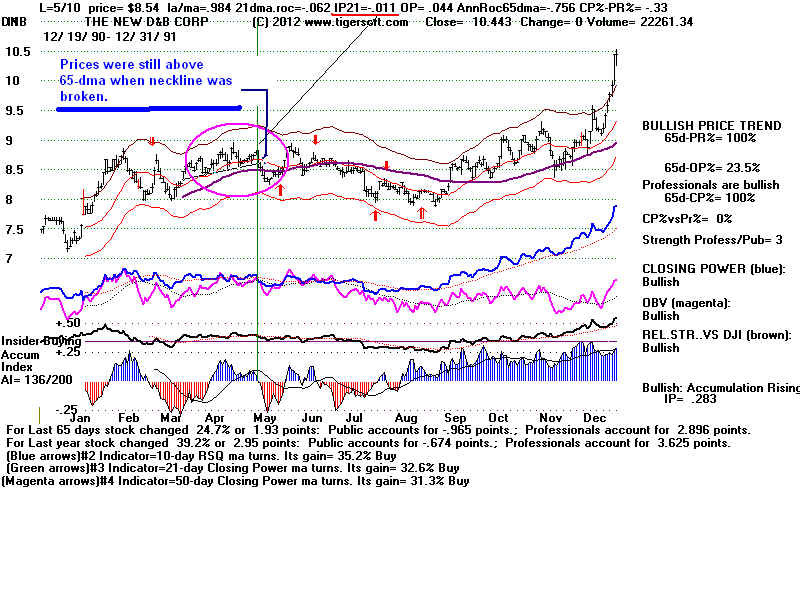

Here we have separated the completed H/S cases where the stock is above above the 65-dma

and those where it is below it when the neckline was violated. Without a Peerless major Sell, we

have to be much more careful with our short sales.

There were 39 completed H/S patterns where the neckline's penetration occurred with

prices below the 65-dma. In 22 of 39 cases, prices fell to the minimum downside objective

before the end of the year. 17 did not. Only 19 of the 39 fell more than 10% from the

close the day the neckline was penetrated. Keep in mind that this was a period in which

the DJI steadily rose except for a 6% decline in December.

H/S Completed with Prices below 54-dma

--- Neckline Break ------- ------------------------- Outcome -------------------------------------

Date IP21 Close Recovery Low Decline Minimum Objective Opct

at Low Met? Price

-------------------------------------------------------------------------------------------------------------------------------------

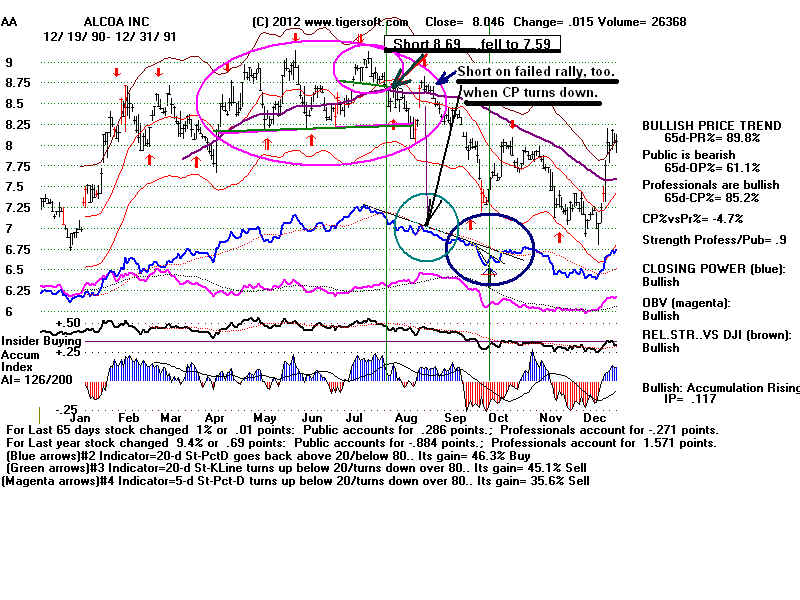

AA Aug 6 +.05 8.47 -- 6.8 19.8% Yes 8.32 .268

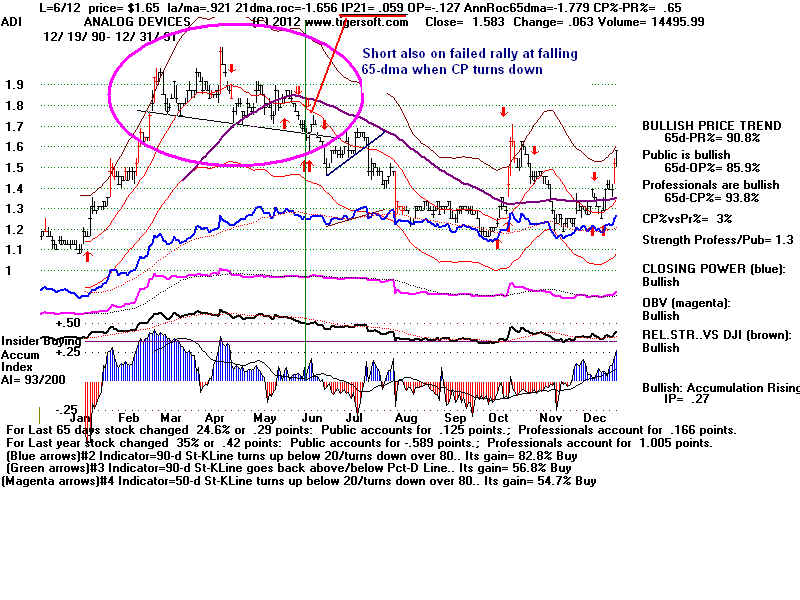

ADI June 12 +.059 1.65 1.7 1.17 29.1% Yes 1.37 -.127

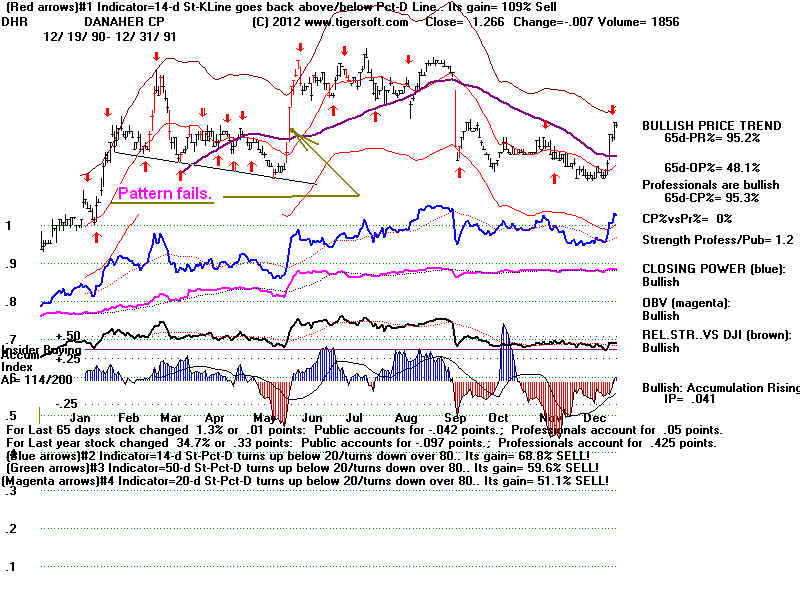

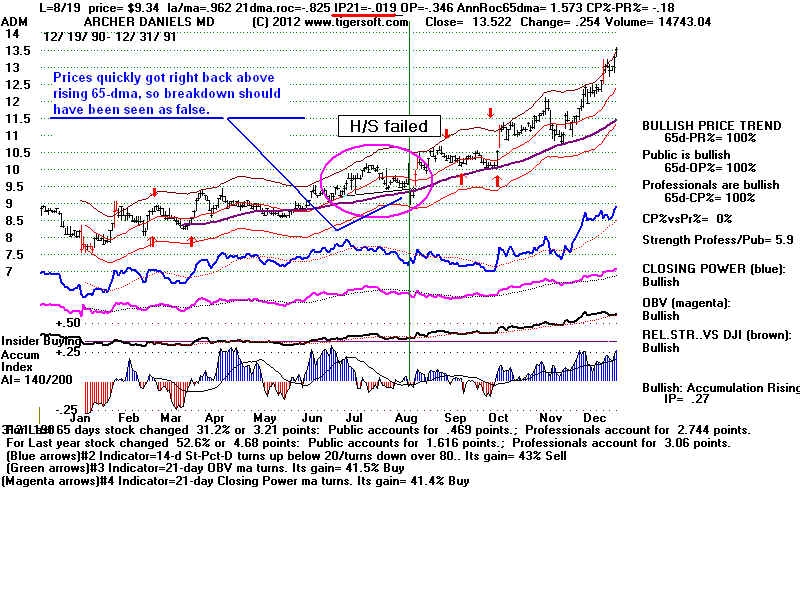

ADM Aug 19 -.019 9.34 Failed two days later when it shot back above both neckline

and 65-dma.

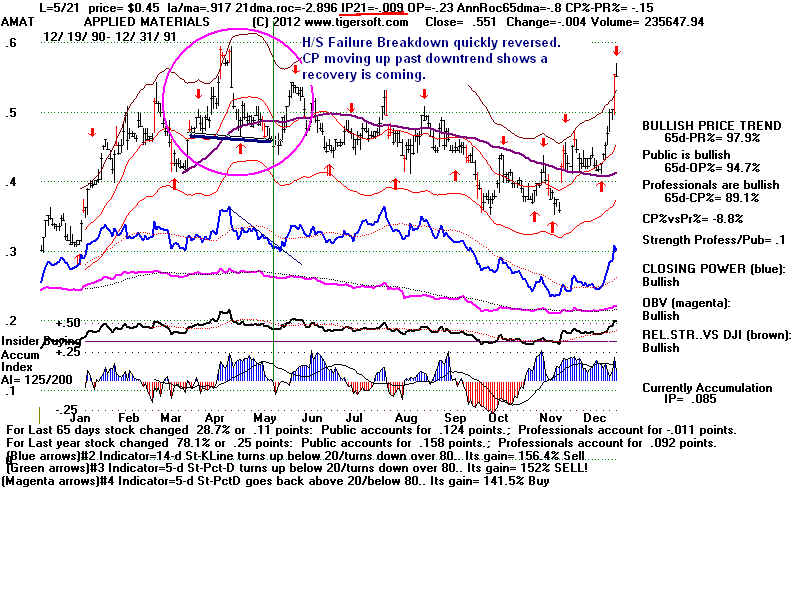

AMAT May 21 -.009 0.45 Failed four days later when it shot back above both neckline

and 65-dma.

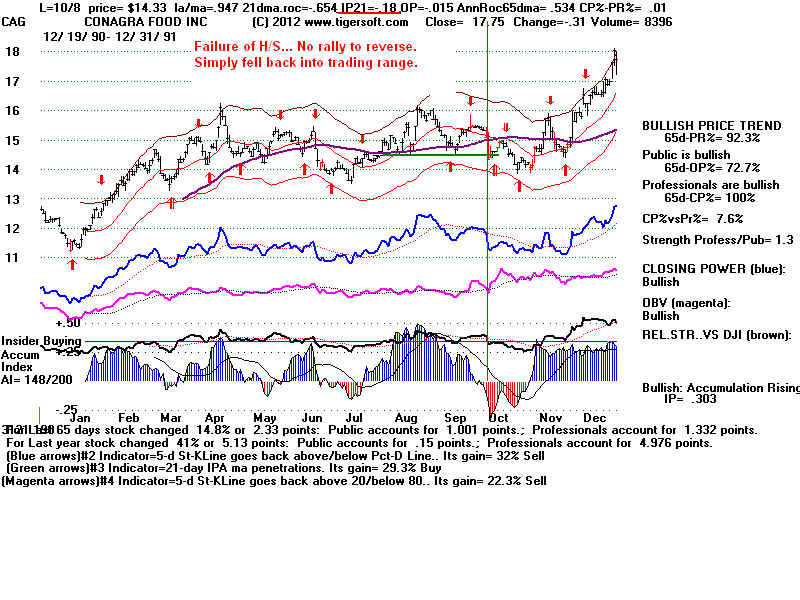

CAG Oct 8 -.18 14.33 15 14 2.3% No. 9 -.015

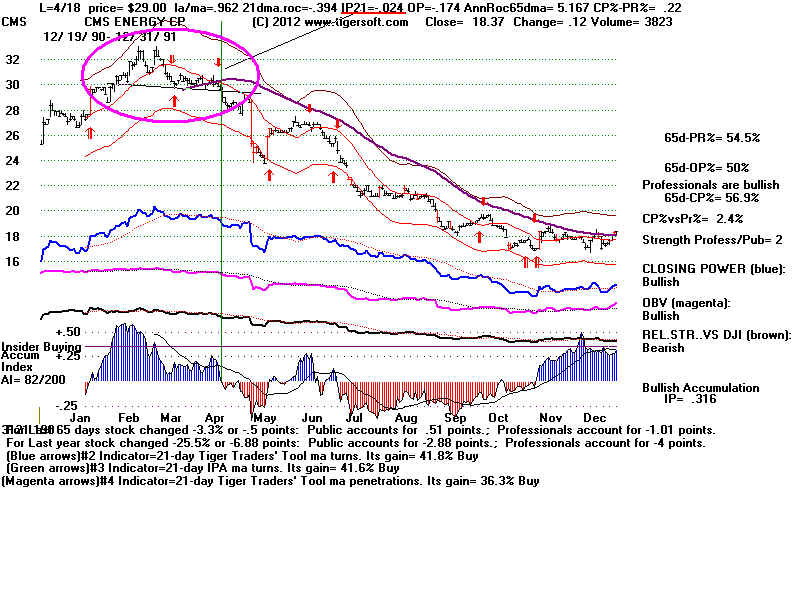

CMS April 18 -.024 29.00 - 17 41.4% Yes 25.90 -.174

DOW March 19 -.175 16.75 --- 15.4 8.1% Yes 15.5 -.235

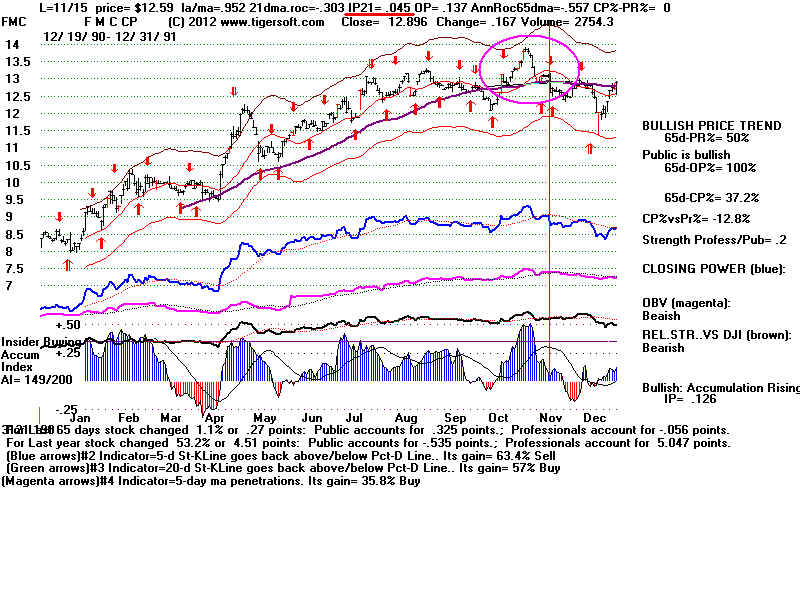

FMC Nov 15 +.045 12.59 --- 11.5 11.8% Yes 11.9 .137

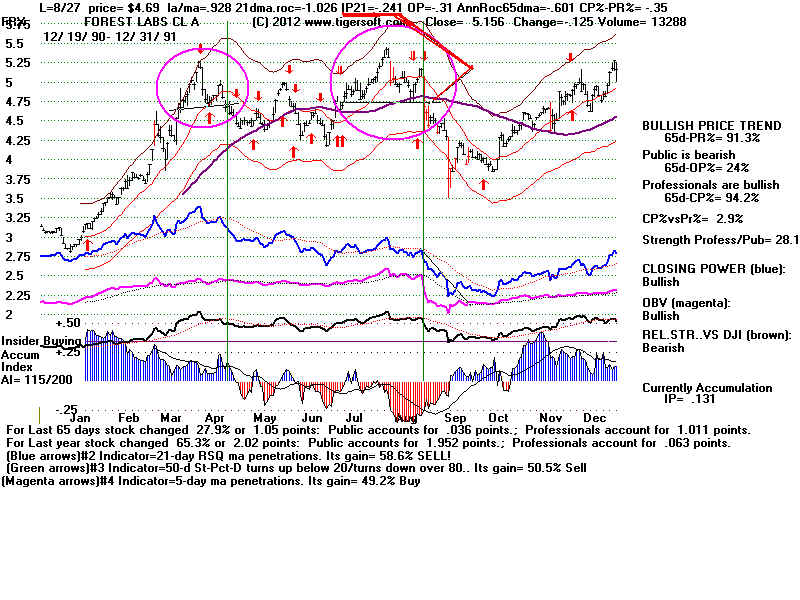

FRX Aug 27 -.241 4.69 --- 3.56 24.1% Yes 4.0 -.31

HSY Sept 9 -.172 9.94 10.3 9.25 6.9% No 90. -.259

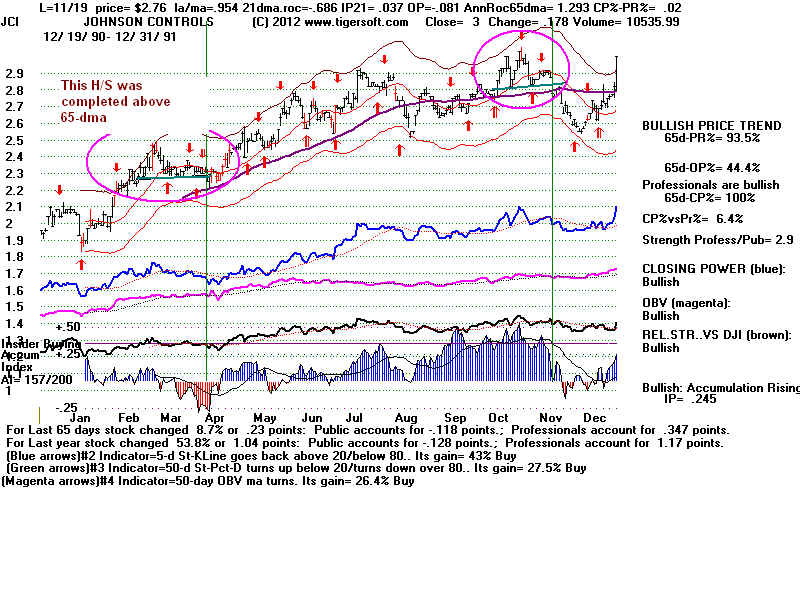

JCI Nov 19 .037 2.76 --- 2.52 8.7% Yes 2.55 -.081

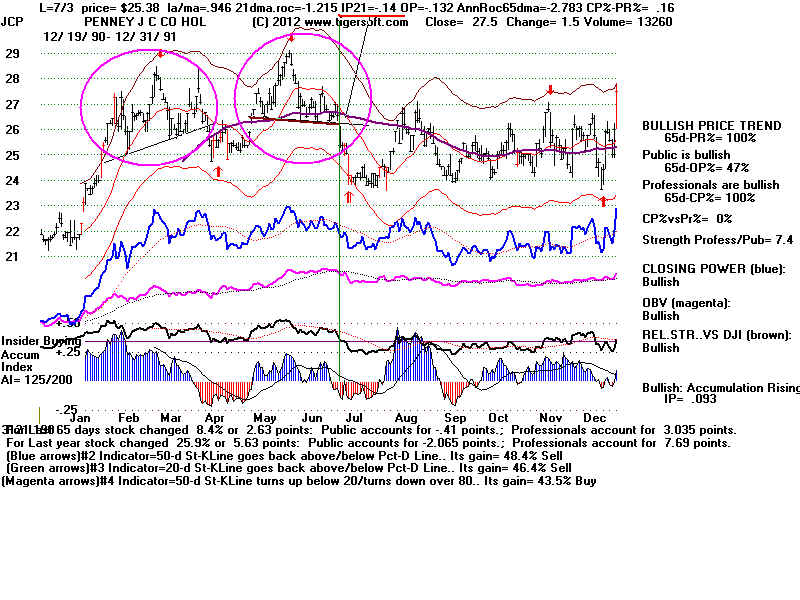

JCP July 3 -.140 25.38 --- 23.75 6.4% Yes 23.75 -.132

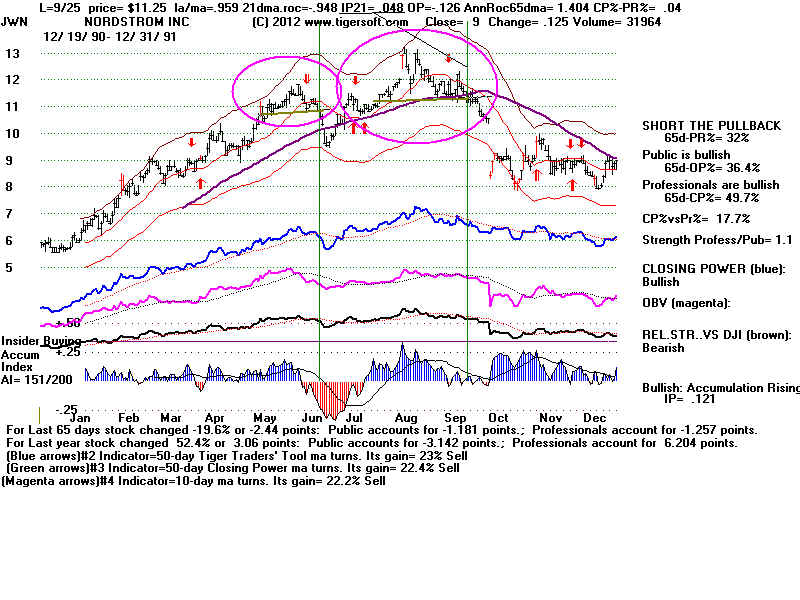

JWN Sept 25 .048 11.25 --- 8.0 28.8% Yes 9.0. -.126

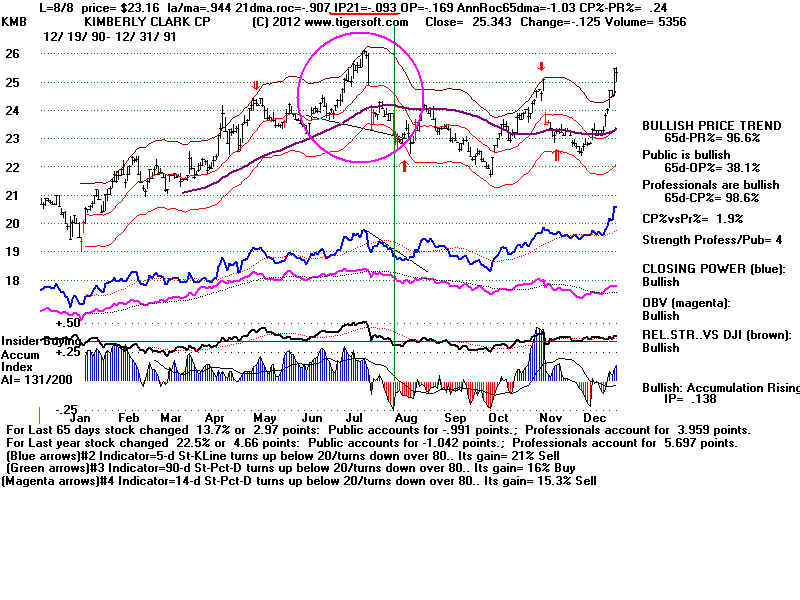

KMB Aug 8 -.093 23.16 24 21.5 6.7% No 20.5 -.169

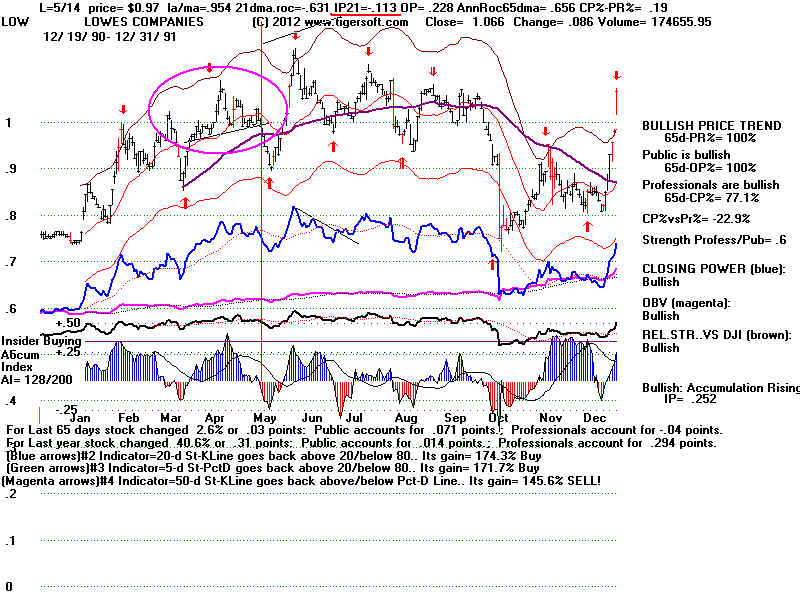

LOW May 14 -.113 0.97 --- 0.9 7.2% Yes 0.92 .228

After fulfilling its downside objective, this stock jumped to a new high. The OPct was

a warning to short sellers not to hold for to low a price.

MDP June 25 -.013 6.94 --- 6.0 13.5% Yes 6.25.

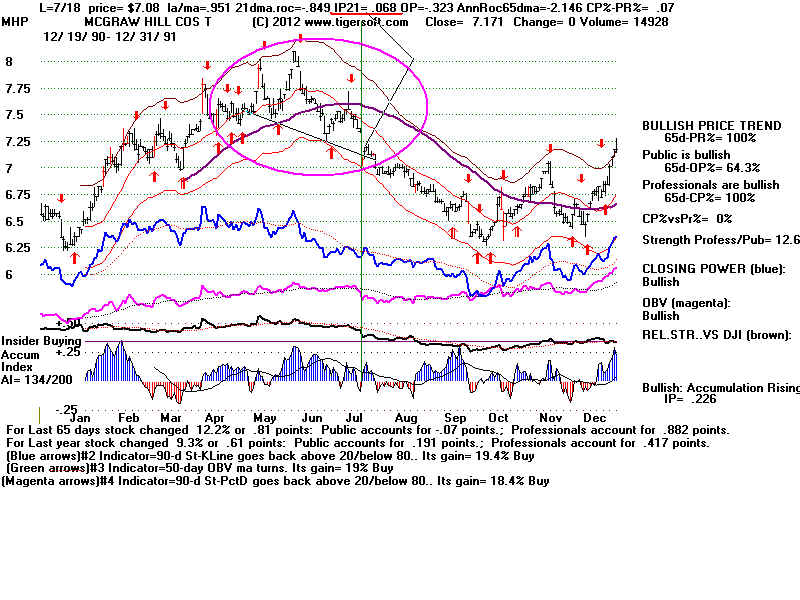

MHP July 18 .068 7.08 7.12 6.27 11.4% Yes 6.30

MMC June 7 .027 12.69 13.30 11.75 7.4% No 11.25

It did fall gradually to 11.25 in November.

The pattern was tall and downsloping.

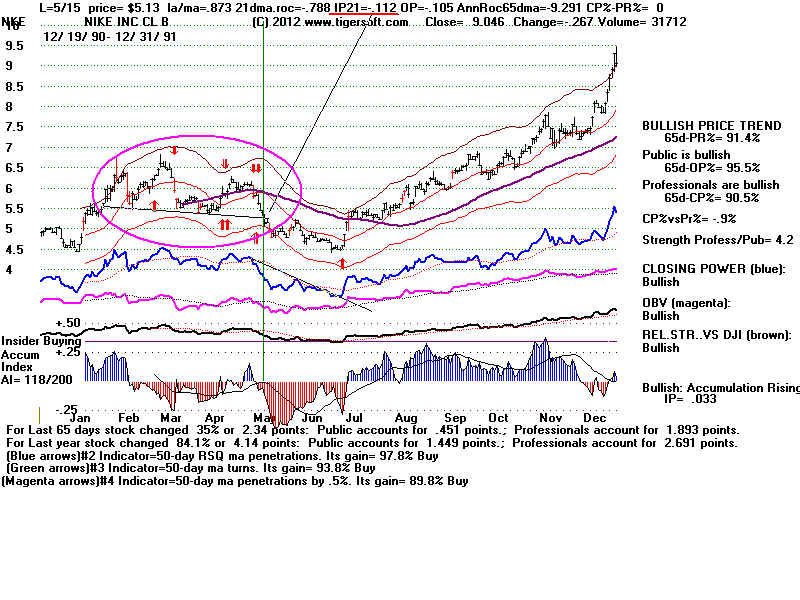

NKE May 15 -.112 5.13 -- 4.5 12.3% No 4.0

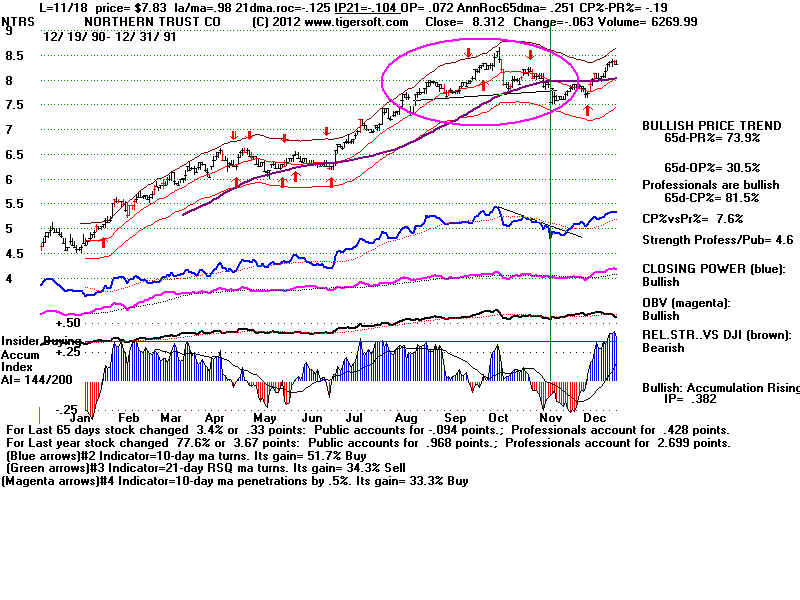

NTRS Nov 18 -.104 7.83 --- 7.5 4.2% No 7.25.

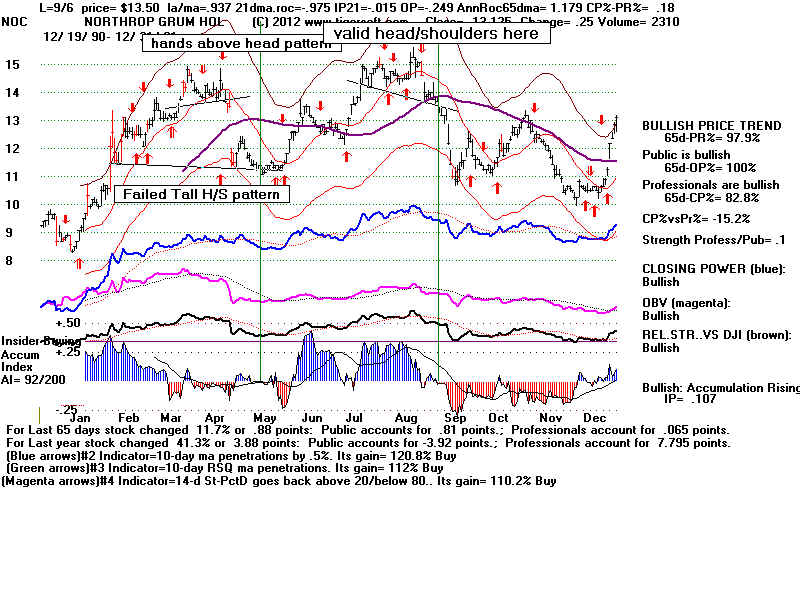

NOC Sept 6 -.015 13.5 -- 10.9 19.3% Yes 11.25

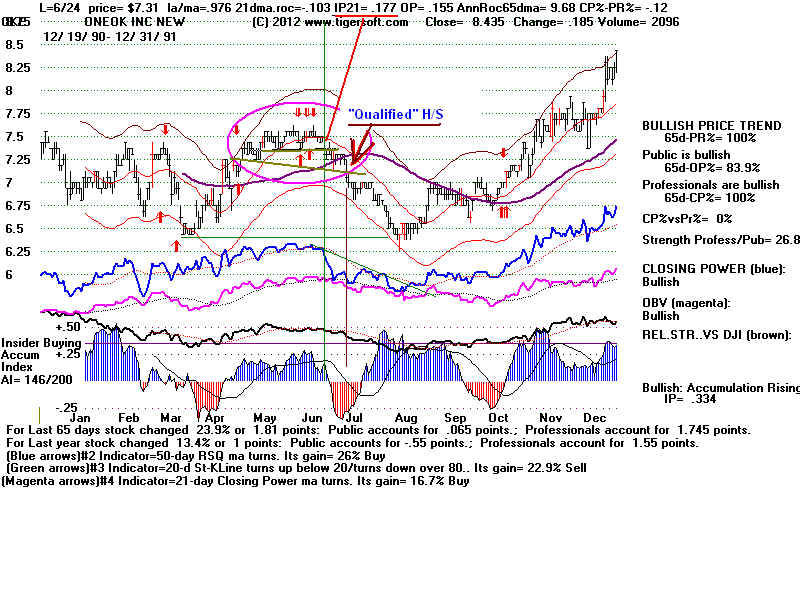

OKE June 24 -.103 7.31 -- 6.25 14.5% Yes 6.6

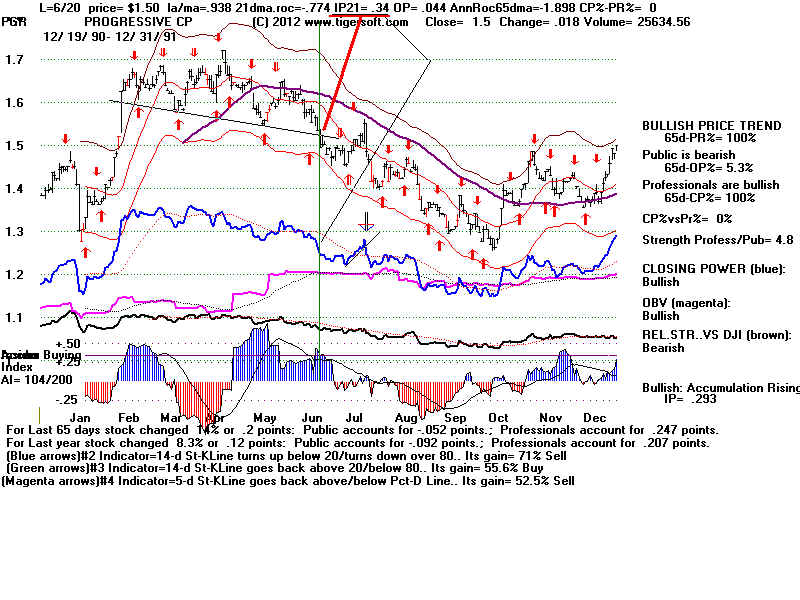

PGR June 20 +.34 1.5 1.55 1.25 16.1% Yes 1.35

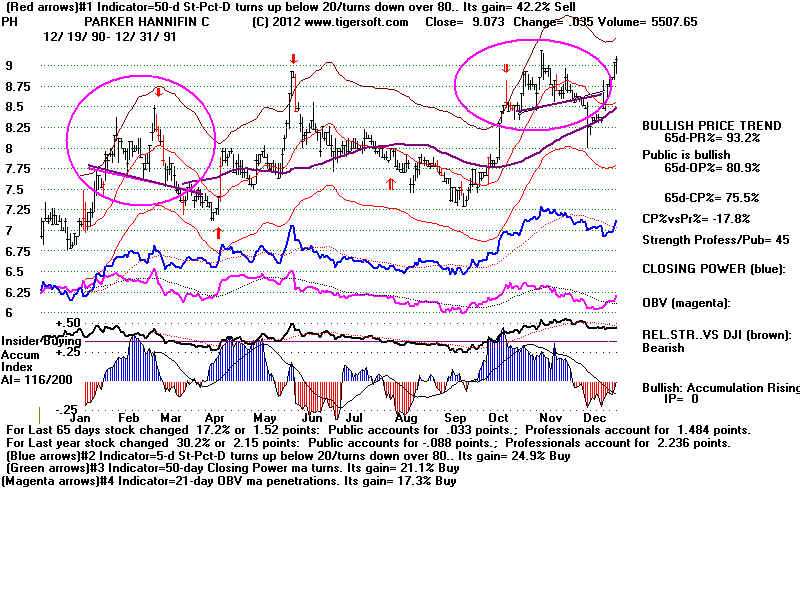

PH March 21 -.13 7.37 .-- 7.15 3.0% No 6.25

This was tall, downsloping pattern.

PH Aug 9 -.295 7.74 -- 7.30 3.0% No 6.6

This was very tall pattern.

RSH June 20 -.142 7.44 -- 5.90 20.7% Yes 6.0

S June 19 -.177 12.47 -- 10.00 19.8% Yes 11.75

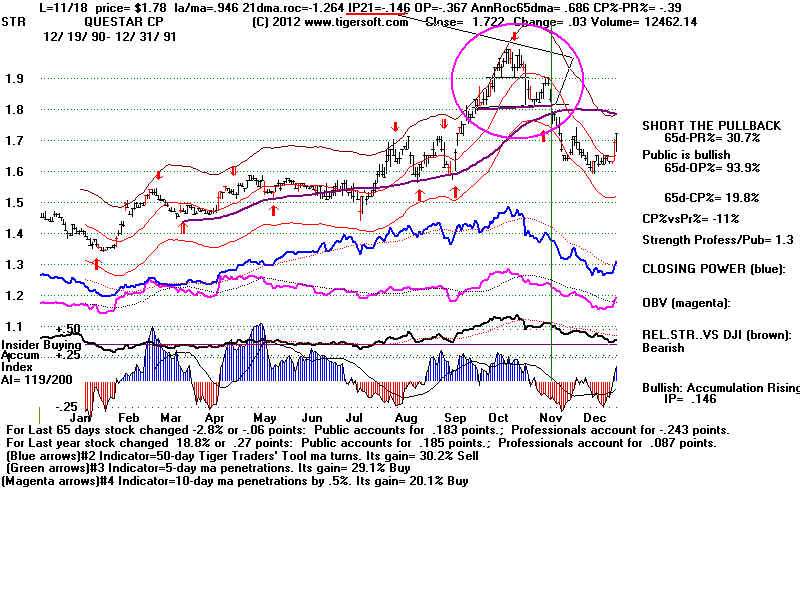

STR Nov 18 -.146 1.78 -- 1.59 10.6% Yes 1.6

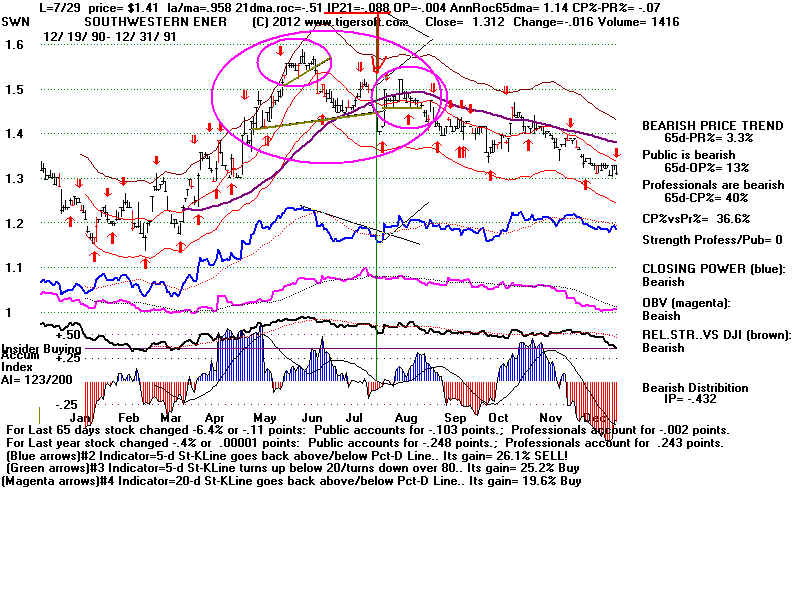

SWN July 29 -.008 1.41 1.52 1.32 6.4% No 1.29

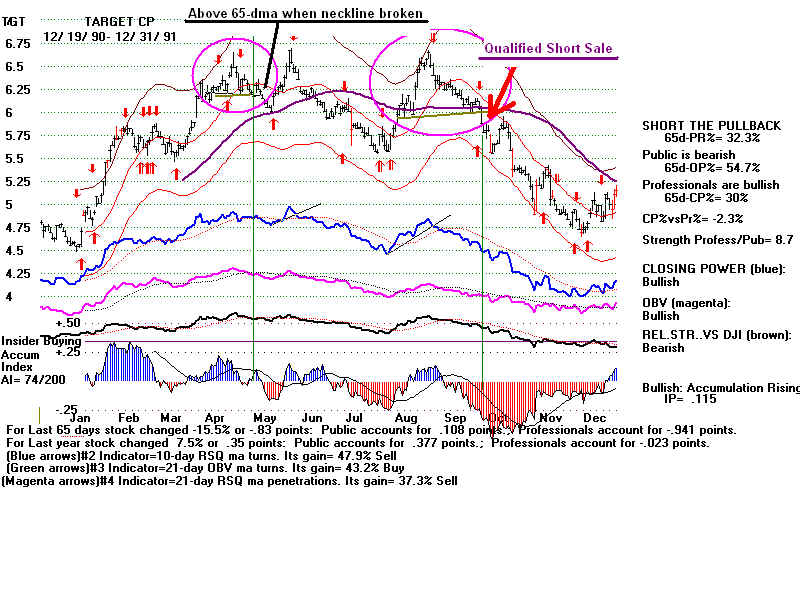

TGT Oct 3 -.306 5.87 -- 4.75 19.3% Yes 4.8

TXN May 1 .021 2.45 -- 1.66 32.2% Yes 2.07

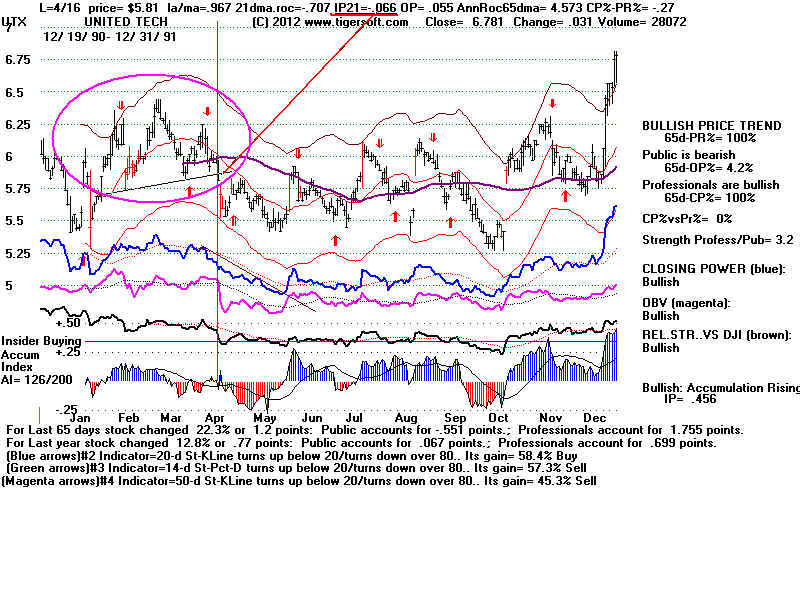

UTX Apr 16 -.066 5.48 6.11 5.41 1.3% Yes 5.42

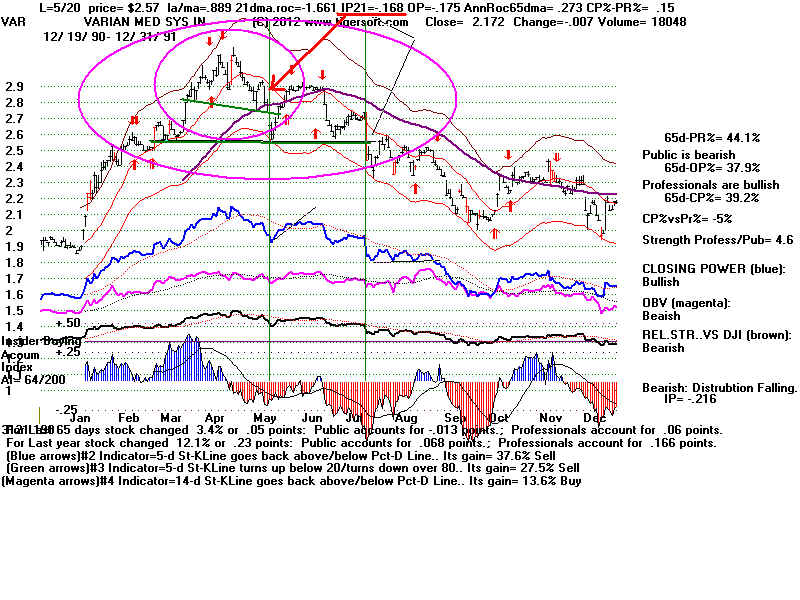

VAR April 17 -.146 2.66 2.90 2.00 24.8% Yes 2.37

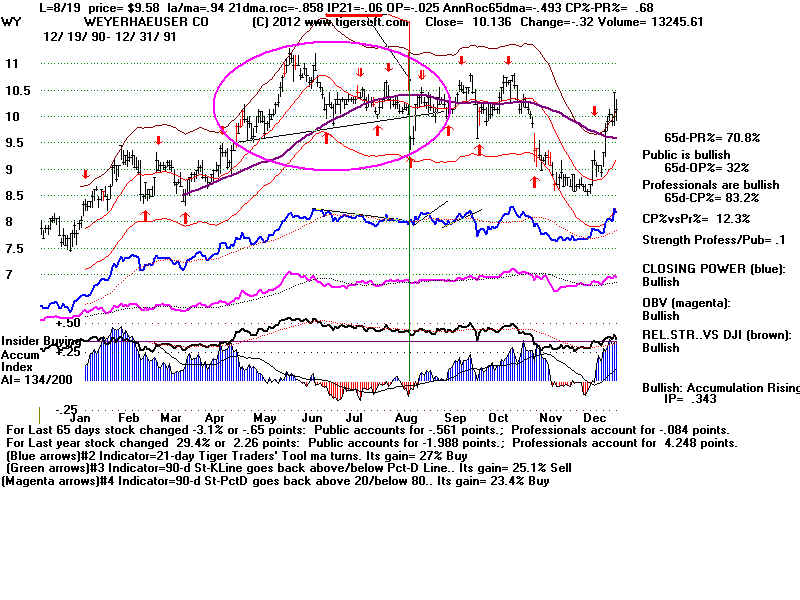

WY Aug 19 -.06 9.58 10.70 8.58 10.5% No 8.40

Objective was reached in Feb 1992.

The biggest decliners were:

CMS 29 to 17 6 months and 1 week.

TXN 32.2% in 3 months and 2 weeks.)

ADI 29.1% in 3 months and 2 weeks.

JWN 28.8% one month.

VAR 24.8%in 4 months 1 week.

FRX 24.1% in 2 weeks

RSH 20.7% in 2 months

Having an Opct score below -.10 on the breakdown seems to help find the best short sales.

la/ma 21dmaroc IP21 Opct CP%-Pr%

CMS 4/18/1991 .962 -.394 -.024 -.174 .22

TXN 5/1/91 .92 -.281 -.021 -.274 -.02

ADI 6/12/91 .921 -1.656 .059 -.127 .65

JWN 11/25/91 .971 -.832 .002 -.117 .05

VAR 5/17/91 .913 -1.465 -.146 -.164 .14

FRX 8/27/91 .928 -1.026 -.241 -.31 -.35

RSH 6/20/91 .924 -.505 -.142 -.101 0

Eliminating from consideration, the cases where the la/ma is above .94 would have eliminated

4 of the 5 biggest losers and only 2 of the 7 biggest decliners..

The five biggest failures:

ADM 8/19/91 .962 -.825 -.019 -.346 -.18

AMAT 5/21/91 .917 -2.896 -.009 -.23 -.15

UTX 4/16/91 .967 -.707 -.066 .055 -.27

CAG 10/ 8/91 .947 -.654 -.180 -.015 .01

NTRS 11/18/91 .98 -.125 -.104 .072 -.19

Waiting for the Closing Power to hook up after the first sell-off would have consistently

achieved trading gains, but they were mostly under 10%.

AA 8.47 ---> 7.47

ADI 1.65 ---> 1.58

ADM 9.34 .

AMAT 0.45

CAG 14.33 ---> 14.29

CMS 29.00 ----> 25.82

DOW 16.75 ----> 16.17

FMC 12.59 ----> 11.95

FRX 4.69 ----> 4.02

HSY 9.94 -----> 10.02

JCI 2.76 ----> 2.58

JCP 25.38 ----> 24.25

JWN 11.25 ---> 9.94

KMB 23.16 ---> 22.81

LOW 0.97

MDP 6.94

MHP 7.08

MMC 12.69

NKE 5.13

NTRS 7.83

NOC 13.5

OKE 7.31

PGR 1.5

PH 7.37

PH 7.74

RSH 7.44

S 12.47

STR 1.78

SWN 1.41

TGT 5.8

TXN 2.45

UTX 5.48

VAR 2.66

WY 9.58

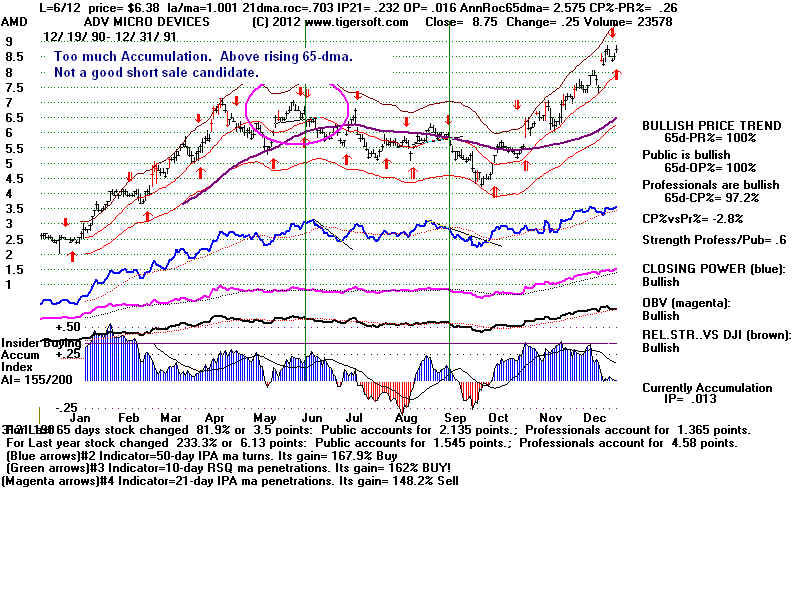

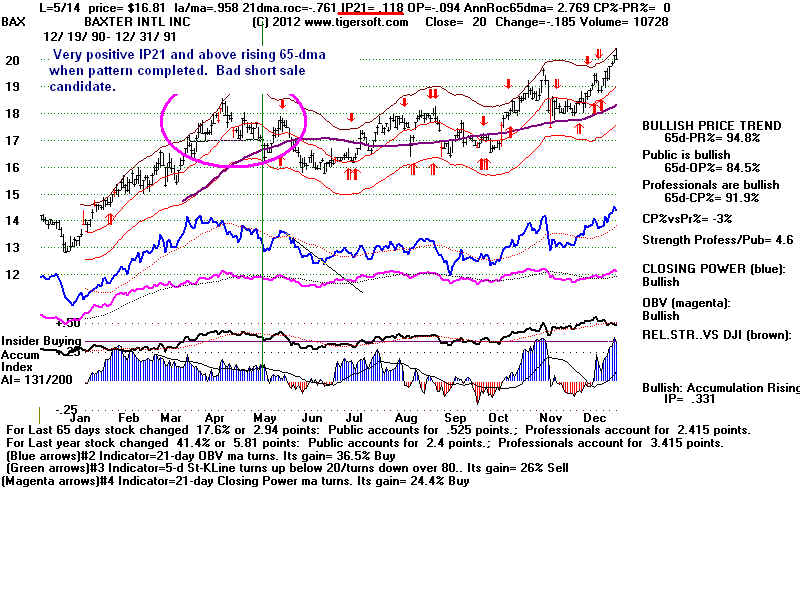

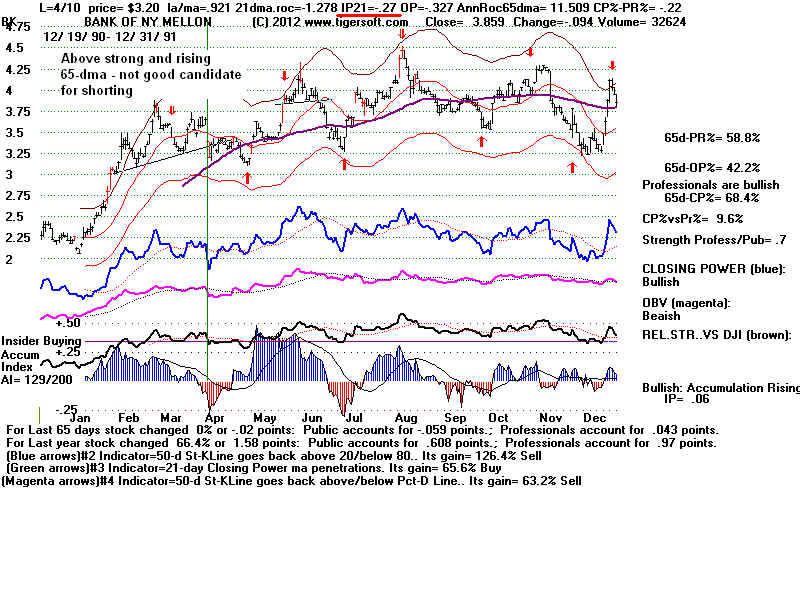

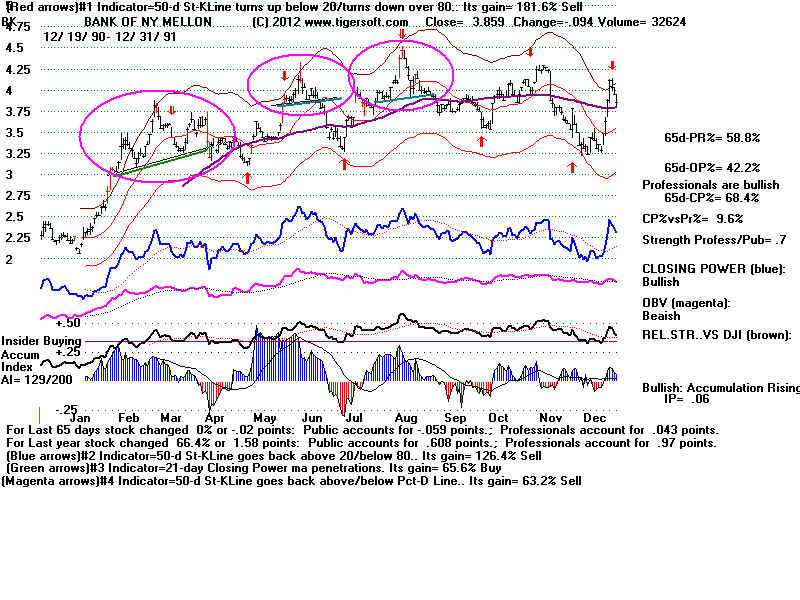

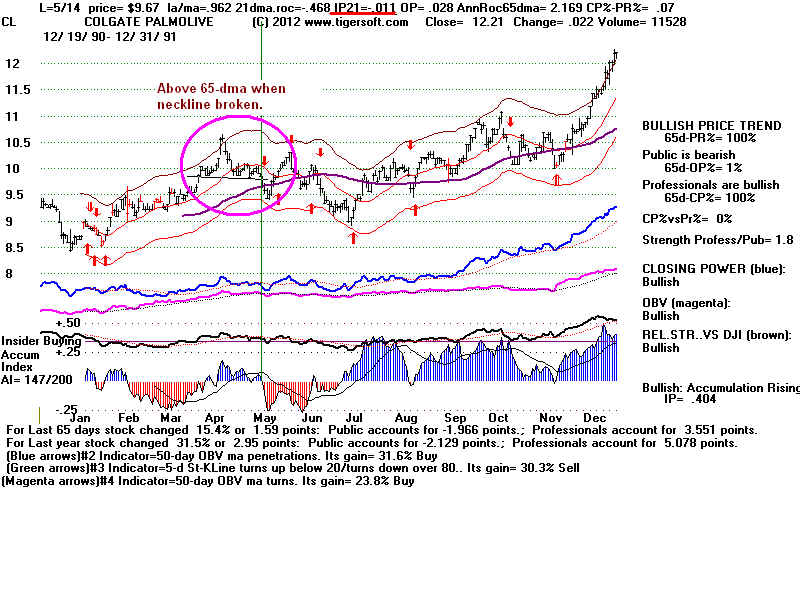

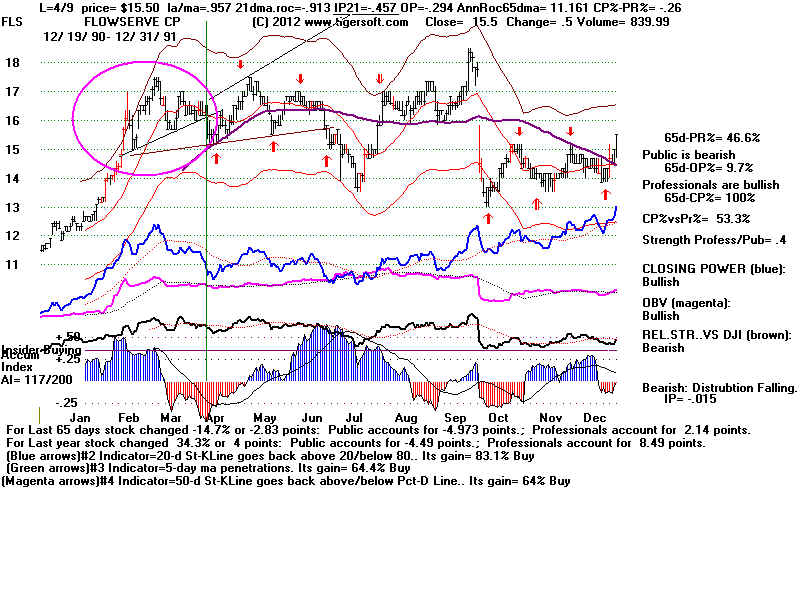

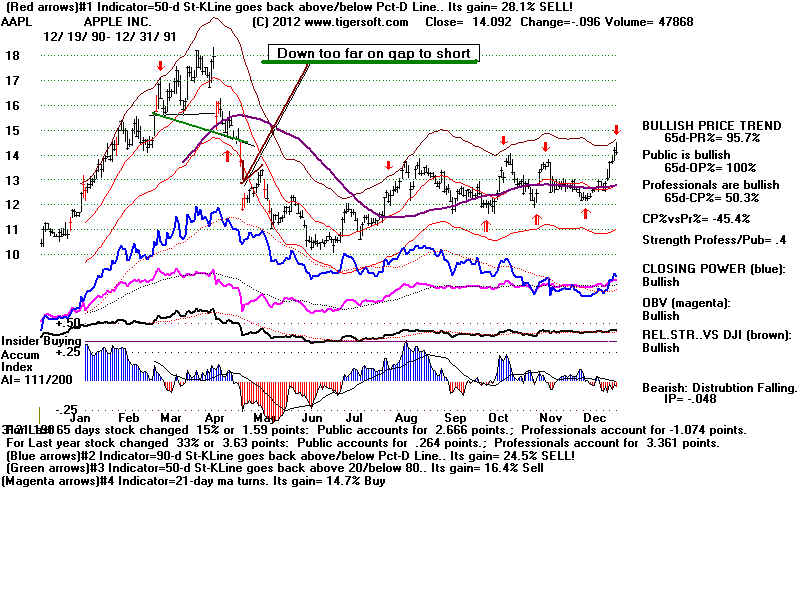

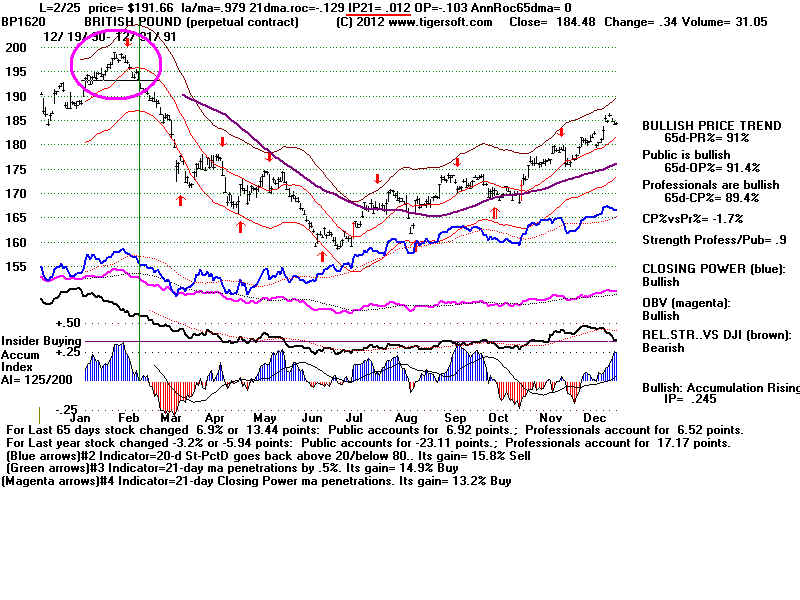

Others - where break in neckline occurs with stock above 65-dma.

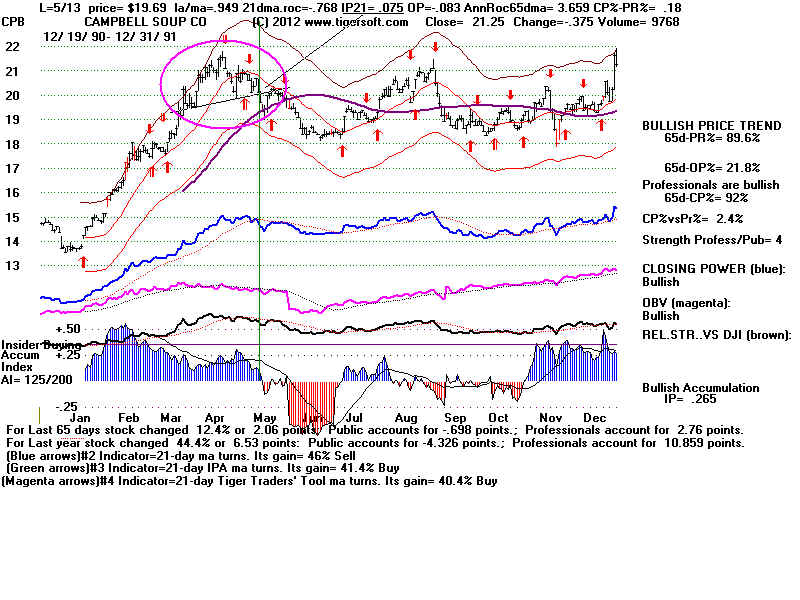

Example CPB

CPB May 13 +.075 19.69 20.1 18.1 CP broke downtrend.

|

|

|

|

|

|