|

Stock

Options' Trading |

We provide the data on more than 800 optionable stocks. Running the Tiger Power Ranker

program reveals those stocks that look best (for call Buying) or worst (for Put Buying). Our books

show you the best screens for these stocks. But even without the Tiger Power Ranker program,

the TigerSoft user will do well using the automatic Buys and Sells for the mature high techs in the

NASDAQ-100. He will do even better if he trades mostly in the direction of Peerless, i.e. he

buys Calls when Peerless is on a major Buy and buys puts when Peerless is on a major Sell.

We suggest that the trader search for the NASDAQ-100 stocks whose optimized system gives

Buys and Sells as often as he is comfortable. Thus a short-term Put and Call buyer might inspect

the NASDAQ-100 stocks to see which show their optimim trading system to be a 14-day Stochastic

and the gain is at least 80% for the last year. While the TigerSoft program finds such stocks almost

instantly, the TigerSoft user can quickly scan the stocks in his universe, looking just at the top row

of the chart. As of 11/12/2007, he would find the following stocks to trade Puts and Calls on.

Year's Current

Stock Gain Status Close Change AI/200 Accum.

-------- ------ --------- ------- ---------- --------- --------------------

ADBE 73 % Sell 42.19 -1.05 148 -.02

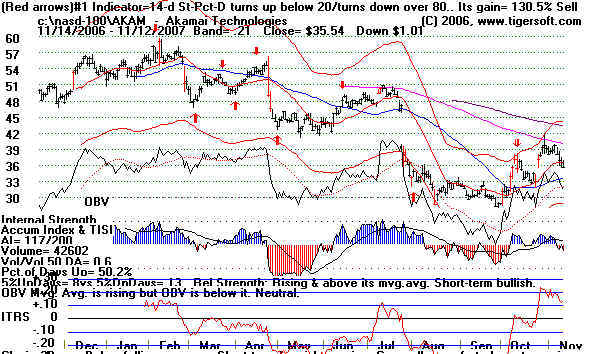

AKAM 130.5% Sell 35.54 -1.01 117 -.06

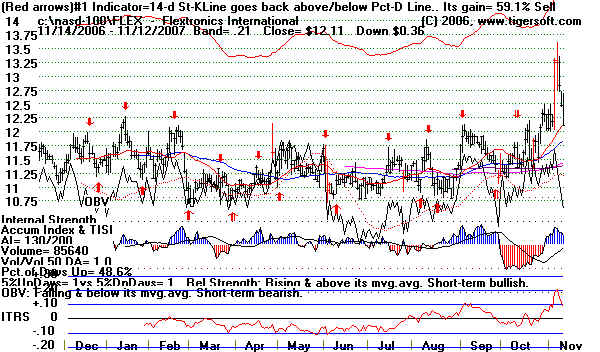

FLEX 59.1% Sell 12.11 -.361 127 .10

MRVL 92.1% Sell 17.14 -.411 75 .2

NTAP 95.9% Sell 26.11 -.77 97 .1

URBN 101.8% Sell 25.49 -.281 138 .08

A glance at the charts below for these stocks will give the Options trader a good idea

how helpful TigerSoft is. Buy Calls on the red Buys and buy Puts when a red Sell is given.

AKAM 130.5% Sell 35.54 -1.01 AI/200=117 Current AI= -.06

FLEX 59.1% Sell 12.11 -.361 AI/200=127 Current AI= .10

MRVL 92.1% Sell 17.14 -.411 AI/200=75 Current AI= .2

NTAP 95.9% Sell 26.11 -.77 AI/200=97 Current AI= .1

URBN 101.8% Sell 25.49 -.281 AI/200= 138 Current AI=.08

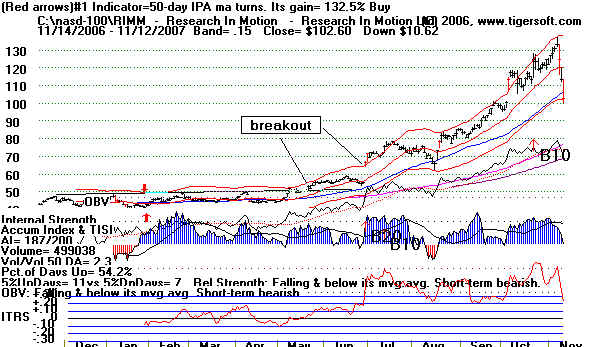

"Explosive Super Stock" principles are seen in best performing NASDAQ-100 Stocks

Notice timely major Buy signals for these stocks. These are automatic fixed-rule signals

that apply to all individual stocks.

AMZN Notice B10/B12/B20 cluster in April

RIMM - Classic Buy B10 Breakout in June..

ISRG - Classic

Multiple Major TigerSoft Buy Signals in June.

Options' Traders will want to look for major Tger Stock Sells to find stocks for their

Put buying and Buy the options when these occur if Peerless.is on a major Sell, too, for

the general market.