12/6/2013 (C) www.tigersoft.com

There have been 32 Buy B19s. The average gain was 8.6%.

There was only one loss. March and October Buy B19s brought

the biggest gains, 12.2% and 15.2%, respectively. January B19s

only 3%.

Size of Gains

>10% 9

5%-9.99% 13

2%-4.99% 8

0%-2% 1

loss 1

BUY B1919290327 B19 303.2 .029

19330724 B19 94.3 .054

19380915 B19 136.2 .156

19380928 B19 133.7 .178

19390127 B19 138.9 .076

19410220 B19 119.9 .067

19460221 B19 195.6 .086

19470421 B19 169.5 .09

19550315 B19 399.3 .173

19560529 B19 477.7 .091

19590210 B19 582.7 .105

19650630 B19 868.04 .135

19660830 B19 775.72 .039

19670411 B19 847.66 .047

19670601 B19 864.98 .075

19741007 B19 607.56 .078

19800328 B19 777.65 .268

19800930 B19 932.42 .058

19870415 B19 2282.95 .026

19940405 B19 3675.41 .016

19971028 B19 7498.32 .225

20020724 B19 8191.29 .064

20040312 B19 10240.08 .031

20050421 B19 10218.6 .133

20070306 B19 12207.59 .143

20071123 B19 12799.04 .064

20080123 B19 12270.17 .023

20081202 B19 8419.09 .063

20090121 B19 8228.1 -.01

20110317 B19 11774.59 .088

20120411 B19 12805.39 .037

20130625 B19 14760.31 .048

-------------------------------------------------

No. = 32 .086

9 13 8 1 1 PE 7 .082 PE + 1 8 .085 PE + 2 7 .088 PE + 3 10 .089 January 3 .03 February 3 .086 March 6 .122 April 6 .058 May 1 .091 June 3 .086 July 2 .059 August 1 .039 September 3 .131 October 2 .152 November 1 .064 December 1 .063 1-10 5 .075 11-20 8 .063 21-30 19 .090 |

---------------------------------------------------------------------------------

8/22/2013

B19

Buy B19s occur when there is a

sharply down day followed by an equally sharp up day.

It is a 2-day reversal upwards Buy. It stems from the unexpected

way the DJI and NYSE

breadth reverse from down to up. Usually, after a steep decline,

the market is doing well simply

to stabalize. A reversal upwards is unusual. It often

portends a rally beyond the upper band.

This is a very helpful

signal, in that since 1956 there has not been a single case in the

21 Buy B19s of even a 1% paper loss. We should note that some of

the most recent Buy B19s

have not been very profitable. It may be that computerized

trading has reached a point where

this signal simply shows their short-term trading activities and

intentions. If this pattern continues,

the signal may have to be downgraded for intermediate-term traders.

However, when it occurs

with other Buy signals, a rally, at least, to the upper band is very

likely.

These B19

reversal occur often when politics intrudes, i.e. when government shifts the

quickly alters the slope of the playing field. We not only expect

these B19s to be more common,

as professionals turn to more to rapid-fire computerized trading, but

also in an economic down-turn

when insiders get wind that the Fed will intervene to stimulate the

economy.

To get a B19, the current day's NYSE

advances/declines must be over 3 and the same ratio

on the day before must be under .333. In most

cases, the current day's NYSE Up Vol must be

more than 4 times NYSE Down volume and the same ratio the day before must be

under .25.

There are some limitations, such as the DJI needing to be below the 1.7%

lower band so that

there is still upside potential. B19s cannot not occur too soon after a

Sell S9. In 2013,

B19 were added where there is a gap upwards on the day of the signal.

This suggests even more

upside energy.

There have been 30 completed Buy B19

trades. The average gain was about 9% at the time

of the next Peerless

Sell. 8 brought gains of more than 10%, but 8 gained less than 3%.

There was only

one loss with a Buy B19. If we take out the one case where the B19

called the bottom in 1974

and gained 72.9%, the average gain would be 6.9%. In the 12 cases when

the B19 occurs with the

DJI above a rising 200-day ma, the gains were more assured. In only two

cases were the declines

as low as 2.6% and 2.8%. In 8 of the 12 cases the gains ranged from

5.8% to 25.4%. The average

gain for B19s in a rising market were 8.8%, even without the benefit of the

single case of the Buy B19

bringing a 72.9% gain.

31 BUY B19s: 1929-2010

Gain Date

P^^ La/Ma IP21

Market Environment

Head/Shoulders Paper

Loss

-----------------------------------------------------------------------------------------------------------------------------------------------------[

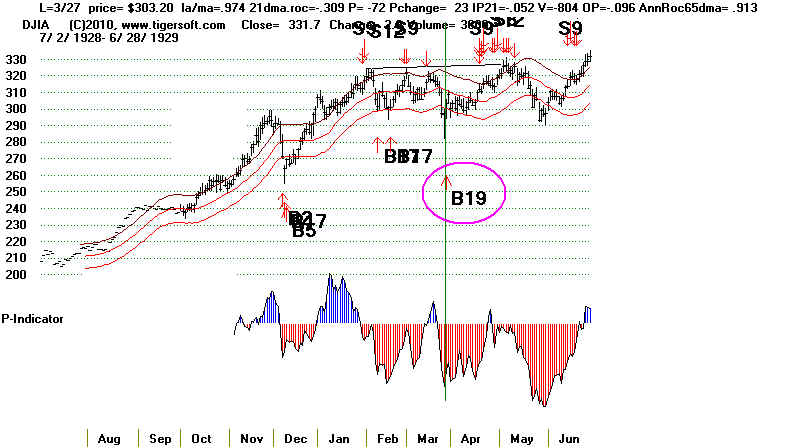

+ .028 3/27/1929 -309

.974 -.085

Rising Market

none

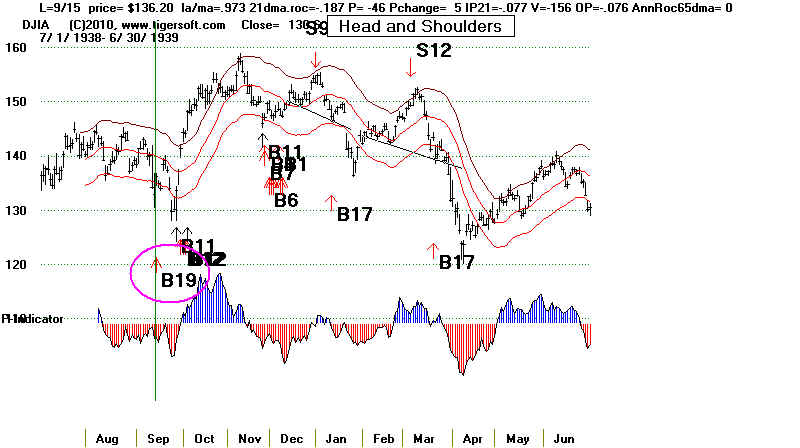

+ .156 9/15/38 -241

.973 -.077

Rising Market

3%

+ .178 9/28/38 -567

.948 -.181

Rising Market

none

+ .067 2/20/41 -599

.969 -.308 below 200 day ma

3.5%

+ .086 2/21/46 -103

.969 .083

Rising Market

soon after head/shoulders none

+ .088 4/21/1947 -426

.976 -.177

below 200 day ma

4%

+ .173 3/15/1955 -161

.974 -.094

Rising Market

none

+ .076 5/29/1956 -161

.963 -.229

Rising Market

none

+ .116 2/10/1959 -64

.986 -.05

Rising Market

none

+ .039 8/30/1966 -299

.948 -.211

below 200 day ma

none

+ .047 4/11/1967 -41

.983 -.027

Rising Market

none

+ .075 6/1/1967 -122

.981 -.034

Rising Market

none

+ .078 10/7/1974 -149

.956 -.152

below 200 day ma

none

+ .223 3/28/1980 -454

.963 -.091

below 200 day ma

none

(Almost B19) + .036

9/28/1981 -524 .983 -.078 below 200

day ma

none

+ .026 4/15/1987 -389

.979 .08

Rising Market

2.5%

(Almost B19) + .028 9/22/1987 -240

.988 -.146 Rising Market

none

+ .016 4/5/1994 -475

.968 .011

below 200 day ma

none

+ .044 10/28/1997 -214

.944 .037

below 200 day ma

1.3%

+ .064 7/24/2002 -673

.936 -.119 below 200

day ma

none

+.165 10/10/2002 -566 .960

-.111

below 200 day ma H/S played out

none

+.133 4/21/2005

-131 .985 -.131 Rising Market

1.5%

+.143 3/6/2007 -21

.974

-.023

Rising Market

1.0%

+ .064 11/23/2007 -373

.948 -.089 Rising Market

none

+ .023 1/23/2008 -138

.957 -.057

below 200 day ma

4.3%

+ .032 3/11/2008 -215

.987 .047

below 200 day ma

1.0%

+ .000

9/18/2008 -186 .972

.037 below 200 day ma

none

+.063 12/2/2008 -339

.981 -.03

below 200 day ma

none

-.01 1/21/2009 -140

.963 -.035

below 200 day ma

none

+.088 3/17/2011 -68

.973 .009

Rising Market

none

+.029 4/11/2012 -156

.976 .020

Rising Market

none

+.048 6/25/2013 -420

.978 -.126

Rising Market

none

8/22/2013 -310

.974 -.046

Rising Market

none

================================

30 completed trades - Avg =

2 losses, 0% to 1%

9 paper losses, 1% to 4.3%

8 gains of more than 10%

6 gains 1%-3.5%

18 gains of more 5%

16 of B19s were in a rising market

14 of B19s were below 200-day ma

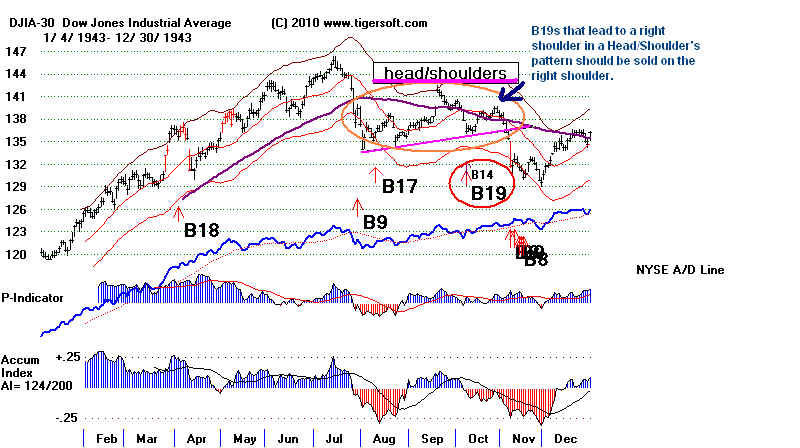

We should be wary of a Buy B19 that

follows soon after the completion of a quick

head and shoulders

formation. Note these patterns in the three B19s below..

|

|

|

Here is a breakdown

of 2011 Peerless B19s. There is not much change. So the patterns

here seem likely to

continue.

31 BUY B19s: 1929-2011 by Month

The best Buy B19 signals occur in March and October. The worst seen to occur

in the

period Decmber to January.

Tax based buying and selling must add greatly to very short-term

volatility.

MONTH GAIN Number

YEARS

----------------------------------------------------------------------------------------------

Jan -1.0% 1

2009

Feb +4.4%

4

1941 1946 1947

1959

Mar +13.6% 5

1929 1955 1980 2007 2008

Apr +6.4%

5

1947 1967 1987 1994 2005

May +7.6%

1

1956

June none

0

July

+6.4% 1

2002

Aug

+3.9% 1

1966

Sept

+3.4% 6

1948(2) 1980 1981 1987 2008

Oct +14.4% 5

1943 1956 1974 1997 2002

Nov +

6.4% 1

2007

Dec -1.0% 1

2009

====================================================

31 completed trades - Avg = 7.6%

31 BUY B19s: 1929-2010 by

Year in Four Year Presidential Cycle

B11a in the third

year of a Presudential Cycle are clearly the most bullish.

Presidential Year N= 8 Avg.Gain = 5.5%

Presidential Year +1 N= 6 Avg.Gain = 5.3%

Presidential Year +2

N= 7 Avg.Gain = 12.5%

Presidential Year +3

N= 10 Avg.Gain = 7.6%

Buy B19's may not

occur within 10 days of each other to avoid whip-saws.

Important: They can reverse quick sell-offs as

well as long bear markets.

B19 Statistics

1. They average a 6.4% gain

when the next Peerless signal is taken as a sell.

2. 90% of B19s were

profitable at time of next Peerless Sell

Only three B19s were not profitable. The biggest loss was 3.2%

3. The biggest paper

loss using a B19 was 8% in 1947. All were between 3% and 8%.

There were paper losses in 7 of the 30 cases but none after 1955.

4. Buy B19s do

occasionally act as reversing Buys. The 13 cases are:

3/27/29 303.2

+ .029

2/21/1946 195.6

+ .006

4/21/1947 169.5

+ .031

9/9/1948 180.3

+ .033 Reversed

a Sell S2 just a few days before.

10/2/1956 475.4

+ .036

8/30/1966 775.72

+ .039

3/28/1980 777.65

+ .223

9/30/1980 932.42

+ .058

9/28/1981 842.56

+ .036

9/22/1987 2568.05 + .028

4/5/1994 3675.41

+ .066

10/28/1997 7498.32 + .044

7/24/2002 8191.29 + .064

Only

5 of the 13 cases saw a DJI gain of more than 4.3%.

5. When the DJI recovered less than 2/3 of what it lost on the previous day,

the gains were

all smaller than 6%.

6. 21 of 27 B19s called

the bottom. All have done so, or nearly so since 1956.

7. There was only one

B19 case in December. It lost money.

8. There were 3 B19s in

2008, showing the many oversold market conditions.

9. Bear markets were

ended with B19s in 1966, 1974, 1980 and 2002.

10.

Steeply declining ROCs (less than -1.6) should be eliminated. This would exclude two

poor trades: 10/1/30 ( - .129 ) and 10/28/2008 ( +.008).

11. Do not use the Buy B19 when the DJI closes more

than 6.5% below the 21-day ma.

This would eliminate two poor

trades: 10/1/30 ( - .129 ), 4/30/31 ( -.037 )

B19 Signals: 1929-1942 and Key Values

"ROC=annualized rate of change of the 21-day ma. So,

-.043 means a slight declining

current trend. "CL/MA"=DJI close/21-day ma. "P",

"IP21", "V" and "OP" are Peerless indicators.

Date

DJI Gain

CL/MA ROC P

IP21 V OP

---------- -----------

---------- --------- ------

------ ----- ------- ------

1 3/27/29 303.2

.029

.974 -.309

-72 -.052 -804

-.096

This was a

reversing Buy.

No Significant paper loss. This was the bottom for a rally to the upper band.

...above 200-day ma

...ratio based up/down volume 1:4 and then 4:1.

-------------------------------------------------------------------------------------------------------------------------------------------

In October 1930, users would have employed the Extreme

Bearish Mode. Thus the following

B19s would not have been allowed. This switch ended in mid

1932. There were two B19s

in this period. They should be eliminated simply by

seeing how fast the 21-day ma was

falling and how far below the 21-day ma the DJI was when

they occurred. The code will

be changed for B19s to reflect this.

Date

DJI

Gain

CL/MA ROC

P

IP21 V

OP

X 10/1/30 214.1

-.129 .908 -2.445 -199 -.057 -1171

-.319 (very negative internals)

X 4/30/31 151.2

-.037

.935 -1.551

-167 -.157 -820 -.375 (very negative internals)

------------------------------------------------------------------------------------------------------------------------------------------

Date

DJI

Gain CL/MA

ROC

P

IP21 V

OP

2. 9/15/38 136.2

.128

.973 -.187

-46 -.077 -156

-.076

There

was a 3% paper loss here.

...above 200-day ma

...ratio based up/down volume 1:4 and then 4:1.

Date

DJI

Gain

CL/MA ROC

P

IP21 V

OP

3. 2/20/41 119.9

.074

.969 -.796 -113 -.308 -129

-.283

There was a 3% paper

loss here.

...below 200-day ma

...ratio based up/down volume 1:4 and then 4:1.

Date

DJI

Gain CL/MA

ROC

P IP21

V OP

4. 10/7/1943 136.4

.013 .98

-.043 41

-.025 12 -.048 smaller

recovery than loss day before.

1/14/44 138.2 S1

There was a 4% paper

loss here. DJI fell

to 130 in mid Nov. before rallying.

...below 200-day ma

...ratio based up/down volume 1:4 and then 4:1.

Date

DJI

Gain CL/MA

ROC

P

IP21 V

OP

5. 2/21/1946 195.6

.006 .969

-.106 -27 .083

-135 0

Right after quick head/shoulders.

This was bottom for a rally then went up past next Sell by 6%

in 3 months.

This was a reversing Buy.

Date

DJI

Gain

CL/MA ROC

P IP21

V OP

6. 2/27/1947 178.9 -.023

.986

.013 7 .106

-63 .023 recovered almost what was lost day before.

Thus was right after quick head/shoulders

There was an 8% paper loss here. DJI fell to 163 in mid May

before rallying.

Date

DJI

Gain CL/MA

ROC

P

IP21 V

OP

7. 4/21/1947 169.5

.088 .976

-.404 -103 -.177

-177 -.109 bigger recovery than loss day before.

There was a 4%

paper loss here. DJI

fell to 163 in mid May before rallying.

This was a reversing Buy.

Date

DJI

Gain

CL/MA ROC

P

IP21 V

OP

8. 9/9/1948 180.3

.033

.989 -.02

70 .11 17

.067 smaller recovery than loss

day before.

There was a 5%

paper loss here. DJI

fell to 171 in late November before rallying.

Thus was a reversing Buy.

It occurred just a few days after a Sell S2. It is probably better to wait

a little longer in these cases.

Date

DJI

Gain CL/MA

ROC

P

IP21 V

OP

9. 3/10/1955 406.8

.254 .987

.302

50 -.05 -96 .226

recovered almost what was lost day before.

There was a 4%

paper loss here. DJI fell

to 391 in mid March before rallying. 3/6/1956

491.40 S12

Date

DJI

Gain

CL/MA ROC

P

IP21 V

OP

10. 5/29/1956 477.7

.076 .963

-.918 -161 -.229

-501 -.586 recovered almost what was lost day

before.

This was the bottom before a rally a little past the

upper band and next Sell.

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

11, 10/2/1956 475.4

.036 .965 -.641

-164 -.172 -435 -.369 recovered almost what was lost day before.

This was the first of two same-level bottoms before a rally

past the upper band and next Sell.

This was a reversing

Buy.

12/6/1956 492.70 S1

Date

DJI Gain

CL/MA

ROC P

IP21

V OP

12. 2/10/1959 582.7

.116 .986 -.199

-22 -.05 -300 .061 bigger recovery

than loss day before.

This was the bottom before a rally past the upper band

and the next Peerless Sell.

4/17/1959

624.10 S9

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

13. 8/30/1966 775.72

.039 .948 -.862 -299

-.211 -14 -.392 recovered almost what was lost day

before.

This was the bottom before a rally to the upper band

and the next Peerless Sell.

This was in a bear market.

9/14/1966 806.23 S9

This was a reversing Buy.

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

14. 4/11/1967 847.66

.047 .983 -.012

-17 -.027 -2

-.024 recovered almost what was lost day before.

This was the bottom before a rally to the upper band

and the next Peerless Sell.

4/21/1967 993.18 S12

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

15. 10/7/1974

607.56 .729 .956 -1.31

-149

.152 -3 -.431

Recovered more than what was

lost day before.

This was the bottom. Rallied to the upper band. Pulled back and

roared upwardsl.

10/18/74

S12 S12

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

16. 3/28/1980 777.65

.223

.963 -1.127 -454 -.091 -13 -.305 recovered more

than what was lost day before.

This was the bottom but two more tests of lows were

needed before bull market began.

This was in a bear market

8/7/1980 950.94 S2

This was a reversing

Buy.

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

17. 9/30/1980 932.42

.058 .985 -.002

-6 -.01 -1

.122 recovered almost what was lost day before.

This was the bottom for a trading range rally to the upper

band. 11/14/1980 986.35 S9

This

was a reversing Buy.

Date

DJI Gain

CL/MA ROC

P

IP21 V OP

18. 9/28/1981 842.56

.036 .983 -.645

-302 -.078 -11 -.234 recovered more than what was lost day

before.

This was a reversing

Buy. This was the bottom for a

trading range rally to the upper band.

This was in a bear market.

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

19. 4/15/1987 2282.95

.026 .979

-.009 -198 .08 -15 .208

recovered almost what was lost day before.

This was the bottom for a trading range rally to the upper

band.

Date

DJI Gain

CL/MA ROC

P

IP21 V OP

20. 9/22/1987 2568.05 .028

.988 -.646 -240

-.146 -30 -.30 recovered more than what was lost day

before.

This was a reversing

Buy. This was the bottom for a trading

range rally to the upper band.

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

21. 4/5/1994

3675.41 .03 .968 -.941

-301 .011 -41 -.107 smaller recovery than what was lost

day before.

This was a reversing

Buy. This was the bottom for a rally to the upper

band.

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

22. 10/28/1997 7498.32 .044 .944

-.737 -175 .037 -48 -.058

recovered less than what was lost day before.

This was the bottom for a rally past the upper band and the

next Sell.

This was

a reversing Buy. This was in a bear market

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

23. 7/24/2002 8191.29 .064

.936 -1.475 -673 -.119 -629 -.514 recovered more than what

was lost day before.

This was a reversing

Buy. This

was the bottom for a rally to the upper band.

This was in a bear market

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

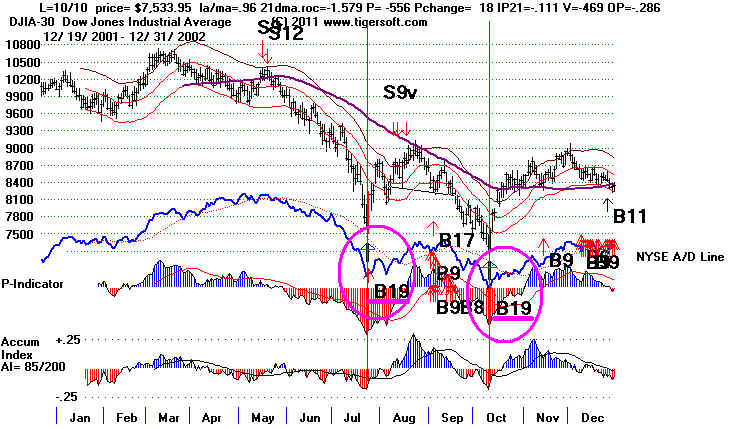

24. 10/10/2002 7533.95 .165

.96 -1.579 -556 -.111 -469 -.286

Recovered more than what was

lost day before.

This

was the bottom for a rally up above the upper band.

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

25. 4/21/2005 10218.6 .133

.985 -.289 -97

-.167 -228 -.168

Recovered more than what was lost day

before.

This was a reversing Buy. This was the bottom for a rally

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

26. 3/ 6/2007 12207.59 .144

.974 -.423 -21

-.023 -254 -.10

Recovered more than what was lost day

before.

This was the bottom for a rally up past the upper band.

This was in a bear market

Date

DJI Gain

CL/MA

ROC P

IP21

V OP

27. 11/23/2007 12799.04 .064 .958

-.779 -414 -.089

-315 -.158

Recovered more than what was lost day

before.

This was the

bottom for a rally to the upper band.

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

28. 3/11/2008 12156.81 .032

.987 -.024 -238

.047 181 -.058

Recovered more than what was lost

day

before.

This was the

bottom for a rally up past the upper band.

Date

DJI

Gain CL/MA

ROC

P

IP21 V OP

29. 9/18/2008

11019.69 .000 .972

-.345 -210 .036

147 .202

Recovered more than what was lost

day before.

This was the bottom for a rally only to falling 21-day ma.

This

was in a bear market

=======================================================================

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

X 10/28/2008 9065.12

.008 .979 -1.661 -653

-.108 -151 -.436

Recovered what was lost

day before.

This was the bottom for a rally only to falling 21-day ma.

This was

in a bear market )

X = Extreme Bear Market

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

X . 12/2/2008 8419.09 -.032

.981 -1.25 -376

-.03 -230 .002

Recovered less than what was

lost day before.

This was in a bear market

X = Extreme Bear Market

Date

DJI Gain

CL/MA

ROC P

IP21 V

OP

X 1/21/2009

8228.10 -.01 .963

-.524 151 - .035 -126 -.185 .

Recovered less

than what was lost daybefore.

This was in a bear market

X = Extreme Bear Market

===================================================================================

Date

DJI

Gain CL/MA

ROC

P

IP21 V OP

30. 3/17/2011

11774.59 .069

.973 -.345

-210 (+100) .009 -218 -/073

Recovered more than what was lost

day before.

This was the bottom for a rally to upper band.

This

was in a bear market

Date

DJI Gain

CL/MA ROC

P

IP21

V OP

31. 10/4/2011 10808.71

opem .972 -0.461

-260 .021 193 .127

Recovered more than what was lost

day before.

This was the bottom for a rally only to falling 21-day ma.

This

was in a bear market

----------------------------------------------------

30

completed trades - Avg = 7.6%