On July 12, 1990, Peerless gave a major reversing Sell S9. On August 3, 1990 the

DJI broke its neckline support. Note the breaking of the neckline support also

was a simultaneous bring of the 65-dma. The IP21 was still positive. Head/Shoulders

that were completed after July 12th in the SP-500 would have been of particular

interest. There were many.

The general market weakness caused by Iraq's seizure of Kuwait surprised many

stocks. Most did not show red negative distribution as their head/shoulders patterns

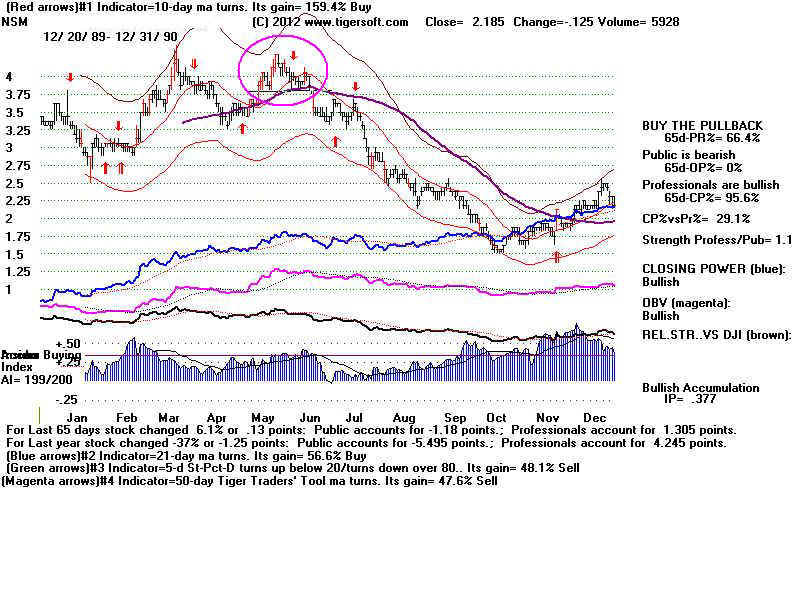

were completed. Volatile NSM fell a long way in sympathy with the market despite

blue Accumulation and a strong Closing Power. This shows why Peerless is helpful.

233 stocks in sample.

" 35 Stocks had at least one completed Head/shoulders.

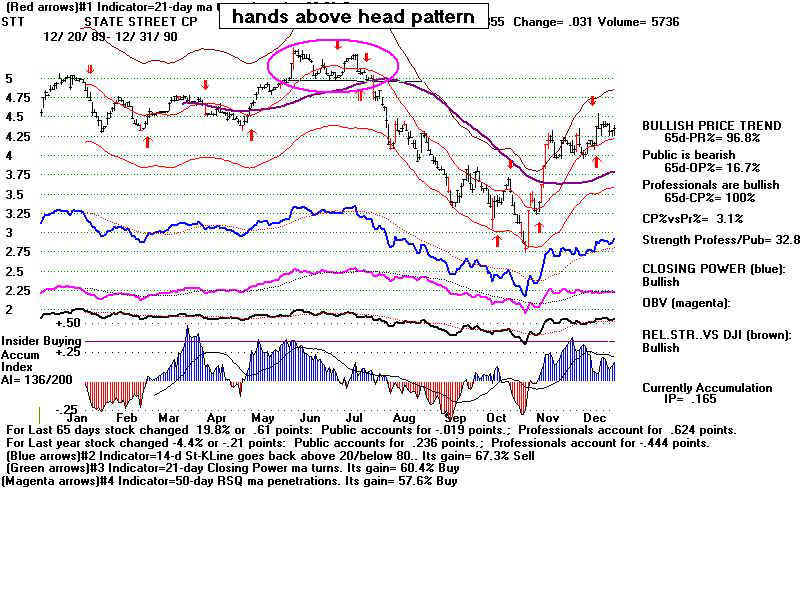

1 (STI) had a Hands above Head pattern.

40 Head and Shoulders patterns, not counting nested multiplle H/S patterns.

36 of the 40 produced declines, at least, fulfilling the minimum downside objective.

31 of the 40 fell more than 15% below their neckline-break without making a

new high first.

30 produced declines of more than 15%. 18 were below 65-dma when neckline was

violated. Only 8 of the 30 has an IP21 below -.04 when neckline was violated.

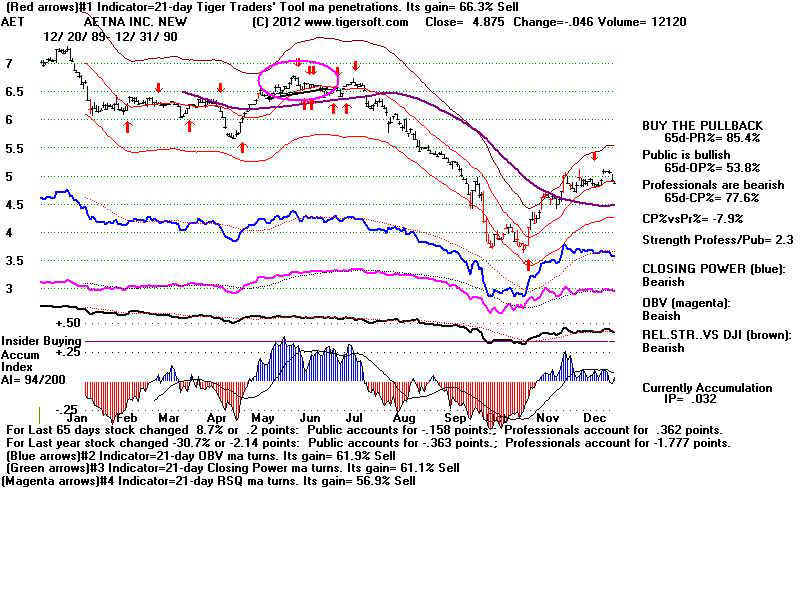

The Biggest H/S Decliners: AET, NSM and R

The Biggest, Most Reliable Decliners: Qualified H/S Decliners

If one required the IP21 to be below -.04 and prices be below the 65-day ma

when the H/S neckline was violated, then there would have been only the five

trades. Consider these the "qualified completed H/S". All would have been profitable.

More than 15% Decline Reached

IP21 when Below 65-dma Did initial decline Prices:

neckline when neckline fuldill downside 1) Breakdown

violated. violated? objective? 2) Subseqent High

3) Subsequent Low

1) 2) 3)

----------------------------------------------------------------------------------------------------------------------------

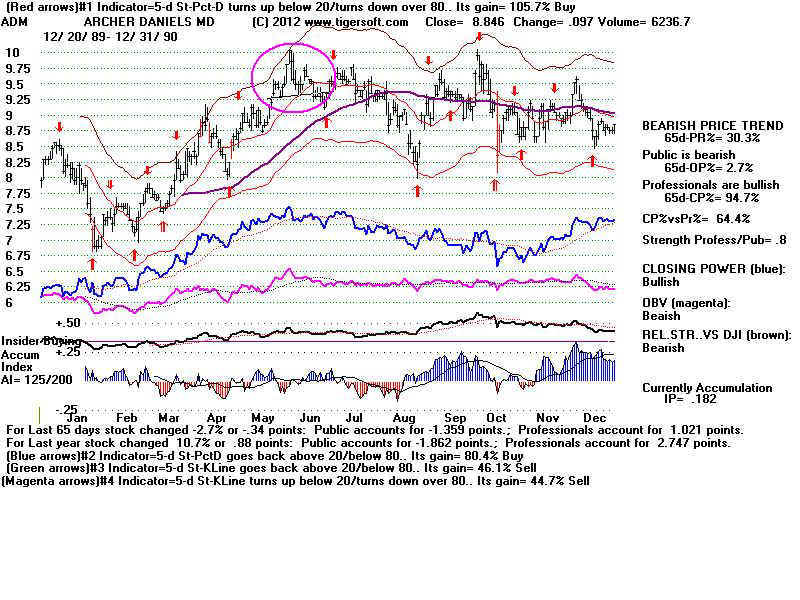

ADM June 22 .025 Yes No 9.25 9.75 8

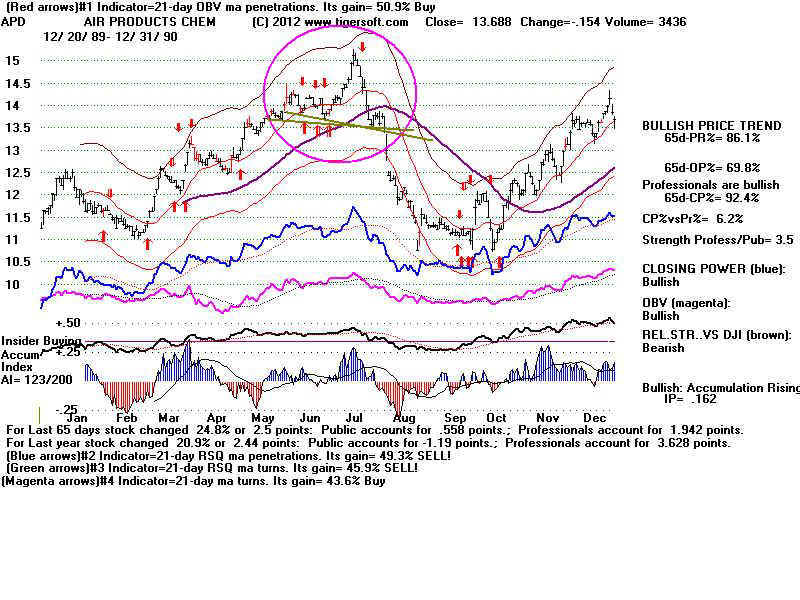

APD Aug 3 -.116 Yes Yes 13.3 - 10.75

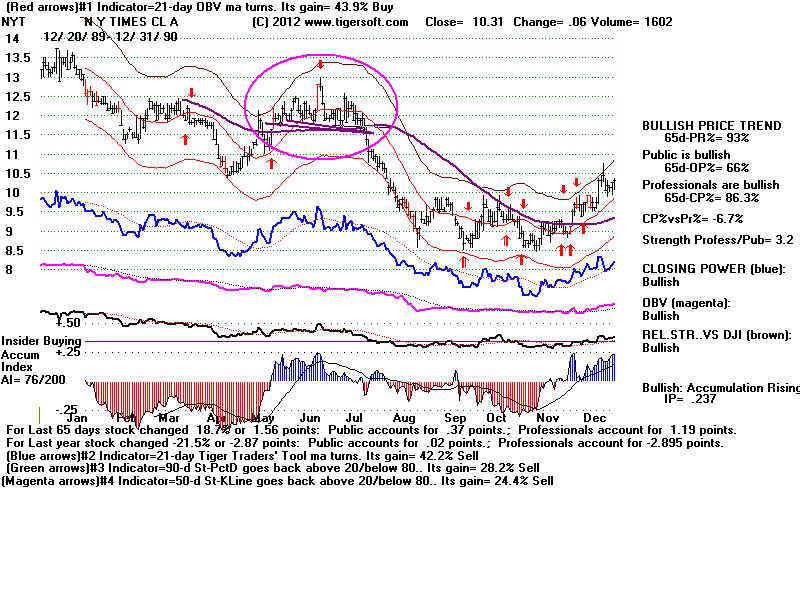

NYT July 23 -.114 Yes Yes 11.4 - 8.5

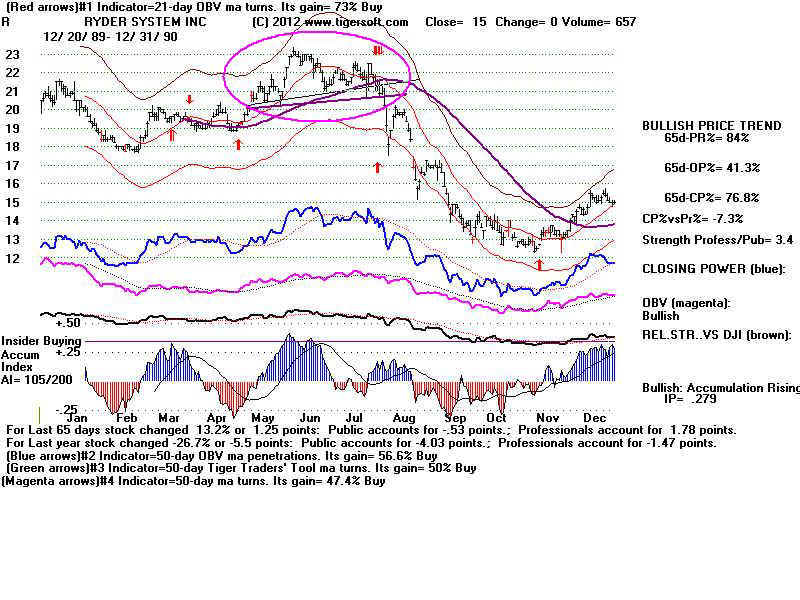

R July 23 -.093 Yes Yes 21.3 - 12.5

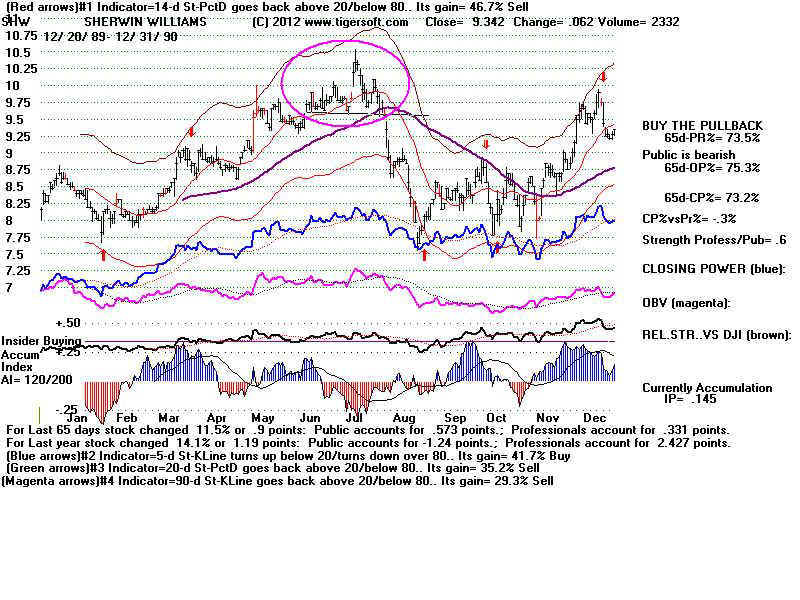

SHW Aug 2 -..083 Yes Yes 9.56 - 7.75

TAP Aug 3 -.192 Yes Yes 11.25 13.0 9.0

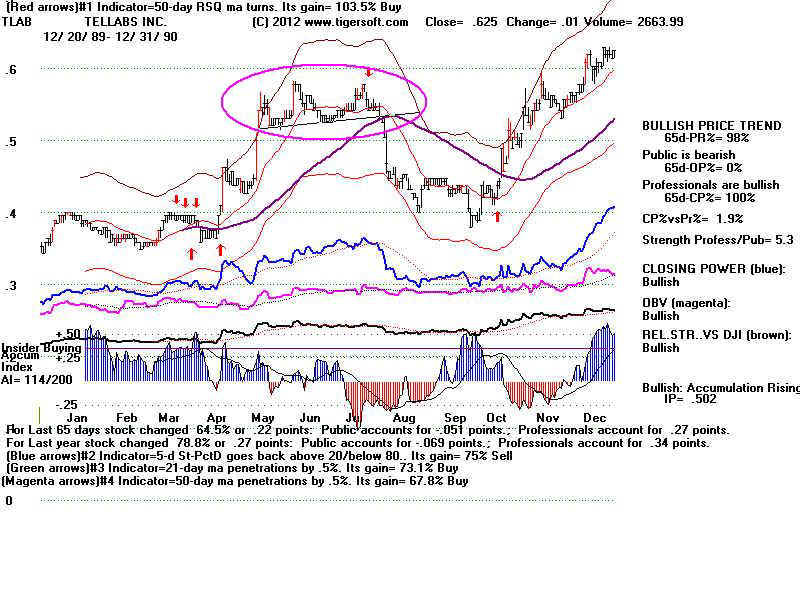

TLAB Aug 1` -.257 Yes Yes .55 - .38

Profits when Using Closing Power To Cover

Close when CP rises CP breaks Take Profits

Neckline Broken above 21-dma downtrend when 15% gain

---------------------------------------------------------------------------------------------------------

APD 13.00 8/3 11.38 9/7/90 11.84 (much worse) 11.05 yes (better)

Downsloping, asymmetirical

r NYT 11.38 7/23 9.81 9/5/90 8.88 (much better) 9.67 yes (worse)

Flat, classic

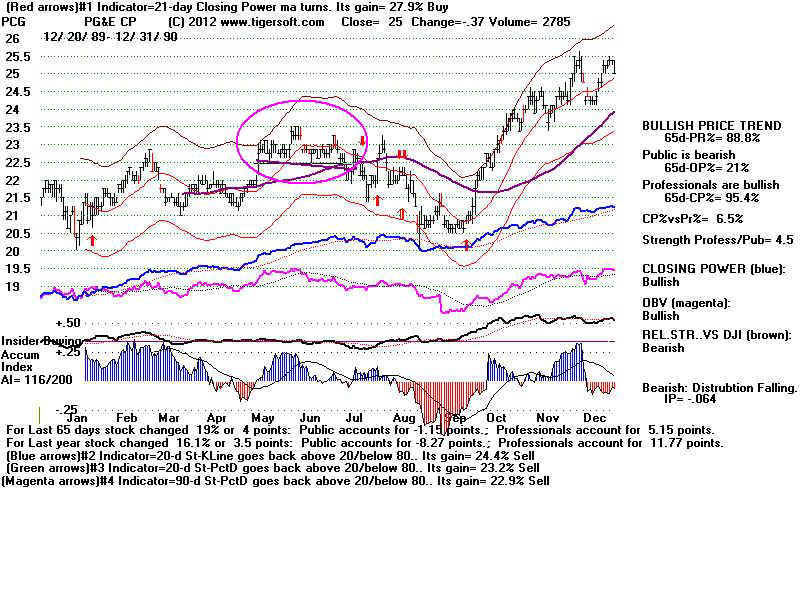

R 20.25 8/2 14.00 10/12/90 14.25 17.21 yes (worse)

Rising, classic

SHW 9.56 8/2 8.56 9/5/90 8.06 (much better) 8.126 yes

Rising, Asymmetrical

TAP 11.25 8/3 12.94 8/29 12.31 (much better) 9.56 yes in November.

Falling, Asymmetrical

TLAB 0.51 8/2 0.44 9/ 7 0.43 .435 yes

Flat, Asymmetrical

--------------------------------------------------------------------------------------------------------------------------------------------------

More than 15% Decline Reached

IP21 when Below 65-dma Did initial decline Prices:

neckline when neckline fuldill downside 1) Breakdown

violated. violated? objective? 2) Subseqent High

3) Subsequent Low

1) 2) 3)

----------------------------------------------------------------------------------------------------------------------------

ADM June 22 .025 Yes No 9.25 9.75 8

AET July 23 -.02 Yes No 6.39 6.7 3.8 Big Decline

The 6/25/90 breakdown did not occur with prices below the neckline.

The 7/23/90 breakdown did. It should have been sold short.

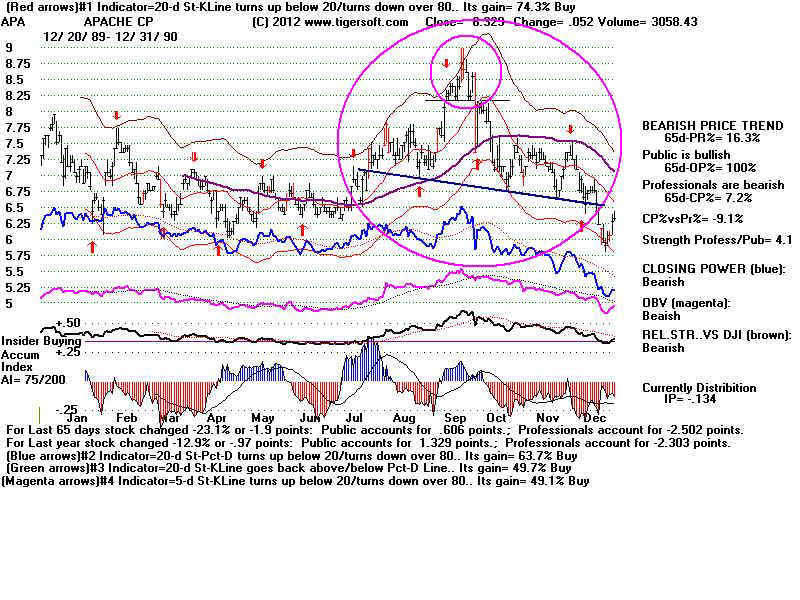

APA Oct 2 .077 No Yes 8.15 8.2 6.0

APD Aug 3 -.116 Yes Yes 13.3 - 10.75

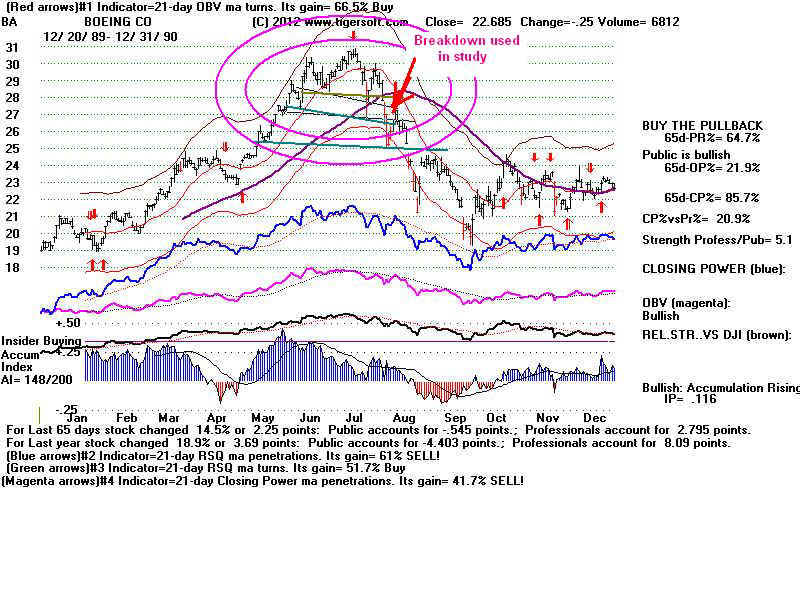

BA Aug 2 .02 Yes Yes 26 27 19.5

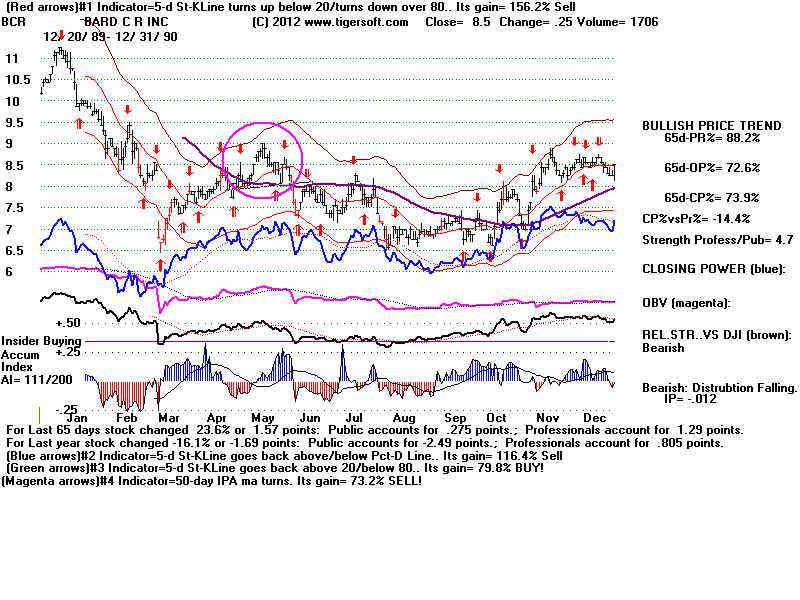

BCR June 5 -.03 Yes No 7.9 8.0 6.5

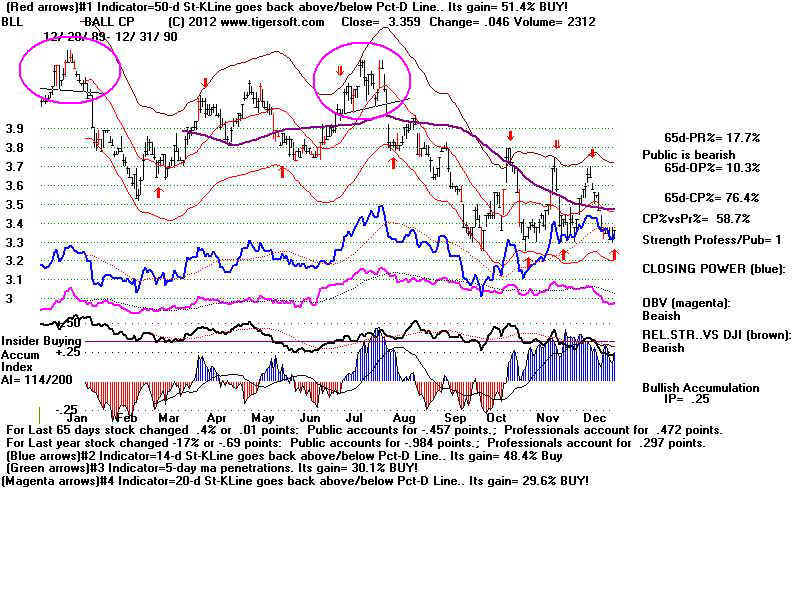

BLL Jan 22 -.062 No Yes 4.1 - 3.55

BLL Aug 3 +.298 No Yes 4.05 - 3.3

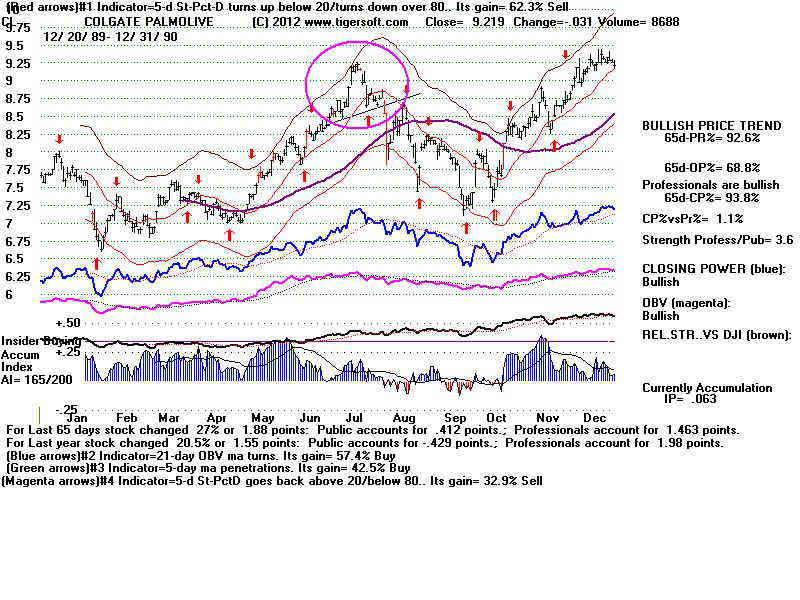

CL Aug 2 -.056 No Yes 8.6 8.7 7.25

Classic H/S and red high volume on neckline break.

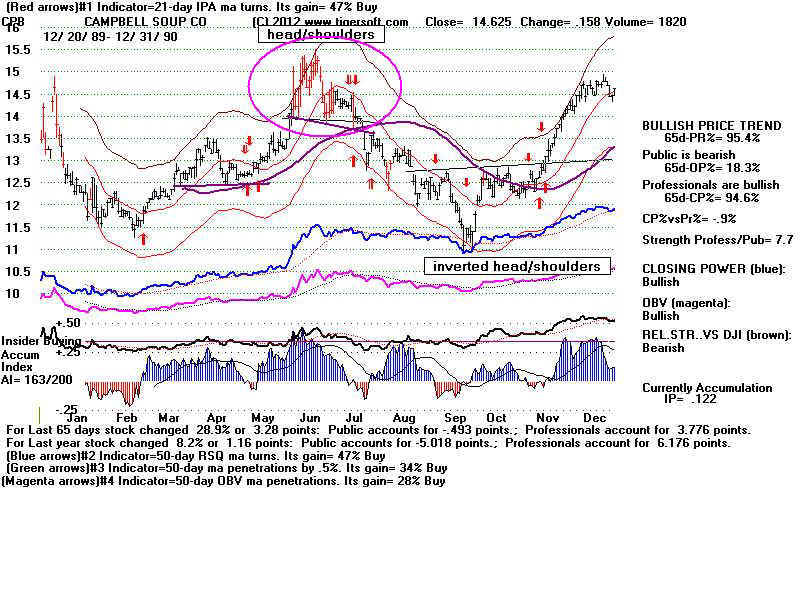

CPB July 13 .016 No No 13.75 - 11.1

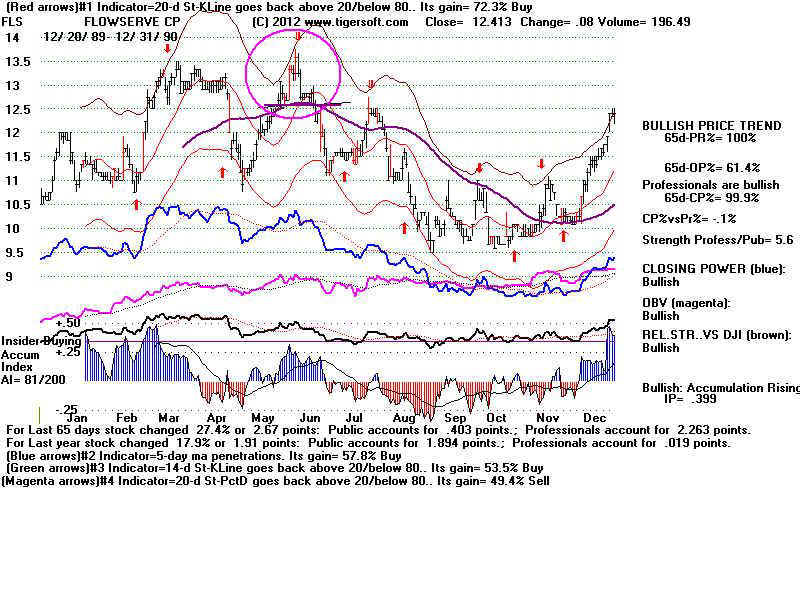

FLS June 19 .129 Yes Yes 12.5 12.6 9.5

GLW June 8 -.002 Yes No 6.6 6.75 5.0

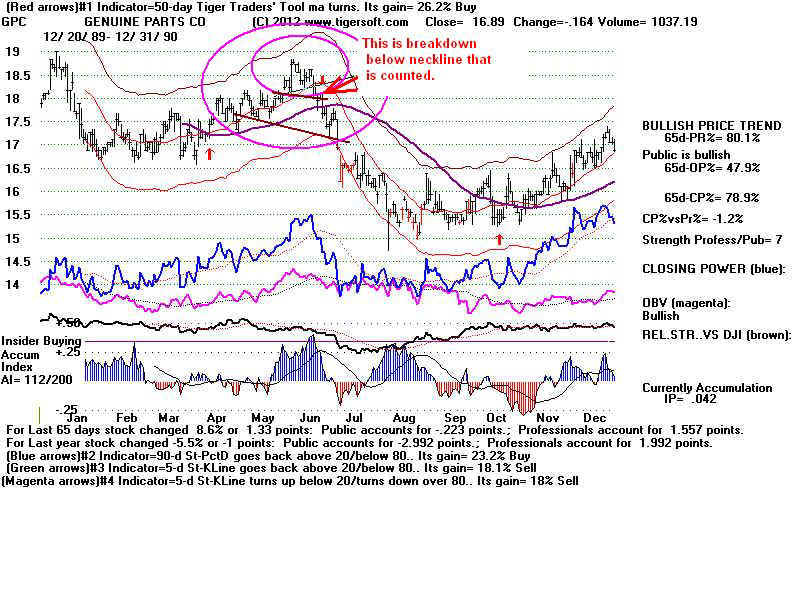

GPC June 18 .408 No No 17.6 - 15.0

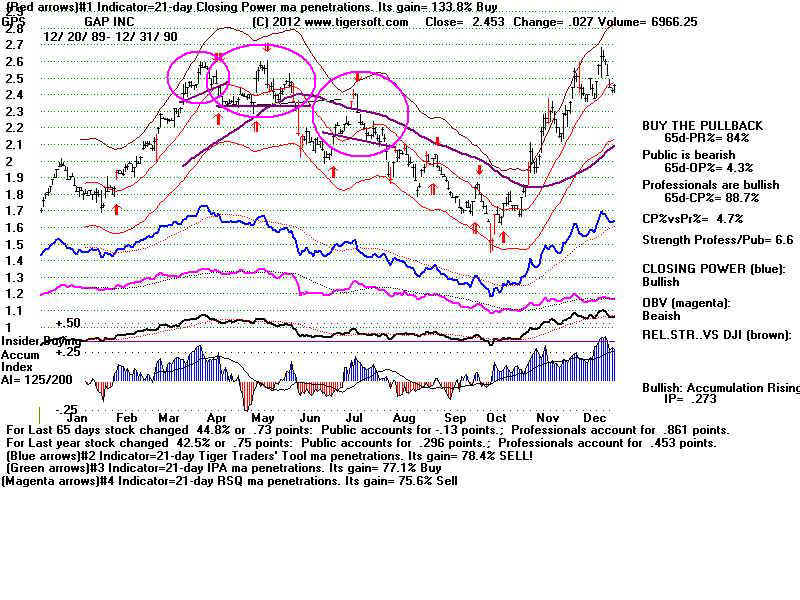

GPS June 6 .06 Yes Yes 2.3 2.4 1.5

GPS Aug 3 .04 Yes No 2.05 2.1 1.6

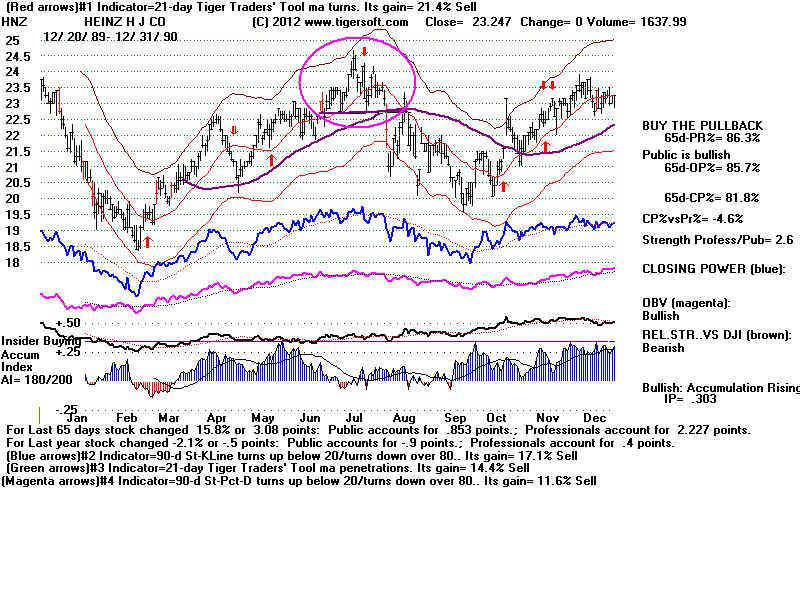

HNZ Aug 3 .107 Yes Yes 22.5 23.3 19.6

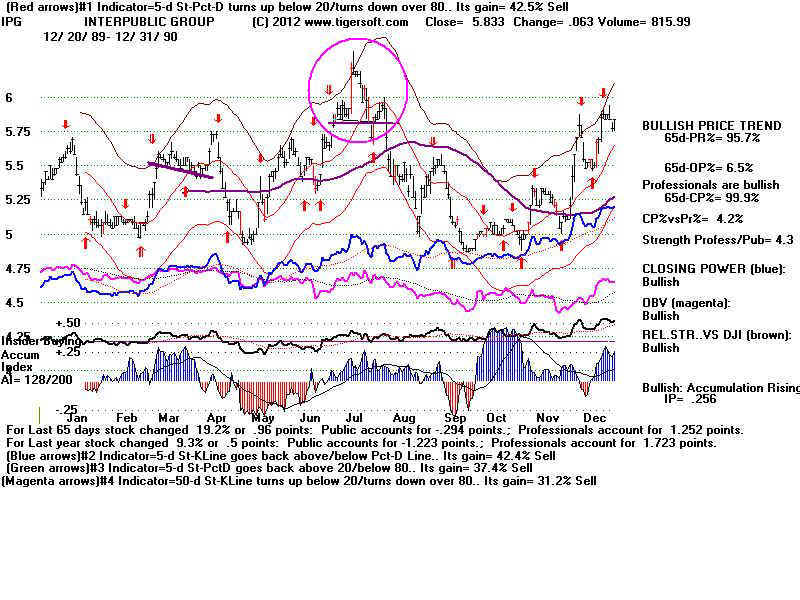

IPG Aug 6 .116 Yes Yes 5.6 - 4.85

JCI July 23 .07 No Yes 2.45 - 1.45

A beautiful, classic H/S Top pattern here. Waiting for the 65-dma

to sell short still would have worked out well.

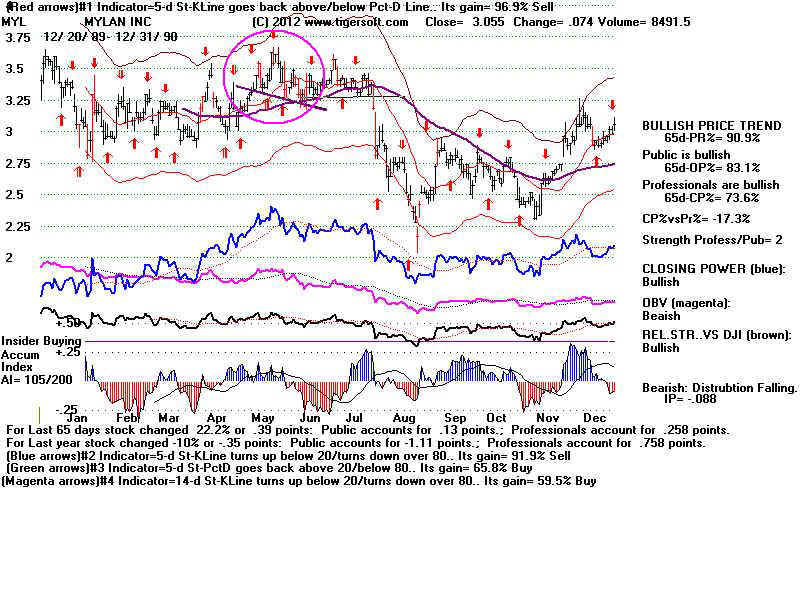

MYL July 26 .135 Yes Yes 3.25 - 2.1

NSM June 18 .357 Yes Yes 3.5 - 1.75 Big Decline

NYT July 23 -.114 Yes Yes 11.4 - 8.5

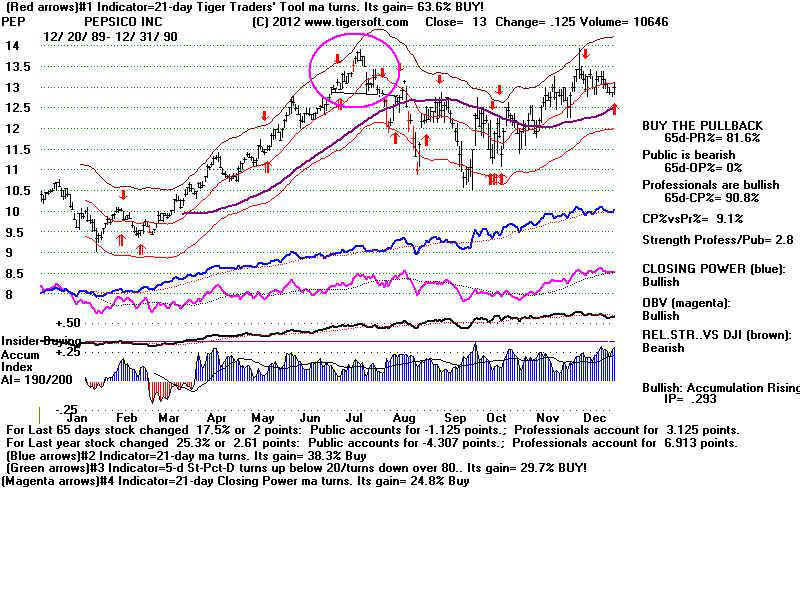

PEP July 31 .091 No Yes 12.6 13.1 10.5

R July 23 -.093 Yes Yes 21.3 - 12.5 Big Decline

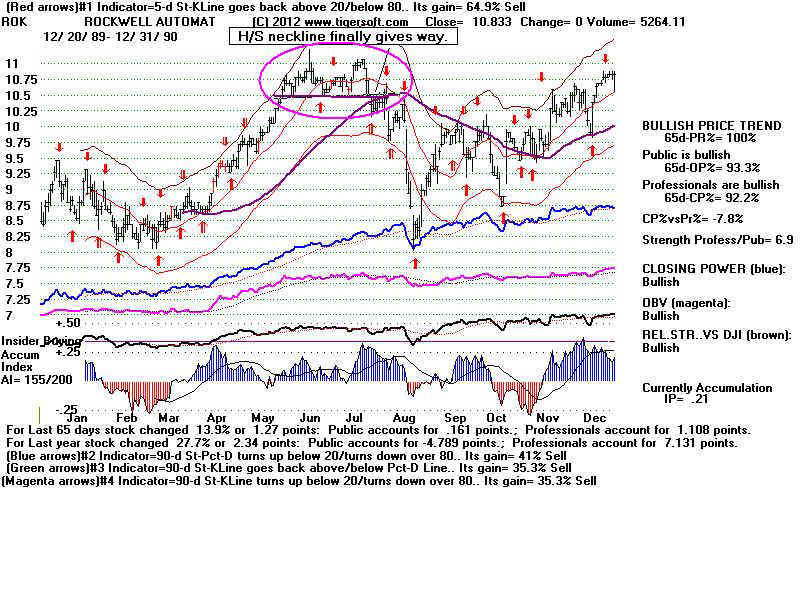

ROK Jjuly 25 .284 Yes No 10.7 - 8.25

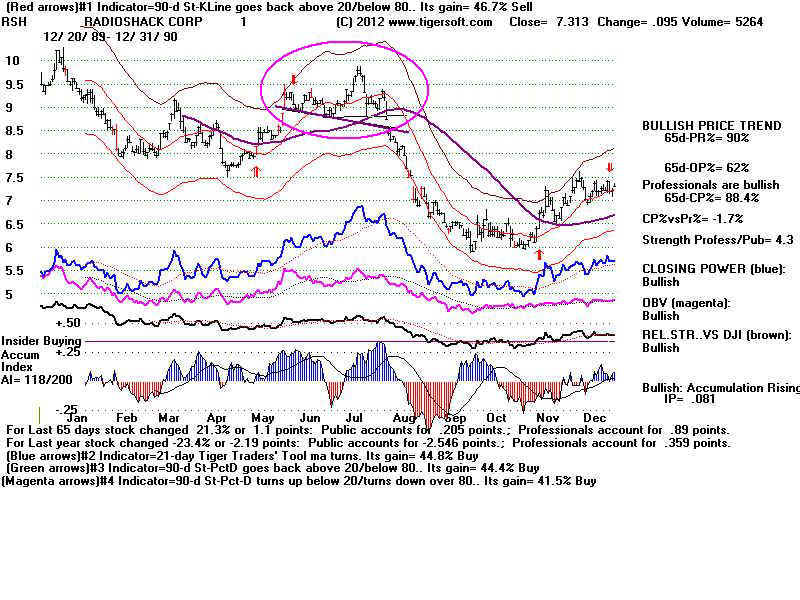

RSH Aug 6 .167 Yes Yes 8.44 - 6.0

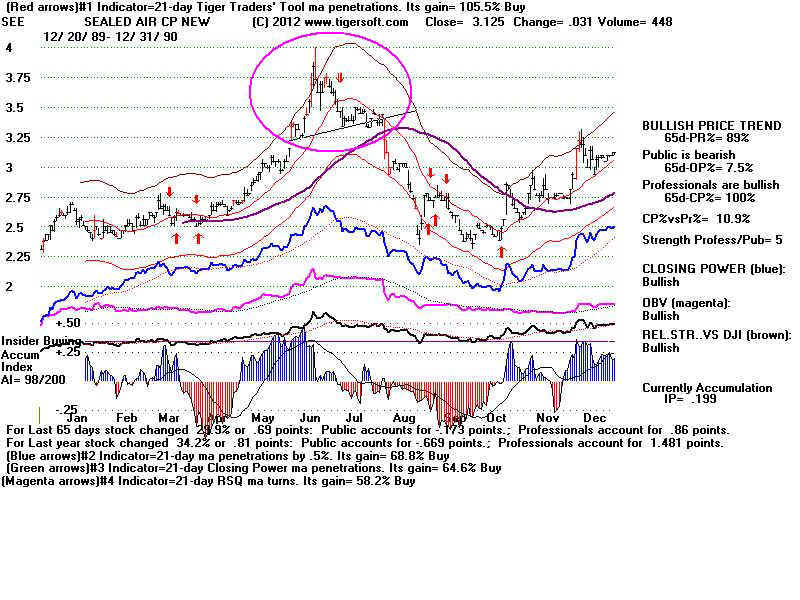

SEE July 24 .111 No Yes 3.33 - 2.3

SHW Aug 2 -..083 Yes Yes 9.56 - 7.75

Red high volume on breakdown.

SUN June 18 -.029 No Yes 19 18.94 13

TAP Aug 3 -.192 Yes Yes 11.25 13.0 9.0

TLAB Aug ` -.257 Yes Yes .55 - .38

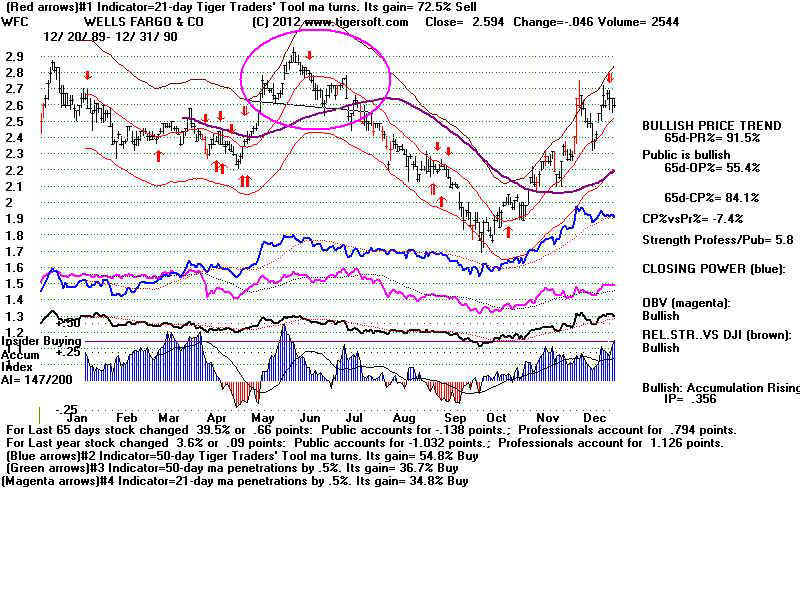

WFC July 10 .221 Yes Yes 2.55 2.62 1.7

Failures including Failures To Reach Minimum Downside Objective

IP21 when Below 65-dma Did initial decline Prices

neckline when neckline fuldill downside

violated. violated? objective? 1) 2) 3)

--------------------------------------------------------------------------------------------------------------------------------------------

GPS Apr 18 .122 No No 2.4 2.6 1.5 Above right shoulder.

HRB Aug 3 .007 No Yes 5.15 5.20 4.5 No 15% decline

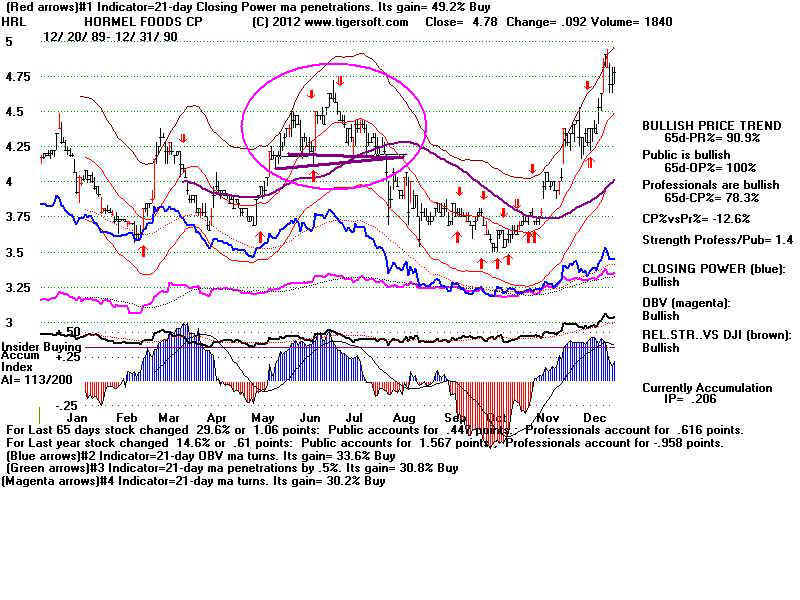

HRL Aug 3 -.098 Yes Yes 4.12 - 3.6 No 15% decline

JNJ April 23 .155 Yes Yes 2.42 2.65 (NH) 1.4 Stopped out.

JNJ Aug 21 .106 Yes No 8 9 (NH) 7.55 Stopped out.

PCG July 9 -.013 No Yes 22.5 23.25 20.4 No 15% decline

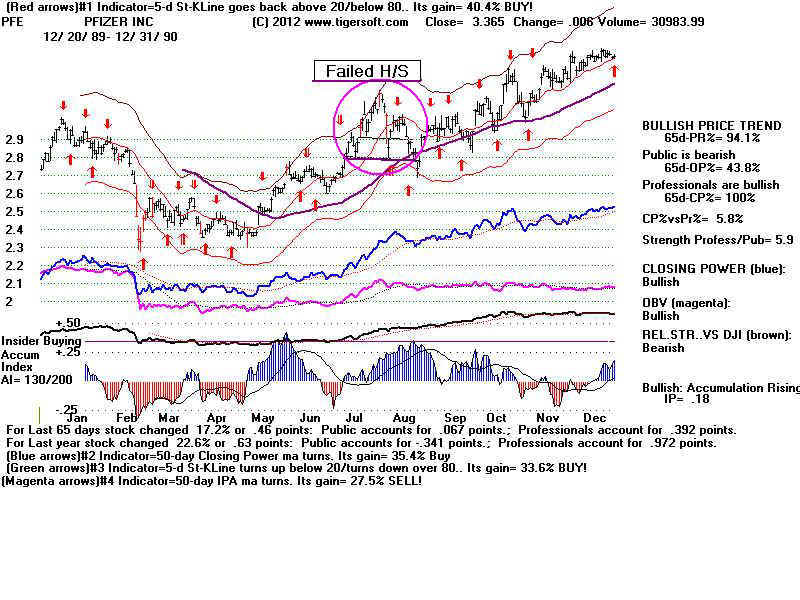

PFE Aug 23 .304 Yes No immediately turned up

ITW April 18 .214 No Yes 6.1 7.2 (NH) 6

ITW June 7 .051 No Yes 6.7 7.2 (NH) 5.0

One (IPG) other stock started to form a H/S, jumped to a new high and then fell sharply.

Presumably to run in the shorts. It did not complete its head/shoulders pattern and

so was not counted here. See also the first uncompleted H/S in MYL. It does

not break neckline and then forms another H/S which does 6 weeks later in Aug.

ROK also refused to complete its neckline without first making a false run

up above the aoex of its previous right shoulder apex. We consider the breakdown

as completing an asymmetrical H/S.

2 (GPS and PFE) failed slightly to fulfill fownside objective.

The GPS breakdown' close was above the rising 65-dma

The IP21 for GPS on the break was +.241 and for PFE it was +.313