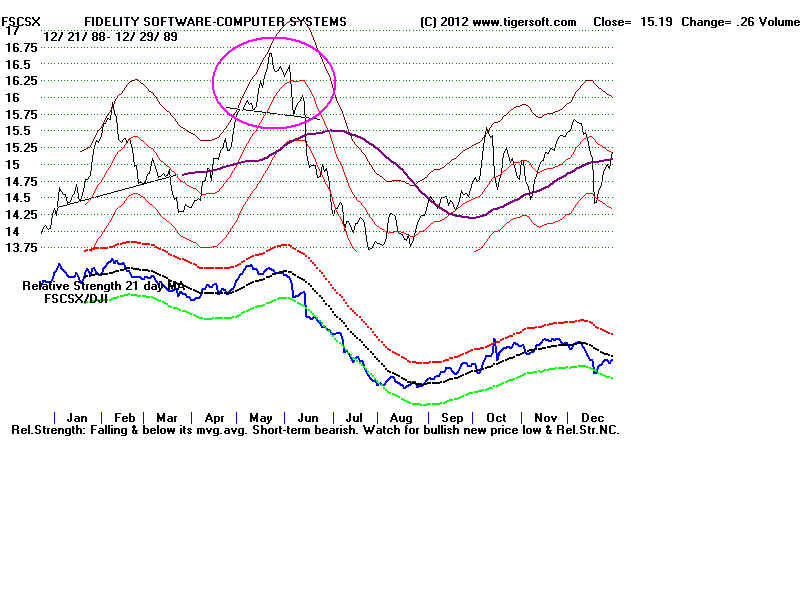

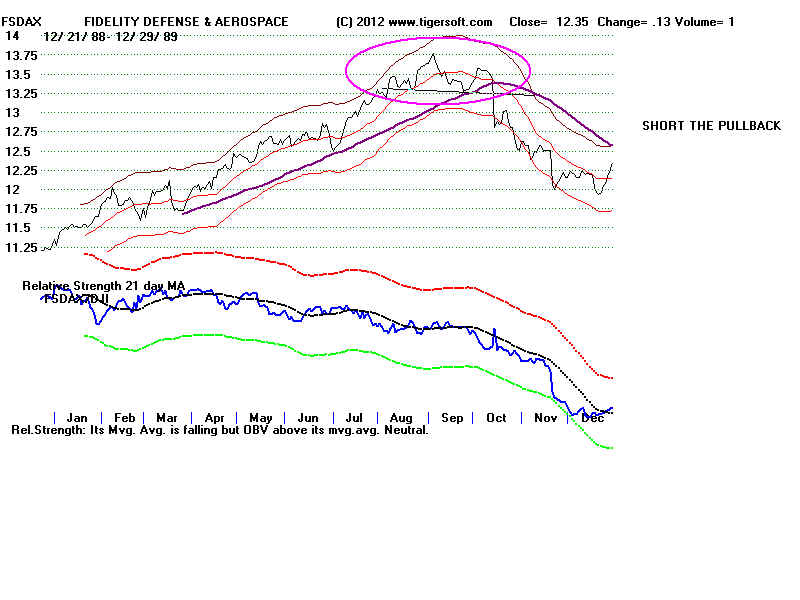

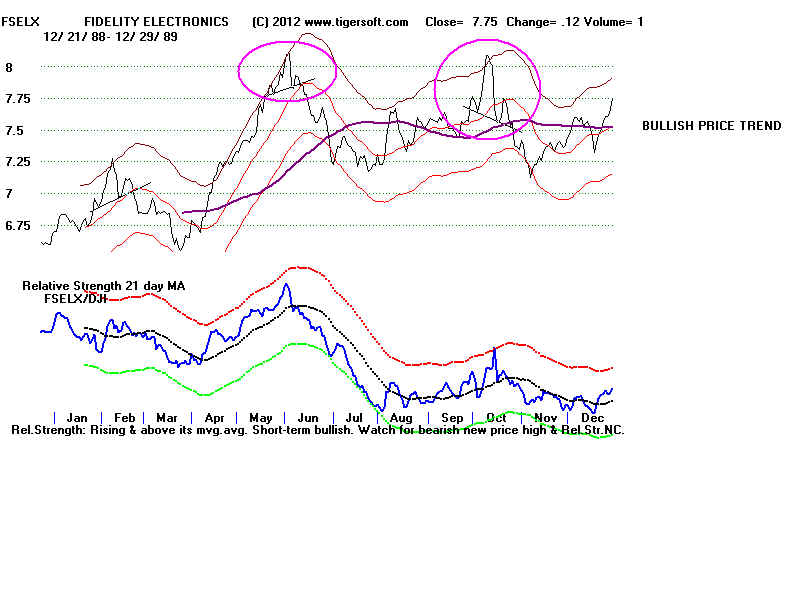

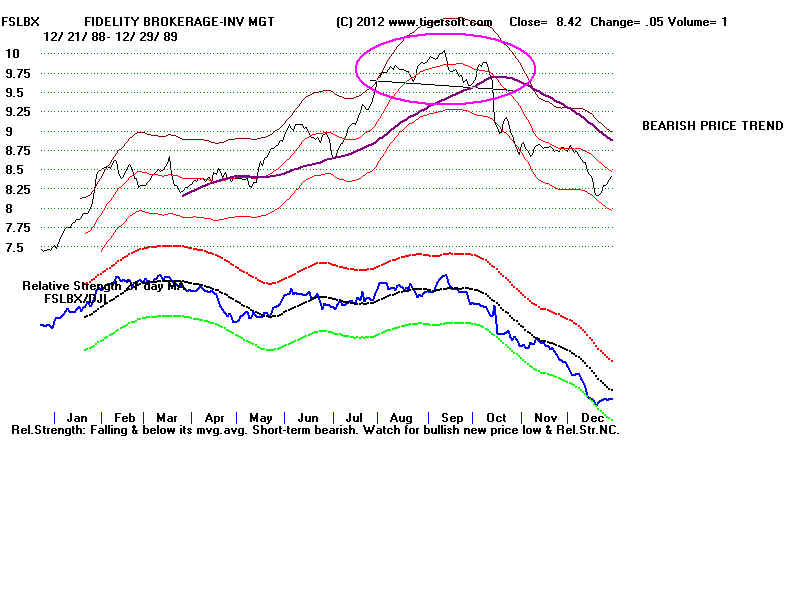

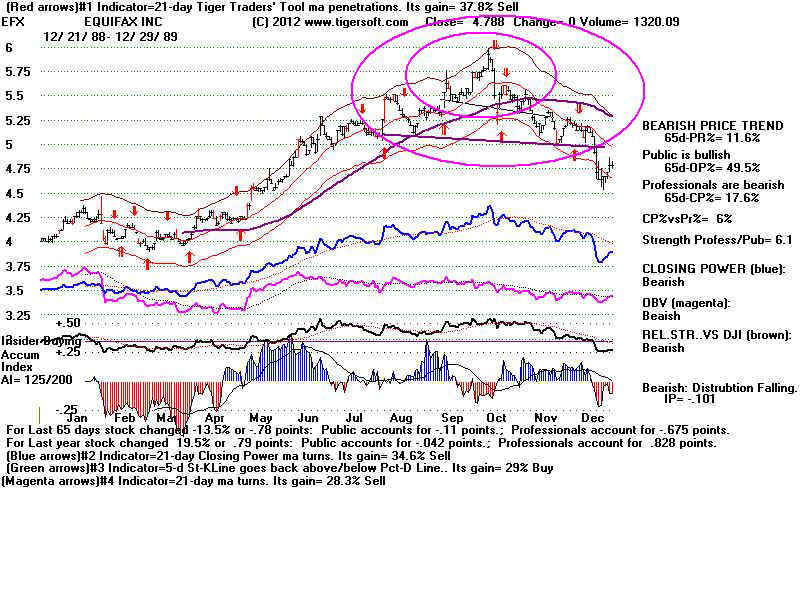

Head and Shoulders or Hands-the Head Patterns are seen below in 39 of the 231 SP-500

stocks from 1988. 39 of the 49 all cases here did meet their minimum downside objective.

This year's study shows the added importance of using the H/S pattern breakdowns

mostly when the break takes the stock below the 65-dma and that break shows an IP21 below -.05.

Waiting for a pullback to short would have prevented shorting 8 of the 11 best H/S Short Sales.

The Study.

There were 49 completed head/shoulders patterns identified here and circled in the charts.

26 of the 49 completed head/shoulders pattterns show pull-backs to

neckline before the minimum downside objective was reached.

Of these 26 pull-backs, in 18 cases, the stock turned down and reached

its mimium downside objective, the height of the H/S pattern from peak to neckline

subtracted from the neckline where the latter was broken. 3 of the pull-backs

did not reach their downside objective.

5 of the 49 had their first rally not stop and instead continue to rise to new highs.

Altogether, 10 of the 49 did not fall at least to their minimum downside objective.

39 of the 49 did reach their downside objective, Most of the declines were small.

7 of these 10 failed H.S breakdowns had a rising 65-dma when prices broke below the

neckline.

7 of these 10 failed H.S breakdowns had an IP21 score above -.05 when prices broke below the

neckline. By contrast 10 of the 11 most successful H/S in this year had an IP21 below -.05.

Mininimum 65-dma broken Classic & 3 month Pull Back to neckline

Objective Met and turned down Symetrical decline potential before low

----------------------------------------------------------------------------------------------------------------------------------

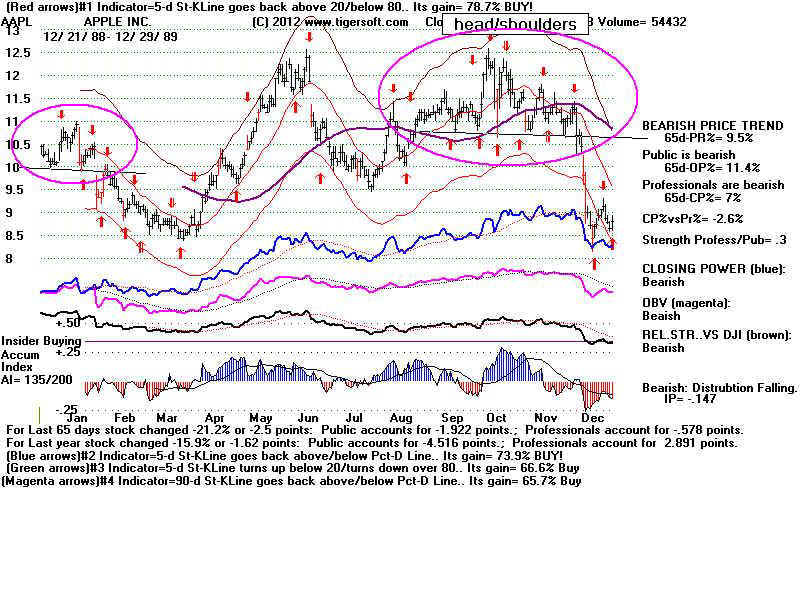

AAPL Jan yes yes yes, flat 9.5 to 8.5 yes

AAPL Nov yes yes no, flat 10.5 to 8.5 no

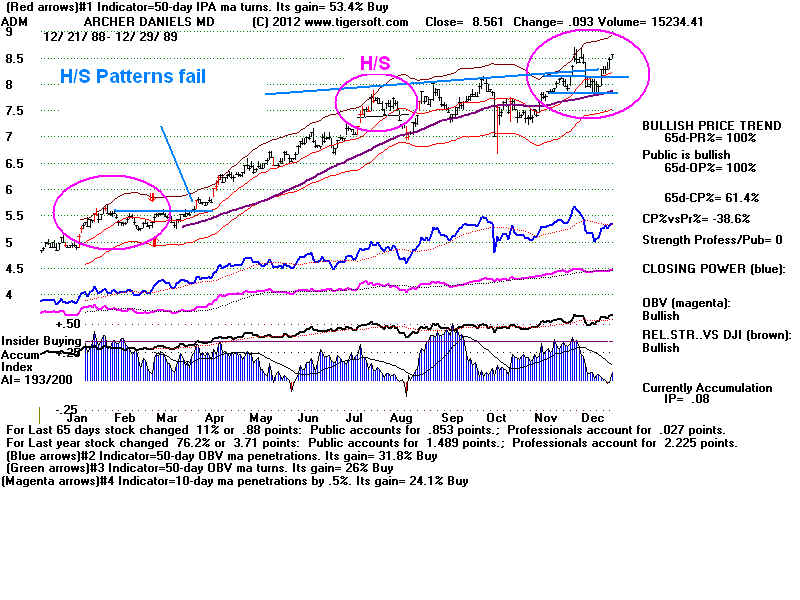

ADM Feb no no no, flat no decline. no

Note high Accumulation on breakdown. IP21 =+ .267

ADM Aug yes no no, flat 7.5 to 7.0 no

Note high Accumulation

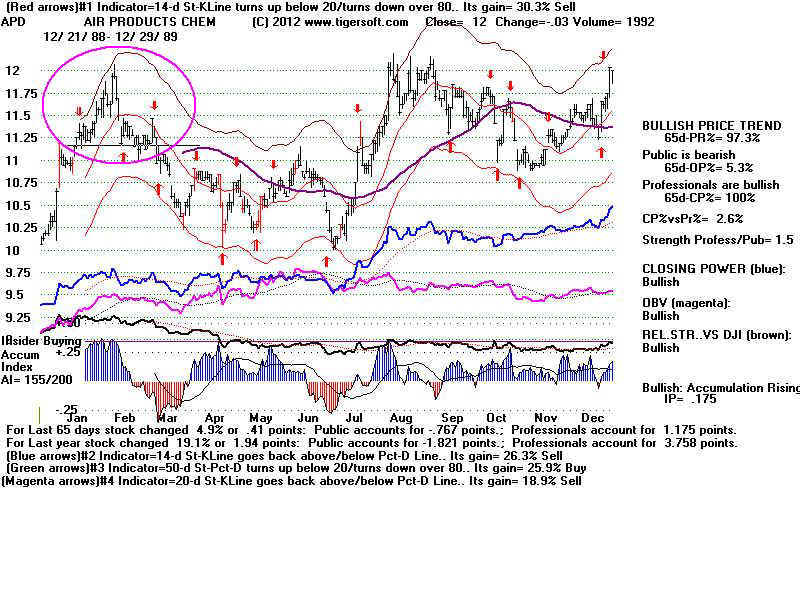

APD Feb yes no yes, flat 11.125 to 10.125 yes

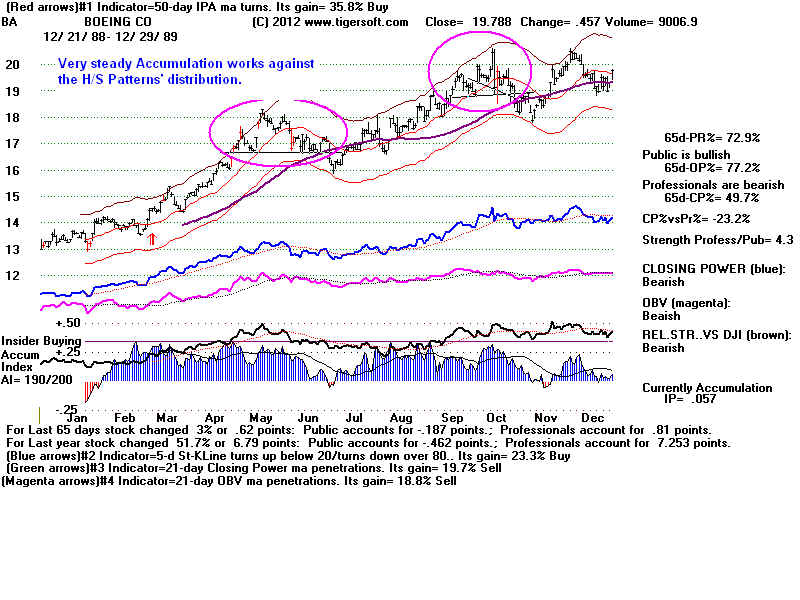

BA June no no no, flat 16.5 to 16. yes - failed

Note high Accumulation on breakdown. IP21 = + .145

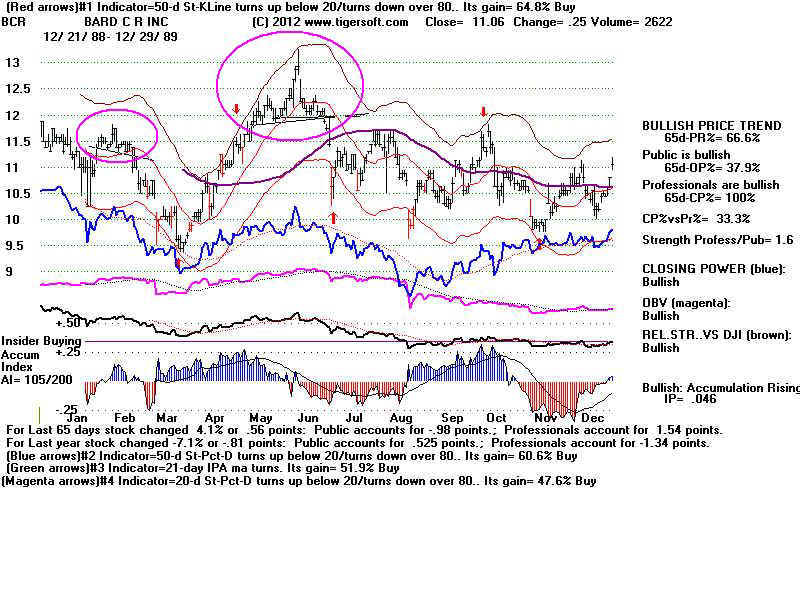

BCR Feb yes yes yes, flat 11.0 to 9.5 no

BCR June yes no no, flat 11.8 to 10 yes

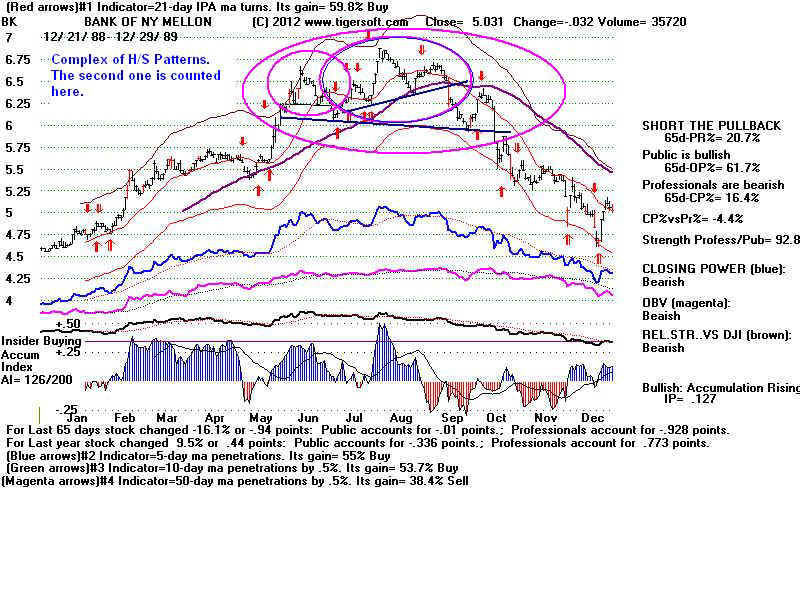

BK Sept yes yes yes, rising 6.3 to 4.7 yes

CEG Mar yes yes no, flat 20 to 19.1 no

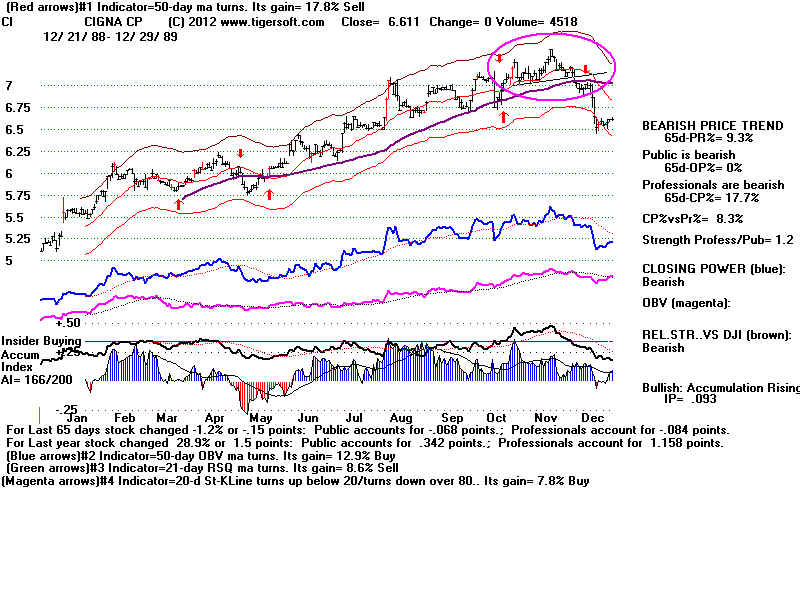

CI Dec yes yes no, rising 7.1 to 6.5 yes

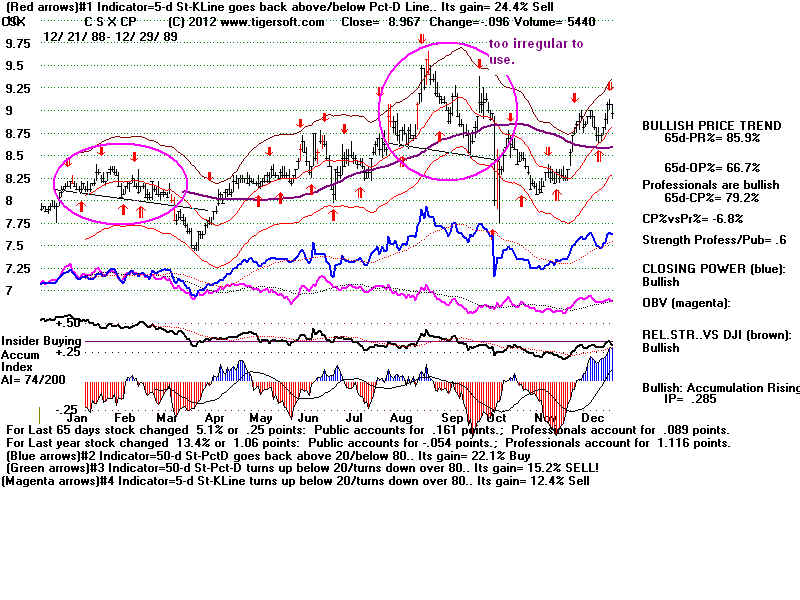

CSC Mar no no no, rising 8.25 to 8.1 yes - failed

IP21 = -.091 on breakdown

CSC Jun yes no yes, rising 8.8 to 8.1 yes

CSX Mar yes yes no, flat 7.8 to 7.5 no

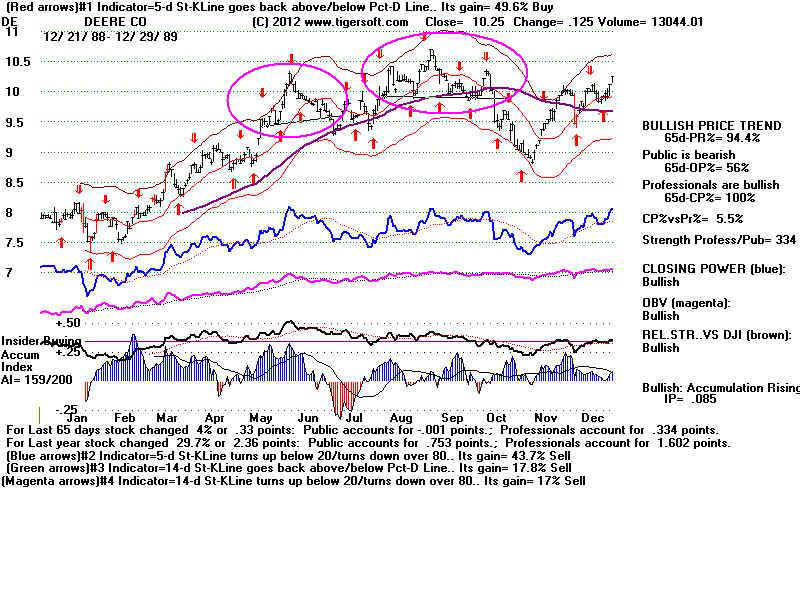

DE July no no yes, rising 9.4 to 9.35 yes - failed

IP21 = -.031 on breakdown

DE Oct yes yes yes, flat 9.7 to 8.9 no

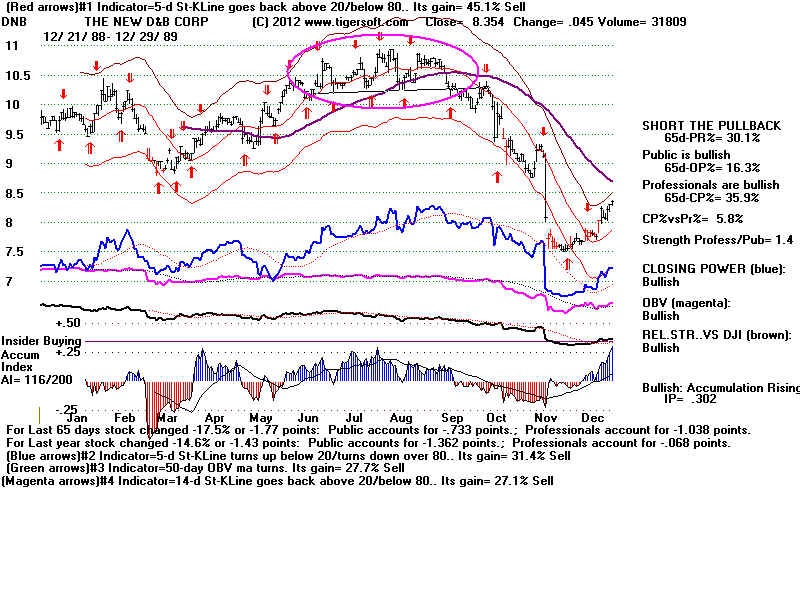

DNB Oct yes yes no, flat 10.1 to 7.5 yes

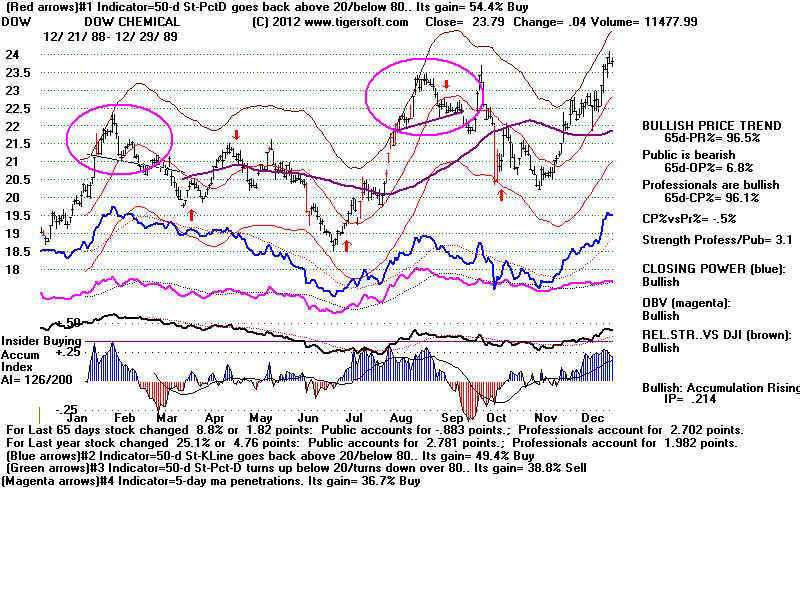

DOW Mar yes no no, falling 20.6 to 18.5 yes

DOW Sept yes no no, rising 22 to 20.4 yes - failed (NH)

EFX Oct yes yes no, falling 5.25 to 4.6 yes

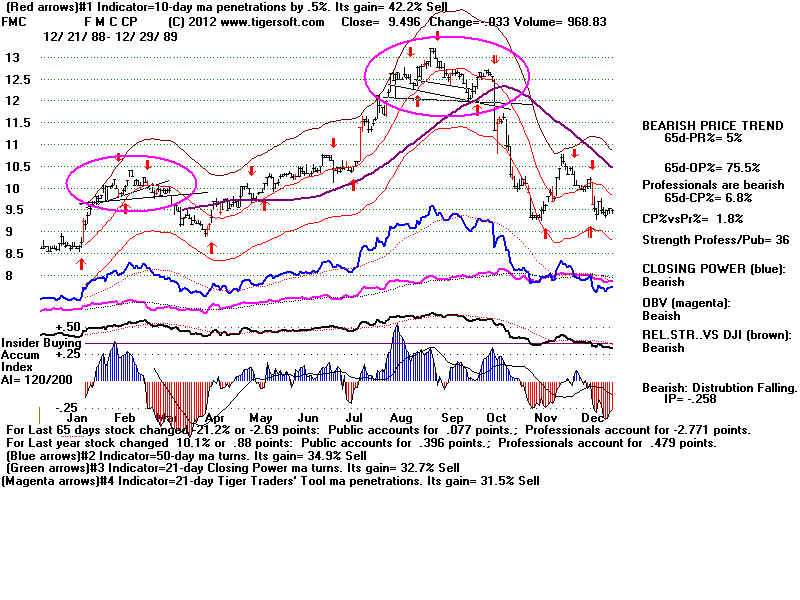

FMC Mar yes no no, rising 9.6 to 8.95 no

FMC Oct yes yes no, rising 10.8 to 9.5 no

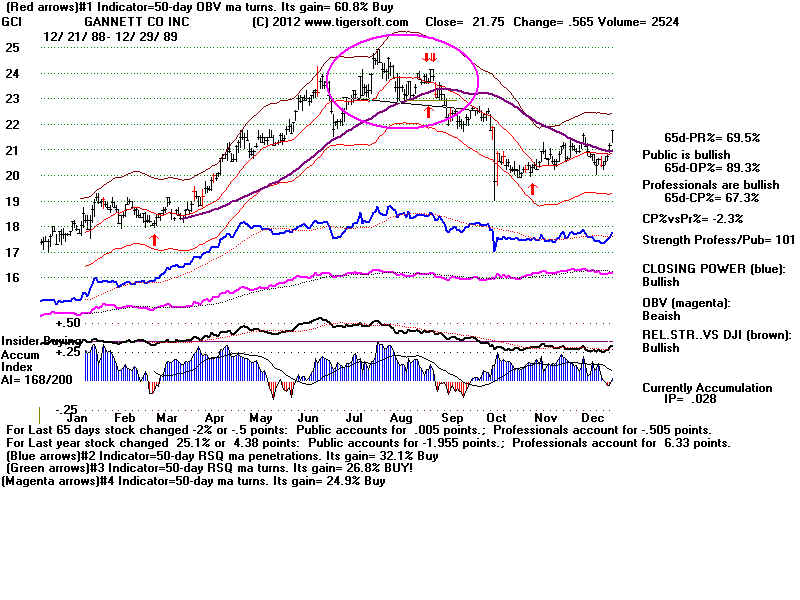

GCI Sept yes yes no, flat 22.1 to 19.5 yes

GPS June yes no no, flat 1.62 to 1.5 no

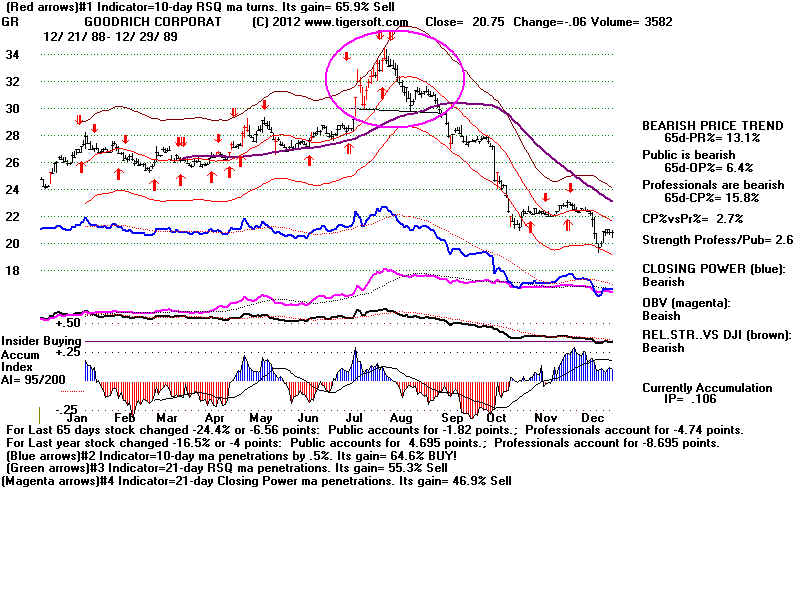

GR Sept yes yes no, flat 29.5 to 20 no

Note heavy distribution on right shoulder

GT Sept yes yes yes, falling 25 to 21.5 no

Note heavy distribution on right shoulder

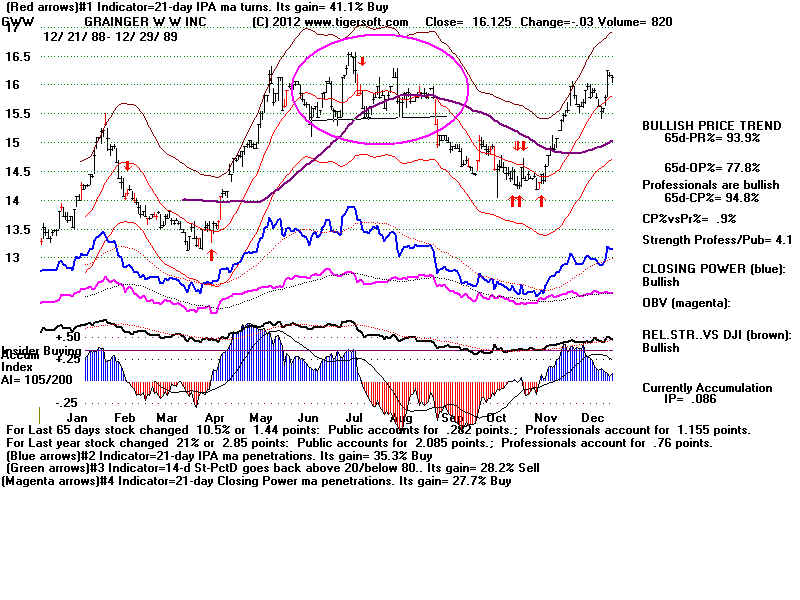

GWW Sept yes yes no, flat 15.4 to 14.2 no

Note heavy distribution on right shoulder

HAS Nov yes yes no, falling 6.3 to 5.3 no

HPQ Feb yes yes no, flat 5.6 to 5.2 yes

INTC June no no yes, falling .93 to .88 yes but failed

IP21 = -.034 on breakdown

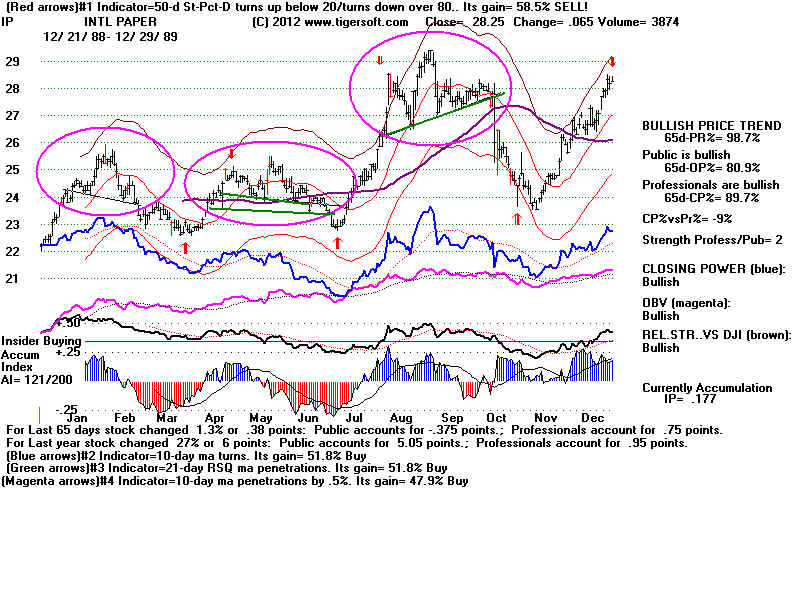

IP Feb no yes yes, flat 23.5 to 22.8 yes but failed

IP21 = -.169 on breakdown

IP June no yes no, flat 23.5 to 23.1 no

IP21 = -.161 on breakdown

IP Oct yes yes yes, rising 27.2 to 23.8 no

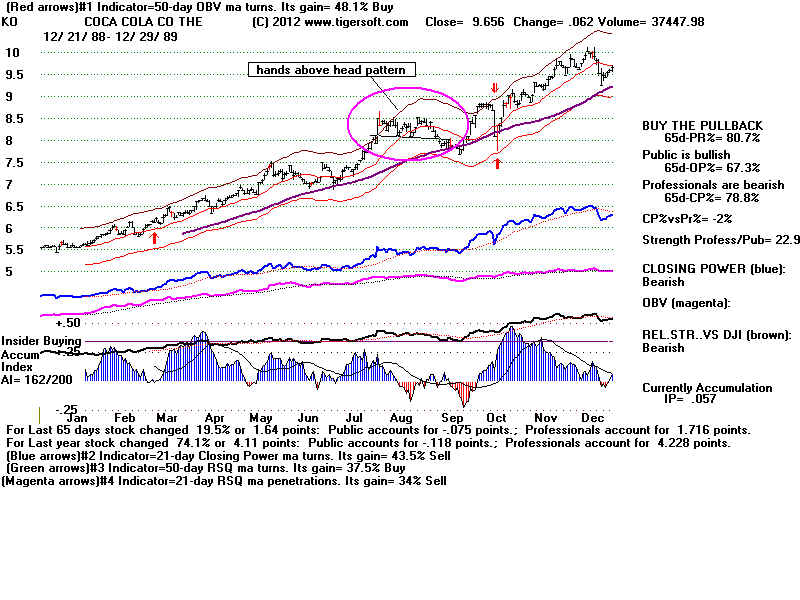

KO Sept no no hands/above head 8 to 7.8 no

IP21 = -.02 on breakdown

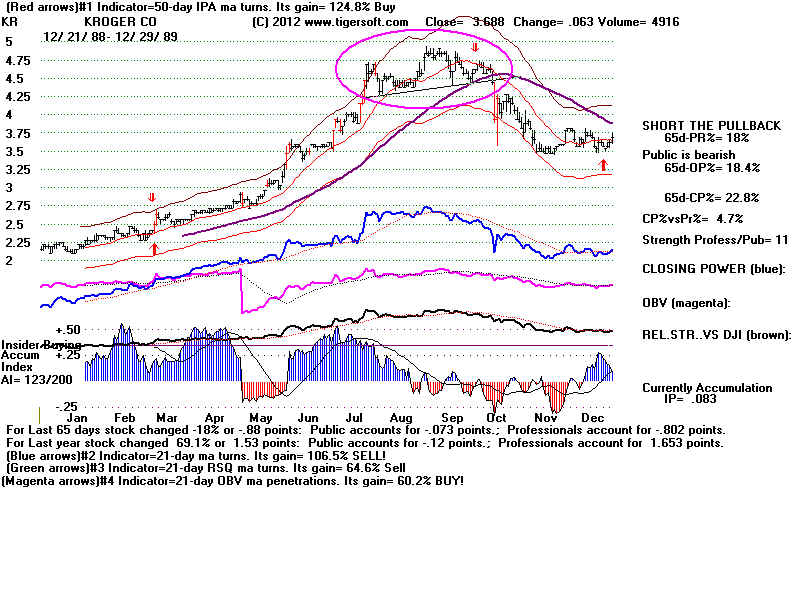

KR Oct yes yes no, rising 4.3 to 3.5 no

Accum turned very negative on breaking of necline.

LEN Feb yes no no, rising 1.6 to 1.28 no

LEN Aug yes yes yes, flat 1.45 to 1.25 yes

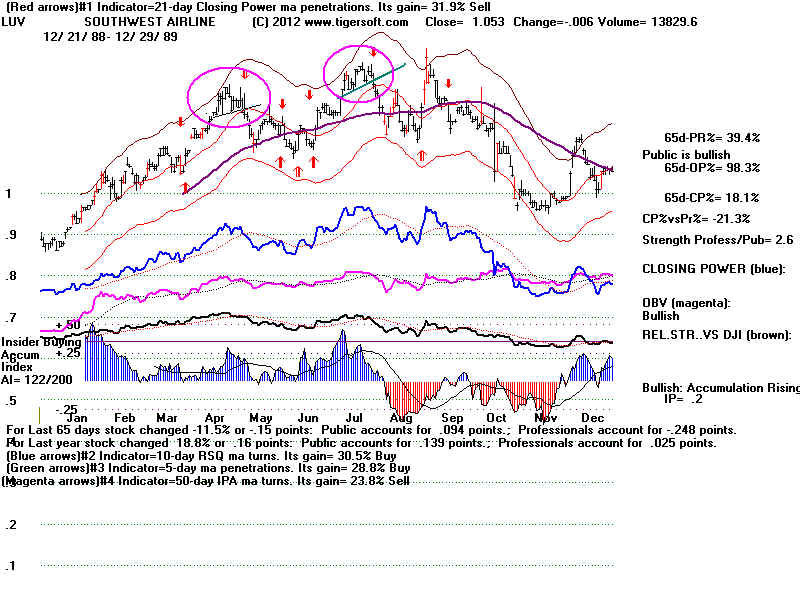

LUV May yes no no, rising 1.21 to 1.12 yes

LUV Aug yes no no, rising 1.30 to 1.15 yes

NEM Feb yes no no, rising 32.1 to 27.6 yes

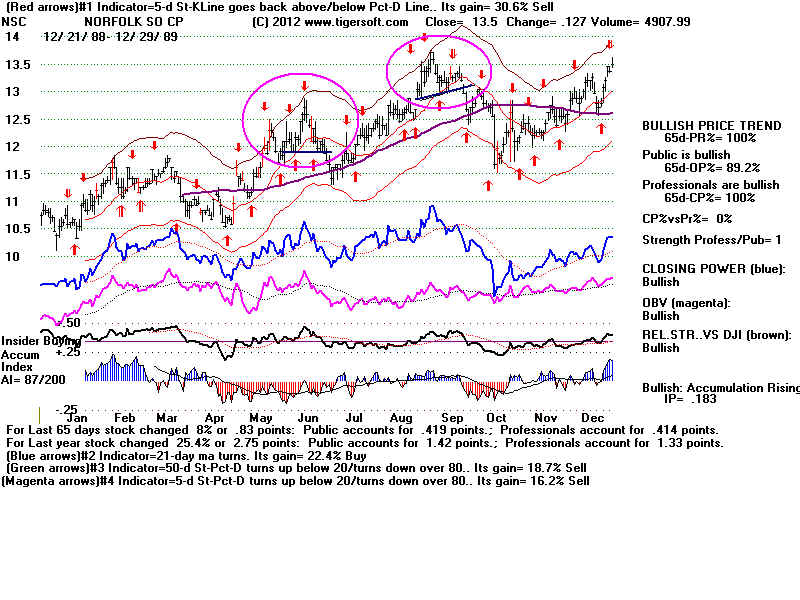

NSC June no no no, flat 11.9 to 11.4 keeps rising

IP21 = -.048 on breakdown

NSC Sept yes no no, rising 13 to 11.6 yes

PH Mar no yes no, rising 8.3 to 7.8 yes but failed

IP21 = +.055 on breakdown

PH Sept yes yes yes, flat 8.75 to 7.25 yes

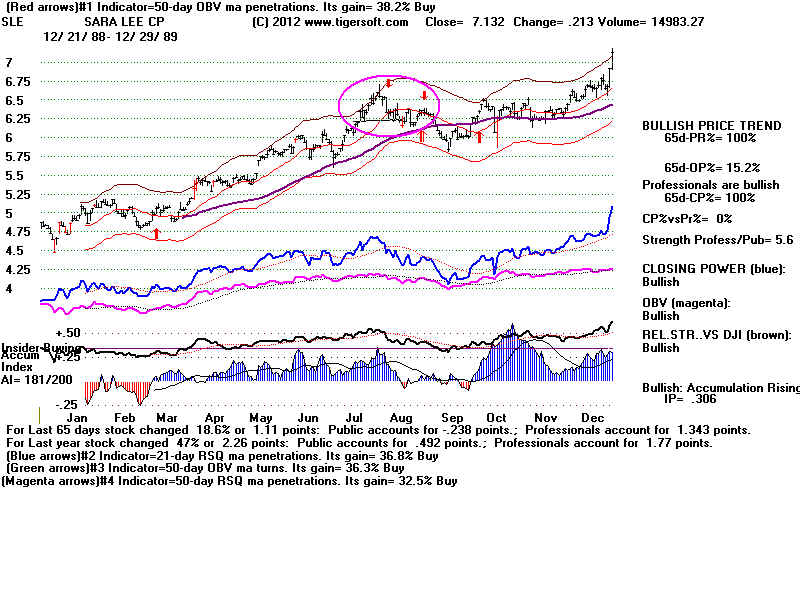

SLE Aug yes no no, flat 6.15 to 5.8 yes

TSO May yes yes yes, flat 5.75 to 4.5 no

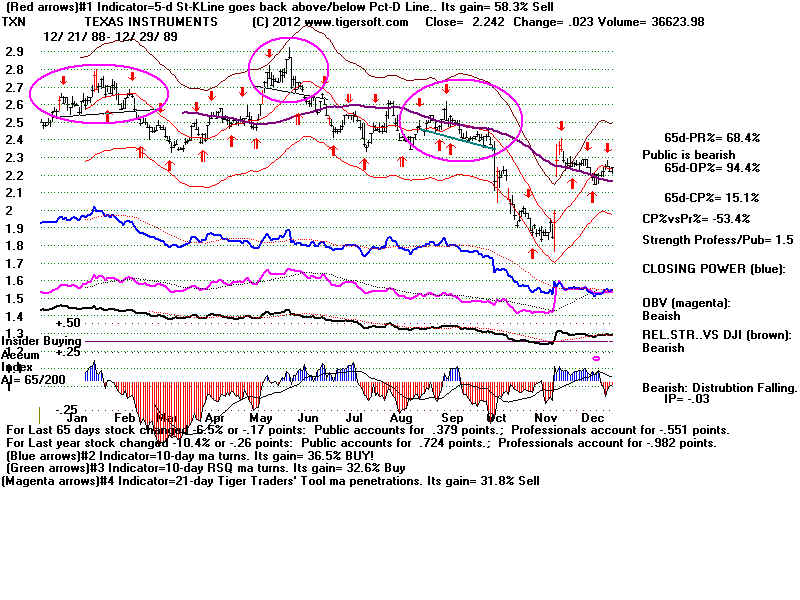

TXN Feb yes yes yes, rising 2.53 to 2.35 no

TXN June yes yes no, falling 2.62 to 1.85 yes

TXN Oct yes yes Continuation yes, falling 2.32 to 1.85 no

Accum turned very negative on breaking of necline.

Only 11 of the 49 completed H/S patterns produced a decline of 15% or more.

Pullbacks occurred in 4 cases of 11 before the low was made for the decline.

5 of the 11 showed flat H/S necklines, 3 had a rising neckline, and in 2 instances

the neckline was falling.

In 9 of the 11 more successful H/S patterns, the breaking of neckline occurred with

the stock below the 65-dma at

that time or a day or two later.

In 8 cases the IP21 was

negative on the breakdown below the neckline.

All but one of these had an

IP21 below -.05.

In only 3 of the 11 did the

Tiger chart show red high volume.

15% Declines or More below Neckline

IP21 <0

IP21

on 65-dma

broken Classic &

3 month

Pull Back

on

Breakdown breakdown and turned

down Symetrical decline

potential before low

------------------------------------------------------------------------------------------------------------------------------------

AAPL Dec yes

-.054

yes

yes, flat 10.5 to 8.5

no

BCR June yes

-.145 no

no, flat

11.8 to 10 yes

BK

Sept yes -.175 yes

yes, rising 6.3 to 4.7 yes

Red high volume on neckline break.

DNB Oct yes

-.008 yes

no, flat 10.15 to 7.54

yes

GR

Sept yes -.094 yes

no, flat 29.5 to 19.69

no

Note heavy distribution on right shoulder

GT

Sept yes -.187 yes

yes, falling 25 to

21.38

no

Note heavy distribution on right shoulder

HAS

Nov yes

+.199 yes

no, falling 6.44 to 5.26

no

IP

Oct yes -.113

yes

yes, rising 27.2 to 23.8

no

KR

Oct yes -.327 yes

no, rising 4.3 to 3.5

no

Accum turned negative on right shoulder

Red high volume on neckline break.

NEM

Feb yes +.069 no

no, rising 32.1 to 27.6

yes

Red high volume on neckline break.

TSO May yes

+.052 yes

yes, flat 5.81 to 4.5

no

was considered too steep.