QUICKSILVER RANKING OF LEVERAGED ETFS:

Annualized 5-day ma Rankings.

When to sell these? The

best approach still remains the changing direction of

the 5-dma. However, when you have a nice profit, watch for

higher red Volume, too.

You may also want to use our Day Traders rules with the highest

ranked. Today

saw quick overnight turn-arounds back up for many foreign ETFs,

presumably because

of Oil's crossing back above its 65-fma.

03/21/16

Short-term traders:

Most Bullish = Best (fastest rising) with Confirming IP21>.19, rising Opening & Closing Power

and Bullish Volume. none qualify

===================================================================================

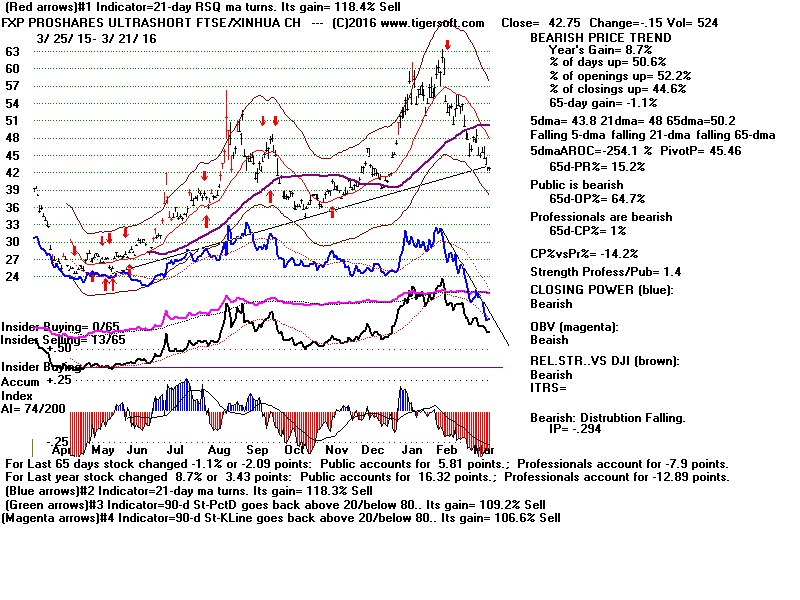

Most Bearish = Best (fastest falling) with Confirming

IP21<-.19, falling Opening & Closing Power

and Bearsh Volume. FXP

C:\leverage - 03/21/16

5DAROC Symbol Last 5-dma Pivot Change

..............................................................................................

IP21 AI/200 OP-PWR CP-PWR PCT-Up Daily Vol. notes

=============================================================================================

1131.6 JNUG 80.84 76.8 66.02 .93

-.03 103 Rising Rising .49 vol.fell on up-day

---------------------------------------------------------------------------------------------

982.3 UWTI 27.95 25.87 21.74 .85

.23 63 Rising Rising .422 vol.fell on up-day

---------------------------------------------------------------------------------------------

975.5 NUGT 66.18 64.7 57.36 -.14

-.03 91 Rising Rising .506 vol.fell on down-day

---------------------------------------------------------------------------------------------

767.3 BRZU 21.13 18.54 14.95 .33

.38 109 Rising Rising .462 vol.fell on up-day

---------------------------------------------------------------------------------------------

712.7 GDJJ 51.8 50.36 45.54 -1.21

-.09 53 Rising Rising .398 bearish

---------------------------------------------------------------------------------------------

660.9 UCO 10.65 10.09 8.97 .22

.28 61 Rising Rising .426 vol.fell on up-day

---------------------------------------------------------------------------------------------

654.2 GDXX 43.79 43.13 39.66 -.23

-.11 62 Rising Rising .474 bearish

---------------------------------------------------------------------------------------------

642 LBJ 17.92 16.37 13.89 .2

.43 92 Rising Rising .458 vol.fell on up-day

---------------------------------------------------------------------------------------------

501.7 EDC 12.93 12.3 11.21 .1

.32 112 Rising Rising .486 vol.fell on up-day

---------------------------------------------------------------------------------------------

454.2 INDL 11.89 11.21 10.36 .42

.47 81 Rising Rising .506 vol.fell on up-day

---------------------------------------------------------------------------------------------

451 USLV 14.01 13.65 12.65 .1

-.15 94 Rising Falling .49 vol.fell on up-day

---------------------------------------------------------------------------------------------

442.7 SOXL 26.94 25.86 24.55 .13

.36 119 Rising Rising .538 vol.fell on up-day

---------------------------------------------------------------------------------------------

420.2 UBR 40 36.66 31.78 .63

.4 113 Rising Rising .474 vol.fell on up-day

---------------------------------------------------------------------------------------------

394.9 ERX 25.04 24.56 22.98 -.32

.38 90 Rising Rising .478 vol.fell on down-day

---------------------------------------------------------------------------------------------

375.3 UMX 26.35 25.15 23.57 0

.02 36 Rising Falling .233 ?

---------------------------------------------------------------------------------------------

362.8 YINN 14.32 13.84 13.1 .06

.23 145 ? Rising .478 vol.fell on up-day

---------------------------------------------------------------------------------------------

351.1 TECL 37.77 36.96 35.56 .38

.42 117 Rising Rising .526 vol.fell on up-day

---------------------------------------------------------------------------------------------

337.2 UDOW 66.26 64.47 62.22 .23

.35 125 Rising Rising .514 vol.fell on up-day

---------------------------------------------------------------------------------------------

329.5 AGQ 34.75 34.13 32.37 .14

-.11 76 Rising ? .486 vol.fell on up-day

---------------------------------------------------------------------------------------------

308.9 UXI 114.78 112.07 107.94 -.33

.6 155 Rising Rising .422 ?

---------------------------------------------------------------------------------------------

308.5 UYM 38.88 38.06 35.83 -.32

.28 118 ? Rising .482 vol.fell on down-day

---------------------------------------------------------------------------------------------

270.6 FAS 24.9 24.27 23.5 -.09

.29 130 Rising Rising .51 vol.fell on down-day

---------------------------------------------------------------------------------------------

266.4 EET 49.02 47.6 44.81 0

-.28 96 Rising Rising .47 ?

---------------------------------------------------------------------------------------------

259.6 DAG 3.58 3.5 3.48 .08

.07 26 Rising Rising .438 vol.fell on up-day

---------------------------------------------------------------------------------------------

258.5 DIG 32.23 31.85 30.48 -.26

.32 95 Rising Rising .462 vol.fell on down-day

---------------------------------------------------------------------------------------------

246.1 XPP 43.05 42.06 40.51 .1

.26 125 Falling Rising .494 bullish

---------------------------------------------------------------------------------------------

236.4 UPRO 62.53 61.25 59.39 .23

.36 125 ? Rising .506 vol.fell on up-day

---------------------------------------------------------------------------------------------

235 ROM 77.64 76.45 74.28 .43

.35 131 Rising Rising .522 vol.fell on up-day

---------------------------------------------------------------------------------------------

229.2 DDM 65.97 64.72 63.23 .23

.34 140 Rising Rising .526 vol.fell on up-day

---------------------------------------------------------------------------------------------

217.3 COPX 15.15 14.62 13.63 .03

.3 54 Rising Rising .462 vol.fell on up-day

---------------------------------------------------------------------------------------------

208.3 DYY 2.5 2.42 2.4 .1

.34 56 Rising Rising .309 bullish

---------------------------------------------------------------------------------------------

207.6 USD 82.5 80.1 77.46 -.2

.29 105 Rising Rising .502 bearish

---------------------------------------------------------------------------------------------

197.2 TQQQ 98.72 97.08 94.86 1.16

.31 128 Rising Rising .51 vol.fell on up-day

---------------------------------------------------------------------------------------------

192.4 URTY 65.13 63.1 59.75 -.59

.31 111 Falling Rising .486 vol.fell on down-day

---------------------------------------------------------------------------------------------

185.6 TNA 55.7 53.99 51.24 -.46

.26 111 Falling Rising .478 vol.fell on down-day

---------------------------------------------------------------------------------------------

184.7 DRN 80.13 80.71 77.29 -2.31

.26 122 Rising Rising .526 bearish

---------------------------------------------------------------------------------------------

172.9 UYG 64.82 63.75 62.42 -.22

.22 110 Rising Rising .51 vol.fell on down-day

---------------------------------------------------------------------------------------------

168.7 YCL 62.92 62.64 61.7 -.33

-.02 112 ? Rising .422 bearish

---------------------------------------------------------------------------------------------

162.2 BIS 45.53 47.45 47.45 -1.84

-.02 100 Rising ? .494 bearish

---------------------------------------------------------------------------------------------

160.1 SSO 63.41 62.54 61.29 .16

.32 117 ? Rising .51 vol.fell on up-day

---------------------------------------------------------------------------------------------

151.3 URE 108.01 108 104.75 -1.62

.28 111 Falling Rising .522 vol.fell on down-day

---------------------------------------------------------------------------------------------

138.7 UWN 2.16 2.17 2.16 -.02

.07 109 Falling Rising .442 vol.fell on down-day

---------------------------------------------------------------------------------------------

135.4 QLD 72.03 71.24 70.08 .52

.39 139 ? Rising .518 vol.fell on up-day

---------------------------------------------------------------------------------------------

133.2 UPW 115.56 115.05 112.5 -.6

.05 109 Rising Rising .522 bearish

---------------------------------------------------------------------------------------------

121.4 UWM 73.46 71.98 69.47 -.5

.34 142 Falling Rising .482 bearish

---------------------------------------------------------------------------------------------

115.9 ULE 16.47 16.46 16.11 -.06

.08 153 Falling Rising .49 bearish

---------------------------------------------------------------------------------------------

92.3 EURL 21.85 21.73 20.92 -.29

.28 143 ? Rising .458 vol.fell on down-day

---------------------------------------------------------------------------------------------

82.4 UCC 105.72 104.68 104 .74

.37 185 Rising Rising .49 bullish

---------------------------------------------------------------------------------------------

73.9 UGL 40.37 40.71 39.7 -.51

-.12 109 Rising Falling .458 vol.fell on down-day

---------------------------------------------------------------------------------------------

62.2 EWV 52.11 52.36 52.63 -.29

-.19 30 Falling Falling .486 vol.fell on down-day

---------------------------------------------------------------------------------------------

51 UST 59.9 59.88 59.4 -.39

.43 114 ? Falling .546 vol.fell on down-day

---------------------------------------------------------------------------------------------

48.3 KRU 79.94 77.73 78 1.43

-.01 44 Rising Rising .478 bullish

---------------------------------------------------------------------------------------------

31.7 TMF 89.27 90 88.86 -2.21

-.16 106 Rising Falling .546 vol.fell on down-day

---------------------------------------------------------------------------------------------

26.8 UPV 37.24 37.23 36.13 -.45

.6 138 ? Rising .446 vol.fell on down-day

---------------------------------------------------------------------------------------------

15.7 DZK 44.72 44.36 42.81 -.3

.64 119 Rising Rising .466 vol.fell on down-day

---------------------------------------------------------------------------------------------

12.6 SBND 3.98 3.94 4.01 .11

0 103 Rising ? .462 bullish

---------------------------------------------------------------------------------------------

11.5 DGAZ 23.3 21.56 22.07 2.41

.05 122 Rising Falling .546 bullish

---------------------------------------------------------------------------------------------

4.7 UBT 83.12 83.7 83.31 -1.61

-.01 92 Rising Falling .55 vol.fell on down-day

---------------------------------------------------------------------------------------------

-4 DGP 25.17 25.43 24.51 -.8

-.36 101 Rising Falling .474 bearish

---------------------------------------------------------------------------------------------

-15.9 RETL 34.69 34.79 34.85 .02

.3 129 Rising Rising .562 vol.fell on up-day

---------------------------------------------------------------------------------------------

-17.4 TBF 23.09 23.05 23.14 .15

.26 86 Falling Rising .438 bullish

---------------------------------------------------------------------------------------------

-26.2 TBT 38.34 38.14 38.47 .61

.13 97 Falling Rising .438 vol.fell on up-day

---------------------------------------------------------------------------------------------

-40.4 TMV 22.45 22.28 22.57 .51

.15 100 Falling Rising .438 bullish

---------------------------------------------------------------------------------------------

-47.7 EFU 41.55 41.89 42.86 .04

-.64 118 Falling Falling .498 vol.fell on up-day

---------------------------------------------------------------------------------------------

-53 PST 21.67 21.69 21.89 .13

.13 109 Rising Rising .438 bullish

---------------------------------------------------------------------------------------------

-60.2 TYO 14.97 14.94 15.13 .19

-.08 134 Rising Rising .406 vol.fell on up-day

---------------------------------------------------------------------------------------------

-73.2 DPK 31.09 31.36 32.43 .15

-.29 85 Falling Falling .534 bullish

---------------------------------------------------------------------------------------------

-75.8 EPV 58.92 59.22 60.86 .51

-.28 80 Falling Falling .526 bullish

---------------------------------------------------------------------------------------------

-81.2 DZZ 6.19 6.14 6.3 .08

.16 101 Falling Rising .518 bullish

---------------------------------------------------------------------------------------------

-90.9 EZJ 77.2 76.77 76.21 .7

-.08 122 Rising Falling .51 bullish

---------------------------------------------------------------------------------------------

-92.4 GLL 81.68 80.87 83.21 1.31

.22 98 Rising Falling .53 bullish

---------------------------------------------------------------------------------------------

-122.6 JPNL 36.82 36.53 36.23 .32

.23 158 ? Rising .514 bullish

---------------------------------------------------------------------------------------------

-127.8 DDG 28.55 28.81 29.51 -.08

-.54 74 Falling Falling .518 vol.fell on down-day

---------------------------------------------------------------------------------------------

-134 TWM 40.02 40.85 42.06 .22

-.36 68 Rising Falling .514 vol.fell on up-day

---------------------------------------------------------------------------------------------

-138 EUO 23.74 23.79 24.33 .11

-.23 50 Rising Falling .518 vol.fell on up-day

---------------------------------------------------------------------------------------------

-138 QID 30.65 31 31.51 -.22

-.36 63 ? Falling .474 vol.fell on down-day

---------------------------------------------------------------------------------------------

-157.4 RXL 56.05 55.27 55.52 .67

.04 131 Falling Rising .526 vol.fell on up-day

---------------------------------------------------------------------------------------------

-158.9 SDS 19.12 19.4 19.8 -.05

-.34 72 ? Falling .49 vol.fell on down-day

---------------------------------------------------------------------------------------------

-161 DRR 55.3 55.57 56.68 .31

-.43 77 ? Falling .498 vol.fell on up-day

---------------------------------------------------------------------------------------------

-166.1 SRS 41.49 41.57 42.9 .56

-.23 102 Rising Falling .466 vol.fell on up-day

---------------------------------------------------------------------------------------------

-170.7 SDD 35.31 36.38 37.71 .18

-.31 97 Falling Falling .337 vol.fell on up-day

---------------------------------------------------------------------------------------------

-173.2 MZZ 37.46 38.13 39.44 .05

-.44 70 Falling Falling .502 vol.fell on up-day

---------------------------------------------------------------------------------------------

-174.2 SKF 47.64 48.46 49.52 .19

-.33 104 Falling Falling .49 vol.fell on up-day

---------------------------------------------------------------------------------------------

-179.8 YCS 75.43 75.94 77.28 .08

.18 103 ? Falling .502 bullish

---------------------------------------------------------------------------------------------

-193.8 DRV 16.71 16.64 17.43 .48

-.06 80 Rising Falling .466 bullish

---------------------------------------------------------------------------------------------

-200.1 CURE 26.53 26.03 26.25 .38

.24 141 Falling Rising .522 vol.fell on up-day

---------------------------------------------------------------------------------------------

-202.8 SQQQ 19.25 19.57 20.06 -.2

-.35 39 ? Falling .49 vol.fell on down-day

---------------------------------------------------------------------------------------------

-215.5 REW 43.91 44.63 45.88 -.3

-.56 118 Falling Falling .434 vol.fell on down-day

---------------------------------------------------------------------------------------------

-215.1 SRTY 29.62 30.65 32.27 .2

-.23 80 Rising Falling .514 vol.fell on up-day

---------------------------------------------------------------------------------------------

-222.4 TZA 45.18 46.81 49.37 .37

-.27 68 Rising Falling .502 vol.fell on up-day

---------------------------------------------------------------------------------------------

-229 BIB 39.6 38.09 38.17 1.54

.03 144 ? Falling .498 bullish

---------------------------------------------------------------------------------------------

-229.9 DXD 19.02 19.4 19.86 -.07

-.32 70 Falling Falling .462 vol.fell on down-day

---------------------------------------------------------------------------------------------

-238.4 SPXS 15.66 16 16.51 -.05

-.36 64 ? Falling .478 vol.fell on down-day

---------------------------------------------------------------------------------------------

-240.6 SPXU 29.4 30.05 31.01 -.11

-.33 61 ? Falling .486 vol.fell on down-day

---------------------------------------------------------------------------------------------

-254.2 FXP 42.75 43.82 45.46 -.15

-.29 74 Falling Falling .506 bearish

---------------------------------------------------------------------------------------------

-272.6 DUG 59.26 60.07 62.88 .49

-.32 100 Falling Falling .526 vol.fell on up-day

---------------------------------------------------------------------------------------------

-286.2 FAZ 42.29 43.54 45.03 .11

-.34 80 Rising Falling .482 vol.fell on up-day

---------------------------------------------------------------------------------------------

-294.1 MIDZ 39.24 40.49 42.75 -.04

-.37 100 Rising Falling .506 vol.fell on down-day

---------------------------------------------------------------------------------------------

-298.5 GASL 2.76 2.98 2.83 -.11

.15 59 Rising Falling .418 vol.fell on down-day

---------------------------------------------------------------------------------------------

-334.8 SMN 29.76 30.51 32.43 .19

-.32 126 Falling Falling .51 vol.fell on up-day

---------------------------------------------------------------------------------------------

-336.9 SDOW 16.08 16.55 17.15 -.04

-.37 72 ? Falling .454 vol.fell on down-day

---------------------------------------------------------------------------------------------

-357.7 EEV 20.05 20.81 22.19 -.09

-.4 91 Falling Falling .518 vol.fell on down-day

---------------------------------------------------------------------------------------------

-358.5 ZSL 47.04 48.13 50.7 -.19

.26 120 Falling Falling .51 bearish

---------------------------------------------------------------------------------------------

-363.3 TECS 26.91 27.54 28.66 -.28

-.43 100 Rising Falling .462 vol.fell on down-day

---------------------------------------------------------------------------------------------

-379.5 YANG 98.62 102.26 108.08 -.08

-.26 69 Falling Falling .514 vol.fell on down-day

---------------------------------------------------------------------------------------------

-422.4 ERY 20.83 21.3 22.83 .3

-.37 97 Falling Falling .522 vol.fell on up-day

---------------------------------------------------------------------------------------------

-443.4 VXX 18.8 19.72 20.87 -.55

-.33 33 Falling Falling .438 vol.fell on down-day

---------------------------------------------------------------------------------------------

-447.9 SOXS 33.44 34.98 36.9 -.19

-.42 96 ? Falling .454 vol.fell on down-day

---------------------------------------------------------------------------------------------

-539.9 EDZ 35.37 37.42 41.24 -.21

-.31 83 Falling Falling .514 vol.fell on down-day

---------------------------------------------------------------------------------------------

-598.1 DSLV 42.8 44.4 48.68 -.25

.13 128 Falling Falling .506 vol.fell on down-day

---------------------------------------------------------------------------------------------

-728.3 BZQ 39.3 44.13 51.64 -.34

-.28 84 Falling Falling .526 vol.fell on down-day

---------------------------------------------------------------------------------------------

-749.2 SCO 110.68 118.02 133.85 -2.4

-.32 115 Falling Falling .574 vol.fell on down-day

---------------------------------------------------------------------------------------------

-1057.5 DTO 142 156.4 185.77 -5.39

-.38 117 ? Falling .578 vol.fell on down-day

---------------------------------------------------------------------------------------------

-1128.5 DWTI 124.69 137.63 166.7 -3.77

-.31 124 Falling Falling .578 vol.fell on down-day

---------------------------------------------------------------------------------------------

-1322.7 DUST 3.14 3.26 3.8 0

0 100 Rising Falling .482 ?

---------------------------------------------------------------------------------------------