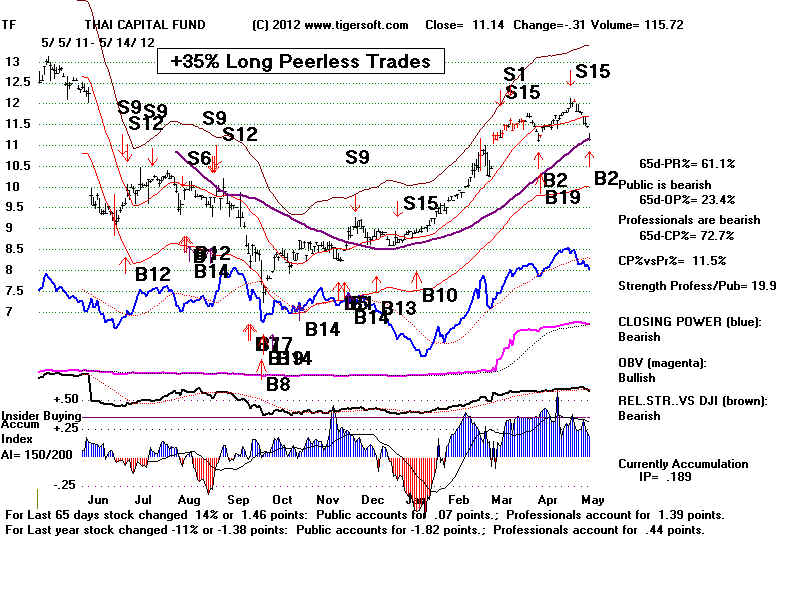

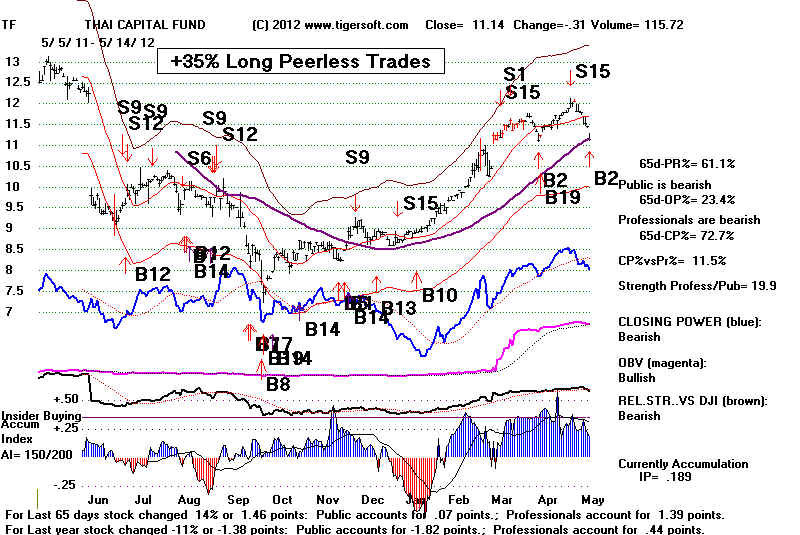

of the Foreign ETFs for this year. Thai Fund traded only on the long side is up +29%

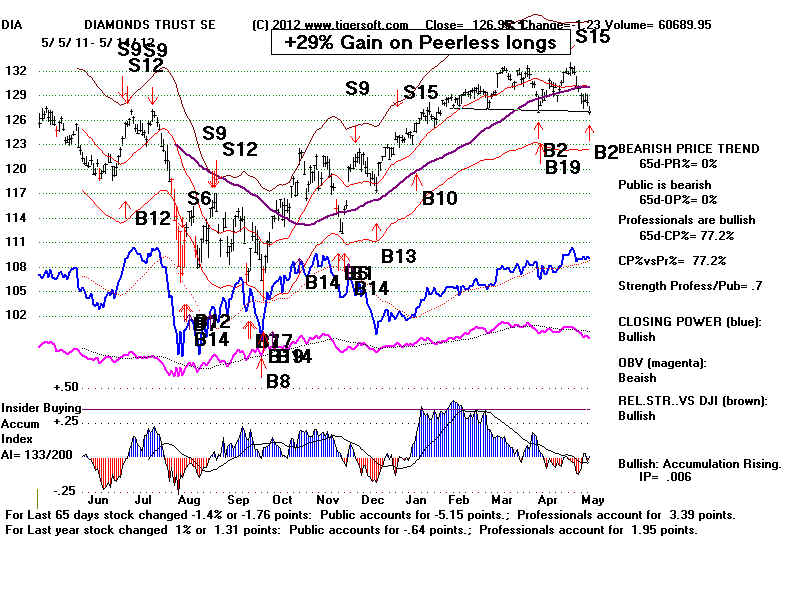

for the last 12 months. TF is interesting because it is still above its 65-dma. DIA traded only

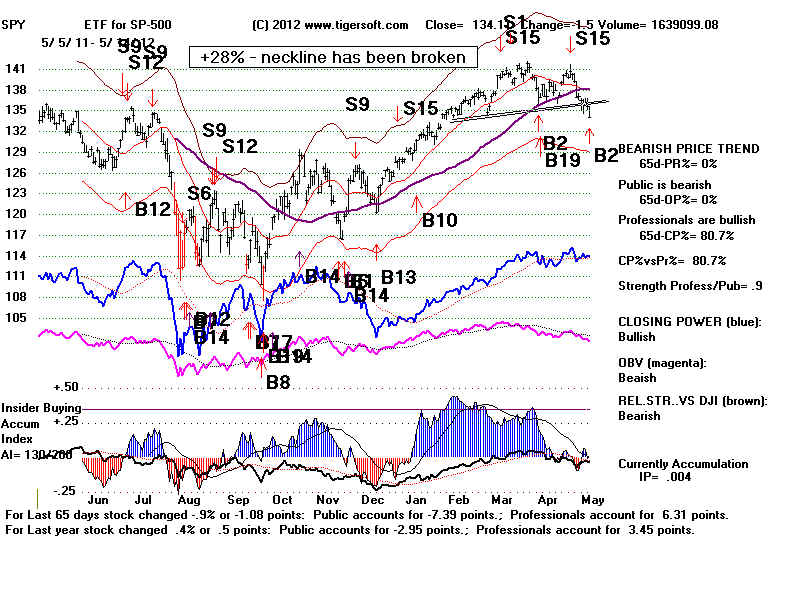

on the long side also is up +29% for the last 12 months. SPY is up +28% but has broken its

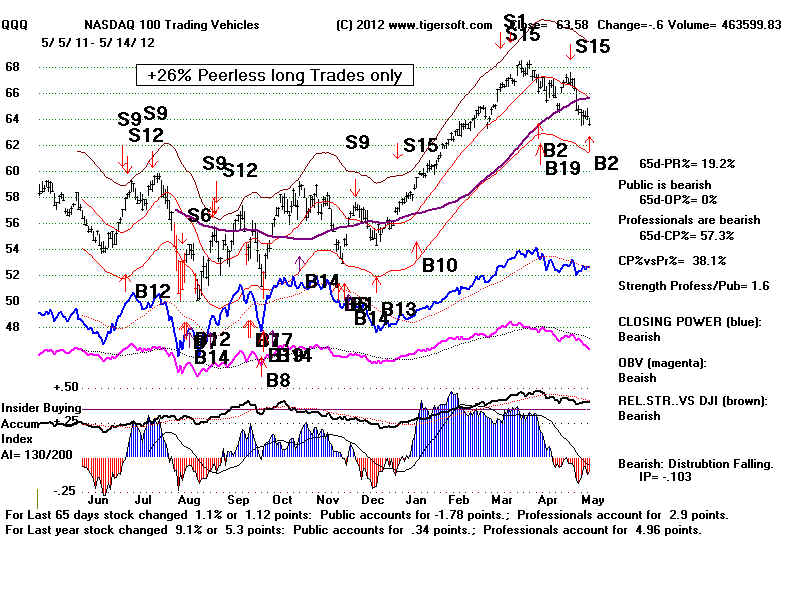

neckline support. QQQ is at its neckline and has gained +26% on the long side.

2012's Strongest and Weakest

Foreign and Major Market ETFs

C:\etfs Days back= 92

12/30/2011 - 5/14/2012

Rank Symbol Name Price Pct.Gain

--------- ----------------------------------- ---------- ------------

1 TF THAI CAPITAL FUND 11.14 29%

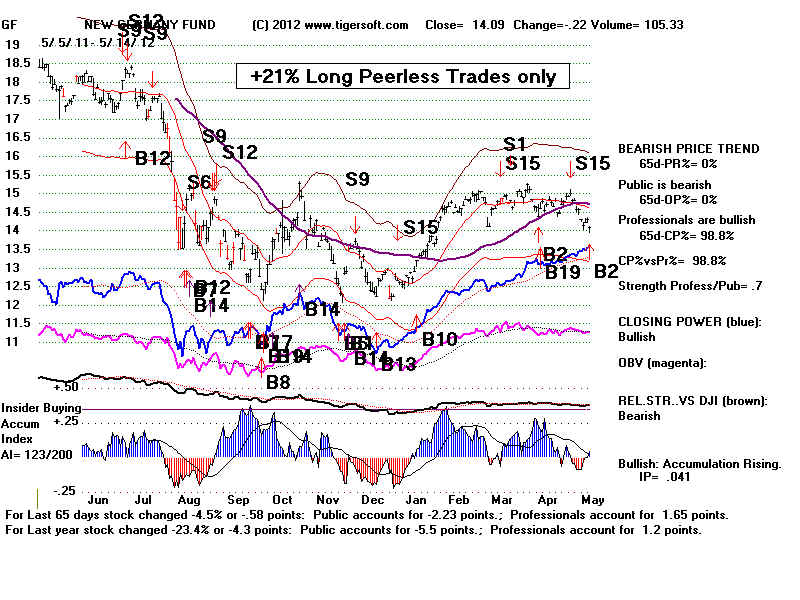

2 GF NEW GERMANY FUND 14.09 15%

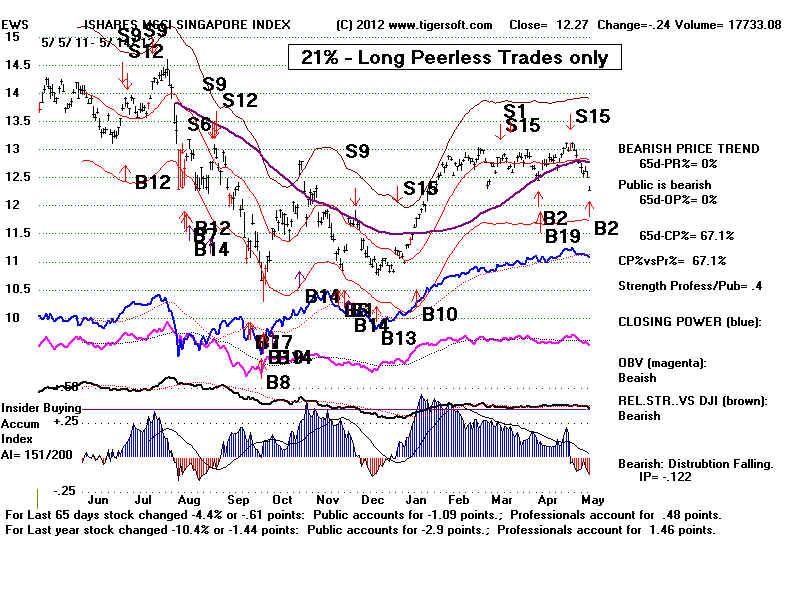

3 EWS ISHARES SINGAPORE 12.27 13%

4 SGF SINGAPORE FUND 12.38 13%

5 QQQ NASDAQ 100 63.58 13%

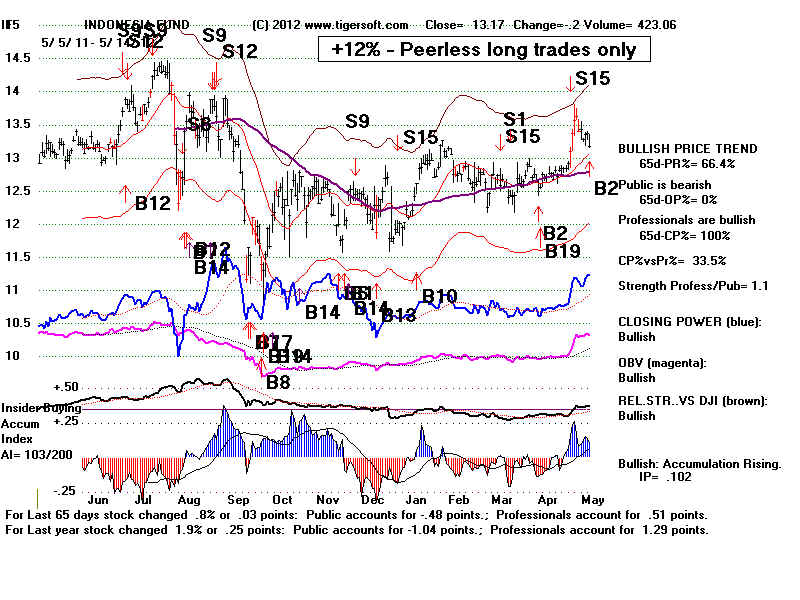

6 IF INDONESIA FUND 13.17 11%

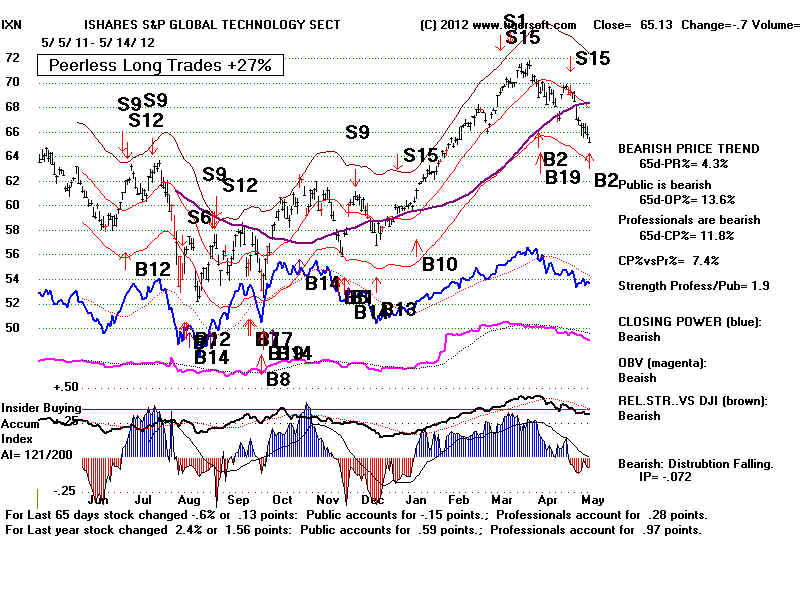

7 IXN ISHARES S&P GLOBAL TECHN 65.13 10%

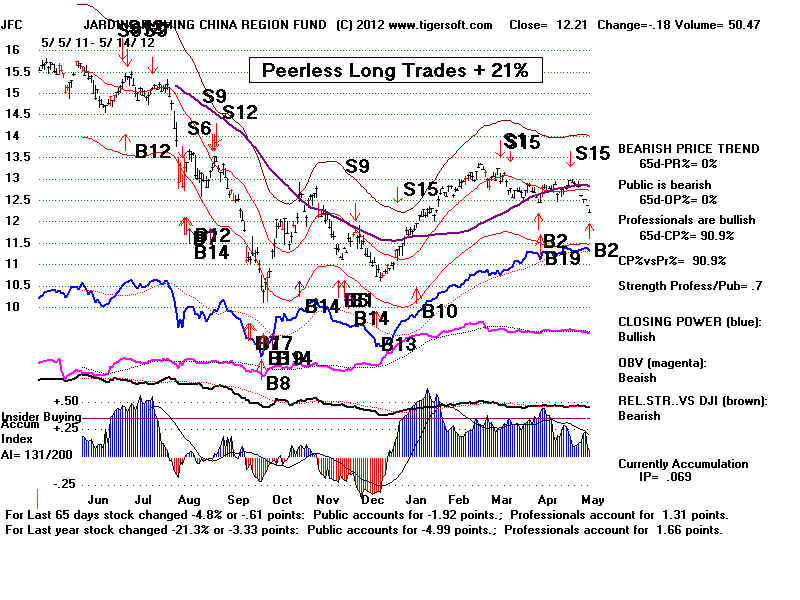

8 JFC JARDINE CHINA REGION FUND 12.21 10%

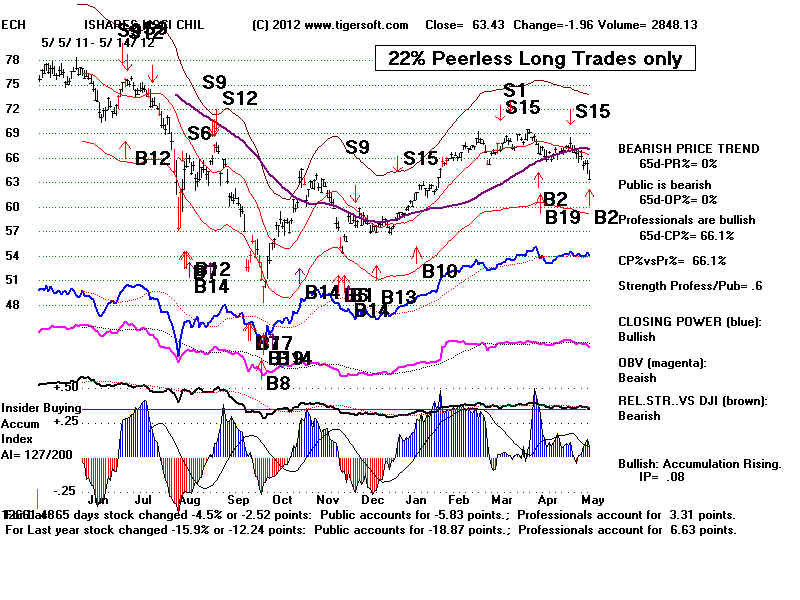

9 ECH ISHARES MSCI CHIL 63.43 9%

10 EWG ISHARES MSCI GERMANY INDEX 20.73 7%

11 EWK ISHARES MSCI BELGIUM INDEX 11.4 7%

12 EWW ISHARES MSCI MEXICO INDEX 57.54 7%

13 GRR ASIA TIGERS FUNDS 12.86 7%

14 TWN TAIWAN FUND 15.51 7%

15 EWH ISHARES MSCI HONG KONG 16.48 6%

16 EWM ISHARES MSCI MALAYSIA INDEX 14.23 6%

17 EWY ISHARES MSCI SOUTH KOREA 55.49 6%

18 MXF MEXICO FUND 23.24 6%

19 SPY ETF for SP-500 134.11 6%

20 CH CHILE FUND 15.81 5%

21 CHN CHINA FUND 21.73 5%

22 EWT ISHARES MSCI TAIWAN INDEX 12.34 5%

23 JOF JAPAN OTC EQUITY FUND 7.55 5%

24 TRF TEMPLETON RUSSIA FUND 14.4 5%

25 CEE CENTRAL EUROPEAN FUND 29.84 4%

26 GCH GREATER CHINA FUND 10.57 4%

27 GMF ST SP EM AS PAC E 68.64 4%

28 HAO CLAYMORE/ALPHASHA 20.2 4%

29 DIA DIAMONDS TRUST SE 126.95 4%

30 EWA ISHARES MSCI AUSTRALIA 22.29 3%

31 GXC STRK SPDR S&P CH 64.34 3%

32 IIF MORGAN STANLEY INDIA 14.57 3%

33 INP IPATH ETNS LINKED 48.3 3%

34 JEQ JAPAN EQUITY FUND 5.18 3%

35 VWO Vanguard Emerging Markets 39.36 3%

36 CAF MORGAN STANLEY CH 19.88 2%

37 EEM ISHARES MSCI EMERGING MKTS 39.06 2%

38 EWD ISHARES MSCI SWEDEN INDEX 25.76 2%

39 EWL ISHARES MSCI SWITZERLAND 23.09 2%

40 EWO ISHARES MSCI AUSTRIA INDEX 14.53 2%

41 EWU ISHARES MSCI UK INDEX 16.5 2%

42 IFN INDIA FUND 19.47 2%

43 ITF ISHARES S&P-TOPIX 150 FUND 39.54 2%

44 VPL Vanguard Pacific Stock 48.84 2%

45 PGJ PowerShares Gldn China 19.94 1%

46 EWJ ISHARES MSCI JAPAN INDEX 9.15 0%

47 IEV ISHARES S&P EUROPE 350 FUND 33.97 0%

48 IXP ISHARES S&P GLOBAL TELECOMM 56.09 0%

49 VGK Vanguard European Stock 41.81 0%

50 FXI iShares FTSE/Xinhua China 25 34.73 -1%

51 KEF KOREA EQUITY FUND 9.03 -1%

52 EWQ IShares MSCI France 19.26 -2%

53 IDX MARJET VECTORS INDONESIA 27.98 -2%

54 ILF ISHARES S&P LATIN AMERICA 40 41.74 -2%

55 EWC ISHARES MSCI CANADA INDEX 26.06 -3%

56 RSX MKT VCTR RUSSIA S 25.95 -3%

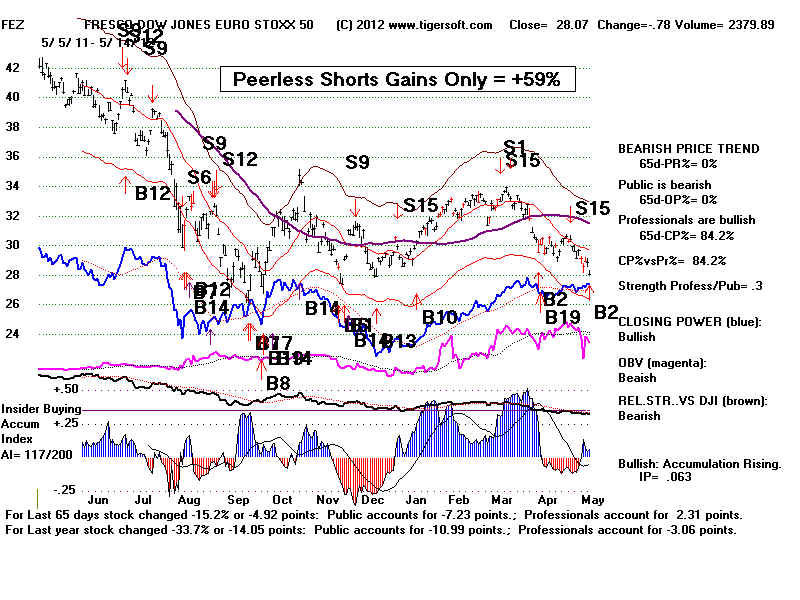

57 FEZ FRESCO DOW JONES EURO 50 28.07 -5%

58 EWZ ISHARES MSCI BRAZIL INDEX 54.25 -6%

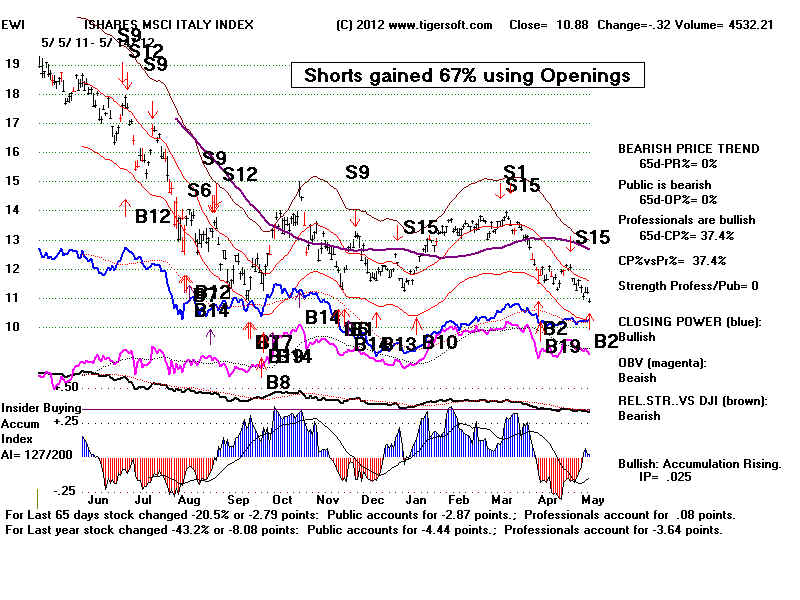

59 EWI ISHARES MSCI ITALY INDEX 10.88 -10%

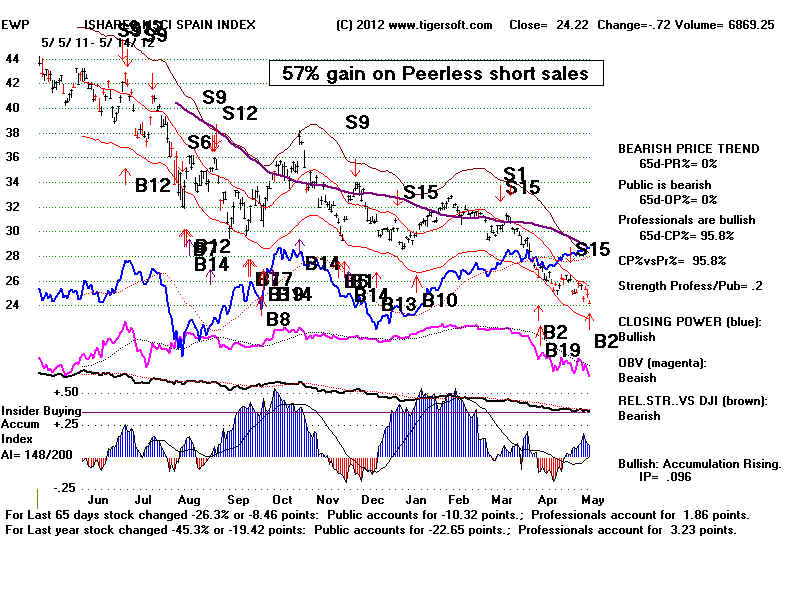

60 EWP ISHARES MSCI SPAIN INDEX 24.22 -20%