The Government's Big Lie about The Rate of Inflation

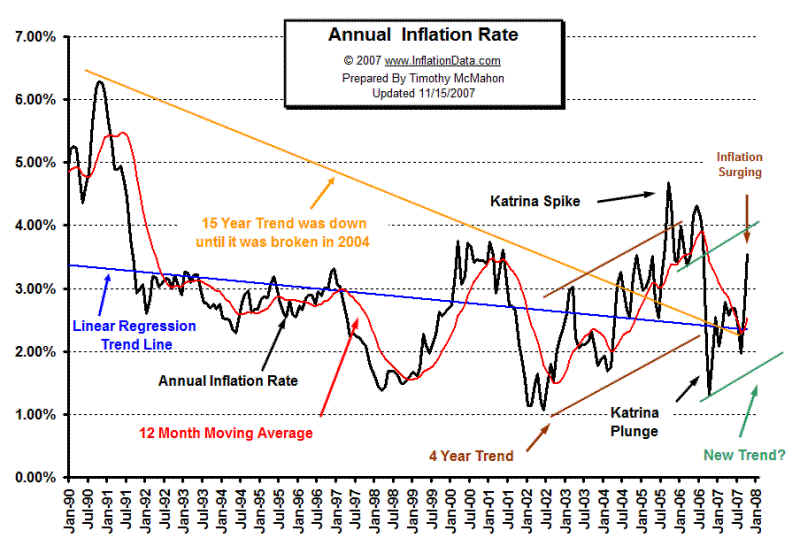

Inflation

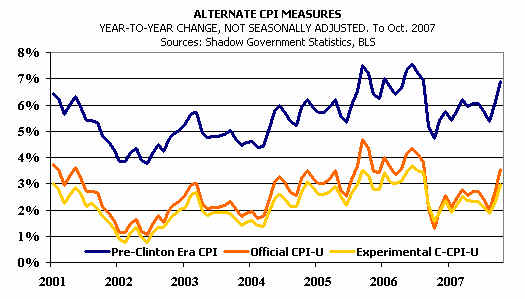

Is Now Running at 7% per year

The

Dollar Is Falling at An Annualized Rate of 8.5%.

Who

Would Buy A Treasury Bond That Pays 4.25%

How

Much Money Is The Treasury Printing?

They

Won't Say. M3<1> Is No Longer reported!

All the heads on TV

talk about how important the "CPI" is as the FED deliberates

on whether to cut rates at their next

meeting, December 11th. But the truth is that the

published CPI rate of inflation is only

about one half the real rate, as we all experience it.

And if the Government really wanted to do

something about inflation, it would stop wasting

billions and billions in Bush's insane

effort to control events in Iraqi a half a world away

from the US.

The Bureau of Labor's

Consumer Price Index understates inflation to an amazingly

high degree/ This is easy to demonstrate.

You can go to their website and see how

any amount spent back, say, in 1953, would now

cost, if the CPI were, indeed, accurate.

http://www.minneapolisfed.org/research/data/us/calc/

For example, we know that back in 1950 the cost

of 100 regular mail stamps was $3.

Now it's $41.00. Using the CPI as a

predictor, we see from the calculator that the

the price of 100 regular stamps should be only

$25.68. When I went to college in the

Fall of 1958, tuition for a year was $2,000.

Now it is $34,530. If the CPI were a good

predictor, a year's tuition would only by

$14,277. When I first moved to San Diego

in 1980, a two bed room apartment cost $315 a

month. Now the same apartment is

$1795. If the CPI meant something, the

rent should only by $789, In 1969, I remember

buying gas for $.24/gallon. Twenty

gallons cost only $4.80. The CPI predicts the

present cost to be $26.98. At

$3.00/gallon now, 20 gallons actually costs $60.00.

Well, you get the idea. The CPI by its

own calculator vastly underestimates the real

rate of inflation. The BLS may say that

medical insurance costs have risen by only

50% over the last 10 years, but I defy you to

find anyone whose insurance policy

has not doubled or tripled!

The Post Office is not

supposed to be making a profit. So either it is concealing a

lot of money somewhere, or the Bureau of Labor

Statistics is not even remotely

accurate. It turns out that first class

postal rates go up at a rate that nearly matches

"M1" (money supply). It is very significant that the Federal Reserve no

longer reveals

or publishes M1. They are

deliberately concealing the real rate of inflation. If M1

is a better estimator of inflation than

the CPI, then since 1984 the real rate of inflation

is more like 5.3% than the 2.4% figures

that the official CPI suggests.

( http://www.autodogmatic.com/index.php/sst/2006/10/04/will_the_real_inflation_please_stand_up )

Why do we care? The

difference between the real rate of inflation and that which

the government is increasing. And the

wider it gets, the less various CPI cost of living

adjustments match reality. Social Security payments and costs would actually be

much

higher if the government were honest.

Retired people heavily dependent on social

security are being deliberately swindled and

impoverished. If the government were

honest, the political pressures to raise such

benefits would be much stronger. But that

would make the deficits even greater; it would

drop the Dollar even faster and interest rates

on government bonds would surely have to be

much higher. The US Treasury would

have no choice but to tax the rich heavily or

go bankrupt! Of course, if you don't care about

such retired people, you may want to applaud

that this computational sleight of hand is probably

saving the US Treasury $200 billion a year.

The truth is the outstanding public debt in the

US is more than $9,000,000,000,000, $9 trillion

dollars! This works out to almost $30,000 per

citizen. The debt rises by $1.4 billion a

day! Maybe, the governmnent should just tell its

citizens, "You don't want the truth

because you can't stand the truth.", as Jack Nicolson did

in "A Few Good Men".

I have shown that the CPI has

been under-estimating inflation for years. But at least

the techniques used were simple enough: a fixed basket of goods were priced at prevailing

market costs for each period, and the

period-to-period change in the cost of that market

basket represented the rate of inflation.

In 1996, influenced by

Greenspan and Michael

Boskin, chief economist for Bush I, the

underestimation process got much worse. Pres-

ident Clinton sought to show Wall Street that

he did not wish to rock the boat. To do this,

he agreed to reappoint Greenspan and he signed

into law basic revisions in the way the cost

of living was calculated. This helped

fuel the bull market from 1997 to 2000.

How

The CPI Is "Cooked"!

1.

Substitution - if the cost of beef rose substitute the price of chicken which

hadn't.

When

new car prices rose the BLS used car prices were substituted.

(

See http://www.bls.gov/cpi/cpifacuv.htm

) When real estate prices rose, more weight

is

given to the cost of renting which has not increased.

"The Boskin/Greenspan argument

was that when steak got too expensive, the consumer

would

substitute hamburger for the steak, and that the inflation measure should reflect the

costs

tied to buying hamburger versus steak, instead of steak versus steak. Of course,

replacing

hamburger for steak in the calculations would reduce the inflation rate, but it

represented

the rate of inflation in terms of maintaining a declining standard of living.

Cost

of living was being replaced by the cost of survival. The old system told you how

much

you had to increase your income in order to keep buying steak. The new system

promised

you hamburger, and then dog food, perhaps, after that. "

(

John Williams at www.shadowstats.com )

2.

Weighting - They went from an arithmetic weighting to a geometric

weighting. The

Boskin/Greenspan

benefit of a geometric weighting was that it automatically gave a lower

weighting

to CPI components that were rising in price, and a higher weighting to those items

dropping

in price.

3.

Hedonics - Example. A specialist at the BLS decided that when a new

27" TV

model

came out with new features and still sold for the same price of $329.99,

because

of the added value the TV was now worth $194 when entered into the BLS data,

despite

the fact that people had to pay $329.99. As new computers get more powerful,

their

cost is reduced in calculating the CPI, even though the consumer pays just as much.

If

the government requires a new additive to gasoline that costs 10 cents, the CPI

deducts

that cost.

These rules were designed to

dramatically lower the appearance of inflation. And they do

just that. The real

costs of housing, energy, food, medical bills, prescription drugs, tuition,

travel and entertainment rise

much faster than the government admits.

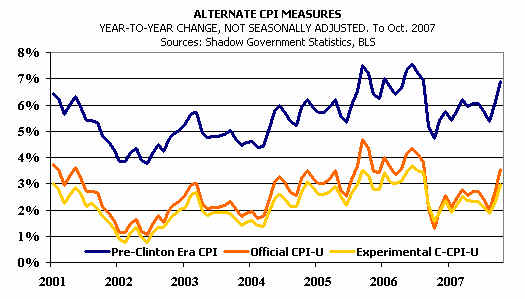

If

the CPI was calculated in the pre-1996 manner, the rate of inflation since then is 6%

not the 3% the government reports.

( Source: http://www.theleftcoaster.com/archives/004721.php )

The government is now being pushed

to resort to phrases like: "excluding volatile food and

energy".

( http://www.shadowstats.com/cgi-bin/sgs?

)

The

BLS current web page says that 2006 inflation is lower than it was in 2005.

How misleading!

(

http://www.bls.gov/opub/mlr/2007/05/art1abs.htm

)

|