Highly

Profitable Currency and Forex Trading

in An Age of Profound Weakness in The Dollar

How do you protect yourself when your country's

currency goes

down

and down, at an increasing rate? If we lived in any

other country

where

the trade balance was so bad and the national debt was so high,

our

currency would be much, much lower and interest rates would probably

be set

at 15% to attract foreign investments! The Dollar has been going

down

steadily. At any time now, its rate of descent could accelerate and a

panic

could start. So, what do we do?

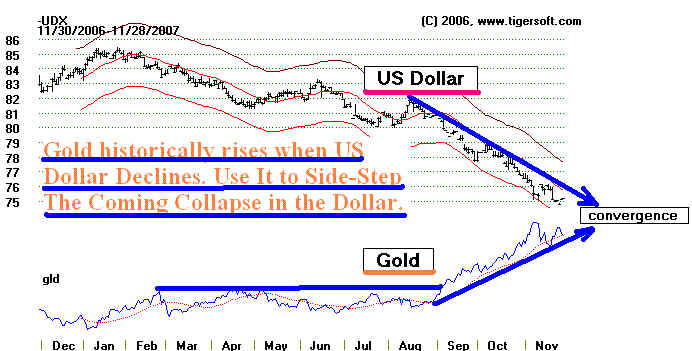

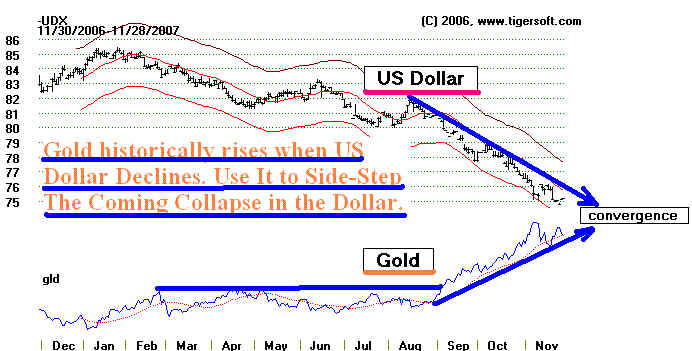

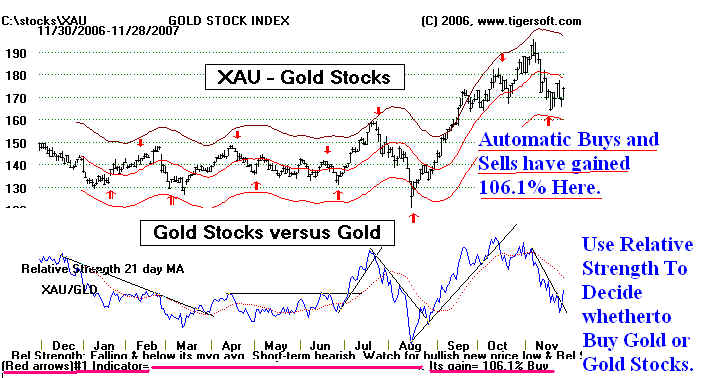

Buying Gold or old stocks is the certainly the

most commonly heard

answer. We have been recommending this since

December 2005. Use the Tiger

charts

to trade them, if you like, and to decide which is better, Gold Bullion

or

Gold Stocks.

------------------ US Dollar and Gold Move Inversely. ---------------------------

-----------

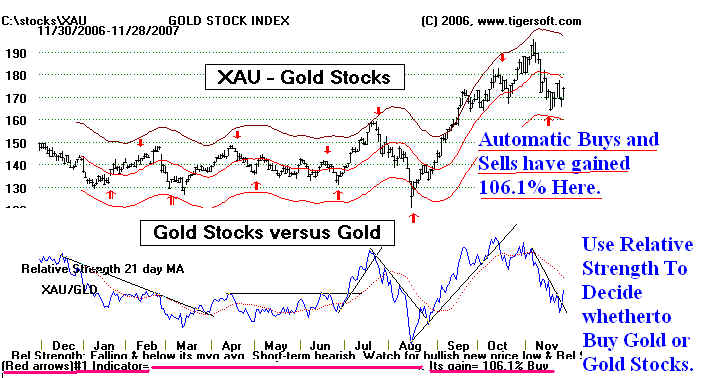

TigerSoft Lets You Trade Gold Stocks Very Profitably. --------------------

TigerSoft's automatic Buys and Sells have garnered 106% this

past year.

====================================================================================

Introduction

Besides gold bullion and

gold stocks, there are other direct steps you might

take to avert personal financial disaster because of the developing collapse of the US

Dollar.

The easiest is to learn how to Buy foreign currencies or, at least foreign currency ETFs.

This can be hugely profitable. You will note that we are only considering the most

liquid

forms of dealing with a weak dollar. Buying Picassos or "Inverted Jennies"

(rare US stamps)

works over a long time. But it takes too much time to sell these. In addition,

we have

recommended foreign stocks and ETFs. But these are very over-extended and could

contract sharply at any time. So, we want here to consider only Gold,

Currency

Speculation and Currency Exchange Traded Funds. You will see that TigerSoft gives

you the advantage of many seeing what insiders ae doing, using the Tiger Accumulation

Index.

Currency speculation has increased dramatically. It is estimated that in 1975 80%

of foreign exchange transactions were commerce related. Currencies changed hands to

allow oil, cars, TV sets, etc to be imported or exposted, Today, some estimate that

number

to be under 10%. Computerization is one of the key factors. Transaction costs

have come

way down. Another reason is Nixon's taking the US off the Gold Standard and allowing

the US Dollar to float.

( http://64.233.167.104/search?q=cache:A1BVZ8pomrwJ:www.twnside.org.sg/title/nar-cn.htm+%22currency+speculation%22+fortunes+made&hl=en&ct=clnk&cd=1&gl=us&client=firefox-a

)

1. Currency Speculation Has

Made Some Very Famous

People Rich: John Meynard Keynes, George Soros...

Back in the 1920's, insider trading was a standard

business practice.

Keynes was an adviser to the

Chancellor of the Exchequer

and the Treasury from

1915 to 1919. Among his

responsibilities were the design

of terms of credit between

Britain and its continental

allies during the war, and

the acquisition of scarce

currencies. He was the

British Treasury's representative

to the Paris Peace Conference

of 1919. His observations

appeared in the highly

influential book The Economic

Consequences of the Peace in 1919,

followed by

A Revision of the Treaty in 1922.

Using statistics provided

to him by the German

delegation, he argued that the

reparations which Germany

was forced to pay to the victors

in the war were too large, would lead to the ruin of the

German economy and result in

further conflict in Europe.

These predictions were borne

out when the German

economy suffered in the hyperinflation

of 1923. Only a

fraction of reparations were

ever paid.

( http://en.wikipedia.org/wiki/John_Maynard_Keynes

)

John Maynard Keynes began his career as a speculator in August 1919, at

the relatively

advanced age of

36 years. Keynes traded on high leverage - his broker

granted him a margin

account to trade

positions of £40,000 with just £4,000 in his account. He traded currencies including

the U.S. dollar,

the French franc, the Italian lira, the Indian rupee, the German mark and the Dutch

florin.

His work as an

economist led him to be bullish on the U.S. dollar and bearish on European currencies,

especially

the German Mark.

He traded accordingly, usually going long on the dollar and short selling European

currencies.

Easter 1920 found

Keynes vacationing in Rome. He learned that his open currency trades had made him a profit

of £22,000 on francs and a

loss of £8,000 on U.S. dollars...

But he Keynes soon learned that short-term currency trading on high margin, using only his

long-term

economic predictions as

a guide, was foolhardy. By late May, despite his belief that the U.S. dollar should rise,

it didn’t. And the

Deutschmark, which Keynes had bet against, refused to fall. To Keynes’s dismay, the

Deutschmark began a

three-month rally. Keynes was almost wiped out.

Whereas in April he had been sitting on net

profits of £14,000, by

the end of May these had reversed into losses of £13,125. His brokers asked Keynes

for £7,000 to keep his

account open. A well known, but anonymous, financier provided him with a loan of £5,000.

Sales of Keynes’s

recently published book The Economic Consequences of Peace had turned out to be

healthy and a letter to

his publisher asking for an advance elicited a check for £1,500. So, Keynes was able to

scrape together the

money he needed to continue trading, but he learned a valuable but painful lesson in

trading.

As he said, "The market can stay irrational longer than you can stay

solvent.” Determined to achieve

financial independence,

Keynes began trading again. He traded more prudently than in his dramatic early months,

using shorter-term

trading indicators and, by December, he was able to pay back the £5,000 loan to his

benefactor.

In the following four

years, Keynes continued to trade using high margin. In 1921 he expanded his trading

activities

to include commodities

- first cotton and then metals, rubber, jute, sugar and wheat - and stocks. By the

end of

1924 he had amassed net

assets of £57,797. The Crash of 1929 hit him hard,

but he soon recovered by using

| his knowledge of

currencies, which had acquired in an official capacity, and quite possibly using his

many contacts.

Bertrand Russell named Keynes as the most intelligent person

he had ever known, commenting,

"Every time I

argued with Keynes, I felt that I took my life in my hands, and I seldom emerged without

feeling

something of a fool." (Source: http://en.wikipedia.org/wiki/John_Maynard_Keynes

)

(Additional Sources: http://www.maynardkeynes.org/keynes/keynes-the-speculator/

R.F. Harrod - The Life Of John Maynard Keynes, 1951 which I read years ago in

Graduate School.)

------------------------------------------------------------------------------------------------------------------------------------------------------

GEORGE SOROS

GEORGE SOROS

George Soros was born Jewish in Hungary 76

years ago. He miraculously escaped the

Holocaust at the age of 17 when he fled to the West, completed his economics studies in

London,

moved to the US, and quickly became part of the New York financial community. Bright

and daring,

he was one of the first hedge fund operators, set up for investors willing to take high

risks. His most

famous financial adventure was in selling short the British Pound in September 1992, at a

time the British

were desperately, but unsuccessfully, trying to halt an inevitable devaluation in the

sterling. His move

made a billion dollar profit for himself and his clients in one day!

Soros Currency Speculation - On Black

Wednesday (September 16, 1992), Soros

became immediately famous when he sold short more than $10 billion worth of pounds, profiting from

the Bank of

England's reluctance to either raise its interest rates to levels comparable to those

of other

European Exchange Rate Mechanism countries or

to float its currency. Finally, the Bank of

England was

forced to withdraw the currency out of the European Exchange Rate Mechanism and to devalue

the

pound

sterling, and Soros earned an estimated US$ 1.1 billion in the process. He was dubbed

"the

man who broke the Bank of England."

The Times October 26, 1992, Monday quoted Soros as saying: "Our total position

by Black

Wednesday had to be worth almost $10 billion. We planned to sell more than that. In fact,

when

Norman Lamont

said just before the devaluation that he would borrow nearly $15 billion to defend

sterling,

we were amused because that was about how much we wanted to sell."

According to Steven Drobny,[9]

Stanley

Druckenmiller, who traded under Soros, originally saw the weakness in the pound.

"Soros' contribution

was pushing him to take a gigantic position," in accord with Druckenmiller's own

research and instincts.

The man George Soros is talking to "used as much as RM30 billion of tax payers' money

and colossaly

lost it all in the Bank Negara's Forex scandal between 1992 to 1994. The chapter

has

not closed as the

money has never been accounted for. Ten years later, in 2004, the same

Malaysian-born money speculator, aka Top

Cat, was made a Finance Minister.

( http://www.jeffooi.com/2006/12/two_money_speculators.php

)

Soros' Malaysian Speculation Made Him Enemies.

In 1997, during the Asian financial crisis,

then Malaysian Prime Minister Mahathir bin Mohamad accused Soros of using the wealth

under his control

to punish ASEAN for

welcoming Myanmar as a

member. Later, he called Soros a moron.[10] Thai

nationals have called Soros "an economic war criminal"

who "sucks the blood from the people".[11]

( http://en.wikipedia.org/wiki/George_Soros

) It is a fair question, I think, how much damage is done

by short selling collapsing currencies. Mexico is close by where I live.

People there are poor. Driving

down the currency of a poorer, underdeveloped company creates a "fire sale" for

that country's assets.

So, making their currency go down even more - and momentum players always push things to

an extreme -

poses real moral problems for me. I understand the temptations of short selling a

weak currency. Currencies

collapse faster than they rise. Our Tiger Accumulation Index often works better at

finding currencies that are

going to advance. Canadian Prime Minister recognized the truth:

"We cannot simply expect those famous

currency speculators to shut off their computer terminals, hang up their red suspenders

and get a life."

(See http://www.iht.com/articles/1997/07/30/baht.t_19.php

)

A Canadian New Democrat wrote: "Speculation not only destabilizes financial systems,

it also is

an economic virus that kills real investment. It is estimated today that only 5 to 10

percent of financial and

currency transactions are related to trade and production, while 90 to 95 percent of these

transactions are

purely speculative. Instead of chasing productive investments, money chases money to yield

paper profits.

Paper entrepreneurs, "the guys in red suspenders", have taken over and diverted

money to unproductive

activities. The economy becomes a casino where money is made on money simply because

someone guessed

it right. What is accomplished, at best, is of no value to society. ( Lorne Nystrom, MP, " Taming Currency

Speculators", May 1999, The New Democrat: http://globalpolicy.igc.org/socecon/glotax/currtax/ndp.htm

)

While I was writing my dissertation in the late 1960's in London, I frequently heard

reference

to the currency speculating Gnomes of Switzerland. They were blamed for forcing

Harold Wildon's

Labor Government to devalue the Pound. The French refer to self-interested

"Anglo-Saxon" currency

speculators. Consider how easy it is for any nation's

politicians to blame foreigners for financial

problems the politicians have really created.

Soros' Economic Philosophy and His Quantun Fund's

Traders to watch on TV:

George Soros's most successful partners at Quantum fund have been Jim Rogers, Victor

Niederhoffer,

and Stanley Druckenmiller, all of whom are famous traders in

their own rights. Soros warns that "the current

system of financial speculation undermines healthy economic development in many

underdeveloped countries.

Soros blames many of the world's problems on the failures inherent in what he

characterizes as

market

fundamentalism. He warns of irrationalism in the markets and dangerous

follow-the-fashionable-

trend excesses. This is called "dynamic disequilibrium" by Soros and

"irrational exuberance" by Greenspan.

Others call it a "bubble". I like the term "piffle".

Corporations are big currency traders. They usually are hedgers. To ensure

that they

are paid what they expect to be paid in contracts involving millions, they may sell short

the foreign

currency. If they do not, a 10% reduction in the currency during the time it takes

to deliver, say,

a steel mill and be paid, may turn a profit into a very big loss. The wilder a

country's currency

swings up and down, the more hedging is likely. Foreign corporations. and certainly

the Chinese

corporations, are undoubtedly trying to lessen the losses incurred by the declining dollar

by selling

the currency short. The high degree of leverage that they can use readily invites

this.

2. Central Banks Can Strengthen A

Currency:

Raising Interest Rates and Buying Their Own Currency.

But Outright Protectionism Backfires and Can Make for

Violent Currency Swings.

Before

we speculate on a currency's fluctuations, we would do well

to know the degree to which

government policies can suddenly move a currency. This makes

currency trading much riskier.

Governments like to surprise, even punish, speculators in its currency.

When they suddenly raise

interest rates or pour hundreds of million into efforts to buy up their own currency in

the Foreign

Exchange Markets, they make financial waves that change technical trends that many

speculators

rely upon. Their intent is usually to shore their currency up, in

part, because they try to make their

financing responsibilities easier to discharge. They want their country's bonds to

be attractive and easier

to market. Hot international money will flow to where it can get the best rates.

That influx usually stops

currency speculators cold. Similarly, when word gets out that interest rates are

going to be lowered, expect

that currency to be under pressure. That is partly why the US Dollar is in such a

steep downtrend now.

Speculators expect more Fed discount rate cuts to help prevent a recession before next

Presidential

Election. (Elsewhere I shown that the Fed's activities before the Presidential

Election year are

highly political.) ( http://www.gata.org/node/5723

)

Usually a nation's banks want a strong currency. The US Treasury Secretary, whoever

he is,

always gives it lip service. Not to do so, would start making traders and bankers

alike believe

it was US policy to drop the dollar intentionally. That would start a run on the

dollar.

It is a sign of how bad the US Dollar's current situation is that US banks now want

"cheap money"

to let them get past the enormous lack of confidence in financial institutions owing to

years of easy loans

to poor credit risks, all to make short term profits. This is quite remarkable. In

writing my dissertation,

which was about British Chancellors of The Exchquer from 1919 to 1937, I found that

the preferred policies

of London's financial community were always upheld by the Bank of England and always

promoted by

the Chancellor, no matter what party he came from. The "view of the City"

was always that they wanted a

stronger British Pound. Of course, it meant more profits. The more hot money

that came into Britain, the

more they could lend out and make profits from. They featured the strong Pound every

time they flew the

nationalist and pro-Empire Union Jack banner. Always they sought reduced government

spending,

balanced budgets and interest rates that were tight enough to make the British Pound seem

the paragon

of enduring stability.

Consider some cases. In June 2001, Brazil's

Central Bank President, Arminio Fraga, suddenly

hiked Brazil's interest rates by 150 basis points (1.5%) to 18.25%. This was "three times what the market

had expected. The move, quickly followed by the bank's purchase of an estimated $320

million in Reals on the local market, stopped a run on the Brazilian currency dead in its

tracks. "It was a master stroke," says Marcelo Mesquita, head of equities

research at UBS

Warburg in Sao Paulo."

( "Sparring with Currency Speculators" - http://www.businessweek.com/magazine/content/01_28/b3740158.htm

)

In another case, currency speculators in the Japanese

Yen were warned by the Prime Minister:

As you can see in the TigerSoft chart below, when the Japanese moved to an 18-month

high of Y109.

13 to the US dollar in mid November on Monday night, Mr Fukuda said: "In the short

term, yen

appreciation would certainly be a problem. Any kind of sudden change in exchange rates

would not

be desirable." He stopped short of threatening Japanese intervention in

the currency markets, but

said: "Speculative movements need to be kept in check. What I am saying is: 'Be

careful, so that it

[intervention] will not happen.'" Earlier his Cabinet Secretary had helped the

Japanese Yen rally

by saying "a high yen is basically good for Japan." We

would simply have bought the yen twice

in the chart below, where the Buy shows that prices crossed back above the 50-day mvg.avg.

and

on the breakout B23 after massive insider buying in October. A 10% profit in five

months makes

a nice currency trade. Breakout buying gets you much quicker action. But use

the Tiger

Accumulation Index to authenticate the breakout.

Protectionism

Usually Fails

The US Government may

also try to protect the Dollar and US jobs by restricting imports through

tariffs, quotas or import regulations. US governments have done little to protect

the loss of blue collar

manufacturing jobs in my life time. With off shore outsourcing, white collar jobs

are being lost in the

millions. Protecting the remaining US jobs will inevitably become an issue in the next

Presidential Election.

Perhaps, the debate will stay focused on illegal immigration. But if it turns to US

jpbs lost overseas,

there will be a groundswell for protectionism, as people feel more jobs are preferential

to the possibility

of higher imported prices. So long as China does not revalue its currency vis-a-vis

the US, job protectionism

will to be very politically expedient campaign platform in 2008.

But, all protectionism invites a backlash and retaliation. Trade wars make currency

trading more

difficult becuase of frequent sudden changes in prices as each new governmental action is

suddenly

factored in. Republicans have since the 1830s been more pro-tariff than the

Democrats.President McKinley

stated "Under free trade the trader is the master and the producer the slave."

But in the 1930's, the

the very protectionist Hawley-Smoot Tariff Act exacerbated the Great

Depression, Republicans in the

White House and Congress since Eisenhower have mostly become free traders. But that

may change.

Or else, the Democrats will shift places on this issue witht he Republicans. The

main point is that

protectionism will probably be a growing force politically in the US. And that will

disrupt trade

and currencies, especially as the possibility of trade wars edges into sight. Proectionism

makes

for more violent swings of the pendulun of currency prices, and that, itself, makes for

more

protectionism.

The BBC reported this month that: "the US Government was planning to

introduce more punitive tariffs,

this time on a range of textiles and lingerie products manufactured in China, triggered

fears about a return

to protectionism and the impact that this might have on the recent recovery in the US

economy. Retaliatory

action Traders are fearful that America's actions could spark retaliatory action by China.

A week ago the

World Trade Organisation ruled against similar import tariffs that the United States had

imposed on steel

imports from around the world. China - already been hit hard by the US steel restrictions

- responded

immediately by calling off buying a shipment of US soybeans.

==================================================================================

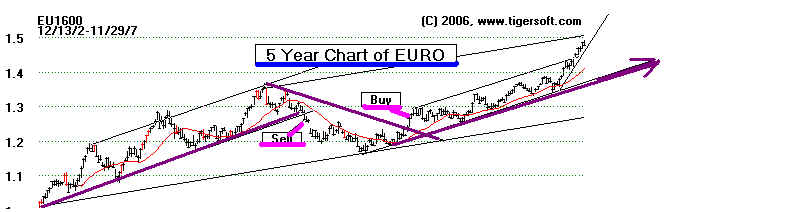

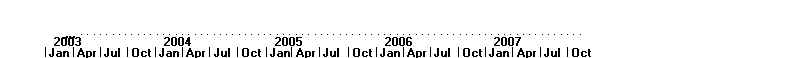

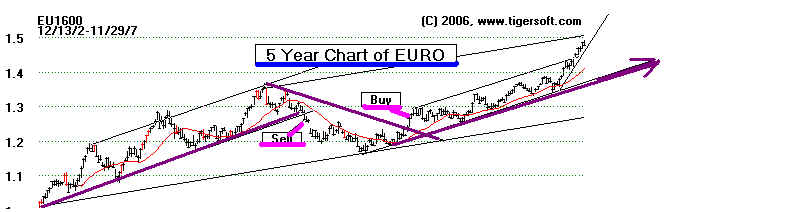

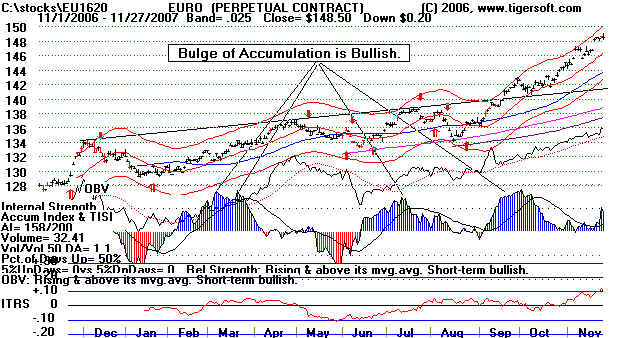

3. Trading Foreign Currencies: EURO: 2000-2007

I want

to show you how to trade the EURO using TigerSoft tools, especially

the Tiger

Accumulation Index, the 50-day moving average

and chart patterns that show resistance

or support. Start with the weekly chart.

Trade with the trend.

Now let's begin here with some basics about trading foreign currencies. If

you think a currency is going

up you can but the currency outright, using the FOREX, or

you can buy ETFs for that currency.

FOREX Trading. The Forex market is a non-stop 2 trillion

dollars per day cash market where currencies

of nations are traded, typically via brokers. Foreign

currencies are constantly and simultaneously bought and sold

across local and global markets and traders' investments increase

or decrease in value based upon currency movements.

1.

The "Forex"is the abbreviated form of Foreign Exchange; it is also referred as

the "Spot FX" market.

In Forex trading, the currency of one nation is traded for that

of another. Therefore, Forex trading is always traded

in currency pairs. The most commonly traded currency pairs are

traded against the US Dollar (USD). The major

currency pairs are the Euro Dollar (EUR/USD); the British Pound

(GBP/USD); the Japanese Yen (USD/JPY)

and the Swiss Franc (USD/CHF).

2. 24-hour

trading, 5 days a week with non-stop access to global Forex dealers.

3. An

enormous liquid market making it easy to trade most currencies. Order are executed at

the fourth decimal point for the EURO. Example the EUR/USD

might trade at 1.4607 dollars per EURO.

4.

Leveraged trading with low margin requirements. One

of the big reasons that Forex trading is an entirely

different animal than stock trading or futures trading is leverage.

Forex trading leverage can be enormous,

as high as 400:1, and in most cases you get to choose the amount of

leverage or gearing you want to trade with.

You can control $100,000 with only $250. Hold this many EUROs, on

a move of the Euro from 1.23 to 1.249,

or 2%, and you make $2,000 from only $250. But nothing is quite

that easy, if the price drops by very much you

will automatically be sold out by your broker, unless you have a lot

more money in the account. Still, you could

easily have made many trades like this, using the tools TigerSoft

offers.

5. In some

cases, no commissions. But you have to buy from brokerage's Dealer.

Here are

some randomly selected links on Forex trading:

http://www.finweb.com/forex-trading/

http://www.traderslog.com/forex-leverage.htm

ETFs In June 2007, the Rydex Group created six more

currency-based exchange-traded funds to

add to its immediately popular EURO ETF - FXE. These

are "exchanged traded funds" which are bought and

sold on the New York Stock Exchange. These ETFs -- the

CurrencyShares Australian Dollar (NYSE: FXA),

British Pound Sterling (NYSE: FXB), Canadian

Dollar (NYSE: FXC), Mexican Peso

(NYSE: FXM),

Swedish Krona (NYSE: FXS), and Swiss Franc

(NYSE: FXF)

funds -- were created to track the price

movements of these currencies. These new creations follow

the first-ever currency ETF, the Euro Currency

Trust (NYSE: FXE), which Rydex launched at

the end of 2005. These are designed to rise in value when the foreign

currency strengthens relative to the U.S. dollar and fall

when the euro weakens.

The

ETFs do not provide any cash income. It seems they could and should. Someone

should

ask Rydex why that is. They apparently keep the

income as profit. There is also no ETF for the Japanese Yen, yot.

You will make money buying FXE (Euro Currency) when the

Euro rises versus the Dollar. This can be

demonstrated below. Compare the moves of FXE and the

EURO. For all practical purposes the EURO

and the FXE are identical. Even our internal strength

indicators (the OBV Line, the Tiger Accumulation

Index and the ITRS are very similar. The two main problems

with the FXE are that it is more thinly traded

the currency and is not traded 24 hours day. As a

result, there is slippage. You are apt to lose the

difference between the bid and ask with each and you will

have to trade only when the NYSE is open.

------------------------------------------------ EURO

-------------------------------------------------------------------------------

------------------------------------------------ FXE (Euro

ETF traded on NYSE) ---------------------------------------------

More will be added later.

http://www.cartoonstock.com/directory/s/spends.asp

|

GEORGE SOROS

GEORGE SOROS