Sample TigerSoft charts

(C) 2014 Tiger Software www.tigersoft.com/BBY/index.htm

------------------------------------------------------------------------------------------------------------------------------

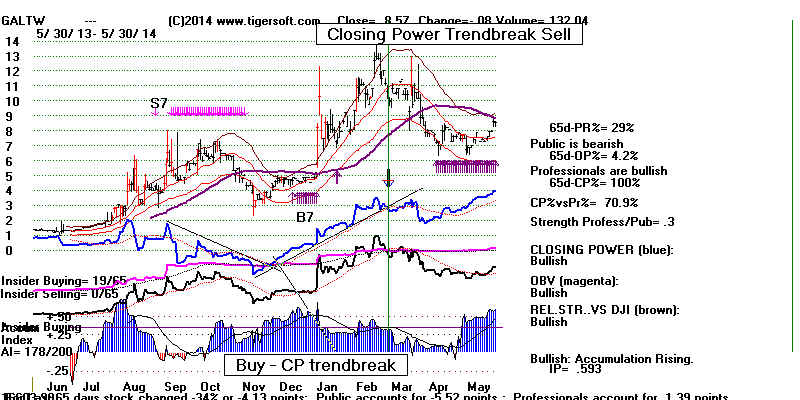

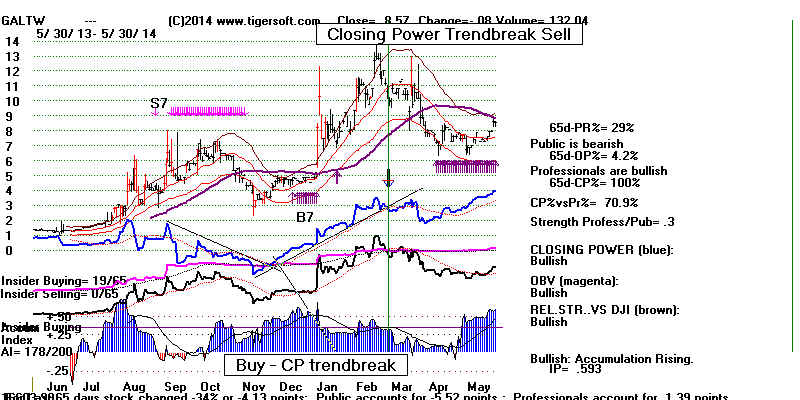

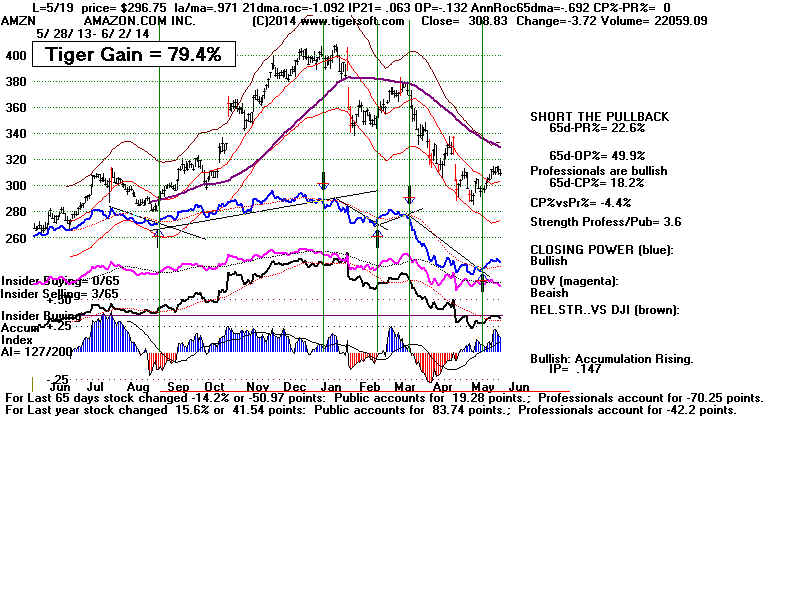

Signals shown are Tiger technical signals compatible with 65-dma

trend.

See how Blue

Tiger Closing Power uptrend was broken before the sell-off

and also how

Tiger Accumulation Index turned negative in November.

This set up a

period of distribution by both insiders and professionals.

The automatic

notes on right side will help you, too. Right now a new

uptrend is being

attempted but Professionals are not yet bullish enough

to bring it to

pass. (5/29/2014 - William Schmidt of TigerSoft )

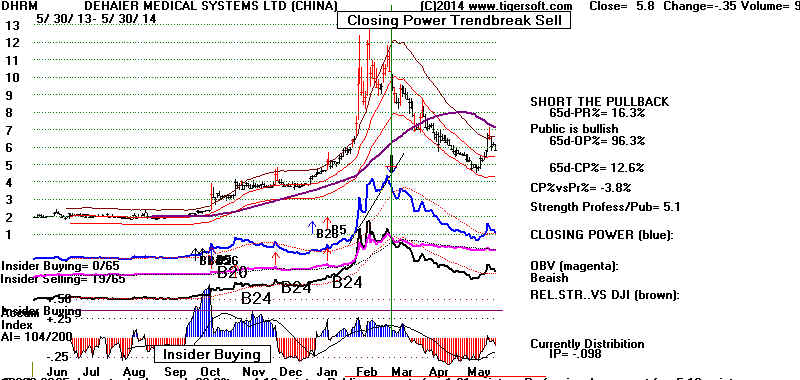

"Love 'em and leave

'em".

This is way too cynical advise for human relationships.

But it is

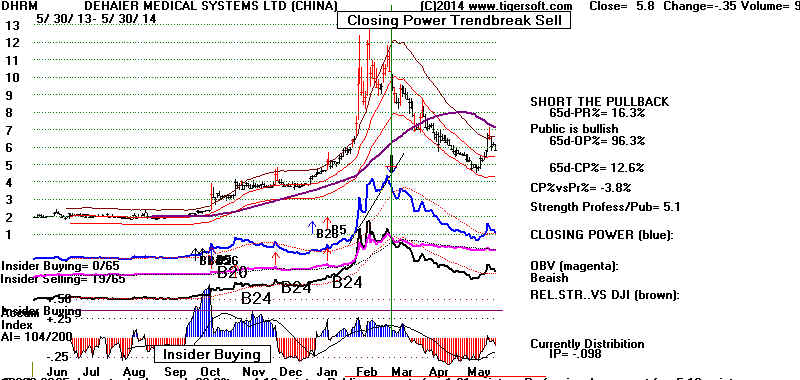

excellent advise for stocks. Way too often stocks are "piffles".

They "yo-yo".

They are run up

for the benefit ot insiders and then collapse when the insiders sell.

This "boom

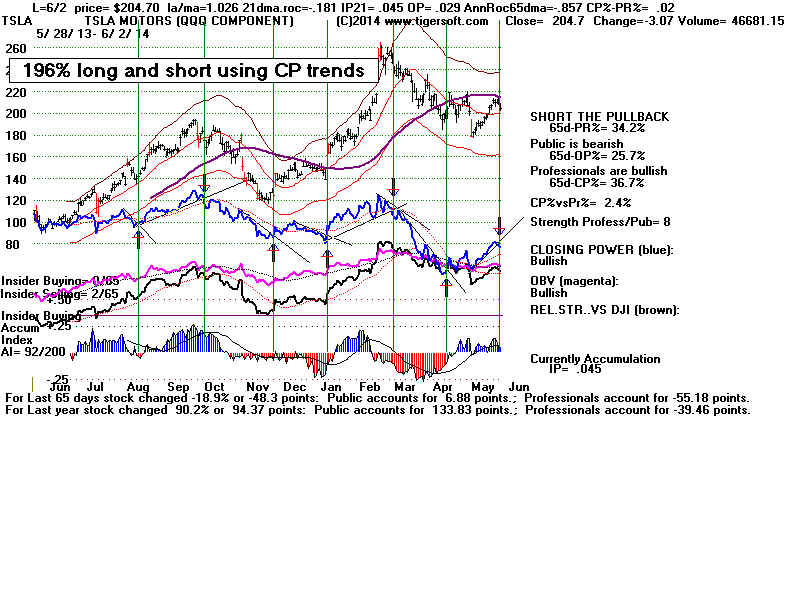

and bust" cycle we TigerSoft users can exploit time after time. Here

is how we do it

with some recent examples.

4 Simple Steps to Make Big Stock Profits Using

TigerSoft

We look for INSIDER

BUYING (as measured by the Tiger Accumulation Index.

Finding

that, we want to see that PROFESSIONAL BUYING (measured by

Tiger

Closing Power) has turned up. At this point we want Tiger's AUTOMATIC BUYS

to begin

buying We then hold so long as the Tiger Closing Power uptrend continues.

We SELL

when the TIGER CP BREAKS ITS UPTRENDLINE. Now the "dumping

usually

starts in these "piffle" stocks.

|

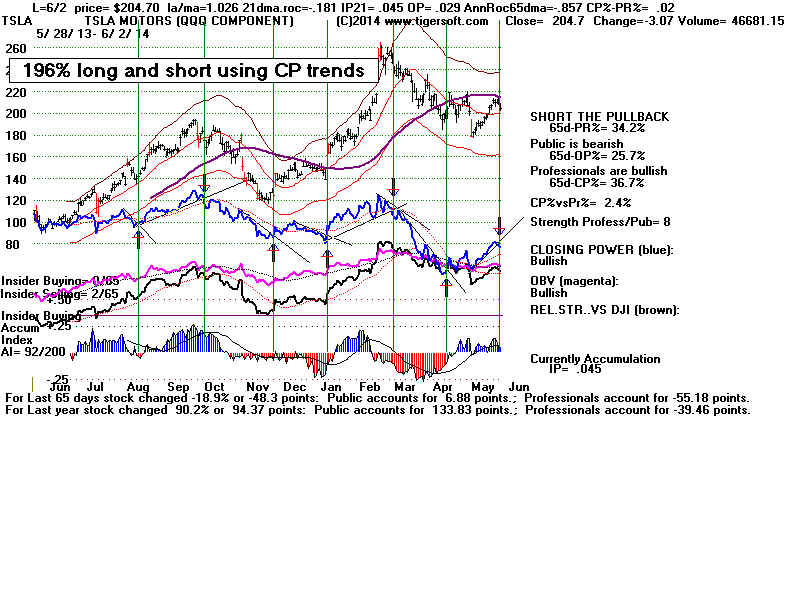

Pretty simple?! We thnk so. Start

trading like this right now.

Contact us. william_schmidt@hotmail.com

858-273-5900

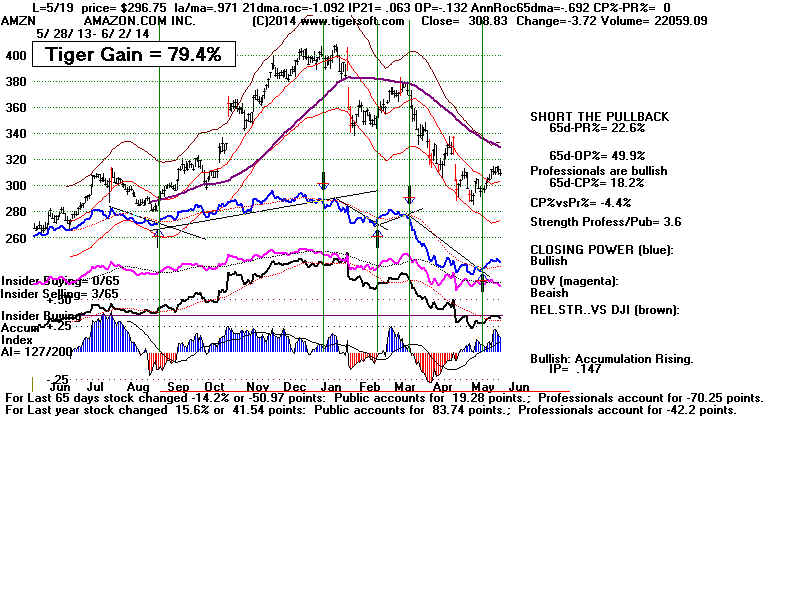

Here

are some more examples

USE

TigerSoft Closing Power Trend-Breaks

|

|

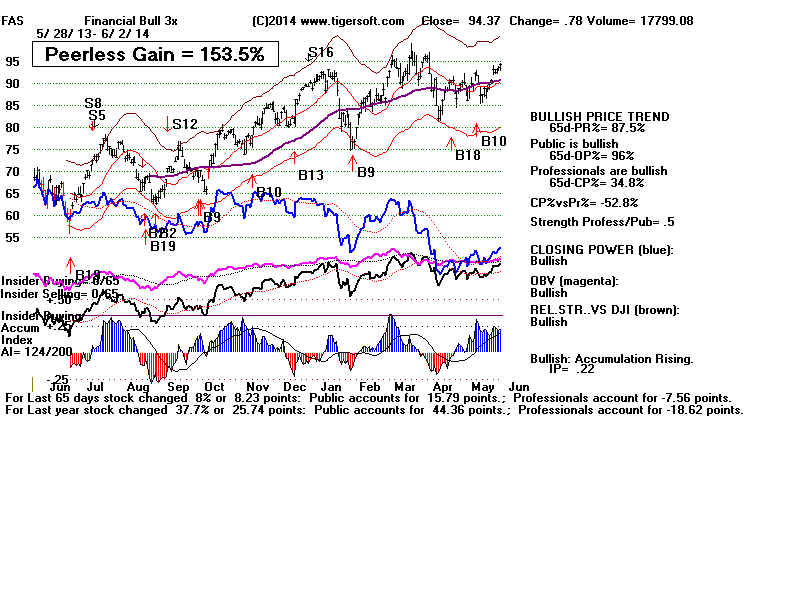

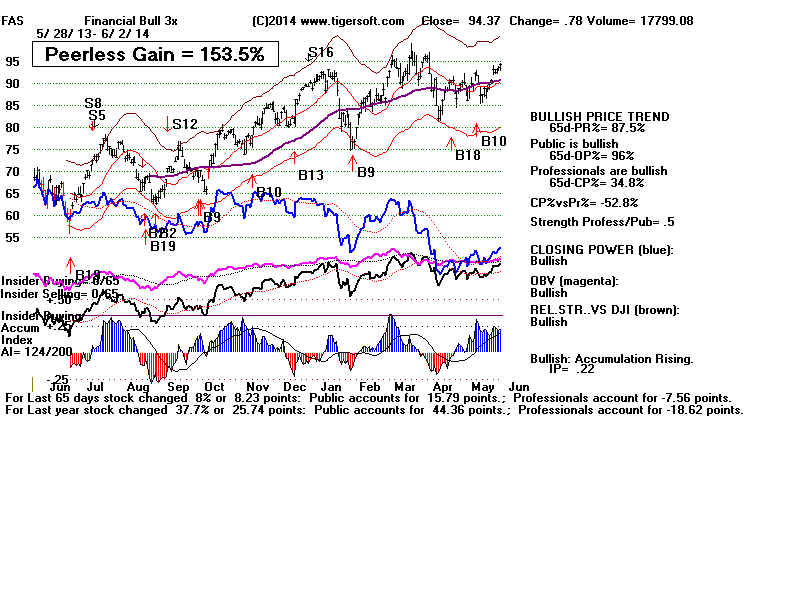

PEERLESS

SIGNALS

Superimpose

the Peerless signals on your chart.

This

works particularly well with major market ETFs and stocks that

move

mostly in synch with the DJI. |

|

|