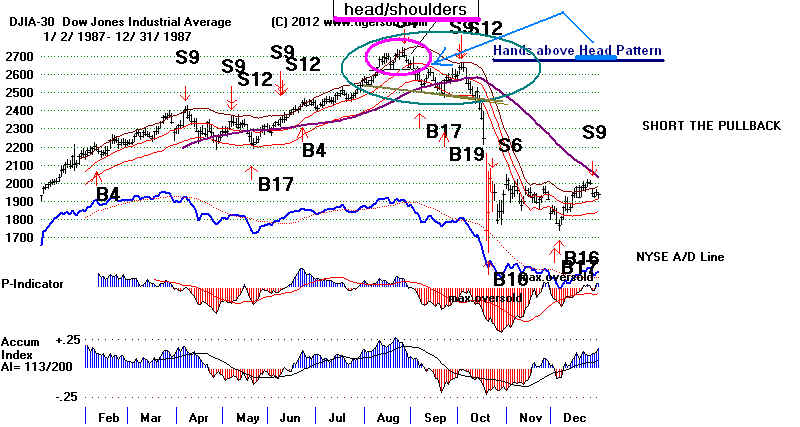

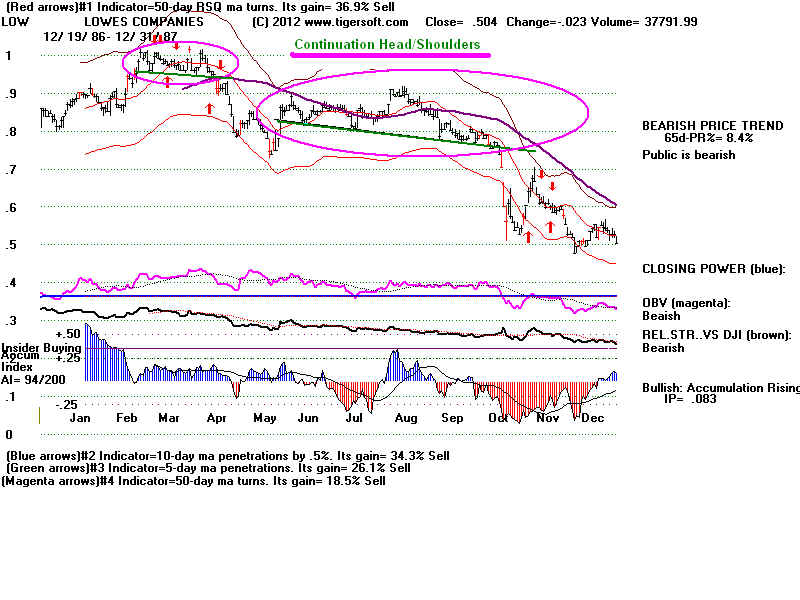

Head and Shoulders or Hands-theHead Patterns are seen below in 44 of the 224 stocks

from 1987 that have survived and thrived, so that they are now included in the SP-500 by 2012.

Most showed red distribution on the right shoulder of the H/S patterns.

Head and shoulders come in a lot more forms or varieties than the classic fom depicted

in technical analysis manuals. All forms are potent. So, the proficient technician should

be able to recognize them in their many variations.

Conclusions:

1987 Only 45/224 current SP-500 stocks traded back then

show one or more head/shoulders patterns as recognized here.

These 45 stocks produced 68 different completed head/shoulders

patterns.

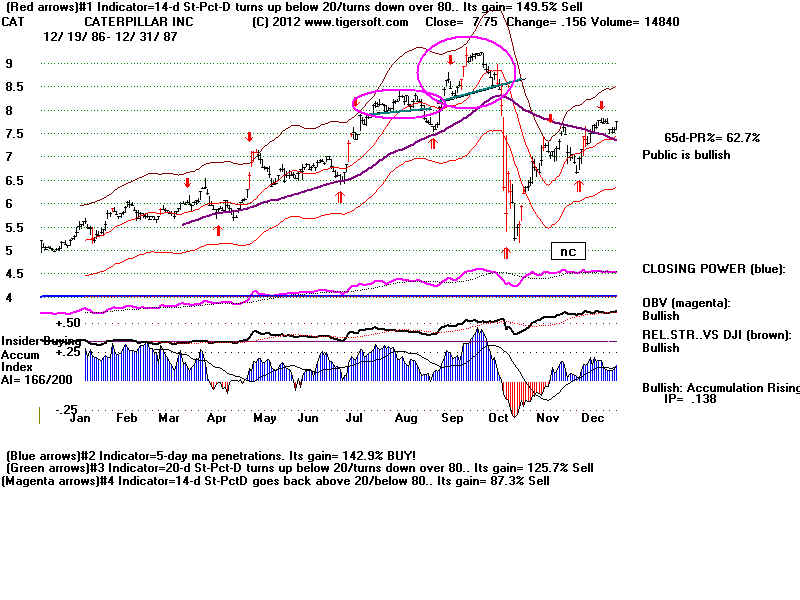

30 of the 45 completed head/shoulders pattterns show pull-backs to

neckline. Usually a sharp break in prices followed. But in 5 cases

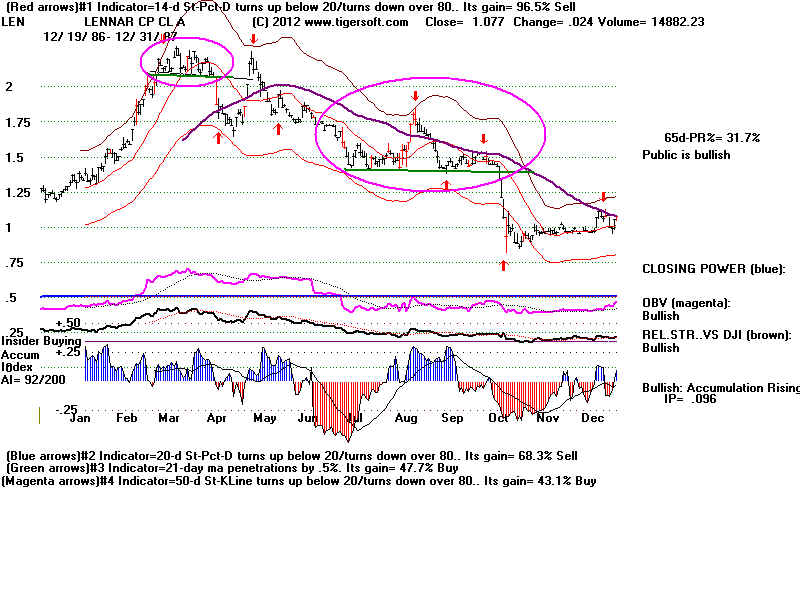

(CAT, F, LEN, UTX and XOM) the pull-back turned into an advance

that took prices above the right shoulder apex. In all 5 cases the

65-dma was rising and the initial penetration of the H/S neckline

did not take prices above the 65-dma..

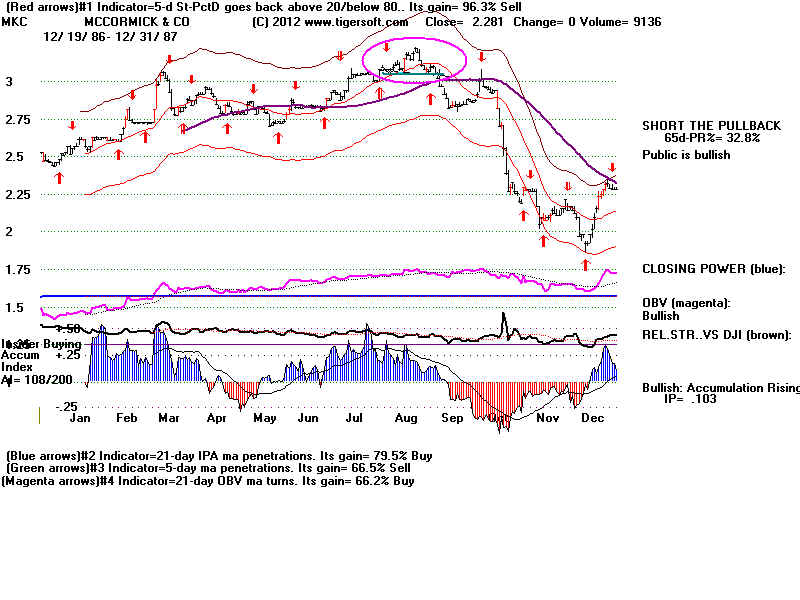

Pullbacks before the minimum downside objective is met are much more likely

when the break in the neckline takes place above the support of the rising 65-dma.

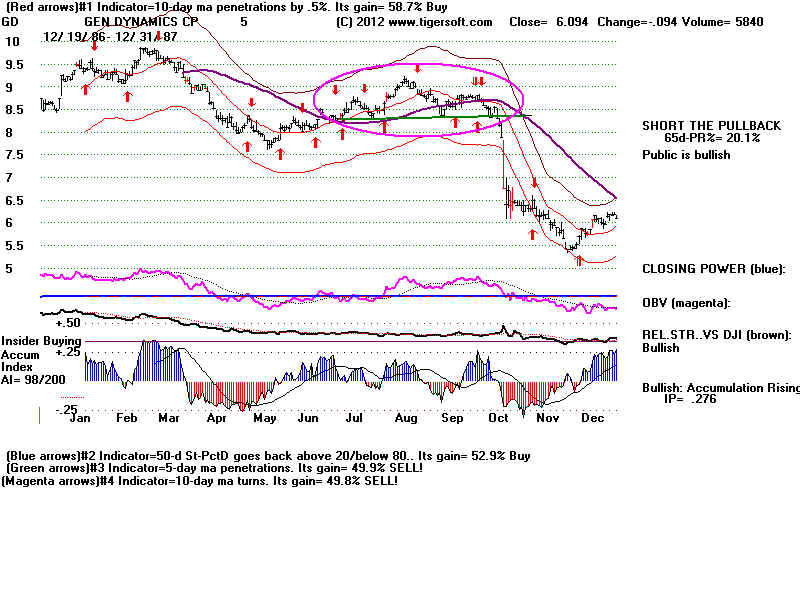

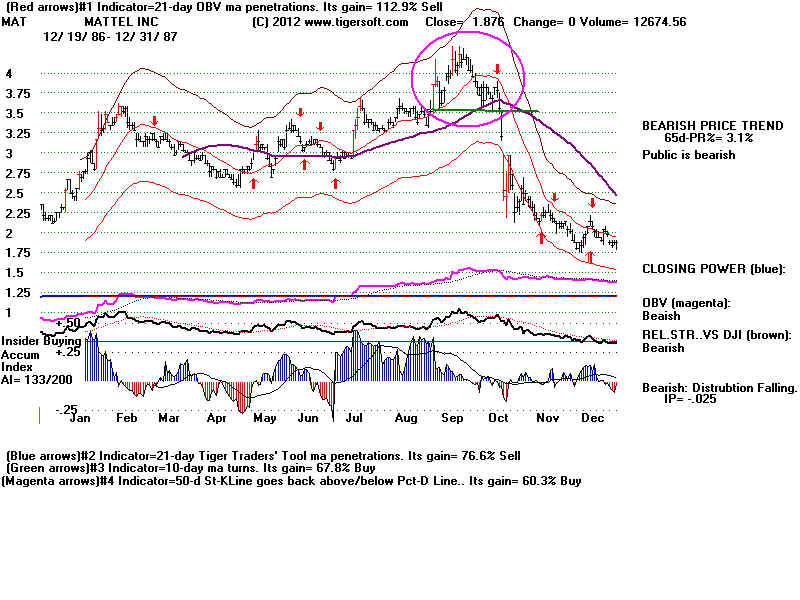

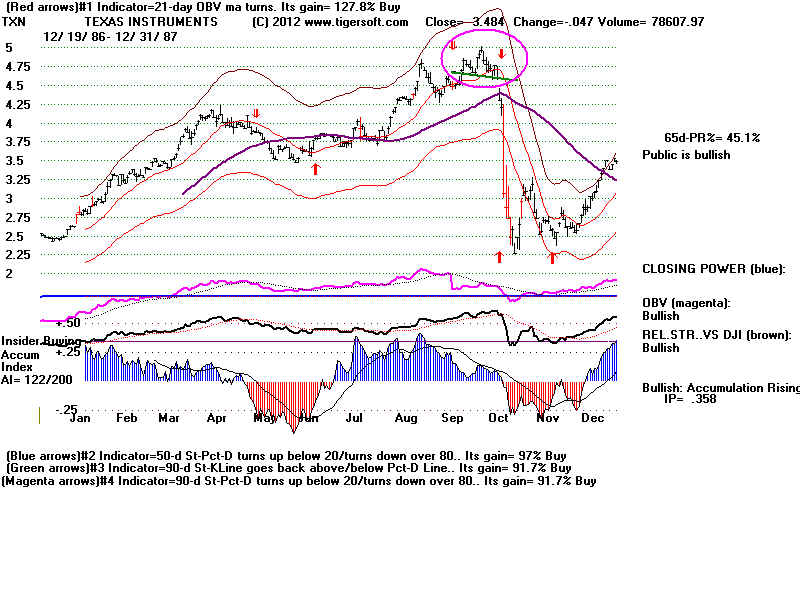

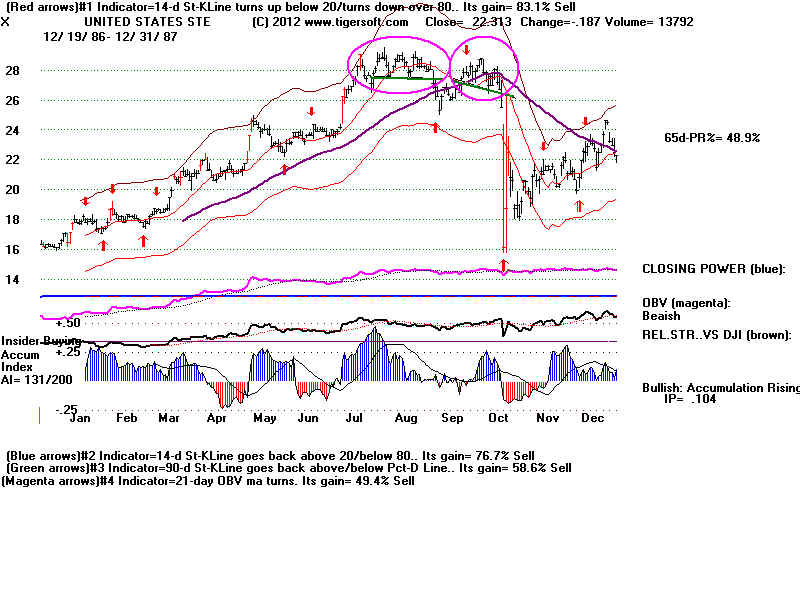

Compare HUM, IFF, KO, S (where there is a pullback) with GD, JCP, MAT, MRK,

SIAL (where steep declines follow the breaking of the neckline). But just because

a stock is still above its 65-dma does not guarantee a pull-back rally. Look at the

huge sell-off in TXN below.

Classic Head/Shoulders patterns brought average drops about the same as the DJI.

The DJI fell 700 points after breaking its 2400 neckline support. This drop of 28.5%

compares closely with the 29% average drop from the necklines in the classic multi-month

head/shoulders patterns.

Gains are calculated by taking the percent change from a point just below the neckline

to the next major low, which here was the low for the rest of 1987.

One month, "mighty mouse" head/shoulders patterns resulted in average 25% declines

even though the patterns were quickly formed and heavy red distribution (from the

Accumulation Index) was not usually present. These patterns should be watched for,

heeded and exploited.

The biggest declines typically came when a stock had already shown an earlier H/S

in the same year or completed a complex of nested head/shoulder patterns. There were 15

such cases in the stocks looked at here. The average gain was 34.9%.

Classic 2-4 Months' Head/Shoulders

Length Neg Dist. Neckline Break Size Drop from neckline

of neckline on right was below 65-dma to lowest level afterwards

shoulder in this year.

------------------------------------------------------------------------------------------------ ----------------- ------------

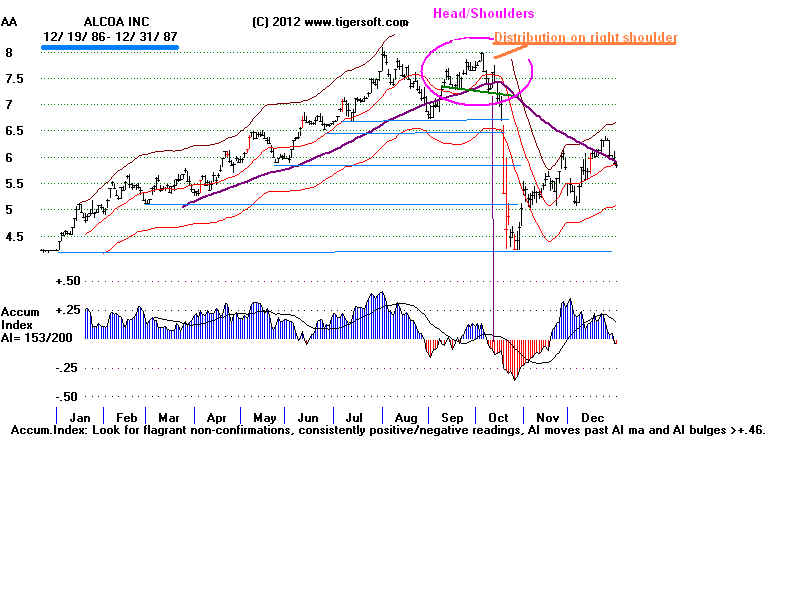

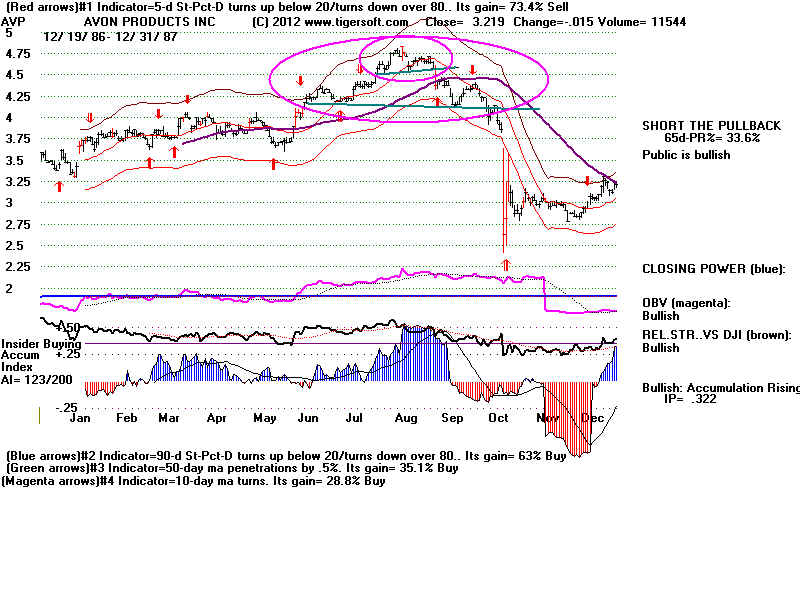

AVP 1987 16 wks yes yes 40% 8 days

There was a pullback to the neclline.

-------------------------------------------------------------------------------------------------------------------------------

BMS 1987 16 wks yes yes 24% 7 days

-------------------------------------------------------------------------------------------------------------------------------

CLX 1987 10 wks yes yes 17% 1 day.

---------------------------------------------------------------------------------------------------------------------------------

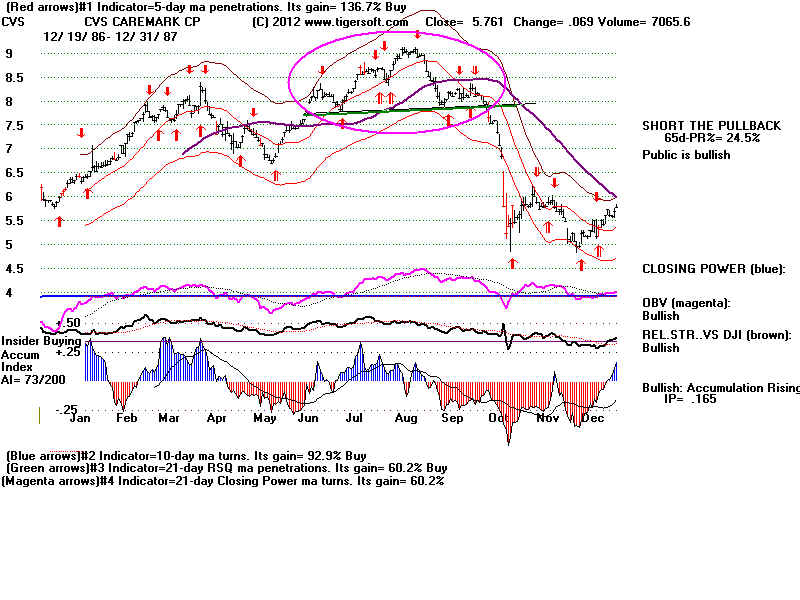

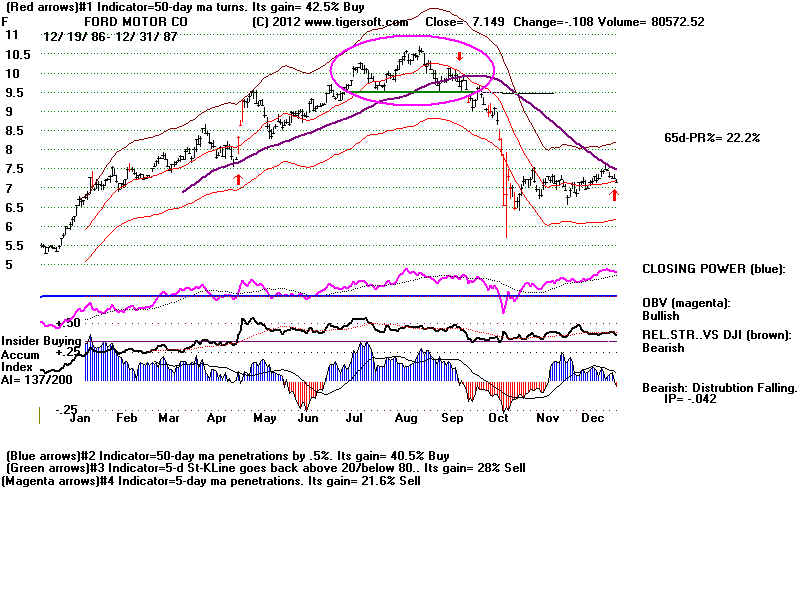

F 1987 8 wks no yes 32% 3 wks

There was a pullback to the neclline.

---------------------------------------------------------------------------------------------------------------------------------

GD 1987 10 wks yes yes 31% 6 wks

- --------------------------------------------------------- --------------------------------------------------------------------------

HESS 1987 15 wks yes yes 38% 6 wks.

There was a recovery back to neckline before plunge.

------------------------------------------------------------------------------------------------------------------------------

(Continuation H/S)

JCP 1987 10 wks yes yes 28% 4 days

- -------------------------------------------------------------------------------------------------------------------------------

LEN 1987 10 wks yes yes 38% 4 days

---------------------------------------------------------------------------------------------------------------------------------

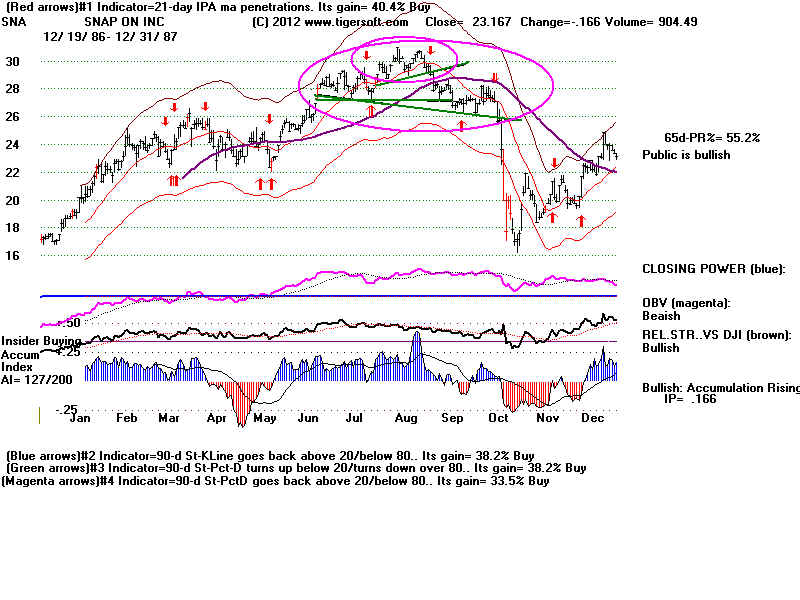

SNA 1987 14 wks no yes 32% 8 days

---------------------------------------------------------------------------------------------------------------------------------

TSN 1987 14 wks no yes 14% 4 wks.

There was a recovery back to neckline before plunge.

--------------------------------------------------------------------------------------------------------------------------------------

N=10 Avg. = 29.4% drop

5 weeks or Shorter Classic Head/Shoulders

Length Neg Dist. Neckline Break Size Drop from neckline

of right was below 65-dma

shoulder

------------------------------------------------------------------------------------------------ ----------------- ------------

IFF 1987 20 days yes no 5% 2 days

Decline stopped at rising 65-dma.

There was a recovery back above apex of right shoulder

-------------------------------------------------------------------------------------------------------------------------------

LUV 1987 22 days no yes 16% 8 weeks.

Gap breakdown and small recovery.

------------------------------------------------------------------------------------------------------------------------------

MKC 1987 23 days no yes 38% 12 wks

There was a recovery to neckline before collapse.

-------------------------------------------------------------------------------------------------------------------------------

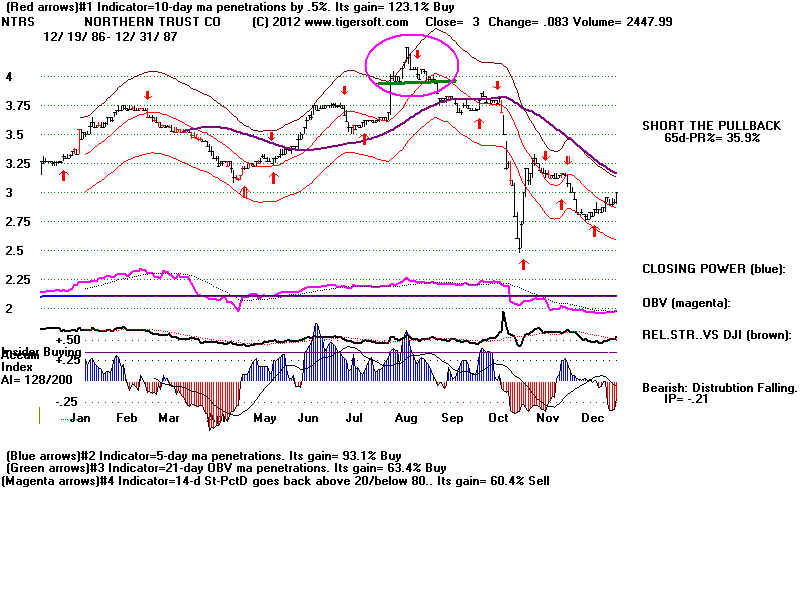

NTRS 1987 23 days no no 34% 8 wks

There was a month long hesitation at the rising 65-dma

until prices turned down.

------------------------------------------------------------------------------------------------------------------------------

RS 1987 15 days no no 36% 8 wks

-------------------------------------------------------------------------------------------------------------------------------

N=5 Avg = 25.8%

2 or More Different H/S Patterns in the Same Year.

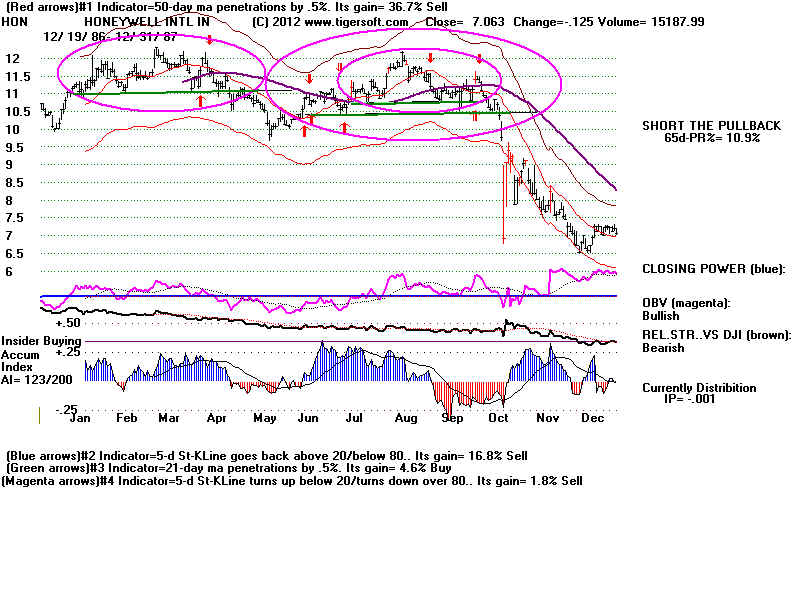

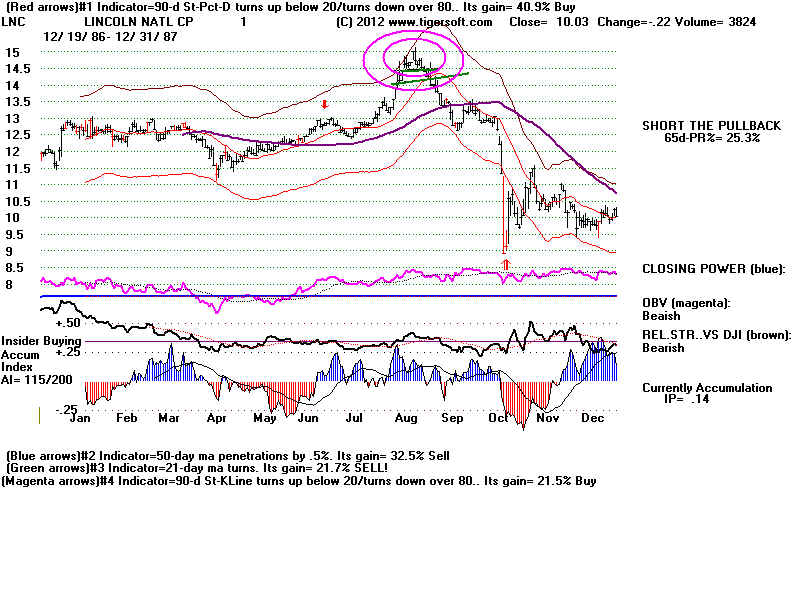

HON Oct 1987 32% 2 days

KO Oct 1987 Above 65-dma. There was a Pullback 38% in 4 weeks.

LEN Oct 1987 35% in 4 days

LUV Oct 1987 28% in 8 weeks

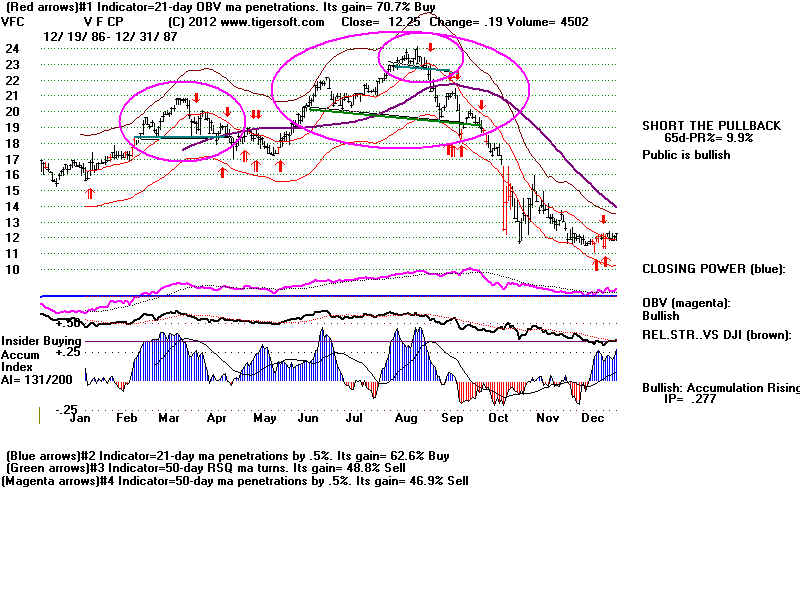

VFC Aug 1987 Above 65-dma. 45% in 14 weeks.

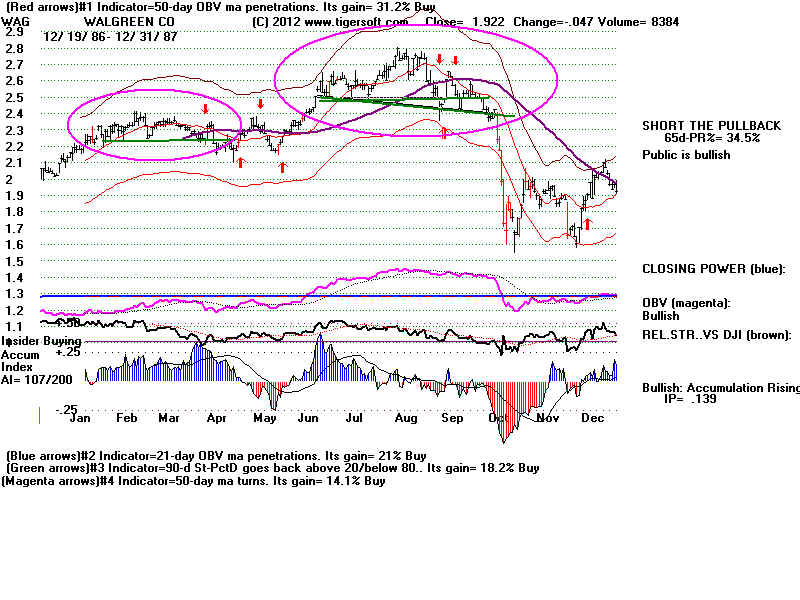

WAG Oct 1987 33% in 11 days

X Oct 1987 38% in 2 days

XOM 1987 - 3 H/S patterns 30% in 2 days

------------------------------------------------------------------------------------------------------

N=8 Avg = 34.9%

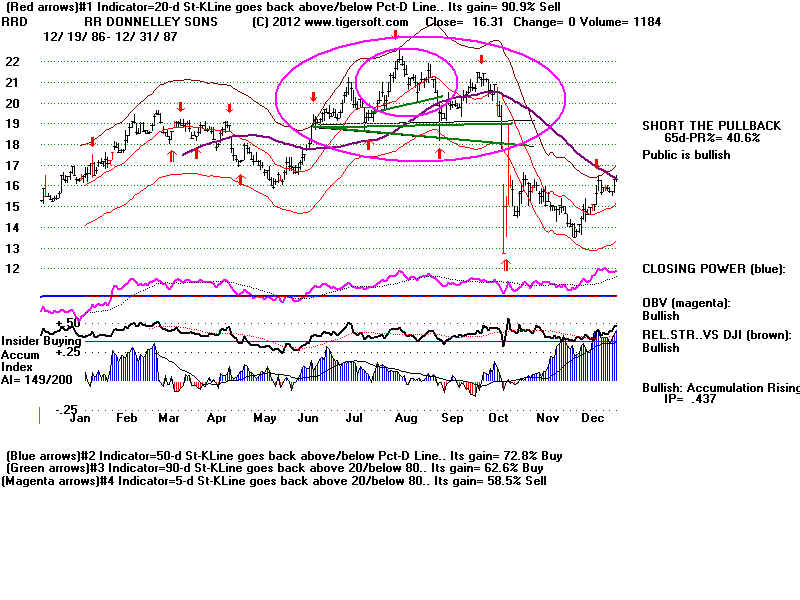

Complex Patterns with Multiple Nested H/S Patterns

(H/S Patterns within H/S Patterns)

AVP Oct 1987 pullback to the neclline. 40% in 8 days

HON Oct 1987 35% in 2 days

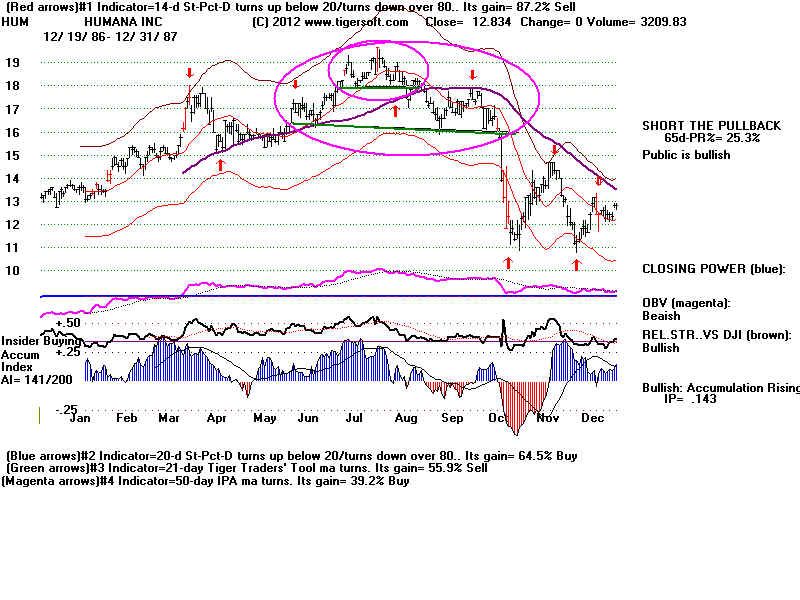

HUM Oct 1987 38% in 10 days

K Oct 1987 32% in 2 days

RRD Oct 1987 30% in 2 days

SNA Oct 1987 34% in 8 days

VFC Sept 1987 pullback above neclline. 35% in 6 weeks.

-----------------------------------------------------------------------------------------------------

N=8 Avg = 34.9%

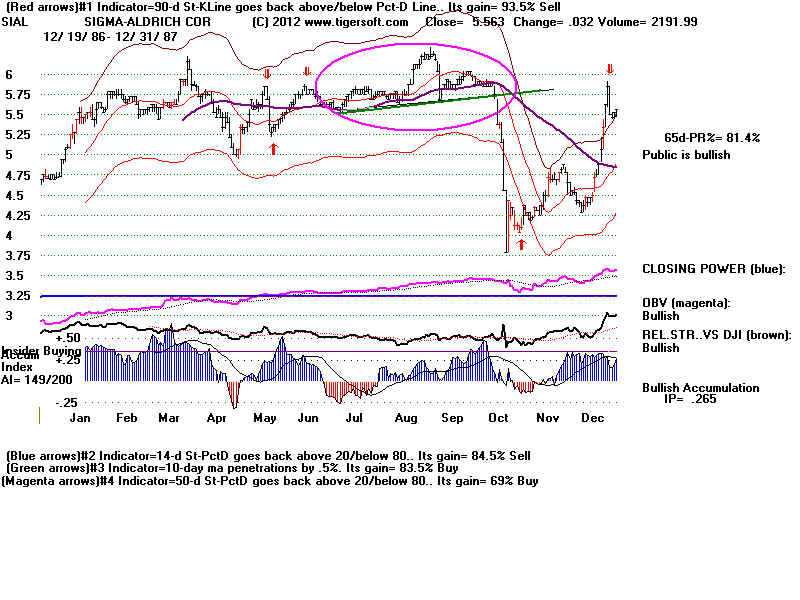

Up-Sloping Neckline

CAT Oct 1987 34% in 7 days

CI Oct 1987 30% in 10 wks

KO 1987 pullback above neclline. 28% in 3 weeks

SIAL Oct 1987 32% in 5 days.

-------------------------------------------------------------------------------------------------------

N=4 Avg = 34.9%

Downsloping Neckline

LOW Oct 1987 32% in 8 weeks.

MUR Sept 1987 pullback above neclline. 40% in 12 weeks.

MRK Oct 1987 19% in 6 days

SNA Oct 1987 34% to 16.5 in 8 days

-------------------------------------------------------------------------------------------------------

N=4 Avg = 31.3%

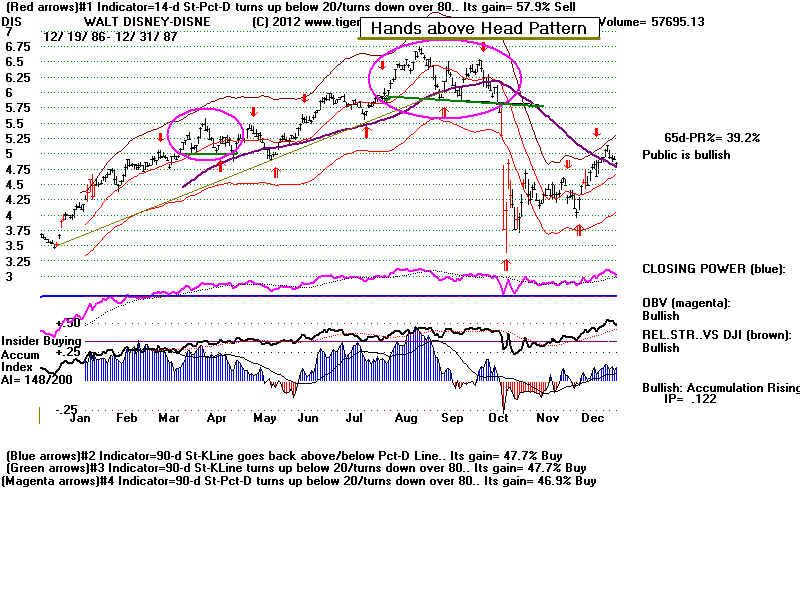

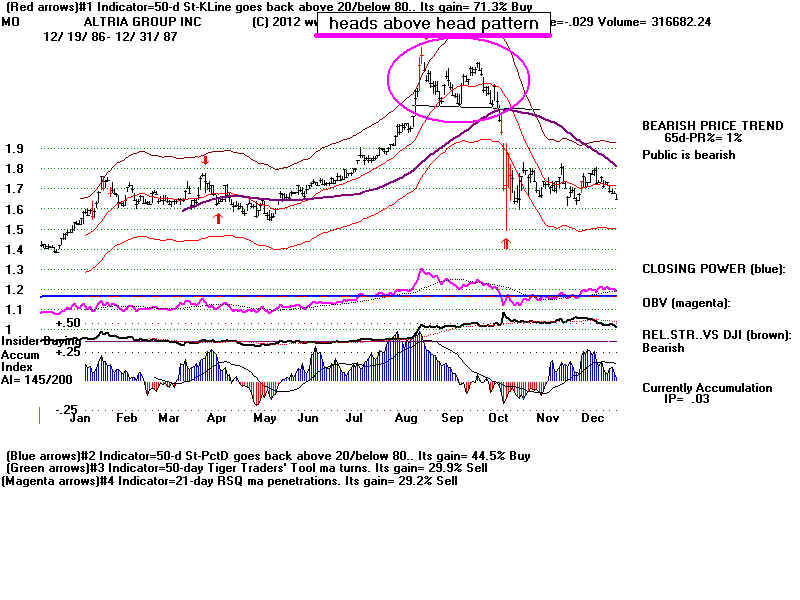

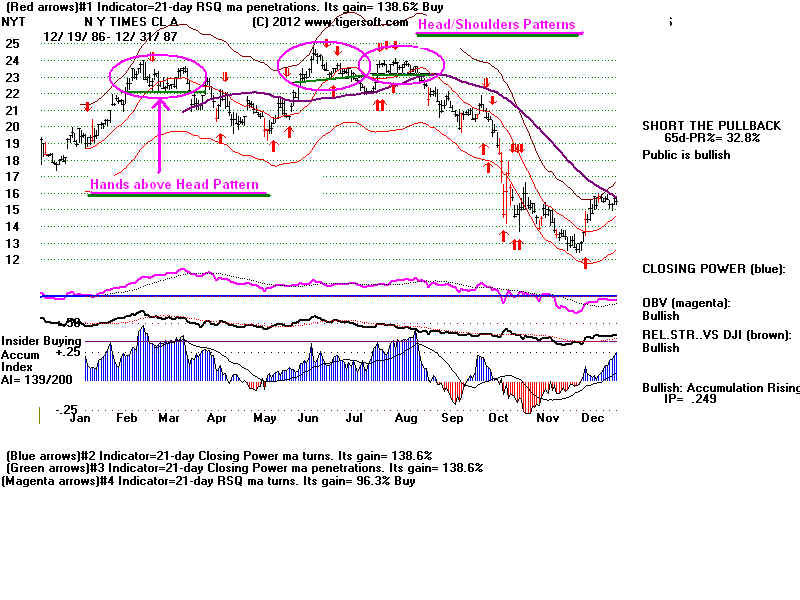

Hands above Head Pattern

DIS Oct 1987 35% in 4 days

MO Oct 1987 22% in 4 days

NYT March 1987 pullback above neclline. Above 65-dma. 7% in 7 weeks.

-------------------------------------------------------------------------------------------------------

N=3 Avg = 21.3%

Asymmetrical Patterns

Bigger Right Shoulders

HUM 1987

MUP 1987

NYTS 1987

RRD 1987

S 1987

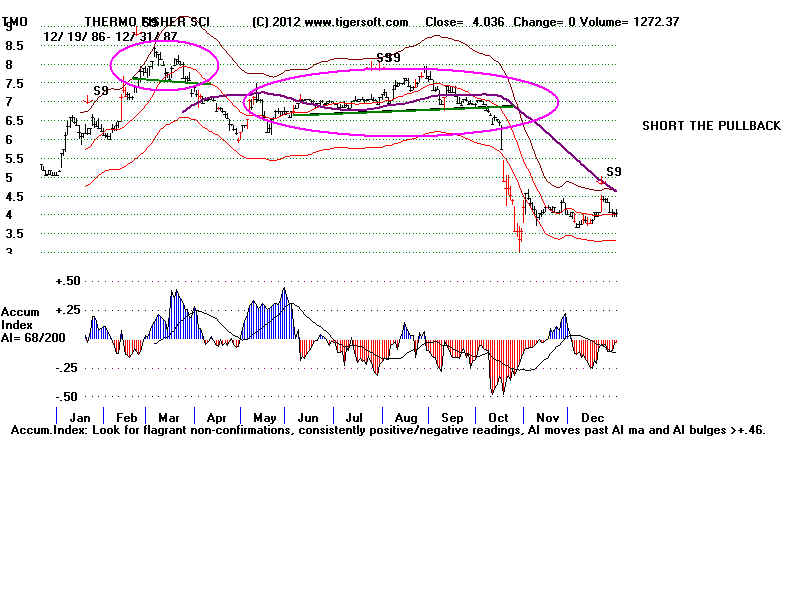

TMO 1987

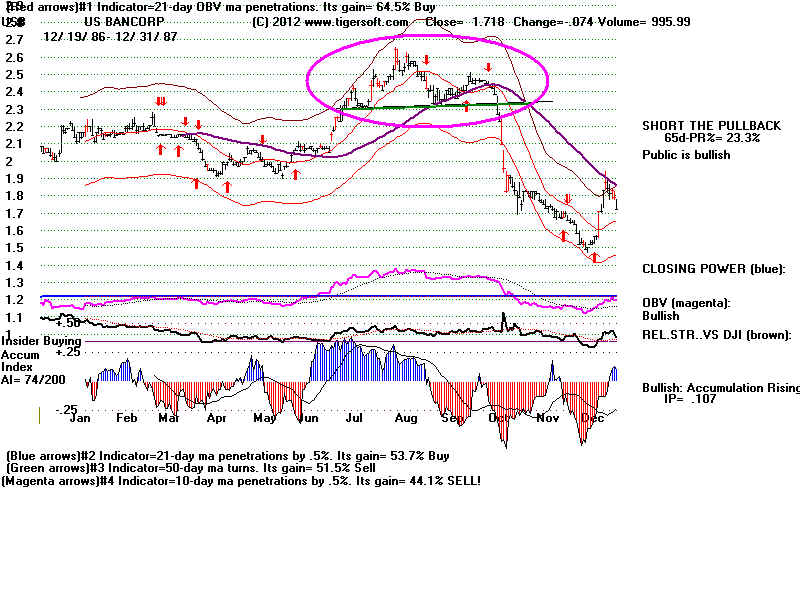

USB 1987

UTX 1987

Bigger Left Shoulders

LOW 1987

TAP 1987

TMO 1987

TSN 1987

End of a lateral move

SIAL 1987

TMO 1987

Quickly formed H/S with very quickly formed right shoulders

RSH 12.5---> 8 wks.

TXN 4.5 ---> 1.25 8 days

Negative/Big Change in Accum Index from left shoulder to right

and classic pattern bring big drops.

--------------------------------------------------------------

AVP

CVS

HON

JCP

LEN

MRK

TMO

USO

Oddities pecliar to individual stocks

TAP pullback and spring back to apex of right shoulder

and then sell-off

DJI's Top in 1987