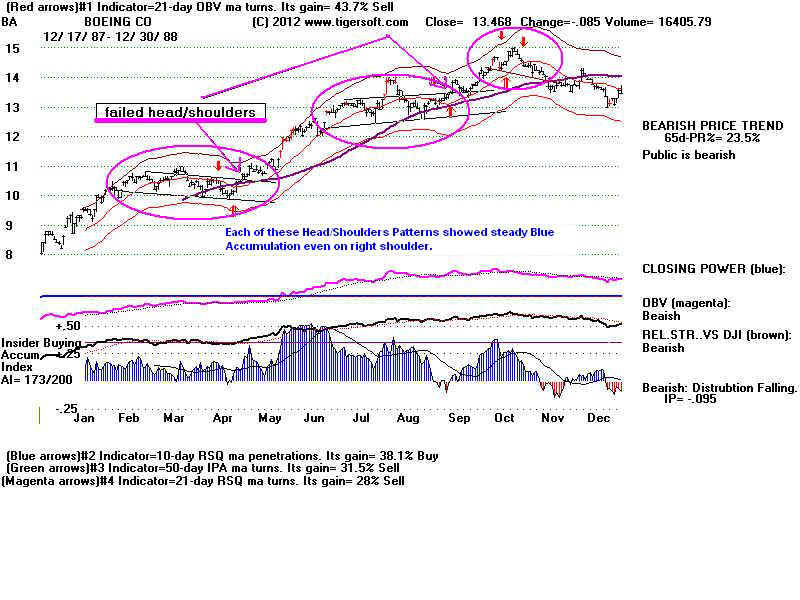

Head and Shoulders or Hands-the Head Patterns are seen below in 28 of the 227 SP-500

stocks from 1988.

There were 36 completed head/shoulders patterns identified here and circled in the charts.

(BA has two incomplete H/S patterns circled to emphasize the importance of waiting

for the pattern to be completed when there is heavy blue Accumulation. )

20 of the 36 completed head/shoulders pattterns show pull-backs to

neckline before the minimum downside objective was reached.

Of these 20 pull-backs, in 14 cases, the stock turned down and reached

its mimium downside objective, the height of the H/S pattern from peak to neckline

subtracted from the neckline where the latter was broken.

Only 6 of the 36 did not fall at least to their minimum downside objective.

But most of the declines were small and ended abruptly. Remember, these patterns

are most potent when there has previously been a big advance. They need something

to reverse. October 1987 had already achieved that.

Mininimum 65-dma broken Classic & 3 month Pull Back

Objective Met and turned down Symetrical decline potential before low

--------------------------------------------------------------------------------------------------------------------

AA yes no no, flat 6.7 to 6.4 after low

AAPL yes no yes, flat 11 to 9.5 yes

BA yes no yes, falling 13.9 to 13. yes

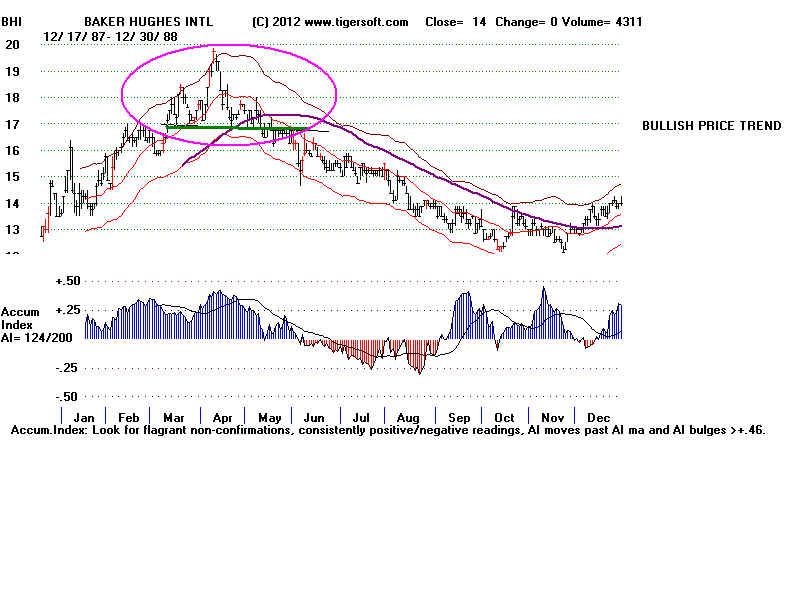

BHI yes yes no, flat 16.8 to 12.5 yes

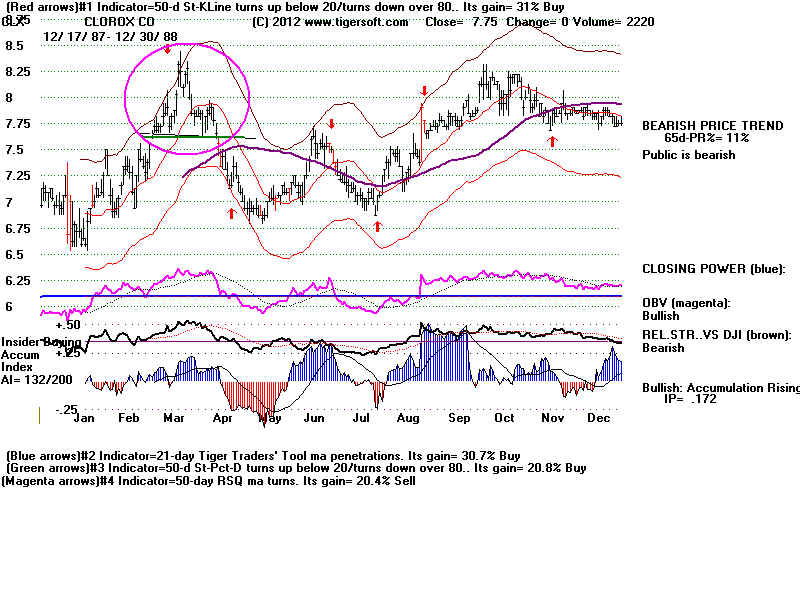

CLX yes yes yes, flat 7.5 to 6.8 after low

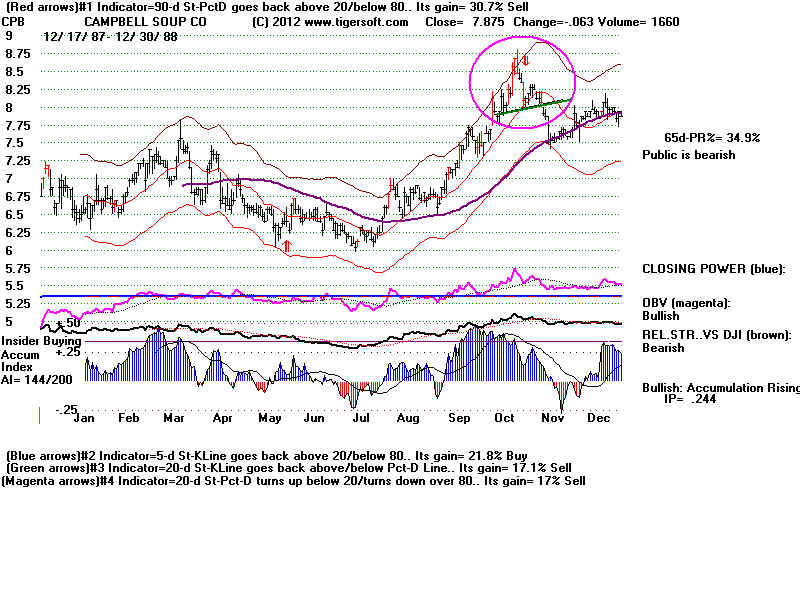

CPB no no yes, rising 8 to 7.5 after low

DD yes no yes, flat 14.4 to 13.2 yes

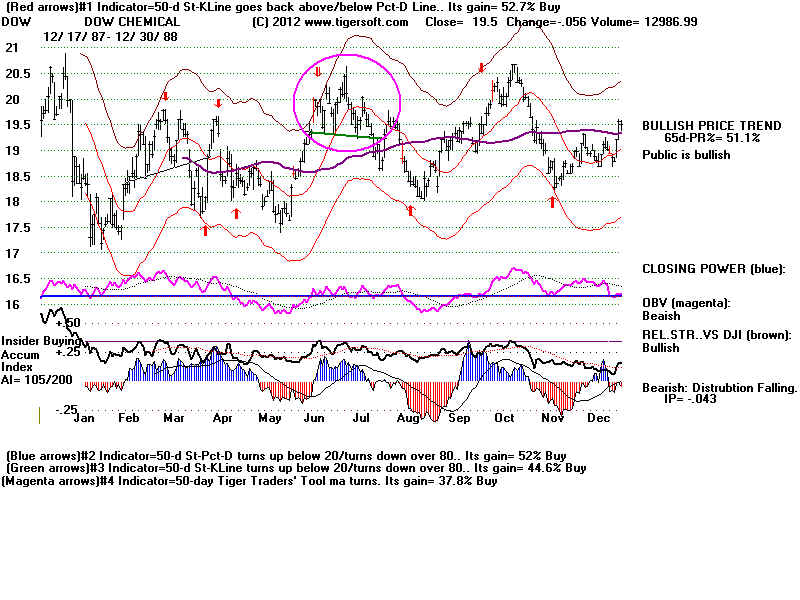

DOW yes no no, flat 19.1 to 18.05 yes

DUK yes no no, falling 6.55 to 6.3 yes

DUK yes no no, rising 6.75 to 6.5 after low

EK yes no no, rising 44 to 42 after low

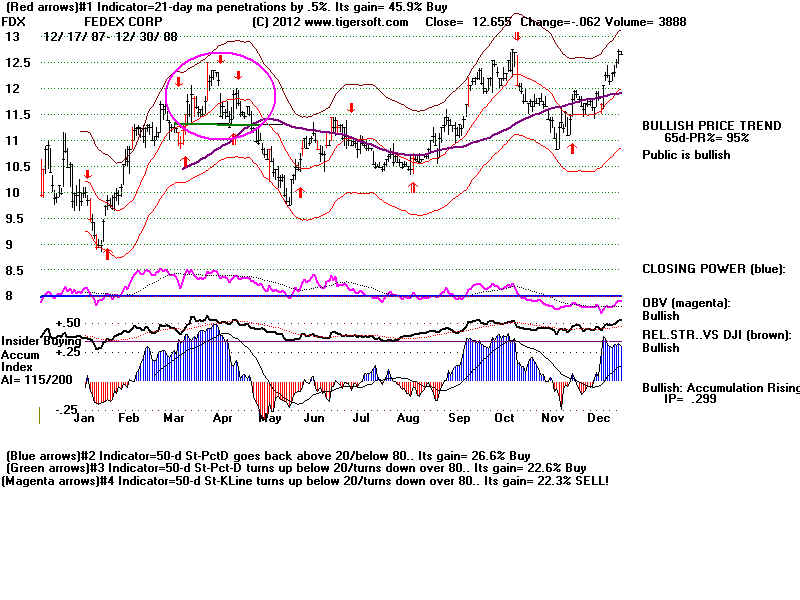

FDX yes yes yes 11.25 to 9.7 after low

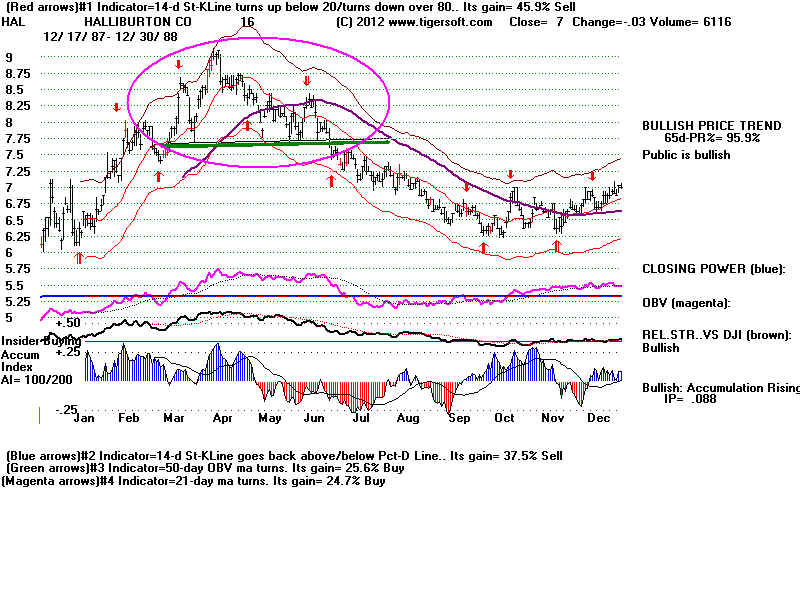

HAL yes yes no, flat 7.5 to 6.25 yes

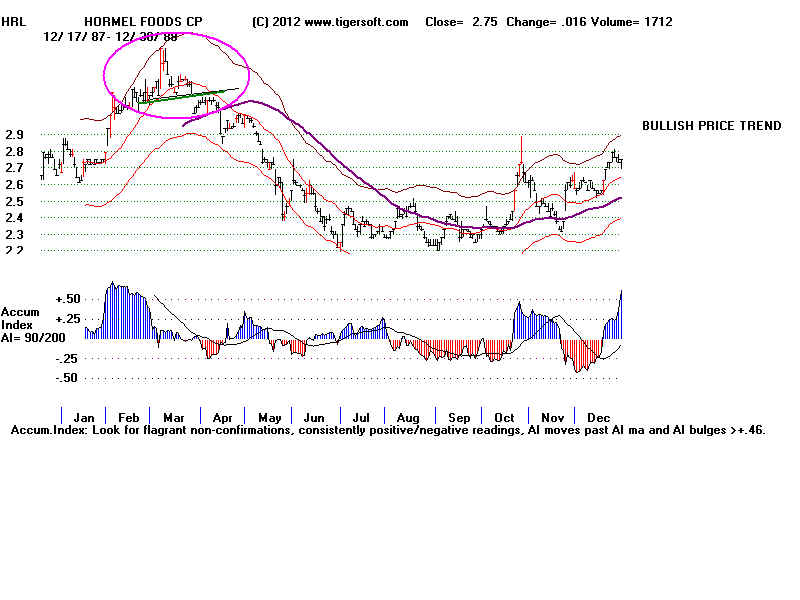

HRL yes no yes 3.1 to 2.2 yes

HUM yes yes no, flat 17.5 to 15 after low

JCP yes yes yes, flat 23.2 to 22 after low

JCP yes yes no, flat 23.5 to 22.8 after low

KMB yes no no, flat 14 to 12.9 after low

MGP yes no yes, flat 7.1 to 6 yes

MGP yes yes yes, falling 8.1 to 7.2 after low

MMM no yes yes, flat 15.3 to 14.75 after low

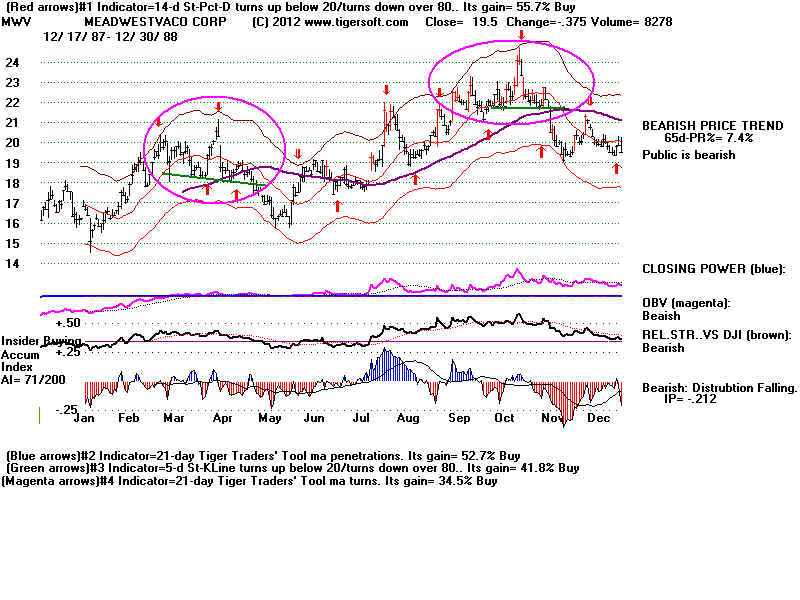

MWV no yes no, falling 17.7 to 16.0 after low

MWV yes yes no, flat 21.5 to 19.2 after low

NOC no no yes, flat 14.2 to 13.5 after low

NOC yes yes yes, flat 16.0 to 12.6 no (a hesitation at neckline)

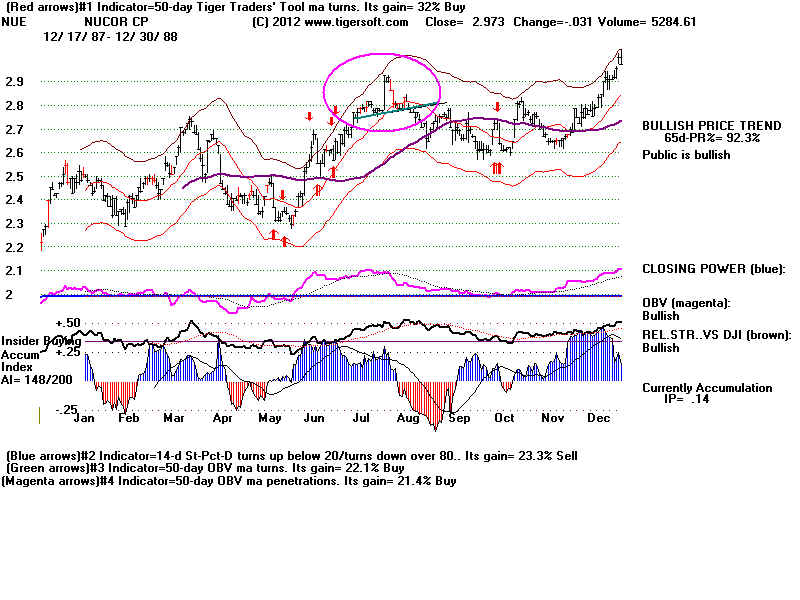

NUE yes no yes, flat 2.75 to 2.6 yes

PPL yes no no, flat 8.75 to 8.3 after low

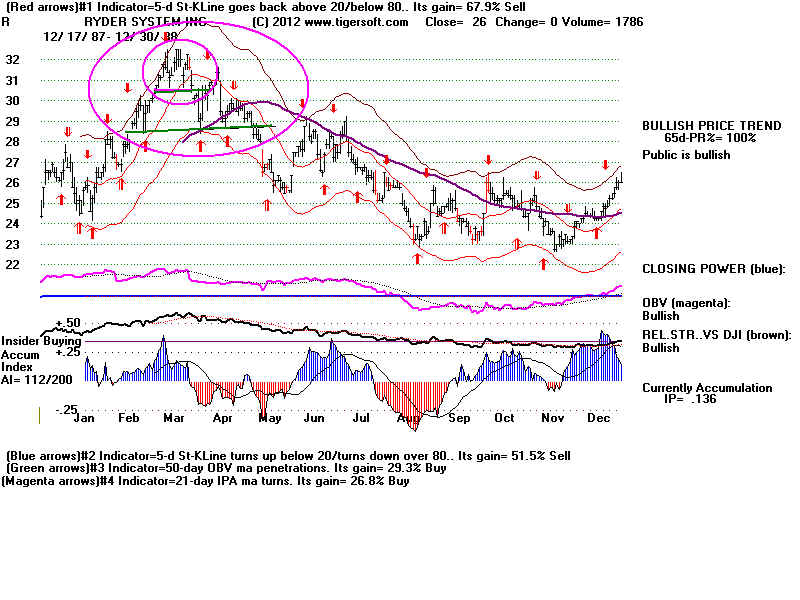

R yes yes no, flat 28 to 23 yes

RRD no yes no, flat 17.6 to 16.6 yes

RRD yes yes no, flat 17.5 to 16.1 yes

RSH yes yes no, falling 11.5 to 9.7 yes (only 1 day)

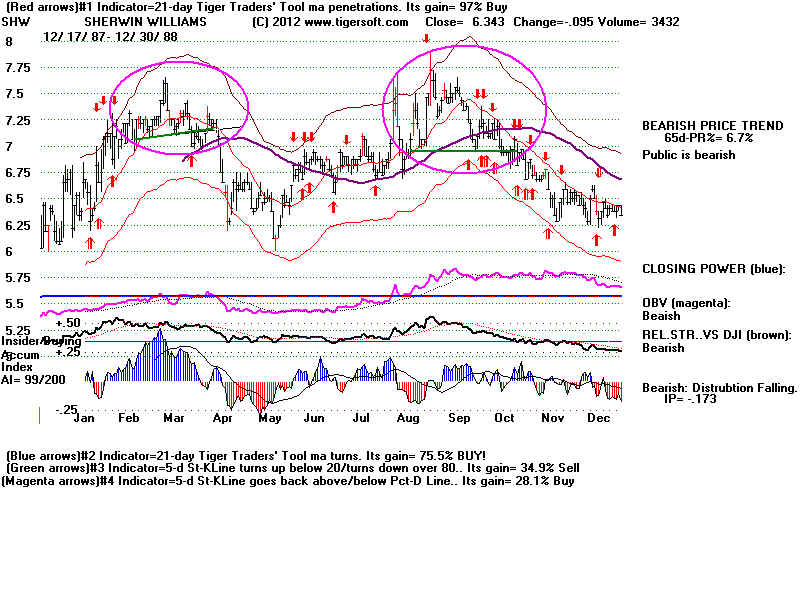

SHW no yes yes, flat 7.1 to 6.1 yes

SHW yes no no, flat 6.8 to 6.3 yes

SUN no yes no, flat 16 to 14.9 yes

UTX yes no no, flat 4.7 to 4.3 yes

UTX yes yes no, falling 5.05 to 4.8 after low

Only 6 of the 36 completed H/S patterns produced a decline of 15% or more.

Pullbacks occurred in all these cases before the low was made for the decline.

5 of the 6 showed flat H/S necklines. In 4 of the 6 the breaking of neckline

occurred with the stock below the 65-dma at that time or a day or two later.

In 4 cases the IP21 was negative on the breakdown below the neckline.

15% Declines or More

IP21 <0 65-dma broken Classic & 3 month Pull Back

on Breakdown and turned down Symetrical decline potential before low

--------------------------------------------------------------------------------------------------------------------

BHI no yes no, flat 16.8 to 12.5 yes

IP21 was positive on neckline breakdown

HRL yes no yes. flat 3.1 to 2.2 yes

IP21 was negative on neckline breakdown

MGP yes no yes, flat 7.1 to 6 yes

IP21 was negative on neckline breakdown

NOC yes yes yes, flat 16.0 to 12.6 no (a hesitation at neckline)

IP21 was negative on neckline breakdown

R yes yes no, flat 28 to 23 yes

IP21 was negative on neckline breakdown

RSH no yes no, falling 11.5 to 9.7 yes (only 1 day)

IP21 was slightly positive on neckline breakdown