Chapter 1 Preface: 4/27/2010

by William Schmidt, Ph.D.

(C) 2010 www.tigersoft.com

EXPLOSIVE

SUPER STOCKS

Chapter 1 Preface: 4/27/2010

by William Schmidt, Ph.D.

(C) 2010 www.tigersoft.com

Insider

Buying - The Tiger Advantage

Insiders know their companies better than nearly anyone.

We would well

to watch what they are doing. When you see heavy insider buying

as TigerSoft measures it, do a little "do-dilligence" on Yahoo and

find out how much they are buying, etc. Another useful site is

http://www.insidercow.com/

How TigerSoft Flags Savvy

Insider Buying

We at

TigerSoft are privy to no insider tips or secrets. But over the

years, we have learned how to spot savvy insider trading that is

about to send the stock up and up and up! This pattern of buying

repeats over and over again, year after year, in all markets, because

someone on the inside knows something very good will happen to a

company in the not too distant future. They know this with a certainty

that is reflected in their manner of buying.

The Three Key

Stages To Watch for

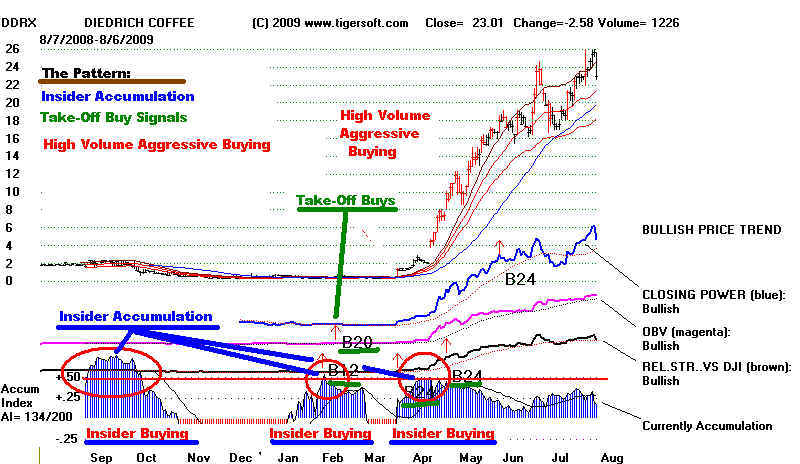

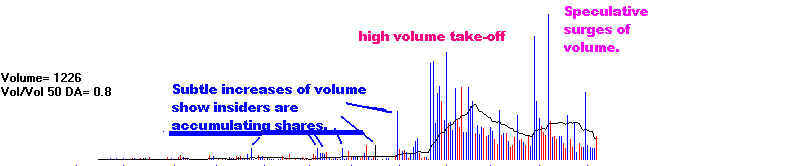

First, they quietly accumulate all the shares they can.

A weak general

market environment makes this a relatively easy pursuit. See the

tell-tale bulges in the

TigerAoft Accumulation Index

in the chart below.

When no more shares are available this way, they become more

aggressive, because they know there is a very high probability that

the stock will be much higher in six months or a year. We spot this

stage technically, using our Accumulation Index, price patterns, volume

and the automatic Buy signals which we have back-tested for the

this purpose over more than 30 years of time with thousands of stocks'

charts.

Finally, because the stock is tightly held and the insiders have

been

quite shrewd, prices rise

very sharply on high (red) volume, as more

and more professionals and a handful of public speculators jump aboard.

If you look closely, you can see all this in the DDRX chart

below.

In particular, see how our TigerSoft Accumulation Index spots the

earlier periods of insider accumulation by rising above the +.5 threshold.

The indicator varies from -1.0 to +1.0. It is quite bullish that there were

three periods when it rose above +.50. A lot of stock was accumulated.

The many automatic Buys are our alerts to buy the stock. The rising

prices show us we were quite right; this was very savvy insider buying.

Who are the insiders in any particular

case? Sometimes, you can tell by

looking at the official inside trading records that corporate insiders must report

to the SEC. More often, there is no easy way to know. But make

no mistake about it, someone on the inside knew. That's why the

trading patterns matched so exactly the model we have constructed

to spot savvy insider buying.

Wall Street's 'Dirty Little

Secret'

INSIDER TRADING IS RAMPANT!

I have

been writing for years about how the SEC is worse than useless and

toothless, because it still gives the least informed members of the public the

dangerous illusion that there is a governmental agency effectively policing and

preventing investment fraud and insider trading. There is so much proof of how

rampant is insider trading that one hardly knows where to begin to discuss it.

The charts tell the story. And they go back years and years, not just to 1990

as shown here. With each new daymore examples emerge. Even governmental

officals decry the state of affairs. The SEC now says it was deliberately

understaffed so that it could not properly regulate under the Bush Administration.

The US law itself seems clear. While corporate insiders,

key employees,

directors and officials may buy or sell their company's shares, they must not

do so based on material non-public information about their company and when they

do make a trade, they must report it to the SEC, which then allows the public to see

what they are up to. If insiders do make trades based on non-public information,

the trades are considered fraudulent and the insiders are judged to have violated

their fiduciary responsibilities. In addition, trades made by insiders tips to

friends and associates are illegal. Again, the insider's duty to public

shareholders is

considered to have been violated by such tips. Stock brokers, analysts and

journalists who in the course of their duties, discover and then trade upon

non-public information that materially affects a company's stock also break

the law, if they "had

reason the believe that the tipper had breached a fiduciary

duty in disclosing information." Federal Court decisions have further clarified

what the law considers insider trading. The SEC v. Texas Gulf Sulfur (1966)

is the most important case in setting the law. TGS found an unusually

rich depost of ores near Timmins, Ontario. Initially, the company issued

discouraging press releases about the discovery's importance, all the while

several directors for the company loaded up on call options and stock. The press

releases were clearly meant to dupe the Canadian farmers, too, into selling or

leasing their land at a fraction of its probable value.

The 1934 Securities and Exchange Act gives the SEC the authority

to demand that violators give up their trading profits. They may also ask a court

to impose a penalty of up to 3 times the profit realized by their insider trading.

The sane law gives the US Justice Department the authority to bring criminal

prosecutions against those engaged in insider tradering. Only a handful of

individuals are brought to court. In 2002, an inside trader could be given a 20-year

jail sentence and be fined up to $5 million. In practice, criminal penalties

are

rarely sought, except in a few high profile cases. As a consequence, such

penalties act as very little deterrent.

Unfortunately for investors, the SEC acquired a reputation

between 2000 and

2008 of being all but toothless and certainly indifferent to insider trading. Too

often

they decided, while the trading may have looked suspicious, it would been too hard

or too politically imconvenient to prove that the insider trading was done because

of illegal use of non-public information. The weaker the SEC's enforcement looked,

the bigger the problem became. In August 2006, the NY

Times ran a lead story on page 1

that Wall Street insider trading had "gone wild". "41% of all mergers worth $1 billion

or more over the last 12 months show signs of insider trading ahead of the deals."

On October

26, 2007, the NY Post quoted a senior SEC official as

saying that insider trading was "rampant"

among Wall Street professionals.

"I am disappointed

in the number of cases we are seeing by people who

make an abundant livelihood in the market..."

In another example, a 5/18/2008 GA0 (Government Accounting)

report on the

SEC wrote: "In one

case, an enforcement attorney told the GAO that a

company offered to pay $1 million to settle a case, but the attorney

recommended no penalty because "they did not believe the commission

would approve the company offer."

See - http://www.star-telegram.com/business/v-print/story/1380769.html

John Mack, the CEO of investment bank,

Morgan Stanley is apparently above

the law. Gary Aguirre, a former

SEC investigator, told a Congressional committee

that he was fired when he tried to interview Mack about tipping off the

hedge fund Pequot Capital Management about a 2001 merger deal between

GE Capital and Heller Financial. Pequot netted $18 million in profits

from the tips. A Congrsssional

Investigation was launched. It

ended up

siding

with Aguierre against his bosses at the SEC

In July 2009, the

Seattle Times noted that the SEC typically goes after the small fries

for insider trading, while well placed insiders and institutions often get off without

even a warning. Insider trading, the articles concludes is rampant. Even former

SEC Chairman Cox admitted this: "There is ample

empirical evidence that there is

significant trading in securities markets on the basis of secret advance knowledge".

So, flagrantly Illegal insider

Trading is rampant and commonplace. This is the

inescapable conclusion we reach looking at all the evidence. The SEC exists mostly

to give the appearance of fairness for all investors on Wall Street. Insiders sell

out on

when false, exaggerated and distorted "good news" comes out that they know will

soon

turn bad. Earnings and earnings' estimates cannot be safely trusted.

After-the-fact

discoveries of "Cooked Books" and CEO Lies and cover-ups are very

common.

Since 2001, the SEC has prosecuted about 50 cases of insider

trading per year.

That is not nearly enough to stem the tide. Insiders who use a modicum of discretion

have no fear, especially if their gains are not out of the ordinary. The SEC picks a

minute

number of high profile individuals to prosecute for insider trading. This is for

show!

99.9% of the other cases where big gains are made flagrantly using insider trading

are ignored. The prosecution of a very few well known people is done for public

consumption, to make it seem that the SEC is protecting the public. This was

mainly true

in the Clinton Administration, too.