TigerSoft

New Service

TigerSoft

New Service BANKERS' "PUMP AND DUMP" =

WATCH OUT, SMALL INVESTORS!

10/31/2009 TIGERSOFT/PEERLESS HOTLINES:

SAMPLES FROM THIS WEEK

Tiger Index of Low Priced Stocks: 2008-2009

BE WARY OF BANKERS' DUMPING STOCKS

THEY BID UP WITH YOUR MONEY

by William Schmidt, Ph.D. (Columbia University)

Since March 2009, many low-priced stocks have risen 1000% or more. This always

ends badly. See the Blog I wrote in June: The Great 2009 Bull Market. At that point

50 stocks were up more than 400% from the bottom. Now these "pump and dump"

low-priced stocks are breaking down. Mayber, there's another rally still for them.

But considering the size of their advance and how much money the Fed and Treasury

have already given banks, I seriously doubt if the rally is sustainable. The evidence

is too strong that the banks have used the money to play the stock market and

not make loans to Main Street.

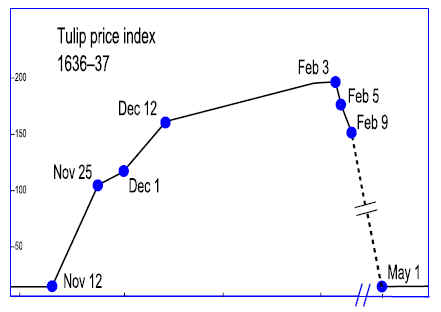

These binges always end bandly. The 1999-2000 net and biotech bubble is still in

most traders' memories. Oil stocks are particularly susceptible and vulnerable to

wild swings up and then DOWN. I was weaned on the 1968 speculative market "

in low priced and tech stocks. Investors should not fall in love with high-fliers.

But they do. Just as economic power is subject to an iron law than destroys

competition and creates monopolies, so to there is an iron law that produces

speculative booms and busts. Both of these iron laws reinforce each other unless

the government aggressively intervenes. Conservative free-trade promoters have

not figured this out.

1968

| Company | 1968 High | 1970 Low | % drop | P/E at High |

| Fairchild Camera | $102.00 | $18.00 | -82% | 443 |

| Teledyne | 72.00 | 13.00 | -82 | 42 |

| Control Data | 163.00 | 28.00 | -83 | 54 |

| Mohawk Data | 111.00 | 18.00 | -84 | 285 |

| Electronic Data | 162.00 | 24.00 | -85 | 352 |

| Optical Scanning | 146.00 | 16.00 | -89 | 200 |

| Itek | 172.00 | 17.00 | -90 | 71 |

| University Computing | 186.00 | 13.00 | -93 | 118 |

|

|

UNDISCLOSED SPECULATING WITH OTHER

PEOPLE'S MONEY IS CRIMINAL

Theodore Dreiser wrote a

novel, "The FInancier", more 70 years ago in

which a banker uses his connections to borrow

big sums from a city government

to buy stock with an interest rate of 0%.

He takes the stock he buys and uses

it as collateral to buy more stock, thereby

pushing up his stocks' prices. As prices

rise, his collateral rises. So he borrows

more and invests more. When a financial

panic comes, he loses everything. He

cannot pay the city back and actually goes to jail.

The only difference now is that no one from

Goldman Sachs will ever go to jail, even

though they are using the money they have

borrowed from taxpayers and the US

Federal Reserve to trade in and out of stocks

electronically.

One of the lessons of the stock market collapse of 87% from September 1929

to July 1932, should have been that banks not

not be allowed to buy stocks and sell

stocks and bonds. When banks become

brokerages, you get the situation

where their mortgages are packaged with

"AAA" ratings and sold to the innocent

and unsuspecting. Particularly galling,

Goldman knew it was selling junk when

it sold $40 billion in mortgages in 2006 and

2007. Why else would it simultaneously

buy $14 billion in CDS from AIG and set up a

$10 short-selling hedge?

"The Securities and Exchange Commission

should be very interested

in

any financial company that secretly decides a financial product is a loser

and

then goes out and actively markets that product or very similar products

to

unsuspecting customers without disclosing its true opinion," said

Laurence

Kotlikoff, a Boston University economics professor who's proposed

a

massive overhaul of the nation's banks. "This is fraud and should be prosecuted."

(

Source )

Such

leverage, power and fraud are always very dangerous to the overall economy,

which depends on confidence, and disastrous to

politcal democracy. Fraud, corruption,

booms and busts were bound to follow banking

de-regulation. But the hard fought

Glass Steagall

1930s' legislation that denied banks the right to become stock

brokerages and investment banks was torn down.

American regulators, Congressmen,

Fed Chairmen and Presidents all ignored the lessons

of history, just as now. Now we

must be prepared again to pay for their

well-rewarded, convenient and venial amnesia.

( Sources )

A year ago, it was obvious to me and millions of Americans that giving a trillion

dollars unconditionally to the biggest, most corrupt

bank monopilies was just

yet another plan, like the

Iraq War, to rob the exhausted US Treasury utterly bare.

We predicted the banks would not use the money to

make new loans or cut homeowners

a break. Banking executives feel a

bewildering sense of sense of entitlement

considering how badly thgeir decisons laid low the

world economy in 2008.

Now,

we are about to see what will happen when the reality of economic

stagnation and widespread depresion conditions

on Main Street overtake the

schemes and machinations of the Wall Street

wizzards that have artificially

bid stocks up so much so quickly on such light

volume.

Goldman

admited it manipulates market when the

compute program it used to do this

was strolen. And until recently, the NYSE

and NASDAQ reported how extensively

member firms were trading for their own

account. Goldman Sachs' share of principal

NYSE trading has gone from 27 percent at the

end of 2008 to fully 50 percent of trades

in the second quarter. This is 20% of all

NYSE trading. Eliot

Spitzer and Blogs such

as

Zero Hedge have been using NYSE data to argue

that Goldman Sachs now has an

almost unfettered ability to control stock

prices. IIn

July, the NYSE bowed to Goldman.

It

now refused to publish this information any longer.

See also

Goldman Sachs: "Engineering Every Major Market Manipulation Since The

Great Depression" (GreenLightAdvisor Views, 6/26/09)

Goldman Sachs: Manipulation Kings of the Market? (Market folly,

6/25/09)

Goldman Sachs Trading Source Code Stolen (The Swamp Report, 7/6/09)

Taibbi

v. Goldman - round 2 (The Swamp Report, 6/30/09)

McClatchy: http://www.mcclatchydc.com/227/story/77791.html

How Moody's sold

its ratings — and sold out investors

Firms are getting

billions, but homeowners still in trouble

Watchdog: Obama's

mortgage relief efforts aren't good enough

Where did that bank

bailout go? Watchdogs aren't sure

Worse than

subprime? Other mortgages imploding slowly

Banks fight to kill

proposed consumer protection agency

Why haven't

any Wall Street tycoons been sent to the slammer?

Nothing good will come out of the enrichment of each Goldman Sachs employees

to the tune of an average 2009 bonus of

$700,000. American home-owners are still

defaulting in record numbers, real unemployment

is over 15% and the only light at the

end of the tunnel is the train of Depression

coming closer and closer. Ordinary

consumer buying power is hardly making a

recovery, except where the Government

has offered temporary tax subsidies.

Without a national job program and guarantee

and without a much more equal distribution of

wealth, it sure looks like we are

doomed to re-live the 1930s, at worst, or the

1970s, at best. Both eras were

dismal. For investors, they put a premium

on market timing, as stock prices

periodically rose and then collapsed

(1929-1932, 1937-1938, 1966, 1969-1970, 1971,

1973-1975, 1977-1978, 1978, 1979, 1980,

1981-1982). For workers, there were lay-offs,

hiring freezes and chronically high

unemployment. For seniors, the collapsing Dollar

meant harder and harder choices as their

depreciated savings ceased to cover their

rent, food and medicines.

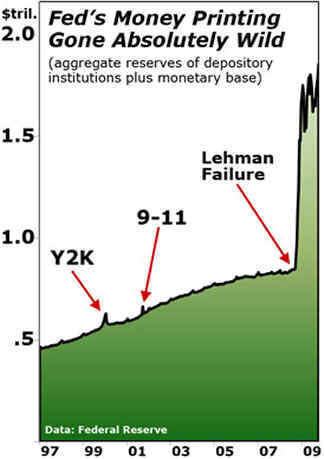

The Federal Reserve under Bernanle has pumped into banks much, much more

liquidity than we have ever seen. Such

Fed infusions also took place from October

1999 to January 2000 (laying the basis for an

even bigger internet bubble and bust);

after the September terrorist attack on New

York (which resulted in a 7 month

bear market rally that ended in April 2002 and

was followed by a big decline until

March 2003. "Up until the day Lehman Brothers collapsed in

September of last year,

it took the Fed a total 5,012 days

— 13 years and 8 months — to double the cash

currency and reserves in the coffers of

U.S. banks. In contrast, after the Lehman

Brothers collapse, it took

Bernanke’s Fed

only 112 days to double the size of U.S.

bank reserves. He accelerated the pace of

bank reserve expansion by a factor of 45 to 1.

http://www.marketoracle.co.uk/Article13574.html

MAJOR SELL "S12" FROM PEERLESS

10/31/2009 TIGERSOFT/PEERLESS HOTLINES:

SAMPLES FROM THIS WEEK

(C)

2009 www.tigersoft.com

Call 858-273-5900.

Email us: william_schmidt@hotmail.com

About Us

Below is the current Peerless chart, 10/30/2009, and below are recent Hotline

comments and recommendations to show you how we judge the market

as of this date.

TigerSoft and Peerless Daily Hotline

10/29/2009

===> Order form to Renew On-Line, "Nightly Peerless/TigerSoft Hotline " ($298/Year)

MAJOR SELL

We recommend using Peerless Stock Market Timing to judge the

trend of the general market. That will also tell you the likely

direction

of your stock, because most stocks rise and fall with the general market.

Here is the current Peerless chart of 10/30/2009. You can see the most

recent signal is a Sell. We do a Hotline each night, to tell users and

subscribers

what we take to be the direction of the market and where it is apt to go

on an intermediate-term basis. It shows the current chart and then

gives

the perspective we have on the market after considering Peerless, TigerSoft,

chart patterns, historical parallels, seasonality and internal strength

indicators.

The Hotline also makes occasional specific recommendations.

BE WARY OF BANKERS' DUMPING STOCKS

THEY BID UP WITH YOUR MONEY

10/29/2009 Sell S12 Operating.

Only A Technical Bounce.

QQQQ Is Still below Resistance of Its 21-Day.

I probably should have awaited for the DJI and QQQQ to break their 50-day ma

before becoming to Haloweenish last night. The fact is that

though volume has been weak and

the S12 shows distribution, breadth has been constructive,

There was no Sell S9 signal.

And it is possible if the P-Indicator does not deteriorate much, we may

get a Buy B9 in a week

or two. None can occur for two weeks after a Sell S12.

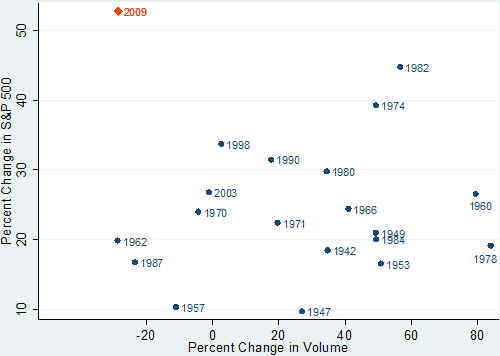

I came across an interetsing chart today. It shows that the 6

month advance in

the DJI is the highest of any new bull market on the lowest and most

negative volume.

Breadth has saved the rally thus far. Perhaps, it will still.

The shallower uptrend

of the NYSE has not yet been violated. The creator of the chart below states that

"if you think of volume as fuel for any

sustainable market rally, then we’ve been

running

on fumes for a few months."

6 Month Gain and 6 Month

Change in Volume

The DJI rebounded 100 today as it

turned up from a little above its rising 50-day ma.

The ratio yesterday of NYSE advances to declines was 1 to 9.

Today's ratio was 4.8 to 1.

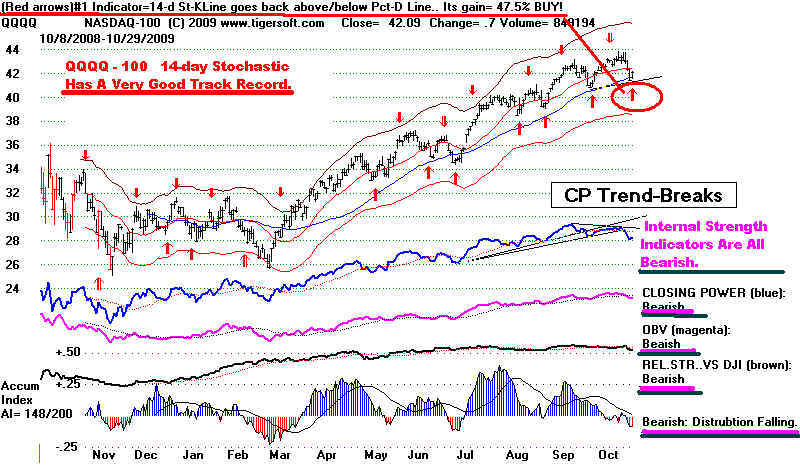

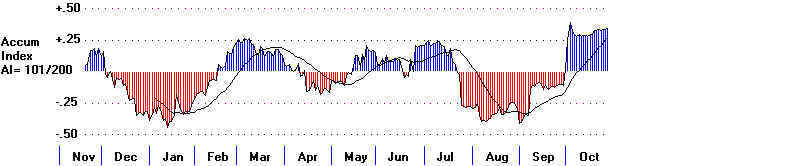

Volume was lower than yesterday. The QQQQ (chart below) was

typical of the long general market

ETFs. After four staight down days, it rose today and gave

a red optimized Stochastic Buy based

on the short-term 14-day Stochastic. The bounce occurred

just where one might look for

one, up from the rising 50-day ma. How far will it advance.

It is still below the resistance

of its now flat red 21-day ma. Most important, all

its key internals are rated "negative' by

the Tiger program. I

QQQQ Internals:

1. The Blue Closing Power is below its

falling 21-day ma.

2. The Magenta OBV is below its falling

21-day ma.

3. The Brown Relative Strength Quotient

is below its falling 21-day ma.

4. The Accumulation Index is Red

(negative) and below its fall 21-dma.

5. The Tiger Dat Traders' Tool is below

its falling 21-dma.

Gold (GLD) rembounded from

the 100 breakout point. The Dollar Fell back from its falling 50-day ma

I would say GLD is at a good buy point again. See the chart

below.

DJI rebounds like we saw

today (10/29/2009) from a rising 50-day ma are normal.

But they do not mean a

big recovery. Below are the historical cases most resembling

the current S12. I have posted in immediately below what the DJI did after the S12

upon

first reaching the rising 50-day ma. Brief bounces do occur. But they

are meaningless

from an intermediate-term perspective because the lower band was always soon hit.

10/28/200 Sell S12 Operating. Bankers' Pump and Dump.

The lower band at 9500 is the first

downside target for the DJIA. Today's DOW closing

below the support of its 21-day ma

invites such a test after the SELL S12. As I showed

yesterday, a deeper decline is more

typical after a bull market S12 with negative OPCT

readings on the last peak.

Confirming that prognosis, the DJI fell 120 today and the rest

of the market dropped even harder.

Downside volume on the NYSE was 10 times

Upside volume. It's been six months

since the number of NYSE advancers was this

low. The number of new lows on the

NYSE was only 11 and on the NASDAQ was only 33.

So, at this stage, what is happening is

that a great many stocks are viciously and quickly

breaking down below their 50-day ma.

They are slicing through this usual support as though

it was non-existent. And, in fact,

it may not be. That is what happens in a classic "pump and

dump". The stock is mostly

dumped on the way down to investors who think that they

are gtting a bargain.

Dumping like this is dangerous.

It reminds me of the classic "Pump and Dump"

manipulation.

This time it is being done by the

likes of Goldman Sachs. JP Mortgan and Bank of America.

So, not only did these banks

"steal" (in my opinion, that is the only word that applies) trillions

from the general public with the

help of Paulson, Geitner and Bernanke, now they are

dumping the over-priced stocks they

recklessly bid up onto the very same people who bailed them

out. What gratitude! No

wonder Glass-Steagall forbad commercial banks for 80 uears from

being investment banks and

brokerages. If I am right, when the whole story comes out about

this "Bankers' Pump and

Dump", buy the stock in the company that makes pitch-forks!

Reading about Pump, Dump and Bankers:

Reading about Pump, Dump and Bankers:

Coming

Soon: More Scandals. Dec. 1, 2005

Criminal Environment Is Created by US Government

Jan. 12, 2005.

Does

Goldman Manipulate The Stock Market?

About that stock

manipulation software Goldman Sachs owns ...

Manipulation

is rife on stock markets « melange

Goldman

Sachs Market Manipulation Dominance at Risk by Theft

THE RISKS OF HOLDING SEEM QUITE HIGH

Technically, the rapid falling below the

50-day ma on very high volume is a clear warning.

Normally, it can be taken as just a

warning unless the stock's Accumulation

Index readings are negative. Then

it must be taken as a SELL, especially when

market conditions look artificial and

over-extended, as now. I think the low volume rallies

and the NYSE own statistics show that the

advance has been pushed up artificially by

banks with public funds. But just

given how far the market has risen, how there has not

been a double-bottom and the history of

the type of Sell S12s we just had, I believe such breaks

in particular stocks make then necessary

and reasonable Sells. There is too much risk not to sell.

A closing below their 65-day ma is more

emphatically a Sell. Use that if you want to be surer.

I think that is what is coming.

If selling is too hard emotionally to do or because you want profits to be

postponed for tax

purposes, then buy some of the leveraged

ETF puts I mentioned last night. This is the approach

I have taken on our Stocks' Hotline.

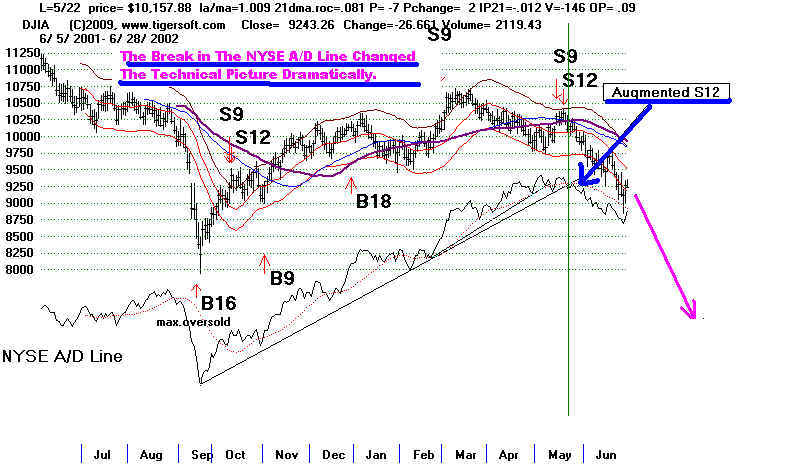

I want to show some typical NASDAQ-100

stocks back in 2002 after the 7 month's uptrending

A/D Line then was broken. See how

quickly these stocks caved in when the NYSE Advance-

Decline-Line was broken then. So

far, only the steeper Advance-Decline Line has been broken.

But with prices and the A/D Line up so

much and so over-extended, it is usually best to employ

the steeper uptrend.

FIRST, NOTE HOW THE BREAK IN THE A/D LINE UPTREND ON 5/22/2002

CHNAGED THE TECHNICAL PICTURE OF THE MARKET DRAMATICALLY.

SECOND,

SEE HOW THESE STOCKS COLLAPSED AFTER 5/22/2002.

Not shown here, QQQQ

fell from 31.40 to a low of 20 five months later.

AAPLE fell from 12 to 7 in 3-4 MONTHS

ADOBE FELL FROM 18 to 9...

CSCO FELL FROM 16 to 9.

10/27/200 Sell S12 Operating.

The Peerless Current Sell S12 is made more bearish by the fact that as the

Sell S12 was occurring, the OPCT was

negative. Since 1928, there have only been six cases

of an independent Sell S12 with a

negative OPCT while the DJI had been in a sustained

uptrend and was above a rising 65-day ma.

The average decline was 12.7%. If you are

bullish still, it is important that the

DJI now NOT drop below the lower 3.5%-4.0% lower

band. We can hope that the

bullish period after the third week of November prevents a

bigger decline, for the sake of all those

that are already jobless.

The research I did tonight on the HOTLINE suggests a 13% decline in the DJI if past

volatility applies. This past year's

volatility has been twice to three times greater. We do not want

to be in stocks that will eventually sell

off as confidence erodes. In additon to selling thinner

stocks that have run up a long ways, look

at the ETFs that allow aggressive leveraged short

selling, Two criteria can be used:

1) high levels of Accumulation and 2) the surpassing the 50-day

ma. TigerSoft Data permits

downloading the large number of leveraged short ETFs.

Here are the ones that look the most

interesting as purchases, either to hedge portfolios

or to be aggressively short: RWM

47.86, SBB 42.37, EFZ 60.16 - IP21= + .34 and

EWV 52.74 and SSG 24.28

Parallel SELL S12s' Statistics

Cases since 1928 Most Resembling Current Sell

S12 with negative OPCT.

.

Formula:

(On-Balance-Volume Pct = 21 days' OBV/Volume for 21 days)

Cases Most Resembling Current S12 with

negative OPCT.

Here they are:

Outcome:

1.

8/24/38

143.50 Fell immediately,

reaching 129.90 below lower band a month later. OP= -.174

10% decline.

2.

7/11/1968

922.82 Fell immediately, reaching

870.37 and lower band 3 weeks later. OP= -.008

10% decline.

3.

4/1/1981 1014.14 Rose to 1024.05 and fell to the lower band in a month, 963.33

-.052

This started the 1981-1982 bear market.

20% decline.

4.

1/6/1983

1070.92 Rose

to 1083.79 and fell to the lower band in 3 weeks, 1030.17 -.134

6% decline.

5.

1/6/1984

1286.64 Immediately declined below lower

band to 1134.63 on 2/23/1984 OP= -.154

16% decline.

6.

12/8/2000

10712.91 Fell immediately to lower band,

10487.29, on 12/21/2000

and then below lower band to 9389.48, on 3/22/2000 OP= -.156

14% decline.

Rallies after, and paper losses from, these Sell S12s occurred only in 2 of the 6

cases

and were by less than 1.5%.

In these cases, no clinching is needed apparently. What

is more to the point now is that in

5 of 6 cases the DJI eventually fell substantially

below the lower band. The lower band support is very important. You can see this

in the 1981 chart below.

1981 Sell S12

Completed S12 Statistics: 1928-2009

Rising Markets:(above 65-dma): S12s with

no Near-By S4,S6, S9

------------------------------------------------------------------------------------

6/12/35 117.1

Reversal loss -8.7% OP= +.072

Avoided using A/D Line trend-break clinching.

6/24/35 120.

Reversal loss -6.1% OP= +.067 Avoided

using A/D Line trend-break clinching.

7/27/38 140.20

fell directly to 136.90 and lower band. OP= +.014

8/5/38

144.50 fell

directly to 136.90 and lower band. OP= +.028

1. 8/24/38

143.50 Fell

immediately, reaching 129.90 below lower band a month later. OP= -.174

3/16/1967 868.49

fell directly to 842.43 .025 lower band

in 3 weeks. OP= +.017

4/21/1967 883.18

Rallied to 899.89 and fell below

lower band in a month, 899.89. OP= +.179

9/14/1967 929.44 Rallied to

937.18 and fell below lower band in 6 weeks to

850. OP= +.109

1/9/1968 908.29

Rallied to 900.24 and fell

below lower band in 19 weeks to 825. OP=

+.158

2. 7/11/1968

922.82 Fell immediately, reaching 870.37 and

lower band 3 weeks later. OP= -.008

10/21/1975 846.82 Rallied

to 860.67 and then fell slightly below lower band, 793.80, on

9/30/75 .OP= +.125

7/17/1978

839.05 Fell only to 21-dma

immedately and then rallied OP= +.051

9/11/1978 907.74

Declined

to lower band at 857.16 in 7 trading days and rallied OP= +.187

3. 4/1/1981

1014.14 Rose

to 1024.05 and fell to the lower band in a month, 963.33 -.052

4.

1/6/1983 1070.92 Rose to 1083.79 and fell to the lower band in 3 weeks, 1030.17

-.134

5. 1/6/1984

1286.64 Immediately

declined below lower band to 1134.63 on 2/23/1984 OP= -.154

10/7/1997 8178.31 Immediately declined below lower band to 7161.15 on 10/27/1997 OP= +.118

6/18/1999 10855.55

DJI rallied to 11300 in 2 months before falling to 10019.71 on

10/15/1999 OP= +.046

7/17/2000 10804.27 Fell immediately to 10511.17 on 7/28/2000,

then rallied to 11259.87 on 9/7/2000 and

then fell to 9975.02 on 10/18/2000

OP= +.193 and OP= +.12 on 2nd S12 two days later.

6.

12/8/2000 10712.91 Fell

immediately to lower band, 10487.29, on 12/21/2000

and then to 9389.48, on 3/22/2000 OP= -.156

10/15/2009 10062.94 (Dial

Data corrected data) OP= -.07

10/21/2009 9949.36 (Dial Data

uncorrected data) OP= -.208

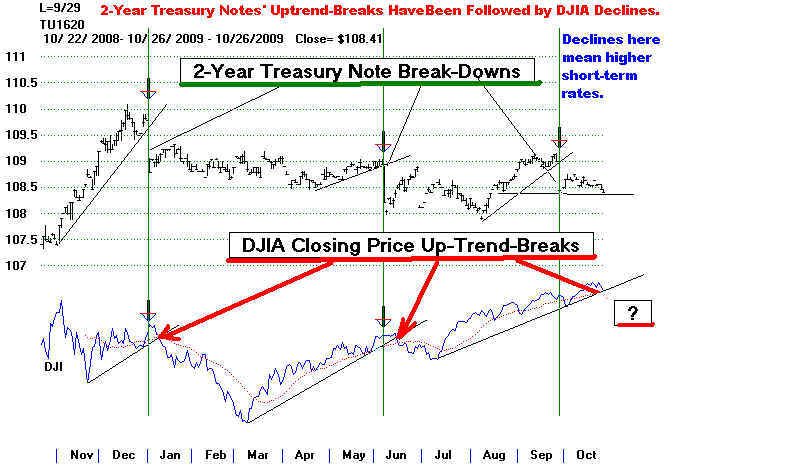

10/26/200 Sell S12Clinched... Be Wary of Trap-Door Declines.

We have an "Isolated Sell 12" in a

rising market. How bearish are these? We have to also

consider

the values of the OPct. At the time of the recent Sell S12 on 10/21/2009, the OPCT

was -.20.

and IP21=.004. It will take some effort to put all the data together. This

will appear

in the next

day. Early returns suggest the S12 and a negative Opct are a reliably bearish

combination. While there is always a chance for a recovery now that the

DJI is back to its

21-day ma,

S12s usually produce deeper declines, especially when the volume indicators

are

bearish, too.

Watch the Dollar.

If it rises and breaks its downtrend, it probably means that the FED will

raise

interest rates a point or two. Banks might then sell the stocks they speculated with

so cheaply

at tax payer expense, rather than make loans. Such expectations go a long way

in

explaining the mix of profit-taking, shorting and the the faltering breadth on the NYSE.

The same

message is being signalled by the way some gold and silver stocks now show

unusually

high distribution and are now falling. See NEM and SSRI. There was a

reason

they could

not make new highs when the Gold

ETF did. If a stock can't make a new high

with

such background fan-fare, it usually has to decline to recharge. I

remind you that

advances

by gold are very often followed by a swooning stock market.

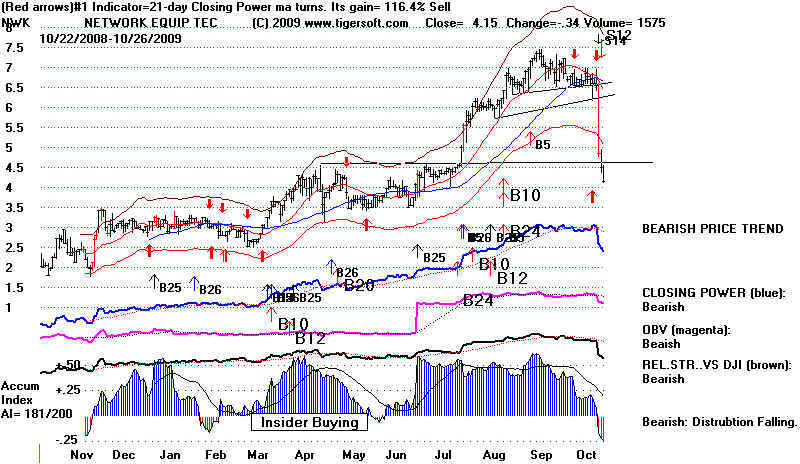

Another

thing to watch is how well stocks that show a lot of Blue Accumulation

do as their

prices fall to the key 50-day ma. If many of these stocks sell off like

NWK just did, wouldn't this

suggest that big money is very skittish. And that would

not be a

good sign. They probably fear that a deeper retest of the lows will be needed.

Indeed,

"V" bottoms are relatively scarce.

Price Pot-Holes Point To Problems in The Market

Serious Break Downs In High Accumulation Stocks Are

Worrisome.

If these high

Accumulation stocks don't hold up, is big money getting nervous again.

Were these stocks

just pumped up only to be dumped on the unspuspecting public on the way down.

Here are some

high Accumulation stocks to watch that have broken their 50-day ma:

AMCS, ATRI, ATSI, BAMM, CAVM, CRED, MEDQ, SMRT

Some interesting

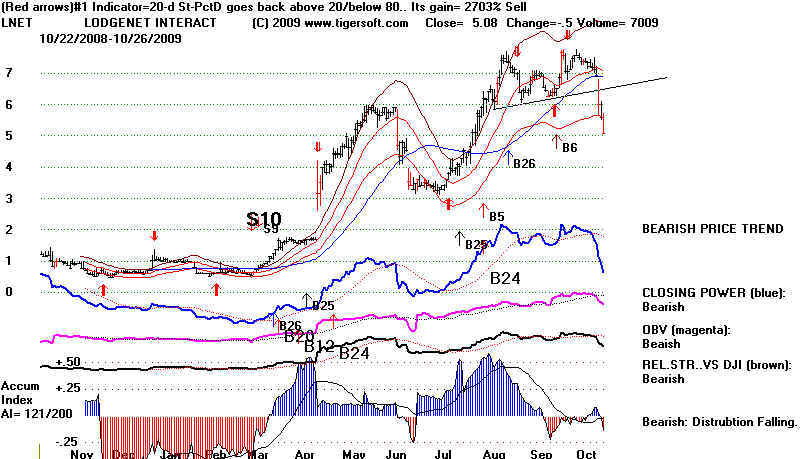

shorts are AAI, ARQL, ASFI, AYR, BAC, CAL. CSFG, LNET, SMRT

10/23/200

Sell S12 --- WATCH THE A/D LINE OF THE NYSE.

The excellent breadth has kept the 7 month 2009

rally going long beyond

where a simple

study of daily volume might have thought possible, so low was

the volume on

much of the rally since March.

But now we should

ask: "What will happen if the good breadth ends?"

The growing

investor optimism and the stock market's direction and apparent

safety may change

rather sharply. To see this, I suggest looking at the reversal

upon the

occurrence of a clinched Sell S12 in early 2002. The break in the long

NYSE A/D Line

uptrend was the light switch! That was also when interest rates were

kept artificially

low after the 9/11 attack. Of course, 2002 saw the run-up to a new war.

Had Bush,

Cheney or the CIA Director been of a different mind, my guess is the

2002 DJI decline

would have been much more shallow.

2002 Top and Clinched Sell S12.

A PICTURE IS WORTH A THOUSAND WORDS