Equity Funding's Accounting Lessons

from the late 1960s...

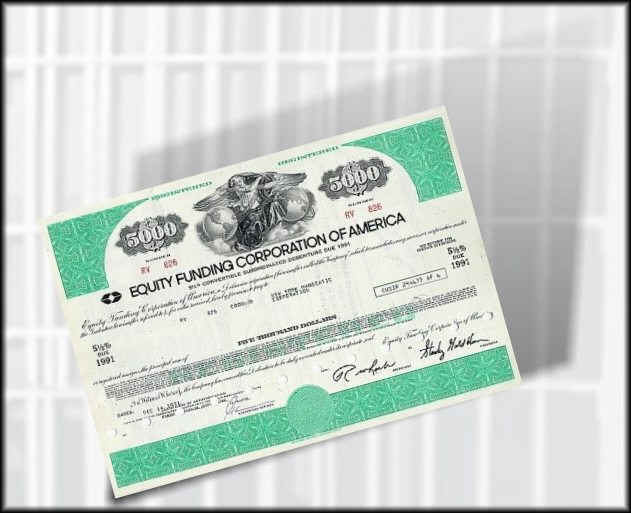

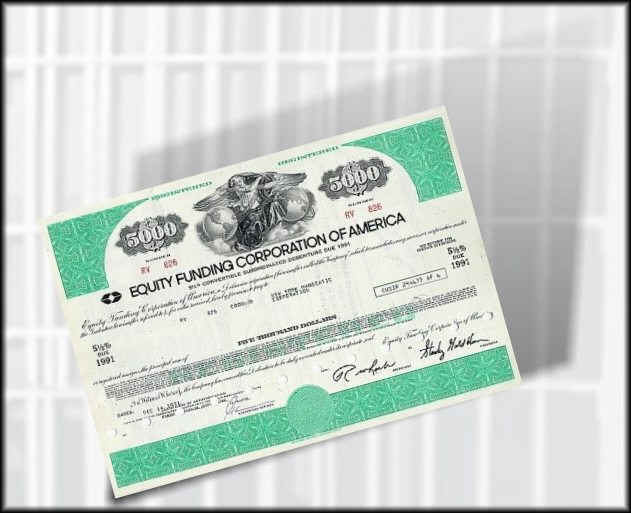

Equity Funding was a Los Angeles-based U.S. financial conglomerate

that marketed a package

of mutual funds and life insurance to private individuals in the 1960s and 70s.

According to a 1969

article in Forbes magazine, Equity hired 150 new salesmen every month. Every quarter

its

earnings got better and better until 1969. After the firm's final collapse in 1974,

one newspaper

speculated that up to 1,000 people at the company knew about the fraud. These

employees kept

quiet, perhaps out of fear; intimidation and even threats of violence were rumored to have

kept

the scheme running.

http://www.thehallofinfamy.org/inductees.php?action=detail&artist=equity_funding

What does a

good accountant say when asked by his CEO

what

the next earnings will look like: "Whatever you would like it be, sir."

Preface:

Accounting Fraud Is Very Easy

The

following is is taken from Wikopedia.

"It is fairly easy for a top executive to reduce the price of his/her

company's stock – due

to information asymmetry. The executive can accelerate

accounting of expected expenses,

delay accounting of expected revenue, engage in off balance sheet transactions to make

the company's profitability appear temporarily poorer, or simply promote and report

severely

conservative (e.g. pessimistic) estimates of future earnings. Such seemingly adverse

earnings

news will be likely to (at least temporarily) reduce share price. (This is again due to

information asymmetries since it

is more common for top executives to do everything

they can to window dress their company's earnings forecasts). There are

typically very

few legal risks to being 'too conservative' in one's accounting and earnings estimates.

A reduced share price makes a company an easier takeover target. When

the company

gets bought out (or taken private) – at a dramatically lower price – the

takeover artist gains

a windfall from the former top executive's actions to surreptitiously reduce share price.

This can represent tens of billions of dollars (questionably) transferred from previous

shareholders to the takeover artist. The former top executive is then rewarded with

a golden

handshake for presiding over the firesale that can sometimes be in the

hundreds of millions of dollars for one or two years of work. (This is nevertheless

an excellent bargain for the takeover artist, who will tend to benefit from developing

a reputation of

being very generous to parting top executives)." "

Equity Funding was a typical 1960s' conglomerate.

Its CEO, a man named Goldblum,

decided to take over other companies using the fast rising shares of his own EQF

stock.

This made it essential for Goldblum to maintain the price of the stock of Equity

Funding.

(He seems never to have thought what would happen if a bear market came along.)

Real growth was too slow. He decided in 1965 to fabricate even better

earnings

He instructed EQF's chief financial officer to make fictitious entries in certain

receivable

and income accounts

www.hancoxandsulem.com/publications/a1equityfunding.htm

By inflating these accounts, the earnings per share beat expectations and EQF

could buy more companies out.

Fictitious entries alone did not bring in cash. But selling policies to

fictitious customers

could. So, EQF executives decided to sell

imaginary policies to other insurance companies

via the redistribution system known as reinsurance. Reinsurance companies pay

money

for policies they buy . Reinsurance is used to spread the risk around.

At the end of the

first year, the issuing insurance companies have to pay the re-insurers part

of the

premiums paid in by the policyholders. So in the first year,

selling imaginary policies

to the re-insurers brought in large amounts of real cash. Before the

premiums

came due, Equity " killed " imaginary policyholders with heart

attacks, car accidents

and cancer. Reporter Robert

Cole wrote for the New York Times back on April 15, 1973,

"Those closest to (the scam) were believed

to have cleverly concealed their tracks through

intimidation, subterfuge, threats of violence and the use of doctored

computer tapes."

Keep in mind,

in 1973 computers were new. Auditors accepted computer printouts as proof

that policies existed. Just one month before it all unraveled, Cowen

& Co. recommended

purchase of Equity Funding "for aggressive accounts." Burnham

& Co., Inc. said on

January 30 "We regard the stock, selling at 9.9 times estimated

1973 earnings,

an excellent value and rate it a Buy."

http://www.davehancox.com/hancox---sulem---public-speaking/publications/equity-funding

The scheme fell apart when an angry over-worked

employee (Raymond Dirks( told the

authorities about Equity's lies and fraud. Soon, rumors spread

throughout Wall Street

and the insurance industry. Within days, the Securities and Exchange

Commission had

informed the California Insurance Department. In 1974, the officers of

the company were

arrested, tried and condemned to prison terms. Equity president Stanley

Goldblum

got 8 years and a fine of $20,000. Five other top execs served sentences

ranging

between 3-7 years.

http://www.buyandhold.com/bh/en/education/history/2004/ray_dirks.html

http://www.networkworld.com/newsletters/sec/2002/01190226.html

."

Notable

accounting scandals (www.Wikopedia.com )

| Nugan Hand Bank |

1980[2] |

|

Australia |

|

| ZZZZ Best |

1986[3] |

|

United States |

Ponzi scheme

run by Barry

Minkow |

| Barlow Clowes |

1988[4] |

|

United Kingdom |

Gilts management service. £110 million missing |

| MiniScribe |

1989[5] |

|

United States |

|

| Polly

Peck |

1990[6] |

|

United Kingdom |

|

| Bank of Credit and Commerce

International |

1991[7] |

|

United Kingdom |

|

| Phar-Mor |

1992[8] |

Coopers & Lybrand |

United States |

mail fraud, wire fraud, bank fraud, and transportation of funds obtained by theft or

fraud |

| Informix |

1996[9] |

Ernst

& Young[10] |

United States |

|

| Sybase |

1997[11][12][13] |

Ernst & Young[14] |

United States |

|

| Cendant |

1998[15] |

Ernst & Young |

United States |

|

| Waste Management, Inc. |

1999[16] |

Arthur

Andersen |

United States |

Financial mistatements |

| MicroStrategy |

2000[17] |

PricewaterhouseCoopers |

United States |

Michael Saylor |

| Unify Corporation |

2000[18] |

Deloitte & Touche |

United States |

|

| Computer Associates |

2000[19] |

KPMG |

United States |

Sanjay Kumar |

| Lernout & Hauspie |

2000 |

KPMG |

Belgium |

Fictitious transactions in Korea and improper accounting methodologies elsewhere |

| Xerox |

2000[20] |

KPMG |

United States |

Falsifying financial results |

| One.Tel |

2001[21] |

Ernst & Young |

Australia |

|

| Enron |

2001[22] |

Arthur Andersen |

United States |

Jeffrey

Skilling, Kenneth

Lay, Andrew

Fastow |

| Adelphia |

2002[23] |

Deloitte & Touche |

United States |

John Rigas |

| AOL |

2002[20] |

Ernst & Young |

United States |

Inflated sales |

| Bristol-Myers Squibb |

2002[20][24] |

PricewaterhouseCoopers |

United States |

Inflated revenues |

| CMS

Energy |

2002[20][25] |

Arthur Andersen |

United States |

Round trip trades |

| Duke

Energy |

2002[20] |

Deloitte & Touche |

United States |

Round trip trades |

| Dynegy |

2002[20] |

Arthur Andersen |

United States |

Round trip trades |

| El Paso Corporation |

2002[20] |

Deloitte & Touche |

United States |

Round trip trades |

| Freddie

Mac |

2002[26] |

PricewaterhouseCoopers |

United States |

Understated earnings |

| Global Crossing |

2002[20] |

Arthur Andersen |

Bermuda |

Network capacity swaps to inflate revenues |

| Halliburton |

2002[20] |

Arthur Andersen |

United States |

Improper booking of cost overruns |

| Homestore.com |

2002[20][27] |

PricewaterhouseCoopers |

United States |

Improper booking of sales |

| ImClone Systems |

2002[28] |

KPMG |

United States |

Samuel

D. Waksal |

| Kmart |

2002[20][29] |

PricewaterhouseCoopers |

United States |

Misleading accounting practices |

| Merck & Co. |

2002[20] |

Pricewaterhouse Coopers |

United States |

Recorded co-payments that were not collected |

| Merrill Lynch |

2002[30] |

Deloitte & Touche |

United States |

Conflict of interest |

| Mirant |

2002[20] |

KPMG |

United States |

Overstated assets and liabilities |

| Nicor |

2002[20] |

Arthur Andersen |

United States |

Overstated assets, understated liabilities |

| Peregrine Systems |

2002[20] |

KPMG |

United States |

Overstated sales |

| Qwest Communications |

2002[20] |

1999, 2000, 2001 Arthur Andersen 2002 October KPMG |

United States |

Inflated revenues |

| Reliant Energy |

2002[20] |

Deloitte & Touche |

United States |

Round trip trades |

| Sunbeam |

2002[31] |

Arthur Andersen |

United States |

|

| Tyco International |

2002[20] |

PricewaterhouseCoopers |

Bermuda |

Improper accounting, Dennis Kozlowski |

| WorldCom |

2002[20] |

Arthur Andersen |

United States |

Overstated cash flows, Bernard Ebbers |

| Royal Ahold |

2003[32] |

Deloitte & Touche |

Netherlands |

Inflating promotional allowances |

| Parmalat |

2003[33][34] |

Grant Thornton SpA |

Italy |

Falsified accounting documents, Calisto Tanzi |

| HealthSouth Corporation |

2003[35] |

Ernst & Young |

United States |

Richard

M. Scrushy |

| Nortel |

2003[36] |

Deloitte & Touche |

Canada |

Distributed ill advised corporate bonuses to top 43 managers |

| Chiquita Brands International |

2004[37] |

Ernst & Young |

United States |

Illegal payments |

| AIG |

2004[38] |

PricewaterhouseCoopers |

United States |

Accounting of structured financial deals |

| Bernard L. Madoff Investment Securities LLC |

2008[39] |

Friehling

& Horowitz |

United States |

Massive Ponzi scheme.[40] |

| Anglo Irish Bank |

2008[41] |

Ernst & Young |

Ireland |

Anglo Irish Bank hidden loans

controversy |

| Satyam Computer Services |

2009[42] |

PricewaterhouseCoopers |

India |

Falsified accounts |

| Lehman Brothers |

2010[43] |

Ernst & Young |

United States |

Failure to disclose Repo

105 transactions to investors |

| Sino-Forest Corporation |

2011[44] |

Ernst & Young |

Canada-China |

|

| Olympus Corporation |

2011[45] |

Ernst & Young |

|