ENRON: The Road To Jail for Key Lay

and

Jeffrey Skilling.:

source: http://institute.ourfuture.org/corporate-wilding

Greed and Opulence, The Fast Lane,

Pals with The President,

MassiveAccounting Fraud,

Endless Lies to The Public, Insider

Trading,

Margin Calls, Bankruptcy and 20,000 People Laid Off.

Before its

bankruptcy on December 2, 2001, Houson-based Enron

employed 20,000 and was

one of the world's biggest electricity, natural gas,

and communications

conglomerates. Its annual report said its revenues were

more than $100 billion

in 2000. Back then, Fortune magazine heralded

Enron as the

country's "most innovative" corporation.

Actually, Enron was

taking big advantage of de-regulation in the energy industry.

Its creativity was

mostly devoted to fabricating accounting illusions which

would pump up its

stock. All this amounted to wilful systematic defrauding

of shareholders for the

benefit of its insider trading chief executives, who

insisted on an opulent

corporate lifestyle no matter the consequences to

those it had a

fiduciary responsibility to protect, namely its employees

and shareholders.

Predictably, they were always very quick to dismiss with

prejudice all

criticism of opaqueness of their earnings reports.

Enron's CEO was a

George Bush Jr. pal, Ken Lay. Its Chief Financial Officers

were Jeff Skilling and

Andrew Fastow. This trio arranged to have assets

and profits regulalry

inflated while placing many debts and losses into

off-shore limited

partnerships, so that they would never make their way

into the firm's

financial reports. Off-shore, these entitites could also

escape US

taxation. The falsifications grew each year because the company

needed to show good

growth to satisfy Wall Street and keep its shares rising

so that the insiders

could sell their own holding at top dollar and Enron

could keep using its

own shares to buy other companies.

When Skilling became

CEO, it became common practice for Enron to record

anticipated

trading gains from its energy wholesaling and trading operations

as actual

gains. The illusion of growth could only be kept alive while the

economy was growing and

investors remained optimistic. When a Wall Street

analyst dared question

Skilling's failure to provide an intelligible balance sheet

with his earnings

report, Skilling called him an "asshole and was applauded

by fellow Enron

executives.

(Source: Beth MacLean and Peter Elkind, Smartest

Guys in the Room:

The Amazing Rise

and Scandalous Fall of Enron, 2003 )

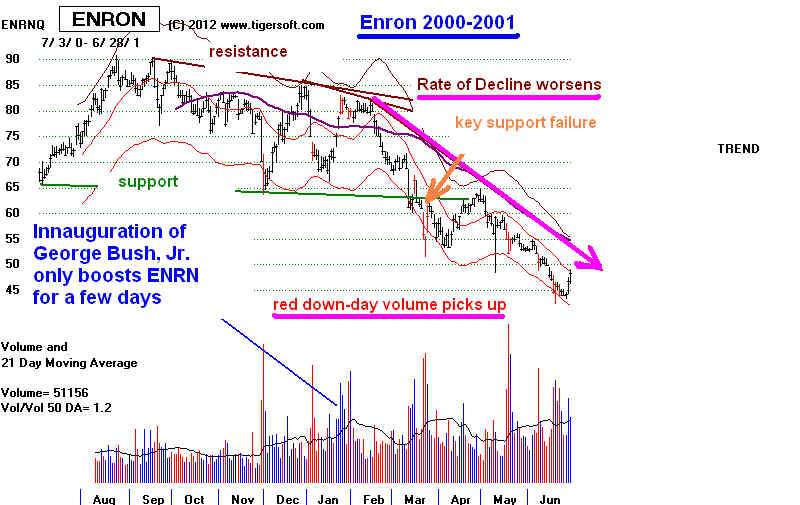

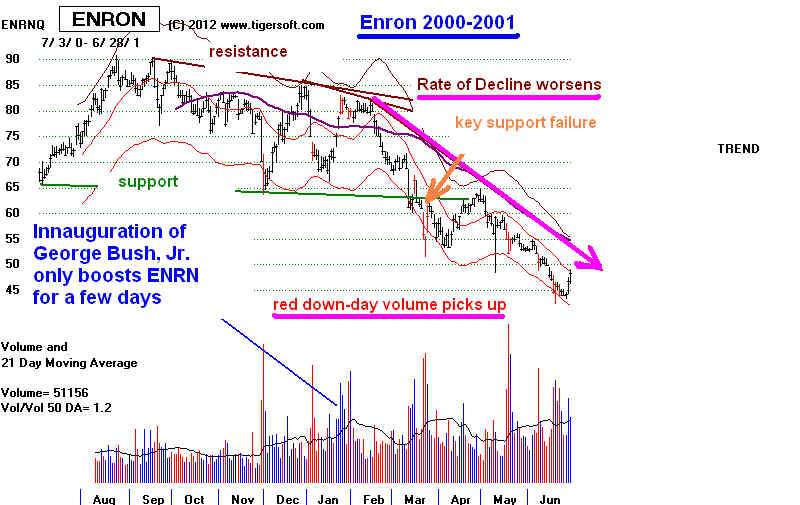

ENRON's Peak in 2000.

2000 saw the peak

in Enron's stock. Investors were told the stock would soon

be over $100. In

addition, Ken Lay had helped boost George Bush Jr. to the

Governorship in Texas

in the 1990s. So, it was expected the new President

would be helpful to

Enron's fortunes. Because of these high hopes, Enron's stock

still performed better

than the DJIA in late 2000 as George Bush was made

President by the

Supreme Court. .

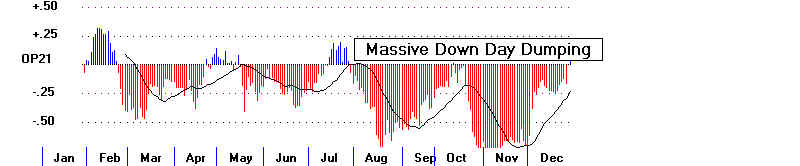

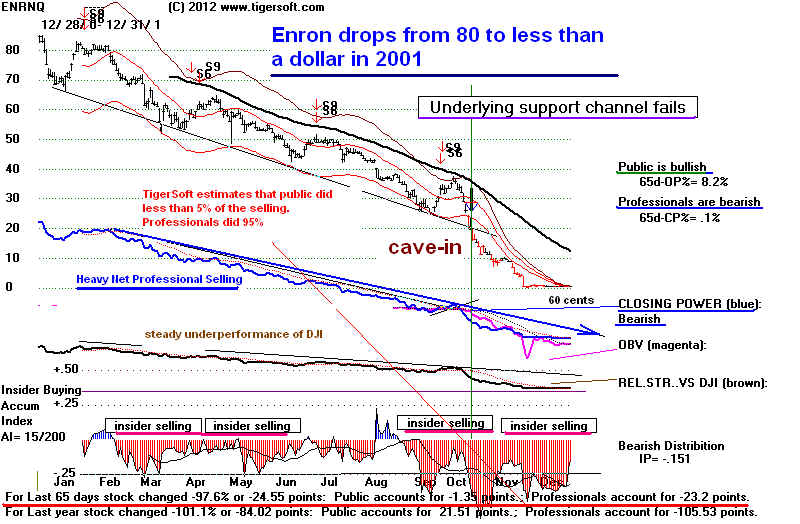

TigerSoft's

Opening and Closing Power showed Enron regularly rose at the

openings only to fall

back at the close. This we call "Public Buying" and

"Professional

Selling." This pattern is usually bearish since the less informed

public is more likely

to buy emotionally at the openings based on public news

stories.

Professionals, on the other hand, make use of the entire trading day.

In this way, their

larger sized orders can be worked into the market.

We can also guess that

the market makers and NYSE Specialist in the

stock were

regularly boosting the stock at the beginning of the day where

they could short it.

They then let it fall off during the rest of the trading day.

Early Warning: Rising Opening Power and Closing Power

Tiger Day Trader's Tool (DTT)

Traders use our

Tiger Day Trader's Tool to see whether there is more upside or

downside potential

each day in a stock. The slope of Enron's Day Traders' Tool

was dramtically

down. This showed it was profitable while the DTT was falling

to use leverage

and sell the stock short at the openng and then cover near the close.

The gains were

modest, but remember that day traders use 3:1 leverage frequently

and the stock was

still advancing rising for the year. Short positions would only have

been taken for

only about 25% of the entire year.

Bush's Innauguration in January 2001 Does Not Save Enron

Ken Lay, Enron's

founder, was one of George Bush Jr.'s biggest campaign

contributor and

supporter in Texas when he ran for Governor and when he

sought the

Presidency. (See materials at the end of this chapter.)

Enron's fraudulent

accounting, however, was too massive to be helped by any

help the new

President or VP Cheney could give in the form of deregulation and

intervention on

Enron's behalf when it was disclosed how Enron had rigged prices

Californians had

to pay for natural gas in the heat wave of 2001 using an assortment

phantom bids and

phoney trading accounts.

The stock market

topped out in 2000 and went into a long bear market until March 2003.

As the stock

market turned down in 2000 and then much more in 2001, institutional

investors became

more cautiou. They started to demand more transparent accounting

in the stocks they

were willing to hold. Enron's accounting had long been questioned

at a professional

level. In this environment more and more institutional clients began

to sell their shares

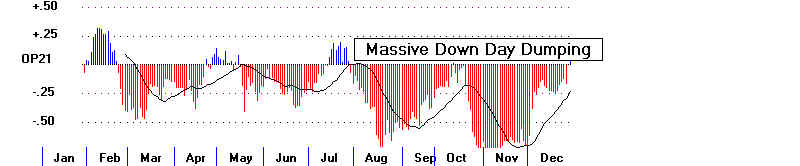

aggressively. We see this in the high volume red down-days on the

Tiger Soft

chart. In March 2001, the stock broke below its price support at 65.

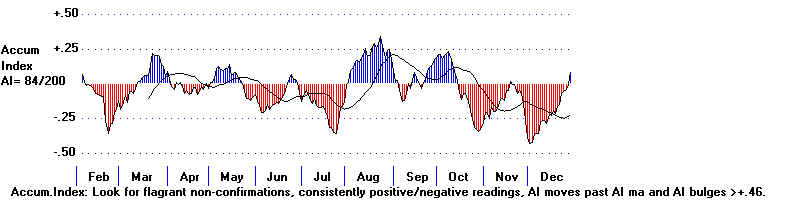

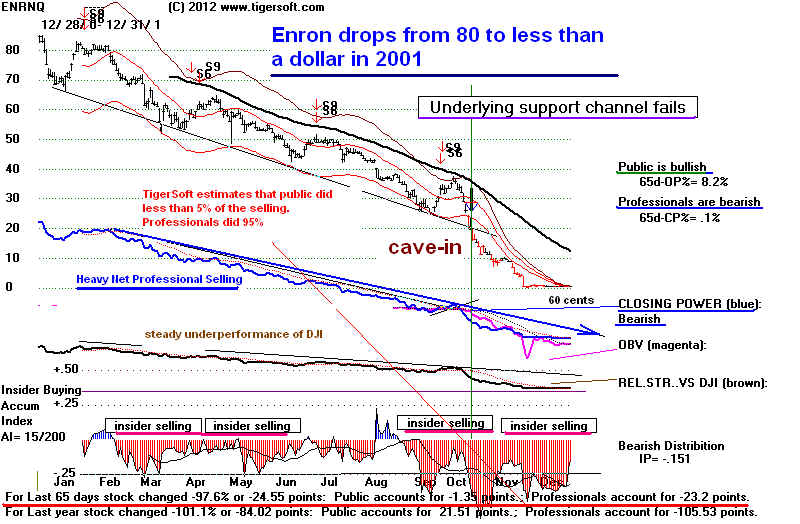

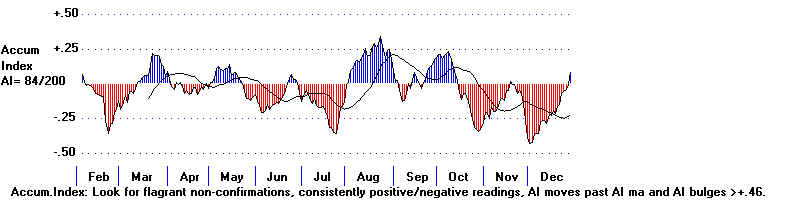

Steady Distribution, Insider and Professional Selling

Enron's

blue Closing Power in the chart TigerSoft chart below remained in a steep

angle

downward for the entire year after August 2000. Professionals were steady net

sellers.

See also the steadily negative (red) readings, often below the -.25 threshold,

from

the Tiger Accumulation Index for Enron, especially after March. We interpret

in

our charts to most commonly be a sign of continuous insider selling on any transient

price

strength the stock may show. The selling is not necessarily by the corporate

insiders

themselves, it can also be by those who notice the heavy selling by corporate

insiders

and their associates. It is difficult to conceal important insider selling very

long.

As a result, Enron's relative strength versus the blue chip DJIA made new

lows in

March

and the stock kept falling. See also the numerous Tiger technical warning on

the

chart.

Bear Market Hits Enron Hard in 2001

In

May 2001, Tiger'S Peerless Stock Market Timing warned of a coming sell-off

with

its automatic Sell S4. The completion of a head/shoulders pattern showed

trouble

lay ahead. Ken Lay's margin account would soon be in big trouble. Lay

claimed

in his criminal defense trial in 2006 that 90% of his net worth was in Enron

stock,

but by 2001 he was 100 million dollars in debt. He maintained he only sold

his

Enron stock to meet tmargin calls. But, the truth was Lay did have other

alternatives

to borrowing from Enron and selling his company's stock. He had $50

million

in other credit lines besides Enron, non-Enron stock and real estate.

(

Source. ) Lay soon surrendered to temptation in 2001 amd sold million of

dollars

worth of Enron, all the while failing to mention to public shareholders

how

bad the accounting and the financial situation were at Enron.

Because

of a loophole in the law requiring timely reporting of sales of stock in

their

own company, Key Lay did not have to report his sales of Enron until the

end

of the calender year. The loophole was for those executive receiving margin

calls

from their stock broker.

(Source: http://www.fatpitchfinancials.com/314/tracking-insider-trading/

)

Bear Market

DJI

Sell-Off Started in May 2001 and ended in 2001 after 9/11 Attack of WTC

Enron's Complete

Collapse in 2001.

On August 14th, 2001,

Lay's protoge and hand-picked successor as Enron CEO,

Jeffrey Skilling,

suddenly resigned. He had been CEO for only six months. He was

to be paid $132 million

in the first year. Skilling had created EnronOnline,

an

Internet-based energy trading

operation, which became widely used but brought

notoriety to Enron as a

result of its rigged trading of electric power to California.

In the middle of the

brown-outs in late July 2001, Skilling was reported to have

quipped "What is

the difference between California and the Titanic? At

least

when the Titanic went

down, the lights were on." Upon quitting his post, Skilling

began dumping $60 million in

Enron stock on the market in blocks of 10,000 to

500,000. Prosecutors

used this to prove "insider trading", arguing that Skilling

knew of the impending

bankruptcy. In 2005, Skilling was found guilty of insider

trading, five counts of

making false statements to auditors and 12 counts of securities

fraud. He was sentenced to

prison for 24 years and fined $45 million.

Ken Lay then returned to

the post of Enron CEO. By then the stock was falling fast.

He still managed to sell

over $70 million worth of Enron stock. He used the

proceeds to meet margin

calls as the stock market fell sharply around the time

of September 11th attack

on the World Trade Center in New York. Lay's wife, Linda,

was accused of selling

500,000 shares of Enron stock totaling $1.2 million on November

28, 2001. Records

show that Mrs. Lay placed the sale order sometime between 10:00

and 10:20 am.

News of Enron's problems, including many millions of dollars in losses

that had been hidden fromt he

public was disclosed for the first time at about

10:30 AM. Soon after

that the stock fell below a dollar. Enron executive Paula Rieker

was also charged with

criminal insider trading. She had obtained 18,380 Enron shares

for $15.51 a share. She then

sold that stock for $49.77 a share in July 2001, a week

before the public was told

about an additional big Enron loss.

Three brokerage giants,

Merrill Lynch, JPMorgan-Chase and Citigroup were

accused by the SEC of helping

Enron inflate profits and conceal debts in 2001.

Merrill had in 1998 fired an

analyst for downgrading Enron, only to scoff at its

investors in private. Merrill

paid an $80 million fine ( Source.

) When the other

companies agreed to take

"corrective action" to prevent such actions in the future,

the charges were dropped. (Source. )

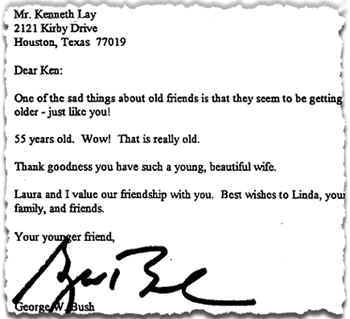

Ken

Lay on the Stand in his own defense in law court in 2006.

Lay "steadfastly refused to accept responsibility for any decision that might

have

contributed to the fall of Enron. Instead, he blamed Enron's troubles

on

a market panic caused by short-sellers, The Wall Street Journal, the bursting

of

the technology boom, the terrorist attacks of Sept. 11 and, most of all, the

schemes

hatched by the former chief financial officer, Andrew S. Fastow.

Kenneth

Lay, his wife and President George Bush

Convicted Enron swindler Kenneth Lay previously had helped

Bush enormously

in

raising campaign contributions. He gave "$122,500 to Bush Gubernatorial

campaign.

Lay had Enron give $50,000 to pay for Bush's second inaugural party

in

Austin in 1999 -- a showcase event that was organized by Karl Rove and others

to

help the Texas governor step onto the national political stage. Bush had given

Enron

exactly what it wanted in 1999, legislation that deregulated the state's

electrical

markets. From this, Lay knew he had found his candidate for president.

"When Bush opened his campaign, Lay opened the cash spigots. As a

"Bush

Pioneer" in the run-up to the 2000 presidential election, Lay was a key

member

of the Bush campaign's fund-raising inner circle. Under Lay's leadership,

Enron

ultimately gave Bush $550,025, making the corporation the Texan's No. 1

career

patron at the time the 2000 election campaign began, according to the

Center

for Public Integrity. Lay personally pumped almost $400,000 into Republican

hard-

and soft-money funds, while Enron slipped another $1.5 million into the GOP's

soft-money

cesspool.

"But that

was just the beginning. Lay sent a letter to Enron executives urging them to

contribute to Bush's campaign. More than 100 of them -- including Skilling, a major

Bush

giver since 1993, when he cut his first $5,000 check to GW's gubernatorial

campaign

-- did just that. Dozens of spouses wrote, including "homemaker" and

frequent

$10,000 donor Linda Lay, gave as well, making the Enron "family"

a

prime source of the money... All told, it is estimated that, over the

years

prior the company's bankruptcy, Lay, his company and its employees

contributed

close to $2 million to fund George W. Bush's political rise. Lay found

other

ways to help, as well. He put Enron's corporate jets at the disposal of the

Bush

campaign in 2000. He kicked in $5,000 to pay for the Florida recount fight,

while

a top Enron "consultant," former Secretary of State James A. Baker III,

ran

the Republican's recount effort. He even paid for his own bookkeeping,

chipping

in $1,000 to help the Bush-Cheney campaign comply with campaign-finance

laws.

And Lay and Enron gave $300,000 to underwrite the Bush-Cheney inauguration

festivities

in 2001.

(Read

- John Nichols, Nation article on the Lay and Bush connection.

http://www.commondreams.org/views06/0526-27.htm

)