OPTIONS TRADING and TIGERSOFT"

BULLISH SPREADS

9/29/2009

(C) 2009 William Schmidt, Ph.D.

A bull call spread is obtained by

buying a call

option with a low exercise price, and selling

another call option with a higher exercise price. Both calls must have the same

underlying

security and expiration month An example. Assume XYZ is currently 100.

Assume the

call option with a strike price of $100 can be bought for $3 per share, or $300 per

contract,

while a call option with a strike price of $115 is selling at $1 per share, or $100

per contract.

A trader can then buy a long position on the $100 strike price option for $300 and

sell a

short position on the $115 option for $100. The net debit for this trade then is $300

- 100 = $200.

This is the most a buyer of this spread can lose. The trade is profitable if

the stock closes

on expirtion above $102. If the stock's closing price on expiration is $110, the

$100 call

option will end at $10 a share, or $1000 per contract, while the $115 call option

expires

worthless. Hence a total profit of $1000 - 200 = $800. In summary, the

trade's profit is limited

to $13 per share, which is the difference in strike prices minus the net debit (15

- 2). The

maximum loss possible on the trade equals $2 per share, the net debit.

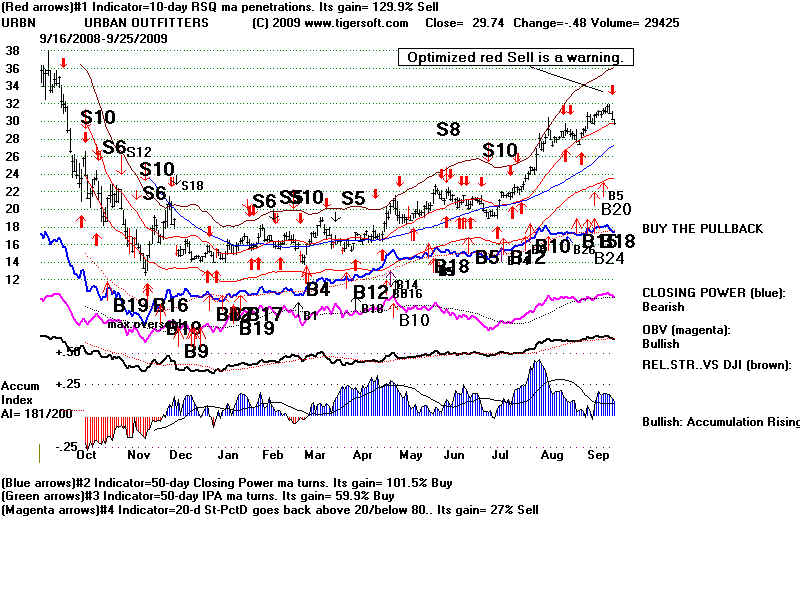

The best and, by far, simplest way to find stocks that should be used for this

approach is

to take NASDAQ-100 stocks, or other stocks which are optionable, and run the Tiger

ANALYSIS

program and employ it with stocks the Tiger program finds to be

"BULLISH". These will

be stocks having a top Power-Ranking that are above the rising 50-day ma when the

Peerless

system is on a Buy. They should have rising CLosing Power Lines, too. A

Closing Power that

is making a new 12 month high ahead of price is considered a prime candidate here.

So is a

stock making a flat topped breakout or a stock with levels of current Accumulation

over +.25.

But the further up any of these stocks is arefrom the 50-day ma, the bigger the

risk, since in a

weak market, many stocks will retreat to the support of the rising 65-day mal.

Using the "BULLISH" screening criteria we get a

good working list for stocks that

should be profitable using this approach. Below is a list of the

"bullish" rated stocks

in the middle of March 2009, April 2009, May 2009, June 2009, July

2009, August 2000,

September 2009. The top 7 Bullish stocks are only considered here, for

brevity's sake.

In actual trading, other ranked "Bullish" should be considered.

March 13, 2009

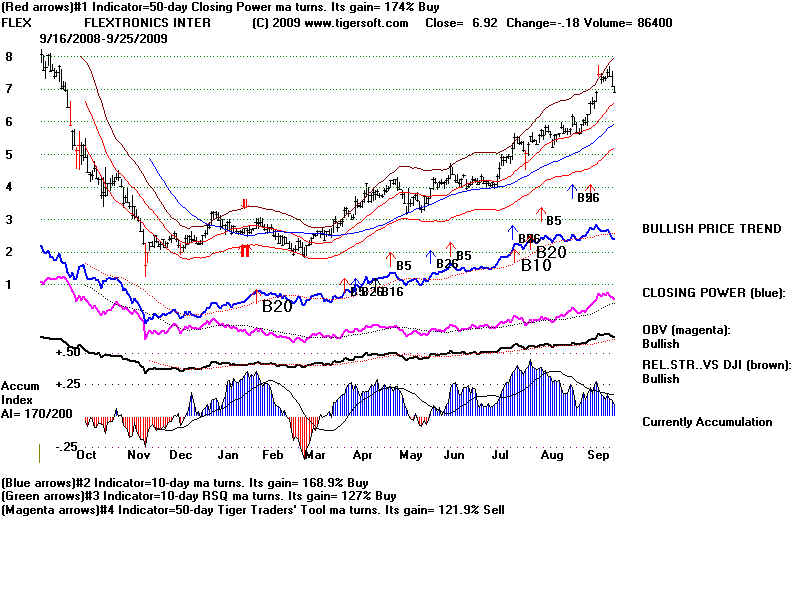

HANS 36.99 still on red 5-day Stochastic

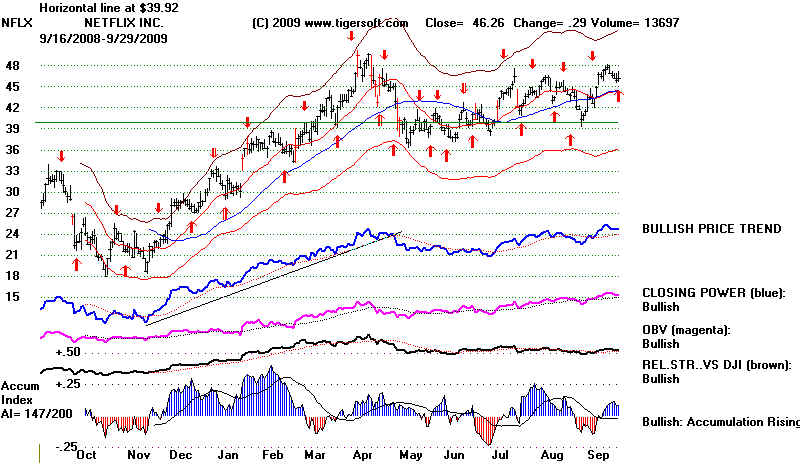

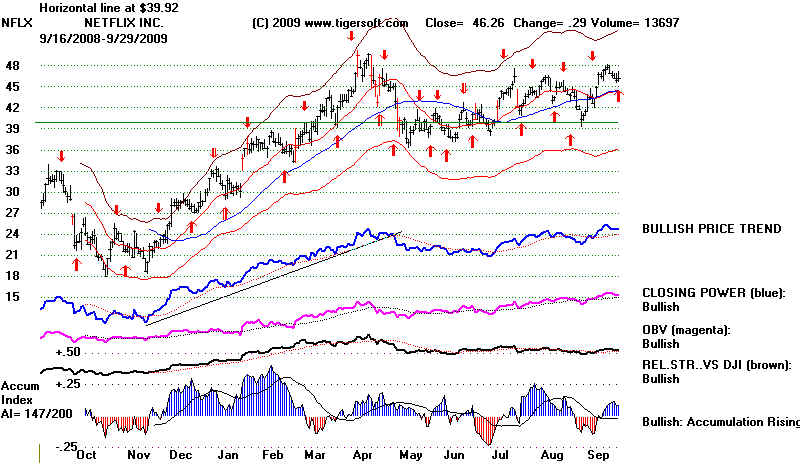

NFLX 39.37 IP21<0 on rally to Feb high. 40 is 12 mo

high. Closing Power is making NHs

March 13, 2009

September 29, 2009

TEVA 45.39 IP21 is barely positive. On red Buy. 49 is 12 mo high.

Closing Power making 12 mo highs.

March 13, 2009

September 29, 2009

BRCM 19.11 IP21 <0 but strong CLosing Power. 30 is 12 mo high. Lots

of upside potential.

March 13, 2009

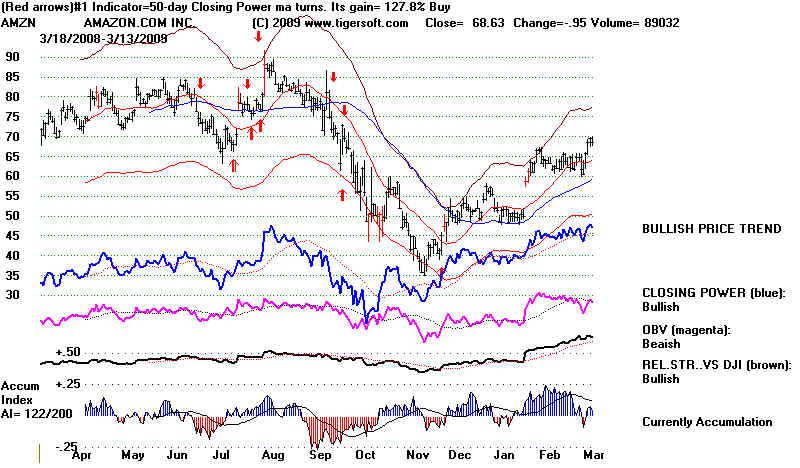

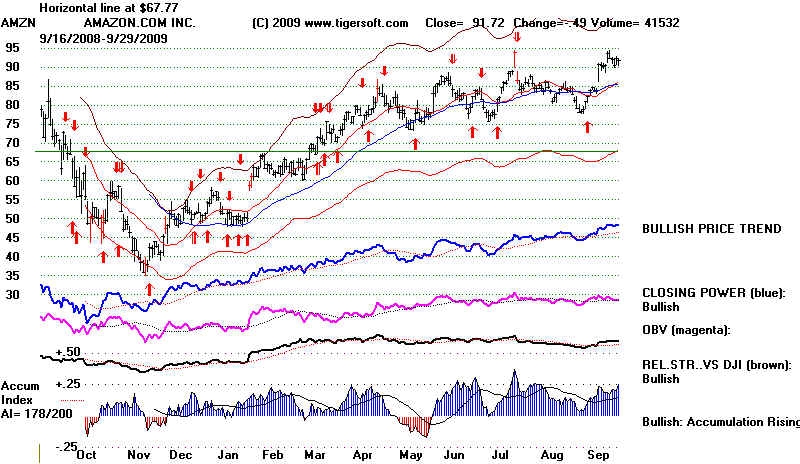

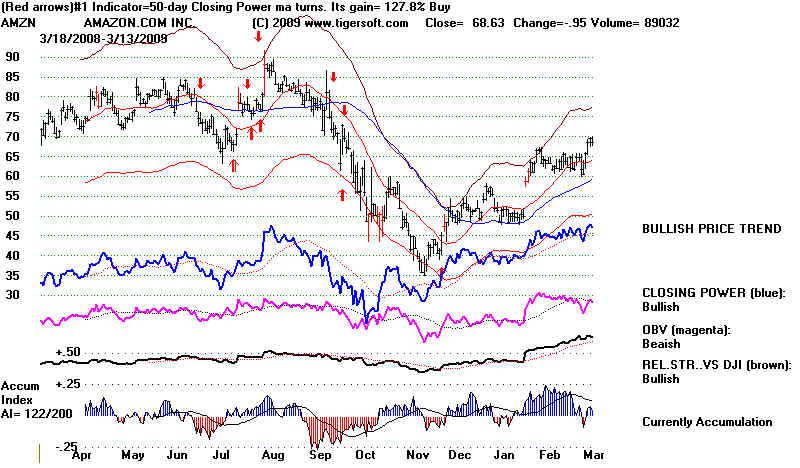

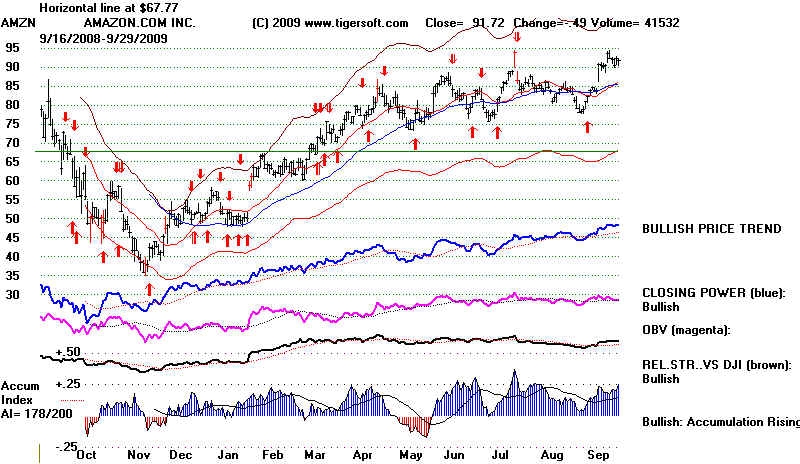

AMZN 68.83 Closing

Power close to making 12 mo high, even though 12 mo price high is at 91.

September 29, 2009

April 15, 2009

NFLX 46.59 on red Sell from 5-day Stochastic that has gained 150.6%

12-month high confirmed by Blue Closing Power.

All sysems are rated bullish, but IP21=.12

ORLY 36.66 -.NH by prices and Closing Power. Current AI over .25

AMZN 74.71 Closing Power NH... 12-mo high=91

HANS 35.82 Stalling out at 37 resistance. CP strong. 37

would be breakout.

ROST 38.83 42 was 12 mo high. CP NH

LRCX 25.62 43 is 12 mo high. All Bullish conditions.

CTSH 22.48 Current AI les than .25. Rel Strength was

rated "bearish". 37 was 12 mo high.

May 15, 2009

HANS 42.61 Current AI over +.25 on NH. CP lagged last

high.

CTSH 25.76 Current AI less than .25. All ratings were

"bullish"

SBUX 12.92 Previous bulge of AI to .36 CP strong.

JNPR 21.56 Current AI = .19 CP cmade NH

even though 12 mo high was .28

June 15, 2009

MXIM 16.31 Current Accum over .28 CP at NH despite 12 mo

price at 23.

JNPR 23.68 Current AI = .05 CP cmade NH

even though 12 mo high was .27

NTAP 19.82 Current AI=.20 CP bacl to 12 mo high

despite prices 7 points below 12 mo high.

CTSH 25.81 Current AI less than 0 . (not bullish at

this point)

AMZN 83.18 Current AI =.25...Closing Power NH... 12-mo high=91

SBUX 14.12 Previous bulge of AI to .36 CP at 12 mo high.

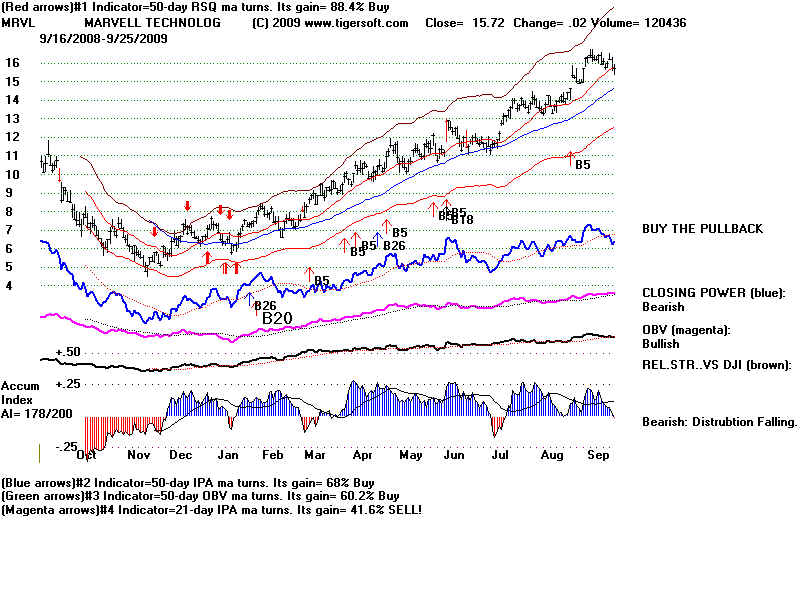

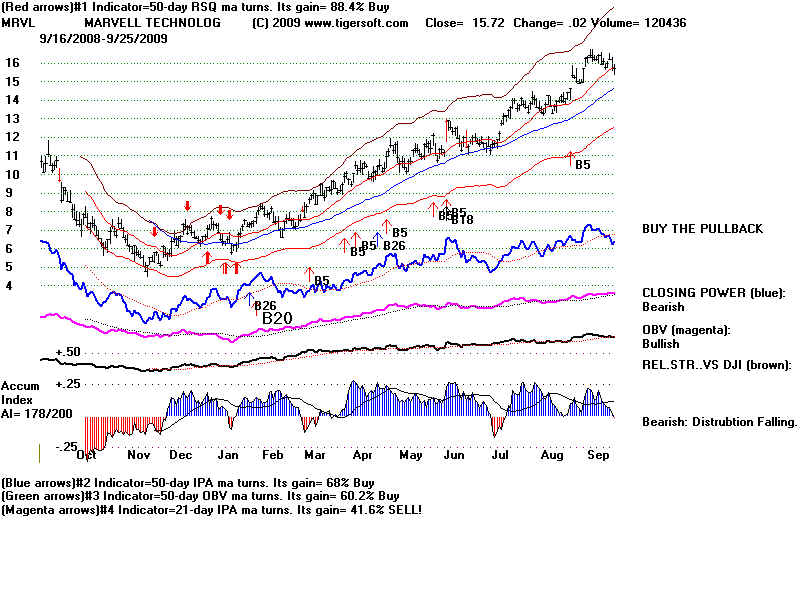

MRVL 12.47 Current AI =.26 .. CP rising but not at 12 mo high.

All indicators were "bullish"

QCOM 44.31 Current AI=.39 CP back to 12 mo highs, Price's 12 mo

high =57.

July 15, 2009

AMZN 84.15 Current AI =.12...Closing Power close to NH... 12-mo high=91

NTAP 20.92 Current AI=.22 CP 12 mo NH, despite prices

6 points below 12 mo high, at 27..

JNPR 25.19 Current AI = .05 CP made NH

even though 12 mo high was .27

MXIM 16.91 Current AI = .10 CP made NH even

though 12 mo high was .23

SBUX 14.42 AI<0 CP at 12 mo high.

MRVL 12.74 AI<0 but stock did rebound from rising 50-day ma

QCOM 46.06 Current AI=.12 CP at 12 mo highs, Price's 12 mo high

=57.

Aug 15, 2009

NTAP 23.59 Current AI=.22 CP 12 mo NH, despite prices 6

points below 12 mo high, at 26

All indicators were bullish.

JNPR 24.61 Current AI=.20 CP has made 12 mo high despite

price high being 27.4

BRCM 26.67 Current AI = .31 CP had been making 12 month highs ahead of

price.

Bulge of AI reached .50 two weeks earlier.

SBUX 14.42 Current AI = .40 CP and price

make 12 mo high. All indicators rated Bullish,

MRVL 13.69 Current AI= .20 OBV and Rel Strength rated

"bearish"

MXIM 18.71 Current AI=.25 CP making 12 mo highs. 12 mo

Price high = 22.

EXPE 22.12 Current AI=.32 CP and price making 12 mo high.

All indicators rated "bullish."

AAPL 166.78 Current AI=.20 All indicators rated "bullish."

CTSH 34.43 Current AI=.22 CP and prices making 12 mo high. All

indicators rated "bullish."

Sept 15, 2009

NTAP 24.72 Current AI=.04 CP and prices made 12 mo NH

All indicators rated "bullish."

JNPR 26.95 Current AI=.15 CPand prices made 12

mo high

BRCM 26.67 Current AI = .21 CP making 12 month highs with price.

Bulge of AI reached .50 two weeks earlier.

SBUX 19.79 Current AI = .23 CP and price

making 12 mo highs .

MRVL 16.21 Current AI= .14 OBV and price making 12 mo highs

.

All indicators rated "bullish."

MXIM 19.23 Current AI=.25 CP making 12 mo highsahead

of price at 20.

EXPE 23.71 Current AI=.20 CP and price making 12 mo high.

All indicators rated "bullish."

AAPL 175.16 Current AI=.16 All indicators rated

"bullish." Steadily rising CP.

==================================================================================

STEPS

TO TAKE TO USE TIGERSOFT HERE.

Update Your Data with

TigerSoft

Updating the data in NASD-100 (where many optionable stocks are).

Go to the Tiger Data Page from Tiger's blue, eight button Peercomm screen.

1. Double-Click Icon for TigerSoft to get to PERCOMM screen.

2. Click Internet button

3. Replace the "0123" between the slashes with the current Data address.

Presently, the current IP21 address is "34567"

The result shoud be that the line says "http://www.tigersoft.com/34567/index.html

When this change is made, click "Display

Web Page Chosen above".

Note that you also enter this address in your internet

surfer to go to the Data Page.

The top of the page will say "Tiger Data and Help

Page".

Become familiar with this page. This is the easiest place

for you to update your stocks

each night.

Find near the top of the page:

Quickie Downloads of Most Requested Data:

PEER04.exe DATA.exe DJI-30.exe HOTSTKS3.exe NASD-100.exe SECTORS.exe

More downloads are available on this page.

including OPTIONS.exe

Open by clicking on the link - NASD-100.exe

You may be able to run this file right from the

web-page. If not save it it to your computer

and then run it. Be sure that you see the

Tiger image on your computer and the installation

taking place.

When with download, click "Finish".

That should take you back to the Tiger

Data Page where you can download other Data. .

Next click the "X" at the

top of the screen. That should take you back to the PEERCOMM

screen. If not find the Tiger

PEERCOMM icon on your desktop and double click it.

That takes you to the 8 button blue

screen that is the starting pount for TigerSoft

SELECT THE CORRECT DIRECTORY

From the Peercomm screen click Select. Use the vertical scroll bar on the left and click

"nasd-100"

and then "OK".

Read the second line on the

Peercomm page. It will tell you the current assumed directory.

It should now say

"Current data directory: c:\nasd-100 101

symbols, updated mm/dd/yy

The last completed trading date

should be there or the previous trading day's date if it is before

6:30 PM.

RUN Tiger's Power-Ranker

From the Peercomm screen click ANALYZE The program takes a few minutes.

When it is finished, click on the button

that says "Go to Main Tiger Menu for Ranking and Graphs".

Unfortunately, this takes you to the

older TigerSoft program. So, click the "X" at the upper right.

That takes you to the Peercomm screen.

Run Peerless-2008 (current main graphing program)

Click the Peercomm button on the upper

right. This is the current Peerless/Tiger program.

Click Daily Stocks

and from the middle section, choose

"Bullish 12.

Top Power Ranked Stocks."

You should get a chart that looks like

this.

Place the signals on the screen

using "Signals-3"

and "Buys/Sells Compatible with 590day ma"

Use the first HELP selection to see the meaning of the signals.

Read also "Indicators, Terms and Concepts".and

"Evaluating Stocks Already

Owned."

Superimpose the Peeless signals to

be sure that we do not have a new major Sell.

Use "Signals-1" and "Superimpose DJI Saved Signals."

Look a whether the public is bullish

(rising Openings) and if the professionals are bullish

(CLosing Power). An uptrend of Closing Power is essential

to assure us that the stock's

uptrend is strong. Click Operations and Restore Simple Bar Chart.

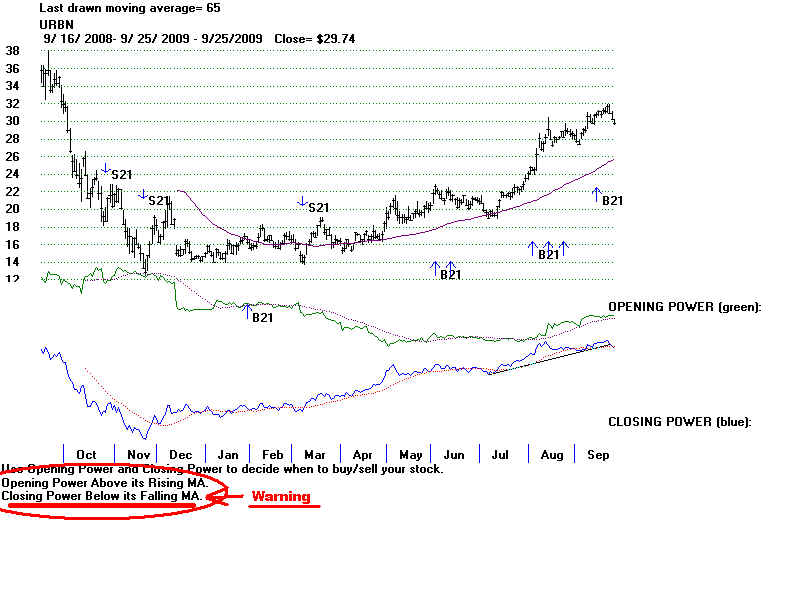

Choose the first item under Indic.3

at the Tiger Basis of

Moves.

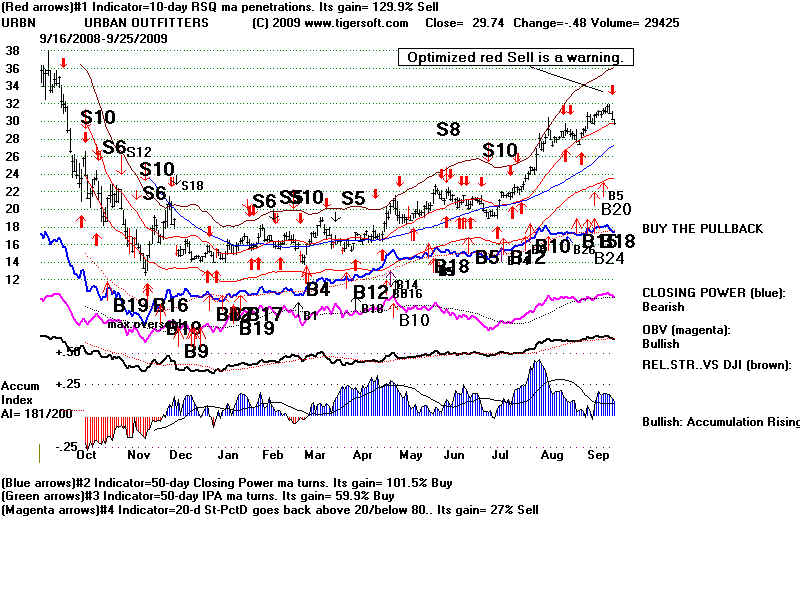

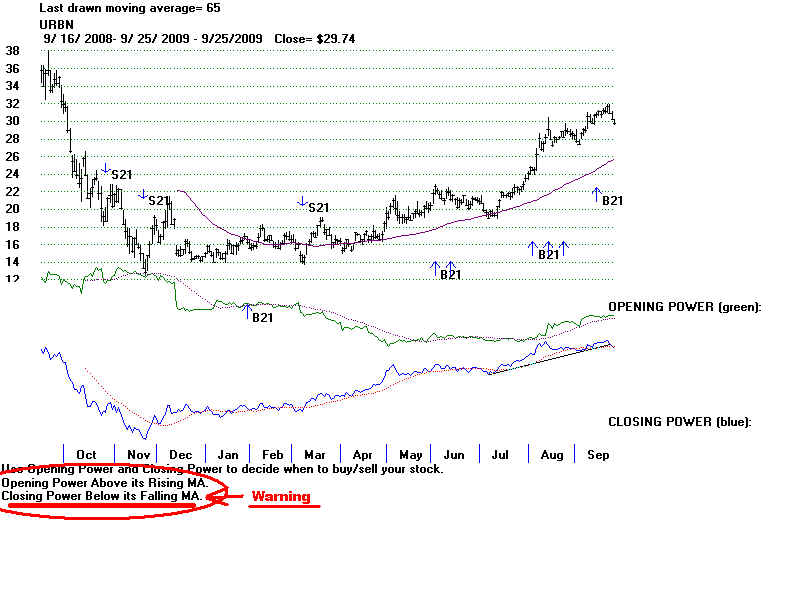

Note the warning at the lower left of the resulting chart:

"Closing Power below its Falling MA".

I would not be bullish on the stock at this point. The Buy B21

shows you the bullish Both-Up

condition. When the CLosing Power subsequently breaks its

uptrend, look for a retreat.

Draw a 65-day ma.using using Mvg Avg at the top. It would be better to become

bullish

when the stock is closer to the rising 65-day ma's support.

Get Next Stock - (Lower and Lower Power

Ranking)

Be sure your keyboard's

Num-Lock key is off. and click the "2" key on the right side. This

takes you to the next stock.