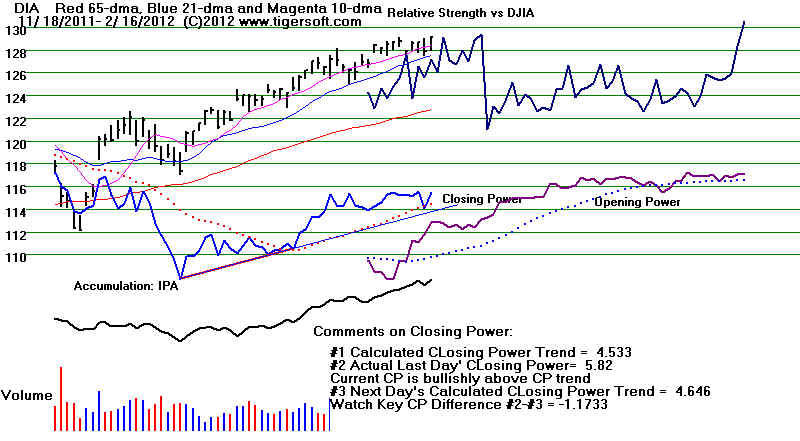

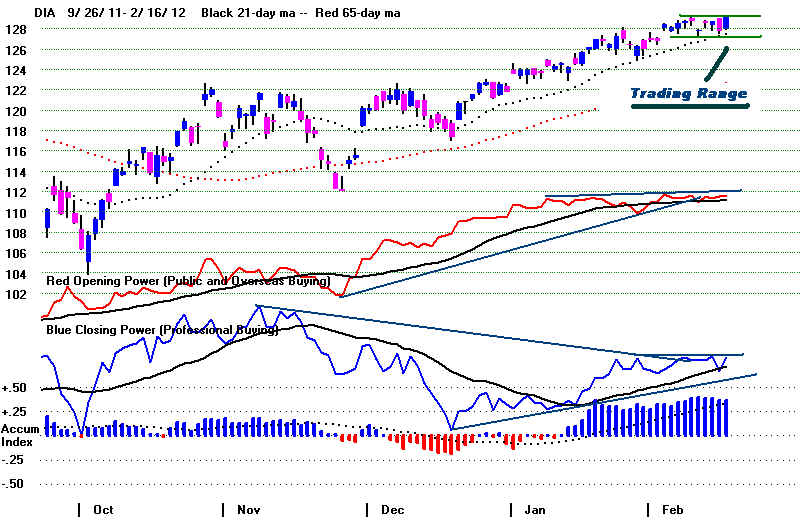

DJIA - PEERLESS - 3/22/2012

IWM - Candle Stick Chart

======= 3/19/2012 =======

25 groups show >50% over 65-dma

3 groups show <50% over 65dma

Pct of Stocks over 65-dma 2-Day Change shown on 3/8/2012, 1-day earlier...

3/`20/2012 3/`19/2012 3/`5/2012 2/17/2012 2/1/2012 1/25/2012 1/11/2012

-------------------------------------------------------------------------------[--[--------------------------------------------------------------------------------------

Homebuilding 96% 96% 92% +4% 96% -4% 100% 100% +4% 83%

Retails 96% +4% 92% -4% 92% +4% 92% +4% 70% +9% 65% +7% 26% -9%

Foreign ETFs 95% -3% 98% 95% -2% 97% +2% 92% +2% 89% +4% 40% +3%

BestREITs 93% 93% 87% -5% 100% 100% 100% 100% -20%

Gaming 90% -5% 95% 75% -9% 90% 86% +7% 93% +7% 86% +7%

HighPrice Stks 89% -2% 91% +2% 88% -6% 94% 94% (new)/

DJI-30 stocks 87% -3% 90% -3% 87% +6% 100% +3% 90% +3% 93% 94% +1%

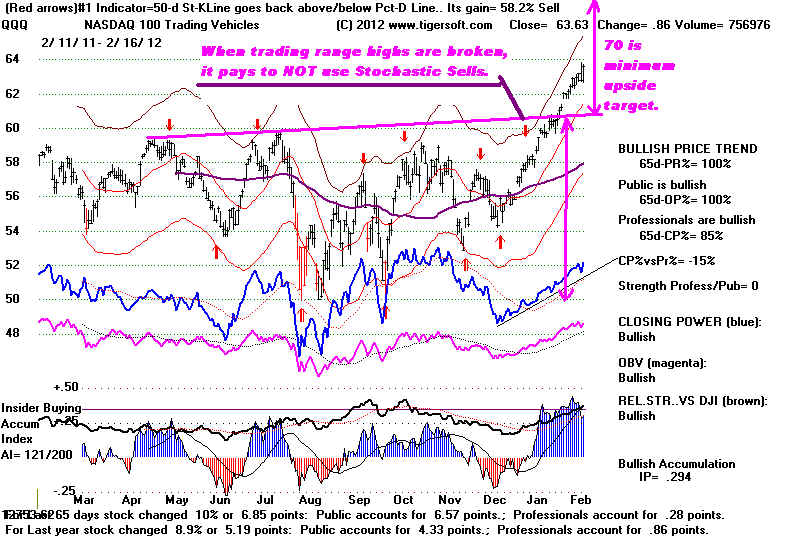

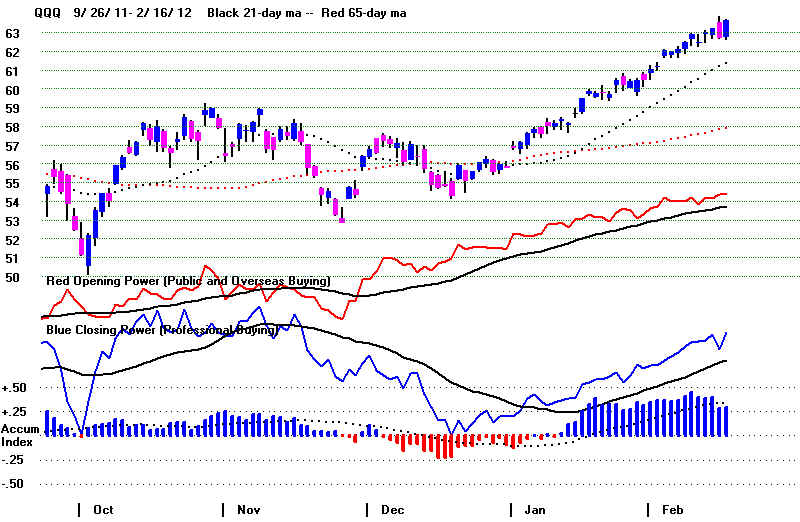

QQQ-100 stocks 87% 87% 84% -4% 89% 86% +7% 84% 72% +3%

Finance Stocks 86% -2% 88% +1% 77% -7% 91% 85% +6% 87% +1% 79% +-2%

SP-500 stocks 81% -3% 84% 78% -1% 86% +1% 81% +4% 83% 78% -2%

Biotech 17 77% -11% 88% +11% 77% -5% 82% 82% 83% +5% 83%

Auto Stocks 76% -3% 79% -3% 82% 87% 90% -2% 90% 82% -2%

Chem 74% 74% 60% -2% 79% 86% +8% 79% 76%+4%

Super 2011 73% 73% -4% 69% 77% -2% 83% +6% 81% 89% +4%

Military 70% -19% 89% 86% +1% 93%

Biotech All 69% -5% 74% -2% 68% -1% 82%+1% 82% 83% +5% 83%

Transport Stock 69% -1% 70% -2% 73% 90% +3% 84% +3% 83% +6% 77% +3%

Low Priced 68% 68% -2% 65% -4% 80% -2% 81%

Green Stks 66% -3% 69% -3% 61% -3% 87% 84% +8% 77% +5% 61% +10%

Chinese Stocks 65% -1% 66% +4% 70% -2% 73% 63% +1% 66% 45% +4%

Food Commodi 60% -10% 70% +2% 80% -10% 80% +10% 60% 80% +10% 60% +20%

Oil stocks .. 58% -7% 65% -3% 65% -6% 77% +2% 65% +3%

Computer Eq 58% -2% 60% 58% -11% 78 +1% 77%+4% 77% -2% 48% +2%

Ind. Materials 57% -8% 65% +3% 57% -5% 76% -1% 84% 86% +6% 74% +5%

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Utility Stocks 47% +1% 46% -7% 52% -1% 68% 71% +5% 72% +10% 71% -3%

Pipelines 43% 43% 79% -7% 77% +8% 77% 85%

Gold/Silver Stks 17% -5% 22% -3% 48% -12% 61% -7% 76% -1% 63% +20% 30% -3% 24%

Bond Funds 12% +3% 9% -2% 93% -4% 86% -2% 99% -1% 97% +3% 96% +1%

DOW STOCKS

NASD-100 STOCKS

SP500 STOCKS

INTEREST RATES

EURO |

GOLD

ETF

GOLD STOCKS,

SILVER

Natural Gas - GAZ

Index of Oil Stocks

BONDS |