Jesse Livermore and TigerSoft's Internal Strength Indicators

See ahttp://www.jesse-livermore.com/start-trading.html

Jesse Livermore

was a self-made man. He traded only his own money - not other

people's, like modern investment banks

and hedge funds. He was known as

the "Great Bear of Wall Street".

He made many million dollars selling short in the Crashes

of 1907-1908 and 1929-1932. He also lost

both fortunes in the bull markets that

followed each crash. One wonders if

he fell in love with the short side?

Did he only trade that way? Why?

It's much safer to play the trend. He didn't

have Peerless.

His thoughts on trading are extraordinarily

helpful because of the insights into

market psychology. His

"trading rules" are one of the foundations of modern

technical analysis. "To invest

or speculate successfully, one must form an opinion

as to what the next move of importance will be

in a given stock. Speculation is nothing

more than anticipating coming movements."

He believed in playing a trend he

believed would continue. Trading range

ups and downs did not interest him.

Most important, Jesse believed the best trading

opportunities occurred at key

"pivot points." He

said: "Whenever I have had the patience to wait for the market

to arrive at what I call a Pivotal Point

before I started to trade; I have always

made money in my operations."

In selling short he wanted prices to

confirm a downtrend by making a new after

an unsuccessful test of a previous low that had

held up for a while. The new lows could

be from a breakdown beklow support in a long,

horizontal trading range or it could

a new low after a false and short-term rally in

lomger-term downtrending stock. At the

pivot point prices Jesse' believed prices could

move up or down. He wanted prices

to turn down from the pivot point. This

would confirm his bearish judgement on the

stock and he would then go short.

He learned to wait for the breakdown at the pivot

point. He believed in letting the market

tell him that he was right.

With Tiger's Accumulation Index in red

territory and the Closing Power confirming thr

price weakness, it usually works out well to

sell short when the stock breaks below its

support. This is consistent with Jesse's

main trading tactic, selling short when a weak

stock turns down from a pivot point.

We also want to see the Relative Strength confirm

the new low, which it did in FSLR and WLT

below.

CP and AI Confirmed Fresh

Price Breakdowns Are Best Shorts

Jesse did not have the advantage of being

able to check the Tiger Internal Strength

Indicators to see if they confirmed the

new low. We must. Many of what prove to

be false new lows are clearly not

confirmed by Tiger's Closing Power, Accumulation

Index, OBV and Relative Strength Quotient

(RSQ).

Here are several examples of unconfirmed

breakdowns.

Accum. Index Failures To Confirm Fresh New Price Low

Decisiveness

Livermore advocated a quick decisiveness in going short. He wanted a buffer of profits

so

that he would not be scared into covering by a minor rally.

"I never benefited much from a

move if I did not get in at somewhere near the beginning

of

the move. And the reason is that I missed the backlog of profit which is very necessary

to

provide the courage and patience to sit thourgh a move until the end comes - and to

stay

through any minor reactions or rallies which were bound to occur from time to time

before

the movement had completed its course."

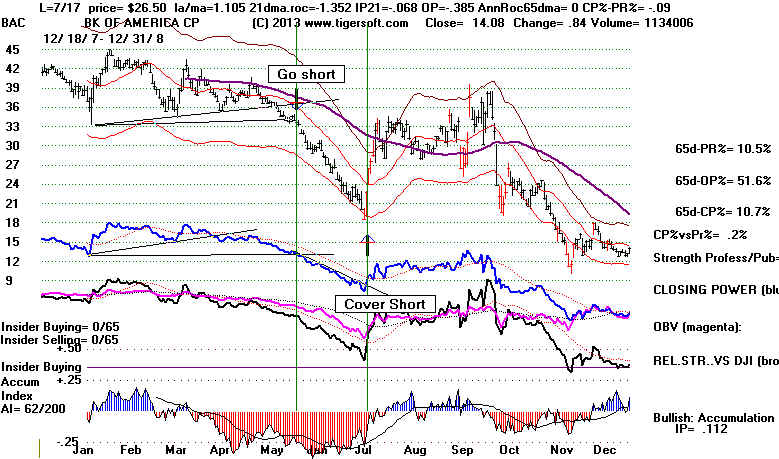

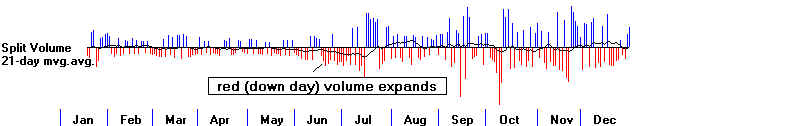

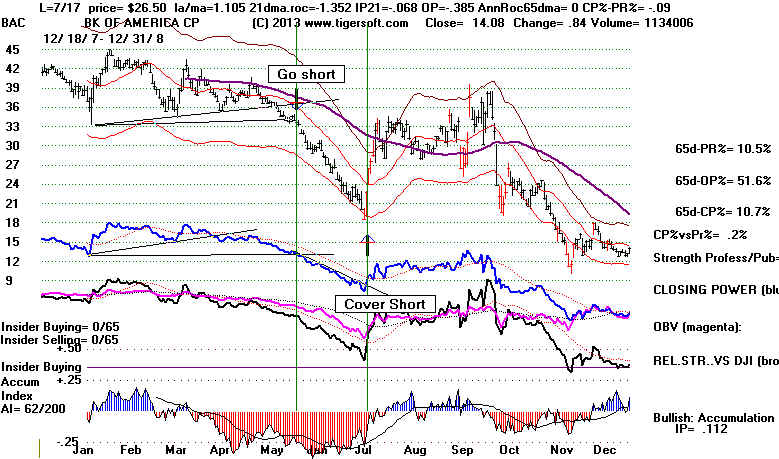

Now apply these ideas to BAC below (Bank of America).

By Livermore's and Tiger's

standards,

BAC was a very fine looking short sale candidate at above 33 in

late May

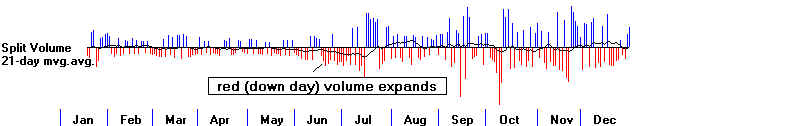

2008. In particular, notice the bottom of the Tiger charts just below. See

the daily

trading volume. Tiger shows volume in red if the stock fell and blue if the stock

advanced

for the day. For Livermore, it was important that the stock's trading volume

expand as

the stock fell and dimminish when it rose in minor counter-trend moves.

When volume

deviated from this pattern, it was a warning for him.

If prices then turned up,

he would

have covered his short sale.

KNOWING WHEN TO SELL SHORT IS ONLY HALF THE BATTLE

KNOWING WHEN TO COVER THE SHORT IS THE OTHER HALF THE BATTLE

We watch the Blue Tiger Closing

Power trend. As long as it is below its

downtrend,

we can safely trust that Professionals are still bearish the stock

and we can

give it every chance to keep falling. But when the Blue Closing Power

breaks its

own downtrend-line, cover your short sale. This shows that Professionals

are turning

net bullish and there could be a "short squeeze".

More of Livermore's Trading

Lessons

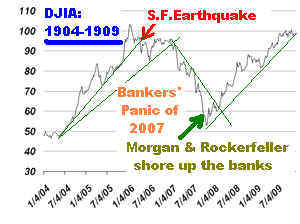

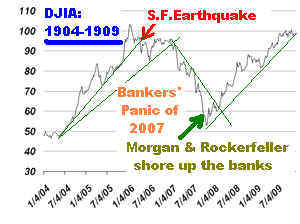

Livermore became

famous after the Panic of 1907 when he made a million selling stocks

short as the market crashed. He had noticed how buying power was drying

up and predicted

that there would be a

swift drop in prices as speculators were forced to sell because of

margin

calls and a lack of credit. See the details at

http://www.tigersoftware.com/TigerBlogs/May-20-2010-/index.html

In 1929, he

noticed market conditions were similar to those of 1907.

DO NOT FALL IN LOVE WITH THE SHORT SIDE.

You can in the DJI chart above, the DJI quickly recovred its losses of

2007 in 2008. Livermore

did not seem to profit from

this bull market. Did he make the mistake, I mentioned earlier, of

falling in love with the

short side and not switiching quickly enough to th ebuy side. It would seem so.

> Instead of making

investment decisions independently, after making millions in the Crash of 1907,

he listened to and heeded

another person's advice regarding Cottom and then added to a losing position.

Livermore is important to use now for the

working philosophy he set out for others on profitably trading

securities. It is said that

he often broke his own rules. While flexibility and pragmatism are important,

breaking his own rules can be a sign of

emotionalism coloring one's judgement. This is risky for the

cool and calculating short selling

trader.

Livermore's Quotes are extraordinarily

insightful for the would-be trader, long or short.

"All through time, people have basically acted and

reacted the same way in the market

as a result of: greed, fear, ignorance, and hope. That is why the numerical formations

and

(stock) patterns recur on a constant basis."

—Jesse Livermore, How To Trade In Stocks.

"The (stock) fluctuations were from the first associated in my mind with

upward or

downward movements. Of course there is always a reason for fluctuations, but the

tape

does not concern itself with the why and wherefore. It doesn't go into

explanations...

The reason for what a certain stock does today may not be known

for

two or three days, or weeks, or months. But what the dickens does that matter?

Your

business is with the tape now.... The reason can wait. But you must act instantly

or

be left. Time and again I see this happen."

...

"There are times when money can be made investing and speculating in stocks,

but

money cannot consistently be made trading every day or every week during

the

year. Only the foolhardy will try it. It just is not in the cards and cannot be

done."

"The point is not so much to buy as cheap as possible

or go short at top price,

but

to buy or sell at the right time."

"I am tired of hearing the public and papers blame Wall Street for parting fools

from

their money... It's the successful business man who is the biggest sucker of

the

lot. He has made a fortune in his own line. How? By being on the job for years;

by

learning all there was to know about it; by taking reasonable chances; by

utilizing

his knowledge and experience to anticipate probabilities."

"Speculation is far too exciting. Most people who speculate hound the brokerage

offices..the

ticker is always on their minds. They are so engrossed with the minor ups

and

downs, they miss the big moves."