|

TigerSoft and Peerless Nightly Hotline (C) 2006 William Schmidt, Ph.D Book-Mark This Address 12/26/2006 .... I show some charts of leading High Accumulation individual stocks below to illustrate power of TigerSoft. HELP: Track Record of Major Peerless Signals |

"Be a

Tiger. Go for it!"

====================================================================================

12/26/2006

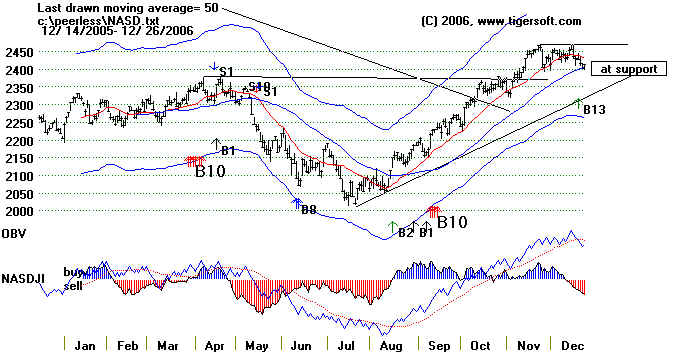

We still operate under major Buys from the Peerless and the

NASDAQ programs. And there is a new

Buy-B13, telling us to expect a Santa Claus rally.

The operative major

Peerless signal is a Buy B18. It proved to be profitable 86% of the time.

It occurred on 9/26/2006 with the

DJIA at 11669. It gains an average 8.2% on the

DJIA at the time of the next major

Sell. If it produces an average gain here, the DJIA will

reach 12650 at the time of the next

major Sell.

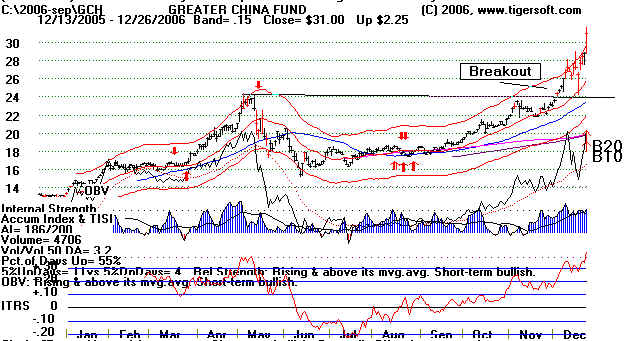

There is a global bull market going on led by China, SE Asia and

Europe. Bull markets like

this are hard to stop, but last May's S9

shows that a major top called by Peerless is strong

enough to stop even them in their tracks.

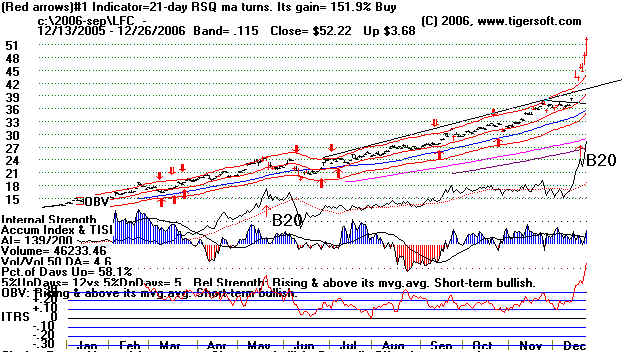

Look at the Chinese life insurance stock below, LFC.

It is up the most of all the bullish

special situations for the last year and is proof that we

should sell our big winners LAST.

It is up 36% in the last four trading days!

But

profit-taking now seems more than prudent if the QQQQ moves below 43.... The

QQQQ

has completed a bearish "hands above

the head" pattern and the DJIA has now gone a record 45

months without a 10% correction..

It is at support. Watch to see which way it moves. The

Red Sell Signal is part of an optimized

system that has gained 35% for the last year. It is oversold.

A great rally hs occurred from

August to the end of November. Now the market is clearly

getting winded. The fizzled

breakouts by the NASDAQ, QQQQ (Nasdaq-100) and

RUT (Russell-2000) are warnings. The

QQQQ (Nasdaq-100) has closed decisively below its

rising 50-day ma with its

Accuumulation Index negative. This is defitiely bearish for the

QQQQ. If it were a stock we

would have to say "Take profits." If it turns out to be leading

the NASDAQ as a whole with this

breakdown, then the NASDAQ will break below its 2400 support,

from its recent bottoms and its own

rising 50-day ma. The NASDAQ closed up 12.33 at

2413.51. Corrections usually

don't begin until January, but this year typical seasonality

repeatedly failed.

The DJI-30 pulled back to its rising

21-day ma and rose a little up from it today... The 21-day ma

has acted frequently as support since the

start of the rally since July. (The 21-day ma is the middle

red dotted line int he DJIA charts below.

) Violations of the 21-day ma are about 60% reliable at

this time of the year in telling you

direction of the next two-three weeks' trend. So weakness by the

DJI and a close below 12400 will have to

be construed as a warning of a rapid further pull-back,

probably to the lower band 2% beneath

current levels.

Also bearish are the 21-day percent

change results for the Fidelity Select Funds. These are

shown just below. As of tonight's

close, only 3 of the 44 Fidelity Select funds show more than

a 1% gain for the last 21 trading

days, But 19 of them are down more than 5%. Some of this

poor performance may owe to dividend

distributions, but there is no doubt that that these leading

funds are being pummeled with

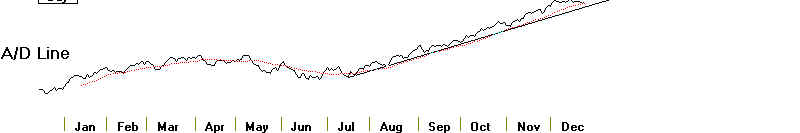

profit-taking. This contradicts the bullish message of the rising slope of

the NYSE A/D Line.

I am also concerned at the swift

deterioration in the Accumulation Index readings for the

QQQQ and SPY (SP-500). Big

money is selling with some urgency. What is it that they know

that is not yet in the public

spotlight? Higher interest rates? Increased US troops in Iraq?

A show-down with Iran over nuclear

weapons? If gold and oil are up tomorrow, we will know it's

a sure sign of renewed Middle

Eastern tensions.

A pattern of weakness after the

opening has started for the QQQQ. This must be watched.

Until the QQQQ gets back above its

21-day ma, I would expect it to continue. So, be careful

about buying tech stocks early in

the trading day.

Perhaps, the DJIA will rebound yet

again from its 21-day ma. But, given how far the markets have

rallied since July and given

that we have not seen a 10% correction in the DJIA in 45 months,

since March 2003, I think we

have to more than a little worried. Taking more profits

seems advisable if the DJIA

falls below 12400.

==========================================

FIDELITY SECTOR FUNDS' PERFORMANCE 12/26

Recent 1 Month Gain

FSTCX Telecommunications

+2%

FSPFX Paper-Forest

+1%

FSUTX Utilities

+1%

Weakest for last 30 days

FSRBX Banking

-12%

FSVLX Home Finance

-10%

FSCHX Chemicals

-10%

FDLSX Leisure

-10%

FSHOX

Construction

-8%

FSLBX

Brokerage

-8%

FSCBX Small Caps

-8%

FIDSX Financial

-8%

FSDPX Industrial Materials

-7%

FSCPX Fidelity Consumer

-7%

FCYIX Cyclical

-7%

FSRPX Retailing

-5%

FSRFX Transportation

-5%

FSNGX Natural Gas

-7%

FSMEX Medical

-5%

FSLEX Electronics

-5%

FBSOX Business

-5%

FSPCX Insurance

-5%

FSDAX Defense

-5%

============================= DJI-30

========================================

Notice the DJI's flat top. This is ordinarily a bullish sign. The DJIA is

still above its

red 32-day ma. That is usually support in an

advancing market.

Flat tops usually bring excellent breakout runs. The

reason is that such selling is too easy.

(More often, the way to make money in the market is to do

what is not so easy or comfortable.)

----------------- NASDAQ remains on a Buy and is at support

--------------------------

.

.

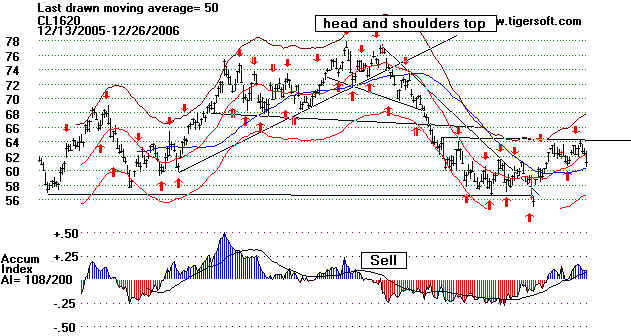

Oil fell sharply back to its rising 50-day ma. A recovery advance by

oil will hurt the

NASDAQ and the stock market generally. Watch

the oil ETF.

---------------------------------------- CRUDE OIL

--------------------------------------------------------------------------------

----------------------------------------------- BIOTECH

------------------------------------------------------------------------

I am concerned that we have not yet had any real recovery by the BBH

(Biotechs).

A close below its support at 185 would be bearish short-term. Its blue 50-day ma is

falling.

Its Accumulation Index is negative. So is its relative strength (ITRS).

-------------------------------------- WEAK DOLLAR and STRONG EURO

----------------------------------------

The Dollar remains under

pressure. Look at the EURO chart below. Notice all the

Accumulation in its chart. Silver and gold do well in

this environment. So do foreign ETTs until there

is a major Sell Signal from Peerless.... We have to be

concerned that the pronounced weakness

in the dollar will get the FED to start

talking about its concern about "Inflationary Pressures", all

the while what it is really concerned about is how it can

finance the huge Federal Deficit" when

foreigners don't trust the dollar and it must soon start

considering raising interest rates

to satisfy them. Fortunately for the bulls, usually

the Fed will not talk about "inflationary

pressures" in December for fear of hurting Christmas

retail sales, because of their importance

to the economy. So, the Fed usually waits until

January or February. That delay buys some

time for the market in December. As a result, big

declines are very rare in December. You have

to go back to 1968 to find a case when a significant

intermediate-term top was made in December.

After

12/25 seasonality:

Since 1965, the

DJI has risen

59%

after the next 3 trading days.

67% after

the next 5 trading days,

67% after the next 10 trading days,

56%

after the next 21-trading.

+1.2% avg.

64% after

the next two months. +2.1% avg.

.........................................................................................................................................................................

======================= GOLD STOCKS AND GOLD ===================================